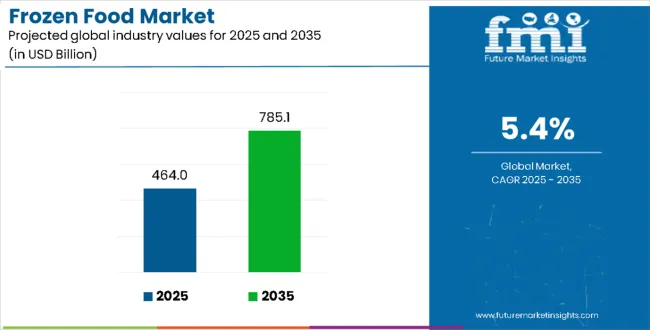

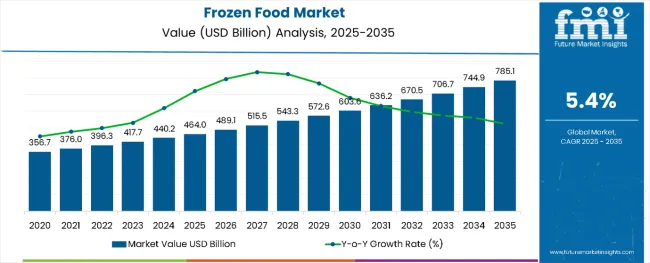

The global frozen food market is projected to grow from USD 464.0 billion in 2025 to approximately USD 785.1 billion by 2035, recording an absolute increase of USD 321.1 billion over the forecast period. This translates into a total growth of 69.2%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.4% between 2025 and 2035. The overall market size is expected to grow by nearly 1.69X during the same period, supported by the rising demand for convenient food solutions and increasing adoption of advanced freezing technologies across diverse product categories.

Frozen Food Market Key Takeaways

| Metric | Value |

|---|---|

| Frozen Food Market Value (2025) | USD 464.0 billion |

| Frozen Food Market Forecast Value (2035) | USD 785.1 billion |

| Frozen Food Market Forecast CAGR | 5.4% |

Between 2025 and 2030, the frozen food market is projected to expand from USD 464.0 billion to USD 609.8 billion, resulting in a value increase of USD 145.8 billion, which represents 45.4% of the total forecast growth for the decade. This phase of growth will be shaped by rising consumer demand for convenience foods, increasing urbanization, and growing adoption of advanced freezing technologies. Food manufacturers are expanding frozen food production capabilities to meet diverse consumer preferences across multiple product categories and geographic markets.

From 2030 to 2035, the market is forecast to grow from USD 609.8 billion to USD 785.1 billion, adding another USD 175.3 billion, which constitutes 54.6% of the overall ten-year expansion. This period is expected to be characterized by technological innovations in freezing processes, development of premium frozen food products, and increasing penetration in emerging markets. The growing emphasis on sustainable packaging and clean-label frozen products will drive demand for advanced processing technologies and specialized manufacturing expertise.

Between 2020 and 2025, the frozen food market experienced accelerated growth, driven by changing consumer lifestyles and increased demand for convenient meal solutions. The market developed significantly during the global pandemic as consumers sought shelf-stable food options and home cooking alternatives. Rising disposable incomes in emerging markets and expanding cold chain infrastructure contributed substantially to market development during this foundational period.

Market expansion is being supported by the increasing pace of modern life and growing consumer demand for convenient, ready-to-eat meal solutions that save preparation time. Frozen foods offer extended shelf life, reduced food waste, and maintained nutritional value through advanced freezing technologies, making them attractive alternatives to fresh products. Modern freezing techniques preserve taste, texture, and nutrients while providing flexibility in meal planning and inventory management for both consumers and foodservice operators.

The expanding cold chain infrastructure and technological advancements in freezing processes are enabling better product quality and wider geographic distribution of frozen foods. Food manufacturers are developing innovative frozen product formulations that cater to diverse dietary preferences including organic, gluten-free, and plant-based options. The growing foodservice industry and increasing adoption of frozen ingredients in restaurant operations create additional demand for specialized frozen food products across multiple market segments.

The market is segmented by freezing technique, product type, sales channel, and region. The freezing technique segment covers blast freezing, belt freezing, and individual quick freezing. The product type segment includes frozen ready meals, frozen fish & seafood, frozen meat products, poultry, pork, beef, frozen dairy products, frozen fruits & vegetables, frozen bakery products, frozen soups & sauces, and others such as (mixed frozen products, frozen snacks, and specialty frozen items). The sales channel segment covers food service industry, retail/household, convenience stores, departmental stores, wholesale stores, mass grocery stores, independent retailers, specialty stores, and others such as (online food delivery platforms and e-commerce grocery channels). The regional segment includes North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

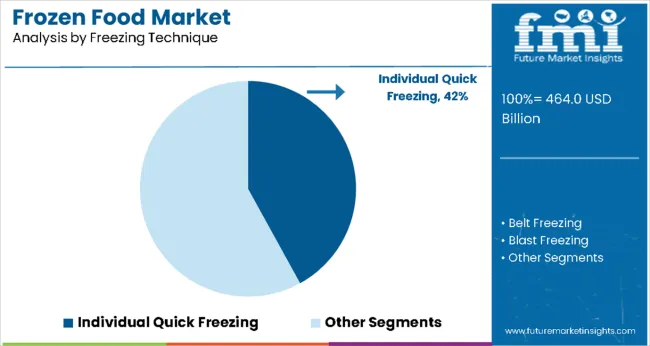

Individual Quick Freezing is projected to account for 42% of the frozen food market in 2025. This leading share is supported by the superior quality preservation capabilities of IQF technology, which maintains individual product integrity and prevents clumping during freezing processes. IQF technology enables rapid freezing of individual food pieces, preserving cellular structure and nutritional content while maintaining optimal texture and appearance upon thawing. The segment benefits from widespread adoption across multiple product categories including fruits, vegetables, seafood, and meat products where individual portion control and quality preservation are critical requirements.

The dominance of Individual Quick Freezing reflects its versatility in processing diverse food types and its ability to deliver premium quality frozen products that closely match fresh product characteristics. Modern IQF systems utilize advanced airflow control and temperature management to achieve uniform freezing across different product sizes and compositions. This technology particularly excels in processing delicate items like berries, seafood, and vegetables where traditional freezing methods might compromise product integrity. The segment's continued growth is driven by increasing consumer expectations for high-quality frozen foods and food manufacturer investments in advanced IQF equipment that enables production of premium frozen products. Additionally, IQF technology supports portion control and reduces product waste in both retail and foodservice applications, making it the preferred choice for quality-conscious manufacturers and consumers seeking convenient, restaurant-quality frozen food options.

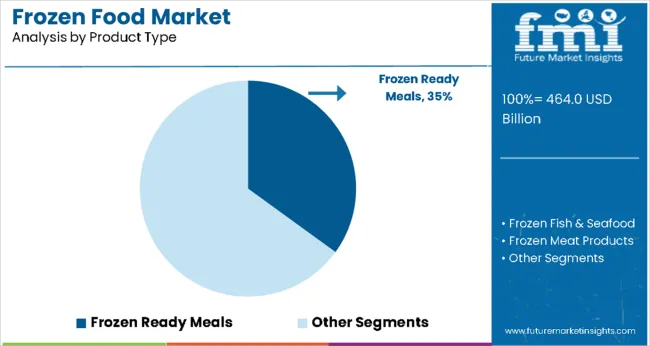

Frozen ready meals are expected to represent 35% of frozen food product type demand in 2025. This dominant share reflects the growing consumer preference for convenient, complete meal solutions that require minimal preparation time while delivering satisfying taste and nutrition. Frozen ready meals cater to busy lifestyles, single-person households, and consumers seeking portion-controlled meal options with extended shelf life. The segment benefits from continuous innovation in flavor profiles, ethnic cuisines, and dietary-specific formulations including low-sodium, organic, and plant-based meal varieties that appeal to diverse consumer preferences.

The frozen ready meals segment demonstrates remarkable adaptability to changing consumer demands through development of gourmet-quality products that rival restaurant meals and home-cooked alternatives. Modern manufacturing techniques enable complex meal assembly with multiple components that maintain individual integrity and flavor profiles throughout the freezing and reheating process. Premium frozen meal brands incorporate high-quality ingredients, authentic recipes, and advanced packaging technologies that preserve meal quality and visual appeal. The segment's growth is further supported by expanding distribution through retail channels, online grocery platforms, and institutional foodservice operations where consistent quality and operational efficiency are paramount. Additionally, frozen ready meals address food safety concerns and reduce kitchen cleanup requirements, making them increasingly attractive to time-conscious consumers who refuse to compromise on meal quality and nutritional value.

Write-up

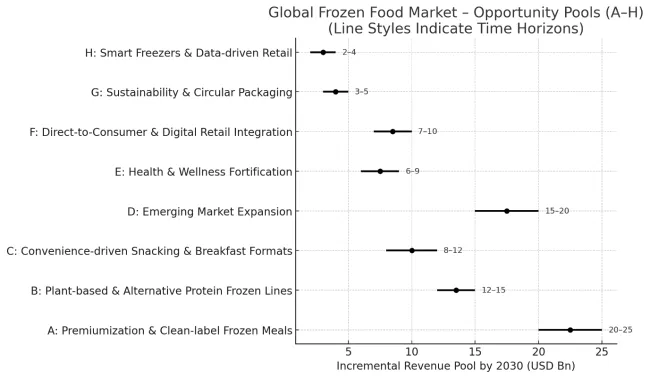

The frozen food sector is undergoing a structural transformation, fueled by convenience, plant-based diets, digital commerce, and sustainability. By 2030, these eight pathways together create USD 73-100 billion in incremental revenue opportunities.

Pathway A - Premiumization & Clean-label Meals. Consumers increasingly reject “cheap frozen dinners” in favor of organic, minimally processed, and chef-inspired products. Premium frozen categories are expected to add USD 20-25 billion by 2030.

Pathway B - Plant-based & Alternative Proteins. Frozen aisles are the launchpad for meat analogs, dairy-free desserts, and seafood substitutes. This segment can generate USD 12-15 billion.

Pathway C - Convenience-driven Formats.Frozen handhelds, smoothie cubes, and bakery-on-the-go formats meet modern snacking and breakfast demand. Pool size: USD 8-12 billion.

Pathway D - Emerging Market Expansion.Cold-chain investments across Asia-Pacific, Latin America, and Africa are unlocking penetration into mass-market frozen meals and snacks. Incremental pool: USD 15-20 billion.

Pathway E - Health & Wellness Fortification.High-protein, gluten-free, low-carb, and functional frozen products align with nutrition-conscious lifestyles. Adds USD 6-9 billion.

Pathway F - Digital Retail Integration.Frozen food is increasingly bought through e-grocery platforms and meal-subscription services. Direct-to-consumer penetration creates USD 7-10 billion.

Pathway G - Sustainability & Circular Packaging.Recyclable trays, compostable films, and carbon-labeled frozen foods become differentiators. Market potential: USD 3-5 billion.

Pathway H - Smart Freezers & Retail Tech.IoT-enabled freezers in retail environments enable inventory tracking, dynamic pricing, and interactive consumer engagement. Smaller but disruptive pool of USD 2-4 billion.

The frozen food market is advancing steadily due to changing consumer lifestyles and increasing demand for convenient meal solutions. However, the market faces challenges including energy costs for cold chain maintenance, consumer perceptions about processed foods, and competition from fresh and minimally processed alternatives. Technological innovations in freezing processes and sustainable packaging continue to influence product development and market growth patterns.

Advancement of Premium and Artisanal Frozen Products

The growing development of premium frozen food products is enabling manufacturers to target quality-conscious consumers who seek restaurant-quality meals and artisanal ingredients in convenient frozen formats. Advanced freezing technologies and sophisticated recipe development allow creation of complex, multi-component meals that maintain individual ingredient integrity and authentic flavors. These premium products command higher margins while satisfying consumer demand for gourmet experiences without compromising convenience, particularly valuable for affluent households and specialty dietary requirements.

Integration of Sustainable Packaging and Clean-Label Formulations

Modern frozen food manufacturers are incorporating sustainable packaging materials and clean-label ingredient formulations that address environmental concerns while meeting consumer preferences for natural products. Development of recyclable packaging solutions and reduction of artificial preservatives and additives enhance product appeal among environmentally conscious consumers. Advanced packaging technologies also improve product visibility, extend shelf life, and provide convenient preparation instructions that enhance the overall consumer experience with frozen food products.

| Countries | CAGR |

|---|---|

| India | 7.9 |

| China | 6.3 |

| Japan | 5.2 |

| United Kingdom | 4.8 |

| France | 4.6 |

| Germany | 4.5 |

| United States | 3.8 |

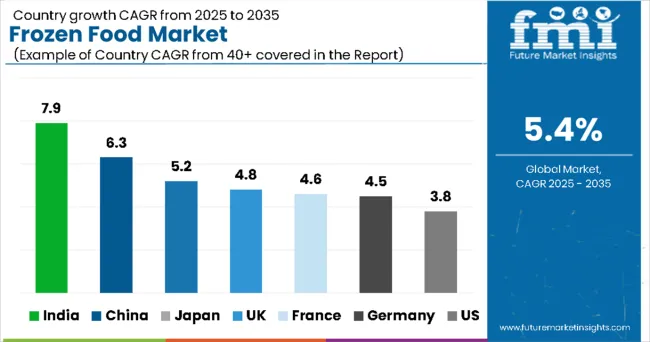

The global frozen food market shows varying growth trends across major regions. India leads with the highest projected CAGR of 7.9%, driven by urbanization, changing consumer preferences, and expanding cold chain infrastructure, which support wider distribution and adoption of convenient frozen foods. China follows closely at 6.3% CAGR, fueled by rapid urbanization, rising disposable incomes, and a growing middle class seeking time-saving and portion-controlled frozen meal solutions. Japan exhibits moderate growth at 5.2% CAGR, supported by advanced food technology, high-quality convenience foods, and an aging population favoring portion-controlled meals. The United Kingdom and France show steady growth at 4.8% and 4.6% CAGR respectively, driven by lifestyle changes, premium product demand, and culinary sophistication. Germany grows at 4.5% CAGR, influenced by efficient retail infrastructure and sustainability trends. The United States demonstrates slower but consistent growth at 3.8% CAGR, supported by an established frozen food culture, innovation, and diverse consumer preferences.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from frozen foodin China is projected to exhibit strong growth at 6.3% CAGR through 2035, driven by rapid urbanization, changing consumer lifestyles, and expanding cold chain infrastructure. China's growing middle class and increasing disposable incomes are creating significant demand for convenient frozen meal solutions and premium frozen ingredients. The country's busy urban lifestyle and smaller household sizes support adoption of portion-controlled frozen products that offer convenience without compromising nutritional value or taste quality.

China's expanding retail infrastructure and growing e-commerce penetration are enabling wider distribution of frozen foods across tier-one and tier-two cities. The government's investment in cold chain logistics and food safety regulations are supporting market development through improved product quality and consumer confidence in frozen food categories.

Demand for frozen food in India is expanding at the highest growth rate of 7.9% CAGR, supported by changing consumer preferences, urbanization trends, and increasing exposure to international food cultures. India's growing organized retail sector and expanding cold chain infrastructure are creating opportunities for frozen food manufacturers to serve diverse regional preferences. The country's large population and increasing disposable income among urban consumers support market development across multiple product categories.

India's traditional food culture is gradually incorporating frozen alternatives that maintain authentic flavors while providing convenience benefits. The expanding foodservice industry and growing acceptance of processed foods among younger consumers create additional growth opportunities for innovative frozen food formulations.

Demand for frozen food in Japan is projected to grow at 5.2% CAGR, supported by the country's advanced food technology and sophisticated consumer preferences for high-quality convenience foods. Japan's aging population and smaller household sizes create consistent demand for portion-controlled frozen meals and premium frozen ingredients. The country's emphasis on food quality and safety standards drives preference for technologically advanced frozen products that maintain superior taste and nutritional characteristics.

Japan's technological leadership in food processing and packaging enables production of innovative frozen products that meet stringent quality requirements. The country's convenience-oriented retail culture and consumer willingness to pay premium prices for quality support development of specialized frozen food segments.

Revenue from frozen food in Germany is expanding at 4.5% CAGR, driven by the country's efficient retail infrastructure and consumer preference for convenient, high-quality food solutions. German consumers demonstrate strong acceptance of frozen foods that offer time-saving benefits without compromising nutritional value or taste quality. The country's advanced cold chain logistics and sophisticated retail environment support consistent availability and quality of diverse frozen food products.

Germany's emphasis on sustainability and clean-label products influences frozen food development toward environmentally responsible packaging and natural ingredient formulations. The country's position as a major food processing hub supports both domestic consumption and export opportunities for German frozen food manufacturers.

Demand for frozen food in the United Kingdom is projected to grow at 4.8% CAGR, supported by busy lifestyles, sophisticated ready meal preferences, and continuous product innovation. UK consumers demonstrate strong preference for high-quality frozen meals that offer restaurant-quality experiences with convenient preparation methods. The country's mature frozen food market supports premium products and diverse dietary options including organic, gluten-free, and plant-based frozen alternatives.

The United Kingdom's emphasis on food innovation and culinary diversity enables development of sophisticated frozen products that cater to evolving consumer preferences. The country's strong retail infrastructure and consumer willingness to embrace new frozen food concepts support market development across multiple product categories.

Revenue from frozen food in France is expanding at 4.6% CAGR, supported by the country's culinary tradition and growing acceptance of high-quality frozen products that maintain authentic flavors and ingredients. French consumers demonstrate increasing appreciation for premium frozen foods that offer convenience without compromising culinary standards. The country's sophisticated food culture supports development of artisanal frozen products that reflect traditional French cooking methods and ingredient quality.

France's position as a culinary leader influences frozen food development toward premium formulations that emphasize authentic flavors, quality ingredients, and sophisticated preparation techniques. The country's focus on food quality and gastronomic excellence creates demand for frozen products that meet rigorous taste and nutritional standards.

Demand for frozen food in the United States is growing at 3.8% CAGR, driven by the country's established frozen food culture and continuous product innovation across multiple categories. American consumers demonstrate strong acceptance of diverse frozen food options including ethnic cuisines, health-focused products, and premium meal solutions. The country's mature retail infrastructure and sophisticated cold chain logistics support consistent availability and quality of extensive frozen food selections.

The United States' emphasis on convenience and dietary diversity enables development of specialized frozen products that cater to specific consumer needs including portion control, nutritional requirements, and lifestyle preferences. The country's large market size and consumer willingness to try new products support innovation in frozen food formulations and packaging technologies.

The frozen food market in Europe is projected to grow from USD 112.6 billion in 2025 to USD 172.5 billion by 2035, registering a CAGR of 4.4% over the forecast period. Germany is expected to lead with a 26.5% share in 2025, followed by France at 17.2%, reflecting strong consumer demand for convenient and ready-to-eat products. Italy represents 13.9% of the market, while the BENELUX region accounts for 9.1% and the Nordic countries for 9.5%.

Spain contributes 7.5%, and the Rest of Europe collectively makes up 16.4%. By 2035, Germany will slightly expand its leadership to 26.8%, France will rise to 17.6%, and Italy will remain stable at 13.9%. BENELUX and the Nordic region are projected at 8.8% and 10.0%, respectively, while Spain will hold 7.5%, and the Rest of Europe will adjust to 15.5%, underscoring the steady consolidation of frozen food consumption across key European markets.

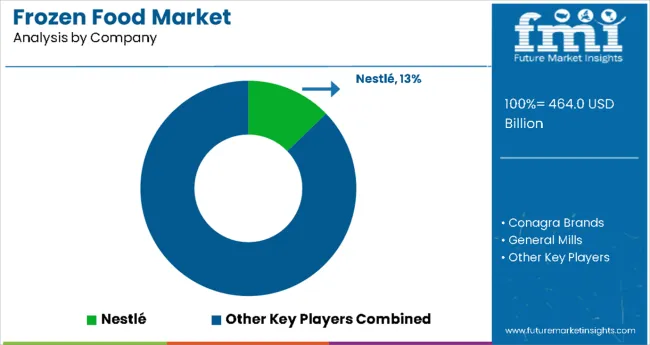

The frozen food market is characterized by competition among global food conglomerates, regional processors, and specialized frozen food manufacturers. Leading companies are investing in advanced freezing technologies, product innovation, and supply chain optimization to strengthen their market positions across diverse product categories and geographic regions. Nestlé leads the market with a 13% share, leveraging its global brand portfolio and distribution network to deliver diverse frozen food solutions. Conagra Brands holds 11.2% market share, focusing on convenient meal solutions and brand innovation. Tyson Foods commands 10.7% of the market through protein-focused products and foodservice expertise. General Mills maintains 10.5% market share with emphasis on consumer brands and product quality, while Unilever accounts for 9.8% through premium products and sustainable practices across multiple frozen food categories.

Frozen foods have moved well beyond convenience, they now sit at the crossroads of food safety, extended shelf life, value-added nutrition, and modern retail logistics. Rising urbanization, dual-income households, expansion of quick-service channels, and rising demand for ready-to-cook/-heat premium offerings have made frozen foods a strategic category for food manufacturers and retailers. Unlocking the next phase of growth requires coordinated action across public policy, trade and standards bodies, equipment and tech providers, ingredient and pack suppliers, and capital providers.

Key Players in the Frozen Food Market

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 464 Billion |

| Freezing Technique | Individual Quick Freezing, Belt Freezing, Blast Freezing |

| Product Type | Frozen Ready Meals, Frozen Fish & Seafood, Frozen Meat Products (Poultry, Pork, and Beef) , Frozen Dairy Products, Frozen Fruits & Vegetables, Frozen Bakery Products, Frozen Soups & Sauces |

| Sales Channel | Food Service Industry, Retail/Household, (Convenience Store, Departmental Stores, Wholesale Stores, Mass Grocery Stores, Independent Retailers, Specialty Stores) |

| Regions Covered | China, Germany, United States, India, Japan, United Kingdom, France |

| Countr ies Covered | China, Germany, United States, India, Japan, United Kingdom, France , and 40+ countries |

| Key Companies Profiled | Bellisio Foods Inc., General Mills Inc., Kellogg Company, Grimway Farms, Hanover Foods Corp, ConAgra Foods, Inc., Seapoint Farms LLC, Smith Frozen Foods Inc., Inventure Foods, Inc., Stahlbush Island Farms, Other Market Players |

| Additional Attributes | Dollar sales by freezing technique and product type, regional demand trends across key markets, competitive landscape with established food manufacturers, consumer preferences for convenience versus fresh products, integration with cold chain logistics and retail technologies, innovations in freezing processes and sustainable packaging solutions, and adoption of premium formulations and clean-label ingredients for health-conscious consumer segments. |

The frozen ready meals segment dominates due to increasing consumer demand for convenience, evolving preferences for multi-cuisine and gourmet options, and advancements in freezing technologies that enhance texture and freshness.

IQF technology leads the market with a 42% share due to its ability to maintain ingredient integrity, texture, and nutrient retention, making it ideal for high-quality gourmet frozen foods.

Key trends include gourmet flash-freezing, smart portion-controlled meals, multi-texture innovation, localized seasonal freezing, and in-transit thaw technology to cater to evolving consumer preferences for convenience, personalization, and authentic frozen meal solutions.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Frozen Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights in the Frozen Food Industry

Market Share Breakdown of Frozen Food Packaging Manufacturers

Frozen Seafood Market Analysis by Nature, Form, End Use, Distribution Channel and Other Products Type Through 2035

Frozen Pet Food Market Growth – Premium Pet Nutrition & Demand 2024-2034

UK Frozen Food Market Growth – Size, Share & Forecast 2025–2035

USA Frozen Food Market Analysis – Demand, Trends & Forecast 2025–2035

ASEAN Frozen Food Market Growth – Trends, Demand & Innovations 2025–2035

Europe Frozen Food Market Trends – Growth, Demand & Forecast 2025–2035

Flexible Frozen Food Packaging Market Growth - Forecast 2025 to 2035

Australia Frozen Food Market Insights – Demand, Size & Industry Trends 2025–2035

Demand for Frozen Food in EU Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Food Market Outlook – Share, Growth & Forecast 2025–2035

Raw, fresh and frozen dog food Market Analysis - Size, Share & Forecast 2025 to 2035

Blast Freezing for Frozen Food and Feed Market Size and Share Forecast Outlook 2025 to 2035

Middle East and North Africa Frozen Food Market Size and Share Forecast Outlook 2025 to 2035

Frozen Egg Market Size and Share Forecast Outlook 2025 to 2035

Frozen Tissues Samples Market Size and Share Forecast Outlook 2025 to 2035

Frozen Pastries Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA