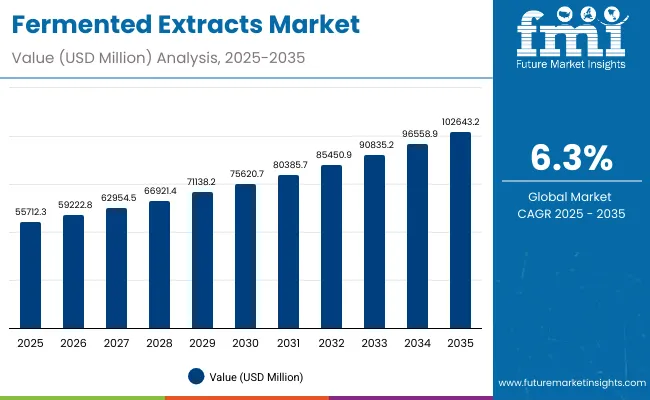

The Fermented Extracts Market is expected to record a valuation of USD 55,712.3 million in 2025 and USD 102,643.2 million in 2035, with an increase of USD 46,930.9 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 6.3% and a 2X increase in market size.

Fermented Extracts Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | 55,712.3 million |

| Market Forecast Value in (2035F) | USD 102,643.2 million |

| Forecast CAGR (2025 to 2035) | 6.3% |

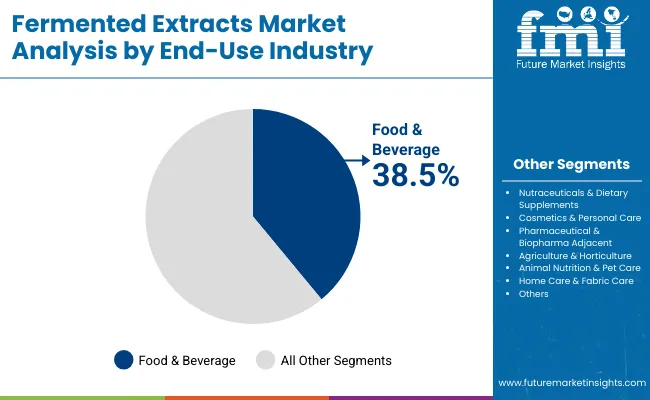

During the first five-year period from 2025 to 2030, the market increases from USD 55,712.3 million to USD 75,620.7 million, adding USD 19,908.4 million, which accounts for 42.4% of the total decade growth. This phase records steady adoption in functional beverages, dairy alternatives, and nutraceutical formulations, driven by the need for bioactive and natural extracts. Food & Beverage end-use dominates this period as it caters to over 38.5% of global applications requiring functional health and flavor benefits.

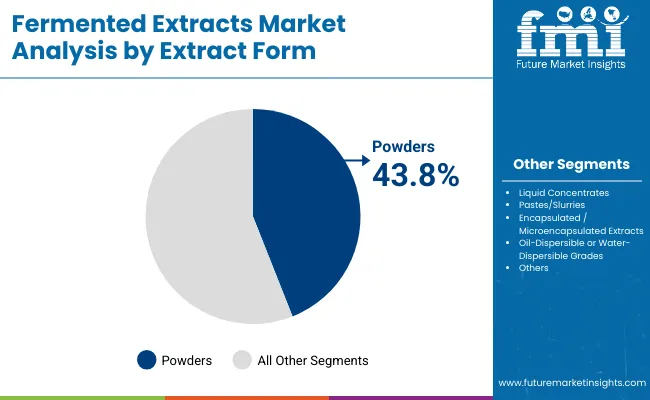

The second half from 2030 to 2035 contributes USD 27,022.5 million, equal to 57.6% of total growth, as the market jumps from USD 75,620.7 million to USD 102,643.2 million. This acceleration is powered by widespread deployment of fermented botanicals, postbiotic complexes, and cosmetics-grade ferments. Nutraceuticals, dietary supplements, and pharmaceutical-adjacent categories expand rapidly, while encapsulated and powder-based forms capture a larger share above 43.8% by the end of the decade. Direct-to-manufacturer channels and ingredient distributors add recurring revenue, increasing the distribution-driven share beyond 60% in total value.

From 2020 to 2024, the Global Fermented Extracts Market grew from USD 41,700 million to USD 55,712.3 million, driven by food & beverage-centric adoption. During this period, the competitive landscape was dominated by ingredient manufacturers controlling nearly 70% of revenue, with leaders such as DuPont, Kerry Group, and Chr. Hansen focusing on plant-based and microbial fermentation for functional foods and nutraceuticals. Competitive differentiation relied on bioavailability, purity, and regulatory compliance, while cosmetics and pharmaceuticals were emerging but secondary contributors. Distribution-led and service-based models had minimal traction, contributing less than 15% of the total market value.

Demand for fermented extracts will expand to USD 55,712.3 million in 2025, and the revenue mix will shift as nutraceuticals, cosmetics, and pharmaceuticals grow to over 35% share. Traditional food ingredient leaders face rising competition from biotechnology-driven players offering postbiotic actives, microencapsulated delivery systems, and subscription-based supply models. Major ingredient vendors are pivoting to hybrid models, integrating sustainability credentials, clean-label certifications, and personalized nutrition solutions to retain relevance. Emerging entrants specializing in marine and algal ferments, AR/VR-backed consumer engagement in cosmetics, and industry-specific delivery platforms are gaining share. The competitive advantage is moving away from ingredient purity alone to ecosystem integration, scalability, and recurring supply agreements.

Advances in fermentation technology have improved yields, purity, and bioactive compound stability, allowing for more efficient extract applications across diverse industries. Plant-based and microbial-derived ferments have gained popularity due to their suitability for natural health benefits, clean-label food formulations, and eco-friendly cosmetics. The rise of powders and encapsulated formats has contributed to enhanced shelf stability and targeted release capabilities. Industries such as food & beverage, nutraceuticals, and cosmetics are driving demand for fermented extracts that can integrate seamlessly into existing workflows. Expansion of dietary supplements, functional beverages, and postbiotic applications has fueled market growth. Innovations in encapsulation, oil-dispersible grades, and mixed microbial consortia are expected to open new application areas. Segment growth is expected to be led by food & beverage components, plant-based sources, and powder forms due to their precision, adaptability, and consumer acceptance.

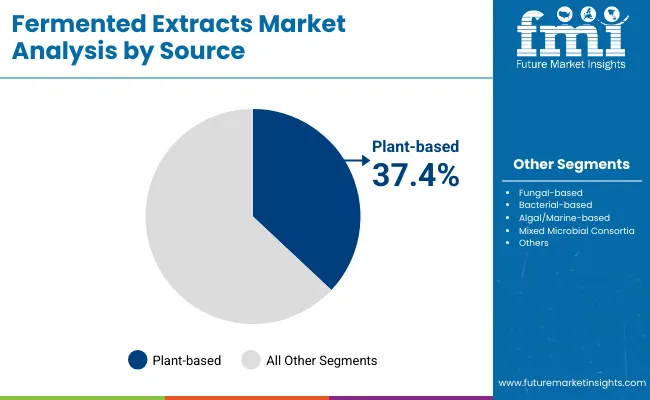

The market is segmented by end-use industry, source, extract form, and distribution channel. End-use industries include food & beverage (functional beverages, dairy & alt-dairy bases, bakery & cereal ingredients, sauces, seasonings, umami extracts, meat & alternative protein processing aids), nutraceuticals & dietary supplements, cosmetics & personal care (skin, hair, hygiene), pharmaceutical & biopharma-adjacent (wound care, oral care), agriculture & horticulture (plant bio stimulants, soil & root zone postbiotics), animal nutrition & pet care (gut health, palatants, feed efficiency), and home care & fabric care (odor control, enzyme boosters). Sources include plant-based, fungal-based, bacterial-based, algal/marine-based, and mixed microbial consortia. Extract forms cover liquid concentrates, powders, pastes/slurries, encapsulated/microencapsulated, and oil- or water-dispersible grades. Distribution channels span direct-to-manufacturer supply, ingredient distributors, and private label/OEM ingredient supply.

| End-Use Industry Segment | Market Value Share, 2025 |

|---|---|

| Food & Beverage | 38.5% |

| Others | 61.5% |

The Food & Beverage segment is projected to contribute 38.5% of the Global Fermented Extracts Market revenue in 2025, maintaining its lead as the dominant end-use category. This is driven by ongoing demand for functional beverages, dairy and alt-dairy bases, bakery ingredients, and flavor-enhancing fermented extracts. Consumers are increasingly seeking natural, bioactive ingredients that support gut health, immunity, and clean-label nutrition. The segment’s growth is also supported by the integration of fermented proteins and postbiotics into alternative protein products and sports nutrition. As functional food formulations expand globally, manufacturers are prioritizing fermented extracts for their health benefits and flavor-enhancement properties. The Food & Beverage segment is expected to retain its position as the backbone of demand for fermented extracts.

| Source Segment | Market Value Share, 2025 |

|---|---|

| Plant-Based | 37.4% |

| Others | 62.6% |

The Plant-based segment is projected to contribute 37.4% of the Global Fermented Extracts Market revenue in 2025, making it the leading source category. This growth is driven by the global shift toward sustainability, vegan lifestyles, and the demand for clean-label plant-derived bio-actives. Plant-based ferments are increasingly used in functional beverages, nutraceuticals, and cosmetics due to their natural health appeal and consumer-friendly positioning. The segment’s expansion is further supported by innovation in algal and botanical substrates, which provide unique phytonutrients and antioxidants. As consumer awareness of plant-based wellness rises, ingredient manufacturers are diversifying portfolios with fermented botanicals, seeds, and plant proteins. The Plant-based segment is expected to continue as the core growth driver in the source category.

| Extract Form Segment | Market Value Share, 2025 |

|---|---|

| Powder | 43.8% |

| Others | 56.2% |

The Powder segment is projected to contribute 43.8% of the Global Fermented Extracts Market revenue in 2025, securing its position as the dominant extract form. This leadership is driven by the widespread use of powdered fermented extracts in food formulations, nutraceuticals, and dietary supplements, where stability, dosing precision, and extended shelf life are key. The segment’s growth is also supported by increasing demand for encapsulated and microencapsulated powder formats that enable controlled release and improved bioavailability. As functional foods, sports nutrition, and pharmaceutical-adjacent applications expand, powders are emerging as the most versatile format. The Powder segment is expected to remain the preferred form for both manufacturers and end users due to its adaptability and cost-effectiveness.

Drivers

Rising Demand for Functional Foods & Nutraceuticals

One of the strongest growth drivers for the global fermented extracts market is the rising consumer demand for functional foods, beverages, and nutraceuticals. The pandemic has permanently shifted consumer preferences toward preventive healthcare, leading to increased use of bioactive ingredients that support immunity, gut health, and metabolic balance. Fermented extracts, particularly postbiotic complexes, fermented botanicals, and bioavailable minerals, are increasingly being recognized as critical components of dietary supplements and functional beverages.

For example, fermented proteins and amino acids are being integrated into sports nutrition, while dairy and alternative-dairy bases fortified with fermented extracts are addressing lactose intolerance and plant-based nutrition demands. The USA and Europe are leading in terms of consumer adoption, but Asia-Pacifice specially India and China are the fastest-growing regions due to rising middle-class incomes, greater consumer awareness, and government initiatives promoting nutrition-rich diets.

The nutraceuticals and dietary supplements industry, which is expanding at double-digit rates in Asia, is directly fueling the uptake of fermented extracts. Manufacturers are investing heavily in marketing strategies that link fermented ingredients to specific health benefits such as immune defense, digestive wellness, and energy enhancement, which resonates strongly with millennial and Gen Z consumers. As food and beverage players continue to reformulate products around “clean-label” and “functional” trends, fermented extracts are becoming the backbone of innovation pipelines, cementing their role as a major demand driver.

Shift Toward Plant-Based & Sustainable Ingredients

The second major driver is the rapid shift toward plant-based and sustainable ingredient sourcing. In 2025, plant-based extracts already account for 37.4% of global market revenue, and this share is projected to grow as consumer lifestyles evolve. The “green wave” in global consumption is not limited to food and beverages but extends to personal care, pharmaceuticals, and animal nutrition. Plant-based ferments derived from botanicals, seeds, herbs, and marine algae are being prioritized because they align with consumer values of sustainability, natural origin, and reduced ecological impact.

Veganism and flexitarian diets are further pushing food companies to incorporate fermented plant proteins into alternative meats, dairy substitutes, and high-protein bakery items. Beyond food, personal care brands are launching fermented filtrates from rice, soy, and green tea to deliver skin-enhancing antioxidants and microbiome-friendly actives. In agriculture, fermented plant-based biostimulants and postbiotics are replacing synthetic chemicals, helping to meet regulatory mandates for reduced pesticide use.

This shift is reinforced by investors, who are increasingly channeling funds toward biotech players specializing in plant and algal fermentations. With regulatory approvals for plant-based claims easier to secure compared to bacterial or fungal ferments, companies are leveraging this pathway for faster commercialization. Overall, the sustainability narrative and consumer willingness to pay a premium for plant-based products are ensuring strong momentum for this driver.

Restraints

High Production Costs and Yield Variability

Despite its promising outlook, the fermented extracts market faces a significant restraint in terms of production costs and yield management. Fermentation processes require controlled bioreactors, specialized microbial strains, and precise monitoring of temperature, pH, and nutrient levels. These conditions are expensive to maintain, especially when scaling up from laboratory batches to commercial production. Variability in yield between batches is another challenge, with minor changes in fermentation conditions leading to fluctuations in product quality and potency.

This is particularly problematic in nutraceutical and pharmaceutical applications, where consistency is critical for regulatory compliance and consumer trust. Smaller companies and startups face significant barriers to entry due to the high capital investment needed for production facilities. Additionally, sourcing high-quality raw substrates for plant and microbial fermentation adds to costs, particularly for companies operating in regions with limited access to bio-feedstocks. While technological advances such as continuous fermentation and AI-driven process optimization are gradually reducing these costs, they remain a key obstacle limiting broader adoption across price-sensitive markets.

Regulatory and Labeling Complexities

The second restraint comes from regulatory and labeling challenges across different markets. Fermented extracts, especially postbiotics, microbial consortia, and pharmaceutical-adjacent ferments, fall into regulatory gray areas where definitions and guidelines are still evolving. For example, while probiotics and prebiotics have well-defined regulatory categories, postbiotics and bioactive fermented botanicals are often treated inconsistently across countries. The European Food Safety Authority (EFSA) requires rigorous scientific evidence for health claims, while the USA Food and Drug Administration (FDA) places fermented extracts under dietary supplement rules with less standardized frameworks.

In Asia, approvals differ by country, with China having one of the most complex registration systems. This inconsistency in regulation increases time-to-market and costs for global manufacturers, who must adapt formulations, labeling, and claims for each region. Moreover, consumer confusion around terms like probiotics, postbiotics, and fermented actives can reduce trust and slow adoption. Companies must invest heavily in compliance, education, and clinical research to navigate these challenges, which restricts smaller firms and adds to industry consolidation.

Key Trends

Growth of Postbiotics & Next-Generation Ferments

One of the most notable trends shaping the market is the rise of postbiotics and next-generation ferments. While probiotics once dominated the microbiome conversation, postbiotics non-living microbial components that provide health benefits are gaining strong traction due to their stability, safety, and wide applicability. Postbiotic complexes are now entering dietary supplements, skincare formulations, and even agriculture, where they enhance plant resilience.

Fermented botanicals such as rice filtrates, green tea ferments, and adaptogen-based extracts are finding space in the cosmetics sector, targeting skin hydration, barrier repair, and anti-aging benefits. Sports nutrition is adopting amino acid and peptide ferments to improve recovery and endurance, while pharmaceutical players are integrating fermented actives into wound care and oral health. As next-generation ferments expand their applications beyond traditional food and beverage, they are redefining market opportunities and driving premiumization.

Expansion of Powdered & Encapsulated Formats

Another significant trend is the growing preference for powdered and encapsulated extract forms. In 2025, powders already account for 43.8% of market revenue, making them the largest format due to their versatility, stability, and ease of use in multiple applications. Encapsulation and microencapsulation technologies are further enhancing the value proposition by improving bioavailability, controlled release, and taste-masking properties. In pharmaceuticals, encapsulated ferments ensure targeted delivery, while in cosmetics, they stabilize sensitive actives against oxidation.

Oil- and water-dispersible grades are also enabling formulators to expand fermented actives into beverages, emulsions, and topical creams. This trend is reinforced by consumer demand for convenience and manufacturers’ desire for longer shelf life and consistent product quality. Over the next decade, encapsulated powders will be at the forefront of innovation pipelines, particularly in dietary supplements and personal care.

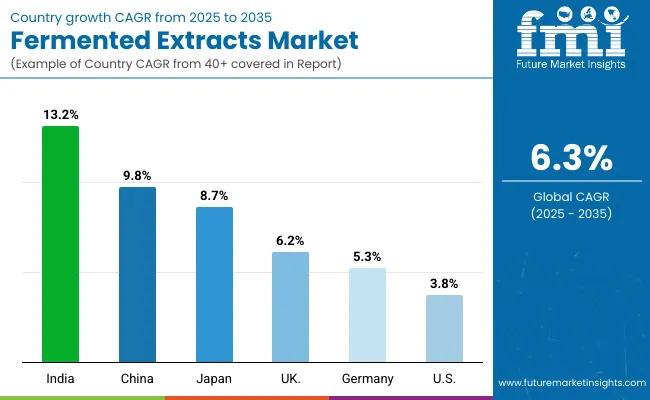

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 9.8% |

| India | 13.2% |

| Germany | 5.3% |

| USA | 3.8% |

| UK | 6.2% |

| Japan | 8.7% |

The global fermented extracts market shows a pronounced regional disparity in adoption speed, strongly influenced by dietary supplement penetration, clean-label demand, and regulatory mandates. Asia-Pacific emerges as the fastest-growing region, anchored by China at 9.8% CAGR and India at 13.2% CAGR. This acceleration is driven by large-scale functional food ecosystems, aggressive investment in nutraceuticals, and government-backed programs promoting herbal and plant-based formulations. China’s regulatory framework promoting natural health foods and traditional Chinese medicine integration further accelerates adoption of fermented extracts in dietary and personal care products. India’s trajectory reflects rapid expansion of dietary supplements and plant-based nutrition, supported by cost competitiveness, Ayurveda-aligned innovation, and export-oriented production.

Europe maintains a strong growth profile, led by Germany at 5.3%, France at 5.6%, and the UK at 6.2%, supported by stringent quality compliance for food safety standards and sustainability reporting. High penetration of functional beverages, probiotics, and postbiotic skincare keeps Europe ahead of North America, particularly in the application of fermented extracts for clean-label foods and natural cosmetics. North America shows moderate expansion, with the USA at 3.8% CAGR, reflecting maturity in core industries and slower nutraceutical adoption relative to Asia. Growth in North America is more service-driven, with increasing demand for encapsulated formats, biotech-derived postbiotics, and functional beverage innovation rather than basic ingredient volume.

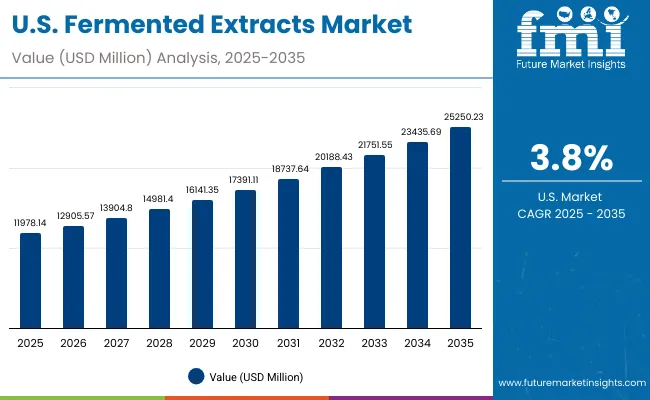

| Year | USA Fermented Extracts Market |

|---|---|

| 2025 | 11978.1 |

| 2026 | 12905.6 |

| 2027 | 13904.8 |

| 2028 | 14981.4 |

| 2029 | 16141.3 |

| 2030 | 17391.1 |

| 2031 | 18737.6 |

| 2032 | 20188.4 |

| 2033 | 21751.5 |

| 2034 | 23435.7 |

| 2035 | 25250.2 |

The fermented extracts market in the United States is projected to grow at a CAGR of 3.8%, led by increased investment across food & beverage, cosmetics, and pharmaceuticals. Functional beverage applications recorded a notable year-on-year rise, particularly among sports nutrition and alternative dairy producers. The healthcare and nutraceutical segments, especially gut-health oriented supplements, have integrated postbiotic complexes for faster market traction. Adoption is also rising in personal care, with fermented filtrates being introduced in skin care and hair care. High consumer demand for premium wellness and clean-label products is creating opportunities for bundled ingredient solutions and long-term supplier partnerships.

The fermented extracts market in the United Kingdom is expected to grow at a CAGR of 6.2%, supported by applications in functional beverages, bakery, and personal care. Alternative protein firms and functional food startups have accelerated usage of plant-based ferments to improve nutrition density and flavor. Skincare and cosmetics players are rapidly integrating fermented rice, tea, and botanical filtrates into formulations for hydration and barrier repair. In retail, fermented flavor enhancers and seasoning extracts are finding space in sauces and convenience foods. The combination of government grants, public-private innovation programs, and academic collaboration continues to fuel both enterprise and consumer adoption.

India is witnessing rapid growth in the fermented extracts market, which is forecast to expand at a CAGR of 13.2% through 2035. A sharp increase in adoption across dietary supplements and functional foods has been driven by affordability and rising awareness among urban and semi-urban populations. Nutraceutical brands are using fermented minerals and postbiotics to align with Ayurveda-inspired wellness trends. Educational institutes and biotech hubs are introducing fermentation research into their programs, while agri-tech companies are deploying plant biostimulants and postbiotic soil treatments. Public health initiatives and consumer interest in immunity-boosting foods are further accelerating demand.

The fermented extracts market in China is expected to grow at a CAGR of 9.8%, the highest among leading economies. This momentum is driven by functional beverage rollouts, large-scale traditional medicine integration, and competitive innovation by local biotech firms. Industrial demand for fermented amino acids, proteins, and seasonings has accelerated across the F&B and alternative protein sectors. Municipal and regional authorities are increasingly supporting fermented agricultural inputs and plant-based biostimulants. Affordable products produced by domestic firms are enabling widespread use in cosmetics, sports nutrition, and consumer health. Cross-sector adoption remains a key growth lever.

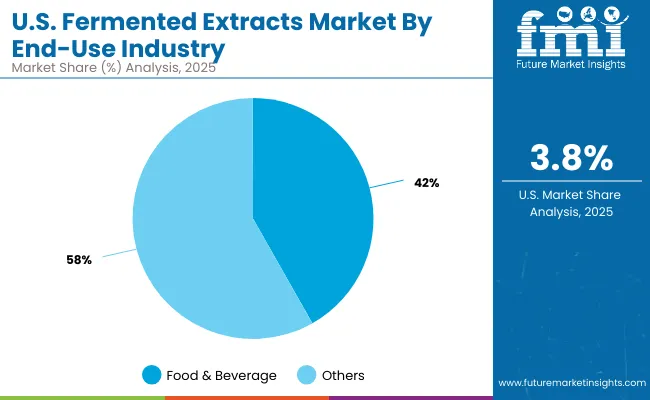

| End-Use Segment | Market Value Share, 2025 |

|---|---|

| Food & Beverage | 41.8% |

| Segment | 58.2% |

The USA fermented extracts market presents strong opportunities in the food & beverage sector, which accounts for 41.8% of total revenue in 2025 (USD 5,006.9 million). This leadership is anchored in the rapid growth of functional beverages, alternative dairy formulations, and fortified bakery products. Consumers are seeking gut-health, immunity, and energy-boosting formulations, creating demand for fermented proteins, postbiotics, and flavor-enhancing extracts. The remaining 58.2% of market value is distributed across nutraceuticals, cosmetics, pharmaceuticals, agriculture, and home care applications, each offering significant headroom for diversification. Cosmetics, in particular, are gaining momentum with fermented filtrates entering skin, hair, and scalp care portfolios. As USA consumers demand natural, clean-label, and bioavailable ingredients, the opportunity lies in cross-industry innovation pairing food-grade extracts with pharmaceutical-adjacent uses and expanding powder and encapsulated formats.

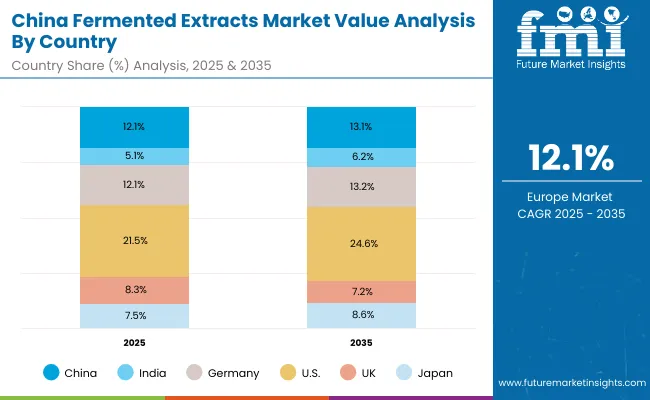

| Source Segment | Market Value Share, 2025 |

|---|---|

| Plant-based | 39.4% |

| Others | 60.6% |

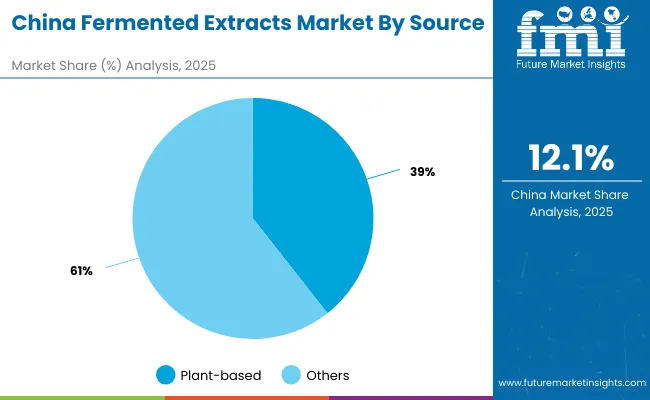

In China, the greatest opportunity lies in plant-based fermented extracts, which contribute 39.4% of total revenue in 2025 (USD 2,656.0 million). The dominance of plant-based formats is driven by consumer preference for natural, herbal, and traditional Chinese medicine (TCM)-aligned formulations. This segment is being accelerated by the expansion of functional beverages, dietary supplements, and plant-based alternative foods. The remaining 60.6% share represents fungal, bacterial, algal, and mixed microbial consortia extracts, which hold long-term opportunity in pharmaceuticals, cosmetics, and agriculture. As consumer awareness of postbiotics and fermented actives grows, demand is expanding into skincare, sports nutrition, and plant biostimulants. Affordable production capabilities of domestic biotech firms will help accelerate penetration across broader consumer categories, positioning China as a key growth driver for the global market.

Key Developments in the Global Fermented Extracts Market

| Item | Value |

|---|---|

| Quantitative Units | USD 55,712.3 million |

| Source | Plant-based, Fungal-based, Bacterial-based, Algal/Marine-based, Mixed Microbial Consortia |

| Extract Form | Liquid Concentrates, Powders, Pastes/Slurries, Encapsulated/Microencapsulated Extracts, Oil-Dispersible or Water-Dispersible Grades |

| End-use Industry | Food & Beverage, Nutraceuticals & Dietary Supplements, Cosmetics & Personal Care, Pharmaceutical & Biopharma Adjacent, Agriculture & Horticulture, Animal Nutrition & Pet Care, Home Care & Fabric Care |

| Distribution Channel | Direct-to-Manufacturer, Ingredient Distributors, Private Label/OEM Ingredient Supply |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DuPont, Kerry Group, Cargill Incorporated, BASF SE, Chr. Hansen, Lonza Group, Ajinomoto Corporation, Associated British Foods PLC, Döhler Group SE, Evonik Industries AG, Lallemand Inc., Kyowa Hakko Kirin Co. Ltd, Lesaffre, Corbion N.V., Arjuna Natural Extracts Ltd. |

| Additional Attributes | Dollar sales by source and extract form, adoption trends in postbiotics and fermented botanicals, rising demand for plant-based and powder formats, sector-specific growth in functional beverages, nutraceuticals, and cosmetics, revenue segmentation across food, pharma, and agriculture, integration with encapsulation and controlled-release technologies, regional trends influenced by clean-label and sustainability initiatives, and innovations in microbial, algal, and mixed consortia fermentation. |

The Global Fermented Extracts Market is estimated to be valued at USD 55,712.3 million in 2025.

The market size for the Global Fermented Extracts Market is projected to reach USD 102,643.2 million by 2035.

The Global Fermented Extracts Market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in the Global Fermented Extracts Market are liquid concentrates, powders, pastes/slurries, encapsulated/microencapsulated extracts, and oil-/water-dispersible grades.

In terms of end-use, the Food & Beverage segment is set to command the largest share at 38.5% in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fermented Rice Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Coffee Market Size and Share Forecast Outlook 2025 to 2035

Fermented Botanicals for Anti-Aging Market Size and Share Forecast Outlook 2025 to 2035

Fermented Vitamins Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fermented Amino Acid Complex Market Size and Share Forecast Outlook 2025 to 2035

Fermented Beverages Market Size and Share Forecast Outlook 2025 to 2035

Fermented Pet Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Fermented Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Face Mask Market Size and Share Forecast Outlook 2025 to 2035

Fermented Processed Food Market Size and Share Forecast Outlook 2025 to 2035

Fermented Dairy Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Dairy Ingredient Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Seaweed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Chymosin Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Flavours Market Size, Growth, and Forecast for 2025 to 2035

Fermented Ingredient Market Size, Growth, and Forecast for 2025 to 2035

Fermented Feed Market Analysis by Product Type, Livestock and Fermentation Process Through 2035

Market Share Breakdown of Fermented Ingredients

Fermented Cucumber Market Trends - Growth & Consumer Demand 2025 to 2035

Fermented Protein Market Trends - Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA