The Europe Fermented Ingredients market is set to grow from an estimated USD 15,763.1 million in 2025 to USD 28,186.7 million by 2035, with a compound annual growth rate (CAGR) of 6.0% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 15,763.1 million |

| Projected Europe Value (2035F) | USD 28,186.7 million |

| Value-based CAGR (2025 to 2035) | 6.0% |

The Europe Fermented Ingredients sector is on the rise with the highest growth rate thanks to the increasing need for natural, sustainable, and functional bio-based ingredients in food, medical, and industrial applications.

The widespread trend towards the consumer preferring clean-label, minimally processed, and naturally derived materials has been the main reason for the shift of industries to the use of fermented ingredients.

Fermented ingredients are utilized the most in the food and beverage industry, and they are produced through microbial fermentation as flavours, organic acids, amino acids, and enzymes, and also for using them as functional ones.

The health of the gut and probiotic-rich foods that are made through fermentation of dairy products, kombucha, and plant-based proteins, are the main pushers of the demand for fermentation-based natural ingredients.

Also, the enzymes generated by fermentation are being widely used in the production of bakery, brewing, and dairy processing, ensuring product stability and texture enhancement. The pharmaceutical industry is also optimized by the adoption of fermentation technology, mostly in the area of the making of antibiotics, vitamins, and L-amino acids, which are used in drug formulations.

The current focus on cutting-edge scientific technology, coupled with biotechnological processes, precisely engineered microbes, and so on, is actively making the industrial and pharmaceutical sectors of fermented ingredients stand aside as far as their production of synthetic alternatives is concerned.

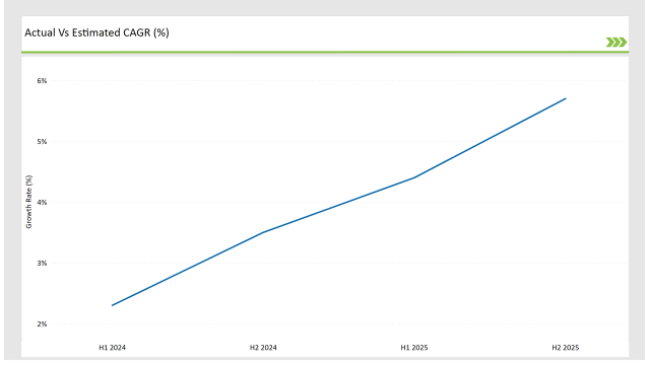

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Fermented Ingredients market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 2.3% |

| H2 (2024 to 2034) | 3.5% |

| H1 (2025 to 2035) | 4.4% |

| H2 (2025 to 2035) | 5.7% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Fermented Ingredients market, the sector is predicted to grow at a CAGR of 2.3% during the first half of 2024, with an increase to 3.5% in the second half of the same year.

In 2025, the growth rate is anticipated to slightly decrease to 4.4% in H1 but is expected to rise to 5.7% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April-24 | DSM-Firmenich launched a new range of precision-fermented amino acids targeted at functional food applications. |

| March-24 | BASF expanded its fermentation-derived vitamin production facility in Germany to meet increasing European demand. |

| February-24 | Kerry Group announced a strategic investment in microbial fermentation technology to develop bio-based food preservatives. |

| January-24 | Novozymes introduced a next-generation industrial enzyme portfolio leveraging fermentation for sustainability in food processing. |

Fermentation-Derived Ingredients in Functional Food and Beverage Applications: The Preferred Choice for Consumers

The demand for fermented foods in the food and beverage sector has been positively influenced by the increasing interest of consumers in probiotic gut-friendly products. Ingredients that are fermented like probiotic cultures, organic acids, and amino acids are vital for the process of flavor enhancement, preservation, and digestion improvement.

Furthermore, the growing prevalence of precision fermentation technology that is aiding in the production of bio-identical dairy proteins, plant-based egg alternates, and functional bioactive compounds is also a factor worth mentioning.

Businesses like DSM, Chr. Hansen and Kerry Group are placing their bets on the development of fermentation-based natural food preservatives and flavor enhancers, leading to the improvement of shelf-life and sensory experience in packaged products.

Innovation in Microbial Fermentation for Antibiotic and Vitamin Production in the Pharmaceutical Industry

Fermentation-derived antibiotics, vitamins, and amino acids, produced through bioprocesses by the fermentation process are mostly used in the pharmaceutical sector, making sure of drug-form formulation efficiency and cost-effectiveness.

The pressure of increasing antibiotic resistance and the need to produce pharmaceuticals sustainably have brought forth microbial fermentation as a green alternative to synthetic manufacturing. Fermentation of B vitamins, amino acids, and probiotics has shown increased application in nutraceuticals and medical supplements, thus strengthening their position in health care by prevention.

The continuous development in bioprocess optimization and precision fermentation has made it possible for pharmaceutical companies like BASF, Novozymes, and DSM to produce fermentation-based high-purity ingredients that not only increase drug effectiveness but also are environmentally friendly.

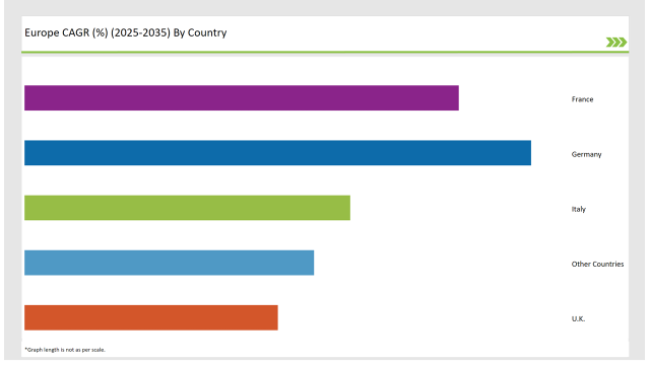

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 28% |

| Italy | 18% |

| UK | 14% |

| France | 24% |

| Other Countries | 16% |

Precision fermentation and alternative protein innovation are making the Netherlands a promising destination for these activities, as it has a well-established food technology and concentrates on sustainable ingredient production.

Not only are the Dutch food and biotech firms leading in coming up with solutions for fermenting plant protein alternatives, microbial fat, and dairy proteins but they are also directly aligned with consumers' growing interest in ethical, high-nutritional-value food sources that are sustainable.

Companies such as DSM, Wageningen University startups, and other fermentation-folie biotech that are exploring plant-based meat and dairy alternatives with the benefits of higher nutrition, better functionality, and a reduced carbon footprint are ensuring the development of these technologies.

The idea of getting rid of chemical additives in food by using microbial fermentation to make preservatives, completely accelerator-free flavour enhancers, and even protein fortifications is becoming a trend.

There is an increase in interest in fermentation-derived ingredients in Spain, especially in the dairy, pharmaceuticals, and nutraceuticals sectors. The stability of probiotic and gut-health products has raised the demand for fermentation organics such as acids, vitamins, and amines in such products as traditional dairy and plant-based dairy.

Spanish dairy companies capitalize on fermentation technology for the enrichment of proteins with probiotics, the improvement of technical features, and the stability of yogurts, cheese alternatives, and fermented beverages, as a means to meet the consumer need for health-oriented and bio-functional food.

In addition to that, Spain's pharmaceutical sector is also experiencing a significant rise in investments directed towards the biopharma and microbial fermentation sectors, which in turn have resulted in the increased production of antibiotics from fermentation, probiotic supplements, and formulations enriched with essential amino acids.

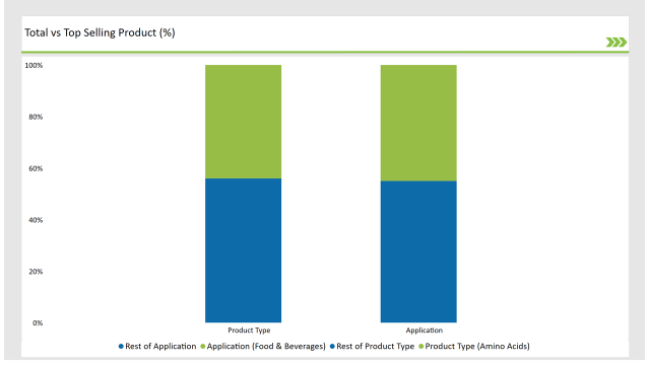

% share of Individual Categories Product Type and Application in 2025

| Main Segment | Market Share (%) |

|---|---|

| Product Type (Amino Acids) | 44% |

| Remaining segments | 56% |

Amino acids are the most important fermented ingredients of the total market which makes them the largest product category. The trend toward hybrid protein-rich formulations in food and beverages, dietary supplements, and pharmaceuticals has drastically increased this segment of the market.

Among the most used fermentation-derived amino acids in protein fortification, sports nutrition, and medical food formulations are nicotinic acid, and methionine because they promote the metabolic absorption of protein and thus the bioavailability of protein.

Furthermore, the pharmaceutical sector is using the microbial fermentation process to manufacture biogenic amino acids that are included in medicines for specific purposes, such as for metabolic disorders, cognitive health, and support of immune status.

Top firms such as Ajinomoto, Evonik, and ADM are augmenting their production of amino acids to cater to the rising industry demand by establishing new plants across Europe.

| Main Segment | Market Share (%) |

|---|---|

| Application (Food & Beverages) | 45% |

| Remaining segments | 55% |

The growing trend towards natural flavours, functional probiotics, and clean-label food preservatives has driven food producers to resort to fermentation-derived organic acids, amino acids, and industrial enzymes since they enhance the shelf life, sensory appeal, and gut health of the product range while maintaining a non-artificial status.

Further, demand for added fermented plant protein sources in meat alternatives, dairy substitutes, and functional drinks has developed the fermentative-solutions issue. The businesses employ strains of bacteria and yeasts to make the new functional foods with better taste, texture, and nutritional advantages.

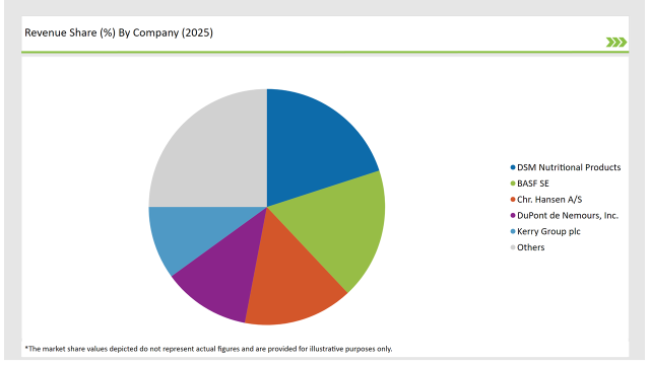

2025 Market share of Europe Fermented Ingredients manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| DSM Nutritional Products | 20% |

| BASF SE | 18% |

| Chr. Hansen A/S | 15% |

| DuPont de Nemours, Inc. | 12% |

| Kerry Group plc | 10% |

| Others | 25% |

Note: The above chart is indicative in nature

The European market comprises enterprises that are increasing the size of their fermentation facilities, improving bioprocess performance, and looking for the use of renewable raw materials to achieve their goal in terms of customer demand for clean and functional labels.

Microbial fermentation asthe main technique in the production of alternative protein, bio-based pharmaceuticals, and functional ingredient synthesis has been instrumental in the shift of companies' focus from solving the production cost issue to scaling up fermentation capabilities.

Strategic mergers and acquisitions are a crucial tool for solidifying, market leadership, for instance, global companies tend to acquire biotech firms that have specific technical expertise in fermentation to expand their knowledge base.

The arrival of new market entrants with disruptive innovations such as startup biotech firms working on fermentation-based food enhancers, plant-based dairy proteins, and precision-fermented probiotics has become a reality through such venturing initiatives.

The innovation of fermented fats, bio-identical dairy proteins, and enzymes that change plant-based ingredients has become essential in the competitive struggle for firms, as it has increased the diversification of products and the efficiency of processes.

As per Form Type, the industry has been categorized into Liquid, and Dry.

As per Product Type, the industry has been categorized into Amino Acids, Organic Acids, Biogas, Polymer, Vitamins, Antibiotics, and Industrial Enzymes.

As per Application, the industry has been categorized into Food & Beverages, Pharmaceuticals, Paper, Feed, and Others.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Fermented Ingredients market is projected to grow at a CAGR of 6.0% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 28,186.7 million.

Key factors driving the Europe fermented ingredients market include the rising consumer demand for natural and clean-label products, which enhances the appeal of fermented ingredients in food and beverages. Additionally, the growing awareness of health benefits associated with probiotics and fermented foods is fueling market growth.

Germany, France, and Italy are the key countries with high consumption rates in the European Fermented Ingredients market.

Leading manufacturers include DSM Nutritional Products, BASF SE, Chr. Hansen A/S, DuPont de Nemours, Inc., and Kerry Group plc known for their innovative and sustainable production techniques and a variety of product lines.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Fermented Ingredients

Europe Savory Ingredients Market Growth – Trends, Demand & Forecast 2025-2035

UK Fermented Ingredients Market Report – Growth, Demand & Industry Forecast 2025–2035

Europe Probiotic Ingredients Market Trends – Growth, Demand & Forecast 2025-2035

USA Fermented Ingredients Market Growth – Trends, Demand & Forecast 2025–2035

ASEAN Fermented Ingredients Market Growth – Innovations, Trends & Forecast 2025–2035

Australia Fermented Ingredients Market Analysis – Demand, Growth & Forecast 2025–2035

Latin America Fermented Ingredients Market Trends – Size, Demand & Forecast 2025–2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA