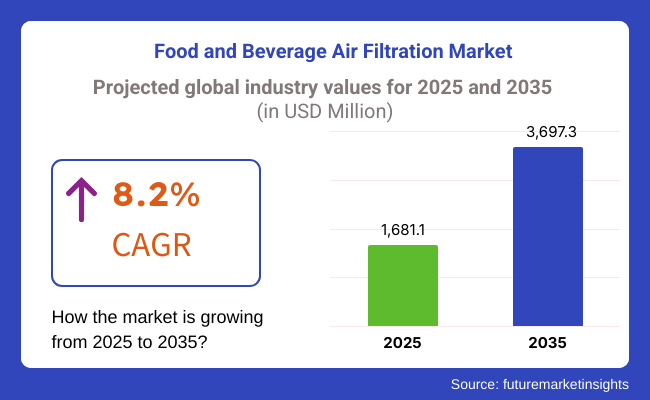

The global food and beverage air filtration market is projected to grow from USD 1681.1 million in 2025 to USD 3,697.3 million by 2035, reflecting a CAGR of 8.2% during the forecast period.

The increasing demand for natural and additive-free products among consumers is expected to impact the air filtration industry significantly. With more food and beverage brands working to meet clean-label demands, filtering system manufacturers are creating systems that help retain air purity without synthetic preservatives. This is especially true in the dairy, bakery, and beverage sectors, where airborne impurities could spoil product quality.

Combined with the recent pandemic experience, which heightened sensitivity towards pathogens in the air, food manufacturers are also concerned about air quality, and more accessible solutions for filtration are being triggered. As regulatory scrutiny continues to grow (e.g., FDA, EFSA), companies are now incorporating smart air filtration technologies capable of real-time monitoring and control. The industry players are also taking advantage of sustainability trends by launching energy-efficient and eco-friendly filtration systems.

Sustainability goals, such as incorporating recyclable filter materials, reducing energy consumption, and improving filtration effectiveness, likely appeal more to food and beverage generators, who may be drawn to such solutions even more than traditional producers. As innovation and regulatory compliance drive the sector, the food and beverage air filtration industry is poised to experience strong growth over the next ten years.

The food and beverage air filtration industry is growing rapidly as manufacturers concentrate on hygiene, compliance with regulations, and product quality. The dairy sector lays special emphasis on high-efficiency particulate air (HEPA) and ultra-low penetration air (ULPA) filters to avoid any kind of contamination during the processing of milk and cheese.

Water and juice beverage manufacturers typically use activated carbon and membrane filtration systems that guarantee air cleanliness in these plants. Besides this, the meat and poultry industry are highly reliant on the industrial filtration systems for the airborne pathogens control and safety for their products.

In bakery & confectionery, air filtration is critical for the control of dust and allergen management, lowering cross-contamination risks. The packaged food industry focuses on sustainability and energy-efficient filtration technology, balancing cost with air purity.

As demand for clean-label and minimally processed food increases among consumers, air filtration technologies are of prime importance to ensure quality, freshness, and safety standards.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and the current year (2025) for the global food and beverage air filtration industry. This analysis reveals crucial shifts in performance and indicates revenue realization patterns, providing stakeholders with a clearer vision of the growth trajectory. The first half of the year (H1) spans from January to June, while the second half (H2) covers July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 7.7% |

| H2 (2024 to 2034) | 8.2% |

| H1 (2025 to 2035) | 7.9% |

| H2 (2025 to 2035) | 8.3% |

In the first half (H1) of the decade from 2025 to 2035, the business is predicted to surge at a CAGR of 8.2%, followed by a higher growth rate of 8.4% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase to 8.5% in the first half and remain considerably high at 8.6% in the second half. In H1, the sector witnessed an increase of 20 BPS, while in H2, the business experienced a increase of 10 BPS.

Between 2020 and 2024, the food and beverage air filtration industry experienced significant growth as manufacturers prioritized hygiene, safety, and compliance with stringent air quality regulations. The pandemic outbreak of COVID-19 created awareness of airborne pollutants, and hence the usage of HEPA and ULPA filters increased to ensure clean processing conditions and avoid contamination.

AI-based monitoring systems were introduced to regulate air quality in real time and schedule cleaning of filters automatically for better operational efficiency. Energy-efficient filtration systems gained popularity in order to reduce operating costs and meet sustainability targets. However, high installation cost and maintenance complexity were still key challenges.

Moving towards 2025 to 2035, the industry will shift toward AI-driven, self-tuning filtration systems with predictive maintenance. Quantum computing and edge AI will enable real-time air quality monitoring with more rapid response to contamination threats. Nanotechnology-based advanced filters will increase filtration efficiency as well as energy saving.

Blockchain supply chains will make traceability and regulatory compliance easier for food safety audits. Sustainable filtration materials and carbon-neutral operations will rule the industry with global environmental ambitions.

AI-enabled autonomous filtration systems will dynamically regulate in accordance with processing conditions to reduce downtime and maximize air quality. The food and beverage industry will increasingly shift towards smart, automated air filtration systems to secure product safety and production efficiency.

A Comparative Industry Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Implementation of HEPA and ULPA filters for the purpose of hygiene and safety norms | Compliance and real-time monitoring through AI with automated control |

| Real-time air quality monitoring and automated filter maintenance through AI | Quantum and edge AI for real-time detection of contamination and response |

| Emphasis on high-efficiency particulate filtration | Filters based on nanotechnology for higher efficiency and energy savings |

| Growing complexity in sourcing high-performance filtration materials | Blockchain-based traceability and automated compliance tracking |

| Increasing energy demand for efficient filtration systems | AI-powered, carbon-neutral filtration using recyclable materials |

| Filter maintenance automation to minimize downtime | AI-based self-adjusting filtration systems for enhanced air quality |

| High cost of installation and maintenance | Low operation costs with AI-optimized filtration systems |

The food and beverage air filtration market is enduring serious risks, especially those that are a result of regulatory compliance and safety standards that are set strictly to the companies. Companies are required to follow the air quality laws that are very strict and are given by medical and agricultural boards like the FDA, USDA, and European Food Safety Authority (EFSA).

A breach of these rules can lead to penalties, closing down operations, and replacement of the product, which could severely influence financial stats. Besides that, technical obsolescence is another critical risk. In the face of the dynamic air filtration technologies, companies have to consistently reinvent their equipment to comply with the new, higher, and more efficient environmental standards.

Neglecting the purchase of HEPA, ULPA, or activated carbon filters can account for less efficiency which not only turns out the product impure but also breaks consumers trust. Supply chain bottlenecks serve as other challenges. The community is dependent on the availability of high-performance materials like fiberglass, electrostatic filters, and antimicrobial coatings which it may source directly from manufacturers.

Trade issues can disrupt supply and material shortages can push out suppliers. All this leads to delays in filter replacement or maintenance which can potentially affect food safety. Moreover, operational costs can still be incurring.

High-performance filtration systems that consume a lot of energy lead to an increase in utility bills along with frequent filter replacements that result in longer-term costs. Meanwhile, small and average-sized food processors get into difficulties in maintaining a balance between cost efficiency and regulatory compliance, thus harming their involvement in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| The USA | 8.0% |

| China | 4.0% |

| India | 10.7% |

| The UK | 4.8% |

| Germany | 5.5% |

FMI is of the opinion that the USA dominates the global food and beverages air filtration market, with an estimated volume of about USD 258.5 million in 2025. The market will grow at a CAGR of 8.0% between 2025 and 2035 based on stringent food safety regulations and emphasis on food hygiene while processing.

The growing demand for processed and packaged foods has driven the demand for sophisticated air filtration systems to avoid contamination and ensure product quality. Companies are developing energy-efficient, high-performance filtration solutions to meet the needs of industries. IoT-enabled smart filtration systems are also picking up, with real-time monitoring and predictive maintenance, optimizing the efficiency of operations.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Strict Regulations | Regulatory authorities enforce tight food safety and sanitation regulations. |

| High Demand for Packaged Foods | Elevated demand for packaged foods due to consumers' liking of convenient, pre-prepared food. |

| Adoption of Advanced Technologies | Advanced filter technologies with live monitoring enhance performance. |

| Focus on Energy Efficiency | Firms manufacture energy-efficient, high-performance filtration systems at affordable costs. |

FMI is of the opinion that China's air filtration industry for food and beverages, which stood at around USD 77.2 million in 2025, is expected to grow at a CAGR of 4.0% during the forecast period. This is because there is fast development in the food processing sector along with increasing awareness among consumers about food safety.

The government initiatives to improve the quality of food force manufacturers to invest in high-end air filtration systems. Local businesses prefer low-cost solutions that are up to global standards in order to build their presence in local and foreign markets. High-efficiency filtration system installation in new plants as well as retrofit installations in old plants have become common practice in order to reduce the risk of contamination and comply with regulatory requirements.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Food Processing Expansion | Increased industrialization increases the demand for filtration systems. |

| Government Food Safety Regulation | Stringent norms compel businesses to implement superior filtration. |

| Low-Cost Solutions | Locally established manufacturers produce cost-efficient, superior technologies. |

| Emerging Export Market | Conformance to global standards enhances foreign trade. |

India's food and beverage air filtration industry at USD 39.2 million in 2025 is expected to increase at a strong CAGR of 10.7% by 2035. Urbanization, the rising middle class, and the processed food culture are driving demand for effective air filtration systems.

The Food Safety and Standards Authority of India (FSSAI) has imposed more regulations, which are forcing manufacturers to improve air filtration units. The industry is also looking at low-cost, environment-friendly alternatives as a way of addressing a price-sensitive industry while still achieving high levels of hygiene.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Urbanization Growth | The growing need for processed food makes better filtration a requirement. |

| Regulatory Compliance | FSSAI requires stricter food safety and hygiene standards. |

| Adoption of Advanced Filtration | HEPA filtration and UV germicidal systems provide food safety. |

| Sustainability Emphasis | Sustainable and cost-effective solutions are gaining popularity. |

Growing health awareness, strict regulations, and more automation in food processing influence the UK air filtration industry for the food and beverage industry. With a growth rate of 4.8% CAGR, the industry is driven by technological advancements in air filtration technology and the application of intelligent monitoring systems.

Organizations are spending on high-efficiency particulate air (HEPA) filters and electrostatic precipitators to improve sanitation and industry standards for supply. Additionally, more focus on cutting airborne contaminants within food production units favors the demand for better filtration solutions.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Tough Food Safety Rules | Tough rules guarantee good levels of cleanliness. |

| Automation of Processes | High-tech equipment necessitates improved air filtering. |

| Embracing Intelligent Monitoring | Real-time monitoring enhances filtration effectiveness. |

| Healthy Conscious Consumers | The demand for safer foodstuffs drives investment infiltration. |

FMI is of the opinion that the German food and beverage air filtration industry, at a CAGR of 5.5%, is driven by technology advancement and sustainability programs. The nation's focus on energy-efficient technologies and adherence to EU food safety regulations allows for ongoing innovation in filtration technology.

Businesses are adding HEPA and activated carbon filters to capture particulates and odors and maintain high levels of food processing standards. Smart factory and Industry 4.0 growth also drives the implementation of smart air filtration systems.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| EU Compliance | Stringent regulations drive the adoption of advanced filtration. |

| Technology Developments | Resource-saving, high-performance systems become available. |

| Smart Factory Integration | Industry 4.0 enables automated air quality monitoring. |

| Sustainability Targets | Eco-friendly filtration solutions gain traction. |

| Segment | Value Share (2025) |

|---|---|

| HEPA and ULPA (By Filter Types) | 38.2% |

By 2025, the total share of the industry will be 38.2% for HEPA and ULPA Filters. These filters are capable of removing over 99.9995% of 0.1-micron or larger particles from the air stream and are used in both dairy processing and manufacturing facilities where food safety in the form of airborne particles can threaten the shelf life of products, as well as in meat processing and bakery operations.

High-Efficiency Particulate Air (HEPA) and Ultra Low Penetrating Air (ULPA) are also driven by stringent mandated air quality imposed by respective regulatory bodies like FDA, USDA, and EFSA. In light of these operational challenges, major filtration players such as Camfil and Donaldson are designing energy-saving HEPA filtration systems that reduce running costs with optimal air cleanliness.

In contrast, cassette filters are essential for pre-filtration and air purification, such as in food processing. They don’t filter at the same ultra-fine particle level that HEPA and ULPA systems do, but they do a good job of capturing larger particulates such as dust, mold spores, and grease, so they can be employed in ventilation systems, HVAC units, and industrial kitchens. Due to their low cost, ease of maintenance, and adaptability in multi-stage filtration setups, they have become a staple in complete air quality management solutions.

Food manufacturers are concentrating increasingly on clean labelling and contamination prevention, so HEPA and ULPA filters will remain prominent in high-risk processing areas, and cassette filters will be an important space for more general air quality control in lower-risk areas of the pouring line.

| Segment | Value Share (2025) |

|---|---|

| Dairy Industry (By End-Use) | 24.5% |

In the food and beverage air filtration industry, which is anticipated to be running more than 25% of the share by 2025, we see the largest end-use sector, which is the dairy sector. Severe air filtration is essential to prevent airborne contamination from bacteria, mold, and yeast that can negatively impact product safety and shelf life.

The growing preference for long-shelf-life dairy products, including UHT milk, yogurt, and cheese, is driving manufacturers to install HEPA and ULPA filtration systems in order to create a sterile environment. Such as high-efficiency air filtration by Nestlé and Danone to accommodate food safety regulations by the FDA, USDA, and EU.

Another factor inspiring investment in cross-contamination prevention tech is the boom in plant-based dairy, such as oats and almond milk. In addition to ensuring that the air does not go rancid at micro levels, air filtration solutions are crucial in maintaining the consistency of essential ingredients, preventing pesticides, etc.

All these factors contribute to the impending to reduce the shelf-life of the products manufactured, leading to the bakery & cereals segment, yet another end-use segment that plays a crucial role in carrying forward this industry. Flour dust, yeast spores, and allergens are among many concerns that filtration systems serve in large-scale bakery operations.

As gluten-free, organic, and clean-label baked goods continue to grow in popularity, manufacturers have turned to high-tech air purification systems to keep their products from coming into contact with one another at the bakery, said the vendors who supply those systems. Cassette and HEPA filters used by brands such as Mondelēz International and Grupo Bimbo keep their production lines in a dirt- and germ-free, hygienic processing environment.

Food and beverage air filtration is still growing very fast because of strict food safety regulations, increased hygiene concerns coupled with heightened production for contamination-free environments. Increased investments in high-efficiency particulate air (HEPA) filters, ultra-low penetration air (ULPA) filters, and the newest antimicrobial filtration technology are being injected into the industry to operate within the invested and set standards legally.

Leading players such as Camfil Group, Donaldson Company, Freudenberg Filtration Technologies, Pall Corporation, and Parker-Hannifin Corporation dominate the industry with comprehensive product portfolios and customized filtration solutions for food processing, dairy, beverage production, and packaging environments. The middle and new companies are taking an interest in creating innovative and cost-effective filtration systems and energy-efficient products that comply with requirements that provide an added share.

Industry evolution is driven by improvements in nanofiber filtration, smart air quality monitoring, and sustainable filter materials. Further, automation and IoT-enabled air filtration systems are beginning to penetrate, offering real-time monitoring and predictive maintenance within manufacturing establishments.

Of the factors that impact competition, ones that tend to have an advantage include regional extension, possible adherence to changing standards in food safety legislation (e.g., FSMA and HACCP), and developments of eco-friendly, washable, and reusable filtration solutions. As the food and beverage industry shifts towards clean-label production and contamination control, the companies investing in cutting-edge air filtration technologies as well as sustainability and digital monitoring capabilities will effectively be left leading the pack in such dynamic competition.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Camfil Group | 18-22% |

| Donaldson Company, Inc. | 15-18% |

| Freudenberg Filtration Technologies | 12-16% |

| Pall Corporation | 10-14% |

| Parker-Hannifin Corporation | 8-12% |

| Other Players | 30-40% |

| Company Name | Key Offerings & Industry Focus |

|---|---|

| Camfil Group | Specializes in high-efficiency air filters (HEPA, ULPA) and energy-efficient solutions for food safety compliance. |

| Donaldson Company, Inc. | Focuses on dust, fume, and mist collection systems to improve air quality in food processing plants. |

| Freudenberg Filtration Technologies | Provides custom-engineered air filtration systems with sustainability-focused innovations. |

| Pall Corporation | Offers advanced membrane filtration solutions for air purity in sensitive food processing areas. |

| Parker-Hannifin Corporation | Develops compressed air and gas filtration systems to prevent contamination in food production. |

Key Company Insights

Camfil Group (18-22%)

A global leader in high-performance air filtration, offering sustainable and energy-efficient solutions for food processing facilities.

Donaldson Company, Inc. (15-18)

Focused more on industrial filtration using the most advanced techniques in cloudy data collection and high-airflow efficiency for use by clients from different food and beverage applications.

Freudenberg Filtration Technologies (12-16)

Concentrating on sustainable air filtration materials, specializing in customized air filtration for all food sectors, allowing differentiation capabilities.

Pall Corporation (10-14)

Excellent in air purification using membrane technology, concentrated on controlling microbes and removing airborne particulate from purified air.

Parker-Hannifin Corporation (8-12)

Provides industrial and compressed air filtration to meet regulatory requirements and enhance safety in production lines.

Other Key Players (30-40% Combined)

Industry segmented into HEPA and ULPA filters, cassette filters, compact pocket filters, dust removal filters, honeycomb (HM) module, pleated filters, moisture separators, activated carbon filters.

Industry segmented into dairy, bakery/cereals, RTE/chilled foods, meat processing, non-alcoholic beverage, wine, beer, cider, distilled spirits, confectionery, cannabis, food ingredients.

Industry segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic countries, Russia and Belarus, and the Middle East & Africa.

The global food and beverage air filtration industry is projected to expand at a CAGR of 8.2% during the forecast period from 2025 to 2035.

By 2035, the industry is expected to surpass a valuation of approximately USD 3,697.3 million, driven by stringent food safety regulations and increasing demand for contamination-free food production environments.

Among the various segments, HEPA and ULPA filters are expected to witness the highest growth due to their superior efficiency in removing airborne contaminants, ensuring compliance with food safety standards.

The industry is primarily driven by increasing food safety regulations, rising demand for minimally processed and allergen-free food, advancements in air filtration technologies, and the integration of IoT-enabled smart filtration systems in food production facilities.

Leading companies in this industry include 3M Company, Camfil Group, Donaldson Company, Inc., Freudenberg Filtration Technologies, Pall Corporation, and Parker-Hannifin Corporation.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Filter Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Filter Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Filter Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Filter Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Filter Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Filter Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Filter Type, 2018 to 2033

Table 22: Europe Market Volume (Units) Forecast by Filter Type, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Filter Type, 2018 to 2033

Table 28: Asia Pacific Market Volume (Units) Forecast by Filter Type, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 30: Asia Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Filter Type, 2018 to 2033

Table 34: MEA Market Volume (Units) Forecast by Filter Type, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 36: MEA Market Volume (Units) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Filter Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Filter Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Filter Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Filter Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Filter Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 16: Global Market Attractiveness by Filter Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End Use, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Filter Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Filter Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Filter Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Filter Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Filter Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 34: North America Market Attractiveness by Filter Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End Use, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Filter Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Filter Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Filter Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Filter Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Filter Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Filter Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Filter Type, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Filter Type, 2018 to 2033

Figure 63: Europe Market Volume (Units) Analysis by Filter Type, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Filter Type, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Filter Type, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 67: Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 70: Europe Market Attractiveness by Filter Type, 2023 to 2033

Figure 71: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Filter Type, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Filter Type, 2018 to 2033

Figure 81: Asia Pacific Market Volume (Units) Analysis by Filter Type, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Filter Type, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Filter Type, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 85: Asia Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Filter Type, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Filter Type, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by End Use, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Filter Type, 2018 to 2033

Figure 99: MEA Market Volume (Units) Analysis by Filter Type, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Filter Type, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Filter Type, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 103: MEA Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 106: MEA Market Attractiveness by Filter Type, 2023 to 2033

Figure 107: MEA Market Attractiveness by End Use, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Food Can Coatings Market Size and Share Forecast Outlook 2025 to 2035

Food Fortifying Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA