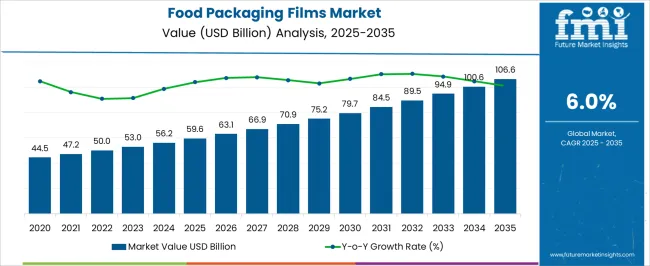

The food packaging films market is projected to grow from USD 59.6 billion in 2025 to USD 106.6 billion in 2035, reflecting a CAGR of 6.0%. During the early adoption phase (2020–2024), the market was gradually expanded from USD 44.5 billion to USD 59.6 billion as innovative packaging solutions were introduced and tested by manufacturers. Pilot applications were deployed to evaluate performance, shelf-life extension, and product protection.

By 2025, the market had reached USD 59.6 billion, and broader incorporation into food and beverage products was observed. Acceptance by retailers and distributors was encouraged through demonstration of efficiency and cost-effectiveness. From 2025 to 2035, the market was observed to transition through scaling (2025–2030) and consolidation (2030–2035). By 2030, the market was expected to surpass USD 75.2 billion, driven by wider implementation across packaged food categories and expansion of production capacities. During the consolidation phase, growth was moderated toward USD 106.6 billion by 2035 as leading suppliers consolidated their presence and smaller players were either aligned or exited the market. The 6.0% CAGR indicated steady expansion, and the market was established as a standard solution for food protection, storage efficiency, and distribution reliability across multiple segments.

| Metric | Value |

|---|---|

| Food Packaging Films Market Estimated Value in (2025 E) | USD 59.6 billion |

| Food Packaging Films Market Forecast Value in (2035 F) | USD 106.6 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The food packaging films market is influenced by several parent markets, each contributing to overall growth. The global packaged food industry is estimated to drive approximately 30%, as demand for ready-to-eat and processed foods is supported through packaging solutions. The flexible packaging segment is considered responsible for 20%, as films are increasingly adopted for wraps, pouches, and multilayer packaging. The polymer and resin production sector is estimated to account for 15%, as raw materials are supplied for film manufacturing.

Printing and labeling services are assessed to influence 10%, as branded packaging and consumer information are incorporated. The cold chain and refrigeration logistics market contributes around 8%, as films are used to maintain product integrity during transport. Retail and distribution channels are evaluated at 7%, as products are merchandised and made accessible to consumers. Food safety and quality monitoring services account for 5%, as films are designed to meet regulatory and quality standards. Machinery and processing equipment are estimated at 5%, as equipment is utilized for film production, coating, and finishing.

The Food Packaging Films market is experiencing robust growth driven by increasing demand for convenience foods, processed snacks, and packaged products across both developed and emerging markets. The market is being influenced by rising consumer awareness regarding product hygiene, shelf life, and food safety. Innovations in flexible and functional packaging solutions are enabling manufacturers to provide lightweight, durable, and sustainable packaging options while maintaining product quality.

The future outlook of this market is shaped by regulatory focus on food contact safety, evolving retail trends, and the rising adoption of automated and smart packaging lines. Growing e-commerce and home delivery services have also accelerated the need for protective and tamper-evident films.

Environmental sustainability initiatives are pushing the development of recyclable and biodegradable materials, which are expected to support long-term market expansion As demand for convenience and packaged foods increases globally, the Food Packaging Films market is anticipated to grow steadily, driven by a combination of material innovation, regulatory compliance, and evolving consumer preferences for safe and durable packaging.

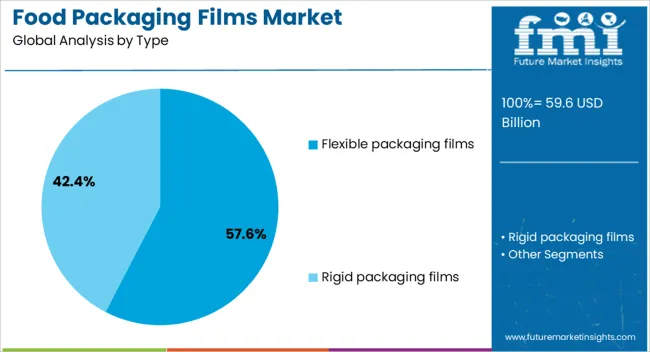

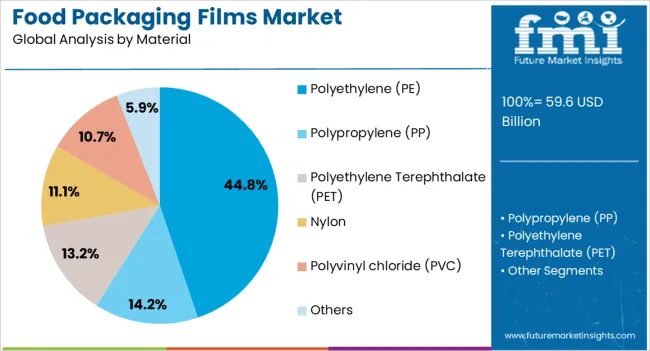

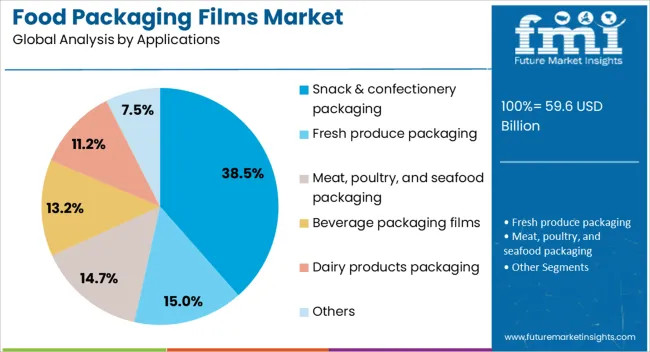

The food packaging films market is segmented by type, material, applications, and geographic regions. By type, food packaging films market is divided into Flexible packaging films and Rigid packaging films. In terms of material, food packaging films market is classified into Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), Nylon, Polyvinyl chloride (PVC), and Others. Based on applications, food packaging films market is segmented into Snack & confectionery packaging, Fresh produce packaging, Meat, poultry, and seafood packaging, Beverage packaging films, Dairy products packaging, and Others. Regionally, the food packaging films industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Flexible packaging films are projected to hold 57.6% of the Food Packaging Films market revenue share in 2025, making them the leading type in the market. This dominance is attributed to their versatility, lightweight nature, and cost-effectiveness, which allow them to be used across a wide variety of food products. The growth of this segment has been supported by the increasing demand for convenience foods, ready-to-eat meals, and retail-ready packaging formats.

Flexible films provide extended shelf life and high barrier properties against moisture, oxygen, and light, which are critical for maintaining food quality. The ability to customize films with printing, lamination, and barrier coatings has further enhanced their appeal to food manufacturers seeking differentiated packaging solutions.

Additionally, the ease of handling and compatibility with automated packaging machinery has encouraged large-scale adoption With rising consumer preference for on-the-go and portion-controlled packaging, flexible packaging films are expected to maintain their leading position, driven by continuous innovation and alignment with sustainability goals.

Polyethylene material is expected to account for 44.8% of the Food Packaging Films market revenue share in 2025, establishing it as the dominant material type. The growth of this segment is being supported by its favorable combination of mechanical strength, flexibility, moisture resistance, and cost-efficiency. Polyethylene films are widely used in applications where lightweight and protective packaging is critical, allowing manufacturers to reduce material costs while ensuring food safety.

Its adaptability to extrusion, lamination, and printing processes makes it suitable for high-volume production and various packaging formats. The material’s compatibility with recycling initiatives and ongoing development of high-performance variants has reinforced its market position.

Furthermore, polyethylene films provide consistent barrier properties essential for maintaining product freshness, particularly for perishable items As the food industry continues to prioritize safe, efficient, and sustainable packaging solutions, polyethylene is expected to sustain its leadership in the market, offering manufacturers both reliability and versatility in meeting regulatory and consumer demands.

The Snack and Confectionery Packaging application segment is projected to hold 38.5% of the Food Packaging Films market revenue share in 2025, making it the largest application area. This dominance is being driven by the rapid growth of the global snack and confectionery industry and rising consumer demand for convenient, ready-to-eat, and individually portioned products. Packaging films in this segment provide critical protection against moisture, oxygen, and light, ensuring product quality and shelf stability.

The increasing use of printed and laminated films enables brand differentiation, product visibility, and promotional marketing, which are important for consumer engagement. Growth has also been reinforced by the adoption of automated packaging lines and high-speed production, where films with superior strength and flexibility are preferred.

Additionally, rising health-conscious trends and the demand for smaller, portion-controlled snack packs have encouraged innovation in flexible packaging As manufacturers continue to focus on attractive, sustainable, and protective packaging solutions, the Snack and Confectionery Packaging segment is expected to remain the leading application in the market.

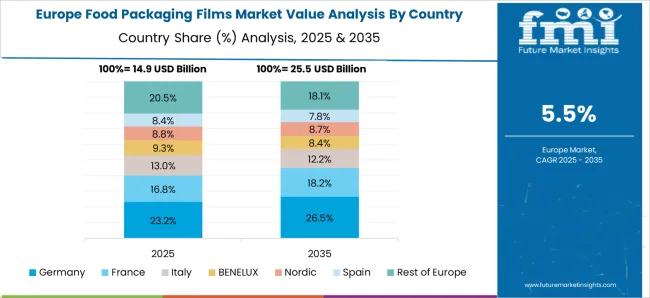

The food packaging films market is growing due to rising demand for extended shelf life, convenience, and safety in packaged food. North America and Europe lead with high-performance films for frozen, processed, and ready-to-eat foods, emphasizing barrier properties, clarity, and durability. Asia-Pacific shows rapid growth driven by packaged food consumption, modern retail expansion, and e-commerce growth. Manufacturers differentiate through multilayer structures, biodegradable films, functional coatings, and printability. Regional variations in regulations, consumer preferences, and supply chain infrastructure influence adoption, product development, and competitive positioning globally.

Barrier performance and shelf-life extension are key factors for food packaging film adoption. North America and Europe emphasize high-barrier films that protect against oxygen, moisture, and light, preserving product freshness for frozen, processed, and perishable foods. Asia-Pacific adoption is rising for both barrier and cost-effective films in retail and e-commerce packaging. Differences in barrier efficiency affect product durability, spoilage rates, and consumer satisfaction. Leading suppliers provide multilayer films with superior gas, moisture, and aroma barriers for premium applications, while regional producers focus on affordable, functional solutions. Barrier property contrasts directly influence adoption, product reliability, and competitive positioning across global food packaging sectors.

Advancements in film materials and functional coatings enhance performance, printability, and sustainability. Europe and North America prioritize multilayer films, metallized layers, and coatings for high-end packaging, enabling heat resistance, anti-fog, and antimicrobial properties. Asia-Pacific markets increasingly adopt functional films for retail-ready and ready-to-eat products, balancing cost with usability. Differences in material innovation impact production efficiency, packaging aesthetics, and consumer acceptance. Premium suppliers invest in proprietary coatings, functional additives, and high-quality polymers, while regional producers offer versatile, affordable materials. Material and coating contrasts shape adoption, application diversity, and competitive differentiation in the global food packaging films market.

Food safety, regulatory approvals, and labeling compliance are critical for film adoption. Europe and North America enforce stringent FDA, EU, and ISO standards for migration, recyclability, and food-contact safety, influencing production and certification. Asia-Pacific exhibits varied regulatory frameworks; developed regions align with global standards, while emerging markets emphasize basic compliance and cost efficiency. Differences in regulatory adherence affect product acceptance, export potential, and brand credibility. Suppliers providing certified, food-safe films gain adoption in high-end applications, while regional producers focus on locally approved, cost-effective solutions. Regulatory contrasts shape market penetration, product trust, and competitiveness across global food packaging film markets.

Consumers and businesses increasingly value recyclable and eco-friendly food packaging films. Europe and North America prioritize recyclable, compostable, and reduced-plastic films for sustainable packaging initiatives and corporate responsibility. Asia-Pacific adoption is growing, with cost-effective recyclable films used in mass-market packaged foods and retail-ready formats. Differences in sustainability adoption affect brand perception, compliance with environmental regulations, and corporate partnerships. Leading suppliers invest in biodegradable polymers, multilayer recyclable solutions, and post-consumer recycling infrastructure, while regional manufacturers provide functional, low-cost alternatives. Sustainability contrasts shape adoption, consumer trust, and strategic positioning in global food packaging films markets.

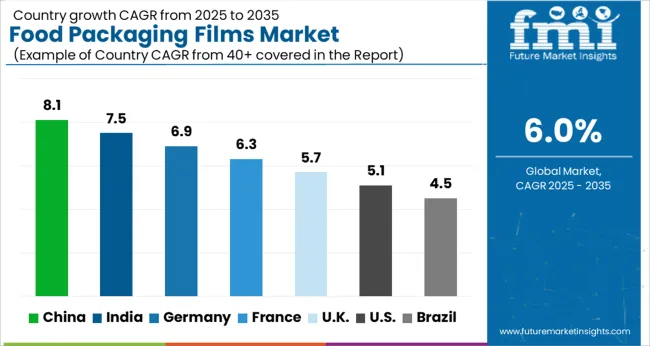

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The global food packaging films market was projected to grow at a 6.0% CAGR through 2035, driven by demand in packaged food, beverages, and perishable goods applications. Among BRICS nations, China recorded 8.1% growth as large-scale manufacturing and processing facilities were commissioned and compliance with industrial and food safety standards was enforced, while India at 7.5% growth saw expansion of production units to meet rising regional demand. In the OECD region, Germany at 6.9% maintained substantial output under strict industrial and regulatory frameworks, while the United Kingdom at 5.7% relied on moderate-scale operations for food and beverage packaging applications. The USA, expanding at 5.1%, remained a mature market with steady demand across commercial, retail, and industrial packaging segments, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The food packaging films market in China is being driven at a CAGR of 8.1% due to rising demand from the processed and ready-to-eat food sectors. Flexible films, barrier films, and biodegradable solutions are being adopted to enhance shelf life, food safety, and product appeal. Manufacturers are being encouraged to produce high quality, durable, and functional packaging films to meet industrial and retail requirements. Distribution through packaging suppliers, supermarkets, and e-commerce platforms is being maintained. Government guidelines on food safety and packaging standards are being followed strictly. Research and development in barrier properties, material strength, and eco-friendly alternatives is being undertaken to support market growth. Urban population growth and increasing consumption of packaged foods are being considered key factors driving adoption of food packaging films in China.

In India, the food packaging films market is being expanded at a CAGR of 7.5% as demand for packaged and ready-to-eat foods rises. Films such as flexible, laminated, and barrier types are being adopted to enhance product safety, freshness, and convenience. Manufacturers are being encouraged to produce high quality and cost-effective solutions suitable for various food products. Distribution through packaging suppliers, retail chains, and e-commerce platforms is being ensured. Government regulations on food safety and packaging compliance are being followed. Awareness campaigns for hygiene and quality packaging are being conducted by industry associations. Rising consumption of packaged foods in urban areas, coupled with increasing retail penetration, is being considered a primary driver for market growth in India.

Food packaging films market in Germany is being driven at a CAGR of 6.9% due to increasing demand for functional, safe, and sustainable packaging in the food sector. Flexible films, laminated solutions, and barrier packaging are being utilized to extend shelf life and maintain food quality. Manufacturers are being encouraged to produce high performance and eco-friendly materials. Distribution through specialized packaging suppliers and retail chains is being ensured. Research in material durability, barrier efficiency, and recyclability is being conducted to improve product performance. Consumers’ preference for packaged convenience foods and strict food safety standards are being considered key growth factors. German food processing and retail companies are adopting modern packaging films to meet regulatory and consumer expectations.

The United Kingdom food packaging films market is being expanded at a CAGR of 5.7% as demand for packaged foods and convenience products continues to rise. Flexible, laminated, and barrier films are being used to maintain product quality, extend shelf life, and improve food safety. Manufacturers are being focused on producing durable, compliant, and functional packaging solutions. Distribution through retail chains, supermarkets, and online platforms is being ensured. Food safety regulations and industry standards are being followed to ensure compliance. Consumer interest in packaged convenience foods, combined with awareness about quality and hygiene, is being considered a key factor driving market growth. Research into recyclable and sustainable film materials is being undertaken to meet changing consumer expectations.

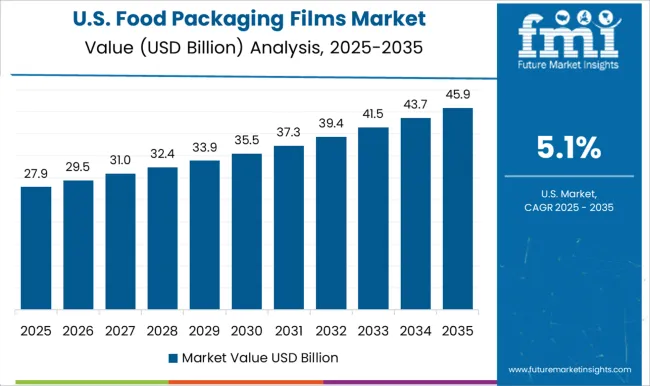

The United States food packaging films market is being driven at a CAGR of 5.1% by growing demand for processed, ready-to-eat, and frozen foods. Food packaging films such as barrier, flexible, and laminated types are being used to maintain freshness, improve shelf life, and ensure safety. Manufacturers are being encouraged to provide high quality, durable, and functional packaging solutions. Distribution through retail chains, food service suppliers, and e-commerce platforms is being maintained. Government regulations and food safety standards are being adhered to. Research and development in advanced materials, barrier efficiency, and environmentally friendly alternatives is being undertaken. Rising consumption of packaged foods and consumer preference for convenience are being considered key growth drivers in the United States.

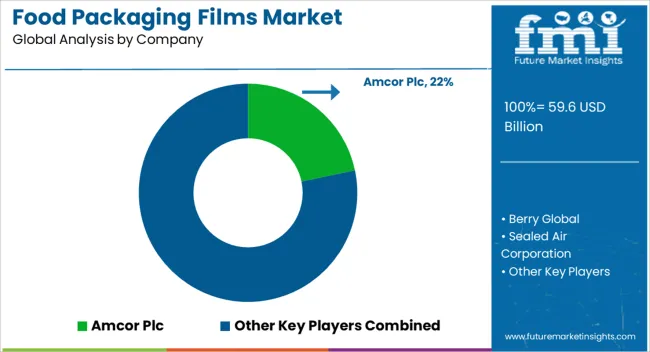

The food packaging films market is characterized by the production and supply of high-performance films that ensure food safety, extend shelf life, and maintain product quality during storage and transportation. Key suppliers in this market are Amcor Plc, Berry Global, Sealed Air Corporation, Mondi Group, Winpak Holdings Inc., Toppan Printing Co., Ltd., and Dupont Teijin Films. A wide range of materials, including polyethylene, polypropylene, polyester, and multilayer films, is manufactured by these companies to meet the diverse packaging requirements of the food industry. Advanced barrier films, flexible packaging solutions, and sustainable alternatives are provided by Amcor Plc and Berry Global, where emphasis is placed on environmental compliance, recyclability, and maintaining the integrity of perishable products. High-performance protective films and specialty packaging materials are produced by Sealed Air Corporation and Mondi Group, ensuring that the packaged food remains fresh and contamination-free. Innovations in biodegradable and compostable films are also being introduced to meet the growing demand for sustainable packaging solutions. Specialty films for high-speed automated packaging lines, retort pouches, and microwave-safe applications are offered by Winpak Holdings Inc., Toppan Printing Co., Ltd., and Dupont Teijin Films. Market expansion is driven by increasing consumer demand for convenience foods, e-commerce food delivery, and processed food products worldwide. Continuous research and development efforts are made by these leading suppliers to improve barrier properties, durability, and eco-friendly characteristics of packaging films. Quality control, compliance with international food safety standards, and global distribution networks are leveraged by these companies to strengthen their position in the competitive food packaging films market.

| Item | Value |

|---|---|

| Quantitative Units | USD 59.6 Billion |

| Type | Flexible packaging films and Rigid packaging films |

| Material | Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), Nylon, Polyvinyl chloride (PVC), and Others |

| Applications | Snack & confectionery packaging, Fresh produce packaging, Meat, poultry, and seafood packaging, Beverage packaging films, Dairy products packaging, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amcor Plc, Berry Global, Sealed Air Corporation, Mondi Group, Winpak Holdings Inc., Toppan Printing Co., Ltd., and Dupont Teijin Films |

| Additional Attributes | Dollar sales vary by film type, including polyethylene, polypropylene, PET, and multilayer films; by application, such as fresh food packaging, frozen food, dairy products, and ready-to-eat meals; by end-use industry, spanning food & beverages, retail, and logistics; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for convenience foods, sustainability initiatives, and food safety regulations. |

The global food packaging films market is estimated to be valued at USD 59.6 billion in 2025.

The market size for the food packaging films market is projected to reach USD 106.6 billion by 2035.

The food packaging films market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in food packaging films market are flexible packaging films and rigid packaging films.

In terms of material, polyethylene (pe) segment to command 44.8% share in the food packaging films market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Food Can Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA