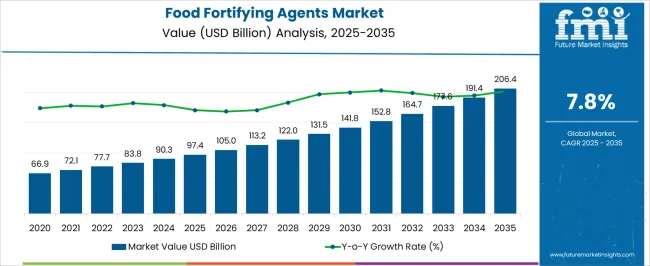

The food fortifying agents market is estimated to be valued at USD 97.4 billion in 2025 and is projected to reach USD 206.4 billion by 2035, registering a compound annual growth rate (CAGR) of 7.8% over the forecast period.

The food fortifying agents market is valued at USD 97.4 billion in 2025 and is expected to reach USD 206.4 billion by 2035, with a CAGR of 7.8%. From 2021 to 2025, the market grows from USD 66.9 billion to USD 97.4 billion, passing through values of USD 72.1 billion, 77.7 billion, 83.8 billion, and 90.3 billion. This initial phase sees steady growth driven by rising awareness about the importance of fortified foods for health and nutrition. The increasing adoption of fortifying agents, such as vitamins and minerals, in processed foods, dairy, beverages, and infant nutrition contributes significantly to this phase.

Between 2026 and 2030, the market accelerates, moving from USD 97.4 billion to USD 141.8 billion, with intermediate values of USD 105.0 billion, 113.2 billion, and 122.0 billion. This period is marked by heightened consumer demand for functional foods that support immune health, energy, and overall wellness, driving both volume and price growth. As manufacturers focus on developing more specialized fortifying agents to cater to specific health needs, price growth contributes to a higher market share.

From 2031 to 2035, the market reaches USD 206.4 billion, with values passing through USD 152.8 billion, 164.7 billion, 177.6 billion, and 191.4 billion.

| Metric | Value |

|---|---|

| Food Fortifying Agents Market Estimated Value in (2025 E) | USD 97.4 billion |

| Food Fortifying Agents Market Forecast Value in (2035 F) | USD 206.4 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

The food and beverage market is the largest contributor, accounting for approximately 40-45%, as food fortifying agents are widely used in foods and beverages to enhance their nutritional value. The rising demand for functional foods and beverages, driven by consumer awareness of health benefits, is the primary factor propelling growth in this sector. The nutraceuticals market follows with around 20-25%, as fortifying agents are integral to dietary supplements and functional foods that offer enhanced nutritional benefits. The increasing focus on health and wellness among consumers boosts the demand for fortification in these products. The healthcare and pharmaceuticals market contributes about 15-18%, with fortified foods being promoted as part of public health initiatives to address nutrient deficiencies.

The growing emphasis on preventive healthcare drives the need for fortified food products, supporting the market. The food processing market accounts for approximately 12-15%, as manufacturers in the food processing industry use fortifying agents to improve the nutritional content of processed foods, which are consumed in large quantities. Finally, the organic and natural food market contributes around 8-10%, as the growing preference for organic and natural foods increases the demand for fortifying agents that align with these choices, such as plant-based vitamins and minerals.

The food fortifying agents market is advancing steadily, driven by increased global awareness surrounding nutrition deficiencies and the preventative role of fortified foods in public health. Governments and health organizations are supporting fortification initiatives to combat malnutrition and related disorders, especially in developing economies.

The growing demand for functional foods, along with shifting dietary preferences toward proactive wellness, is encouraging food manufacturers to incorporate fortifying agents into a wide range of products. As consumers become more health-conscious and ingredient-aware, there is a heightened focus on fortification strategies that are clean-label, bioavailable, and backed by clinical efficacy.

The future outlook is positive as technological innovations enable better nutrient stability and absorption, and as regulatory frameworks increasingly promote standardized, safe fortification practices across the food and beverage industry

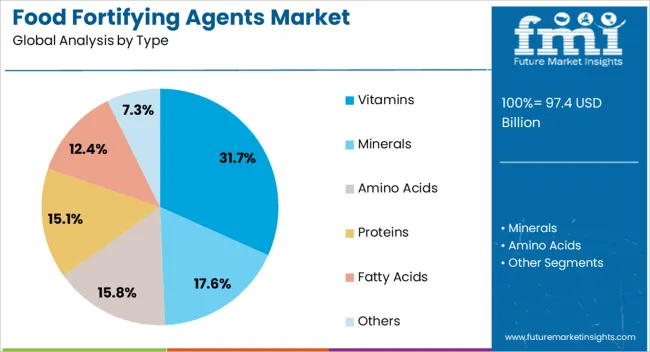

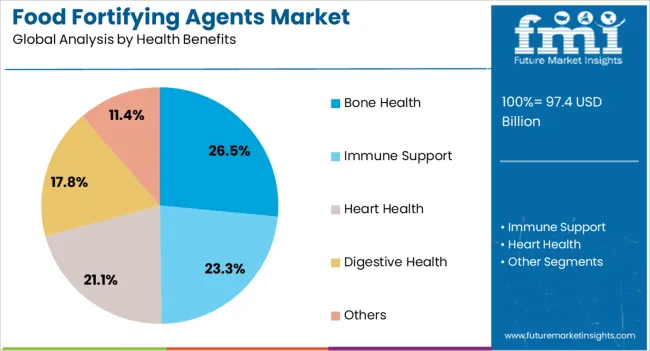

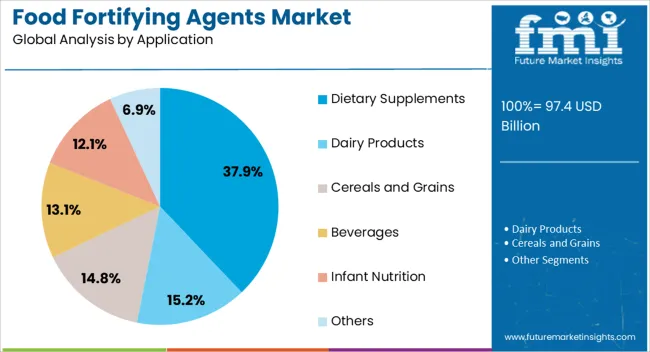

The food fortifying agents market is segmented by type, health benefits, application, and geographic regions. By type, food fortifying agents market is divided into vitamins, minerals, amino acids, proteins, fatty acids, and others. In terms of health benefits, food fortifying agents market is classified into bone health, immune support, heart health, digestive health, and others. Based on application, food fortifying agents market is segmented into dietary supplements, dairy products, cereals and grains, beverages, infant nutrition, and others. Regionally, the food fortifying agents industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The vitamins segment dominates the type category with a 31.7% market share, attributed to its widespread applicability and established role in addressing micronutrient deficiencies. Vitamins are essential for metabolic functions, immune support, and overall vitality, making them a preferred fortifying agent in both staple foods and functional products.

This segment is bolstered by high consumer recognition and acceptance, along with consistent demand from food manufacturers seeking to meet recommended dietary intake standards. Advances in microencapsulation and stability-enhancing technologies have improved the shelf life and efficacy of vitamin-fortified products, widening their application scope.

As health trends evolve, the market for vitamins is expected to retain momentum, supported by ongoing R&D in natural and plant-derived vitamin sources that appeal to clean-label consumers

The bone health segment holds a 26.5% share within the health benefits category, underscoring its significance in addressing aging population needs and preventing musculoskeletal disorders. Fortifying agents targeting bone health, particularly those rich in calcium, vitamin D, and magnesium, are increasingly integrated into dairy products, beverages, and nutritional supplements.

This segment has gained traction amid rising osteoporosis awareness and the growing prevalence of bone-related issues across both developed and emerging markets. Functional foods catering to bone density maintenance and joint health are being actively promoted by healthcare professionals, further driving consumer interest.

The emphasis on preventative care and long-term wellness continues to support demand in this segment, which is expected to expand further with innovations in bioavailable and plant-based fortification solutions

The dietary supplements segment leads the application category with a 37.9% market share, reflecting strong consumer demand for targeted nutrition in convenient formats. Fortifying agents are extensively used in supplement formulations to support various health goals, including immunity, cognition, and metabolic function.

This segment benefits from rising disposable incomes, increased fitness consciousness, and the proliferation of e-commerce platforms offering customized nutrition solutions. Regulatory support for supplement labeling and efficacy claims has enhanced consumer confidence, further boosting market penetration.

Additionally, advancements in delivery formats such as gummies, powders, and functional beverages have expanded the appeal of fortified supplements across age groups. Continued focus on preventive health and lifestyle-driven wellness trends is anticipated to sustain growth in this high-performing application segment

The food fortifying agents market is expanding as consumers increasingly prioritize nutrition and health, driving demand for products that enhance the nutritional profile of food. Fortified foods have become a key solution to combat malnutrition and nutrient deficiencies, particularly in regions where access to diverse food sources is limited. The market is driven by rising awareness about the benefits of fortification, government regulations, and the growing adoption of functional foods. However, challenges such as regulatory compliance, high production costs, and consumer concerns over the safety of synthetic additives can impede market growth. Opportunities lie in the development of natural and organic fortifying agents, along with innovations in food formulations that cater to specific health benefits such as immunity and gut health.

The food fortifying agents market is seeing growth due to increasing consumer awareness of the health benefits of fortified foods. Nutrient fortification helps address deficiencies in vitamins, minerals, and other essential nutrients, particularly in developing regions where dietary restrictions and food insecurity are prevalent. As consumers become more health-conscious, fortified foods such as cereals, dairy, and beverages are being consumed for added nutritional benefits like improved immune function, bone health, and digestion. The rise in demand for functional foods, which offer benefits beyond basic nutrition, is boosting the need for food fortifying agents. This trend is especially evident in infant and pediatric nutrition, where the demand for fortified products is high to support growth and development during critical stages.

The food fortifying agents market faces challenges related to regulatory compliance, cost constraints, and consumer perception. Different countries have varying regulations regarding the use of fortifying agents, which can complicate global market entry for suppliers. Compliance with these diverse standards, especially around labeling and nutrient content, requires significant investment and expertise. Additionally, the use of synthetic additives and fortifying agents can be a point of concern for some consumers, particularly those who prefer natural or organic ingredients. The cost of production can also be a barrier, particularly for small-scale manufacturers, as fortifying agents and raw materials can be expensive. Navigating these challenges while meeting consumer demands for transparency, quality, and affordability will be key to success in the market.

With growing consumer preference for clean-label products and natural ingredients, manufacturers are focusing on the development of plant-based, organic, and non-GMO fortifying agents. Additionally, as interest in specific health benefits such as gut health, immunity, and mental wellness grows, there is increasing demand for fortifying agents that can address these concerns. Fortification with probiotics, prebiotics, and plant-derived vitamins is gaining traction, especially in functional foods. As more consumers seek personalized nutrition solutions, the market for targeted fortification that addresses specific health concerns will continue to expand.

The food fortifying agents market is experiencing trends focused on innovation, transparency, and ingredient sourcing. As consumers become more discerning about the ingredients in their food, manufacturers are increasingly offering transparency regarding the sourcing and quality of fortifying agents. The use of innovative ingredients, such as plant-based proteins, natural antioxidants, and bioavailable vitamins, is driving market differentiation. Furthermore, there is a growing trend towards fortifying products that cater to specific dietary needs, such as vegan, gluten-free, or allergen-free formulations. Brands that can demonstrate transparency in sourcing, product formulations, and safety testing are likely to build strong consumer trust and loyalty.

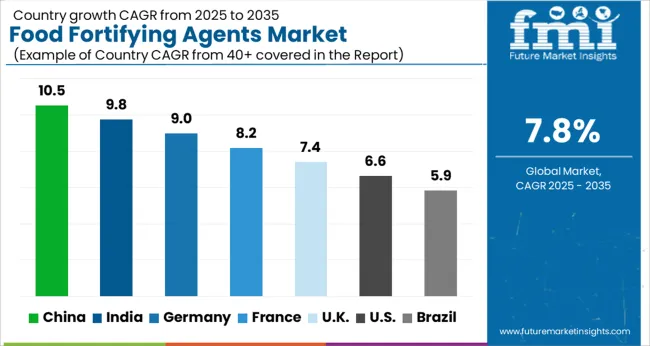

| Country | CAGR |

|---|---|

| China | 10.5% |

| India | 9.8% |

| Germany | 9.0% |

| France | 8.2% |

| UK | 7.4% |

| USA | 6.6% |

| Brazil | 5.9% |

The global food fortifying agents market is expected to grow at a CAGR of 7.8% from 2025 to 2035. China leads with a growth rate of 10.5%, followed by India at 9.8% and Germany at 9.0%. The UK and USA show more moderate growth rates of 7.4% and 6.6%, respectively. The market is being driven by increasing awareness of nutritional deficiencies, government food fortification programs, and rising demand for health-conscious functional foods. As the global population focuses on maintaining better health and wellness, the market for food fortifying agents is set for significant expansion. The analysis includes over 40+ countries, with the leading markets detailed below.

The food fortifying agents market in China is set to grow at a CAGR of 10.5% from 2025 to 2035. The rapid growth is driven by the increasing awareness about nutritional deficiencies and the rising demand for fortified food products. With China’s expanding population and improving economic conditions, there is a higher focus on health and wellness, leading to greater adoption of fortified food and beverages. The government’s initiatives to improve public health through nutrition programs are contributing to the market's growth. As China’s food and beverage industry evolves, food fortifying agents are increasingly used to improve the nutritional profile of processed foods, dairy, and beverages. The trend toward natural and organic ingredients is also pushing the demand for clean-label fortifying agents, which are perceived as healthier alternatives.

The food fortifying agents market in India is projected to grow at a CAGR of 9.8% from 2025 to 2035. The rapid growth in India is attributed to the rising awareness of nutrition, especially among the urban population. With a significant portion of the population facing micronutrient deficiencies, the demand for fortified foods is on the rise. Government-driven initiatives like food fortification programs have spurred the adoption of fortifying agents in staple foods such as flour, rice, and oil. Furthermore, the growing middle class, coupled with changing dietary patterns and increasing disposable income, is driving demand for fortified products in the food and beverage industry. The rise in the number of health-conscious consumers is also pushing the adoption of functional foods that include fortifying agents for better health outcomes.

The food fortifying agents market in Germany is expected to grow at a CAGR of 9.0% from 2025 to 2035. Germany’s food and beverage sector is heavily influenced by consumer demand for high-quality and nutritious products. The growing trend towards healthier eating and preventive healthcare is driving the demand for fortified foods in the country. The increasing aging population in Germany has led to higher demand for fortified foods that provide essential nutrients for better health and aging. Germany’s strong focus on maintaining a healthy diet has led to the rising popularity of functional foods and beverages, which are enhanced with essential nutrients. The German government’s emphasis on food safety and health regulations also plays a role in the market’s growth.

The UK’s food fortifying agents market is projected to grow at a CAGR of 7.4% from 2025 to 2035. The UK market is being driven by a growing demand for functional and fortified foods, particularly among health-conscious consumers. As consumers become more aware of the benefits of fortified foods in maintaining a balanced diet and preventing nutritional deficiencies, the demand for food fortifying agents is on the rise. The government’s support for food fortification programs, particularly for vulnerable groups, is also contributing to the market’s growth. The UK is also witnessing a shift towards plant-based and organic products, which are seeing the incorporation of fortifying agents to enhance their nutritional value.

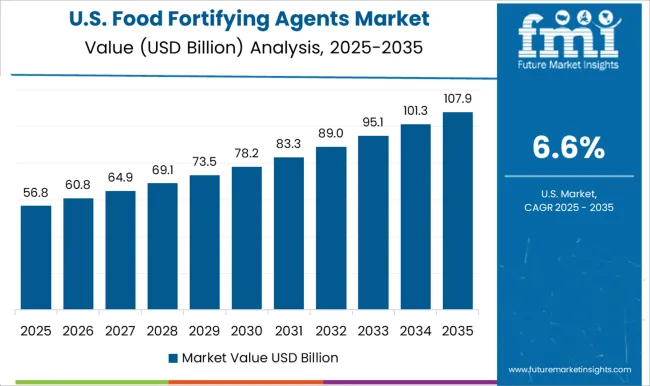

The USA food fortifying agents market is expected to grow at a CAGR of 6.6% from 2025 to 2035. The increasing awareness about diet-related health issues, such as obesity and malnutrition, is driving the demand for fortified foods in the USA Consumers are looking for more convenient, nutritious food options that help maintain a balanced diet, and fortifying agents are key to fulfilling these needs. The rise of functional foods, such as fortified cereals, dairy products, and beverages, is boosting the demand for food fortifying agents. The growing emphasis on preventative healthcare and wellness, coupled with government regulations supporting food fortification, further strengthens market prospects.

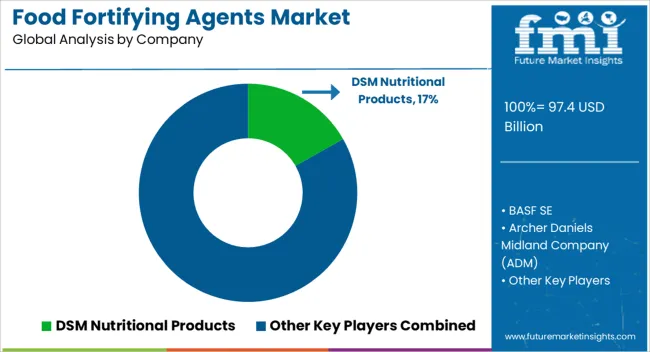

The food fortifying agents market is highly competitive, with leading players focusing on innovation, nutritional enhancement, and expanding their product portfolios to meet growing consumer demand for healthier and more nutrient-rich foods. DSM Nutritional Products is a key player in the market, providing a wide range of fortifying agents, including vitamins, minerals, and probiotics. Their strategy focuses on combining science with nutrition to offer advanced, health-focused solutions for the food and beverage industry.

BASF SE follows closely, offering food fortification solutions designed to enhance the nutritional value of products while meeting regulatory and consumer expectations. They emphasize sustainable sourcing and innovation in nutrient delivery systems. Archer Daniels Midland Company (ADM) and Cargill, Incorporated leverage their extensive networks to offer functional ingredients, including vitamins, minerals, and proteins, for the fortification of food and beverages. ADM focuses on providing nutrient-rich solutions for a variety of food categories, from snacks to beverages, while Cargill emphasizes its global expertise in producing ingredients that support healthier diets.

Ingredion Incorporated, Kerry Group, and Lonza Group offer specialized fortifying agents designed to cater to the increasing demand for plant-based, allergen-free, and functional ingredients. Kerry Group highlights its expertise in taste and nutrition, offering fortifying solutions that enhance flavor and functionality without compromising on health benefits. Tate & Lyle PLC, Glanbia Nutritionals, and Nutra Food Ingredients LLC focus on providing targeted fortification solutions to enhance product appeal and nutritional content. They emphasize clean-label, non-GMO, and natural ingredients in their offerings.

Companies like Watson Inc., SternVitamin GmbH & Co. KG, and Starbest Brands specialize in tailored fortifying solutions, with a focus on product customization to meet specific market needs. Corbion and Barentz provide fortifying agents aimed at boosting health and sustainability in food products, with a particular emphasis on functional benefits. Product brochures from these companies emphasize the health benefits of fortification, focusing on key nutrients like vitamins, minerals, and proteins. They highlight features such as product versatility, taste enhancement, and regulatory compliance, positioning their solutions as essential for companies looking to meet evolving consumer demands for healthier and more nutritious food options.

| Items | Values |

|---|---|

| Quantitative Units | USD 97.4 billion |

| Type | Vitamins, Minerals, Amino Acids, Proteins, Fatty Acids, and Others |

| Health Benefits | Bone Health, Immune Support, Heart Health, Digestive Health, and Others |

| Application | Dietary Supplements, Dairy Products, Cereals and Grains, Beverages, Infant Nutrition, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DSM Nutritional Products, BASF SE, Archer Daniels Midland Company (ADM), Cargill,Incorporated, Ingredion Incorporated, Kerry Group, Lonza Group, Tate & Lyle PLC, Glanbia Nutritionals, Nutra Food Ingredients LLC, Watson Inc., SternVitamin GmbH & Co. KG, Starbest Brands, Corbion, and Barentz |

| Additional Attributes | Dollar sales of fortified foods span vitamins, minerals, amino acids, fibers, and more, applied in bakery, dairy, beverages, meat, and snacks. Growth is fueled by health focus, lifestyle diseases, and regional adoption. |

The global food fortifying agents market is estimated to be valued at USD 97.4 billion in 2025.

The market size for the food fortifying agents market is projected to reach USD 206.4 billion by 2035.

The food fortifying agents market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in food fortifying agents market are vitamins, minerals, amino acids, proteins, fatty acids and others.

In terms of health benefits, bone health segment to command 26.5% share in the food fortifying agents market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA