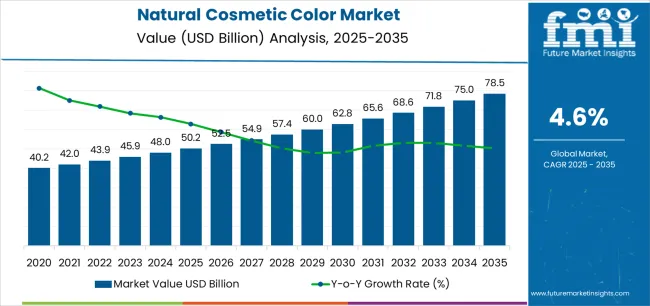

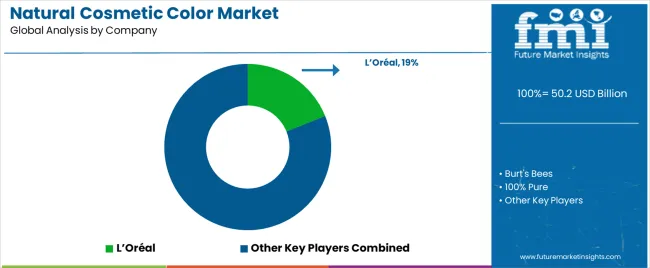

The Natural Cosmetic Color Market is estimated to be valued at USD 50.2 billion in 2025 and is projected to reach USD 78.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

The natural cosmetic color market is expanding steadily due to growing consumer preference for clean-label, plant-derived, and sustainable beauty products. Rising awareness about the adverse effects of synthetic pigments and the increasing shift toward eco-friendly formulations are driving the adoption of natural colorants across cosmetics and personal care segments. Market growth is further influenced by regulatory encouragement for natural ingredients and technological innovations enhancing color stability and product performance.

Manufacturers are focusing on bio-based extraction methods, organic certifications, and micro-encapsulation techniques to ensure consistency and longevity of natural pigments. Demand from both premium and mass-market brands is contributing to supply diversification and pricing stability.

Future growth is expected to be supported by the integration of natural colors into multifunctional products and the rising influence of ethical consumption trends These factors collectively reinforce the long-term growth rationale and position the market for continuous expansion across global cosmetic and personal care industries.

| Metric | Value |

|---|---|

| Natural Cosmetic Color Market Estimated Value in (2025 E) | USD 50.2 billion |

| Natural Cosmetic Color Market Forecast Value in (2035 F) | USD 78.5 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

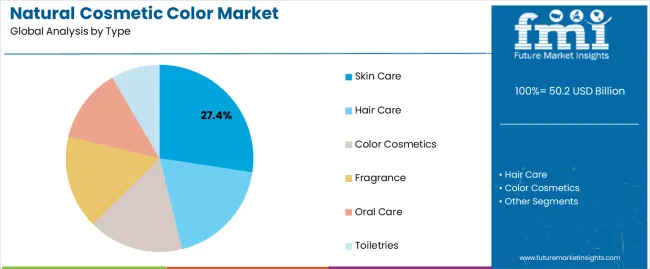

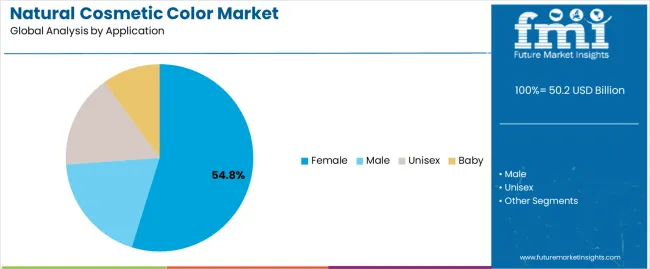

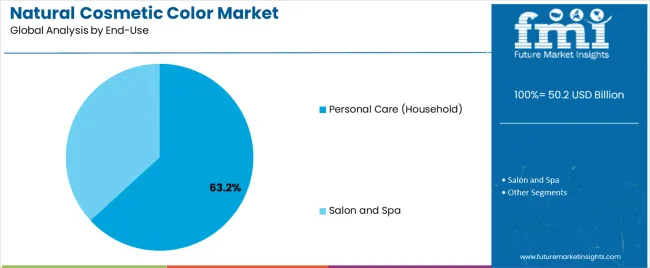

The market is segmented by Type, Application, End-Use, and Sales Channel and region. By Type, the market is divided into Skin Care, Hair Care, Color Cosmetics, Fragrance, Oral Care, and Toiletries. In terms of Application, the market is classified into Female, Male, Unisex, and Baby. Based on End-Use, the market is segmented into Personal Care (Household) and Salon and Spa. By Sales Channel, the market is divided into Online Stores, Hypermarket/Supermarket, Convenience Stores, Speciality Stores, Wholesale/Distributors, and Club Stores. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The skin care segment, accounting for 27.40% of the type category, has been leading due to the widespread use of natural pigments in creams, lotions, and facial products. Growth is driven by rising demand for toxin-free formulations that deliver both aesthetic and therapeutic benefits.

Manufacturers are increasingly focusing on sourcing botanical and mineral-based pigments to enhance product safety and align with consumer expectations for transparency and sustainability. Advancements in extraction and stabilization processes have improved texture compatibility and color retention, supporting broader product innovation.

Consistent consumer interest in anti-aging and skin-brightening applications has reinforced the segment’s market position Continued expansion of clean beauty trends and premium skin care offerings is expected to sustain segment growth and strengthen its contribution to the overall market share.

The female application segment, representing 54.80% of the application category, dominates the market owing to higher consumption of beauty and personal care products among women. The segment benefits from strong brand positioning, diverse product portfolios, and targeted marketing emphasizing natural and safe cosmetics.

Rising female workforce participation and increasing disposable incomes are further driving product adoption. Preference for plant-based and cruelty-free formulations has enhanced demand for natural pigments in makeup and skincare ranges.

Market growth is being reinforced by premium product launches and personalized beauty solutions catering specifically to female consumers Ongoing awareness campaigns promoting ingredient transparency and sustainability are expected to further consolidate this segment’s leadership in the coming years.

The personal care (household) segment, holding 63.20% of the end-use category, leads the market due to extensive utilization of natural colorants in soaps, shampoos, creams, and daily-use cosmetics. Growth is driven by increasing consumer awareness of ingredient safety and long-term health benefits associated with natural products.

Manufacturers are expanding their natural pigment portfolios to meet the rising demand for sustainable and biodegradable colorants across household personal care items. Product innovations emphasizing natural origin, non-toxic composition, and allergen-free properties are gaining traction.

Enhanced retail availability and strong e-commerce penetration are supporting volume expansion The segment’s dominance is expected to continue as personal care brands increasingly integrate natural color solutions into mainstream and premium product lines to meet evolving consumer preferences.

Skin care is the top purpose for which natural cosmetic color is used. Females are the predominant users of natural cosmetic color.

For 2025, skin care is expected to account for 38.4% of the market share by type. Some of the key drivers for the increasing use of natural cosmetic color in skin care are:

| Attributes | Details |

|---|---|

| Top Type | Skin Care |

| Market Share (2025) | 38.4% |

Female application of natural cosmetic color is anticipated to account for 76.2% of the market share. Some of the key drivers for the progress of female application of natural cosmetic color include:

| Attributes | Details |

|---|---|

| Top Application | Female |

| Market Share (2025) | 76.2% |

The Asia Pacific’s considerable young population is driving the demand in the natural cosmetic color industry. The burgeoning beauty and personal care sector in the region is also contributing to the market’s acceleration in the Asia Pacific.

The rise of disposable income is making sure people are buying more beauty products in North America. The influence of social media is also felt in the market’s progress in the region.

| Countries | CAGR |

|---|---|

| Canada | 4.5% |

| China | 9.0% |

| Japan | 6.9% |

| Singapore | 7.3% |

| India | 9.8% |

The market is set to register a CAGR of 4.5% in Canada for the forecast period. The key drivers for growth are:

The CAGR for natural cosmetic color in China is tipped to be 9.0% over the forecast period. Some of the key factors driving the growth are:

The CAGR for natural cosmetic color in Japan is tipped to be 6.9% over the forecast period. Some of the key factors driving the growth are:

The market is expected to register a CAGR of 7.3% in Singapore for the forecast period. Some of the key trends include:

The market is expected to register a CAGR of 9.8% in India. Some of the key trends include:

Companies in the natural color cosmetic market are taking the online route to increase brand presence. Tie-ups with beauty and entertainment industry-related influencers are common.

Geographic expansion is a key area of focus for market players, especially with the opportunity for cheap raw materials. Cosmetic brands previously manufacturing beauty products with chemical ingredients are seeing the opportunities in the market and entering the natural color industry.

Recent Developments in the Natural Cosmetic Color Market

The global natural cosmetic color market is estimated to be valued at USD 50.2 billion in 2025.

The market size for the natural cosmetic color market is projected to reach USD 78.5 billion by 2035.

The natural cosmetic color market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in natural cosmetic color market are skin care, hair care, color cosmetics, fragrance, oral care and toiletries.

In terms of application, female segment to command 54.8% share in the natural cosmetic color market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Natural Cosmetics Market - Size, Share, and Forecast 2025-2035

Natural Food Colors Market Analysis - Size, Share, and Forecast 2025 to 2035

Male Color Cosmetics Market - Trends, Growth & Forecast 2025 to 2035

Japan Natural Cosmetics Market Analysis - Size, Share & Trends 2025 to 2035

Korea Natural Cosmetics Market Analysis – Size, Share & Trends 2025 to 2035

GCC Natural Food Color Market Growth – Trends, Demand & Innovations 2025–2035

Product Type, Packaging Type, Consumer Orientation, Sales Channel, Category Type, and Country segment in the Europe Natural Cosmetics Market.

ASEAN Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Germany Natural Food Color Market Growth – Trends, Demand & Innovations 2025–2035

Solvent-Free Natural Color Dispersions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Western Europe Natural Cosmetics Market Analysis - Size, Share & Trends 2025 to 2035

Aluminum-free Natural Food Color Market Size and Share Forecast Outlook 2025 to 2035

United States Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

United Kingdom Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

Natural Refrigerant Chiller Market Size and Share Forecast Outlook 2025 to 2035

Natural Antioxidant Market Size and Share Forecast Outlook 2025 to 2035

Natural Disaster Detection IoT Market Forecast Outlook 2025 to 2035

Cosmetic Pigment Market Forecast and Outlook 2025 to 2035

Cosmetic Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA