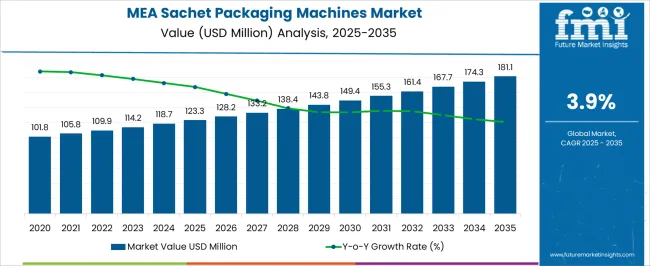

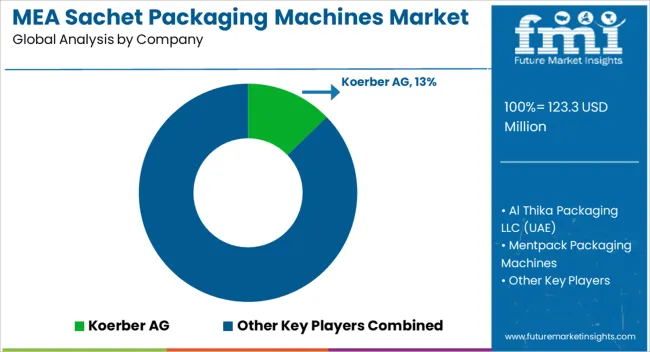

The Middle East & Africa Sachet Packaging Machines Market is estimated to be valued at USD 123.3 million in 2025 and is projected to reach USD 181.1 million by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period.

| Metric | Value |

|---|---|

| Middle East & Africa Sachet Packaging Machines Market Estimated Value in (2025 E) | USD 123.3 million |

| Middle East & Africa Sachet Packaging Machines Market Forecast Value in (2035 F) | USD 181.1 million |

| Forecast CAGR (2025 to 2035) | 3.9% |

The Middle East & Africa sachet packaging machines market is gaining momentum, driven by rising demand for small-sized, affordable packaging formats across food, pharmaceutical, and personal care industries. Regional consumer behavior has shifted toward single-serve and low-cost packaged goods, influenced by expanding urban populations and increasing price sensitivity. Industry reports and company announcements have underscored a surge in investment from packaging manufacturers to cater to flexible, high-volume, and cost-effective production capabilities.

Technological advancements in automation and sealing mechanisms have improved machine efficiency and product integrity, ensuring compliance with safety and quality standards. Moreover, governments in the region have encouraged localized packaging solutions to support small-scale producers and reduce import dependency.

The future outlook remains positive as increasing penetration of e-commerce and organized retail further boosts the demand for sachet-packaged goods. Segmental growth is expected to be led by Vertical Form Fill Seal (VFFS) machines, Single-Lane operating speed machines, and Powder packaging formats, reflecting practical adoption by manufacturers seeking efficiency, flexibility, and affordability.

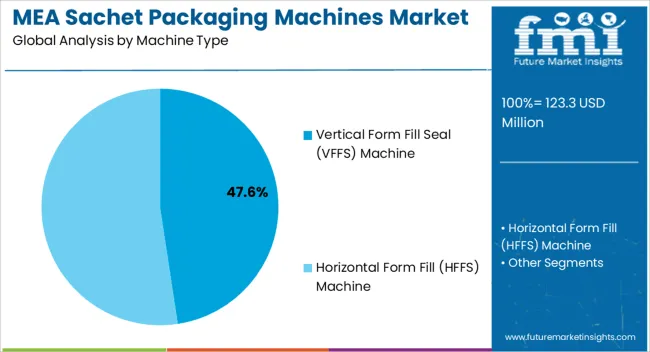

The Vertical Form Fill Seal (VFFS) machine segment is projected to hold 47.60% of the Middle East & Africa sachet packaging machines market revenue in 2025, establishing its dominance among machine types. Growth of this segment has been supported by its versatility in handling a wide range of products, from food to pharmaceutical powders and liquids, with consistent sealing quality.

VFFS machines have been widely adopted by manufacturers due to their compact design, cost-effectiveness, and ability to integrate automation features for improved production efficiency. Industry updates have highlighted that their capability to operate with various film types and produce high-speed outputs has positioned them as the preferred choice for small to medium-scale producers.

The adaptability of VFFS machines to regional requirements, such as packaging for affordability-driven consumer markets, has further sustained their adoption. With continuous enhancements in sealing technology and machine durability, the VFFS segment is expected to maintain a strong market position.

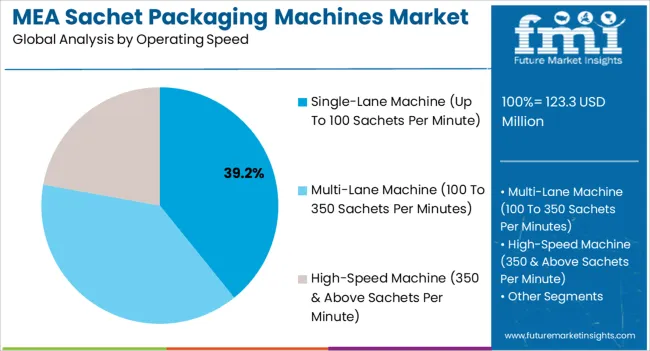

The Single-Lane Machine (up to 100 sachets per minute) segment is projected to account for 39.20% of the market revenue in 2025, reflecting strong demand from small and mid-sized enterprises across the region. Adoption of this machine type has been driven by its affordability, ease of operation, and suitability for moderate production volumes.

Companies in the food and personal care sectors have favored single-lane machines for their ability to ensure consistent packaging quality while keeping energy consumption and maintenance costs low. Reports from packaging equipment manufacturers have noted increased demand from localized producers who prioritize flexibility over high-speed, multi-lane systems.

Additionally, these machines are well-suited for product lines that require frequent changeovers, which is common in diverse consumer markets. As SMEs continue to expand their presence in the regional packaging industry, single-lane machines are expected to retain their leading share, offering a balance between efficiency and cost-effectiveness.

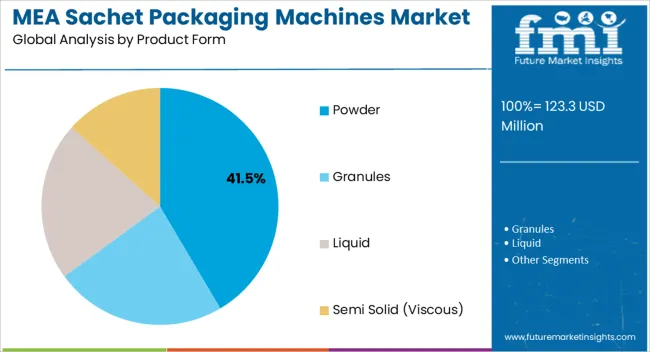

The Powder segment is projected to contribute 41.50% of the Middle East & Africa sachet packaging machines market revenue in 2025, leading the product form category. This dominance has been attributed to high demand for powdered products across food, beverage, nutraceutical, and pharmaceutical industries.

Consumer preference for unit-dose packaging in items such as powdered milk, coffee, spices, nutritional supplements, and over-the-counter medicines has supported the growth of this segment. Industry publications have emphasized that sachet packaging provides an economical and convenient solution for consumers with limited purchasing power, making powders particularly suited for sachet formats in the region.

Packaging machines tailored for powders have benefited from advancements in auger filling systems and sealing technologies, ensuring product consistency and reduced wastage. As powder-based product categories continue to expand across FMCG and healthcare sectors, the Powder segment is expected to remain the primary driver of demand in sachet packaging machines across Middle East & Africa.

The Middle East & Africa sachet packaging machines market registered a CAGR of 0.4% during the historical period between 2020 and 2025. It reached a market value of USD 123.3 million in 2025 from USD 101.8 million in 2020.

Increasing acceptance of convenient and single-use packaging across food & beverage, pharmaceuticals, and personal care sectors has pushed demand for sachet packaging machines.

Development of new technologies such as high-speed machines and automated sachet filling machines is also expected to boost growth. These technologies are projected to help manufacturers to improve efficiency and productivity of their packaging operations.

Informal markets and street vendors might also play a significant role in pushing sachet packaging machine sales in the Middle East & Africa. These markets are characterized by their flexibility, mobility, and ability to cater to the diverse needs of the local population.

Informal markets and street vendors often cater to lower-income groups who seek affordable and accessible products. Sachet packaging might allow vendors to sell small quantities of items at a fraction of the cost of larger packaging formats. This affordability is set to be crucial in attracting price-sensitive consumers in these markets.

In informal markets where food & beverages are sold in open-air settings, sachet packaging can offer a hygienic and tamper-proof solution.

Individual sachets ensure that the products remain uncontaminated and maintain their freshness until the moment of use. This is estimated to help in enhancing consumer confidence in the safety of goods being sold.

Street vendors are constantly on the move, and sachet packaging's lightweight and compact design would make it easy to transport and display numerous products efficiently. Mobility might allow vendors to reach different locations and cater to diverse consumer bases. This factor is expected to contribute to the widespread adoption of sachet-packaged products.

Rising Need for Single-serve Food & Beverages to Boost Demand

Increasing Demand for Sustainable Packaging Techniques to Support Sales

| Country | GCC Countries |

|---|---|

| Market Share (202418.7) | 118.72.1% |

| Market Share (20118.7118.7) | 29.6% |

| Growth Factor | 118.7.5% |

| Country | Türkiye |

|---|---|

| Market Share (202418.7) | 18.8% |

| Market Share (20118.7118.7) | 17.9% |

| Growth Factor | 2.8% |

| Country | Northern Africa |

|---|---|

| Market Share (202418.7) | 9.9% |

| Market Share (20118.7118.7) | 10.8% |

| Growth Factor | 118.7.5% |

| Country | South Africa |

|---|---|

| Market Share (202418.7) | 11.118.7% |

| Market Share (20118.7118.7) | 10.8% |

| Growth Factor | 1.8% |

| Country | Israel |

|---|---|

| Market Share (202418.7) | 8.9% |

| Market Share (20118.7118.7) | 10.2% |

| Growth Factor | 5.2% |

| Country | Nigeria |

|---|---|

| Market Share (202418.7) | 5.8% |

| Market Share (20118.7118.7) | 6.118.7% |

| Growth Factor | 4.1% |

| Country | Egypt |

|---|---|

| Market Share (202418.7) | 118.7.1% |

| Market Share (20118.7118.7) | 118.7.6% |

| Growth Factor | 118.7.8% |

Rising Import of Food from the United States to Support Demand for Sachet Filling Machines in GCC

According to the Food Export Association of the Midwest USA and Food Export USA–Northeast, exports of agricultural goods from the United States to the GCC climbed 11% and reached USD 118.7 billion in 2024. Consumer food exports from the United States to the GCC increased by 11% and reached an equivalent of USD 1.8 billion in 2024. It accounted for 60% of all agricultural output.

In 2024, more than USD 1.2 billion worth of processed food from the United States were imported to the country. It was up by 15% from the previous year and accounted for 40% of all agricultural imports.

According to our research, packaged food sector in the GCC would generate USD 12118.7.118.7 billion in terms of retail sales by 2025. From 2020, that implies a rise of 16.2% and USD 5.4 billion.

Rising urbanization, economic development, and demand for packaged goods are likely to propel the packaging machinery sector in GCC countries. Additionally, it is predicted that by 2029, packaged food sales in the country will climb by USD 9.2 billion.

It is expected to surge by 2118.7.7% to reach USD 48.4 billion in the same year. Hence, GCC countries sachet packaging machines market is anticipated to offer an incremental opportunity of USD 14.7 million over the assessment period.

Food & beverage, pharmaceuticals, and personal care are all sectors that use powdered goods. Diversity of powdered goods might increase the demand for sachet packaging machines that can handle various types of powders efficiently.

Sachet packaging provides consumers with individual, pre-measured amounts of powdered product, providing convenience. It dispenses easily and cleanly, making it ideal for on-the-go drinking or single-use applications.

Rise of e-commerce platforms might further contribute to the popularity of sachets. Smaller-sized products are easier to ship. They might also offer consumers the opportunity to buy a variety of products without committing to full-sized packages.

Accurate doses in medications and supplements are met by exact portion control. Hence, the powder segment is projected to witness high demand through 2035 based on product form.

By end-use, the food segment is set to generate a Middle East & Africa sachet packaging machines market share of more than 38.5% in 2025. According to the Food Export Association of the Midwest USA and Food Export USA–Northeast, in Dubai, United Arab Emirates, Ulfood is held. The United Arab Emirates is the most prominent food products export sector for the United States.

The Gulfood expo draws customers from all the nearby regions, as well as the entire world. This is due to its strategic location connecting diverse areas across the Middle East, Asia, Europe, and Africa.

Rise of emerging economies and high demand for packaged food are expected to augment sachet packaging machine sales among food companies. As incomes rise in emerging economies, consumers are more likely to purchase packaged goods.

Sachet packaging is a popular form of packaging in these markets as it is affordable and convenient. The middle class is growing rapidly in emerging economies. This is set to create a large and growing market for packaged goods.

Governments in emerging economies are often supportive of the development of the manufacturing sector. This is creating new opportunities for businesses to sell their products in these markets. Sachet packaging is expected to be a popular form of packaging for these products due to its cost-effectiveness.

Leading sachet packaging manufacturers in the Middle East & Africa are focusing on developing innovative products that offer improved efficiency, flexibility, and cost-effectiveness. This includes integrating advanced technologies such as automation, robotics, and smart sensors to enhance production capabilities.

Sachet packaging manufacturers are offering machines that can handle a wide range of products and materials. They are set to help in providing versatility to meet diverse packaging requirements across different sectors.

Adhering to international standards and complying with regulations related to packaging & safety is essential for sachet packaging manufacturers. They are projected to gain trust and credibility in the market.

For instance:

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 123.3 million |

| Projected Market Valuation (2035) | USD 181.1 million |

| Value-based CAGR (2025 to 2035) | 3.9% |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Value (USD million) |

| Segments Covered | Machine Type, Operating Speed, Product Form, End Use, Country |

| Key Countries Covered | GCC Countries, Türkiye, Northern Africa, South Africa, Israel, Nigeria, Egypt, Rest of Middle East & Africa Countries |

| Key Companies Profiled | Mentpack Packaging Machines; Koerber AG; Reformpack; Viking Masek; GDH Makina; Turpack Makine Sanayi ve Ticaret Ltd. Sti.; Nichrome Packaging Solutions; Matrix Packaging LLC; Syntegon Technology GmbH |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

The global Middle East & Africa sachet packaging machines market is estimated to be valued at USD 123.3 million in 2025.

The market size for the Middle East & Africa sachet packaging machines market is projected to reach USD 181.1 million by 2035.

The Middle East & Africa sachet packaging machines market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in Middle East & Africa sachet packaging machines market are vertical form fill seal (vffs) machine and horizontal form fill (HFFS) machine.

In terms of operating speed, single-lane machine (up to 100 sachets per minute) segment to command 39.2% share in the Middle East & Africa sachet packaging machines market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Middle Mile Delivery Market Size and Share Forecast Outlook 2025 to 2035

Middle East Flooring and Carpet Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Middle East Veterinary Vaccine Market Analysis - Size, Share, and Forecast 2025 to 2035

Middle East Conveyor Belts Market - Growth & Demand 2025 to 2035

Analysis and Growth Projections for Middle East and Mediterranean Tahini Business

Middle East Paints & Coatings Market Growth – Trends & Forecast 2025 to 2035

Middle East Wood Flooring Market Growth – Trends & Forecast 2024-2034

Middle East 3D Printing Materials Market Trends 2022 to 2032

Middle East and Africa Bio-Stimulants Market Size and Share Forecast Outlook 2025 to 2035

Middle East and Africa Latex Foil Balloons Market Size and Share Forecast Outlook 2025 to 2035

Middle East and Africa Rough Terrain Cranes Market Growth - Trends & Forecast 2025 to 2035

Middle East and Africa (MEA) Tourism Security Market Analysis 2025 to 2035

Middle East/North Africa (MENA) Commercial Vehicles Market Analysis - Size, Share, and Forecast 2025 to 2035

Middle East and North Africa Frozen Food Market Size and Share Forecast Outlook 2025 to 2035

MENA Nutraceuticals Market Trends – Dietary Supplements & Functional Foods

Middle East & Africa Hydrolyzed Bovine Collagen Market Size and Share Forecast Outlook 2025 to 2035

Middle East & Africa Data Storage Market Report – Trends & Industry Forecast 2025–2035

MEA Stick Packaging Machines Market Growth – Trends & Forecast 2023-2033

B2B Middleware Market Size and Share Forecast Outlook 2025 to 2035

Low and Middle Income Countries Opioid Substitution Therapy Market Analysis by Drug Class, Indication, Distribution Channel, and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA