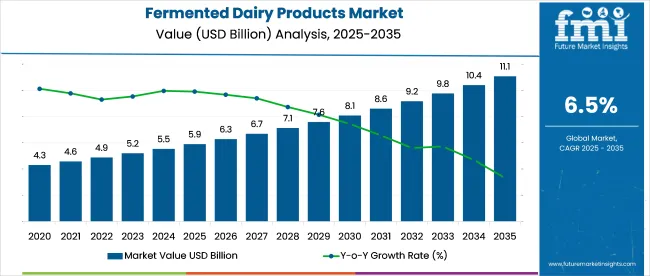

The global fermented dairy products market is projected to expand significantly over the next decade, growing from a market size of USD 5.9 billion in 2025 to USD 11.1 billion by 2035, reflecting a strong CAGR of 6.5% during the forecast period. This growth trajectory highlights increasing global interest in functional foods that offer both nutritional and health-related benefits.

| Attribute | Values |

|---|---|

| Estimated Industry Size (2025E) | USD 5.9 billion |

| Projected Industry Value (2035F) | USD 11.1 billion |

| CAGR (2025 to 2035) | 6.5% |

Consumers across developed and developing regions are actively shifting toward dairy products such as yogurt, kefir, and traditional cultured cheeses due to their perceived role in supporting gut health, immunity, and well-being.

Julie Smolyansky, President and CEO of Lifeway Foods, confirmed this trend by stating, “We brought a lot of consumers into the Lifeway family since the pandemic began. We learned about what’s important to them and how they use kefir in their cooking and smoothies”. This heightened awareness has created fertile ground for dairy manufacturers to invest in clean-label, probiotic-enriched offerings that align with evolving dietary preferences and goals.

The industry accounts for 11-13% of the global dairy and dairy products industry, driven by its strong demand within both traditional and modern dietary patterns. Within the functional foods market, fermented dairy holds a 15-18% share, primarily due to its probiotic content and digestive health benefits. It represents about 10-12% of the health and wellness foods industry, as consumers increasingly seek clean-label, gut-friendly options.

In the broader probiotics industry, fermented dairy products constitute a significant 30-35% share, being one of the most accessible probiotic-rich food types. Compared to the food and beverage industry, its share is smaller, around 1.5-2%, though growing due to shifting consumer health priorities. The industry involves a complex integration of raw milk collection, bacterial culture development, controlled fermentation, and post-processing such as pasteurization and packaging.

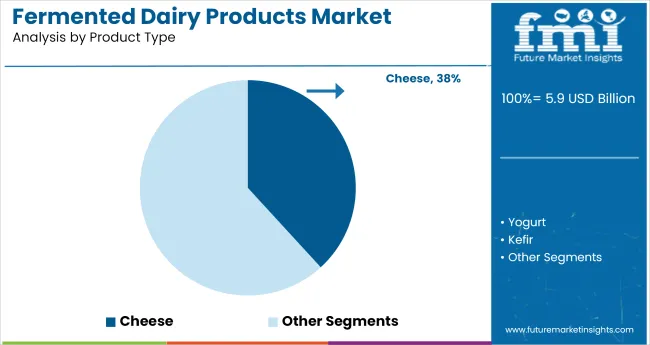

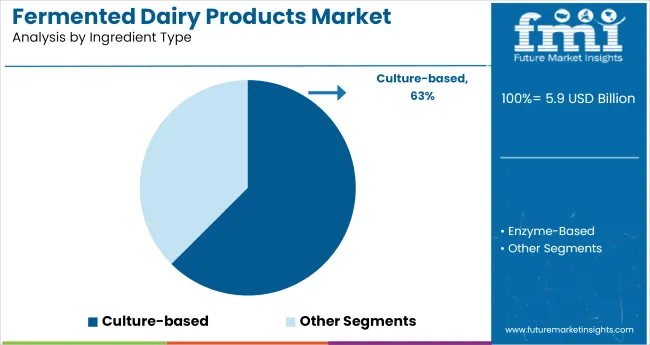

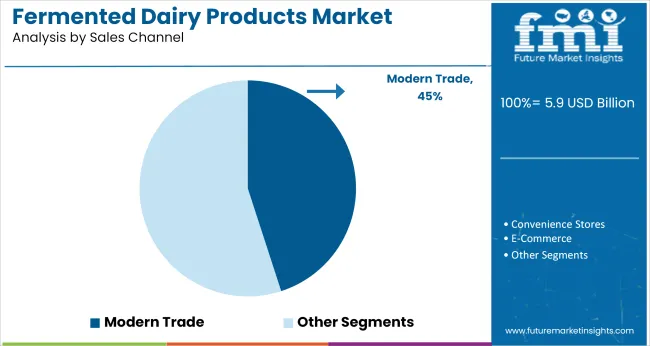

Cheese leads the fermented dairy products market with a 38.2% share due to its versatility and nutritional appeal. Culture-based ingredients dominate with a 62.5% share, driven by demand for natural, probiotic-rich foods. Modern trade remains the top sales channel, contributing over 45% of sales through supermarkets and hypermarkets.

Cheese is the top-performing product in the fermented dairy products market, commanding a 38.2% share in 2025. Its widespread consumption stems from its unique flavor profiles, textural variety, and suitability as both a snack and meal ingredient. Innovations in probiotic-fortified and protein-enriched cheese have expanded its appeal to health-conscious consumers.

Its integration into both fast food and gourmet segments underscores its broad industry penetration. As cheese continues to evolve with functional benefits and new flavor infusions, it maintains its dominant status across retail, foodservice, and artisanal channels, making it the most commercially resilient and consumer-preferred dairy product.

Culture-based ingredients are projected to hold a commanding 63% share of the fermented dairy products industry in 2025. These ingredients utilize live bacterial strains to initiate fermentation while delivering probiotic and digestive health benefits. They are highly preferred for clean-label, minimally processed dairy items like yogurt, kefir, and soft cheeses. Unlike enzyme-modified variants, culture-based options meet rising wellness and microbiome-health demands.

Their natural origin and “living food” appeal resonate strongly with health-conscious consumers. As awareness of gut health grows, culture-based fermentation continues to drive innovation in functional dairy, especially among premium and organic product lines worldwide.

Modern trade dominates fermented dairy product distribution with a 45%+ market share in 2025. Large retail formats-supermarkets, hypermarkets, and health-focused stores-enable product visibility and cold-chain reliability, which are vital for perishable dairy goods. These outlets support consumer discovery through health aisles, in-store tastings, and promotional campaigns.

Urban and semi-urban centers favor modern trade due to accessibility and shopping convenience. The format also benefits producers by offering shelf space for differentiated, premium SKUs. With increasing footfall and evolving shopper behavior, modern trade continues to be the preferred channel for purchasing refrigerated, wellness-oriented fermented dairy products.

Clean-label demand is transforming fermented dairy formulations, with consumers favoring additive-free, probiotic-rich products. Simultaneously, cold chain improvements are expanding market access, reducing spoilage, and boosting e-commerce sales in emerging regions.

Clean-Label Demand Reshapes Formulation Strategies

The surge in clean-label and health-conscious consumption is driving fundamental shifts in how products are formulated and marketed. Consumers now prioritize minimally processed, additive-free options, especially those with probiotic and digestive health benefits.

This shift is encouraging manufacturers to eliminate artificial preservatives and sweeteners and focus on transparency in ingredient sourcing. As a result, brands are reformulating legacy products and introducing new variants that highlight natural cultures and functional claims like "gut-friendly" or "immunity-boosting."

Cold Chain Optimization Boosts Market Accessibility

Efficient cold chain logistics have become central to expanding the reach of products, especially in emerging markets where infrastructure gaps traditionally limited distribution. Investments in cold storage, IoT-based temperature monitoring, and last-mile refrigerated delivery are lowering spoilage rates and enabling wider penetration into tier-2 and tier-3 cities. This has empowered modern trade and e-commerce retailers to scale offerings while ensuring quality and compliance with regulatory norms.

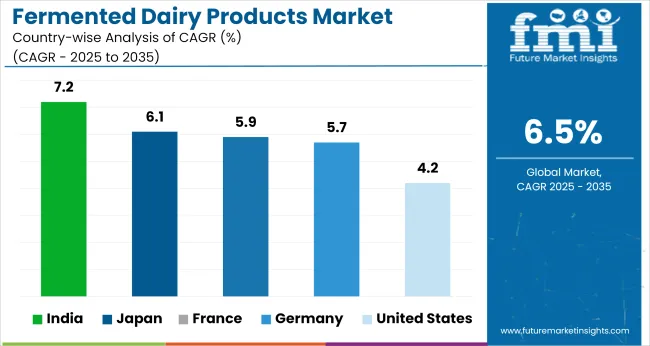

The report covers a detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.2% |

| Germany | 5.7% |

| France | 5.9% |

| Japan | 6.1% |

| India | 7.2% |

The fermented dairy products market is projected to grow at varied rates across key nations from 2025 to 2035. India leads with a 7.2% CAGR, supported by city expansion, traditional dairy habits, and rising functional food awareness. Japan follows at 6.1%, driven by an aging population and strong demand for fortified probiotic dairy.

France and Germany, with CAGRs of 5.9% and 5.7% respectively, benefit from clean-label trends, organic offerings, and artisanal positioning. The USA grows at 4.2%, reflecting a mature industry focused on digestive wellness and reformulated probiotic products. The report covers a detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

The United State fermented dairy products market is estimated to grow at a CAGR of 4.2% during the forecast period. The industry in the U.S. is experiencing moderate yet steady growth driven by a maturing consumer base increasingly focused on functional nutrition, digestive wellness, and clean-label products.

While traditional yogurt continues to be a staple, innovative offerings such as Greek yogurt with live cultures, high-protein fermented milk beverages, and probiotic-infused cheeses are finding favor among health-conscious Americans. Aging demographics and rising awareness around gut microbiota have accelerated demand for probiotic-rich fermented dairy items.

Wellness trends are encouraging dairy manufacturers to reformulate with lower sugar and fewer additives to meet evolving dietary patterns.

The German fermented dairy products market is forecasted to grow at a CAGR of 5.7% between 2025 and 2035. Germany represents one of the most robust industries in Europe for fermented dairy products, owing to its long-standing culinary traditions and high per capita dairy consumption.

The strong preference for natural and locally sourced products aligns perfectly with the clean-label and probiotic trend. Consumers are actively seeking out organic dairy options, with increasing interest in traditional fermented items like quark, kefir, and yogurt-based drinks. The country’s commitment to food quality standards and consumer education around gut health supports the consistent growth in this segment.

The Indian fermented dairy products industry is expected to grow at a CAGR of 7.2% from 2025 to 2035. India represents a rapidly growing and high-potential industry for fermented dairy products, driven by rising city expansion, increasing disposable incomes, and evolving dietary habits. The traditional familiarity with fermented milk-based items like lassi, chaas, and curd gives this industry a strong cultural advantage.

In recent years, there has been a shift toward packaged and probiotic-enhanced versions of these familiar products, especially among younger and health-aware consumers in urban centers. With increasing concerns around digestive health, immunity, and clean eating, manufacturers are leveraging functional positioning to launch value-added fermented dairy lines.

The French fermented dairy products market is projected to grow at a CAGR of 5.9% during the forecast period. France continues to be a prominent European industry for fermented dairy due to its rich dairy heritage and established consumer trust in fermented food traditions. Fermented cheese varieties, artisanal yogurt, and probiotic milk drinks have gained increased attention among French consumers prioritizing balanced diets and gastrointestinal wellness.

The ongoing shift toward organic and low-sugar fermented dairy aligns with the French market’s focus on quality, taste, and traceability. To legacy brands, local start-ups are emerging in dairy fermentation and plant-based hybrid offerings.

The fermented dairy products market in Japan is estimated to grow at a CAGR of 6.1% from 2025 to 2035. Japan is witnessing strong growth in the fermented dairy space as consumers increasingly integrate Western-style probiotic dairy products into their daily diet alongside traditional fermented foods like natto and miso.

The cultural acceptance of fermentation, combined with the country’s advanced understanding of gut health and aging-related nutrition, supports the adoption of products like probiotic yogurt, drinkable kefir, and fermented cheese. Japanese consumers value functional food that provides specific health benefits such as immunity support, reduced inflammation, and improved digestion. Leading dairy players are investing in R&D and premiumization, launching fortified variants targeting age-related health concerns.

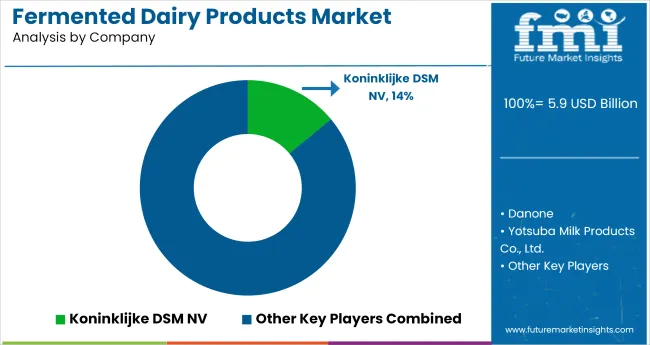

Leading Fermented Dairy Products Suppliers

Leading Company - Danone

Market Share - 14%

The fermented dairy products market is dominated by established players such as Danone, General Mills Inc., and Nestlé Health Science, who lead through diverse product portfolios, advanced fermentation technologies, and global brand presence across yogurt, kefir, and cultured beverages.

Key players like Koninklijke DSM NV, Arla Foods Ingredients Group P/S, and Chobani, LLC focus on probiotic innovation, clean-label solutions, and nutritional enhancement to address functional health trends. Emerging players including Yotsuba Milk Products Co., Ltd., Dairy Manufacturers, Inc., Meadow Foods Limited, and Parmolat S.p.A. are strengthening regional markets with tailored offerings.

Demand is driven by digestive health awareness, rising protein intake, and consumer preference for natural, fermented nutrition.

Recent Fermented Dairy Products Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 5.9 billion |

| Projected Market Size (2035) | USD 11.1 billion |

| CAGR (2025 to 2035) | 6.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and volume in metric tons |

| Product Type Analyzed (Segment 1) | Yogurt, Kefir, Cheese, Sour Cream, Buttermilk, and Others. |

| Ingredient Type Analyzed (Segment 2) | Culture-Based and Enzyme-Based. |

| S ales Channel Analyzed (Segment 3) | Modern Trade, Convenience Stores, E-Commerce, and Other Retail Formats. |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Koninklijke DSM NV, Danone, Yotsuba Milk Products Co., Ltd., Chobani, LLC, General Mills Inc., Dairy Manufacturers, Inc., Meadow Foods Limited, Nestle Health Science, Parmolat S.p.A, Arla Foods Ingredients Group P/S, |

| Additional Attributes | Dollar sales, share, demand trends by product type, key growth regions, consumer preferences for probiotics and clean-label, distribution performance, and opportunities in functional segments. |

The industry is segmented into yogurt, kefir, cheese, sour cream, buttermilk, and others.

The industry is segmented into culture-based and enzyme-based.

The industry includes modern trade, convenience stores, e-commerce, and other retail formats.

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is valued at USD 5.9 billion in 2025.

It is forecasted to reach USD 11.1 billion by 2035.

The industry is anticipated to grow at a CAGR of 6.5% during this period.

Culture-based is projected to lead the market with a 62.5% share in 2025.

Asia Pacific, particularly India, is expected to be the key growth region with a projected growth rate of 7.2%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dairy Products Market Analysis by Product Type, End Use, Distribution Channel and Region through 2035

Fermented Dairy Ingredient Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

UHT Dairy Products Market - Size, Share, and Forecast Outlook 2025 to 2035

Spicy Dairy Products Market Size and Share Forecast Outlook 2025 to 2035

Savory Dairy Products Market

Dairy-Free RTD Coffee Products Market

Fortified Dairy Products Market Size and Share Forecast Outlook 2025 to 2035

Functional Dairy Products Market Trends - Health & Nutrition 2025 to 2035

Dairy Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Dairy Container Market Analysis Size and Share Forecast Outlook 2025 to 2035

Fermented Coffee Market Size and Share Forecast Outlook 2025 to 2035

Dairy Packaging Market Size and Share Forecast Outlook 2025 to 2035

Dairy Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Fermented Botanicals for Anti-Aging Market Size and Share Forecast Outlook 2025 to 2035

Fermented Vitamins Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fermented Amino Acid Complex Market Size and Share Forecast Outlook 2025 to 2035

Fermented Beverages Market Size and Share Forecast Outlook 2025 to 2035

Fermented Rice Extracts Market Size and Share Forecast Outlook 2025 to 2035

Fermented Pet Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Fermented Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA