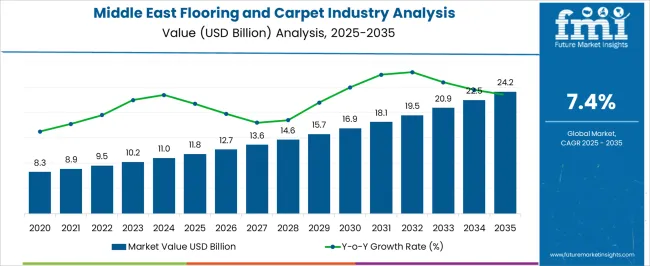

The Middle East Flooring and Carpet Industry Analysis is estimated to be valued at USD 11.8 billion in 2025 and is projected to reach USD 24.2 billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period.

| Metric | Value |

|---|---|

| Middle East Flooring and Carpet Industry Analysis Estimated Value in (2025 E) | USD 11.8 billion |

| Middle East Flooring and Carpet Industry Analysis Forecast Value in (2035 F) | USD 24.2 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The Middle East flooring and carpet industry is experiencing steady growth. Rising urbanization, increasing disposable incomes, and expanding real estate and hospitality sectors are driving demand for aesthetically appealing and durable flooring solutions. Current market dynamics are characterized by a preference for high-quality, easy-to-maintain materials and the adoption of modern interior design trends.

Investment in residential and commercial infrastructure has further strengthened demand for carpets and other flooring products. Technological advancements in manufacturing, enhanced product durability, and improved supply chain efficiency are enabling broader market penetration. The future outlook is shaped by continued construction activity, growing awareness of sustainable and low-maintenance materials, and the influence of international design trends.

Growth rationale is supported by the ability of manufacturers to offer innovative designs, cost-effective solutions, and diverse material options that cater to regional preferences These factors are expected to sustain steady market expansion, enhance product adoption across applications, and reinforce the industry’s competitive positioning over the forecast horizon.

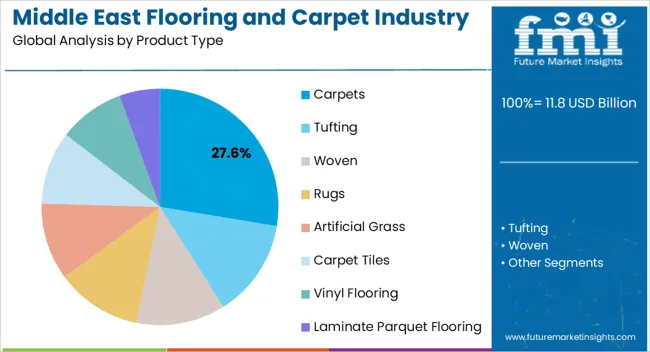

The carpets segment, accounting for 27.6% of the product type category, has maintained a leading position due to its aesthetic appeal, comfort, and versatility across residential and commercial spaces. Its adoption has been reinforced by evolving interior design preferences and the growing demand for customized patterns and textures.

Technological improvements in weaving, tufting, and finishing processes have enhanced product quality, durability, and stain resistance. Distribution networks have facilitated timely availability, while competitive pricing strategies have ensured accessibility across diverse consumer segments.

Continued focus on premium and designer carpet offerings is expected to sustain market share, as well as reinforce brand loyalty and adoption across high-growth residential and commercial segments.

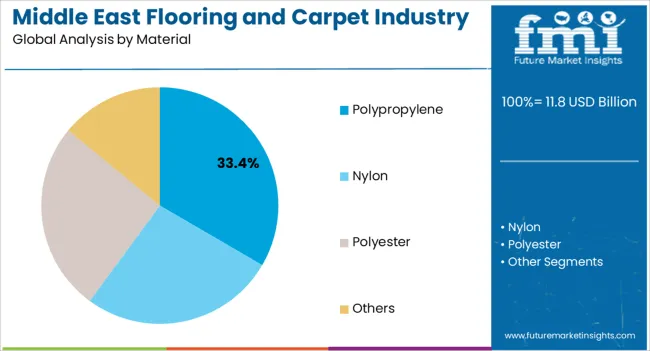

The polypropylene segment, representing 33.4% of the material category, has been leading due to its cost-effectiveness, durability, and ease of maintenance. Its widespread use is supported by resistance to staining, fading, and wear, which makes it suitable for high-traffic areas and diverse applications.

Manufacturing advancements have optimized fiber quality, texture, and color retention, enhancing product attractiveness and functional performance. The segment’s growth is also influenced by sustainability initiatives and recyclability considerations, which have increased its appeal in environmentally conscious markets.

Continued innovation in polypropylene-based products is expected to maintain dominance, ensuring consistent contribution to overall market share.

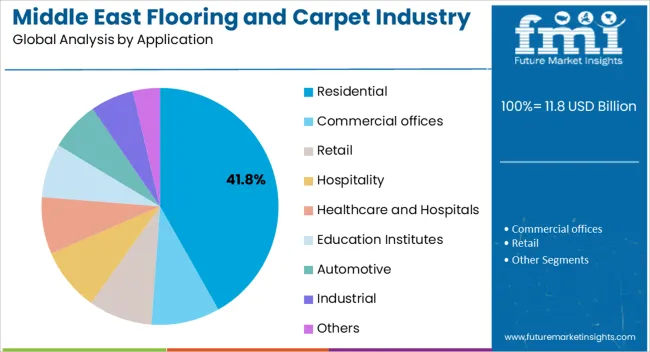

The residential segment, holding 41.8% of the application category, has emerged as the leading application due to increasing home ownership, urban apartment development, and consumer preference for premium interior decor solutions. Adoption has been driven by aesthetic appeal, comfort, and functionality, while rising disposable incomes have enabled the purchase of high-quality flooring and carpet solutions.

Retail expansion, e-commerce channels, and home improvement initiatives have enhanced accessibility and convenience for end-users.

Continued demand for residential carpets is expected to sustain segment share, supported by ongoing urbanization, design trends, and the introduction of innovative product designs tailored for home environments.

| Report Attributes | Details |

|---|---|

| Market value in 2025 | USD 9,432.1 million |

It is anticipated that the growing use of machine-made laminates, carpets, rugs, and other flooring options will create new expansion opportunities. The market expansion for carpet and flooring is expected to be driven by the increasing demand for innovative flooring solutions. The growing population is driving the need for residential structures, which is expected to support the expansion of the flooring and carpet markets.

The scope for flooring and carpet product sales in the Middle East is anticipated to be supported by the increasing popularity of carpet tiles and luxury goods in commercial areas. It is expected that the growing consumer preference for attractive flooring options and interior design for their homes will propel market expansion. The Middle East is known for having access to sophisticated and aesthetically pleasing flooring options.

The table below lists the top five nations expected to experience prominent growth during the forecast period. Qatar and Saudi Arabia are expected to experience the most significant development among these nations.

Forecast CAGRs from 2025 to 2035

| Countries | CAGR from 2025 to 2035 |

|---|---|

| Saudi Arabia | 9% |

| The UAE | 8.1% |

| Qatar | 9.4% |

| Oman | 4.9% |

| Kuwait | 8.7% |

Saudi Arabia is expected to achieve a 9% compound annual growth rate (CAGR) during the forecast period. There is a significant construction boom underway in Saudi Arabia, with numerous infrastructural, business, and residential projects in various stages of development. These developments span a variety of commercial centers to megacities such as Neom. The demand for premium carpets and flooring materials increases as construction projects become larger.

Developers and contractors look for long-lasting, visually beautiful solutions to meet the various requirements of these projects.

The population of the nation is rapidly urbanizing, with more people living in major cities like Riyadh as well as Jeddah. Modernization of residential and commercial areas is prioritized alongside urbanization. The demand for flooring and carpet solutions that align with modern interior design trends is increasing among consumers and businesses.

Sales of flooring accessories and carpets in the UAE are projected to grow at an 8.1% CAGR from 2025 to 2035. The United Arab Emirates is widely recognized for its thriving tourist and hospitality sector, featuring opulent resorts, hotels, and commercial assets. Superior carpeting and flooring are essential for maintaining a high level of comfort and elegance for both visitors and locals. Using high-quality materials is essential for creating warm and inviting spaces.

Expo 2024 was held in the United Arab Emirates, marking a major international event that promoted infrastructure development and building projects. Large-scale facilities are needed for these kinds of events, and many of these require excellent carpet and flooring options. The UAE is also well known for holding a lot of shows and events, which fuels demand for carpeting and flooring.

Qatar is expected to emerge as an important contributor to the flooring and carpet landscape of the Middle East. It is poised to develop at a 9.4% CAGR during the forecast period. The 2025 FIFA World Cup was held in Qatar, which sparked a boom in building projects, including stadiums, lodging, and transportation. To create comfortable and safe spaces for guests, a lot of flooring and carpeting materials must be used in these construction projects.

In Qatar, environmentally friendly and sustainable building methods are highly valued. As a result, there is a growing demand for environmentally friendly green flooring options that align with regional sustainability goals. Flooring materials that fit these requirements are in great demand.

Oman is likely to expand with a 4.9% CAGR from 2025 to 2035. The real estate market in Oman is experiencing growth, with both residential and commercial developments on the rise. The demand for dependable and aesthetically pleasing flooring and carpeting products is driven by the expansion of residential and commercial buildings.

Its tourism sector is booming, and the country has an increasing number of leisure and recreational options. These types of companies require flooring options that are both aesthetically pleasing and long-lasting, able to withstand heavy foot traffic while creating welcoming environments that enhance the allure of regional tourism spots.

Kuwait is poised to expand at an 8.7% compound annual growth rate (CAGR) during the forecast period. Kuwait is concentrating on modernizing and renovating its existing buildings, particularly in its residential and commercial districts. There is a demand for new carpet and flooring as a result of these efforts to improve and repair houses. Companies and property owners seek modern and practical ways to revitalize their spaces.

The construction of hotels, restaurants, and office buildings is contributing to the growth of regional hospitality and commercial sectors. To create opulent and useful spaces, premium flooring options are essential. There is an increased need for high-quality carpet and flooring materials.

The table below highlights how carpets are projected to take up a significant global market share by product type. The residential application segment is likely to garner the dominant market share in 2025.

| Category | Revenue Share in 2025 |

|---|---|

| Carpets by Product Type | 32.9% |

| Residential Application | 35.2% |

The carpets segment is expected to account for a 32.9% revenue share in 2025. In the Middle East, carpets have a significant cultural value. They are frequently used to enhance the appearance of residential and commercial buildings, define and adorn rooms, and provide comfort. Carpets are a popular choice due to the cultural emphasis on creating pleasant spaces in the region and being hospitable.

Warmth and insulation from carpets are particularly beneficial in the diverse environment of the Middle East. Carpets are a versatile and useful flooring option since they keep interiors cool in hot desert locations and offer comfort and protection against cold floors in the winter.

Based on the application, the residential segment is anticipated to take up a significant share. In 2025, the segment acquired 35.2% of the Middle East flooring and carpet revenue share.

The Middle East features a diverse range of climates, including hot, dry deserts. Carpets and flooring options offer both comfort and insulation. They are a sensible option for residential areas, as they keep interiors cooler in arid regions and provide warmth and insulation against cold floors in the winter.

Middle Eastern interior design heavily relies on carpets and flooring options. They are prized for their capacity to improve the aesthetics and design of hospitable, culturally diverse homes. The area has a long-standing custom of adorning homes with elaborate carpet patterns and warm flooring materials to convey a feeling of coziness and warmth.

Flooring and carpet manufacturers are cautiously expanding their product offerings to cater to the diverse needs of their Middle Eastern clientele. It involves introducing a wider range of flooring types, patterns, and styles. Businesses can appeal to a variety of market segments, including residential and commercial locations, as well as the industrial and hospitality industries, by offering a wide range of products.

To cater to distinct use cases and aesthetic preferences, they may offer a variety of flooring solutions, including hardwood, carpet tiles, laminate, ceramic, vinyl, and others. This tactic draws in more consumers by positioning these businesses as one-stop shops for all flooring needs in addition to increasing revenue shares.

Some of the prominent developments by the important companies in this domain are provided below.

| Company | Key Developments |

|---|---|

| Beaulieu International Group |

|

| RAK Ceramics |

|

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 11.8 billion |

| Projected Industry Size in 2035 | USD 24.2 billion |

| Anticipated CAGR from 2025 to 2035 | 7.4% |

| Historical Analysis of Demand for Flooring and Carpet in the Middle East | 2020 to 2025 |

| Demand Forecast for Flooring and Carpet in the Middle East | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Analysis of key factors influencing Flooring and Carpet adoption in the Middle East, Insights on Global Players and their Industry Strategy in the Middle East, Ecosystem Analysis of Manufacturers in the Middle East |

| Key Countries Analyzed while Studying Opportunities in Flooring and Carpet in the Middle East | Saudi Arabia, United Arab Emirates, Egypt, Turkey, Iran, Qatar, Oman, Kuwait, Bahrain, Jordan, Rest of the Middle East |

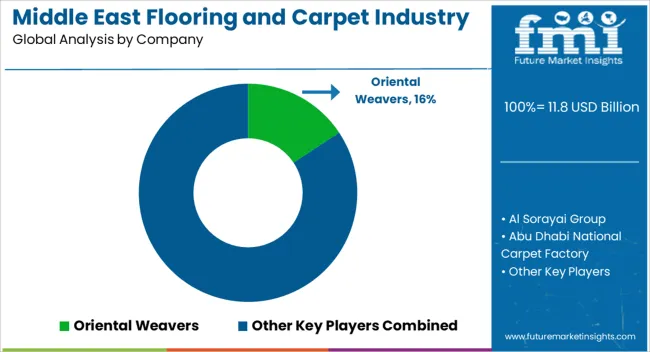

| Key Companies Profiled | Al Sorayai Group; Abu Dhabi National Carpet Factory; Mac Carpet; Prado Egypt For Carpet; Gheytaran Carpet; Oriental Weavers; Standard Carpets Ind. LLC.; Saida Carpets; Dormina; Al Mira Carpet Factory; Abdullatif Carpets |

The global middle east flooring and carpet industry analysis is estimated to be valued at USD 11.8 billion in 2025.

The market size for the middle east flooring and carpet industry analysis is projected to reach USD 24.2 billion by 2035.

The middle east flooring and carpet industry analysis is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in middle east flooring and carpet industry analysis are carpets, tufting, woven, rugs, _accent rugs, _area rugs, _others rugs, artificial grass, carpet tiles, vinyl flooring and laminate parquet flooring.

In terms of material, polypropylene segment to command 33.4% share in the middle east flooring and carpet industry analysis in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Middle Mile Delivery Market Size and Share Forecast Outlook 2025 to 2035

Middle East & Africa Sachet Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Middle East & Africa Hydrolyzed Bovine Collagen Market Size and Share Forecast Outlook 2025 to 2035

Middle East & Africa Data Storage Market Report – Trends & Industry Forecast 2025–2035

Middle East Veterinary Vaccine Market Analysis - Size, Share, and Forecast 2025 to 2035

Middle East/North Africa (MENA) Commercial Vehicles Market Analysis - Size, Share, and Forecast 2025 to 2035

Middle East Conveyor Belts Market - Growth & Demand 2025 to 2035

MEA Stick Packaging Machines Market Growth – Trends & Forecast 2023-2033

Middle East 3D Printing Materials Market Trends 2022 to 2032

Middle East and North Africa Frozen Food Market Size and Share Forecast Outlook 2025 to 2035

Middle East and Africa Bio-Stimulants Market Size and Share Forecast Outlook 2025 to 2035

Middle East and Africa Latex Foil Balloons Market Size and Share Forecast Outlook 2025 to 2035

Middle East and Africa Rough Terrain Cranes Market Growth - Trends & Forecast 2025 to 2035

Analysis and Growth Projections for Middle East and Mediterranean Tahini Business

Middle East and Africa (MEA) Tourism Security Market Analysis 2025 to 2035

MENA Nutraceuticals Market Trends – Dietary Supplements & Functional Foods

Middle East Paints & Coatings Market Growth – Trends & Forecast 2025 to 2035

Middle East Wood Flooring Market Growth – Trends & Forecast 2024-2034

B2B Middleware Market Size and Share Forecast Outlook 2025 to 2035

Low and Middle Income Countries Opioid Substitution Therapy Market Analysis by Drug Class, Indication, Distribution Channel, and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA