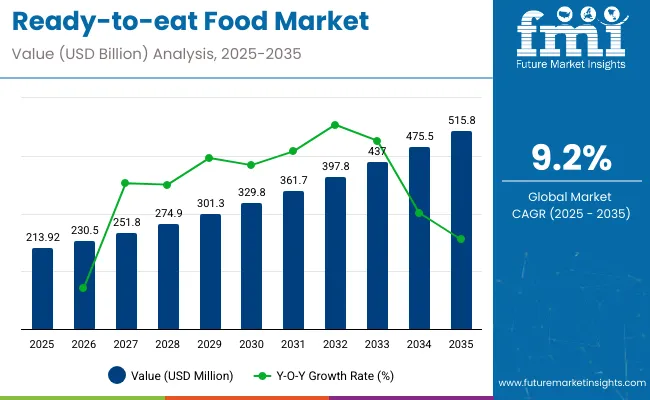

The global ready-to-eat food market is expected to grow from USD 213.92 billion in 2025 to USD 515.80 billion by 2035, reflecting a CAGR of 9.2%. The ready-to-eat (RTE) food market is experiencing significant growth due to a combination of changing consumer lifestyles, increasing urbanization, and the rising demand for convenience. In today's fast-paced world, more people are juggling busy work schedules, long commutes, and numerous personal responsibilities, leaving them with limited time or energy to cook traditional meals.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 213.92 Billion |

| Projected Global Industry Value (2035F) | USD 515.80 Billion |

| Value-based CAGR (2025 to 2035) | 9.2% |

As a result, consumers are increasingly opting for quick, easy meal solutions that require minimal preparation and effort. Ready-to-eat foods perfectly meet this demand, offering pre-cooked, packaged meals that can be heated and consumed within minutes.

Additionally, the growing number of single-person households and dual-income families has further fueled this trend, as these demographics often prefer hassle-free meal options that fit their dynamic routines. Moreover, improvements in packaging technology and cold chain logistics have made it easier to store and distribute RTE meals safely, contributing to their wider availability across supermarkets, convenience stores, and online platforms.

Another major factor driving the growth of the RTE food market is the evolving perception of product quality and nutritional value. In the past, ready-to-eat meals were often associated with low quality or poor health standards. However, manufacturers have responded to consumer demands by offering a wider variety of healthy, gourmet, and diet-specific options, including organic, vegan, gluten-free, and protein-rich meals. This diversification appeals to health-conscious consumers and those with dietary restrictions, broadening the market base.

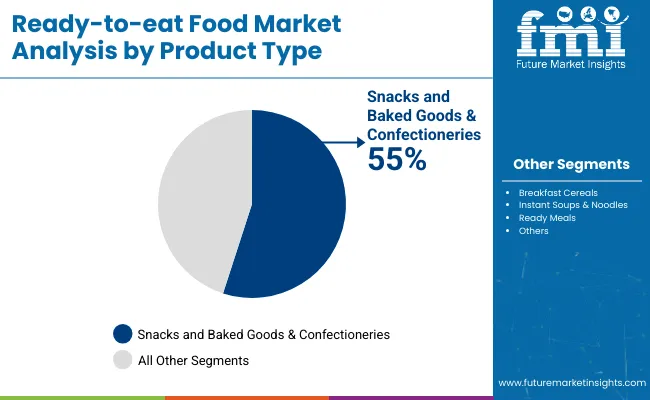

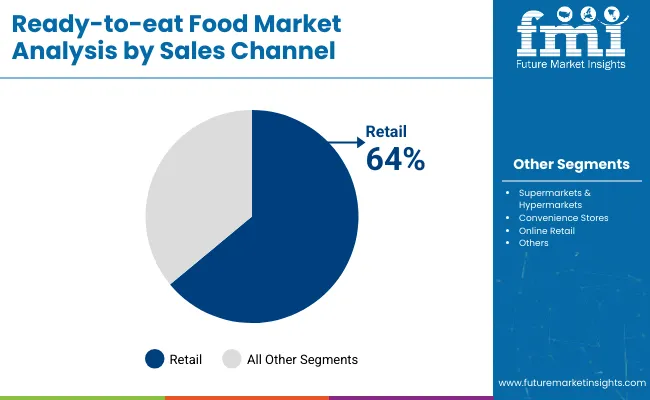

In terms of product type, the snacks and baked goods & confectioneries segment accounts for 55% share. With respect to sales channel, the retail segment captures 64% share. India is the fastest-growing country and is set to grow at 11.8% CAGR during the study period.

The rise of e-commerce and food delivery apps has made it even more convenient for consumers to access RTE meals, particularly in urban and semi-urban areas. Innovations in food processing, such as vacuum sealing and retort packaging, have also improved shelf life without compromising taste or nutrition. Together, these factors make RTE foods an increasingly attractive option for modern consumers, driving sustained growth in the global market.

Spending on ready-to-eat (RTE) food varies by region, shaped by factors like income, urbanization, work habits, and food culture. In high-income areas, consumers spend more on convenience-oriented meals, such as pre-packaged entrees and restaurant dining. Meanwhile, developing markets show more modest per capita spending, with rising demand driven by growing urban middle classes and increasing availability through retail and delivery channels.

The global trade of ready-to-eat (RTE) food is expanding rapidly, fueled by growing urban populations, busy lifestyles, and rising demand for convenience. Both developed and emerging markets are active participants in this trade, with supply chains adapting to ensure product quality and safety during transportation.

By product type, snacks and baked goods & confectioneries segment dominates the market. It has a market share of 55%. Ready-to-eat bakery and confectionery products have high demand due to their convenience, delicious taste, and wide variety.

Busy lifestyles leave little time for cooking or baking at home, making these products an easy and quick option for snacks or meals. Their attractive packaging and long shelf life add to their appeal, ensuring freshness and ease of storage. Additionally, these products often cater to diverse tastes with options like cakes, pastries, cookies, and chocolates, satisfying cravings for sweet and savory treats. The growing trend of on-the-go eating and impulse buying further fuels their popularity in both urban and rural markets.

| Segment | Value Share (2025) |

|---|---|

| Baker & Confectionary (Product Type) | 55% |

Ready-to-eat (RTE) food is majorly sold through online retail due to the convenience, variety, and time-saving benefits it offers to consumers. Online platforms allow customers to browse a wide range of RTE products from different brands, compare prices, read reviews, and place orders from the comfort of their homes.

The rise of food delivery apps, e-commerce grocery services, and improved cold chain logistics has made it easier to deliver fresh and packaged RTE foods quickly and safely. Additionally, busy urban lifestyles and increased smartphone and internet usage have accelerated the shift toward online shopping, making it a preferred channel for purchasing ready-to-eat meals and snacks.

| Segment | Value Share (2025) |

|---|---|

| Retail (Sales Channel) | 64% |

Growing global demand for convenience food is the main factor driving the ready-to-eat food markets expansion. It is due to both the growing number of working women worldwide and the busy lifestyle of the consumer. Also, the consumers increasing disposable income which is driving them to spend money on convenience food is also anticipated to grow the expansion of the ready-to-eat food market during the forecast period.

The ready-to-eat food market is expected to grow as a result of rapid urbanization and improving consumer lifestyles. Moreover, the expansion of the ready-to-eat food market is also a result of the growth in the food processing sector increasing penetration of Once more it is anticipated that the market expansion of ready-to-eat food will be supported by the numerous food manufacturers in the market span of time.

During the period 2020 to 2024, the sales grew at a CAGR of 8.7%, and it is predicted to continue to grow at a CAGR of 9.2% during the forecast period of 2025 to 2035.

Ready-to-eat options were becoming more and more popular among consumers with hectic schedules who wanted a quick and easy meal solution. The RTE market saw a surge of innovation during this time. Rapid growth was observed in the demand for prepared frozen foods.

These meals provided convenience and a high-quality dining experience satisfying customers need for wholesome and well-balanced options. Demand for natural customized and healthful foods that dont compromise on ingredients or health objectives is rising. Professionals who work are willing to spend money on convenience food without sacrificing their health.

The market and customer base for upscale convenience and ready-to-eat foods are being created by this trend. The market offers a broad range of RTE products such as meat products bakery and confectionery goods and instant breakfast and cereals. In addition, ready-to-eat salads and vegetables are gaining popularity in developing nations because they are tasty easy to eat and people are becoming more conscious of the health advantages of vegetables.

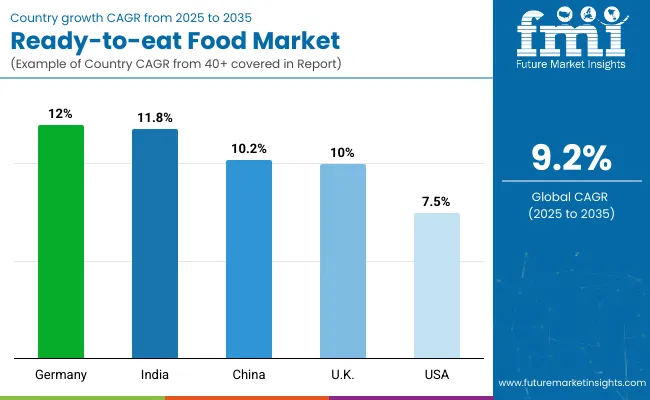

The following table shows the forecasted growth rates of the significant three geographies revenues. USA, China and India come under the exhibit of high consumption, recording CAGRs of 7.5%, 10.2% and 11.8%, respectively, through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| United States | 7.5% |

| China | 10.2% |

| India | 11.8% |

By 2035 the USA is predicted to grow at a compound annual growth rate (CAGR) of 7.5%. The rising consumption of ready-to-eat foods particularly frozen pizza in the USA is responsible for the markets expansion. The quality and freshness of prepared foods along with their affordability are what propel the markets expansion in the USA.

The working populations growing reliance on ready-to-eat meals is anticipated to fuel regional market expansion. Demand for healthy fast food substitutes is rising as a result of peoples growing health consciousness which is propelling market expansion.

Indias market for ready-to-eat food is expected to grow at a remarkable 11.8% compound annual growth rate (CAGR) indicating the countrys strong demand for quick and simple food options and its bright future. The ready-to-eat food market in India is expanding due to the countrys largest working population and growing disposable income.

Growing urban working cultures and fast-paced lifestyles are reducing the amount of time available for cooking and food preparation which is driving market growth. India’s ready-to-eat food market consists of a variety of foods including snacks traditional Chinese foods world cuisines and soups. This diversity accommodates the wide range of interests and preferences within the population.

One important aspect of the distribution of ready-to-eat (RTE) food products in China is e-commerce. In China consumers can conveniently purchase a variety of prepared meals snacks and convenience items online. Chinese consumers following global trends are increasingly looking for ready-to-eat options made with natural and healthier ingredients.

Goods that support a wholesome lifestyle are gaining a lot of popularity. Chinas vast and varied regions are home to a variety of culinary customs and tastes. RTE food producers plan to adapt their products to suit regional tastes and cultural quirks.

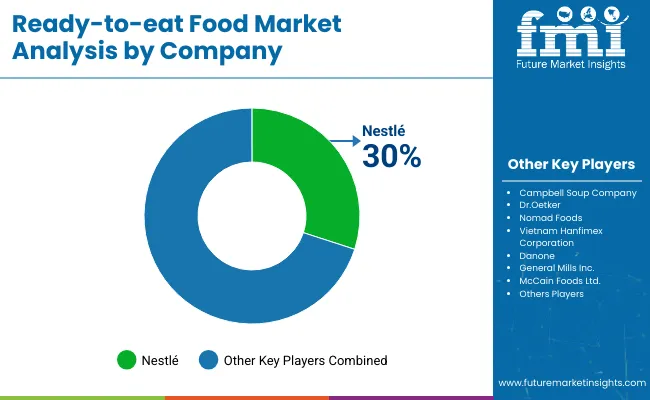

Tier 1 companies comprises are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base. They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size players having a presence in some regions and highly influencing the local commerce. Tier 3 companies comprises mostly of small-scale businesses serving niche economies and serving at the local presence. Due to a number of domestic and foreign businesses, the market for ready-to-eat foods is fragmented. Leading producers are concentrating on product innovation to satisfy global consumers changing health preferences.

By bean species, methods industry has been categorized into Breakfast Cereals, Instant Soups & Noodles, Ready Meals, Snacks and Baked Goods & Confectioneries

By product, industry has been categorized into Supermarkets & Hypermarkets, Convenience Stores and Online Retail

Industry analysis has been carried out in key countries of North America; Europe, Middle East, Africa, ASEAN, South Asia, Asia, New Zealand and Australia

The market is expected to grow at a CAGR of 9.2% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 515.80 Billion.

Demand for convenience food is increasing demand for Ready-to-eat Food Market.

North America is expected to dominate the global consumption.

Some of the key players in manufacturing include Danone, General Mills Inc., McCain Foods Ltd. and more.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ready-to-Eat Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Dinner Ready-to-Eat (RTE) Food Market - Trends & Consumer Insights 2025 to 2035

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA