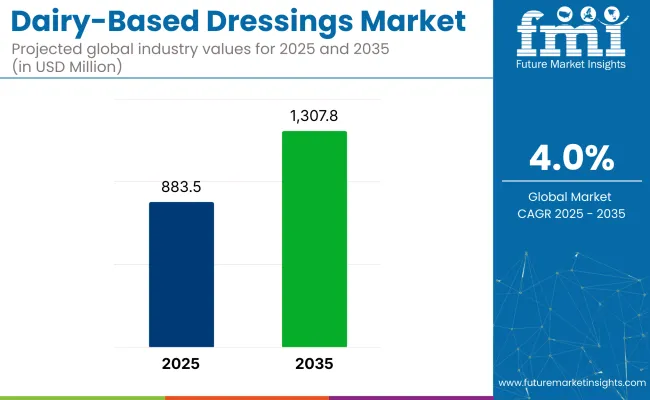

The global dairy-based dressings market is expected to reach USD 883.5 million in 2025, with projections indicating a rise to USD 1,307.8 million by 2035. This growth reflects a steady CAGR of 4.0% over the forecast period.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 883.5 million |

| Projected Global Value (2035F) | USD 1,307.8 million |

| Value-based CAGR (2025 to 2035) | 4.0% |

The industry expansion is fueled by increased consumer preference for creamy and rich textures in salad dressings, sauces, and dips, along with a growing focus on premium and indulgent ingredients. In North America, these dressings are firmly established in both retail and foodservice sectors. In Europe, these dressings remain popular in traditional cuisines. For instance, in Italy and France, they complement regional salads and dips.

The industry is held in a focused yet influential position across its parent industries. Within the salad and dip dressings industry, approximately 25-30% is accounted for, driven by consumer demand for creamy textures and tangy profiles. In the broader sauces, dips, and spreads category, a share of 8-10% is estimated, with competition being faced alongside mayonnaise, vinaigrettes, and plant-based alternatives.

Within the convenience and packaged food industry, around 2-3% is comprised, representing a small but growing condiment segment. In the functional and clean-label food space, about 5-7% is contributed, favored for probiotic and yogurt-based formulations. Across the global dairy products industry, its share is under 1%, reflecting niche usage relative to milk, cheese, and yogurt, but being noted for value-added innovation.

A November 2024 report by Tate & Lyle highlighted that the future of food and beverage brands relies on creating exciting textures and adapting to changes in taste and mouthfeel. Marina Di Migueli, Global Marketing Director, Texturants and Proteins at Tate & Lyle, emphasized that successful brands will be those innovating textures and anticipating consumer trends.

She noted that factors like climate change, busy lifestyles, and the demand for healthier alternatives will drive reformulations. Brands that focus on maintaining great-tasting, adaptable products will thrive in the evolving industry.

The dairy-based dressings market is segmented by product type into creamy salad dressings, Greek yogurt salad dressing, vinaigrette salad dressing, organic salad dressings, and vinaigrettes. By storage type, the segmentation includes refrigerated and shelf-stable forms.

By distribution channel, products are distributed hrough online and offline channels. The industry is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

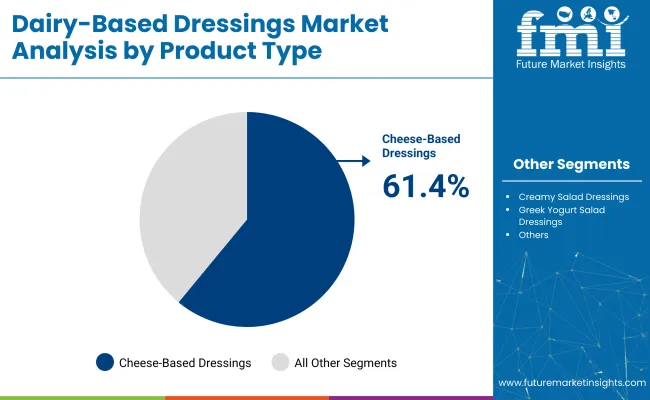

Cheese-based dressings are projected to hold 61.4% industry share in 2025. These dressings are highly favored due to their rich, creamy texture and versatile flavor profile. The demand for cheese-based dressings remains robust, especially in the foodservice and retail sectors, where indulgence-driven consumers continue to seek creamy options.

Leading brands like Hidden Valley, Ken’s Foods, and Primal Kitchen are investing heavily in this segment to cater to the growing preference for familiar, flavorful dressing options. Cheese-based dressings are also being innovated upon with variations such as reduced-fat and organic versions, aligning with changing consumer needs.

Buttermilk and yogurt-based dressings are projected to capture 38.6% industry share in 2025. These dressings are becoming increasingly popular as consumers seek healthier, lighter alternatives to traditional cheese-based dressings.

Brands like Chobani and Danone are capitalizing on these trends by introducing yogurt-based dressings to appeal to the health-conscious demographic. These dressings offer functional benefits while maintaining a flavorful profile, leading to their rising demand across retail and foodservice channels

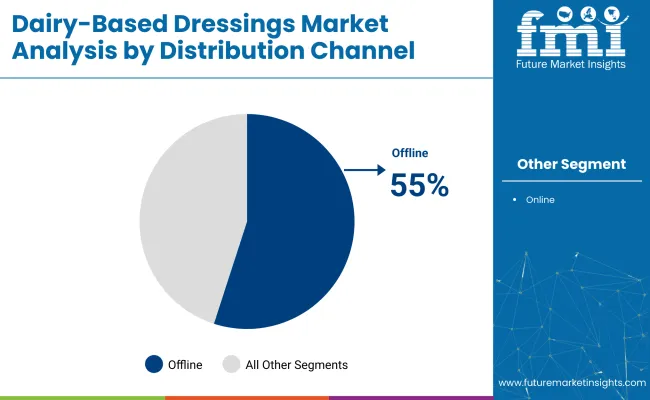

Offline distribution channels are expected to account for 55% industry share in 2025. These channels continue to dominate the industry. Grocery stores remain the primary venues for purchasing these products, allowing consumers to interact with products in-store before making a purchase.

The offline retail space is characterized by its strong consumer loyalty, with leading brands benefiting from strategic placements in high-traffic locations. Retail giants like Walmart and Target contribute significantly to this segment’s growth by offering easy access to popular dairy-based dressings, helping to maintain offline channels as the main source of product sales.

The industry is being expanded due to growing consumer demand for healthier, convenient meal options and innovative flavors. The rising popularity of yogurt-based and protein-enriched dressings, along with clean-label trends, is supporting growth. However, challenges, including price volatility and competition from plant-based alternatives, are being faced by manufacturers.

Drivers of Growth in Dairy-Based Dressings

Growth is driven by the increasing demand for low-fat, organic, and clean-label products among health-conscious consumers. The preference for rich, creamy flavors remains strong, especially in the foodservice sector. Additionally, the rising consumption of salads and vegetables as part of healthier diets is fueling demand for complementary dressings. These evolving dietary trends are positively impacting the industry, leading to continued growth in the segment.

Challenges Hindering Dairy-Based Dressings Growth

Rising awareness of lactose intolerance and growing demand for dairy-free alternatives are challenging the industry. The shift toward plant-based dressings limits growth, while concerns over high calorie and fat content deter health-conscious consumers. Additionally, the higher pricing of organic dairy dressings makes them less appealing to price-sensitive buyers.

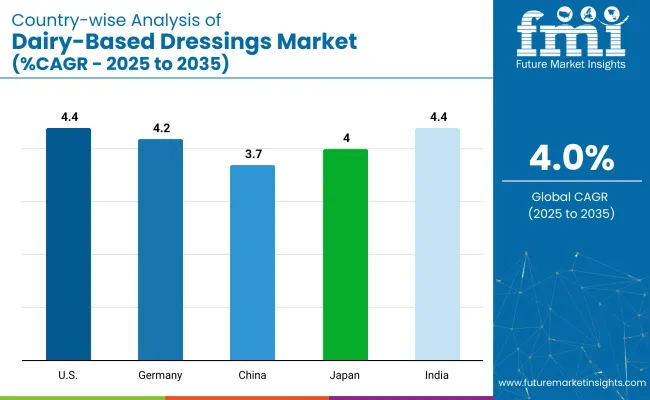

| Countries | CAGR (2025 to 20235) |

|---|---|

| USA | 4.4% |

| Germany | 4.2% |

| China | 3.7% |

| Japan | 4% |

| India | 4.4% |

The dairy-based dressings market is projected to grow at a global CAGR of 4.0% from 2025 to 2035. In OECD countries, steady growth is observed, with the United States leading at 4.4%, followed by Germany at 4.2%, Japan at 4.0%, and the EU at 4.0%. These markets are characterized by mature demand, premium product consumption, and health-conscious trends.

In BRICS nations, a higher growth potential is seen, with India’s market expanding at 4.4%, driven by rising incomes and urbanization. China’s growth rate is slower at 3.7%, while other BRICS countries like South Africa, Brazil, and Russia also show lower but consistent growth.

The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

The sales of the dairy-based dressings market in the United States are set to grow at a CAGR of 4.4% through 2035, driven by increasing demand for premium, health-conscious, and clean-label products. Consumers are gravitating toward innovative dairy-based sauces featuring flavors like avocado, bacon, and spicy variations.

Ready-to-eat options have become staples in retail and fast-food sectors, further fueling growth. Consumer preferences in the USA differ from those in regions such as the UK, Germany, Japan, China, and India, where traditional flavors and packaging are more prominent. The USA market is characterized by strong demand for high-quality ingredients and convenience.

Demand for dairy-based dressings in Germany is expanding at a CAGR of 4.2% from 2025 to 2035, driven by rising demand for healthier food options and growing interest in international cuisines. German consumers are leaning toward organic and clean-label dairy-based dressings, focusing on high-quality ingredients and minimal processing.

Retail and foodservice sectors are experiencing significant growth, particularly for ready-to-eat products. While traditional flavors remain popular, there is a rising demand for innovative and international flavors. Increased shelf space and expanding retail chains are enhancing product visibility, helping dairy-based dressings reach a broader audience.

China is anticipated to grow at a CAGR of 3.7% through 2035, driven by increasing exposure to Western food trends and rising demand for convenient, packaged products. The industry is fueled by rising disposable incomes and the growing middle class, particularly in large cities.

Despite this, per capita consumption remains significantly lower than global averages, indicating substantial untapped potential, especially in semi-rural and rural areas. E-commerce platforms and international retail chains are playing an important role in improving product accessibility and expanding industry reach. While dairy-based sauce sare still considered niche products, demand continues to grow as Chinese consumers experiment with new flavors.

Sales of dairy-based dressings in Japan are projected to grow at a CAGR of 4.0% from 2025 to 2035, fueled by increasing awareness of healthier food options and the popularity of Western-style salads. Consumers are becoming more health-conscious and opting for dairy-based sauces with natural ingredients and fewer additives.

Retail and foodservice sectors are playing a key role in expanding the industry, particularly through ready-to-eat options. International flavor sare increasingly being adopted, complementing traditional Japanese dressings while maintaining the health-conscious trend. As more retail outlets introduce these innovative products, the demand for dairy-based dressings is expected to continue growing, with a focus on convenience and high-quality ingredients.

The Indian market is expected to grow at a CAGR of 4.4% from 2025 to 2035, driven by rising disposable incomes and increased exposure to global food trends. The shift from traditional food consumption to packaged, ready-to-eat options is gaining momentum, especially among the middle class in cities.

These dressings are growing in popularity, particularly among younger consumers seeking Western-style convenience foods. Despite these trends, per capita consumption remains significantly below the global average, highlighting considerable untapped potential in rural and semi-rural areas. Organized retail chains and e-commerce platforms are increasing product availability, contributing to wider consumer awareness and industry growth.

The dairy-based dressing brands are retooling their strategies to align with consumer demand for healthier option and flavor innovation. Kraft Heinz and Unilever (Hellmann’s) are ramping up industry penetration by leveraging direct-to-consumer (D2C) channels and expanding ready-to-eat options in metropolitan areas.

Their product portfolios are diversifying with organic, clean-label dressings, often incorporating eco-friendly packaging and ethically sourced ingredients. Similarly, Nestlé and Danone are focusing on regional preferences, introducing dairy-based variants with probiotics and plant-based alternatives to cater to emerging economies. Regional players like Primo Foods are taking a premium approach, offering organic dairy-based sauces while appealing to natural ingredient trends.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025E) | USD 883.5 million |

| Industry Value (2035F) | USD 1,307.8 million |

| Value-based CAGR (2025 to 2035) | 4.0% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and Metric tons for volume |

| Product Types Analyzed | Creamy salad dressings, Greek yogurt salad dressing, vinaigrette salad dressing, organic salad dressings, vinaigrettes |

| Storage Types Analyzed | Refrigerated, Shelf-stable |

| Distribution Channels Analyzed | Online, Offline |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa |

| Key Players | TIC Gums, Inc., Dairy Chem Inc., Lite house Inc., Dari fair Foods, Inc., Santini Foods, Inc., Tate & Lyle PLC, Other Emerging Players |

| Additional Attributes | Dollar sales by product type and region, demand trends for refrigerated vs. shelf-stable, impact of online retail, regional consumption patterns, innovation in organic and Greek yogurt dressings |

The industry includes creamy salad dressings, Greek yogurt salad dressing, vinaigrette salad dressing, organic salad dressings, and vinaigrettes.

The industry is segmented into refrigerated or shelf-stable forms.

These products are sold through online and offline channels.

The industry is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The industry is projected to reach USD 1,307.8 million by 2035.

The industry is expected to grow at a CAGR of 4.0% from 2025 to 2035.

Cheese-based dressings are expected to dominate with 61.4% share in 2025.

The industry is estimated to reach USD 883.5 million in 2025.

North America, particularly the United States, is expected to be the key growth region with a projected growth rate of 4.7%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sour Dressings Market

Sauces, Dressings, And Condiments Market Size and Share Forecast Outlook 2025 to 2035

Vascular Dressings Market

Fat Free Salad Dressings Market

Demand for Sauces, Dressings, and Condiments in Europe Outlook - Share, Growth & Forecast 2025 to 2035

Hydrokinetic Fibre Dressings Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Wound Care Dressings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA