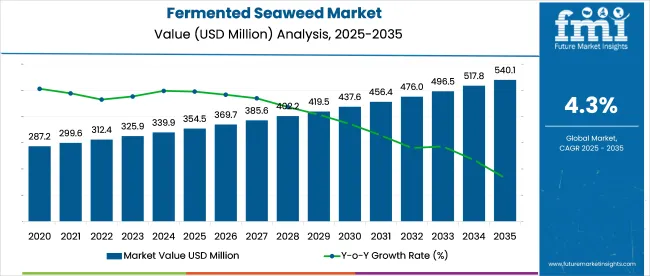

The fermented seaweed market is projected to grow from USD 354.5 million in 2025 to USD 540.1 million by 2035 at a CAGR of 4.3%. Over 60% of current demand originates from functional food, supplement, and fermented snack applications, with East Asia contributing over 40% of total volume.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 354.5 million |

| Projected Market Size in 2035 | USD 540.1 million |

| CAGR (2025 to 2035) | 4.3% |

India, China, and South Korea are scaling coastal fermentation hubs to meet rising B2B demand. Cost per kilogram has declined by 12-15% since 2022 due to shorter microbial fermentation cycles. Growth is being influenced by supply chain consolidation, bioactive strain development, and demand for marine-derived gut health ingredients across OECD and ASEAN markets.

“Seaweed is this bountiful resource. It doesn’t require any fertilizers or pesticides. It doesn’t need fresh water. It doesn’t compete with land-based crops. We still need to feed a lot of people,” said Matthew Perkins, founder and CEO of Macro Oceans.

“We thought there was an opportunity to take this really scalable, interesting, sustainable resource and transform it into materials, and we began in beauty because beauty is a wonderful place that needs high-performance materials that are sustainable.”(Beauty Independent, October 28, 2024)

The fermented seaweed market is valued at approximately USD 354.5 million in 2025, representing a niche segment across its broader parent categories. It accounts for nearly 6-8% of the seaweed-based products market, which includes unfermented food, hydrocolloids, and personal care extracts. Within the global fermented food and beverage market estimated at over USD 28 billion its share remains under 1.5%.

In the functional ingredients market, which exceeds USD 70 billion, fermented seaweed captures less than 0.5%, reflecting its early-stage adoption. In the nutraceutical and dietary supplements sector (valued at over USD 300 billion), its share is fractional below 0.1%. Despite the low volume share, fermented seaweed holds strategic importance as a high-value, clean-label bioactive with growing relevance in gut health, immunity, and detox product categories.

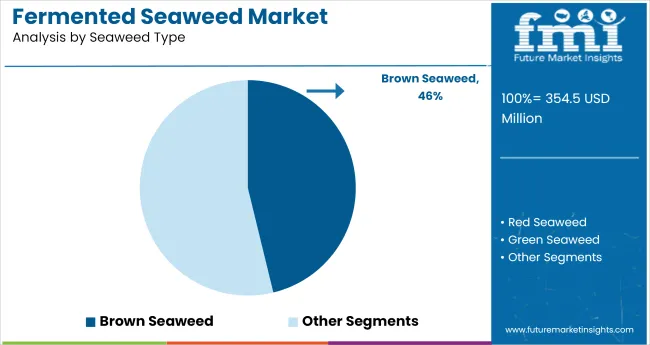

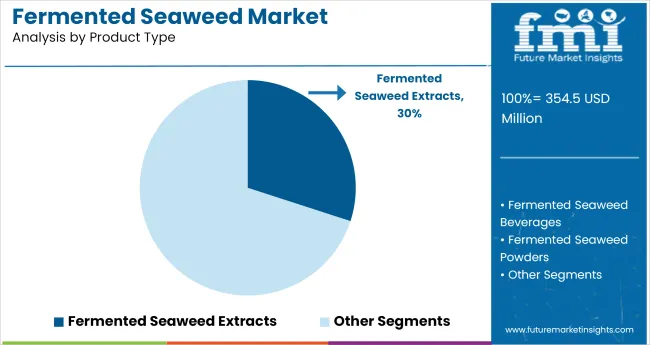

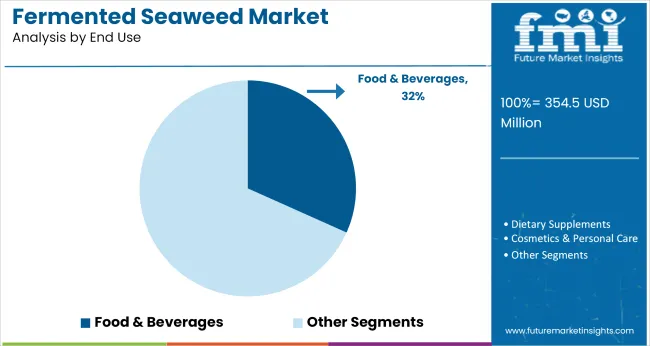

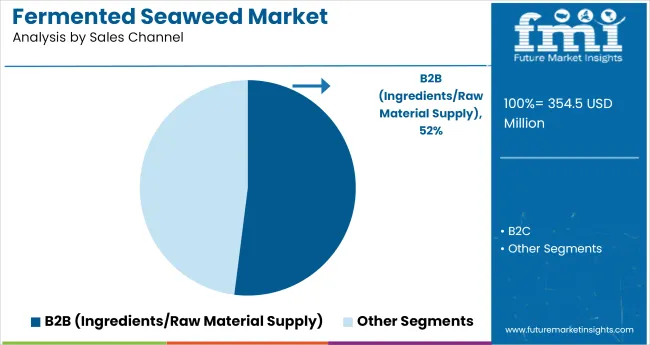

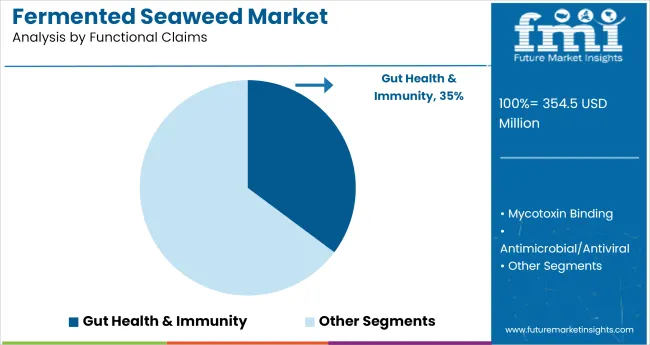

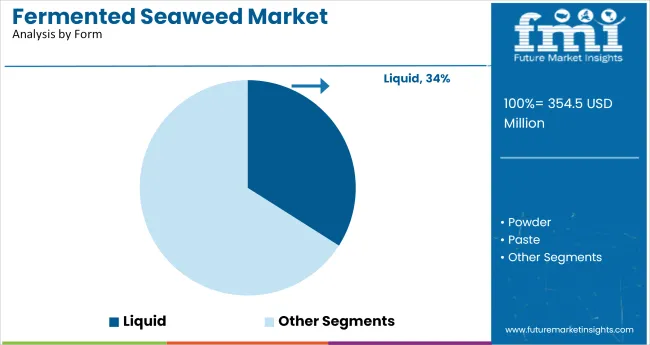

In 2025, brown seaweed leads by seaweed type with 46% share. Fermented seaweed extracts hold 30% in product type, while food & beverages dominate end use with 32%. B2B accounts for 52% in sales channel. Lactic acid fermentation holds 38.4%, gut health claims lead with 28%, and liquid form dominates with 34%. East Asia leads regional demand, followed by South Asia & Pacific and Europe. Regional analysis includes North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Brown seaweed accounted for 46% of usage in 2025 due to its higher yield of fermentable polysaccharides such as fucoidan and alginate. Its structural integrity and nutrient retention post-fermentation have increased its use in food-grade concentrates and cosmetic emulsions. Sourcing from East Asian coastlines, particularly Korea and Japan, has remained consistent. Among the three types, brown seaweed offers the most cost-effective base for commercial fermentation, with broader application across gut health formulations and prebiotic-enhanced nutrition.

Fermented seaweed extracts held 30% share, favored for their high concentration of active compounds, solubility, and formulation adaptability. These extracts have been used across dietary supplements, facial serums, and beverage additives, where controlled potency is essential. Their low viscosity allows for seamless blending into B2B ingredient systems. Extracts from red and brown seaweed have outperformed other formats in export-led demand due to reduced transport weight and increased shelf stability, especially in Asia-Pacific and Western European supply networks.

Food and beverage applications contributed 32% to total demand, where fermented seaweed has been positioned for digestive health, savory enhancement, and functional snacking. It has been embedded in liquid concentrates, seasoning blends, and nutritional bars targeting microbiome modulation. The umami flavor of seaweed combined with postbiotics from fermentation makes it suitable for clean-label product development. Formulation trials by beverage start-ups and snack manufacturers across Japan, Singapore, and Australia have fueled regional product innovations using fermented macroalgae.

A 52% share was held by B2B supply channels in 2025, driven by bulk ingredient demand in personal care, nutraceutical, and food manufacturing. Large-scale fermentation operations have preferred direct contracts with buyers seeking custom viscosity, pH, and nutrient concentration. Ingredient processors across the US, France, and South Korea have structured multi-year agreements for fermented extracts and powders. In contrast, fragmented retail distribution has remained limited to specialty wellness stores and online natural product platforms.

Lactic acid fermentation captured 38.4% of the market, recognized for preserving phenolic content, reducing microbial risk, and aligning with organic product certifications. The method has been used for both low-acid beverages and water-soluble pastes in the gut-health segment. Its compatibility with cold-fill processing and high bioavailability outcomes has increased adoption. Manufacturers in Germany, Taiwan, and India have upgraded fermentation capacity specifically for lactic-based seaweed processing to meet rising contract manufacturing demand from supplement and beverage brands.

Functional positioning around gut health made up 35% of the market, supported by high consumer awareness of digestive well-being and microbiome support. Fermented seaweed has delivered prebiotic fiber, marine polyphenols, and beneficial bacterial metabolites in both capsule and drinkable formats. Claims on packaging now emphasize bowel regularity, immune regulation, and microbial balance. Formulators in the United States and South Korea have focused on blending seaweed fermentates with inulin and other fiber-based carriers to broaden the claim stack.

Liquid forms held 34% of the total segment, attributed to their dispersibility, formulation flexibility, and high absorption rates. Liquid seaweed fermentates have been used in agricultural foliar sprays, cosmeceutical mists, and drinkable dietary supplements. Their ease of handling in manufacturing pipelines has reduced dosing variability and storage complexity. Producers in France, Japan, and New Zealand have prioritized liquid fermentation batches, using them as base inputs for downstream processing in both functional beverage and biostimulant categories.

The industry is being shaped by evolving nutritional preferences, bioactive ingredient exploration, and a widening scope of fermentation technologies. Rising demand from the dietary supplement, functional foods, and cosmetics industries has strengthened the commercial case for fermented seaweed. However, variability in seaweed biomass quality and regional supply imbalances remain key barriers for consistent scale-up.

Functional Nutrition Driving Fermented Seaweed Integration

The increasing inclusion of fermented seaweed in dietary supplements and fortified foods is driven by its ability to enhance mineral absorption and antioxidant activity. Lactic acid and yeast fermentation methods are being deployed to create seaweed powders and extracts with higher polyphenol and prebiotic content. By 2025, dietary supplements captured 23.4% of end-use share, while B2B ingredient sales through functional food brands remained dominant across East Asia and Europe.

Supply-Driven Volatility Limiting Scale-Up Potential

Fermented product consistency is affected by oceanic biomass variability, which impacts fermentation efficiency and compound profiles. Green seaweed showed a 12–17% lower fermentation yield than brown variants. Regulatory misalignment across ASEAN and EU zones delayed market entry of over 40 new fermented seaweed formulations between 2022 and 2024. The B2B supply chain continues to be fragmented, with over 70% of raw seaweed sourced from artisanal producers lacking standardized quality protocols.

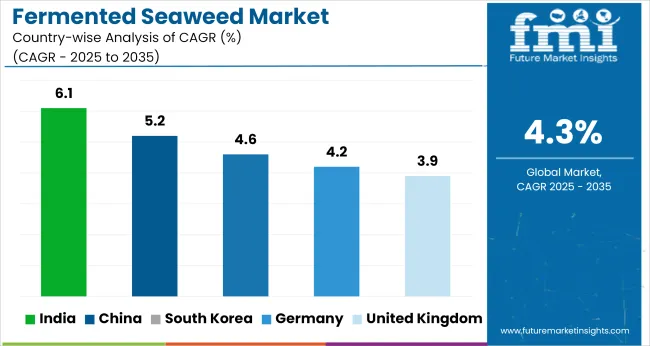

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 6.1% |

| China | 5.2% |

| South Korea | 4.6% |

| Germany | 4.2% |

| United Kingdom | 3.9% |

The global fermented seaweed market is forecast to grow at a 4.3% CAGR from 2025 to 2035. Among the forty countries analyzed, India leads at 6.1%, followed by China at 5.2% and South Korea at 4.6%. Germany and the United Kingdom, both OECD members, trail with CAGRs of 4.2% and 3.9% respectively.

BRICS nations like India and China outperform the global average by notable margins, while advanced economies in the OECD cluster show more restrained expansion. The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

The report provides a detailed analysis of 40+ countries, with the top five countries listed as a reference.

India is projected to register a 6.1% CAGR between 2025 and 2035, surpassing global and BRICS averages. Early adoption during 2020 to 2024 was shaped by functional food experiments among Ayurveda-focused startups. Between 2025 and 2035, momentum has shifted toward B2C nutrition brands using red seaweed in gut-health drinks and fortified powders.

State-backed seaweed farming programs in Tamil Nadu and Gujarat have enabled consistent supply, reducing dependency on imported raw biomass. Category expansion beyond coastal regions has been achieved through D2C subscription bundles and vernacular influencer outreach.

China is forecast to expand at a CAGR of 5.2% from 2025 to 2035. During 2020 to 2024, fermented seaweed remained an ingredient in traditional condiments and preserved foods. The current decade has seen rapid expansion into fortified beverages and dietary supplements.

Domestic marine biotech firms have integrated kelp and wakame strains into value-added food formats, often enabled by mobile health platforms. New regulatory guidance in 2026 on functional claims allowed full-scale retail distribution through pharmacy chains and wellness stores.

A CAGR of 4.6% has been projected for South Korea through 2035. Growth during 2020 to 2024 was tied to preserved food traditions. From 2025 onward, clinical skincare and digestive wellness categories began integrating encapsulated seaweed ferments and hydrogel-based formats. K-beauty brands commercialized cosmetic formats with dual health and aesthetic claims. Regulatory filters introduced by MFDS in 2027 strengthened compliance for products positioned under health and functional labeling frameworks.

Germany is projected to achieve a 4.2% CAGR between 2025 and 2035. Prior to this, fermented seaweed use was concentrated in select cosmeceuticals and organic food SKUs. Since 2025, interest has shifted toward fermented brown seaweed in digestive and immune-support supplements.

Food producers aligned with EU health claim mandates have invested in validated bioactive extractions. Schleswig-Holstein localized aquaculture output has reduced reliance on imports and supported retail expansion in functional beverages and skincare channels.

The United Kingdom is expected to grow at a 3.9% CAGR during the 2025 to 2035 period. Early-stage demand remained limited to vegan food and supplement startups operating in niche health channels. Supermarket private labels have since scaled production of fermented seaweed snacks and capsules, particularly from native red algae.

Government-backed aquaculture pilots in Wales and Scotland improved ingredient availability for domestic processing. NHS-endorsed pilot kits incorporating prebiotic seaweed blends accelerated legitimacy for gut-health aligned supplementation.

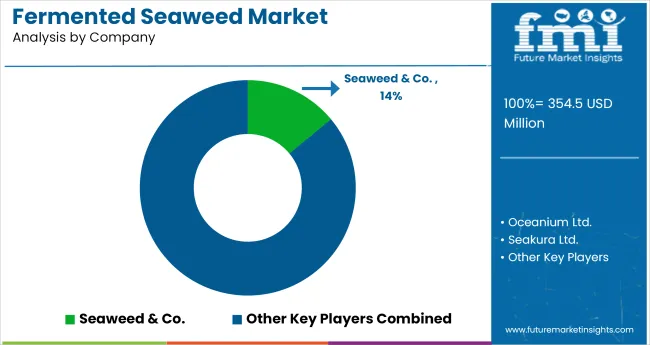

The fermented seaweed market is led by companies focused on high-value bioactives, precision fermentation, and traceable marine inputs. Seaweed & Co. (UK) and Oceanium (Scotland) dominate B2B ingredient supply through patented extraction and gut-health positioning. Seakura (Israel) and Macro Oceans (USA) invest in scalable low-sodium formulations for food and personal care use. Phytality (Australia) targets vegan nutraceuticals in APAC via its PhycoDigest platform.

Competition is intensifying as fermented seaweed gains traction in clean-label wellness products and cosmeceuticals. Industry players are adopting three core strategies: proprietary biorefinery development, biotech-algae collaborations for consistent raw material supply, and expansion into digital and therapeutic retail formats. Traceability, functionality, and platform compatibility remain essential to defending premium shelf space in this evolving industry.

Leading Company - Seaweed & Co.Market Share - 14%

Recent Fermented Seaweed Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 354.5 million |

| Projected Market Size (2035) | USD 540.1 million |

| CAGR (2025 to 2035) | 4.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and thousand metric tons for volume |

| Seaweed Types Analyzed (Segment 1) | Red Seaweed, Brown Seaweed, Green Seaweed |

| Product Types Analyzed (Segment 2) | Fermented Seaweed Extracts, Fermented Seaweed Beverages, Fermented Seaweed Powders, Fermented Seaweed Pastes |

| End Uses Analyzed (Segment 3) | Food & Beverages, Dietary Supplements, Cosmetics & Personal Care, Animal Feed & Pet Food, Fertilizers & Bio-stimulants |

| Sales Channels Analyzed (Segment 4) | B2B (Ingredients/Raw Material Supply), Supermarkets/Hypermarkets, Specialty Stores, Online Retail |

| Functionality/Claims Analyzed (Segment 5) | Gut Health, Antioxidant, Detoxification, Immunity Support, Skin Health |

| Forms Analyzed (Segment 6) | Liquid, Powder, Paste, Capsule/Tablets (for supplements) |

| Fermentation Methods Analyzed (Segment 7) | Lactic Acid Fermentation, Yeast Fermentation, Mixed Culture Fermentation |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Seaweed & Co., Oceanium Ltd., Seakura Ltd., Macro Oceans Inc., Phytality ( PhycoDigest ), Others |

| Additional Attributes | Dollar sales, share by seaweed type and end use, demand rise in gut health and immunity segments, fermentation innovation using mixed cultures, regional variation in ingredient sourcing and distribution channels |

The segment includes Red Seaweed, Brown Seaweed, and Green Seaweed.

This includes Fermented Seaweed Extracts, Fermented Seaweed Beverages, Fermented Seaweed Powders, and Fermented Seaweed Pastes.

This segment covers Food & Beverages, Dietary Supplements, Cosmetics & Personal Care, Animal Feed & Pet Food, and Fertilizers & Bio-stimulants.

The industry is segmented into B2B (Ingredients/Raw Material Supply), Supermarkets/Hypermarkets, Specialty Stores, and Online Retail.

This includes Gut Health, Antioxidant, Detoxification, Immunity Support, and Skin Health.

The segment includes Liquid, Powder, Paste, and Capsule/Tablets (for supplements).

This includes Lactic Acid Fermentation, Yeast Fermentation, and Mixed Culture Fermentation.

Regional analysis includes North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

The industry is projected to reach USD 354.5 million in 2025.

The industry is expected to grow at a CAGR of 4.3% from 2025 to 2035.

Brown seaweed is expected to capture 46% in 2025.

East Asia is projected to account for over 40% of the total volume in 2025.

The industry is projected to reach USD 540.1 million by 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fermented Rice Filtrate Market Size and Share Forecast Outlook 2025 to 2035

Seaweed Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Coffee Market Size and Share Forecast Outlook 2025 to 2035

Seaweed-Based Anti-Aging Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Fermented Botanicals for Anti-Aging Market Size and Share Forecast Outlook 2025 to 2035

Fermented Vitamins Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fermented Amino Acid Complex Market Size and Share Forecast Outlook 2025 to 2035

Fermented Beverages Market Size and Share Forecast Outlook 2025 to 2035

Fermented Rice Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Pet Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Seaweed Derived Minerals Market Size and Share Forecast Outlook 2025 to 2035

Fermented Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Face Mask Market Size and Share Forecast Outlook 2025 to 2035

Fermented Processed Food Market Size and Share Forecast Outlook 2025 to 2035

Fermented Dairy Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Dairy Ingredient Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Chymosin Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Seaweed Protein Market - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Flavours Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA