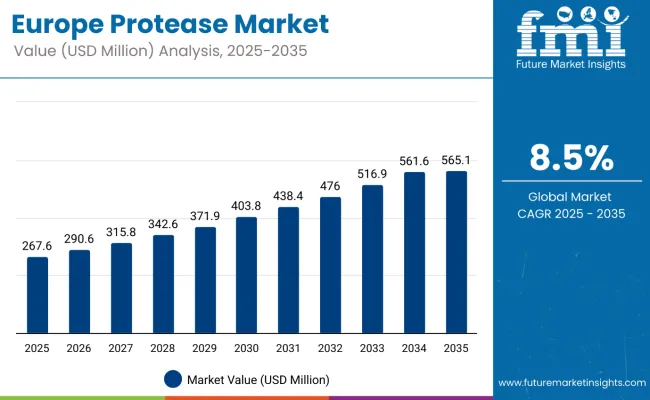

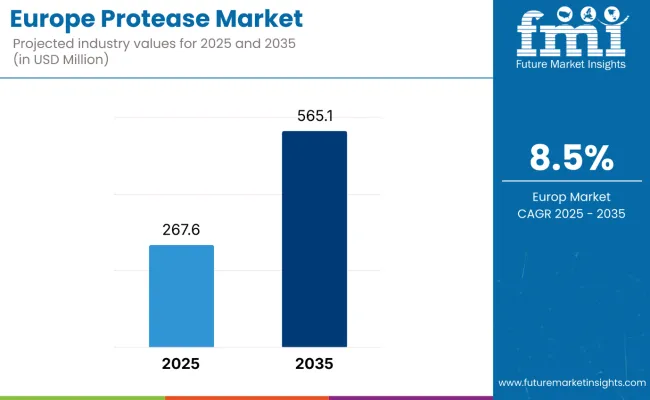

Sales of protease in Europe are estimated at USD 267.6 million in 2025, and are projected to reach USD 565.1 million by 2035, reflecting a CAGR of 8.5% over the forecast period. This growth is attributed to rising adoption in the food & beverage industry, expanding applications in industrial processes, and increasing consumer awareness of health and nutrition.

By 2025, per capita usage in leading countries such as Germany, France, and Italy averages between 0.9 and 1.5 kilograms, with projections reaching 1.8 kilograms by 2035. Germany is expected to generate USD 137.2 million in protease sales by 2035, followed by France (USD 122.4 million), Italy (USD 95.1 million), the United Kingdom (USD 57.4 million), and Spain (USD 45.9 million).

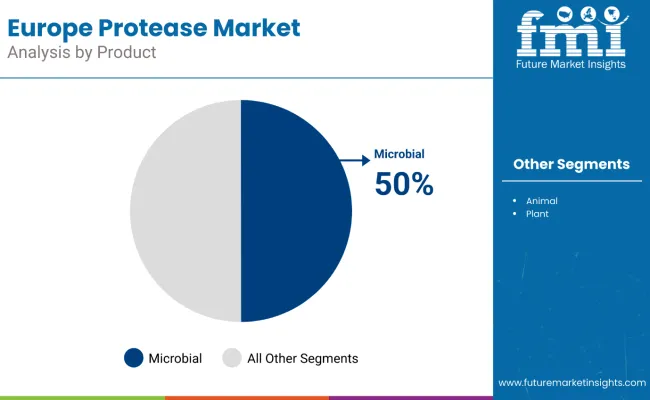

Microbial continues to contribute the most to demand, expected to account for 50% of total sales in 2025, owing to their high efficiency, broad applications, and cost-effectiveness. By application, the food and beverage sector represents the dominant segment, responsible for 43.7% of sales, while industrial and pharmaceutical uses are expanding steadily.

Consumer adoption is concentrated among food processors, bakeries, confectionery manufacturers, and detergent producers. The demand is primarily driven by functionality, process efficiency, and clean-label trends. Premium positioning supports value growth, but industrial and household applications remain the key volume drivers. Regional disparities persist, though per capita consumption in emerging countries such as Poland and Nordic regions is narrowing the gap with mature markets like Germany and France.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 267.6 million |

| Projected Value (2035F) | USD 565.1 million |

| CAGR (2025 to 2035) | 8.5% |

The protease in Europe is classified by product, form, end-use application, and country. By product type, the key classification includes microbial, animal, and plant proteases. By application, the segment spans food & beverage, pharmaceuticals, and industrial uses. By form, the segment covers liquid, powder, and granule formats.

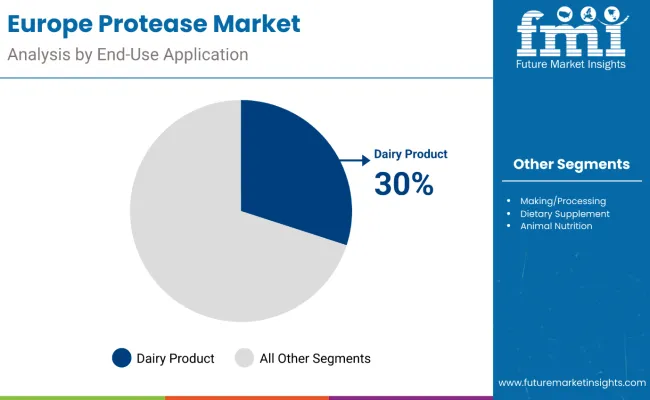

By end-use applications, the classification includes dairy products, brewing, meat products and processing, bakery & confectionery, baby food/infant food, oil & fat processing, starch and grain processing, fruits and vegetable processing, cheese making/processing, egg products, beverages, dietary supplements/pharmaceutical products, personal care products, and animal nutrition. By countries, the analysis covers Germany, France, Italy, Spain, United Kingdom, Russia, and Poland.

Microbial protease are projected to dominate sales in 2025, supported by high enzyme activity, cost-efficiency, and versatile application potential. Animal and plant-derived proteases grow steadily, serving specialized nutritional and functional requirements.

Protease end-use applications in Europe span a variety of sectors, including dairy products, bakery and confectionery, meat processing, and beverages. Dairy products are projected to account for 30% of total protease sales in 2025, reflecting strong adoption across milk, cheese, yogurt, and other processed dairy categories.

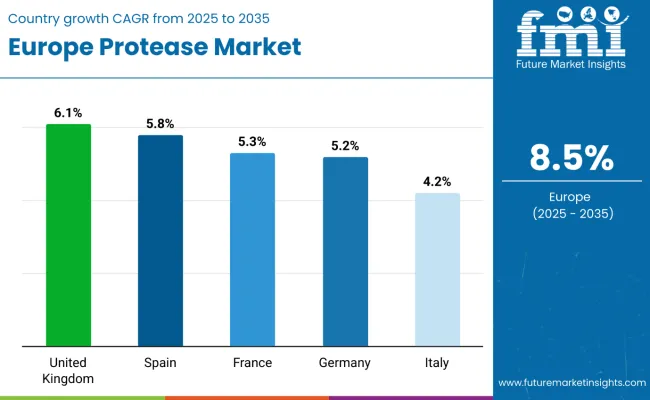

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.1% |

| Spain | 5.8% |

| France | 5.3% |

| Germany | 5.2% |

| Italy | 4.2% |

Between 2025 and 2035, demand for protease is projected to expand across all major European countries, but the pace of growth will vary based on food processing innovation, industrial capabilities, and enzyme adoption trends. Among the top five countries analyzed, the United Kingdom and Spain are expected to register the fastest compound annual growth rates of 6.1% and 5.8% respectively, outpacing other established European enzyme markets. This acceleration is underpinned by factors such as expanding bakery and dairy industries, rising consumer health consciousness, and increasing adoption of convenience and functional food ingredients. In both countries, per capita protease consumption is projected to rise steadily from 2025 to 2035, driven by enhanced food manufacturing capabilities and industrial enzyme integration.

The UK is expected to grow at a CAGR of 6.1%, supported by increasing demand for functional foods and expanding industrial applications. Per capita usage is projected to rise from 0.9 kg in 2025 to 1.5 kg by 2035, with total sales reaching USD 57.4 million. Spain is forecast to grow at a CAGR of 5.8%, driven by rising awareness of protein-enriched foods and industrial enzyme applications. Per capita usage is projected to increase from 0.8 kg to 1.4 kg over the same period, with sales reaching USD 45.9 million by 2035. France is expected to expand at a CAGR of 5.3%, underpinned by demand for health-oriented products and growing dairy processing capabilities. Per capita usage is projected to increase from 1.1 kg to 1.6 kg, with total sales reaching USD 122.4 million.

Germany, despite a slower CAGR of 5.2%, will remain the largest contributor by absolute sales value, reaching USD 137.2 million by 2035, supported by adoption of low-carb diets, bakery innovations, and industrial enzyme usage. Per capita usage is expected to rise from 1.2 kg in 2025 to 1.8 kg in 2035, with total sales reaching USD 137.2 million. Italy is forecast to grow at a CAGR of 4.2%, supported by traditional dairy consumption patterns and moderate industrial enzyme adoption. Per capita usage is projected to increase from 0.9 kg to 1.4 kg, with total sales reaching USD 95.1 million.

Together, these five countries form the core of protease demand in Europe, though their individual growth paths highlight the importance of country-specific strategies in enzyme application development, industrial integration, and food processing partnerships.

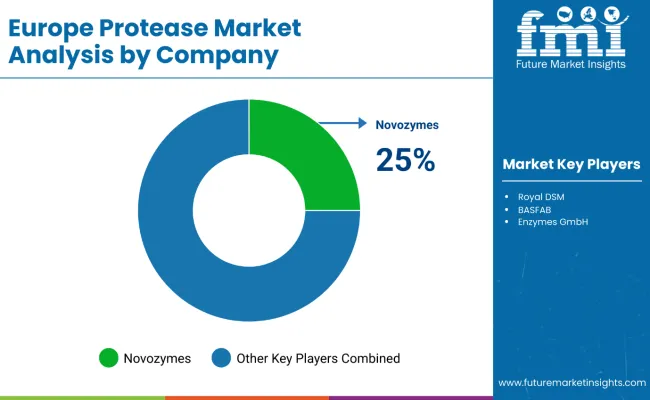

A mix of established enzyme manufacturers and specialized ingredient providers defines the competitive environment in the European protease space. Operational excellence, product quality, and strategic supply chain management, rather than product innovation alone, remain decisive success factors: the leading suppliers collectively serve a wide range of industrial and food processing clients across Europe and maintain strong channel presence.

Novozymes A/S holds a dominant position with microbial protease formulations. The company leverages robust R&D capabilities and an extensive industrial distribution network to deliver technically advanced solutions, ensuring reliable performance in food, beverage, and detergent applications. Its focus on application support strengthens relationships with European manufacturers seeking high-efficiency enzymatic solutions.

DSM emphasizes technical support and custom formulation services tailored for food and pharmaceutical sectors. By integrating specialized enzyme solutions with client-specific process requirements, the company reinforces its presence across industrial and nutritional applications while enhancing adoption in high-value segments.

Rossari Biotech Limited capitalizes on innovation to provide specialized protease offerings for both industrial and consumer markets. Its strategic emphasis on product customization and sector-specific applications enables strong penetration in the baking, dairy, and detergent industries, supporting growth across multiple European regions.

Kemin Industries focuses on integrated ingredient solutions targeting bakery and food processing applications. Through a combination of technical expertise, functional performance, and collaborative development programs, the company strengthens its position as a trusted partner for food manufacturers seeking efficiency and consistent quality.

Private-label programs and ongoing consolidation trends are reshaping the competitive landscape, with technical expertise and application support emerging as critical differentiators for smaller players aiming to maintain market relevance in the European protease sector.

Key Developments

In June 2024, Kemin Industries acquired Archangel Inc., a specialist in antimicrobials for biofuel fermentation. The deal adds NOVA™ EZL and EZP products to Kemin’s portfolio, transfers four patent applications, and brings Archangel founder Allen Ziegler as Principal Sales Manager, strengthening bacterial control solutions and innovation in USA biofuel production.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 267.6 Million |

| Product | Microbial, Animal, and Plant |

| Form | Liquid and Powder & Granule |

| End Use Application | Dairy Products, Brewing, Meat Products and Processing, Bakery & Confectionery, Baby Food/Infant Food, Oil & Fat Processing, Starch and Grain Processing, Fruits and Vegetable Processing, Cheese Making/Processing, Egg Products, Beverages, Dietary Supplements/Pharmaceutical Products, Personal Care Products, and Animal Nutrition |

| Countries Covered | Germany, France, Italy, Spain, United Kingdom, BENELUX, Nordic, Russia, and Poland |

| Key Companies Profiled | Rossari Biotech Limited, Novozymes, Kemin Industries, Inc., Nagase and Co. Ltd., Jiangsu Boli Bioproducts Co. Ltd, Creative Enzymes, Lallemand Inc., Advanced Enzyme Technologies Limited, BASF, AB Enzymes GmbH, and Royal DSM |

| Additional Attributes | Dollar sales by product type and application, regional demand trends, premiumization in dairy powders, influence of clean-label trends, impact of sustainability on manufacturing & packaging, rise of plant-based protein foods, and competitive strategies focusing on taste, texture, and nutritional fortification |

The global europe protease market is estimated to be valued at USD 267.6 million in 2025.

The market size for the europe protease market is projected to reach USD 605.0 million by 2035.

The europe protease market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in europe protease market are animal, plant and microbial.

In terms of form, liquid segment to command 55.2% share in the europe protease market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Europe's Golden Generation Travel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA