The Global Fermented Face Mask Market is expected to record a valuation of USD 1,327.4 million in 2025 and USD 2,564.8 million in 2035, with an increase of USD 1,237.4 million, which equals a growth of 93.3% over the decade. The overall expansion represents a CAGR of 6.81% and a 2X increase in market size.

Global Fermented Face Mask Market Key Takeaways

| Metric | Value |

|---|---|

| Global Fermented Face Mask Market Estimated Value in (2025E) | USD 1,327.4 million |

| Global Fermented Face Mask Market Forecast Value in (2035F) | USD 2,564.8 million |

| Forecast CAGR (2025 to 2035) | 6.8% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,327.4 million to USD 1,845.1 million, adding USD 517.7 million, which accounts for 41.8% of the total decade growth. This phase records steady adoption in brightening, hydration, and anti-aging fermented masks, driven by the influence of K-beauty trends and rising microbiome skincare awareness. Sheet masks dominate this period as they cater to over 60% of product-level applications, especially in Asia-Pacific and parts of North America.

The second half from 2030 to 2035 contributes USD 719.7 million, equal to 58.2% of total growth, as the market jumps from USD 1,845.1 million to USD 2,564.8 million. This acceleration is powered by widespread deployment of post-procedure recovery masks, functional fermented creams, and microbiome-repair forms in clinical skincare and D2C channels.

Hydrogel and cream masks together capture a larger share above 45% by the end of the decade. Ingredient-led innovation using Bifida, Kombucha, and Mushroom Ferments adds product value, increasing premium segment share beyond 55% in total revenue.

From 2020 to 2024, the Global Fermented Face Mask Market grew from USD 701 million to USD 1,162 million, driven by sheet mask-centric adoption. During this period, the competitive landscape was dominated by Asia-based brands controlling nearly 65% of revenue, with leaders such as Amorepacific, LG H&H, and Tonymoly focusing on mass-volume fermented SKUs for hydration and brightening.

Competitive differentiation relied on ingredient purity, packaging innovation, and skin concern specificity, while fermented actives like Galactomyces and Rice Ferment were bundled into hero SKUs. Service-based models such as mask subscription kits had limited traction, contributing less than 8% of the total market value.

Demand for fermented face masks will expand to USD 1,327.4 million in 2025, and the revenue mix will shift as microbiome repair and sensitive skin-focused solutions grow to over 30% share. Traditional leaders face rising competition from digital-first brands offering science-backed formulations, fermented barrier-repair masks, and ingredient traceability platforms.

Major brands are pivoting to hybrid skincare systems, integrating probiotic routines and clinically tested forms to retain consumer trust. Emerging entrants specializing in post-procedure solutions, sustainable packaging, and AI-driven skin concern mapping are gaining share. The competitive advantage is moving away from single-product innovation to ecosystem strength, skin concern alignment, and repeat-use loyalty models.

The market is segmented by product type, fermented ingredient, packaging form, skin concern, distribution channel, and region. Product types include sheet masks, cream masks, gel masks, peel-off masks, hydrogel masks, and mud/clay-based fermented masks, addressing diverse consumer routines and delivery forms.

By fermented ingredient, key segments include Galactomyces, Bifida, Saccharomyces, Rice Ferment, Kombucha, Lactobacillus, Mushroom, and Botanical Ferments. Packaging segmentation includes single-use pouches, jars/tubs, tubes/airless pumps, biodegradable forms, ampoule sheets, and resealable zip packs, highlighting sustainability and convenience.

Skin concerns are segmented into brightening, hydration, anti-aging, acne control, microbiome support, sensitive skin soothing, and post-procedure recovery, reflecting how consumers select masks based on function. Distribution channels include online retailers (D2C, marketplaces), beauty specialty stores, supermarkets, pharmacy chains, dermatology clinics, and department stores.

Regionally, the market scope spans North America, Latin America, Western and Eastern Europe, China, Japan, India, Southeast Asia, Central Asia, and the Middle East and Africa, reflecting wide geographic adoption and ingredient localization strategies.

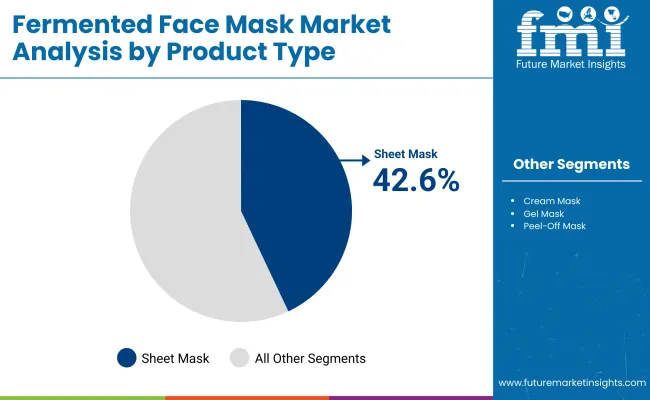

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Sheet Masks | 42.6% |

| Others | 57.4% |

The sheet masks segment is projected to contribute 42.6% of the Global Fermented Face Mask Market revenue in 2025, maintaining its lead as the dominant product category. This dominance is driven by the continued popularity of single-use sachet-based sheet masks in Asia-Pacific, particularly in markets like China, South Korea, and Japan, where fermented ingredients are already deeply integrated into daily skincare routines.

Consumer preference for convenient, hygienic, and intensive skincare treatments has elevated the sheet mask form as a staple in both mid-tier and premium skincare lines. The use of fermented actives such as Galactomyces, Rice Ferment, and Saccharomyces in sheet masks offers visible improvements in brightening, hydration, and skin texture, enhancing repeat usage and brand loyalty. The segment’s growth is also supported by increasing adoption in Western markets, where sheet masks are often positioned as entry-point products for functional skincare.

With the rise of sustainable packaging and biodegradable material innovation, brands are enhancing the appeal of sheet masks to eco-conscious consumers. The form is expected to retain its leadership due to its versatility, affordability, and ability to deliver fermented actives in a controlled-dose form.

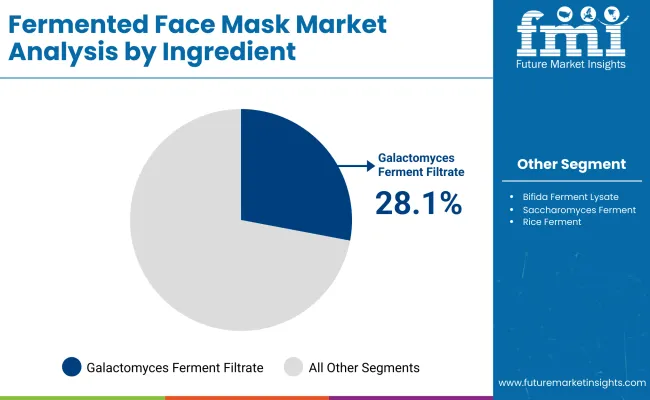

| Ingredient Segment | Market Value Share, 2025 |

|---|---|

| Galactomyces Ferment Filtrate | 28.1% |

| Others | 71.9% |

The Galactomyces Ferment Filtrate segment is projected to contribute 28.1% of the Global Fermented Face Mask Market revenue in 2025, establishing itself as the leading fermented ingredient type. Known for its efficacy in brightening, sebum control, and improving skin texture, Galactomyces has become a hero ingredient in a wide range of sheet, gel, and hydrogel masks globally.

Its dominance stems from its early commercialization in the Asian skincare industry, especially by premium brands in Japan and South Korea, and its subsequent adoption by global brands as a probiotic-rich, naturally fermented ingredient with proven results.

Consumers associate Galactomyces with high-performance skincare routines focused on radiance and clarity, making it a cornerstone in formulations targeting dullness, uneven tone, and early signs of aging. The segment’s growth is further supported by its strong clinical backing, versatility across skin types, and compatibility with complementary actives like niacinamide and hyaluronic acid.

As the global skincare market moves toward ingredient transparency and microbiome-safe formulations, Galactomyces is expected to remain a frontline ingredient in fermented mask innovation across both mass and premium segments.

| Packaging Segment | Market Value Share, 2025 |

|---|---|

| Single-use Pouches (Sachets) | 46.3% |

| Others | 53.7% |

The single-use pouches segment is projected to contribute 46.3% of the Global Fermented Face Mask Market revenue in 2025, securing its position as the leading packaging form. This dominance is driven by the popularity of sheet masks, which are predominantly packaged in sachet-style pouches, offering pre-measured, hygienic, and convenient application for consumers. Single-use sachets are especially preferred in Asia-Pacific markets, where daily or weekly sheet mask use is common.

The form ensures maximum freshness of fermented ingredients like Galactomyces, Bifida, and Rice Ferment, which are sensitive to air and contamination. It also supports on-the-go skincare routines, trial packs, and bundling in gift or discovery sets, enhancing its commercial viability across online and offline retail channels.

Growth in this segment is further supported by advancements in biodegradable materials and eco-friendly single-use forms, aligning with rising consumer demand for sustainability without compromising convenience. As the market continues to favor intensive treatment-based skincare, single-use pouches are expected to remain a core delivery mechanism for fermented mask formulations.

The fermented face mask market is growing due to increasing demand for microbiome-friendly skincare, rising consumer awareness of fermented actives, and growing adoption of K-beauty and J-beauty skincare rituals worldwide. Fermented ingredients such as Galactomyces Ferment Filtrate, Bifida Ferment Lysate, and Lactobacillus Ferment offer improved skin penetration, barrier repair, and brightening benefitsmaking them popular across both mass and premium skincare segments.

The rising prevalence of urban skin stress, pollution-related dullness, and consumer shift toward functional skincare are driving the use of fermented masks targeted at hydration, brightening, and anti-aging. Sheet masks remain dominant due to their convenience and popularity in Asia-Pacific, while cream-based and hydrogel masks are gaining share in North America and Europe.

Packaging innovationssuch as biodegradable sachets, ampoule kits, and resealable packsare further expanding product appeal, particularly in the clean beauty and dermocosmetic space. Online retail platforms, D2C channels, and dermo-clinics are playing a central role in distribution, while ingredient transparency and product personalization are fueling brand differentiation. Growth is also supported by the increasing influence of skin concern-specific routines, particularly in brightening & skin tone correction, hydration, and microbiome repair.

Rising Demand for Microbiome-Friendly Skincare

Fermented ingredients such as Galactomyces, Lactobacillus, and Bifida Ferment Lysate are rich in amino acids, peptides, and enzymes that support the skin’s natural microbiome. Growing consumer awareness of barrier repair, skin flora balance, and inflammation reduction is driving demand for fermented masks formulated to protect and strengthen the skin’s ecosystem.

This is particularly resonant among consumers with sensitive, acne-prone, or aging skin, where fermented actives are perceived as gentler and more effective than synthetic ingredients.

Global Popularity of K-Beauty and J-Beauty Rituals

The widespread influence of Korean and Japanese beauty trends has accelerated the adoption of fermented skincare productsespecially maskson a global scale. These regions have long histories of using fermentation in skincare, and global consumers increasingly view K-beauty-style fermented masks as scientifically backed yet natural. Sheet masks containing rice ferment, kombucha, and mushroom-based formulations are now mainstream, not only in Asia but also in North America and Europe.

Short Shelf Life and Ingredient Sensitivity

Fermented ingredients are often biologically active and sensitive to temperature, pH, and exposure to air or light. This presents formulation challenges and limits shelf life, particularly for masks in multi-use jars or tubes. Brands must invest in specialized stabilizers and airtight packaging, which increases production cost and can deter smaller players from entering the fermented skincare space.

Limited Consumer Awareness in Emerging Markets

While fermented skincare is well-established in East Asia and gaining traction in the USA and Europe, awareness remains relatively low in Latin America, Africa, and parts of South Asia. Many consumers are unfamiliar with fermentation’s skin benefits, and local marketing campaigns often prioritize more familiar active ingredients. Without strong educational outreach, adoption may remain slow in price-sensitive or trend-lagging regions.

Growth of Functional Masking (Targeted Skin Concerns)

Consumers are increasingly selecting masks based on specific skin concerns such as post-procedure recovery, microbiome support, or anti-pollution repair. Fermented masks are well-suited for this trend, as different ferment strains are being marketed as functional solutions, not just general moisturizers. This is shifting fermented masks from the “pampering” category into dermocosmetic and clinical skincare routines.

Sustainable Packaging & Clean Label Movement

The rise of eco-conscious beauty is pushing brands to move away from plastic-heavy, single-use packaging toward biodegradable sachets, recyclable pouches, and reusable forms for cream and gel masks. In parallel, fermented masks are increasingly formulated with minimalist, transparent ingredient lists, aligning with the broader clean beauty movement. Brands offering both clean, ethical ingredients and low-waste packaging are gaining competitive edge in premium and mass segments alike.

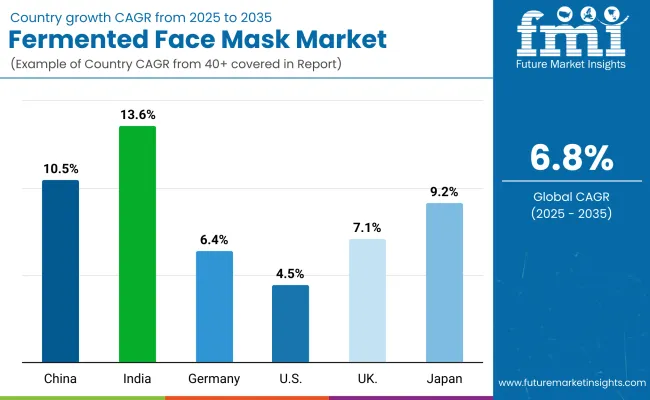

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 10.5% |

| India | 13.6% |

| Germany | 6.4% |

| USA | 4.5% |

| UK. | 7.1% |

| Japan | 9.2% |

The global Fermented Face Mask Market shows a pronounced regional disparity in adoption speed, strongly influenced by consumer skincare awareness, K-beauty influence, microbiome innovation, and retail channel maturity. Asia-Pacific emerges as the fastest-growing region, anchored by India at 13.6% CAGR and China at 10.5% CAGR. This acceleration is driven by rising skincare adoption in Tier-2 and Tier-3 cities, the widespread influence of K-beauty formulations, and growing investments in fermented active R&D by regional brands.

China’s strong D2C ecosystem and ingredient traceability mandates further accelerate demand for functional fermented masks targeted at brightening, hydration, and skin tone correction. India’s trajectory reflects increasing penetration of sheet and cream-based fermented masks across online platforms and modern retail, supported by Gen Z demand for microbiome-safe, clean-label skincare.

Europe maintains a strong growth profile, led by Germany at 6.4% CAGR and the UK at 7.1% CAGR, supported by a growing shift toward dermocosmetic-grade fermented products and sustainability-conscious packaging. High consumer trust in scientific formulations, combined with retailer focus on ingredient transparency, keeps Europe ahead of North America particularly in categories like biodegradable sheet masks and post-procedure fermented recovery creams.

North America shows moderate expansion, with the USA at 4.5% CAGR, reflecting a mature skincare market with slower uptake of traditional sheet mask forms. Growth in this region is more cream mask-driven, with increasing demand for barrier-repair and anti-aging fermented formulations, particularly through premium beauty and pharmacy channels.

Rather than rapid expansion in product volume, North America’s growth is centered on high-value hybrid forms, clean beauty certifications, and subscription-based D2C delivery models. Japan, while a pioneer in fermented skincare, registers a robust 9.2% CAGR, reflecting steady demand and consumer preference for long-trusted domestic brands. Innovation in kombucha and mushroom-based ferments continues, but volume growth remains conservative compared to emerging Asia-Pacific markets.

| Year | USA Berberine Market (USD Million) |

|---|---|

| 2025 | 293.36 |

| 2026 | 310.68 |

| 2027 | 329.02 |

| 2028 | 348.45 |

| 2029 | 369.03 |

| 2030 | 390.82 |

| 2031 | 413.89 |

| 2032 | 438.33 |

| 2033 | 464.21 |

| 2034 | 491.63 |

| 2035 | 520.65 |

The Fermented Face Mask Market in the United States is projected to grow at a CAGR of 4.5%, led by rising consumer preference for barrier-repair and anti-aging fermented formulations. Cream-based masks have recorded a notable year-on-year rise, particularly within the premium beauty, wellness, and pharmacy-led channels. Fermented actives such as Bifida Ferment Lysate and Lactobacillus Ferment are increasingly favored for their role in strengthening the skin microbiome, particularly among aging and sensitive skin consumers.

Growth is further supported by the uptake of subscription-based skincare routines, increasing integration of fermented masks into nighttime regimens, and preference for leave-on cream and hydrogel forms over traditional sheet masks. USA consumers also value minimalist ingredient labels, pushing brands toward clean, transparent, and clinically-backed fermented formulations.

Barrier repair and microbiome support are key use cases driving fermented mask adoption. Leave-on cream masks are gaining traction over single-use sheet masks due to perceived efficacy and lower waste. D2C brands and wellness retailers are integrating fermented actives into broader skincare ecosystems and bundled routines.

The Fermented Face Mask Market in the United Kingdom is expected to grow at a CAGR of 7.1%, supported by applications in clinical skincare, premium clean beauty, and sustainable packaging innovation. UK-based beauty brands and distributors are increasingly sourcing microbiome-safe fermented actives for use in anti-aging and sensitive skin formulations.

Pharmacies and department stores are expanding fermented cream mask offerings, particularly those focused on barrier repair and brightening. Heritage skincare institutions and boutique brands are also incorporating kombucha and mushroom ferments to promote natural efficacy and heritage ingredient appeal.

Consumer demand for transparent ingredient labeling and ethical sourcing is driving interest in brands offering fermentation-derived actives with clinical validation. Public-private beauty accelerators and dermatology-focused R&D hubs are fostering innovation in this category.

India is witnessing rapid growth in the Fermented Face Mask Market, which is forecast to expand at a CAGR of 13.6% through 2035 the fastest among all major markets. A sharp increase in demand across Tier-2 and Tier-3 cities is driven by social media awareness, rising D2C skincare brands, and growing popularity of ingredient-focused routines.

Indian consumers are showing strong interest in sheet masks and cream masks enriched with fermented rice, Galactomyces, and Bifida Ferment Lysate for brightening and hydration benefits. Domestic beauty and wellness startups are launching locally produced fermented masks with plant-based actives, combining Ayurveda with fermentation.

Pharmacies and e-commerce platforms like Nykaa and Tira are scaling up curated fermented product ranges for millennial and Gen Z audiences. Meanwhile, dermatologists and clinics are recommending fermented post-treatment masks for barrier support and soothing effects.

The Fermented Face Mask Market in China is expected to grow at a CAGR of 10.5%, one of the highest among leading skincare economies. This momentum is fueled by widespread adoption of brightening and tone-correcting sheet masks, which hold 31.8% of skin concern-based demand, and aggressive expansion of K-beauty and C-beauty fermented lines across online marketplaces like Tmall and Douyin.

The Chinese market is heavily ingredient-driven, with Galactomyces, Saccharomyces, and Rice Ferment dominating brightening and hydration mask forms. City-level beauty regulations and digital traceability policies are pushing brands to use scientifically backed ferments. Moreover, domestic beauty tech brands are experimenting with AI-driven personalization and mask layering systems to deliver fermented actives more effectively.

| Market Share | 2025 |

|---|---|

| China | 12.9% |

| India | 5.1% |

| Germany | 11.4% |

| USA | 22.1% |

| UK | 8.9% |

| Japan | 7.6% |

| Market Share | 2035 |

|---|---|

| China | 11.7% |

| India | 6.4% |

| Germany | 13.1% |

| USA | 20.3% |

| UK | 9.3% |

| Japan | 8.1% |

| Product Segment | Market Value Share, 2025 |

|---|---|

| Cream M asks | 35.4% |

| Others | 64.6% |

The USA Fermented Face Mask Market is valued at USD 293.36 million in 2025, with cream masks leading at 35.4% due to their higher perceived efficacy, longer wear time, and alignment with barrier-repair and anti-aging trends. This segment benefits from premium positioning in wellness retail, pharmacy-led beauty, and D2C subscription models.

Cream masks cater to mature consumers seeking microbiome-supportive skincare, often enriched with fermented actives like Bifida Ferment Lysate and Lactobacillus Ferment. Their rise is supported by the USA market’s preference for multifunctional skincare that integrates into nighttime routines, along with growing consumer demand for sustainable, leave-on formats that minimize waste compared to single-use sheet masks.

Other formats, including sheet and hydrogel masks, remain popular in specific niches but face slower growth due to market maturity. Clean-label and clinically validated formulations are expected to drive continued cream mask adoption, particularly as hybrid skincare ecosystems become mainstream.

| Skin Concern Segment | Market Value Share, 2025 |

|---|---|

| Brightening & Skin Tone Correction | 31.8% |

| Others | 68.2% |

The China Fermented Face Mask Market is valued at USD 171.23 million in 2025, with brightening and skin tone correction masks leading at 31.8%. This dominance reflects China’s deep-rooted beauty culture emphasizing skin luminosity, even tone, and prevention of pigmentation. Brightening-focused sheet masks enriched with ferments like Galactomyces, Saccharomyces, and Rice Ferment are widely adopted, particularly through high-traffic online platforms such as Tmall and Douyin.

This segment’s growth is amplified by aggressive expansion from both K-beauty and C-beauty brands, government-backed ingredient traceability initiatives, and AI-powered personalization tools that recommend products based on skin profiling. While brightening masks lead, hydration, anti-aging, and barrier-repair categories are also expanding, especially within premium and clinical skincare channels.

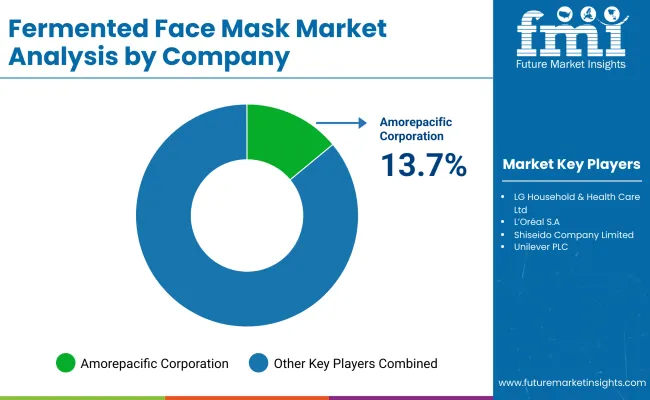

The Global Fermented Face Mask Market is moderately fragmented, with multinational beauty corporations, regional skincare innovators, and niche clean beauty specialists competing across diverse product forms and retail channels. Amorepacific Corporation leads the global market with a 13.7% value share in 2025, leveraging its deep expertise in fermentation-based actives, brand heritage in K-beauty, and expansive multi-brand portfolio including Sulwhasoo, Laneige, and Innisfree.

The company’s strategic dominance is supported by its focus on fermented sheet and hydrogel masks, advanced microbiome research, and integration of clinical testing with ingredient transparency. Its distribution network spans online marketplaces, retail chains, and D2C platforms, enabling penetration across both premium and mass-market price points.

Other established players such as L'Oréal S.A., Unilever PLC, LG Household & Health Care Ltd., Shiseido Company, and Beiersdorf AG hold substantial positions in regional markets. These companies are expanding fermented product lines through investments in dermocosmetic skincare, hybrid cream masks, and sustainable packaging innovation.

Many are integrating post-procedure recovery formulations and microbiome-focused actives to enhance product positioning in clinical skincare categories. Mid-sized and emerging brandsincluding Dr. Alva Biotechnology Co., Bloomage Biotechnology Corporation Limited, Tonymoly Co., Ltd., and Kolmar Korea Co., Ltd.focus on specific ingredient claims such as Galactomyces, Bifida, and kombucha ferment, often targeting younger consumers, clean beauty enthusiasts, or D2C-first segments. These brands are innovating around sachet packaging, biodegradable mask sheets, and multi-day mask kits to increase consumer engagement.

Competitive differentiation in this market is increasingly driven by ingredient traceability, skin concern-specific efficacy, and sustainability credentialsrather than form innovation alone. As personalization, clinical validation, and skin microbiome science become more mainstream, the competitive edge is shifting toward branded ecosystems that combine transparent actives, routine-based product sets, and digitally enabled retail experiences.

Key Developments in Global Fermented Mask Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,327 million |

| Product Type | Sheet Masks, Cream Masks, Gel Masks, Peel-Off Masks, Hydrogel Masks, Mud/Clay-Based Fermented Masks |

| Ingredient Type | Galactomyces Ferment Filtrate, Bifida Ferment Lysate, Saccharomyces Ferment, Lactobacillus Ferment, Rice Ferment, Kombucha Ferment, Mushroom Ferments, Botanical Ferments |

| Packaging Type | Single-use Pouches (Sachets), Multi-use Jars or Tubs, Tubes or Airless Pumps, Biodegradable Packaging, Resealable Zip Packs, Ampoule/Blister Sheet Packaging |

| Skin Concern | Anti-aging & Wrinkle Reduction, Brightening & Skin Tone Correction, Hydration & Moisturizing, Skin Barrier Repair & Microbiome Support, Acne & Oil Control, Soothing for Sensitive Skin, Post-Procedure Recovery |

| Distribution Channel | Online Retailers (D2C, Brand Websites, Marketplaces), Beauty Specialty Stores, Supermarkets & Hypermarkets, Pharmacy Chains & Drugstores, Dermatology Clinics & Aesthetic Centers, Department Stores |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amorepacific Corporation, LG Household & Health Care Ltd., L’Oréal S.A., Estée Lauder Companies Inc., Shiseido Company Limited, Bloomage Biotechnology Corporation Limited, Tonymoly Co., Ltd., Unilever PLC, Beiersdorf AG, Kolmar Korea Co., Ltd., Dr. Alva Biotechnology Co., Ltd., Johnson & Johnson Services, Inc., Chlitina Holding Limited, Shanghai Jahwa United Co., Ltd., Procter & Gamble Co. |

| Additional Attributes | Dollar sales by product type, ingredient, packaging, skin concern, and distribution channel. Trends in natural fermentation, probiotic-infused skincare, and microbiome-focused formulations. Region-specific consumer behavior and pricing trends. Growth of single-use sachets, K-beauty influence, and e-commerce as a primary channel. Ingredient innovation in fermented yeast, mushroom, and kombucha derivatives. |

The Global Fermented Mask Market is estimated to be valued at USD 1,327.4 million in 2025.

The market size is projected to reach USD 2,564.8 million by 2035.

The Fermented Mask Market is expected to grow at a 6.8% CAGR between 2025 and 2035

The key product types include Sheet Masks, Cream Masks, Gel Masks, Peel-Off Masks, Hydrogel Masks, and Mud/Clay-Based Fermented Masks.

Sheet Masks will command the highest share with 42.6% of the global market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fermented Coffee Market Size and Share Forecast Outlook 2025 to 2035

Fermented Botanicals for Anti-Aging Market Size and Share Forecast Outlook 2025 to 2035

Fermented Vitamins Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fermented Amino Acid Complex Market Size and Share Forecast Outlook 2025 to 2035

Fermented Beverages Market Size and Share Forecast Outlook 2025 to 2035

Fermented Rice Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Pet Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Fermented Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Processed Food Market Size and Share Forecast Outlook 2025 to 2035

Fermented Dairy Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Dairy Ingredient Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Seaweed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Chymosin Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Flavours Market Size, Growth, and Forecast for 2025 to 2035

Fermented Ingredient Market Size, Growth, and Forecast for 2025 to 2035

Fermented Feed Market Analysis by Product Type, Livestock and Fermentation Process Through 2035

Market Share Breakdown of Fermented Ingredients

Fermented Cucumber Market Trends - Growth & Consumer Demand 2025 to 2035

Fermented Protein Market Trends - Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA