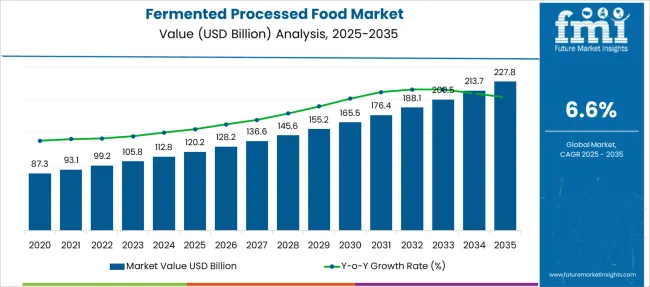

The Fermented Processed Food Market is estimated to be valued at USD 120.2 billion in 2025 and is projected to reach USD 227.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period.

| Metric | Value |

|---|---|

| Fermented Processed Food Market Estimated Value in (2025 E) | USD 120.2 billion |

| Fermented Processed Food Market Forecast Value in (2035 F) | USD 227.8 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The fermented processed food market is advancing steadily due to rising consumer demand for functional foods that support digestive and immune health. This growth is being fueled by increased awareness of gut microbiota, the health-promoting benefits of probiotics, and clean-label food preferences. Manufacturers are enhancing product formulations using targeted microbial strains and controlled fermentation techniques to improve nutritional content, shelf stability, and flavor complexity.

In addition, the trend toward natural preservation methods is contributing to the resurgence of traditional fermentation practices adapted through modern bioprocessing. Technological innovation in food biotechnology and packaging is also enabling longer shelf lives and safer transport of live cultures.

With heightened focus on sustainable production methods and personalized nutrition, fermented foods are increasingly being positioned as both daily staples and specialty wellness products. These evolving consumer and industry dynamics are expected to drive consistent expansion of the market across developed and emerging economies.

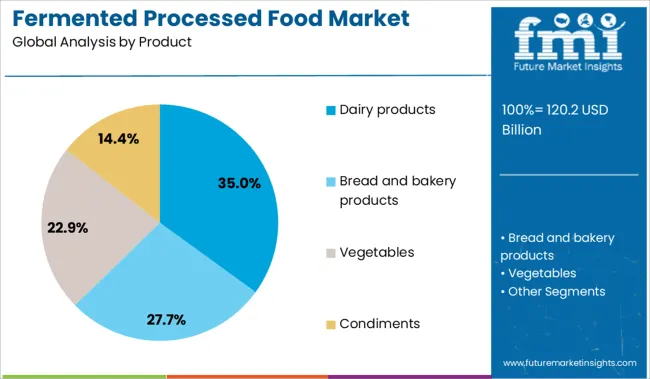

The market is segmented by Product and Microorganism and region. By Product, the market is divided into Dairy products, Yogurt, Cheese, Buttermilk, Kefir, Bread and bakery products, Sourdough bread, Fermented pastries, Vegetables, Sauerkraut, Kimchi, Fermented pickles, Condiments, Soy sauce, Miso, Fish sauce, Fermented chili pastes, Beverages, Kombucha, Wine, Beer, and Cider.

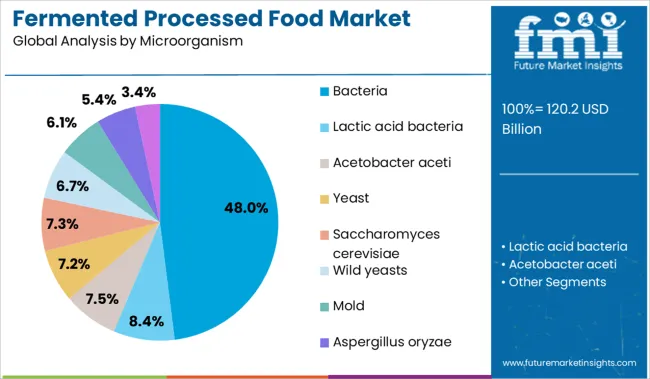

In terms of Microorganism, the market is classified into Bacteria, Lactic acid bacteria, Acetobacter aceti, Yeast, Saccharomyces cerevisiae, Wild yeasts, Mold, Aspergillus oryzae, and Penicillium. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The dairy products subsegment is projected to hold 35% of the fermented processed food market revenue share in 2025, positioning it as the leading product category. This dominance has been supported by the long-standing integration of fermentation in dairy production, resulting in a wide portfolio of products that are both familiar and nutritionally rich. The use of fermentation in dairy enhances digestibility, increases shelf life, and supports probiotic delivery, aligning with growing consumer interest in gut health and functional foods.

Dairy-based fermented products are also highly versatile, allowing for customization in flavor, texture, and health benefits. Advances in microbial processing and strain selection have enabled consistent product quality while expanding health claims, particularly around immunity and metabolic health.

Moreover, dairy remains a preferred matrix for fermentation due to its natural compatibility with probiotic cultures, which has allowed producers to scale innovation without significant structural changes. The segment continues to grow as consumer trust in dairy fermentation remains strong and nutritional awareness expands globally.

The bacteria subsegment is expected to command 48% of the fermented processed food market revenue share in 2025, establishing it as the leading microorganism type used in fermentation. This leadership has been attributed to the essential role bacteria play in producing beneficial enzymes, vitamins, and organic acids that enhance both safety and nutritional quality of food products. Lactic acid bacteria, in particular, have been recognized for their functional contributions to gut health, preservation, and sensory improvement.

The adaptability of bacterial strains to diverse substrates and environmental conditions has made them indispensable in large-scale fermentation processes. Additionally, their compatibility with dairy, vegetable, cereal, and meat-based products has expanded their application across the entire fermented food spectrum.

Scientific advancements in strain isolation and genome editing have allowed for targeted functionalities, such as improved digestibility and immune modulation. The established regulatory safety profiles of bacterial strains have further accelerated their adoption, reinforcing their continued dominance within the market.

Demand for gut-health-enhancing products has increased interest in items like kimchi, sauerkraut, tempeh, miso, and yogurt-based snacks. Brands are innovating with fusion formats, kombucha-infused dressings or probiotic-rich snack bars, while rebranding ethnic staples for mainstream shelves. Shelf-stable variants with clean labels and reduced sugar are driving retail adoption across convenience and health-focused formats.

Consumer preference has shifted toward fermented processed foods that combine heritage value with digestive health claims. Products like miso soup, kefir, and kimchi are now positioned as probiotic-rich functional foods rather than just ethnic cuisine. For instance, GT’s Kombucha expanded into fermented sparkling water formats to appeal to wellness-focused consumers. Wildbrine rebranded traditional sauerkraut with global flavor infusions like sriracha and Thai basil to boost appeal in natural food stores. These products benefit from scientific association with gut microbiota support, immune modulation, and nutrient absorption. Supermarkets and online platforms are dedicating premium shelf space to cold-chain fermented items. The increased crossover between functional nutrition and culinary exploration is driving demand for fermented products in both snacking and meal preparation categories.

A major challenge in the fermented processed food space is maintaining consistent microbial viability across shelf life and supply chains. Unlike heat-processed foods, fermented products rely on live cultures, which are sensitive to time, temperature, and packaging. For example, refrigerated kimchi or fresh kefir lose active cultures if stored improperly, limiting product efficacy and consumer trust. Brands like Bubbies have faced hurdles in ensuring shelf-stable fermentation without compromising probiotic content. Labeling accuracy around CFUs (colony-forming units) is under scrutiny from regulators and nutrition advocates. Additionally, global expansion is hindered by regulatory ambiguity around live microbial claims in processed foods. These inconsistencies increase risk for manufacturers and limit broader functional positioning across markets.

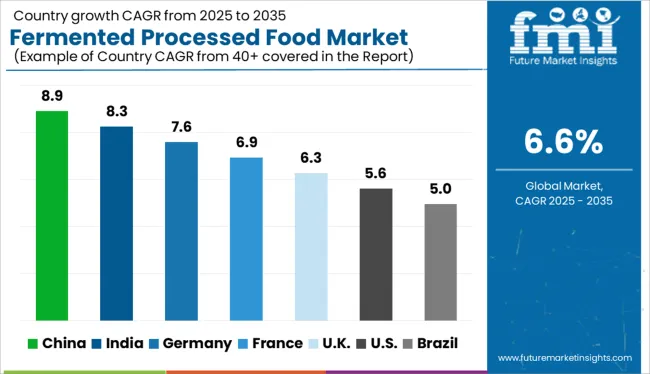

| Country | CAGR |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| France | 6.9% |

| UK | 6.3% |

| USA | 5.6% |

| Brazil | 5.0% |

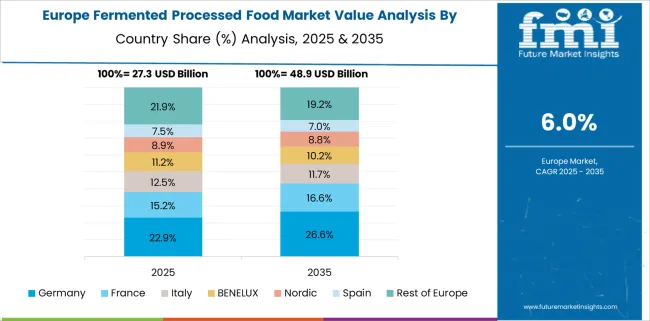

The global fermented processed food market is projected to grow at a 7% CAGR through 2035, with performance diverging across key economic blocs. China and India, both part of BRICS, lead at 8.9% and 8.3% respectively, supported by scaled production of traditional staples and packaged probiotic innovations. Germany and France, members of the OECD, post 7.6% and 6.9%, shaped by regulatory-driven claims and limited SKU experimentation. The United Kingdom follows at 6.3%, where the transition from niche fermented beverages to mainstream sauces and sourdough reflects a volume-focused market reset. This divergence signals BRICS-led supply chain acceleration, while OECD markets prioritize clean-label validation and certification-led product reformulation. The report includes analysis of over 40 countries, with five profiled below for reference.

Sales of the fermented processed food in China are expanding at a CAGR of 8.9% from 2025 to 2035. Consumer preferences are rapidly shifting toward probiotic-enriched, shelf-stable products across dairy, soy, and savory categories. Retailers are increasing probiotic SKU offerings tied to digestive wellness and freshness perception. Fermented side dishes such as pickled vegetables and bean curds are witnessing high traction in convenience-driven meal segments. Domestic brands are investing in fusion innovations, combining traditional fermentation with modern functional ingredients. Smart packaging and QR-based freshness indicators are gaining attention in cities.

Demand for fermented processed food in India is growing at a CAGR of 8.3% from 2025 to 2035. Ready-to-use idli-dosa batter, probiotic curds, and kanji beverages are rapidly expanding into mid-tier retail chains. Government initiatives through FSSAI and local R&D hubs are supporting microbial stability, packaging norms, and shelf-life improvement. Regional brands are receiving financial support to modernize fermentation processes and introduce batch-certified products. Demand is concentrated in metro areas where functional foods are being adopted as part of mainstream diets. Cross-brand collaboration with health food retailers is shaping pricing and formulation decisions.

Sales of fermented processed food in Germany are expected to grow at a CAGR of 7.6% from 2025 to 2035. Market evolution is shaped by mandatory compliance under BfR and BVL directives, governing microbial safety, fermentation transparency, and traceability. Fermented foods must disclose origin of starter cultures, strain properties, and fermentation controls. Organic-labeled SKUs require additional documentation under EU Regulation 2018/848. Innovation remains concentrated in functional dairy, cheese, and non-dairy fermented snacks where dual-label certification organic and probiotic is prioritized. Unlike BRICS counterparts, German manufacturers invest heavily in validation studies and microbial registries. Stringent regulations limit speed-to-market but support high product trust.

Demand for fermented processed food in France is forecasted to grow at a CAGR of 6.9% from 2025 to 2035. While dairy-based and bakery fermentation dominate, newer categories like kimchi, kefir, and miso remain confined to premium stores. Unlike China and India, where fermented foods span price tiers and retail formats, France continues to favor artisanal and legacy products. Retail expansion is slower outside major cities, limiting innovation exposure. Specialty fermented beverages are gaining some momentum, but adoption is regional rather than national. Consumer expectations revolve around familiar taste profiles and EU-origin authenticity. Experimentation remains limited, with shelf dynamics favoring traditional over globally influenced formulations.

The United Kingdom fermented processed food market is expected to expand at a CAGR of 6.3% from 2025 to 2035, up from under 4% growth recorded between 2020 and 2024. Early market development was driven by kombucha and yogurt-based probiotic drinks in online wellness stores. Current momentum favors hybrid fermented sauces, sourdough baking kits, and functional spreads entering grocery shelves. Branded players are pushing culinary utility over probiotic claims. Shelf-stable, heat-tolerant fermented options are expected to dominate new launches. Retailers are investing in bundled fermented assortments to improve household penetration. Future demand will center around brand versatility, not just health narratives.

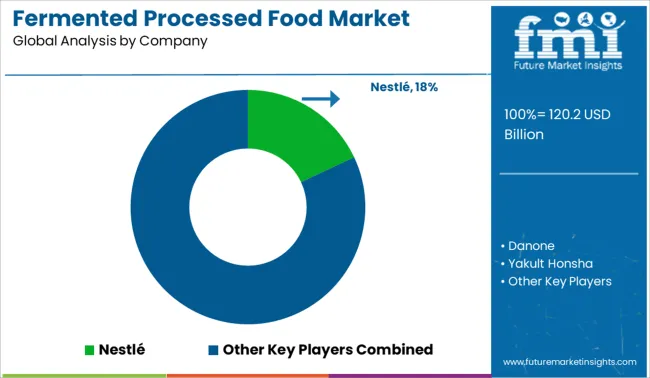

The fermented processed food industry is led by a mix of global dairy giants, functional food specialists, and diversified FMCG players. Nestlé holds the leading position with a significant market share, driven by its global footprint in probiotic yogurts, kefir drinks, and infant nutrition. Danone and Yakult Honsha maintain strongholds in Asia and Europe through gut-health branding and clinical backing of fermented dairy lines. PepsiCo and General Mills have expanded into plant-based fermented snacks and cultured beverages. Chobani focuses on high-protein, low-sugar formulations, capturing the wellness-conscious segment. Fonterra and DSM contribute through B2B supply of fermented ingredients and cultures. The market is now shaped by bacterial strain transparency, clean-label positioning, and portfolio diversification across dairy and non-dairy fermented formats.

| Item | Value |

|---|---|

| Quantitative Units | USD 120.2 Billion |

| Product | Dairy products, Yogurt, Cheese, Buttermilk, Kefir, Bread and bakery products, Sourdough bread, Fermented pastries, Vegetables, Sauerkraut, Kimchi, Fermented pickles, Condiments, Soy sauce, Miso, Fish sauce, Fermented chili pastes, Beverages, Kombucha, Wine, Beer, and Cider |

| Microorganism | Bacteria, Lactic acid bacteria, Acetobacter aceti, Yeast, Saccharomyces cerevisiae, Wild yeasts, Mold, Aspergillus oryzae, and Penicillium |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nestlé, Danone, Yakult Honsha, PepsiCo, General Mills, Chobani, Fonterra, and DSM |

| Additional Attributes | Dollar sales for fermented processed foods are rising across categories like yogurt, kefir, kimchi, kombucha, and tempeh, with probiotic-rich and plant-based variants capturing increased share. There’s growing consumer interest in gut and immune health. Contract manufacturers are scaling boutique brands, particularly in North America and Asia-Pacific, while sustainable packaging innovations are emerging. |

The global fermented processed food market is estimated to be valued at USD 120.2 billion in 2025.

The market size for the fermented processed food market is projected to reach USD 227.8 billion by 2035.

The fermented processed food market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in fermented processed food market are dairy products, yogurt, cheese, buttermilk, kefir, bread and bakery products, sourdough bread, fermented pastries, vegetables, sauerkraut, kimchi, fermented pickles, condiments, soy sauce, miso, fish sauce, fermented chili pastes, beverages, kombucha, wine, beer and cider.

In terms of microorganism, bacteria segment to command 48.0% share in the fermented processed food market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fermented Coffee Market Size and Share Forecast Outlook 2025 to 2035

Fermented Botanicals for Anti-Aging Market Size and Share Forecast Outlook 2025 to 2035

Fermented Vitamins Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fermented Amino Acid Complex Market Size and Share Forecast Outlook 2025 to 2035

Fermented Beverages Market Size and Share Forecast Outlook 2025 to 2035

Fermented Rice Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Pet Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Fermented Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Face Mask Market Size and Share Forecast Outlook 2025 to 2035

Fermented Dairy Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Dairy Ingredient Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Seaweed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Chymosin Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Flavours Market Size, Growth, and Forecast for 2025 to 2035

Fermented Ingredient Market Size, Growth, and Forecast for 2025 to 2035

Fermented Feed Market Analysis by Product Type, Livestock and Fermentation Process Through 2035

Market Share Breakdown of Fermented Ingredients

Fermented Cucumber Market Trends - Growth & Consumer Demand 2025 to 2035

Fermented Protein Market Trends - Innovations & Growth 2025 to 2035

Fermented Sweeteners Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA