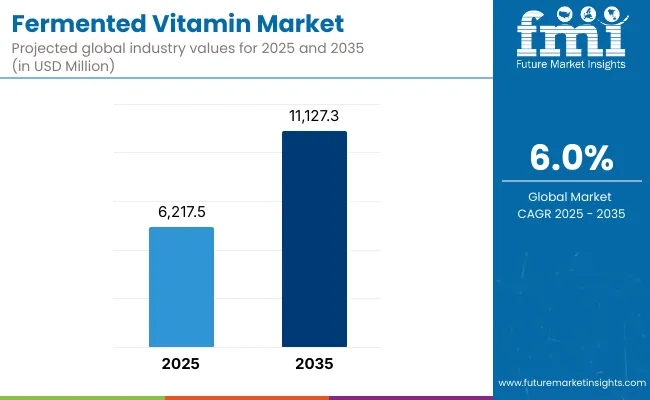

The market is expected to record a valuation of USD 6,217.5 million in 2025 and reach USD 11,127.3 million in 2035, reflecting a 6.0% CAGR. From 2025 to 2030, about USD 2.0 billion in incremental value is anticipated, supported by dietary supplements, fortified beverages, and functional skincare.

Fermented Vitamins Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value In (2025E) | USD 6,217.5 Million |

| Market Forecast Value In (2035f) | USD 11,127.3 Million |

| Forecast CAGR (2025 to 2035) | 6.0 % |

A 2025 valuation of USD 6.22 billion has been indicated, rising to USD 11.13 billion by 2035 at a CAGR of 6.0%. Vitamin B Complex is positioned as the leading type, while microbial fermentation anchors supply. Asia, led by China and India, is expected to gain share by 2035. dsm-firmenich is assessed as the leading supplier cohort, with BASF’s 2025 restarts poised to stabilize broader vitamin availability.

From 2030 to 2035, a further ~USD 2.9 billion is projected as algal fermentation scales and personalized nutrition platforms deepen penetration. Integration into clinical nutrition, sports performance, and animal health is expected to broaden use cases. Digital commerce should accelerate access, while investments in strains and capacity expansion will enhance supply reliability. Asia-Pacific, particularly China and India, is forecast to drive share gains, with China’s global share rising from 17% in 2025 to 21% in 2035.

The expansion of the Fermented Vitamins Market is being propelled by advancements in microbial and algal fermentation technologies, offering higher bioavailability and eco-friendly production methods. Increasing consumer preference for clean-label, naturally derived vitamins has been reinforced by the rise of personalized nutrition and functional foods. Portable formats such as capsules and tablets are being integrated with software-driven wellness platforms, enabling scalable adoption across healthcare and consumer industries. The automation of fermentation processes has further enhanced production reliability, while pharmaceutical applications of vitamins in therapeutic and preventive care settings have solidified their role in global health strategies. The convergence of sustainable sourcing, clinical validation, and expanding dietary supplementation is projected to sustain long-term growth.

The growth of the Fermented Vitamins Market is being fueled by the convergence of health awareness, sustainability, and technological innovation. Rising consumer demand for clean-label and naturally derived nutrients has accelerated the shift away from synthetic vitamins toward fermentation-based alternatives that offer higher bioavailability and better digestibility. Advances in microbial and algal fermentation, coupled with strain engineering, are delivering consistent yields, lower impurity levels, and scalable production suited for pharmaceutical, dietary supplement, and functional food applications.

Preventive healthcare trends and the popularity of personalized nutrition have further reinforced demand, particularly for B-complex and multivitamin blends that target energy, immunity, and overall wellness. Expanding use in fortified foods, nutraceutical beverages, clinical nutrition, and beauty-from-within formulations has broadened application diversity. At the same time, Industry 4.0-enabled biomanufacturing practices are enhancing efficiency, quality, and traceability, making fermented vitamins attractive to both brands and regulators, thereby sustaining long-term market momentum.

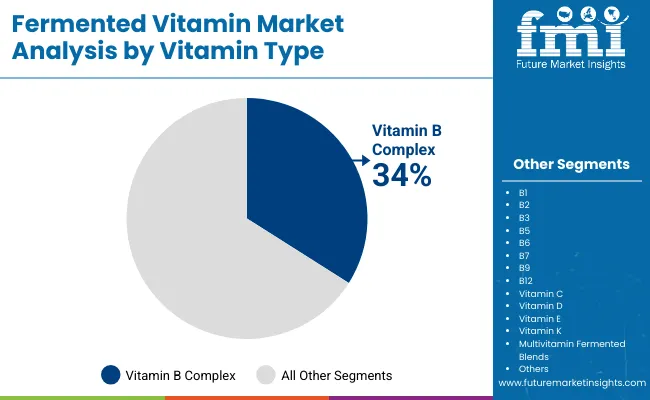

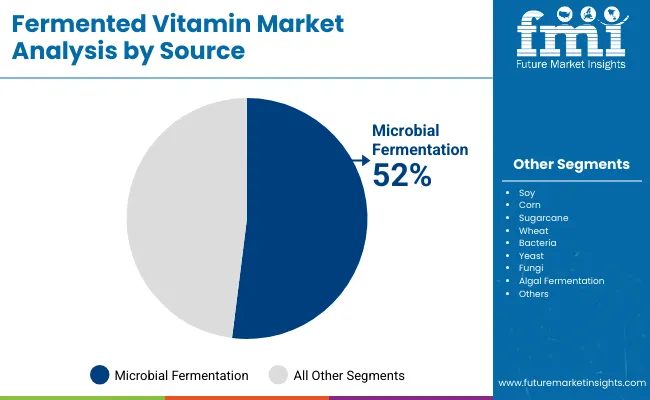

The Fermented Vitamins Market is segmented across vitamin type, source, form, application, and end user, each reflecting distinct growth pathways and consumer adoption dynamics. Vitamin type analysis highlights the dominance of B-complex and C, supported by their central roles in energy metabolism, immunity, and cognitive health, while multivitamin blends emerge as the fastest-growing due to their holistic appeal. Source segmentation emphasizes microbial fermentation as the established backbone of supply, with plant-based and algal methods expanding rapidly to align with sustainability and vegan preferences.

Form segmentation reveals powders as the most widely used for fortification, while capsules, tablets, and liquids gain traction through convenience, personalization, and e-commerce distribution. Applications range from dietary supplements and pharmaceuticals to animal nutrition and cosmetics, illustrating the versatility of fermented vitamins across industries. End-user analysis points to dietary supplement brands and pharmaceutical companies as leading demand drivers, shaping global adoption and reinforcing the market’s diversified growth base.

| Vitamin Type | Market Value Share, 2025 |

|---|---|

| Vitamin B Complex | 34.0% |

| Others | 66.0% |

The vitamin type segment is expected to witness strong differentiation, with Vitamin B Complex positioned as the dominant contributor in 2025. Its broad functional benefits across energy, cognition, and cellular processes have reinforced integration into dietary supplements, fortified foods, and therapeutic formulations. Rising adoption of personalized nutrition and preventive healthcare has further expanded its market base, particularly in capsules, tablets, and multivitamin blends where B-complex remains the cornerstone.

Although other vitamins including C, A, D, E, and K hold important application-specific roles, their collective contribution is outweighed by the sustained dominance of B-complex. This pattern reflects the critical positioning of B-complex as a foundation nutrient category, securing its relevance across consumer, pharmaceutical, and clinical nutrition markets while continuing to attract investment in fermentation innovation.

| Source | Market Value Share, 2025 |

|---|---|

| Microbial Fermentation | 52.00% |

| Others | 48.00% |

The source segment continues to highlight microbial fermentation as the central driver of the fermented vitamins industry. Its established scalability, cost efficiency, and technical reliability have positioned it as the preferred production method for critical vitamins such as B12, K2, and riboflavin. Pharmaceutical companies, dietary supplement brands, and food and beverage manufacturers rely heavily on microbial fermentation due to its ability to deliver consistent purity and bioavailability. While plant-based and algal fermentation methods are advancing rapidly with sustainability and vegan credentials, they remain secondary to microbial platforms in absolute share. The dominance of microbial fermentation reflects both legacy infrastructure and its adaptability to industrial-scale processes, ensuring it remains the backbone of vitamin production through 2025.

| Form | Market Value Share, 2025 |

|---|---|

| Powder | 60.00% |

| Others | 40.00% |

The form segment is expected to be led by powders, which represent the most versatile and widely adopted delivery form in 2025. Powders enable seamless integration into functional foods, fortified beverages, and dietary supplements, while also serving pharmaceutical and clinical nutrition requirements. Their compatibility with multiple end uses, cost-effectiveness, and longer shelf life have reinforced dominance. Although capsules, tablets, and liquids are gaining rapid traction due to convenience and personalization, powders continue to underpin industrial-scale formulations where blending, stability, and scalability are prioritized. The leading share of powders reflects their utility across both B2B manufacturing and consumer-facing applications, highlighting their indispensable role in the supply chain for fermented vitamins.

A multi-factor interplay is expected to shape demand, supply, and innovation in the Fermented Vitamins Market. Fermentation efficiency, sustainability, and clean-label positioning are anticipated to propel demand, while input volatility and regulatory scrutiny are likely to challenge smaller producers. Trends reflect alignment with preventive healthcare, personalized nutrition, and digital commerce expansion.

Driver: Bio-manufacturing scale and strain innovation will raise potency, consistency, and margins

Production capacity is anticipated to expand through optimized fermentation techniques and advanced downstream purification. Proprietary microbial strains for vitamins B12, K2, and riboflavin are projected to deliver higher yields and purity, aligning with pharmaceutical-grade standards. This consistency is expected to strengthen consumer trust in supplements, fortified beverages, and clinical applications. Plant-based feedstocks such as corn and sugarcane hydrolysates are likely to enhance sustainability credentials while reducing supply risk. As Industry 4.0-enabled process control improves efficiency, contract bio-manufacturers are positioned to offer turnkey solutions, accelerating launches for supplement and cosmetic brands. These innovations are forecast to reinforce microbial fermentation’s leadership while expanding accessibility across industries.

Restraint: Input volatility, specification tightening, and compliance burden will compress smaller players

Feedstock dependency on agricultural commodities exposes producers to cost volatility, while energy-intensive fermentation processes add further margin pressure. Regulatory expectations are becoming stricter, with pharmacopeial standards demanding lower impurities and improved stability for blends and liquids. Traceability, allergen management, and non-GMO verification are now prerequisites for market entry in the USA, EU, and Japan. These factors disproportionately challenge smaller producers, extending validation timelines and increasing compliance costs. The need for stability studies and formulation adjustments in multivitamin blends also raises complexity, reducing speed to market. Such conditions are expected to encourage industry consolidation, with distributors and large players gaining advantage through robust quality assurance and digital batch records.

Trend: Personalized nutrition, clean-label preferences, and digital commerce expansion will redefine adoption

Consumer preference for natural, eco-friendly, and bioavailable nutrients is accelerating demand for fermented vitamins across capsules, tablets, and liquids. Personalized wellness platforms are leveraging data-driven insights to recommend specific vitamin formulations, creating new opportunities for multivitamin blends and targeted products. Digital commerce channels, including subscription-based models and direct-to-consumer platforms, are expanding access to premium formats, particularly in supplements and beauty-from-within categories.

Cosmetic and functional beverage manufacturers are also integrating vitamins C and E into skin and immunity-focused offerings, reinforcing cross-industry adoption. Sustainability expectations are further supporting investment in plant-based and algal fermentation, positioning them as high-growth alternatives alongside microbial platforms. Together, these trends indicate that clean-label positioning and personalized delivery formats will shape the next phase of structural transformation.

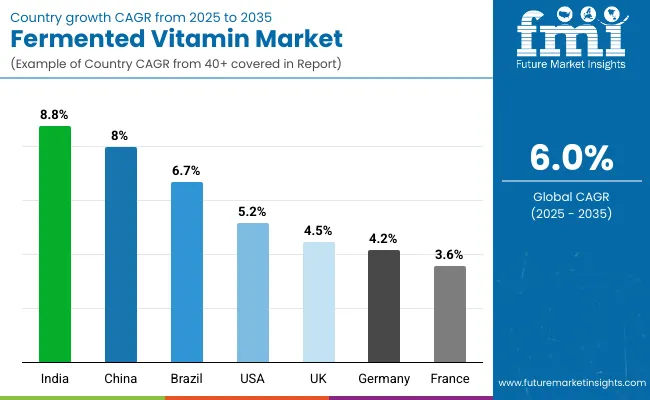

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 8.0% |

| India | 8.8% |

| Germany | 4.2% |

| France | 3.6% |

| UK | 4.5% |

| USA | 5.2% |

| Brazil | 6.7% |

Adoption is expected to advance unevenly across regions as industrial capabilities, policy frameworks, and consumer preferences diverge. In Asia-Pacific, capacity build-out and strong supplement penetration are projected to accelerate growth, supported by EV-like scale effects in precision manufacturing and Industry 4.0 practices in bio-plants. Europe is anticipated to emphasize compliance, sustainability, and traceability, with producers aligning to stringent pharmacopeial and labeling rules that raise barriers to entry but enable premium positioning.

North America is expected to leverage clinical validation and multichannel distribution, with direct-to-consumer brands expanding capsules and liquids through e-commerce while large food and beverage companies grow fortification programs. Across regions, digital quality systems, clean-label marketing, and integration into preventive healthcare are likely to reinforce demand. Divergent regulatory timelines and input cost exposure are expected to shape competitive strategies, while ecosystem strength in fermentation equipment, media, and downstream processing will determine the pace of innovation and export readiness.

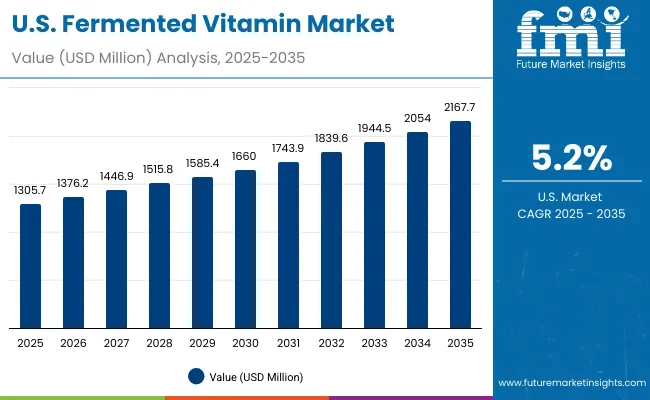

| Year | USA Fermented Vitamins Market (USD Million) |

|---|---|

| 2025 | 1,305.7 |

| 2026 | 1,376.2 |

| 2027 | 1,446.9 |

| 2028 | 1,515.8 |

| 2029 | 1,585.4 |

| 2030 | 1,660.0 |

| 2031 | 1,743.9 |

| 2032 | 1,839.6 |

| 2033 | 1,944.5 |

| 2034 | 2,054.0 |

| 2035 | 2,167.7 |

A CAGR of 5.2% through 2035 is anticipated. Growth is expected to be anchored in dietary supplements and sports nutrition as capsules and tablets gain convenience share, while liquids expand in fortified beverages. Pharmaceutical and clinical nutrition uses should rise as stability and impurity controls improve for B-complex and K2 grades. Retail and DTC channels are projected to scale online sales, supported by transparent sourcing and non-GMO positioning. Food and beverage manufacturers are likely to broaden fortification in functional drinks, aided by powders that blend cleanly and meet label claims. Partnerships between bio-manufacturers and healthcare brands are expected to elevate clinical evidence and accelerate premiumization.

A CAGR of 4.5% is projected. The market is expected to prioritize clean-label credentials and audited supply chains, supporting microbial and plant-based sources in multivitamin blends. Retailers are likely to expand private-label supplements with verified vegan and allergen-controlled claims. Pharmaceutical alignment to MHRA and EU standards is anticipated to lift demand for higher-spec vitamins B12 and riboflavin. Fortified beverages should gain traction as functional hydration grows, while e-commerce continues to streamline distribution. Sustainability disclosures and recyclable packaging are expected to influence buyer selection, particularly in capsules and powders.

A CAGR of 8.8% is forecast, the highest among key countries. Expansion is expected to be powered by preventive healthcare awareness, widespread use of B-complex and vitamin C supplements, and government support for nutraceutical exports. Contract fermentation facilities utilizing corn and sugarcane substrates are anticipated to enhance supply security while supporting affordability. Capsules and tablets dominate domestic demand, though fortified beverages and functional foods are rapidly gaining acceptance. Export capability is projected to improve through pharmacopeial alignment and sustainability certifications, making India a competitive hub in regional supply networks.

A CAGR of 8.0% is anticipated, reinforcing China’s role as a global growth engine. Investments in microbial and algal fermentation are expected to strengthen leadership in B12, K2, and riboflavin supply. Domestic demand for fortified beverages and multivitamin blends is expanding rapidly, supported by consumer preference for immunity and beauty-from-within products. Government-led quality audits and sustainability targets are shaping industrial practices, pushing producers toward Industry 4.0 systems. Export strength in high-volume vitamins is forecast to increase, further consolidating China’s role in global supply chains.

A CAGR of 4.2% is projected. Germany is expected to maintain emphasis on pharmaceutical-grade compliance, rigorous stability studies, and lifecycle assessments of fermentation processes. Premium positioning in pharmaceutical and clinical nutrition markets will reinforce demand for high-spec vitamins, particularly B-complex and K2. Food and beverage fortification continues steadily, while cosmetics adopt vitamin C and E in skincare and serums. Collaboration with advanced equipment providers and process-analytics firms sustains competitive efficiency. Direct B2B distribution is dominant, though online professional supplement sales are gradually expanding.

A CAGR of around 5-6% is expected. Vitamin C and B-complex dominate domestic consumption, reflecting their strong roles in immunity and energy support. Multivitamin blends are projected to rise fastest, aligned with consumer preference for holistic health solutions. Aging demographics are likely to sustain preventive care adoption, particularly in capsules and tablets. Pharmaceutical and clinical nutrition uses emphasize microbial and algal fermentation due to strict safety and purity expectations. Labeling transparency and traceability remain decisive in brand selection, reinforcing trust in premium formulations.

A high-single-digit CAGR is projected, supported by growing integration of vitamins into functional foods, sports nutrition, and K-beauty. Microbial fermentation maintains dominance, though algal and plant-based sources are rising quickly due to strong sustainability appeal. Capsules and liquids are anticipated to expand in both supplement and cosmetic categories. Local innovation ecosystems, supported by digital health platforms and robust quality controls, are expected to shorten product cycles and accelerate premium launches. Export-oriented suppliers will likely leverage this advantage to strengthen regional leadership.

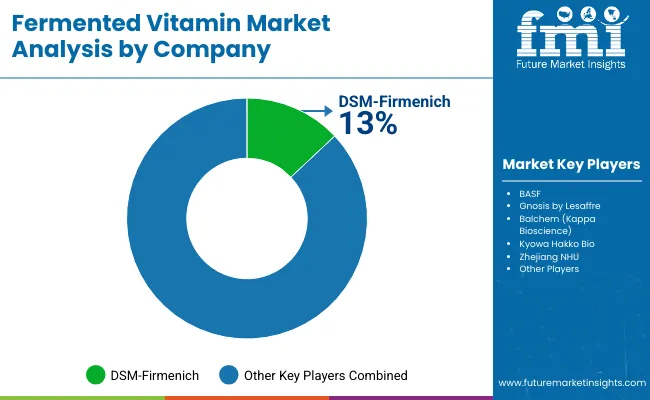

The competitive landscape of the Fermented Vitamins Market is expected to remain anchored by a few global leaders with extensive manufacturing capabilities, supported by regional specialists that cater to niche demands. dsm-firmenich is anticipated to maintain its leadership, driven by broad product coverage across B-complex, vitamin C, and clinical-grade vitamins, coupled with multi-site fermentation capacity and strong integration into pharmaceutical and nutrition channels.

BASF is positioned as a critical supplier, particularly in vitamins A and E, where production restarts are expected to stabilize availability and pricing across fortified food and personal care categories. Category-focused specialists such as Gnosis by Lesaffre and Balchem (Kappa Bioscience) are projected to dominate the fermented vitamin K2 space, leveraging their expertise in high-purity MK-7 production and strong clinical validation. Regional producers, including Zhejiang NHU and Kyowa Hakko Bio, provide scale and diversification, especially in Asia. The broader market outside of dsm-firmenich remains fragmented, with mid-sized innovators and contract manufacturers increasingly focusing on plant-based and algal fermentation methods to address sustainability and clean-label demands.

Key Developments in Fermented Vitamins Market

| Item | Details |

|---|---|

| Market Size, 2025 | USD 6,217.5 Million |

| Market Size, 2035 | USD 11,127.3 Million |

| Absolute Growth (2025-2035) | USD 4,909.8 Million |

| CAGR (2025-2035) | 6.00% |

| Value Added 2025-2030 | ~USD 1,985.5 Million |

| Value Added 2030-2035 | ~USD 2,924.3 Million |

| Vitamin Type (2025) | Vitamin B Complex leads with 34.0% share |

| Source (2025) | Microbial Fermentation leads with 52.0% share |

| Form (2025) | Powder leads with 6 0.0% share |

| Application (2025) | Dietary Supplements & Sports Nutrition leads with 34.0% share |

| End User (2025) | Dietary Supplement Brands lead with 30.0% share |

| Key Growth Regions (CAGR) | India (8.8%), China (8.0%), South Asia & Pacific (8.0%), East Asia (7.5%) |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, UK, Germany, France, China, India, Japan, South Korea, Brazil |

| Key Companies Profiled | dsm-firmenich, BASF, Gnosis by Lesaffre, Balchem (Kappa Bioscience), Kyowa Hakko Bio, Zhejiang NHU |

| Additional Attributes | Clean-label adoption, traceability, ESG alignment, Industry 4.0 in fermentation, personalized nutrition integration, e-commerce enablement |

The market is valued at USD 6,217.5 million in 2025.

The market is forecasted to reach USD 11,127.3 million by 2035.

The market is projected to expand at a CAGR of 6.0% over the forecast period.

Vitamin B Complex is expected to dominate, holding a 34.0% share in 2025.

Microbial Fermentation is anticipated to lead, accounting for 52.0% of the market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fermented Coffee Market Size and Share Forecast Outlook 2025 to 2035

Fermented Botanicals for Anti-Aging Market Size and Share Forecast Outlook 2025 to 2035

Fermented Amino Acid Complex Market Size and Share Forecast Outlook 2025 to 2035

Fermented Beverages Market Size and Share Forecast Outlook 2025 to 2035

Fermented Rice Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Pet Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Fermented Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Face Mask Market Size and Share Forecast Outlook 2025 to 2035

Fermented Processed Food Market Size and Share Forecast Outlook 2025 to 2035

Fermented Dairy Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Dairy Ingredient Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Seaweed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Chymosin Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Flavours Market Size, Growth, and Forecast for 2025 to 2035

Fermented Ingredient Market Size, Growth, and Forecast for 2025 to 2035

Fermented Feed Market Analysis by Product Type, Livestock and Fermentation Process Through 2035

Market Share Breakdown of Fermented Ingredients

Fermented Cucumber Market Trends - Growth & Consumer Demand 2025 to 2035

Fermented Protein Market Trends - Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA