The global fermented ingredients market is moderately consolidated. Major players in the market are multinational corporations, regional companies, and niche brands. It is dominated by multinational companies such as DuPont, Kerry Group, Cargill, BASF, and Chr. Hansen, which account for around 60% of the global share, boasting high R&D investments, innovative fermentation technology, and large-scale production.

Regional players like Angel Yeast Company of China, Biorigin from Brazil, Corbion from Netherlands, and Lesaffre of France hold a 25% market share due to the primacy of regional production and efficient fermentative processes.

Emerging and niche players with 15% of market share occupy the rest and include Meiji from Japan, BioSpringer of France, and Lallemand from Canada, which supply to the growing organic, plant-based, and specialty ingredients segment.

The top five players have control over 50% of the market, thus a structured yet competitive landscape with a drive for fermentation process technological advancement, growing demand for clean-label, functional, and sustainable ingredients, and more applications in food, pharmaceuticals, and cosmetics.

| Global Market Share 2025 | Industry Share (%) |

|---|---|

| Top Multinationals (DuPont, Kerry Group, Cargill, BASF, Chr. Hansen) | 60% |

| Regional Leaders (Angel Yeast, Biorigin, Corbion, Lesaffre) | 25% |

| Startups & Niche Brands (Meiji, BioSpringer, Lallemand) | 15% |

The market is moderately consolidated. The top five companies account for 50% of total industry share.

The global fermented ingredients market is diversified. The largest share is Amino Acids, which hold around 44% of the market. The most common amino acids used are the nutritional and functional properties of lysine, glutamic acid, and tryptophan, associated with food, pharmaceutical, and feed applications.

The Organic Acids segment is 20% of the market; it comprises elements such as lactic acid, citric acid, and acetic acid, valued for their preservative, flavoring, and pH-regulating properties.

Other fermented product types that constitute 36% of the market include Biogas, Polymers, Vitamins, Antibiotics, and Industrial Enzymes, which meet specific industry needs and applications. Different varieties of fermented product types of help meet the diversified demand of the food, pharmaceutical, and industrial sector.

The applications of fermented ingredients are categorized, and the leading segment is food & beverages at 45%, which covers over half of the market. It is applied largely in the food and beverage area to enhance flavor, texture, shelf life, and nutritional content.

The Pharmaceuticals portion of the market is 26%, as ingredients are increasingly fermented in medications, supplements, and personal care products. The remaining 29% of the market is divided into other applications; these include Paper, Feed, and a category designated as Others, which will include specialized and emerging uses for fermented ingredients into industries such as cosmetics, textiles, and biofuels. The versatility of the fermented ingredients over diverse applications justifies their role in fulfilling evolving demands in numerous industries.

2024 was the year of the most forward-thinking innovations and strategic growths in fermented ingredients. Players focused on bio fermentation, precision fermentation, and regional market penetration. Such cost-efficient mergers of biotech companies and food and beverage manufacturers ensured sustainable ingredient development. Functional food applications accelerate dramatically through consumer preference for gut health and sustainability-related procurement factors.

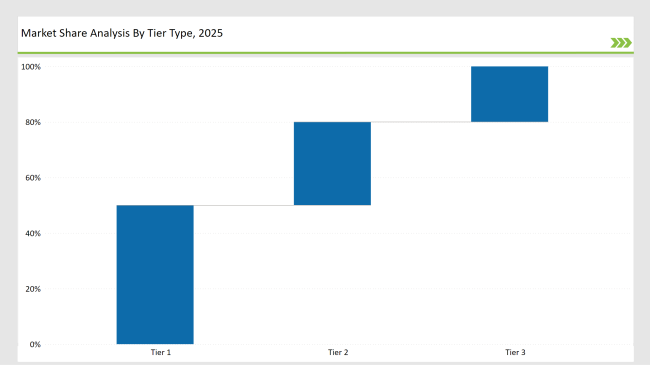

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 50% |

| Example of Key Players | DuPont, Kerry Group, Cargill, BASF, Chr. Hansen |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 30% |

| Example of Key Players | Corbion, Angel Yeast, Novozymes, Lesaffre |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 20% |

| Example of Key Players | BioSpringer, Meiji, Zhejiang NHU Co., Startups |

| Brand | Key Focus |

|---|---|

| DuPont | Developed AI-powered fermentation optimization for improved efficiency and cost reduction. |

| Kerry Group | Expanded investment in plant-based fermentation for dairy alternatives and meat substitutes. |

| Cargill | Strengthening partnerships with biotech firms to develop next-generation probiotics. |

| Chr. Hansen | Launched precision fermentation solutions to enhance probiotic production for dietary supplements. |

| Angel Yeast | Invested in sustainable yeast extract production to support clean-label food solutions. |

| Corbion | Acquired a biotech startup to expand capabilities in bio-based food preservation. |

| BASF | Introduced bioactive fermented ingredients for premium skincare and pharmaceutical applications. |

| Meiji | Expanded probiotic beverage offerings to cater to the growing functional drinks segment. |

| Evonik | Increased amino acid production capacity to meet rising demand in nutritional applications. |

| BioSpringer | Partnered with leading food manufacturers for organic yeast extract solutions. |

The increasing demand by consumers focused on gut health and immunity-boosting aspects is likely to drive the global fermented ingredients market to flourish with growth soon. The development and growth of probiotic-enriched functional food products like yogurts, kombucha, and dairy alternatives will gain importance from the companies' perspective.

Increasing investments and innovations are being witnessed in the precision fermentation space in terms of production for plant-based dairy, egg, and meat alternatives. Companies like Perfect Day and Nature's Fynd are spearheading this field using advanced fermentation methods to create these animal-free products that are functionally similar in properties and characteristics to their traditionally derived counterparts.

The Asia-Pacific region is likely to be the most rapidly expanding market for fermented ingredients, and China and India together are likely to drive a major share of global market growth.

Manufacturers should strategically establish regional production hubs and form local partnerships to capitalize on the rising demand for fermented ingredients in this dynamic and rapidly expanding market.

The global demand for fermented ingredients from the pharmaceutical industry is being seen to advance as the requirements for fermented bioactive, enzyme-based therapy, and probiotic formulations keep rising.

Pharmaceutical formulations have been accepting increasing amounts of fermented ingredients ranging from medicines to supplements and even personal care, in view of the proven effectiveness and safety to cater to specific health issues.

This expanding use of fermented products in the pharmaceutical industry holds great promise for manufacturers to upgrade their product lines and to collaborate with industry majors to pursue innovation and meet the dynamic needs of this segment.

The top five companies-DuPont, Kerry Group, Cargill, BASF, and Chr. Hansen-collectively control 50% of the global market, leveraging advanced fermentation technologies and strong supply chains.

Sustainable fermentation reduces waste by 30-40% and enables eco-friendly, zero-carbon production, helping brands meet global environmental regulations.

Chr. Hansen, Perfect Day, and Nature’s Fynd are leading advancements in precision fermentation for dairy, protein, and pharmaceutical applications.

AI-powered fermentation optimization is reducing production costs by 15-20% while enhancing efficiency and product consistency.

Regulatory hurdles, raw material price volatility, and scaling up precision fermentation technologies remain key challenges for market players.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fermented Coffee Market Size and Share Forecast Outlook 2025 to 2035

Fermented Botanicals for Anti-Aging Market Size and Share Forecast Outlook 2025 to 2035

Fermented Vitamins Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fermented Amino Acid Complex Market Size and Share Forecast Outlook 2025 to 2035

Fermented Beverages Market Size and Share Forecast Outlook 2025 to 2035

Fermented Rice Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Pet Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Fermented Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Face Mask Market Size and Share Forecast Outlook 2025 to 2035

Fermented Processed Food Market Size and Share Forecast Outlook 2025 to 2035

Fermented Dairy Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Dairy Ingredient Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Seaweed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Chymosin Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Flavours Market Size, Growth, and Forecast for 2025 to 2035

Fermented Ingredient Market Size, Growth, and Forecast for 2025 to 2035

Fermented Feed Market Analysis by Product Type, Livestock and Fermentation Process Through 2035

Fermented Cucumber Market Trends - Growth & Consumer Demand 2025 to 2035

Fermented Protein Market Trends - Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA