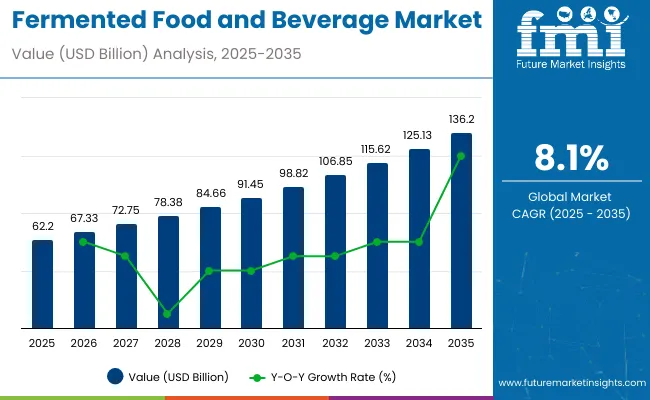

The global fermented food and beverage market is anticipated to register significant growth, expanding from USD 62.2 billion in 2025 to USD 136.2 billion by 2035, at a CAGR of 8.1%. The market is experiencing rapid transformation driven by increasing consumer interest in functional health, particularly in gut, immune, and metabolic health, as well as a resurgence in traditional fermentation practices across cultures.

Rising urbanization, health consciousness, and dietary shifts toward plant-based and naturally preserved foods are fueling demand. Fermented dairy, beverages, soy-based foods, and vegetables are witnessing widespread acceptance, with innovation in non-dairy probiotics, alcoholic kombucha, and fermented sauces gaining traction. Prebiotics and probiotics are also being integrated into supplements, infant formula, and fortified bakery products.

Major industry participants are investing in fermentation biotechnology, optimizing strain selection, and scaling aerobic and anaerobic fermentation platforms for both high-value nutrition and mass-market consumption. The expanding global reach of K-beauty, J-wellness, and Mediterranean diets has further embedded fermented ingredients into the global nutrition ecosystem.

The market is witnessing increased investments, mergers, and acquisitions aimed at expanding product portfolios and market reach. Notably, companies are focusing on fermented plant-based foods, aligning with sustainability and health trends.Regulatory support for functional claims and favorable consumer sentiment toward natural food preservation have established fermentation as a cornerstone of food innovation. Markets in Asia and Western Europe are driving cultural adoption, while North America is accelerating with clinical-grade product launches in probiotic-rich foods.

Supply chain operations encounter ingredient sourcing challenges as fermented food production requires coordination between culture suppliers, raw material procurement, and cold chain logistics while managing culture viability, ingredient traceability, and shelf life considerations that affect both product quality and inventory management. Procurement teams work with supplier qualification departments to establish culture storage and handling procedures while managing inventory rotation for temperature-sensitive ingredients.

Restaurant and food service operations encounter menu integration challenges as fermented ingredients require coordination between kitchen preparation procedures, staff training, and inventory management while managing flavor profile consistency and food safety protocols. Culinary teams coordinate with procurement departments to establish supplier relationships while working with service staff about customer education and allergen management across diverse fermented ingredient applications.

The integration of biotechnology advances introduces operational considerations as precision fermentation and engineered culture development require coordination between traditional food manufacturing and biotechnology capabilities while maintaining regulatory compliance and consumer acceptance. Technical operations teams coordinate with research institutions to establish technology transfer procedures while managing scale-up validation and quality verification that addresses both innovation objectives and commercial viability across evolving fermented food applications and market opportunities.

Per capita consumption of fermented food and beverages is growing globally as consumers become more health-conscious and seek products that promote gut health, immunity, and overall wellness. Fermented foods such as yogurt, kimchi, sauerkraut, and beverages like kombucha and kefir are increasingly popular due to their probiotic benefits and traditional appeal. This rise in consumption is supported by expanding product variety, growing awareness of fermentation benefits, and evolving dietary preferences.

Developed Countries

In countries like the United States, Germany, Japan, South Korea, and the United Kingdom, per capita consumption of fermented foods and beverages is relatively high. Consumers in these markets often prioritize premium, organic, and health-enhancing products. Well-developed retail infrastructure and increasing availability of artisanal and innovative fermented products further drive demand.

Emerging Markets

Countries including India, Brazil, Indonesia, South Africa, and Mexico are witnessing steady growth in per capita consumption of fermented food and beverages. Rising urbanization, improved food processing technologies, and increased health awareness contribute to this trend. Traditional fermented foods continue to be staple diets, while new fermented products are gaining popularity among younger consumers.

Trade Landscape of Fermented Food & Beverages

The global trade of fermented food and beverages is expanding due to rising consumer demand for health-focused and traditional products worldwide. Trade flows are shaped by regional production strengths, cultural preferences, and growing international interest in fermented specialties. Exporters and importers navigate complex regulatory environments related to food safety, labeling, and quality standards to access new markets.

Major Exporting Countries

Key exporters include South Korea, Germany, the Netherlands, China, and the United States. South Korea is a leading exporter of traditional fermented products like kimchi, while Germany and the Netherlands specialize in dairy-based fermented goods such as yogurt and cheese. China exports a wide range of fermented foods and beverages to neighboring Asian markets. The United States is known for innovative fermented beverages like kombucha.

Major Importing Countries

Top importers include the United States, Japan, the United Kingdom, Canada, and Australia. These countries import fermented products to meet growing consumer interest in probiotic and functional foods. Emerging markets in Latin America, the Middle East, and Southeast Asia are also increasing imports due to expanding middle-class populations and evolving dietary habits.

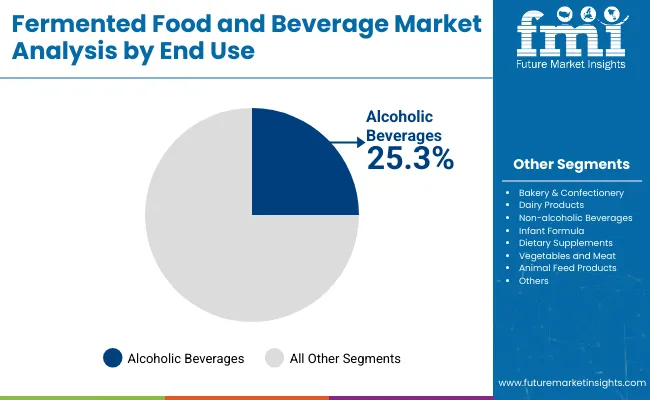

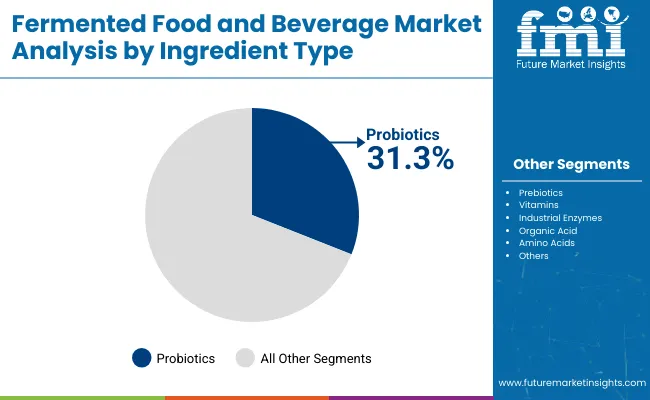

The fermented food and beverage market is led by alcoholic beverages with a 25.3% share, driven by innovations in fermented spirits and beers. On the ingredient side, probiotics dominate with 31.3% share due to their broad usage across food, beverage, and supplement categories.

The alcoholic beverages segment, which includes beer, wine, and traditional liquors like sake and palm wine, is projected to account for 25.3% of the global market in 2025. Demand is being driven by a younger demographic favoring craft brews and health-conscious drinkers turning to low-alcohol, probiotic-infused alcoholic options. Innovative products like kombucha beer, hard kefir, and botanical-based alcoholic ferments are creating new sub-categories with functional health benefits. Microbreweries are leveraging fermentation science to produce unique flavor profiles while minimizing additives.

In developing markets, there is a revival of traditional fermented alcoholic drinks adapted for modern packaging and branding. Meanwhile, premiumization trends are encouraging consumers to pay more for small-batch, aged, and clean-label spirits. Established brewers and startups alike are integrating postbiotic ingredients and live cultures to create distinctive, gut-friendly alcoholic offerings. Investment in cold chain logistics and functional ingredient sourcing is further enabling this segment’s expansion across global markets.

Accounting for an estimated 31.3% share in 2025, the probiotics segment stands as the most promising ingredient type in the fermented food and beverage landscape. Probiotics-comprising live beneficial bacteria such as Lactobacillus, Bifidobacterium, and Saccharomyces-are widely recognized for their role in improving gut microbiota balance, immune function, and even mental wellness via the gut-brain axis. They are now included not only in yogurts and beverages but also in snacks, sauces, and meal replacements, expanding their applications beyond traditional dairy.

The segment’s growth is supported by robust clinical studies, rising digestive health awareness, and personalization trends. Startups are introducing probiotic gummies, shelf-stable supplements, and customized mixes based on microbiome tests. Regulatory clarity in developed regions is encouraging new entrants to pursue EFSA and FDA-compliant formulations.

Additionally, synbiotic innovations-combining prebiotics and probiotics-are enhancing product efficacy and consumer interest. Global investments are rising in probiotic strain development, fermentation facilities, and delivery mechanisms, driving the segment’s strong trajectory.

Growth is fueled by rising demand for clean-label foods, natural preservation, and wellness-focused nutrition. Key challenges include probiotic strain stability and cold-chain logistics. Opportunities emerge in personalized nutrition and fermented cosmetic products. However, competition from synthetic additives and regulatory hurdles around health claims continue to pose significant risks for market expansion.

Functional Health Drives Fermentation's Return to Mainstream Diets

Health-focused consumers are turning to fermented products for gut support, immune enhancement, and overall wellness. Probiotic drinks, yogurts, and pickles offer bioactive compounds that improve microbiota balance and digestion. Functional fermentation also supports weight management and metabolic health, with growing evidence linking gut health to brain function.

Brands are capitalizing on these benefits to develop products with dual roles-nutrition and preventive care. Fermented superfoods and drinks are being marketed as part of holistic wellness routines. With growing clinical validation, fermentation has evolved from a traditional preservation method to a cornerstone of functional health innovation.

Cold Chain Dependence and Shelf Stability Remain Key Barriers

Many fermented foods and probiotic drinks require refrigeration to maintain viability of live cultures. This limits scalability in regions lacking cold-chain infrastructure. Shelf stability is often compromised by strain degradation, reducing efficacy and consumer satisfaction.

Even in developed markets, high logistics costs make low-margin products challenging. Innovations in encapsulated strains, freeze-drying, and aseptic processing are progressing but still expensive. Brands are now working to develop postbiotic and heat-stable alternatives to mitigate this limitation. Until these technologies scale, cold chain dependency will continue to restrict market penetration in price-sensitive and infrastructure-deficient markets.

Personalized Probiotics and Beauty-from-Within Expand Application Scope

Fermentation is evolving beyond food into nutraceuticals, skincare, and personalized nutrition. Advances in microbiome science allow manufacturers to develop customized probiotic profiles for individual health needs. Startups and multinationals are now combining AI with gut health diagnostics to deliver tailored fermented solutions.

The beauty-from-within trend is also driving demand for fermented collagen drinks, enzyme boosters, and functional shots. Fermented herbs and fruits are being used in wellness teas, sleep aids, and stress-reduction drinks. This cross-sector convergence is opening new markets and allowing fermentation-based products to reach high-income consumers seeking precision health solutions.

Lack of Global Regulations for Probiotic Claims Hampers Innovation

Despite rising demand, many countries lack standardized frameworks for probiotic labeling and health claims. Definitions of live culture content, strain naming, and functional benefits vary significantly. This limits innovation and complicates cross-border marketing. Companies hesitate to invest in novel probiotic strains due to uncertain approval pathways.

Clinical trial requirements for functional claims are costly and time-consuming. Inconsistent regulatory language also affects consumer understanding. Industry players are advocating for harmonized standards under bodies like Codex Alimentarius and national food safety agencies. Until then, regulatory ambiguity remains a bottleneck for faster product development and brand differentiation.

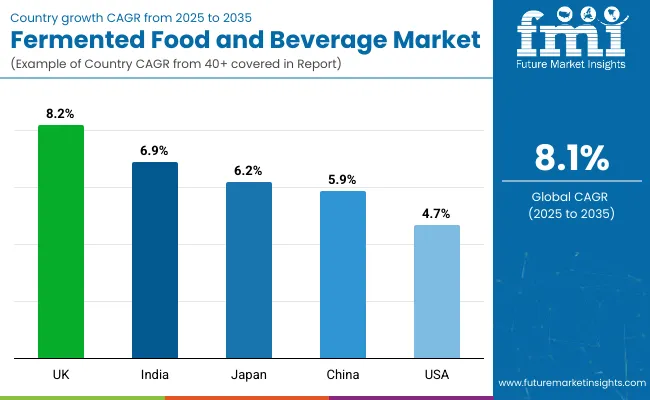

The USA and Japan dominate clinical-grade fermented product innovation, backed by mature wellness markets. China and India are expanding rapidly in functional drinks and traditional ferments. The UK, registering a robust 8.2% CAGR, is emerging as a high-growth hub driven by premiumization, plant-based demand, and rising awareness of gut health benefits.

In the United States, the fermented food and beverage market is projected to grow at a CAGR of 4.7% from 2025 to 2035. This growth is underpinned by the rising demand for gut-friendly functional foods, primarily driven by consumer focus on digestive health, immunity, and clean-label diets. Products such as kombucha, kefir, kimchi, and Greek yogurt continue to gain traction across mainstream retail shelves. In addition to traditional categories, there is increasing interest in plant-based probiotic drinks and protein-fortified fermented snacks.

The clinical nutrition and wellness segments are integrating fermented products into dietary programs. Regulatory clarity, a robust cold-chain infrastructure, and continuous R&D investments from major players like Danone, Nestlé, and ADM are fostering category innovation. Startups offering personalized probiotics and fermented condiments are also contributing to shelf expansion and consumer education. The USA remains a high-potential market for premium, science-backed fermentation solutions.

The United Kingdom’s fermented food and beverage market is projected to grow at 8.2% CAGR, exceeding the global average. This high growth rate is driven by consumer preference for plant-based probiotic foods, low-alcohol ferments, and digestive health solutions. Kombucha, kimchi, kefir, and vegan yogurt have become widely available in supermarkets and health-focused outlets. The rising incidence of IBS and other digestive conditions is prompting more consumers to seek fermented solutions.

Direct-to-consumer brands are innovating with gut-health focused snacks, low-FODMAP condiments, and prebiotic-rich sodas. Clean-label and free-from formulations have accelerated product development, especially among flexitarian consumers. Retailers are responding with expanded cold-chain support and curated wellness aisles.

Startups are also experimenting with fermented legumes, sauerkraut dips, and bioactive juices. Regulatory support for functional food claims and public campaigns on microbiome health are driving further awareness. The UK’s premium health segment remains highly responsive to fermentation-led innovation.

China’s fermented food and beverage market is forecast to expand at a CAGR of 5.9% through 2035. This growth is being fueled by rising health consciousness among urban populations and increased attention to gut health. Traditional products such as fermented soybeans, black garlic, pickled vegetables, and vinegar-based condiments continue to perform strongly. However, modern fermented formats-such as probiotic yogurts, enzyme teas, and functional beverages-are becoming popular, particularly among millennials and wellness-conscious adults.

Domestic brands are innovating with flavors and ingredients that merge traditional medicine and modern probiotic science. International players are entering the market through partnerships and e-commerce platforms to leverage China’s vast consumer base. Shelf-stable fermented products with added prebiotics and vitamins are gaining shelf share across tier-one cities. Regulatory approvals for health claims are becoming more streamlined, making China a highly strategic market for both functional and cultural fermentation-based foods.

India’s fermented food and beverage market is set to grow at the highest CAGR of 6.9% between 2025 and 2035. Traditional Indian ferments-such as curd, lassi, dosa batter, kanji, and pickled vegetables-form the foundation of daily diets across regions. In recent years, urban consumers have shifted toward probiotic-rich yogurt drinks, fermented health shots, and kombucha, signaling a fusion of traditional preferences with modern wellness trends. Ayurvedic nutrition and plant-based fermented snacks are also rising in demand.

Several startups are introducing functional beverages fortified with prebiotics, postbiotics, and herbal ferments. E-commerce and health-focused retail chains are expanding access to premium and functional SKUs. Domestic manufacturing capacity and India’s young demographic offer large-scale opportunities for market penetration. With increasing consumer education and regulatory support for nutraceuticals, India presents a fast-evolving landscape for both traditional and bioengineered fermented food innovation.

Fermented food and beverages market in Japan is expected to grow at a CAGR of 6.2%, driven by the cultural acceptance and daily use of fermented products. Long-standing staples such as miso, natto, soy sauce, and fermented rice beverages dominate consumption across age groups. However, the market is also being shaped by rising demand for fermented functional drinks, collagen supplements, and beauty-enhancing ferments. Japan's aging population is particularly drawn to fermentation-based foods due to their digestive and cardiovascular health benefits.

Health-conscious young consumers are adopting low-sugar, probiotic-enhanced drinks that combine convenience with clinical claims. Retail chains and vending machines offer high accessibility to chilled fermented drinks and snacks. Leading local brands are investing in new bacterial strains and packaging formats that appeal to both domestic and international markets. With a robust R&D infrastructure and a strong regulatory framework, Japan continues to lead in functional fermentation and cosmeceutical food applications.

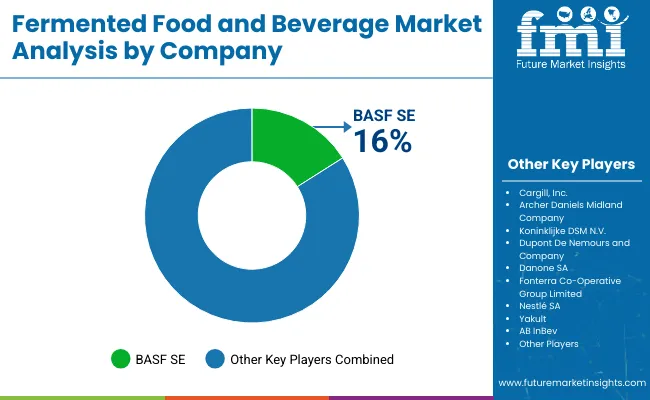

The fermented food and beverage market is moderately concentrated. Global leaders focus on probiotics, dairy alternatives, nutraceuticals, and fermentation-based ingredients. Danone S.A., Nestlé S.A., Yakult Honsha Co., Ltd., Fonterra Co-operative Group Limited, and Cargill, Inc. lead with probiotic yogurts, functional drinks, and dairy alternatives offering validated health benefits. AB InBev dominates fermented alcoholic beverages, investing in hybrid kombucha beers. BASF SE, Archer Daniels Midland Company, Koninklijke DSM N.V., and DuPont de Nemours and Company provide fermentation-based enzymes, acids, and bioactive components for food, beverage, and nutraceutical applications.

Tier 2 players and startups focus on localized kombucha, vegan ferments, and small-batch fermented sauces, often in direct-to-consumer channels in the UK and US, offering functional drinks with prebiotics and shelf-stable probiotics. Innovation emphasizes strain stability, cold-chain optimization, and AI-based product personalization while extending shelf life without reducing microbial efficacy.

Halal, kosher, and clean-label certifications are increasingly important for global market expansion. Companies are exploring fermentation applications in cosmetics, baby food, and sports nutrition. Success depends on combining R&D, scalable production, and strong health-focused branding, positioning leading suppliers to capture both premium and high-volume market segments.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 62.2 billion |

| Projected Market Size (2035) | USD 136.2 billion |

| CAGR (2025 to 2035) | 8.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Ingredient Types Analyzed (Segment 1) | Prebiotics, Probiotics, Vitamins, Industrial Enzymes, Organic Acid, Amino Acids, Others |

| Fermentation Processes Analyzed (Segment 2) | Anaerobic Fermentation, Aerobic Fermentation, Continuous Fermentation, Batch Fermentation, Others |

| End Uses Analyzed | Bakery & Confectionery, Dairy Products, Alcoholic Beverages, Non-alcoholic Beverages, Infant Formula, Dietary Supplements, Vegetables and Meat, Animal Feed Products, Fermented Chilli Sauce, Fermented Fish Sauce, Others |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East and Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players Influencing the Fermented Food and Beverage Market | Danone S.A., Nestlé S.A., Yakult Honsha Co., Ltd., Fonterra Co-operative Group Limited, Cargill, Inc., BASF SE, Archer Daniels Midland Company, Koninklijke DSM N.V., DuPont de Nemours and Company, AB InBev |

| Additional Attributes | Demand for gut health and immunity-boosting products, Innovation in plant-based fermented foods, Expansion of functional beverages, Role of probiotics in dietary supplements, Regional fermentation traditions and preferences, Rise in clean-label and organic fermentation trends |

By ingredient type, the industry is segmented into prebiotics, probiotics, vitamins, industrial enzymes, organic acid, amino acids and others.

By fermentation process, the industry includes anaerobic fermentation, aerobic fermentation, continuous fermentation, batch fermentation and others.

By end use, the industry is divided in to bakery & confectionery, dairy products, alcoholic beverages, non-alcoholic beverages, infant formula, dietary supplements, vegetables and meat, animal feed products, fermented chili sauce, fermented fish sauce and others.

Regionally, the industry is studied in North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia and Middle East and Africa.

It is estimated to reach USD 62.2 billion in 2025.

The market is forecast to reach USD 136.2 billion by 2035.

Alcoholic beverages accounts for 25.3% of the market in 2025.

Probiotics, with a market share of 31.3% leads the market.

Key companies include Danone, Nestlé, DSM, Cargill, Yakult, and AB InBev.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Tons) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Ingredient Type, 2019 to 2034

Table 4: Global Market Volume (Tons) Forecast by Ingredient Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Fermentation Process, 2019 to 2034

Table 6: Global Market Volume (Tons) Forecast by Fermentation Process, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 8: Global Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Ingredient Type, 2019 to 2034

Table 12: North America Market Volume (Tons) Forecast by Ingredient Type, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Fermentation Process, 2019 to 2034

Table 14: North America Market Volume (Tons) Forecast by Fermentation Process, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 16: North America Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Ingredient Type, 2019 to 2034

Table 20: Latin America Market Volume (Tons) Forecast by Ingredient Type, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Fermentation Process, 2019 to 2034

Table 22: Latin America Market Volume (Tons) Forecast by Fermentation Process, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 24: Latin America Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Ingredient Type, 2019 to 2034

Table 28: Western Europe Market Volume (Tons) Forecast by Ingredient Type, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by Fermentation Process, 2019 to 2034

Table 30: Western Europe Market Volume (Tons) Forecast by Fermentation Process, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 32: Western Europe Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Ingredient Type, 2019 to 2034

Table 36: Eastern Europe Market Volume (Tons) Forecast by Ingredient Type, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Fermentation Process, 2019 to 2034

Table 38: Eastern Europe Market Volume (Tons) Forecast by Fermentation Process, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 40: Eastern Europe Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Ingredient Type, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Tons) Forecast by Ingredient Type, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Fermentation Process, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Tons) Forecast by Fermentation Process, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Ingredient Type, 2019 to 2034

Table 52: East Asia Market Volume (Tons) Forecast by Ingredient Type, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by Fermentation Process, 2019 to 2034

Table 54: East Asia Market Volume (Tons) Forecast by Fermentation Process, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 56: East Asia Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Ingredient Type, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Tons) Forecast by Ingredient Type, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Fermentation Process, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Tons) Forecast by Fermentation Process, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Tons) Forecast by End Use, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Ingredient Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Fermentation Process, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by End Use, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Tons) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Ingredient Type, 2019 to 2034

Figure 10: Global Market Volume (Tons) Analysis by Ingredient Type, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Ingredient Type, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Ingredient Type, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by Fermentation Process, 2019 to 2034

Figure 14: Global Market Volume (Tons) Analysis by Fermentation Process, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Fermentation Process, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Fermentation Process, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 18: Global Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 21: Global Market Attractiveness by Ingredient Type, 2024 to 2034

Figure 22: Global Market Attractiveness by Fermentation Process, 2024 to 2034

Figure 23: Global Market Attractiveness by End Use, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Ingredient Type, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Fermentation Process, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Ingredient Type, 2019 to 2034

Figure 34: North America Market Volume (Tons) Analysis by Ingredient Type, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Ingredient Type, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Ingredient Type, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Fermentation Process, 2019 to 2034

Figure 38: North America Market Volume (Tons) Analysis by Fermentation Process, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Fermentation Process, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Fermentation Process, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 42: North America Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 45: North America Market Attractiveness by Ingredient Type, 2024 to 2034

Figure 46: North America Market Attractiveness by Fermentation Process, 2024 to 2034

Figure 47: North America Market Attractiveness by End Use, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Ingredient Type, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by Fermentation Process, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Ingredient Type, 2019 to 2034

Figure 58: Latin America Market Volume (Tons) Analysis by Ingredient Type, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Ingredient Type, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Ingredient Type, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by Fermentation Process, 2019 to 2034

Figure 62: Latin America Market Volume (Tons) Analysis by Fermentation Process, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Fermentation Process, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Fermentation Process, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 66: Latin America Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Ingredient Type, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Fermentation Process, 2024 to 2034

Figure 71: Latin America Market Attractiveness by End Use, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Ingredient Type, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by Fermentation Process, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Ingredient Type, 2019 to 2034

Figure 82: Western Europe Market Volume (Tons) Analysis by Ingredient Type, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Ingredient Type, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Ingredient Type, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by Fermentation Process, 2019 to 2034

Figure 86: Western Europe Market Volume (Tons) Analysis by Fermentation Process, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Fermentation Process, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Fermentation Process, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 90: Western Europe Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Ingredient Type, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by Fermentation Process, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by End Use, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Ingredient Type, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by Fermentation Process, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Ingredient Type, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Tons) Analysis by Ingredient Type, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Ingredient Type, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Ingredient Type, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Fermentation Process, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Tons) Analysis by Fermentation Process, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Fermentation Process, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Fermentation Process, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Ingredient Type, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by Fermentation Process, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by End Use, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Ingredient Type, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by Fermentation Process, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by End Use, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Ingredient Type, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Tons) Analysis by Ingredient Type, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Ingredient Type, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Ingredient Type, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Fermentation Process, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Tons) Analysis by Fermentation Process, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Fermentation Process, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Fermentation Process, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Ingredient Type, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by Fermentation Process, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by End Use, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Ingredient Type, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by Fermentation Process, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by End Use, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Ingredient Type, 2019 to 2034

Figure 154: East Asia Market Volume (Tons) Analysis by Ingredient Type, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Ingredient Type, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Ingredient Type, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by Fermentation Process, 2019 to 2034

Figure 158: East Asia Market Volume (Tons) Analysis by Fermentation Process, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Fermentation Process, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Fermentation Process, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 162: East Asia Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Ingredient Type, 2024 to 2034

Figure 166: East Asia Market Attractiveness by Fermentation Process, 2024 to 2034

Figure 167: East Asia Market Attractiveness by End Use, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Ingredient Type, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by Fermentation Process, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by End Use, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Ingredient Type, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Tons) Analysis by Ingredient Type, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Ingredient Type, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Ingredient Type, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Fermentation Process, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Tons) Analysis by Fermentation Process, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Fermentation Process, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Fermentation Process, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Ingredient Type, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Fermentation Process, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by End Use, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fermented Coffee Market Size and Share Forecast Outlook 2025 to 2035

Fermented Botanicals for Anti-Aging Market Size and Share Forecast Outlook 2025 to 2035

Fermented Vitamins Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fermented Amino Acid Complex Market Size and Share Forecast Outlook 2025 to 2035

Fermented Rice Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Pet Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Fermented Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Face Mask Market Size and Share Forecast Outlook 2025 to 2035

Fermented Dairy Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Dairy Ingredient Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Seaweed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Chymosin Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Flavours Market Size, Growth, and Forecast for 2025 to 2035

Fermented Ingredient Market Size, Growth, and Forecast for 2025 to 2035

Fermented Feed Market Analysis by Product Type, Livestock and Fermentation Process Through 2035

Market Share Breakdown of Fermented Ingredients

Fermented Cucumber Market Trends - Growth & Consumer Demand 2025 to 2035

Fermented Protein Market Trends - Innovations & Growth 2025 to 2035

Fermented Sweeteners Market

Fermented Beverages Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA