The Europe Fish Oil market is set to grow from an estimated USD 3,017.3 million in 2025 to USD 6,466.0 million by 2035, with a compound annual growth rate (CAGR) of 7.9% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 3,017.3 million |

| Projected Europe Industry Value (2035F) | USD 6,466.0 million |

| Value-based CAGR (2025 to 2035) | 7.9% |

The European fish oil market is expected to increase steadily in market growth over the past few years, and the growth is expected to continue to rise as a result of continued increases in the demand for Omega-3 fatty acids - fatty acids that support various health benefits including, cardiovascular support, cognitive enhancement, and anti-inflammatory effects.

For instance, the interest of Europeans has grown much stronger in fishing oil that is produced sustainably and responsibly. Concerns about overfishing and environmental impact are now important issues, so consumers and manufacturers alike are seeking alternative sources, including algae oil and krill oil, which confer the same health benefits as fish oil but originate from a more sustainable source.

Algal oil is the one that has gained the most attention and popularity because it can serve the needs of vegan and vegetarian consumers who are specifically looking for plant-based Omega-3 supplements.

Enterprises such as DSM Nutritional Products, Orkla Health, and Nordic Naturals which have been the cornerstones of the market are characterized by their provision of high-quality and responsibly sourced fish oils.

These organizations as well are broadening their focus on product innovation, for example, the launching of new delivery formats including -Omega-3 emulsions, powders, and gummies, to address a wider range of consumer needs.

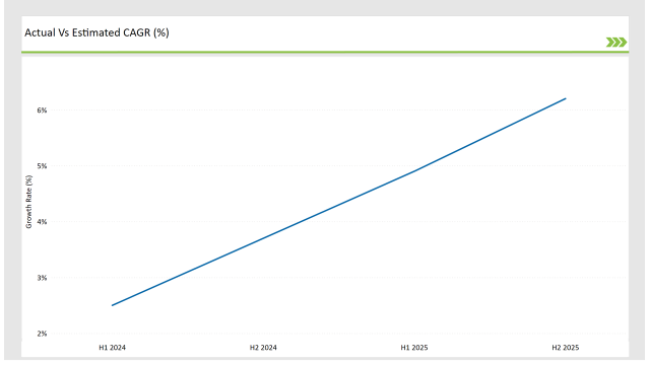

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Fish Oil market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 2.5% |

| H2 (2024 to 2034) | 3.7% |

| H1 (2025 to 2035) | 4.9% |

| H2 (2025 to 2035) | 6.2% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Fish Oil market, the sector is predicted to grow at a CAGR of 2.5% during the first half of 2024, with an increase to 3.7% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 4.9% in H1 but is expected to rise to 6.2% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April 2024 | Product Launch: Orkla Health expanded its range of Omega-3 supplements by introducing a new line of softgels containing a combination of fish oil and algae oil to cater to vegan consumers. |

| March 2024 | Sustainability Initiative: DSM Nutritional Products announced the launch of a fully traceable fish oil supply chain, aimed at increasing transparency and ensuring sustainable fishing practices. |

| February 2024 | Partnership: Nordic Naturals entered a strategic partnership with the University of Copenhagen to conduct clinical research on the benefits of fish oil in cognitive function and cardiovascular health. |

The Surging Demand for Sustainable Alternatives in Algal and Krill Oil

As the world continues to grapple with overfishing, coupled with increased awareness of sustainable production, consumers and manufacturers alike are switching to more sustainable forms of fish oil.

Both algal oil and krill oil were strong contenders in the European market because they were high in Omega-3 content and produced in a very environmentally responsible manner. Algal oil is especially popular with vegan and vegetarian consumers who seek to avoid products of animal origin.

This has led to important product innovation: many companies have developed combined Omega-3 formulations that contain both fish and algae oils to cover a broader consumer base.

Krill oil sourced from the Antarctica Ocean tiny crustaceans is gaining popularity and has greater bioavailability, offering better antioxidants believed to boost these benefits in general. One good example is Aker BioMarine, a main player in krill oil. The firm found some sustainability aspects in their products through the development of Eco-Harvesting™ technology that gives minimum impact on the environment.

Wider Applications in Cosmetics and Personal Care

Today, since consumers demand healthy products as well as beauty, fish oil has obtained considerable importance in a wide variety of skin care products such as moisturizers, serums, and anti-aging creams. The European market is expected to witness an upsurge in the use of fish oil in beauty products because more consumers will demand natural yet effective ingredients.

Companies such as Epax have capitalized on this trend by infusing their high-quality Omega-3 fish oil into cosmetic formulations that target anti-aging and anti-inflammatory skincare treatments. These products have gained acceptance among European consumers; especially, a growing number are now opting to spend more in Germany and France on premium formulation-based skincare items.

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Norway | 35% |

| Denmark | 20% |

| UK | 15% |

| Germany | 10% |

| Other Countries | 25% |

Germany is the number one market for fish oil in Europe due to its powerful health and wellness industry. The German people have embraced Omega-3 fatty acids as part of their diet the benefits of which the country has been aware of for quite some time. That is why, fish oil pills, especially these in liquid and softgel formats, infiltrate the German nutraceuticals market so much.

In recent times, German consumers have also become more meticulous about their fish oil product sourcing and quality, which has led to an increased demand for sustainably sourced and traceable products. To cater to this need, companies like Norsan have been making available top-notch fish oils that are wild-caught and thereby meeting both sustainability control and strict European regulations.

France, as another major driver for the expansion of the European fish oil sector, stands out primarily thanks to increasing consumer awareness about the importance of Omega-3 Essential fatty acids in promoting overall well-being. The French increasingly support nutraceuticals and supplements, notably those that particularly address cardiovascular health, the health of the brain, and inflammation.

Moreover, the French market is witnessing a transition to the acquisition of products made from algae and krill oil which is being steered by the demand for these plant-based and algae-based omega-3 supplements. For instance, Arkopharma has been at the forefront of innovation through both the development of fish oil products and the manufacturing of plant-based alternatives, thus serving a wide range of customers.

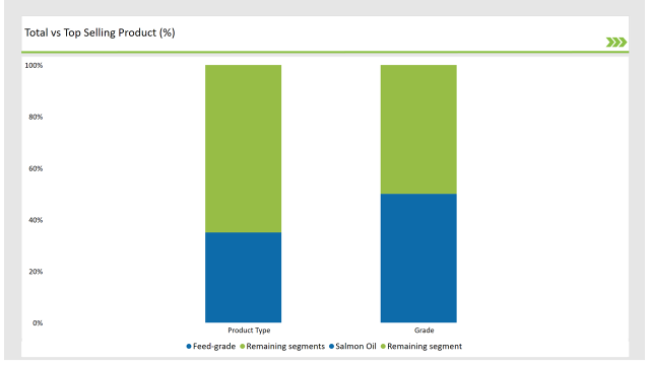

% share of Individual Categories Grade and Product Type in 2025

| Main Segment | Market Share (%) |

|---|---|

| Grade (Feed-grade) | 50% |

| Remaining segments | 50% |

The feed grade segment is the most significant growing sub-segment in the European fish oil market. The demand for high-quality omega-3 fatty acids in animal nutrition is rising, and livestock and aquaculture industries are expanding.

There is a pressing need for nutritious and sustainable feed options. The fatty acids eicosapentaenoic acid and docosahexaenoic acid which most fish including cod and herring are rich in, are known to aid in the reproduction, growth, health, and welfare of farmed fish and shellfish.

Support for this development comes also from the increasing number of companies that started to use fish oil as an ingredient in feed formulations, mostly in aquaculture and pet food.

| Main Segment | Market Share (%) |

|---|---|

| Product Type (Salmon Oil) | 35% |

| Remaining segments | 65% |

The salmon oil sector is the rapidly growing category in the European fish oil industry because of its high weight in omega-3 fatty acids. Thanks to the many health benefits that it offers, salmon oil has become one of the most sought-after products in the functional food market and dietary supplements. The product acts by lowering the level of EPA and DHA in the blood, of salmon oil.

The emergence of pet ownership has led to the growing need for meals with salmon oil being the main component in pet foods, which makes it more balanced and diverse for pet nutrition.

The recent innovations made by manufacturers focus on upgrading the functional conditions and quality of salmon oil, which allows the segment to maintain its positive growth. The sustainability and health aspects will continue to be the main reasons for the demand for salmon oil in different fields.

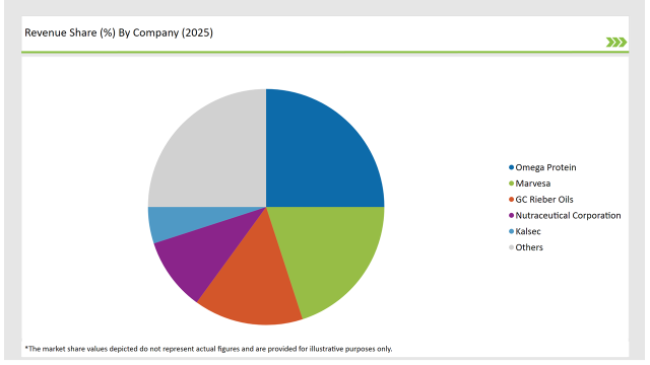

2025 Market share of Europe Fish Oil manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Omega Protein | 25% |

| Marvesa | 20% |

| GC Rieber Oils | 15% |

| Nutraceutical Corporation | 10% |

| Kalsec | 5% |

| Others | 25% |

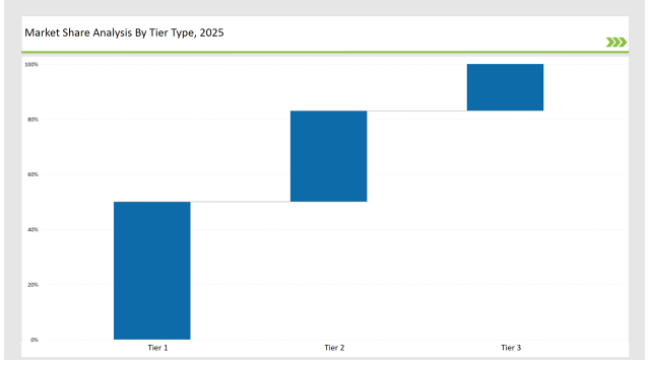

The European fish oil market is not densely populated but dominated by a few major companies. However, smaller fish oil firms primarily cater to regional and niche markets. The Tier 1 companies- namely, DSM Nutritional Products, Orkla Health, and Nordic Naturals- head this market with great distribution networks and huge operations.

These leaders are well-positioned to take advantage of the demand that is increasingly from consumers who have a demand for high-quality fish oils, sourced sustainably, and formulated innovatively.

Tier 2 firms include Aker BioMarine and Norsan, both of which have niche market orientation, krill oil, and sustainable fish oil, respectively. While they may not be the size of the Tier 1 companies, those companies have been able to create their niches by targeting the more environmentally conscious consumers and premium product offerings.

Companies operating at Tier 3, for example, the local suppliers and regional manufacturers, address more local needs but have managed to differ from others with quality products like organic or small-batch fish oils.

As per Grade, the industry has been categorized into Feed Grade, Food Grade, and Pharma Grade.

As per Product Type, the industry has been categorized into Salmon Oil, Tuna Oil, Cod Liver Oil, Sardine Oil, Squalene Oil, Krill Oil, Anchovy Oil, Menhaden Oil and Others.

As per Process, the industry has been categorized into Crude Fish Oil, Refined Fish Oil, and Modified Fish Oil.

As per End User, the industry has been categorized into Aqua-Feed, Food and Beverages, Dietary Supplements, Cosmetic and Beauty Products.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Fish Oil market is projected to grow at a CAGR of 7.9% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 6,466.0 million.

Key factors driving the European fish oil market include the increasing demand for omega-3 fatty acids for health benefits and the growing popularity of fish oil supplements in the wellness and dietary sectors. Additionally, rising awareness of sustainable fishing practices and the nutritional value of fish oil are contributing to market growth.

Germany, Norway, and UK are the key countries with high consumption rates in the European Fish Oil market.

Leading manufacturers include Omega Protein, Marvesa, GC Rieber Oils, Nutraceutical Corporation, and Kalsec known for their innovative and sustainable production techniques and a variety of product lines.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Europe's Golden Generation Travel Market Size and Share Forecast Outlook 2025 to 2035

Europe Automotive Night Vision System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA