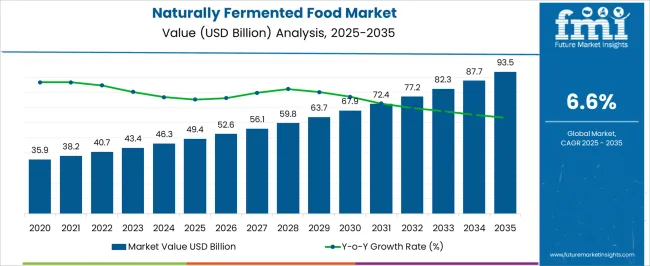

The naturally fermented food market is estimated to be valued at USD 49.4 billion in 2025 and is projected to reach USD 93.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period.

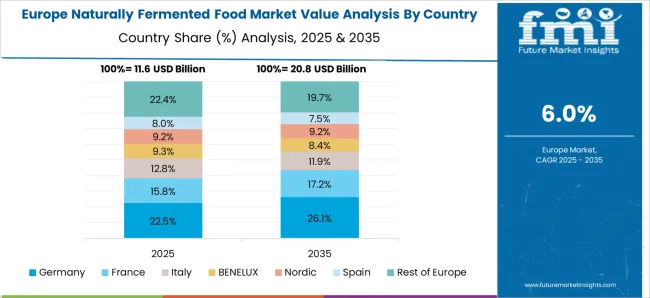

Asia-Pacific emerges as the dominant region due to longstanding culinary traditions that emphasize fermented products, widespread domestic consumption, and a growing retail and e-commerce infrastructure that facilitates distribution. Countries such as China, Japan, and South Korea maintain strong adoption rates for naturally fermented foods, fueled by health-conscious trends and established production networks, resulting in a robust contribution to overall market growth. Europe shows steady expansion with moderate growth, supported by increasing consumer interest in organic, probiotic-rich, and artisanal fermented products. Regulatory frameworks in key markets such as Germany, France, and the United Kingdom ensure product safety and labeling standards, which drive consumer trust but can also limit rapid market penetration due to compliance costs.

North America demonstrates comparatively slower growth, primarily influenced by smaller traditional consumer bases and the need for education regarding fermented food benefits. However, urban centers and health-focused segments contribute to gradual adoption. Asia-Pacific is expected to account for the largest market share, followed by Europe and North America, highlighting an imbalance shaped by cultural acceptance, regulatory environments, and supply chain maturity. This regional disparity underscores the importance of localized strategies for production, marketing, and distribution to optimize market capture.

| Metric | Value |

|---|---|

| Naturally Fermented Food Market Estimated Value in (2025 E) | USD 49.4 billion |

| Naturally Fermented Food Market Forecast Value in (2035 F) | USD 93.5 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The naturally fermented food market is regarded as a niche but expanding segment across multiple food and health industries. It is estimated to hold 6.5% of the functional foods and probiotics market, driven by consumer focus on digestive health and gut microbiome support. In the dairy products sector, a 4.8% share is observed, primarily through yogurt, kefir, and cheese varieties. Packaged foods account for 3.7%, reflecting demand for ready-to-eat fermented products such as pickles, kimchi, and sauces. Fermented beverages contribute 5.1%, including kombucha, kvass, and fermented teas. Health and wellness food products represent 2.9%, highlighting a rising preference for natural, additive-free nutrition solutions.

Recent industry trends have been shaped by technological innovation in fermentation processes, clean label positioning, and functional ingredient inclusion. Groundbreaking developments include precision fermentation for consistent probiotic activity, plant-based fermented foods, and cold-chain enabled distribution to maintain live cultures. Key players have pursued collaborations with research institutions and ingredient suppliers to develop new strains, enhance shelf life, and expand flavor profiles. Strategies include direct-to-consumer offerings, subscription models, and expansion into mass retail channels. Regional growth is led by North America and Europe due to awareness of digestive health, while Asia-Pacific shows increasing adoption driven by traditional fermented foods and growing urban demand. Functional benefits, flavor diversification, and natural processing continue to shape market expansion.

The market is demonstrating strong growth momentum, driven by rising consumer preference for foods that align with health, wellness, and clean-label trends. Growing awareness of the nutritional benefits of probiotics, enzymes, and bioactive compounds produced through natural fermentation is encouraging adoption across diverse demographics. Manufacturers are responding to this shift by innovating product lines, enhancing flavors, and incorporating traditional fermentation techniques with modern quality controls.

The market is further supported by increasing demand for products perceived as minimally processed and free from artificial additives. Rising disposable incomes, expansion of organized retail, and the influence of social media in promoting fermented food health benefits are also contributing to this growth.

Advances in packaging and cold chain logistics have enabled broader product availability while maintaining freshness and quality As consumers seek functional foods to support gut health, immunity, and overall wellness, naturally fermented products are expected to continue experiencing significant growth in both developed and emerging markets.

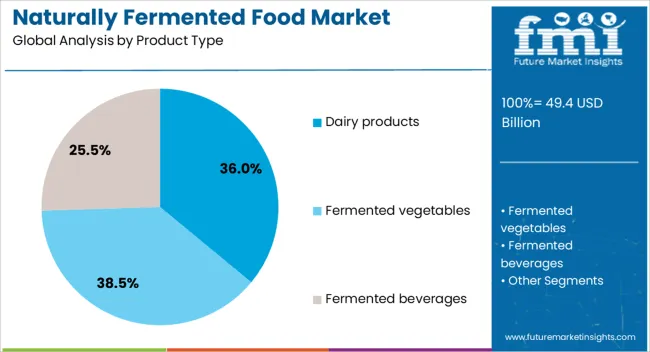

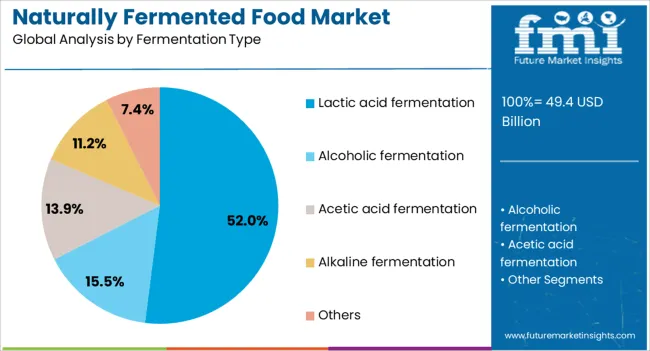

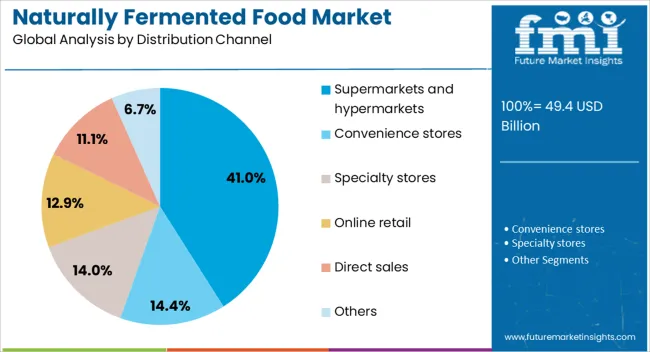

The naturally fermented food market is segmented by product type, fermentation type, distribution channel, and geographic regions. By product type, naturally fermented food market is divided into dairy products, fermented vegetables, fermented beverages, fermented soy products, fermented cereals and grains, fermented meat and fish, and others. In terms of fermentation type, naturally fermented food market is classified into lactic acid fermentation, alcoholic fermentation, acetic acid fermentation, alkaline fermentation, and others. Based on distribution channel, naturally fermented food market is segmented into supermarkets and hypermarkets, convenience stores, specialty stores, online retail, direct sales, and others. Regionally, the naturally fermented food industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The dairy products segment is projected to account for 36% of the naturally fermented food market revenue share in 2025, making it the leading product type. This dominance is being supported by the widespread consumption of fermented dairy items that are rich in probiotics and essential nutrients. The nutritional profile of fermented dairy products, which includes high-quality protein, calcium, and bioactive compounds, has reinforced their role in promoting digestive health and immunity. The segment has also benefitted from the adaptability of dairy products in diverse diets and cultural cuisines, enabling broad market penetration. Advancements in fermentation processes have improved product consistency and shelf life without compromising natural attributes, further enhancing consumer trust. Increased urbanization, expanding cold storage facilities, and targeted marketing campaigns highlighting the health benefits of fermented dairy have strengthened the segment’s growth As global dietary habits increasingly favor functional and nutritious food choices, fermented dairy products are expected to maintain their leading position in the overall market.

The lactic acid fermentation segment is expected to hold 52% of the Naturally Fermented Food market revenue share in 2025, establishing it as the dominant fermentation type. This growth is being driven by the ability of lactic acid fermentation to enhance flavor, texture, and nutritional content while acting as a natural preservative. The process is recognized for producing probiotics and other bioactive compounds that contribute to digestive health and overall wellness, aligning with the rising demand for functional foods. Its compatibility with a wide range of raw materials, including dairy, vegetables, and cereals, has enabled extensive application in multiple product categories. The method’s efficiency in inhibiting spoilage microorganisms without artificial preservatives has further increased its appeal among health-conscious consumers. Technological improvements in controlled fermentation have ensured consistent quality and scalability, supporting industrial adoption With growing global interest in naturally preserved, nutrient-rich foods, lactic acid fermentation is expected to remain a cornerstone in the production of naturally fermented food products.

The supermarkets and hypermarkets segment is projected to represent 41% of the market revenue share in 2025, making it the leading distribution channel. This leadership is being reinforced by the extensive reach and convenience offered by large-format retail outlets, which provide consumers with diverse product selections under one roof. The ability to display a wide variety of naturally fermented foods, including both local and international brands, has increased consumer exposure and trial. Enhanced in-store promotions, sampling activities, and strategic product placements have been instrumental in driving sales in this segment. Supermarkets and hypermarkets also benefit from advanced storage and refrigeration infrastructure, ensuring that fermented products maintain their freshness and quality throughout the supply chain. The trust consumers place in these retail formats for quality assurance and product authenticity has further solidified their dominance As the demand for health-oriented and functional foods continues to grow, supermarkets and hypermarkets are expected to sustain their leading role in the distribution of naturally fermented products.

The market has expanded as consumer awareness of health, taste, and functional benefits of fermented products has increased globally. Foods such as yogurt, kimchi, sauerkraut, kefir, miso, and kombucha have been produced using microbial fermentation processes that enhance nutritional value, preserve shelf life, and develop characteristic flavors. Growth has been driven by rising interest in gut health, probiotics, and clean label products. Production techniques have been optimized for consistency, quality, and safety, while distribution channels including retail, e-commerce, and foodservice have supported broader market penetration.

The naturally fermented food segment has been strongly influenced by increasing awareness of probiotics, digestive wellness, and immune support. Microorganisms such as Lactobacillus and Bifidobacterium have been incorporated to improve gut microbiota balance. Dairy and plant based fermented foods provide vitamins, minerals, and bioactive compounds that support overall health. Demand has been particularly strong among health conscious consumers, families, and aging populations seeking non pharmaceutical ways to maintain wellness. Functional beverages like kombucha and kefir have become mainstream, reflecting a shift toward preventive health practices. The association of fermented foods with improved digestion, immunity, and metabolic support has reinforced adoption across global markets.

Manufacturers have expanded product lines to include diverse flavors, textures, and regional specialties to attract a wider consumer base. Kimchi, sauerkraut, and pickled vegetables are available in traditional, spicy, and fusion variants. Sweet, savory, and carbonated fermented beverages have been introduced to appeal to different taste preferences. Shelf stable and ready to consume formats have enhanced convenience for modern lifestyles. Innovations such as blended dairy alternatives, gluten free fermented snacks, and fruit infused kombucha have targeted niche health and dietary segments. This diversification has increased consumer choice, encouraged trial, and strengthened brand differentiation in a competitive market.

The distribution of naturally fermented foods has been supported by the growth of retail chains, specialty stores, and online platforms. E-commerce has enabled small scale artisanal producers to reach wider audiences, while cold chain logistics have preserved product quality and shelf life. Supermarkets and convenience stores have expanded fermented food sections to include ready to eat and packaged options. Foodservice applications in restaurants, cafes, and health focused eateries have also contributed to visibility and adoption. Accessibility across multiple channels has increased consumption frequency, encouraged experimentation, and reinforced market expansion, particularly in urban centers and health driven communities.

Food safety and quality regulations have played a critical role in shaping naturally fermented food production. Standards related to microbial counts, hygienic processing, labeling, and shelf life testing have been enforced to ensure consumer safety. Hazard analysis and critical control point (HACCP) protocols, along with traceability systems, have been implemented to maintain consistency. Manufacturers have invested in controlled fermentation environments, starter cultures, and process monitoring to reduce contamination risk. Compliance with local and international food safety standards has been necessary to access global markets, while maintaining the authenticity and natural properties of fermentation. These regulatory and safety measures have guided production innovation and fostered consumer trust in the market.

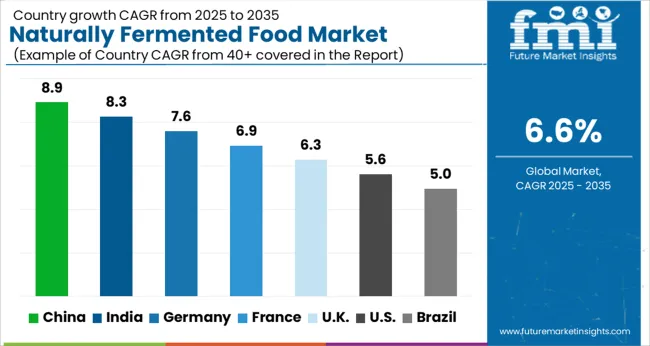

| Country | CAGR |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| France | 6.9% |

| UK | 6.3% |

| USA | 5.6% |

| Brazil | 5.0% |

China led the market with a forecast CAGR of 8.9%, driven by strong domestic consumption, traditional culinary practices, and expansion in commercial fermentation facilities. India followed at 8.3%, supported by growing adoption of probiotic-rich diets and increasing production capabilities in dairy and snack segments. Germany recorded 7.6%, leveraging advanced fermentation technologies and strong demand in the health-focused food sector. The United Kingdom grew at 6.3%, emphasizing innovation in functional foods and artisan fermentation products. The United States registered 5.6%, with growth driven by the rising popularity of fermented beverages and specialty foods. Together, these countries represent the primary regions advancing production, adoption, and innovation in naturally fermented foods. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is witnessing a CAGR of 8.9% in the market, fueled by increasing consumer preference for traditional and health-oriented food products. The rising awareness of probiotics, gut health, and functional foods is driving demand across urban and semi-urban regions. Local food manufacturers are innovating with fermented vegetables, dairy products, and beverages to cater to evolving consumer tastes. The expansion of modern retail channels, e-commerce platforms, and food service segments further enhances accessibility. Government initiatives promoting traditional food practices and safety regulations encourage quality production standards. China’s market for naturally fermented foods continues to grow steadily, supported by cultural acceptance, health-conscious consumer trends, and expanding distribution networks.

India is expanding at a CAGR of 8.3% in the market, driven by increasing awareness of fermented dairy, pickles, and traditional beverages. Rising health consciousness, coupled with cultural preference for naturally prepared foods, supports sustained demand. Local startups and SMEs focus on introducing hygienically prepared, ready-to-eat fermented products for urban consumers. Evolving retail infrastructure, including supermarkets and online grocery platforms, facilitates easy availability. Government campaigns promoting nutrition, food safety, and quality standards encourage the adoption of naturally fermented foods. India presents significant opportunities for manufacturers, leveraging traditional recipes, health-oriented consumption, and an expanding organized retail environment.

Germany is growing at a CAGR of 7.6% in the market, driven by high consumer demand for probiotic products, organic foods, and functional nutrition. Supermarkets and specialty stores are introducing a wide range of fermented dairy, plant-based, and beverage products. Consumers increasingly seek health benefits, taste variety, and certified organic options. Research and development in natural fermentation processes enhance product safety and shelf-life. Regulatory compliance and quality assurance standards ensure consumer trust. Germany presents a mature market with steady growth potential, where innovation, sustainability, and health trends are shaping the naturally fermented food segment.

The United Kingdom is progressing at a CAGR of 6.3% in the market, supported by consumer interest in gut health, artisanal food products, and clean-label ingredients. Local brands focus on fermented vegetables, dairy, and beverages to meet lifestyle and health-conscious demands. Increasing presence of farmers’ markets, health stores, and online retailers enhances accessibility. Sustainability and ethical sourcing influence product development and packaging choices. Government initiatives promoting nutritional awareness and safe food handling further encourage market adoption. The UK market continues to grow steadily, driven by consumer preference for natural, high-quality, and functional fermented foods.

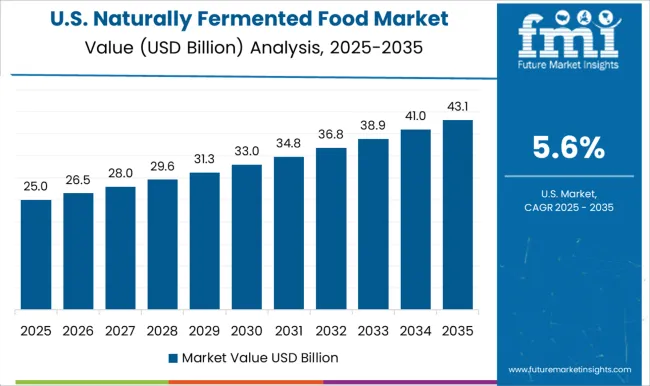

The United States is growing at a CAGR of 5.6% in the market, supported by strong demand for probiotics, health-focused diets, and plant-based fermented products. Consumers are increasingly incorporating fermented foods such as kombucha, kefir, sauerkraut, and kimchi into daily diets for wellness benefits. Organic certifications and non-GMO labeling enhance consumer confidence. Online platforms and retail chains improve product availability across regions. Companies focus on innovative flavors, convenient packaging, and extended shelf-life products to attract urban and health-conscious consumers. The US market presents steady growth opportunities, with health trends, product innovation, and organized retail driving adoption of naturally fermented foods.

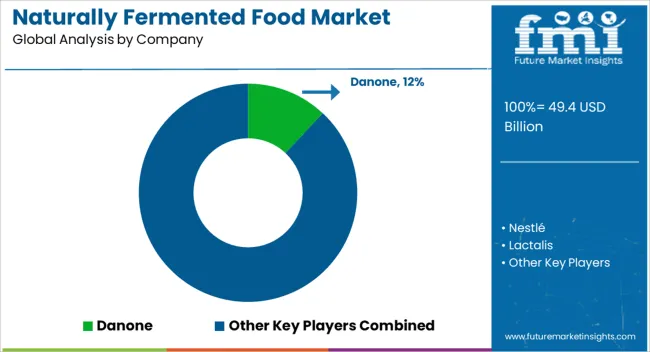

The market is expanding globally due to growing consumer preference for probiotic-rich, gut-friendly, and clean-label foods. Danone stands out as a major player, offering a wide portfolio of yogurts, fermented dairy products, and probiotic beverages designed to improve digestive health and overall wellness. Nestlé contributes with its diverse range of fermented foods and beverages, leveraging research and innovation to enhance flavor profiles, nutritional value, and shelf stability. Lactalis specializes in traditional and artisanal fermented dairy products, combining heritage techniques with modern processing for consistent quality and taste. Yakult Honsha has established a global presence through its probiotic drinks, which are scientifically formulated to support intestinal microbiota and strengthen immunity.

Chobani LLC is renowned for its Greek yogurt products and fermented dairy innovations, emphasizing natural ingredients, minimal additives, and high protein content to cater to health-conscious consumers. Fonterra Co-operative Group focuses on large-scale dairy fermentation, producing a variety of fermented products for both domestic and industrial markets, ensuring sustainability and nutritional integrity. Arla Foods provides an extensive line of fermented dairy products, emphasizing natural fermentation processes and functional benefits such as improved gut health. Collectively, these providers drive market growth through product innovation, strong distribution networks, and a focus on health-oriented consumer trends.

| Item | Value |

|---|---|

| Quantitative Units | USD 49.4 billion |

| Product Type | Dairy products, Fermented vegetables, Fermented beverages, Fermented soy products, Fermented cereals and grains, Fermented meat and fish, and Others |

| Fermentation Type | Lactic acid fermentation, Alcoholic fermentation, Acetic acid fermentation, Alkaline fermentation, and Others |

| Distribution Channel | Supermarkets and hypermarkets, Convenience stores, Specialty stores, Online retail, Direct sales, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Danone, Nestlé, Lactalis, Yakult Honsha, Chobani LLC, Fonterra Co-operative Group, and Arla Foods |

| Additional Attributes | Dollar sales by food type and distribution channel, demand dynamics across retail, foodservice, and health-focused segments, regional trends in fermented food adoption, innovation in probiotic formulations, flavor development, and packaging, environmental impact of production and waste management, and emerging use cases in functional foods and digestive health products. |

The global naturally fermented food market is estimated to be valued at USD 49.4 billion in 2025.

The market size for the naturally fermented food market is projected to reach USD 93.5 billion by 2035.

The naturally fermented food market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in naturally fermented food market are dairy products, yogurt, cheese, kefir, fermented vegetables, kimchi, sauerkraut, and others.

In terms of fermentation type, lactic acid fermentation segment to command 52.0% share in the naturally fermented food market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Naturally Derived Fatty Alcohol Market Size and Share Forecast Outlook 2025 to 2035

Naturally Derived Sweeteners Market Size and Share Forecast Outlook 2025 to 2035

Naturally Cultured Beverages Market

Fermented Coffee Market Size and Share Forecast Outlook 2025 to 2035

Fermented Botanicals for Anti-Aging Market Size and Share Forecast Outlook 2025 to 2035

Fermented Vitamins Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fermented Amino Acid Complex Market Size and Share Forecast Outlook 2025 to 2035

Fermented Beverages Market Size and Share Forecast Outlook 2025 to 2035

Fermented Rice Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Pet Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Fermented Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Face Mask Market Size and Share Forecast Outlook 2025 to 2035

Fermented Dairy Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Dairy Ingredient Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Seaweed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Chymosin Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Flavours Market Size, Growth, and Forecast for 2025 to 2035

Fermented Ingredient Market Size, Growth, and Forecast for 2025 to 2035

Fermented Feed Market Analysis by Product Type, Livestock and Fermentation Process Through 2035

Market Share Breakdown of Fermented Ingredients

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA