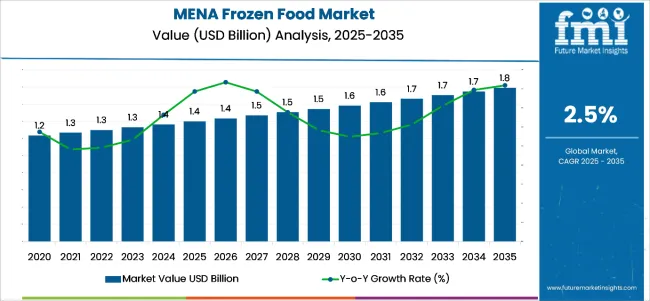

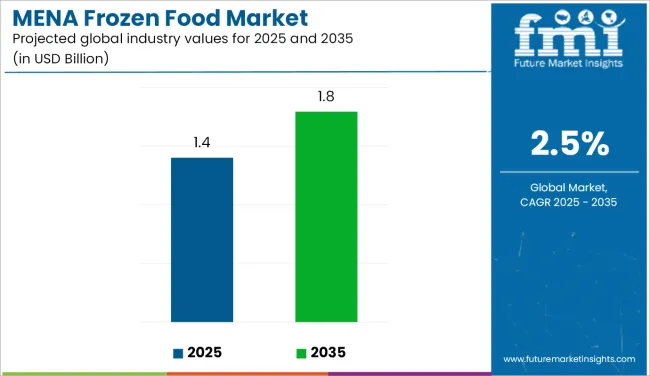

The Middle East and North Africa frozen food market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 1.8 billion by 2035, registering a CAGR of 2.5% over the forecast period. The market is projected to add an absolute dollar opportunity of USD 0.4 billion over the forecast period. This reflects a 1.28 times growth with a compound annual growth rate of 2.5%. The markets evolution is expected to be shaped by rising demand for convenient and long-shelf-life products, increasing penetration of modern retail formats, and the growing popularity of frozen meals in both urban and expatriate populations across the region.

By 2030, the market is likely to reach approximately USD 1.6 billion, accounting for USD 0.2 billion in incremental value over the first half of the period. The remaining USD 0.2 billion is expected during the second half, suggesting a steady growth pattern with demand driven by product innovation and premiumization. Product diversification across frozen fruits, vegetables, ready meals, and snacks is gaining momentum due to evolving consumer lifestyles and rising disposable incomes.

Companies such as General Mills Inc. and Al Kabeer Group are advancing their competitive positions through strategic expansion in high-growth markets like the UAE and Saudi Arabia, along with investments in cold chain infrastructure and localized product offerings. Premium positioning, coupled with targeted marketing campaigns, is enabling brands to capture health-conscious consumers and strengthen presence in modern trade channels.

| Metric | Value |

|---|---|

| Middle East and North Africa Frozen Food Market Estimated Value in (2025E) | USD 1.4 billion |

| Middle East and North Africa Frozen Food Market Forecast Value in (2035F) | USD 1.8 billion |

| Forecast CAGR (2025 to 2035) | 2.5% |

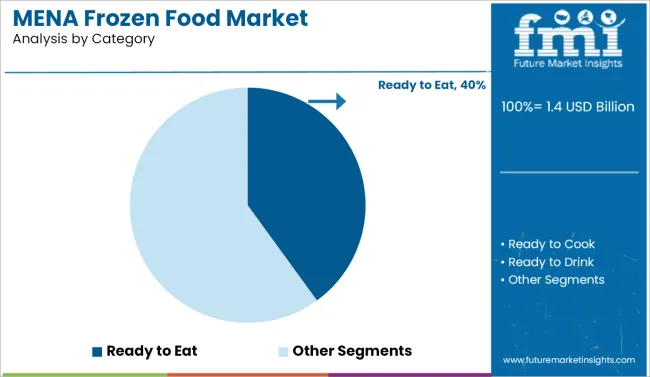

The market accounts for approximately 36% of the overall convenience food market in the region, supported by its long shelf life, ease of preparation, and rising consumption in major population centers. It contributes about 28% of the ready-to-eat meals market, driven by demand from busy households and an expanding HoReCa sector. The market makes up close to 25% of the premium packaged food segment, supported by innovations in packaging, preservation, and premium-quality frozen ingredients.

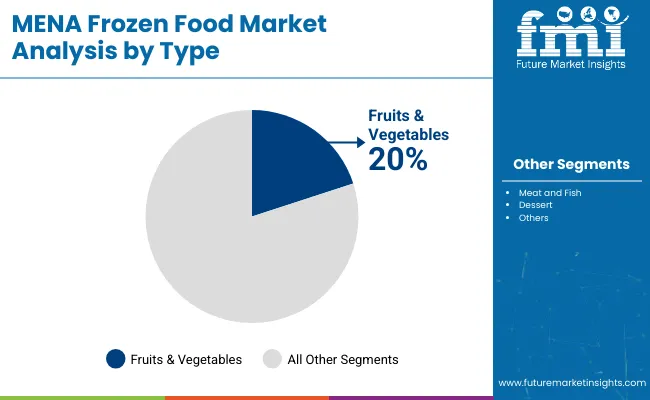

In the healthy eating segment, frozen fruits and vegetables hold roughly 18% of the healthy snacking market share, benefiting from growing awareness of nutrient retention in frozen produce. The sector also accounts for nearly 20% of the plant-based convenience foods segment, aligning with consumer interest in vegetarian and vegan meal options.

Structural transformation in the market is driven by changing lifestyles, the expansion of modern retail, and the adoption of advanced freezing technologies that preserve flavor, texture, and nutrition. Product diversification is accelerating, with manufacturers offering gourmet frozen meals, international cuisines, and healthier options with reduced sodium and preservatives. Strategic alliances between frozen food producers, cold chain logistics providers, and large retail chains are enhancing accessibility and visibility across MENA markets.

The Middle East and North Africa frozen food market is expanding due to growth in city-based consumption, busy lifestyles, and rising demand for convenient, long-shelf-life food products without compromising quality. Frozen foods offer year-round availability of seasonal items such as fruits, vegetables, and seafood, aligning well with consumer needs in the region’s hot climate where food preservation is critical.

Growing adoption of modern retail formats, including supermarkets and hypermarkets, alongside the rapid rise of e-commerce grocery platforms, is enhancing product accessibility. Consumers are increasingly receptive to ready-to-eat and ready-to-cook frozen meals, driven by changing dietary habits and exposure to international cuisines.

Health and quality-conscious consumers are recognizing frozen food’s ability to preserve nutrients, taste, and texture, making it a viable alternative to fresh produce. Additionally, regional investments in cold chain infrastructure, advanced freezing technologies, and innovative product offerings such as fortified frozen meals and plant-based frozen options are further accelerating market penetration.

The market is segmented by type, category, distribution channel, freezing technique, and country. By type, the market is divided into fruits and vegetables, meat and fish, dessert, snacks, cooked ready meals, and others (frozen bakery items, frozen sauces & gravies, mixed/variety packs, and value-added ingredient blends). Based on category, the market is classified into ready-to-eat, ready-to-cook, ready-to-drink, and others (ingredient kits, partially prepared bases, and meal components).

In terms of distribution channel, the market is segmented into supermarkets & hypermarkets, convenience stores, online channels, and others (HoReCa hotels/restaurant/cafés, specialty frozen stores, and direct-to-consumer subscription services). By freezing technique, the market is divided into blast freezing, belt freezing, individual quick freezing (IQF), and others (cryogenic/liquid nitrogen freezing, plate freezing, and tunnel freezing). By country, the market is classified into UAE, Saudi Arabia, Qatar, Kuwait, and Egypt.

Fruits & vegetables hold the largest share in the Middle East and North Africa frozen food market at 20.0% in 2025. This segment is the most lucrative due to its steady year-round demand, lower raw material costs compared to processed meals, and strong appeal across both health-conscious and mainstream consumers. Premiumized offerings such as IQF berries, mixed vegetable blends, and blanched vegetable kits allow brands to capture higher margins than bulk frozen produce.

Growth is fueled by nutrient-retention messaging, expanded freezer space in retail, and rising foodservice usage for quick-prep menus. Seasonal availability advantages and stable pricing make it a reliable revenue driver. However, success hinges on cold-chain reliability, processing quality, and packaging choices that maintain brand trust. Strategic focus on IQF technology, traceability, and value-added SKUs can further consolidate leadership in this segment. Critical constraints include cold-chain integrity, blanching/processing quality, and packaging concerns; failures on these fronts erode margins and damage brand trust.

Ready-to-eat (RTE) is the most lucrative segment in the Middle East & North Africa frozen food market with a 2025 share of 40%, because it captures the intersection of high consumer willingness to pay, strong repeat purchase behavior, and favorable margin structures. RTE benefits from growth in city-based consumption, dual-income households, and accelerated e-commerce and instant-delivery adoption channels that favor convenience and premium positioning.

Product innovation (ethnic ready meals, health-focused low-salt/plant-based lines, single-serve premium bowls) supports higher ASPs and private-label substitution, while HoReCa demand for single-portion frozen solutions adds B2B volume. Operationally, RTE commands better gross margins than basic frozen vegetables due to value-added processing, specialized packaging, and branding. Key risks include cold-chain costs, regulatory labeling, and pressures around packaging; however, investments in cold-chain efficiency, recyclable packaging, and localized SKU development unlock further upside.

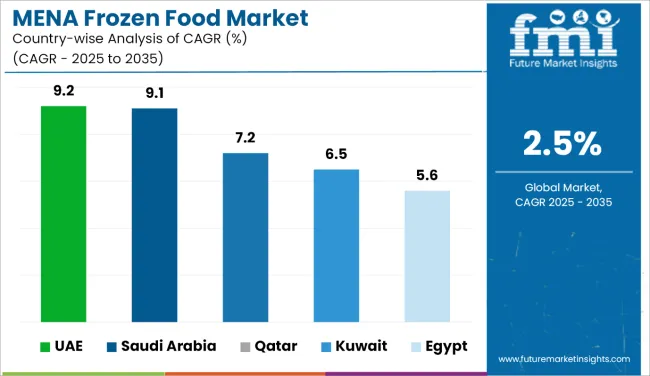

| Countries | CAGR |

|---|---|

| UAE | 9.2% |

| Saudi Arabia | 9.1% |

| Qatar | 7.2% |

| Kuwait | 6.5% |

| Egypt | 5.6% |

In the Middle East and North Africa frozen food market, the United Arab Emirates leads with a CAGR of 9.2%, driven by a robust expatriate population, tourism, and advanced retail infrastructure. Saudi Arabia follows closely at 9.1%, supported by Vision 2030 reforms, modern retail expansion, and a strong preference for poultry and seafood. Qatar posts a solid 7.2%, benefiting from high incomes, a premium consumer base, and post World Cup tourism momentum.

Kuwait records 6.5%, where high purchasing power and changing family structures sustain demand for premium imports and convenience foods. Egypt grows more moderately at 5.6%, propelled by population growth, affordability, and rising female workforce participation, but constrained by slower e-commerce adoption.

Sales of frozen food in UAE are expected to grow at a CAGR of 9.2% from 2025 to 2035. Rising expatriate population and busy lifestyles are driving demand for ready-to-eat and premium frozen products. Increasing retail penetration and strong cold chain infrastructure enhance product accessibility.

Tourism growth further boosts the hospitality sector's demand for frozen meats, seafood, and desserts. E-commerce grocery platforms are expanding their frozen product offerings, tapping into urban and tech-savvy consumers. Government regulations on food safety encourage high-quality imports, strengthening trust in frozen food consumption. Premiumization trends see growth in healthier and organic frozen options.

Revenue from frozen food in Saudi Arabia will grow at a CAGR of 9.1% from 2025 to 2035. The nation’s growing working population is embracing quick-meal solutions, increasing demand for frozen ready meals and snacks. Vision 2030 initiatives boost retail modernization and food service growth. Demand for frozen poultry, fish, and ready bakery products is surging, particularly in urban centers.

Large-scale supermarket and hypermarket expansion enhances accessibility. Premium imported frozen goods are increasingly favored due to rising incomes. Investment in cold chain technology ensures minimal product spoilage during transport. Healthy frozen options are entering the mainstream as consumers adopt balanced diets.

Demand for frozen food in Egypt is projected to expand at a CAGR of 5.6% from 2025 to 2035. Population growth and urbanization are increasing the demand for frozen vegetables, meat, and snacks. Rising female workforce participation is driving purchases of ready-to-cook products. Economic reforms have improved the retail landscape, leading to more organized outlets. Affordability remains key, with bulk-pack frozen products seeing popularity among middle-income consumers.

E-commerce penetration is slower than in Gulf markets but gradually expanding. Government campaigns on food safety are building trust in packaged frozen goods. Seasonal demand spikes occur during festive and Ramadan periods. Import reliance remains significant, particularly for frozen seafood and specialty items.

Sales of frozen food in Qatar are expected to grow at a CAGR of 7.2% from 2025 to 2035. High disposable incomes and an expatriate-majority population support a premium frozen food segment. Demand for frozen meat, seafood, and bakery items is strong in both retail and hospitality channels. The FIFA World Cup legacy continues to boost tourism, indirectly increasing foodservice consumption. Import dependency necessitates advanced cold chain systems to maintain product quality.

Supermarkets and gourmet stores increasingly stock organic and specialty frozen foods. Online grocery platforms have become key players, offering rapid delivery for frozen goods. Government oversight on food imports ensures high safety standards. Innovation in packaging is enhancing shelf appeal and shelf life.

Demand for frozen food in Kuwait will grow at a CAGR of 6.5% from 2025 to 2035. Increasing working-age population and changing family structures support higher demand for ready-to-eat and ready-to-cook frozen items. High per capita income drives preference for premium imported frozen foods. The hospitality sector is expanding, fueling demand for bulk frozen ingredients. Retailers are increasingly investing in freezer space to accommodate a broader range of products. Consumer awareness of hygiene and safety in frozen foods is improving. Digital grocery platforms offer same-day delivery of frozen goods, particularly in urban areas.

In 2024, frozen food sales in the Middle East and North Africa grew by 12% year-on-year, with Gulf Cooperation Council countries accounting for 46% of the total regional market value. Consumption is led by frozen meat, seafood, bakery, and ready-to-cook items in both household and foodservice channels. Modern retail expansion, driven by supermarket and hypermarket growth, is improving accessibility to a wider product range.

The hospitality and tourism sectors, particularly in the Gulf, are fueling bulk demand from hotels, restaurants, and catering services. Premiumization trends are evident in rising sales of organic, gluten-free, and high-protein frozen products. E-commerce grocery platforms are gaining traction in major cities, offering fast delivery and competitive product variety, which enhances consumer convenience and brand trust.

Retail and Hospitality Demand Drive Frozen Food Uptake

Hotels, restaurants, and catering operators across the region are significantly contributing to frozen food demand, particularly for bulk-purchased meats, seafood, and bakery products. In Gulf countries, tourism growth is directly influencing higher consumption volumes in the hospitality sector. Household demand is expanding as working-age populations adopt ready-to-cook and ready-to-eat frozen products to save time. Modern retail penetration has improved distribution efficiency, with large chains introducing wider product assortments, including premium imports. E-commerce is enabling smaller brands to enter the market through online-first strategies, capitalizing on tech-savvy urban consumers. Cold chain advancements are reducing wastage rates by maintaining consistent quality from supplier to end-user, especially in import-heavy markets.

Import Dependency, Infrastructure Gaps, and Price Volatility Constrain Growth

High dependency on imported frozen products exposes the market to global price fluctuations and currency exchange risks, with import costs contributing up to 40% of retail pricing. Customs clearance requirements for frozen goods can delay product availability by 1-3 weeks, affecting peak-season supply. In North Africa, limited cold storage capacity leads to higher spoilage rates, raising distribution losses by up to 18%. Energy costs for frozen storage are 12-15% higher compared to chilled products, impacting operational budgets. Smaller distributors face limited access to premium retail shelf space, dominated by large-scale retail groups. While Gulf states benefit from advanced cold chain systems, parts of North Africa and smaller Middle Eastern economies still face logistical bottlenecks, which restrict product diversity and market penetration.

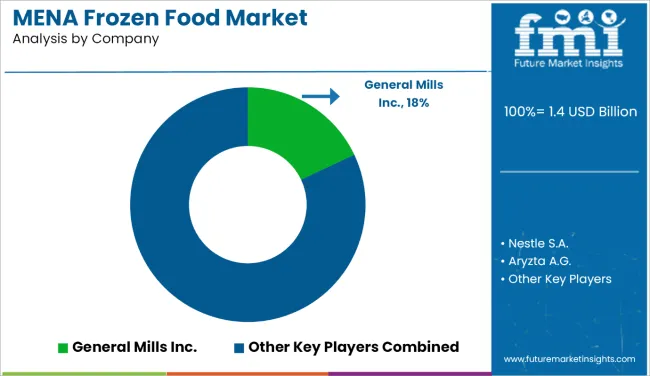

The market is moderately consolidated, led by General Mills Inc. with an 18% market share. The company’s stronghold is built on a diverse frozen product portfolio, robust brand equity, and well-established retail distribution networks across key MENA countries.

Key players in the market include Nestlé S.A., Al Kabeer Group, Sunbulah Group, and Kraft Heinz Company, each offering extensive frozen food categories such as ready-to-eat meals, frozen fruits and vegetables, meat and fish, and snacks. These companies leverage global sourcing capabilities, advanced freezing technologies, and brand localization strategies to appeal to both traditional and modern trade consumers.

Emerging regional players are gaining traction by focusing on Halal-certified offerings, value-based pricing, and country-specific taste profiles. Established players, however, retain an advantage through scale efficiencies, consistent product quality, and premium positioning in urban retail channels.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Type | Fruits and Vegetables, Meat and Fish, Dessert, Snacks, Cooked Ready Meals, Others (Frozen dairy, bakery, and specialty items) |

| Category | Ready to Eat, Ready to Cook, Ready to Drink, Others (Partially prepared frozen foods) |

| Distribution Channel | Supermarkets & Hypermarkets, Convenience Stores, Online Channels, Others (Wholesalers, specialty frozen food shops) |

| Freezing Technique | Blast Freezing, Belt Freezing, Individual Quick Freezing (IQF), Others (Cryogenic freezing, plate freezing) |

| Regions Covered | Middle East & North Africa |

| Top Countries Covered | United Arab Emirates, Saudi Arabia, Egypt, Qatar, Kuwait, and Others |

| Key Companies Profiled | Aryzta A.G., Ajinomoto Co. Inc., Cargill Incorporated, General Mills Inc., JBS S.A., Kellogg Company, The Kraft Heinz Company, Nestle S.A., ConAgra Brands, Inc., Associated British Foods Plc. |

| Additional Attributes | Rising demand for convenient and ready-to-eat meal options, growth in cold chain infrastructure, expanding quick-service restaurant (QSR) sector |

The global Middle East and North Africa frozen food market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the Middle East and North Africa frozen food market is projected to reach USD 1.8 billion by 2035.

The Middle East and North Africa frozen food market is expected to grow at a 2.4% CAGR between 2025 and 2035.

The key product types in Middle East and North Africa frozen food market are frozen fruits and vegetables, frozen meat and fish, frozen desert, frozen snacks, frozen cooked ready meals and other.

In terms of category, ready-to-eat segment to command 41.2% share in the Middle East and North Africa frozen food market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Middle East/North Africa (MENA) Commercial Vehicles Market Analysis - Size, Share, and Forecast 2025 to 2035

MENA Nutraceuticals Market Trends – Dietary Supplements & Functional Foods

Middle East & Africa Sachet Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Middle East & Africa Hydrolyzed Bovine Collagen Market Size and Share Forecast Outlook 2025 to 2035

Middle East & Africa Data Storage Market Report – Trends & Industry Forecast 2025–2035

MEA Stick Packaging Machines Market Growth – Trends & Forecast 2023-2033

Middle East and Africa Bio-Stimulants Market Size and Share Forecast Outlook 2025 to 2035

Middle East and Africa Latex Foil Balloons Market Size and Share Forecast Outlook 2025 to 2035

Middle East and Africa Rough Terrain Cranes Market Growth - Trends & Forecast 2025 to 2035

Middle East and Africa (MEA) Tourism Security Market Analysis 2025 to 2035

Food Premix Industry Analysis in Middle East - Size and Share Forecast Outlook 2025 to 2035

Demand for 5G Driver Amplifier in Middle East & Africa Size and Share Forecast Outlook 2025 to 2035

Demand for Cobalt Salt for Tires in Middle East & Africa Size and Share Forecast Outlook 2025 to 2035

Demand for Autonomous Aerial Robot in Middle East & Africa Size and Share Forecast Outlook 2025 to 2035

Demand for Cellulose Diacetate Film in Middle East & Africa Size and Share Forecast Outlook 2025 to 2035

Demand for Gable Top Aseptic Cartons in Middle East & Africa Size and Share Forecast Outlook 2025 to 2035

Asia & MEA PET Bottle Market Trends & Industry Forecast 2024-2034

Demand for Biomass Hot Air Generator Furnace in Middle East & Africa Size and Share Forecast Outlook 2025 to 2035

Retail Glass Packaging Industry Analysis in Europe and the Middle East and Africa - Size, Share, and Forecast 2025 to 2035

Frozen Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA