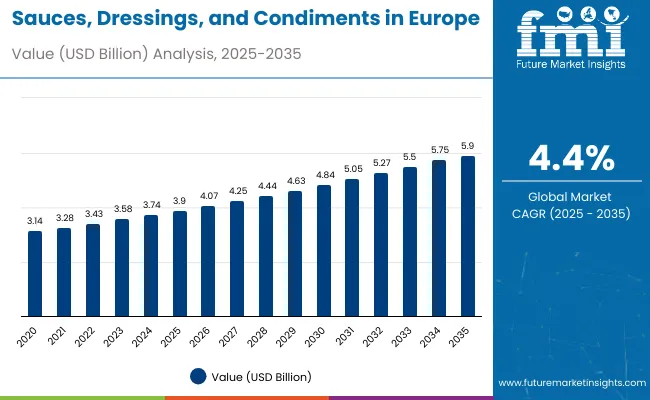

Sales of sauces, dressings, and condiments in Europe are estimated at USD 3.9 billion in 2025, with projections indicating a rise to USD 5.9 billion by 2035, reflecting a CAGR of 4.4% over the forecast period. This growth is attributed to rising adoption of international cuisines, expanding applications in food service establishments, and increasing consumer demand for convenience foods and flavor enhancement.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 3. 9 billion |

| Projected Value (2035F) | USD 5.9 billion |

| CAGR (2025 to 2035) | 4.4% |

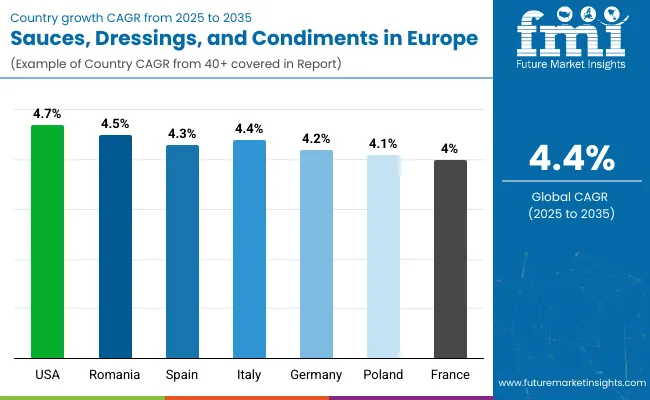

The United Kingdom is expected to generate the highest growth rate at 4.7% CAGR by 2035, followed by Romania at 4.5%, Spain is expected to grow at 4.3% CAGR, while Italy will expand at 4.4% CAGR, Germany (4.2% CAGR), Poland (4.1% CAGR), and France (4.0% CAGR).

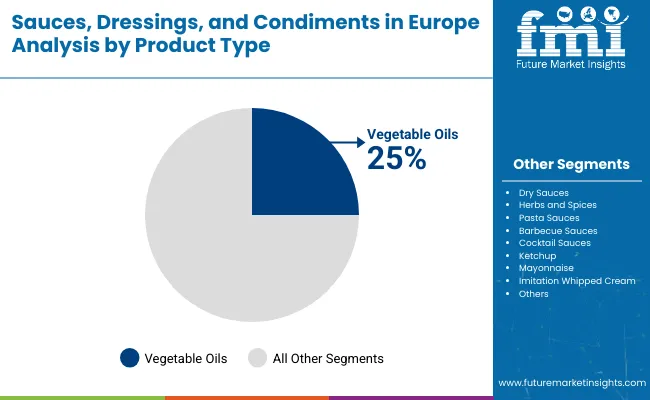

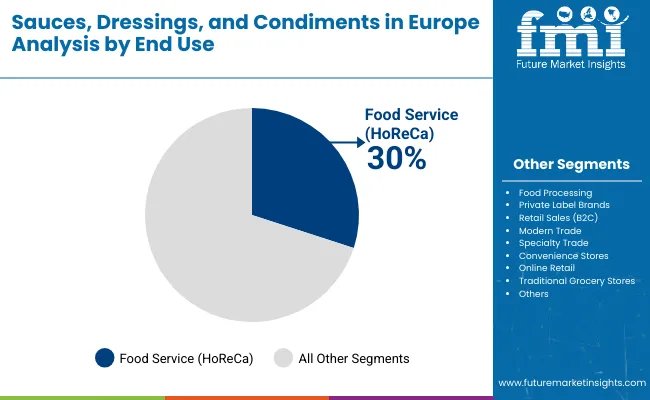

Vegetable oils continue to contribute the most to demand, expected to account for 25% of total sales in 2025, owing to their versatility, broad applications in cooking, and consumer preference for flavor enhancement. By application, food service (HoReCa) processes represent the dominant segment, responsible for 30% of sales, while retail and industrial applications are expanding steadily.

Consumer adoption is concentrated in restaurants, cafes, hotels, food processors, and retail chains. Demand is primarily driven by functionality, taste enhancement, and convenience trends. Premium positioning supports value growth, but food service and retail applications remain the key volume drivers. Regional disparities persist, though consumption patterns in emerging markets such as Romania and Poland are narrowing the gap with mature markets like Germany and France.

The sauces, dressings, and condiments segment in Europe is classified by product type, end-use, and country. By product type, it includes dry sauces, herbs and spices, pasta sauces, barbecue sauces, cocktail sauces, ketchup, mayonnaise, imitation whipped cream, and vegetable oils.

By application, categories encompass food processing, private label brands, food service (HoReCa), retail sales (B2C), modern trade, specialty trade, convenience stores, online retail, traditional grocery stores, and other channels. Leading countries include Germany, France, Italy, Spain, the United Kingdom, Poland, and Romania.

By product type, vegetable oils are projected to account for 25% of total sales in 2025, underscoring their central role in culinary, processing, and retail applications.

Sauces, dressings, and condiments end-use applications in Europe span a variety of sectors, including food service, retail sales, food processing, and private label brands. Food service (HoReCa) is projected to account for 30% of total sales in 2025, reflecting strong adoption across hotels, restaurants, cafes, and catering services.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.7% |

| Romania | 4.5% |

| Spain | 4.3% |

| Italy | 4.4% |

| Germany | 4.2% |

| Poland | 4.1% |

| France | 4.0% |

Between 2025 and 2035, demand for sauces, dressings, and condiments is projected to expand across all major European countries. Still, the pace of growth will vary based on food service innovation, retail capabilities, and consumer adoption trends. Among the seven countries analyzed, the United Kingdom and Romania are expected to register the fastest compound annual growth rates of 4.7% and 4.5% respectively, outpacing other established European markets. This acceleration is underpinned by factors such as expanding food service industries, rising consumer income levels, and increasing adoption of international cuisines and convenience foods. In both countries, per capita consumption is projected to increase steadily from 2025 to 2035, driven by enhanced culinary diversity and food service integration.

The UK is expected to grow at a CAGR of 4.7%, supported by increasing demand for premium condiments and expanding multicultural food preferences. Per capita consumption is projected to rise from 12.5 kg in 2025 to 18.2 kg by 2035, with total market value reaching USD 892.4 million. Romania is forecast to grow at a CAGR of 4.5%, driven by rising urbanization and growing food service adoption. Per capita consumption is projected to increase from 8.2 kg to 12.1 kg over the same period, with market value reaching USD 267.8 million by 2035. Spain and Italy are expected to expand at a CAGR of 4.3% each, underpinned by traditional culinary heritage and moderate retail growth. Spain's per capita consumption is projected to increase from 14.1 kg to 20.5 kg, with total market value reaching USD 645.3 million. Italy's consumption is expected to rise from 13.8 kg to 20.0 kg, with market value reaching USD 712.6 million.

Germany is projected to grow at a CAGR of 4.2%, driven by stable consumer demand and established food processing capabilities. Per capita consumption is expected to rise from 15.2 kg in 2025 to 21.8 kg in 2035, with total market value reaching USD 1.124 billion. Poland is forecast to grow at a CAGR of 4.1%, supported by emerging market dynamics and increasing food service adoption. Per capita consumption is projected to increase from 9.6 kg to 13.8 kg, with market value reaching USD 298.7 million. France is expected to expand at a CAGR of 4.0%, reflecting mature market conditions with steady growth patterns. Per capita consumption is projected to increase from 16.3 kg to 23.2 kg, with total market value reaching USD 967.5 million.

Collectively, these seven countries represent the core of the demand for sauces, dressings, and condiments in Europe. Still, their individual growth paths highlight the importance of country-specific strategies in product development, distribution partnerships, and food service integration.

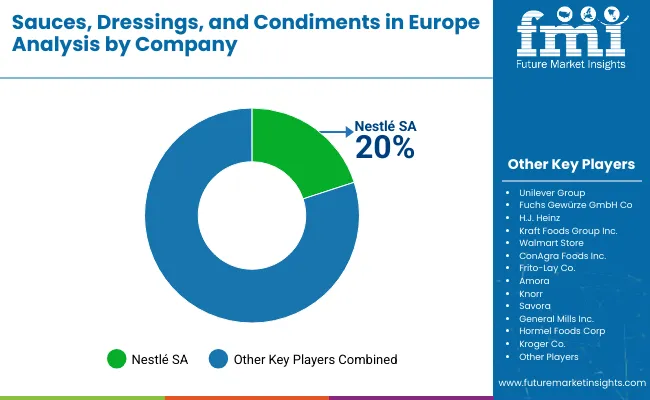

A mix of established food manufacturers and specialized condiment providers defines the competitive environment in the European sauces, dressings, and condiments space. Operational excellence, brand recognition, and strategic distribution management, rather than product innovation alone, remain decisive success factors: the leading suppliers collectively serve a wide range of food service and retail clients across Europe and maintain strong market presence.

Nestlé SA holds a dominant position with 20% market share through its comprehensive sauce and seasoning portfolios. The company leverages robust brand recognition and extensive distribution networks to deliver consistent quality solutions, ensuring reliable performance in both food service and retail applications. Its focus on flavor innovation strengthens relationships with European consumers seeking convenient meal solutions.

Unilever Group emphasizes brand portfolio management and consumer-focused product development tailored for retail and food service sectors. By integrating established brands with consumer-specific taste preferences, the company reinforces its presence across traditional and premium segments while enhancing adoption in high-value applications.

H.J. Heinz capitalizes on brand heritage to provide specialized ketchup and sauce offerings for both institutional and consumer markets. Its strategic emphasis on quality consistency and sector-specific applications enables strong penetration in the food service, retail, and food processing industries, supporting growth across multiple European regions.

Kraft Foods Group focuses on integrated ingredient solutions targeting retail and food processing applications. Through a combination of brand strength, functional performance, and supply chain efficiency, the company strengthens its position as a trusted partner for food manufacturers and retailers seeking consistency and market appeal.

Private-label programs and ongoing market consolidation trends are reshaping the competitive landscape, with brand strength and distribution excellence emerging as critical differentiators for players aiming to maintain market relevance in the European sauces, dressings, and condiments sector.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 3. 9 Billion |

| Product Type | Dry Sauces, Herbs and Spices, Pasta Sauces, Barbecue Sauces, Cocktail Sauces, Ketchup, Mayonnaise, Imitation Whipped Cream, Vegetable Oils |

| End Use Application | Food Processing, Private Label Brands, Food Service (HoReCa), Retail Sales (B2C), Modern Trade, Specialty Trade, Convenience Stores, Online Retail, Traditional Grocery Stores, Other Channels |

| Key Region | Europe |

| Countries Covered | Germany, France, Italy, Spain, the United Kingdom, Poland, Romania |

| Key Companies Profiled | Nestle SA, Unilever Group, Fuchs Gewürze GmbH Co, H.J. Heinz, Kraft Foods Group Inc., Walmart Store, ConAgra Foods Inc., Frito-Lay Co., Amora, Knorr, Savora, General Mills Inc., Hormel Foods Corp, Kroger Co. |

| Additional Attributes | Dollar sales by application and purity grade, regional demand trends, competitive landscape, consumer preferences for natural versus synthetic alternatives, sustainable sourcing practices, clean-label formulations, regional demand trends, and evolving consumer preferences toward natural ingredients |

The industry can be segmented by product type into several categories, including dry sauces, herbs and spices, pasta sauces, barbecue sauces, cocktail sauces, ketchup, mayonnaise, imitation whipped cream, vegetable oils, and others.

Segmentation by end-use application includes food processing, private label brands, food service (HoReCa), retail sales (B2C), modern trade, specialty stores, convenience stores, online retail, traditional grocery stores, and other channels.

In 2025, the total sales of sauces, dressings, and condiments in Europe will be valued at USD 3.9 billion.

By 2035, the sales of sauces, dressings, and condiments in Europe are forecasted to reach USD 5.9 billion, reflecting a CAGR of 4.4%.

Vegetable oils will lead the product category with a 25% share in 2025.

The UK is anticipated to grow at the fastest pace with a CAGR of 4.7% from 2025 to 2035, closely followed by Romania at 4.5%.

The food service (HoReCa) sector is projected to lead the end-use segment with a 30% share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA