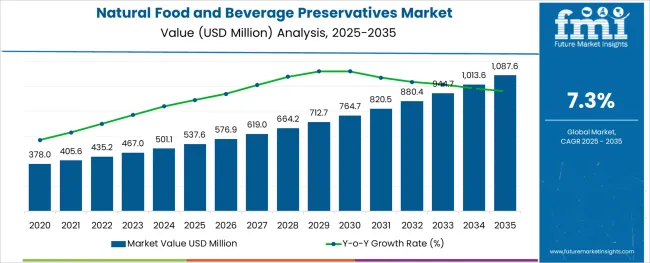

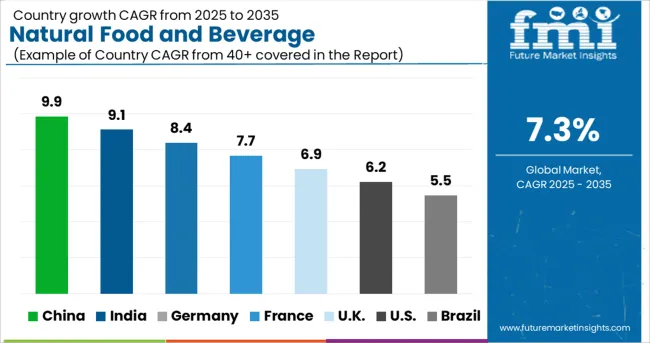

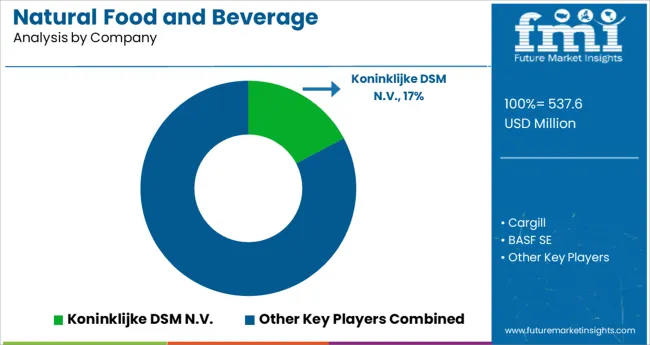

The Natural Food and Beverage Preservatives Market is estimated to be valued at USD 537.6 million in 2025 and is projected to reach USD 1087.6 million by 2035, registering a compound annual growth rate (CAGR) of 7.3% over the forecast period.

The natural food and beverage preservatives market is gaining strong momentum as global manufacturers respond to rising consumer demand for clean-label and minimally processed products. Regulatory pressure to limit synthetic additives in food systems has accelerated the shift toward natural preservation methods derived from plant, microbial, and mineral sources

Advancements in extraction technologies and improved stability of natural compounds under various processing conditions are enhancing the commercial viability of these preservatives. Key market drivers include increasing health awareness, growing demand for organic and allergen-free products, and a sharp rise in cold-chain distribution requiring extended shelf life.

Manufacturers are investing in multifunctional natural agents that provide both antimicrobial and antioxidant protection while maintaining flavor, texture, and nutritional integrity. Future growth will be supported by innovations in encapsulation, natural fermentation systems, and regulatory approvals expanding the permissible use of these ingredients across broader food categories and geographies.

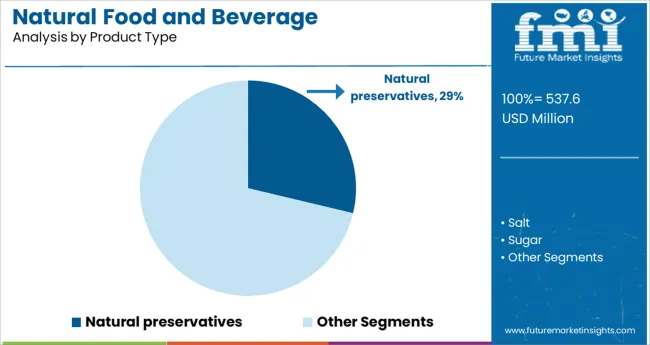

The market is segmented by Product Type, Function, Application Type, and Form and region. By Product Type, the market is divided into Natural preservatives, Salt, Sugar, Alcohol, Vinegar, Rosemary Extracts, Others, Artificial preservatives, Benzoates, Sodium Benzoate, Benzoic Acid, Nitrites, Sodium nitrates, Sulfite, Sulfur Dioxide, Acetic Acid, Sodium Diacetate, Lactic Acid, Sorbates, Sodium Sorbate, Potassium Sorbate, Propionates, and Others.

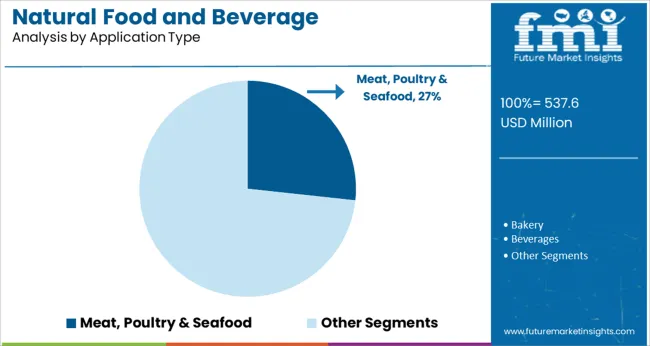

In terms of Function, the market is classified into Antimicrobials, Antioxidants, Chelating Agents, Flavoring agents, Restaurants, Emulsifier, and Others. Based on Application Type, the market is segmented into Meat, Poultry & Seafood, Bakery, Beverages, Dairy products, Confectionery, Frozen Food, Snack Food, Fats and Oils, and Others.

By Form, the market is divided into Solid and Liquid. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Natural preservatives are anticipated to account for 28.7% of revenue within the product type category in 2025. This leading position is being reinforced by increasing consumer demand for food and beverages formulated without synthetic chemicals or artificial additives.

Derived from botanical, microbial, and mineral sources, natural preservatives have gained traction across health-conscious and premium product segments. The adoption has been further driven by regulatory constraints around synthetic preservative usage, particularly in North America and Europe, creating a favorable compliance environment for natural alternatives.

Advancements in ingredient stability, process compatibility, and clean-label certifications have enhanced the commercial adoption of these compounds. Food producers are increasingly incorporating natural agents not only to meet consumer expectations but also to support brand differentiation in a competitive market, securing the segment’s continued growth.

Antimicrobials are projected to contribute 39.5% of total revenue in 2025 within the function category, maintaining their leadership due to their essential role in inhibiting bacterial, yeast, and mold growth. This segment’s dominance stems from the high effectiveness of natural antimicrobial agents such as plant-based extracts and bioactive peptides in controlling spoilage and pathogenic microorganisms.

As global food safety standards become stricter, the need for effective natural antimicrobials in both ready-to-eat and minimally processed food has intensified. Their use also aligns with the growing preference for preservatives that not only extend shelf life but also retain product freshness and integrity.

Continued R&D in natural antimicrobial blends that target specific spoilage organisms while ensuring sensory neutrality is expected to sustain their critical role in natural food preservation strategies.

The meat poultry and seafood category is projected to account for 26.7% of application-based revenue in 2025, marking it as the leading segment for natural preservative use. This is being driven by the high perishability of these protein-rich food types and the growing regulatory and consumer scrutiny surrounding microbial contamination.

Natural preservatives have proven effective in maintaining freshness, controlling pathogens, and extending shelf life without altering taste or appearance, which is critical in this segment. The industry is also facing mounting pressure to eliminate synthetic nitrites and sulfites, further accelerating the shift to natural solutions.

Advanced formulations, including those using rosemary extract, cultured sugar blends, and fermentation-derived compounds, are being adopted for their broad-spectrum microbial control and compatibility with cold-chain logistics. As consumer demand rises for clean-label meats and seafoods, this application area is expected to remain central to innovation and revenue generation in the natural preservatives market.

The natural food and beverage preservatives market has received a lot of traction in the industry. In response to the burgeoning market for packaged food and beverages, the global natural preservatives market is primarily driven by the ever-increasing demand for ready-made food products.

Consumers are turning more and more to ready-made food products due to their busy lifestyles. Demand for foods with longer shelf lives has increased as a result of rising convenience product needs, driving up demand for natural food preservatives.

The usage of natural food preservatives has increased recently due to the rising demand for ready-to-eat food products. As they frequently don't contain preservatives, the rising demand for organic food items is limiting market growth for natural food preservatives.

There are many different methods and additives used to preserve food. These processes also include nuclear radiation for keeping natural foods and beverages preserved. Chemical preservatives are commonly used to prevent spoilage since they suppress the growth of microbes and bacteria.

The global natural food and beverage preservatives market is segmented into seven regions, including North America, Latin America, Eastern Europe, Western Europe, Middle East and Africa (MEA), Asia Pacific excluding Japan (APEJ), and Japan.

Due to rapid urbanization and high consumer disposable income, China is experiencing a surge in the demand for packaged food products, such as frozen foods and sweets. The industry is also growing as organic food demand increases, necessitating the use of various types of food preservatives.

Due to the rapid adoption of convenience and packaged foods in Asia-Pacific and the Middle East & Africa, the natural food preservatives market forecasts an increase in demand for natural preservatives equipment.

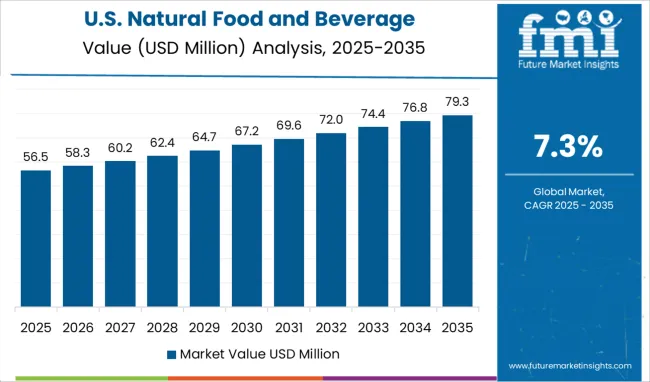

Taking up 37.5% of the market share, North America is projected to account for over one-third of the overall market in 2024. The United States dominates the natural food and beverage preservatives market, with a growth rate of 6%.

The primary factors anticipated to propel the growth of the natural food preservatives market in this region are the rise in consumption of ready-to-eat food products and the rise in consumption of healthy food, particularly with clean-label ingredients.

Approximately 28.5% of the natural food and beverage preservatives market share belongs to Europe. There has been a significant advancement in the technology for natural preservatives as a result of the number of illnesses caused by synthetic substances in food.

Prominent companies such as TRinternational, Inc., Chemical Stores Inc., and Bentoli Inc., among others, have made significant contributions to the science of natural preservatives.

Some of the leading companies operating in the global membrane filter cartridge market include Koninklijke DSM N.V. Akzo Nobel N.V., Cargill, Incorporated, DuPont, etc.

Hansen Holding A/S acquired JenneweinBiotechnologie GmbH in September 2024 to enter the high-growth human milk oligosaccharides market. Prior to 2025, the business plans to invest more than EUR 200 million in production assets, including a brownfield factory, to increase output and meet anticipated demand.

A major player, IFF, completed the merger with DuPont's nutrition and bioscience division in February 2024. IFF will continue to be the name of the new company.

Some of the leading companies operating in the global natural food and beverage preservatives market include Koninklijke DSM N.V. Akzo Nobel N.V., Cargill, Incorporated, DuPont, etc.

A number of key strategic initiatives have been adopted by the leading players in the natural food preservatives industry to gain significant market share globally, including product launches and partnership acquisitions.

Leading companies are embracing cutting-edge marketing strategies, technical advancements in medical diagnostics, and mergers and acquisitions.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 7.3% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million, CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Product Type, Function, Application Type, Form, Region |

| Regions Covered | North America; Latin America; Western Europe; Middle East and Africa |

| Key Countries Profiled | United States of America, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Russia, Poland, Australia, New Zealand, China, India, Japan, GCC Countries, South Africa, North Africa |

| Key Companies Profiled | Koninklijke DSM N.V.; Akzo Nobel N.V.; Cargill; Incorporated; DuPont |

| Customization | Available Upon Request |

The global natural food and beverage preservatives market is estimated to be valued at USD 537.6 million in 2025.

It is projected to reach USD 1,087.6 million by 2035.

The market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types are natural preservatives, salt, sugar, alcohol, vinegar, rosemary extracts, others, artificial preservatives, benzoates, sodium benzoate, benzoic acid, nitrites, sodium nitrates, sulfite, sulfur dioxide, acetic acid, sodium diacetate, lactic acid, sorbates, sodium sorbate, potassium sorbate, propionates and others.

antimicrobials segment is expected to dominate with a 39.5% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Natural Food Preservatives Market Size and Share Forecast Outlook 2025 to 2035

Global Food Preservatives Market Size, Growth, and Forecast for 2025 to 2035

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverages Air Filters Market Size and Share Forecast Outlook 2025 to 2035

Natural Food Flavors Market Size and Share Forecast Outlook 2025 to 2035

Natural Food Colors Market Analysis - Size, Share, and Forecast 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Protective Cultures Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Microalgae Market - Demand & Future Innovations 2025 to 2035

Analysis and Growth Projections for Food and Beverage Additive Market

Food and Beverages Color Fixing Agents Market Analysis by Product Type, Application and Region through 2035

Food & Beverage Disinfection Market – Safety & Industry Trends 2025 to 2035

Food and Beverage Air Filtration Market Analysis by Filter Type, End Use, and Region Through 2035

Natural Pet Food Market Insights - Nutrition & Consumer Trends 2025 to 2035

GCC Natural Food Color Market Growth – Trends, Demand & Innovations 2025–2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Naturally Cultured Beverages Market

Naturally Fermented Food Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA