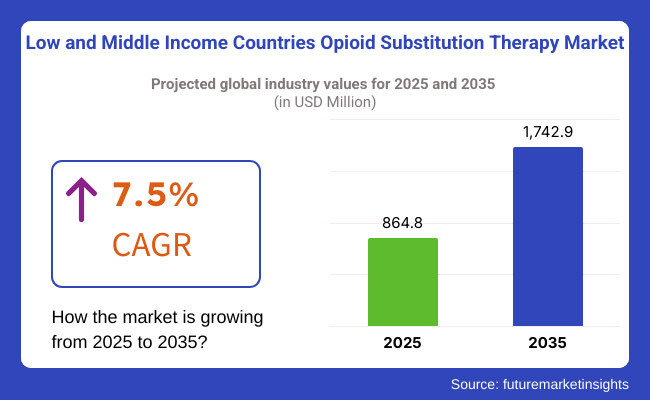

The low and middle income countries opioid substitution therapy market is slated to exhibit USD 864.8 million in 2025. The industry is poised to showcase 7.5% CAGR from 2025 to 2035 and reach USD 1,742.9 million by 2035.

This upsurge can be ascribed to a combination of factors like the increased governmental and NGO backing and the surge of opioid dependency cases. The distribution of medication-assisted treatment (MAT) which is processed with the help of opioid agonists such as methadone, buprenorphine, and naloxone is a crucial step toward saving lives

A case in point is the increase of OST programs in countries like India and Nigeria which are faced with the problem of opioid and other health issues that are driven by the support of international organizations.

One of the critical challenges that LMICs face is the legal and regulatory barriers regarding opioid-based treatment. Furthermore, these countries' healthcare systems primarily lack the professional workers who have experience in chemical dependency which reduces the effectiveness of the OST facilities.

The understanding that opioid addiction stands out as a crucial public health problem has thus been the need for LMICs to modify their public policies and allocate more resources to the sector. The nations using community empowerment approaches along with the digital health innovations are the ones that have registered positive results in treatment adherence and health outcomes.

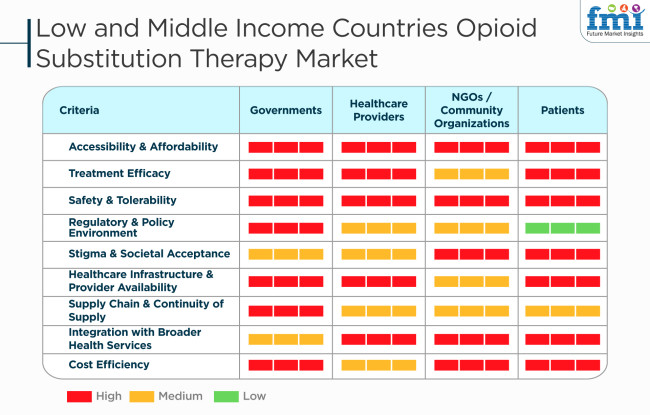

Low and middle-income countries need to deal with many barriers in the opioid substitution therapy market that have a great impact on governments, healthcare providers, NGOs, and patients. Accessibility and affordability are the main challenges that remain, limiting the reach of essential drugs. The efficacy and safety of the treatment are the points that are necessary, but adverse policy issues like regulatory and policy constraints on the use of the drug make it unattainable for people. Societal labeling is still a quality issue, beyond which people are inhibited from seeking the therapy they so rightly need. Poor healthcare structure and a lack of medical practitioners also function as impediments to the effectiveness of treatment.

The bottleneck in the supply chain leads to the inability to get a regular supply of medicines, thus disrupting the treatment process. The insufficient integration with the general health services infrastructure erodes the efficiency of the entire program. Governments and healthcare institutions, who constantly worry about cost efficiency, are in pursuit of solutions that will not only provide necessary drugs to the patients but also achieve effective and sustainable opioid substitution therapy in the long run.

During the years 2020 to 2024, low and middle-income nations (LMICs) have progressively identified opioid substitution therapy (OST) as a key intervention for addressing opioid dependence. This time was marked by a coordinated attempt to mainstream OST into prevailing health systems in a bid to decrease the negative consequences of opioid abuse and facilitate harm reduction. Evidence-based interventions are treated along with the availability of methadone and buprenorphine in promoting the treatment of opioid use disorder in these domains. Joint efforts by the government, NGOs, and international agencies have been instrumental in making OST service access more available, socially as well as medically.

During 2025 to 2035, OST demand in LMICs is further going to increase. Additional growth is anticipated due to rising awareness about opioid use disorder and the efficacy of substitution therapies. Formulation and delivery technologies for drugs will advance to improve adherence and access. The challenges remain, however, in the form of regulatory obstacles, stigma around treatment for addiction, and inequalities in healthcare infrastructure. These challenges will need to be addressed through long-term policy support, investment in healthcare systems, and community mobilization to make OST services effective and accessible to a broad range of diverse LMIC settings.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| WHO and UNODC advocated for harm reduction activities, but national policies in most LMICs were still restrictive. Insufficient government funding for OST expansion. | Policy reforms mandate decriminalization and harm reduction. Governments implement national OST programs with global funding support. |

| Limited use of digital health technologies for OST tracking. A few mobile health (mHealth) programs for addiction treatment. | Artificial intelligence-based mobile platforms facilitate remote OST management and adherence monitoring. Blockchain ensures prescription tracking and delivery. |

| Growing need based on increasing opioid dependence but stigma and access issues restricted uptake. | Higher acceptance of OST as a result of sensitization efforts. Growth in community-based and pharmacy-dispensed OST programs. |

| WHO and NGO-driven projects expanded access in certain LMICs. Increase in illicit use of opioids necessitated harm reduction efforts. | Expansion of OST led by governments, telemedicine implementation, and addiction treatment predictive analytics through AI. |

| Overreliance on overseas suppliers. Reduced investment in local methadone and buprenorphine production. | Domestic OST drug production increase. Supply chain optimization using AI reduces shortages and enhances affordability. |

| Import dependence on wealthy countries. Supply chain interruptions in the COVID-19 period impacted availability. | Decentralized production hubs increase affordability and access. AI-driven distribution networks enhance last-mile delivery in rural areas. |

One of the biggest dangers in the opioid substitution therapy (OST) market in LMICs is the regulatory and legal problems. Many states have very tough drug policies that restrict the distribution and use of opioid substitutes like methadone and buprenorphine. Paperwork, licensing, and shifting political will can blockade or hamper the movement of therapy programs.

Absence of adequate health facilities is another major stumbling block. Many LMICs do not have well equipped clinics, skilled medical professionals, and a supply chain for OST distribution. This leads to irregular treatment which in turn results in a higher dropout rate and, consequently, a greater risk of relapse among patients.

Affordability and funding constraints are the major threats. OST programs need much of the funding to carry on, these funds are frequently sourced from government budgets or foreign donors. A drop in the economy, a cut in funding, or a shift in public health priorities could decrease the financial support for these programs, thus making them unsustainable in the future.

Social stigma and cultural opposition to opioid substitution therapy are still the main barriers to the adoption of these programs. In several LMICs, drug dependence is seen as a sin rather than a disorder; hence, the policymakers, the healthcare providers, and the patients before accepting it to be with OST. The communication of false information must be tackled, and the public's knowledge of the project needs to be increased.

Pricing strategies for the OST sector in LMICs must merge issues of affordability and sustainability to the point that all can access drugs in the long run. Given that a lot of the patients are economically underprivileged; the use of cost-effective means is important in achieving acceptance and adherence to treatment programs on a large scale.

Subsidization of medications through the government is a widely used strategy, where OST medications are offered for free, or at a meager cost, through the public health care system. The governments make agreements about bulk prices with the pharmaceutical manufacturers or rely on the international aid programs for the treatments to be cheaper for patients.

Cost-plus pricing is the tool used by private heath care facilities and pharmaceutical companies to ensure that they are profitable; meanwhile, patients are not affected much by the price of the medicine. In LMICs that have low purchasing power, this method should not be used without adjustments to the price if it is believed that it will limit patient access.

Tiered pricing is an excellent pricing model that is based on the income level and/or funding source of the patients. OST medications can be given to low-income patients at a discounted price while other healthcare providers or NGOs that can afford to pay more can maintain the standard price which in turn ensures a balanced revenue model.

Public-private partnerships (PPP) can also be effective in securing a well-running and affordable pricing strategy. Collaborative projects among governments, international organizations, and pharmaceutical companies should lead to the negotiation of bulk purchases, which will in turn, ensure both the affordability and the availability of these drugs in the LMICs.

Methadone is the most commonly used opioid agonist in opioid substitution therapy (OST), due to its long half-life, clinically proven effectiveness in alleviating craving and providing withdrawal blocking. Its low cost renders it especially feasible in low- and middle-income countries (LMICs), where funding for opioid use disorder treatment programs is frequently limited. It is recommended by the World Health Organization (WHO) and United Nations Office on Drugs and Crime (UNODC), which strongly promote the use of methadone maintenance treatment (MMT).

The primary indication of Opioid Substitution Therapy (OST) is Opioid Withdrawal and Opioid Use Disorder (OUD). OST is a treatment strategy under medical supervision where illicit opioids (e.g., heroin or fentanyl) are substituted with long-acting, less euphoric opioid agonists such as methadone or buprenorphine. This stabilizes patients, suppresses cravings, and prevents withdrawal, enabling individuals to reassert control over their lives while minimizing the risks of opioid misuse, including overdose and infectious diseases.

The largest distribution channel for Opioid Substitution Therapy (OST) is government-funded centers, NGOs, and tenders. OST is a public health program to decrease the harm caused by opioid dependence, including overdose deaths, HIV infection, and crime. Numerous governments across the globe, including those in low and middle income countries, operate OST programs through public health clinics, hospitals, and NGOs that offer methadone, buprenorphine, or naloxone at low or no cost to the patients.

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 6.8% |

| China | 7.5% |

| India | 7.9% |

The market for opioid substitution therapy in Brazil is growing on the increasing trend of opioid abuse, total government efforts to curb drug abuse, and more exposure to harm reduction policies. Prescription opioid abuse in Brazil has also grown, further driving the demand for buprenorphine and methadone as replacement medication.

Government-sponsored healthcare programs, supported by global organizations, are driving OST adoption. Furthermore, increased telemedicine service coverage and mobile clinics are supplementing treatment supply in rural and underserved communities.

FMI is of the opinion that the Brazil market is slated to grow at 6.8% CAGR during the study period.

Growth Drivers in Brazil

| Key Drivers | Details |

|---|---|

| Opioid Abuse Boosted | Increased prescription opioid abuse driving OST demand |

| Government Harm Reduction Programs | OST implementation to prevent opioid-related deaths |

| Growth in Telehealth | Expanded access to OST via telemedicine and mobile health clinics |

| Subsidy by Government & Generic Drug Availability | Lower cost of methadone & buprenorphine treatment |

| Global Alliances | International health organizations' support for enhancing OST programs |

China's opioid substitution therapy market increases due to policy-driven harm reduction, increased growth of methadone maintenance treatment (MMT) clinics, and increased education on the treatment of opioid use disorders. China possesses one of the largest OST infrastructures in the globe, with massive government investment guaranteeing its sustainability.

The addition of digital health technologies, like AI-based remote consultation, is facilitating patient tracking and compliance. China's pharma sector is also facilitating cost-effective domestic production of opioid substitution drugs, increasing market access.

FMI believes that the China market will achieve 7.5% CAGR during the forecast period.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| Big OST Network | National roll-out of MMT clinics increasing treatment coverage |

| Strong Government Support | Policies supportive of opioid addiction treatment driving OST adoption |

| Integration of Digital Health | AI-driven tracking and telemedicine streamlining patient compliance |

| Emerging Pharmaceutical Industry | Domestic production reducing opioid replacement drug prices |

| R&D Spending Growing | OST improvements leading to cost-effective and efficient treatment |

India's opioid substitution therapy market is growing with rising opioid abuse rates, growing government attention, and improving healthcare infrastructure. India has a huge opioid dependence epidemic sweeping across northern states, controlled by heroin and synthetic opioid abuse.

The Indian government, as well as global health organizations, are increasingly supporting OST programs through subsidized buprenorphine and methadone treatment. Moreover, non-profit and community health organization set-ups are contributing to OST supply among high-risk groups.

FMI is of the opinion that the India market is slated to grow at 7.9% CAGR during the study period.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Increased Opioid Dependence | Man-made opioid and heroin dependence on the increase fueling the need for OST |

| Government OST Programs | Government-run public health programs increasing accessibility to OST |

| Subsidized Medications | Methadone and buprenorphine both made affordable via government subsidy |

| Nonprofit & Community Outreach | Expanded access to OST to under-served groups |

| Rural Healthcare Expansion | Mobile clinics and telemedicine centers expanding access to OST |

Some of the key players include Indivior, Hikma Pharmaceuticals, Mallinckrodt Pharmaceuticals, and local generic drug manufacturers. They want to expand their reach using affordable pricing strategies, regulatory collaborations, and supply chain developments. At the same time, developing market contenders seek to establish themselves within this evolving regulatory landscape by coming up with novel formulations of drugs and patient-centric treatment models. International health organizations financing, harm reduction, and alternative medication-assisted treatment also shape the competitive environment.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Indivior PLC | 22-26% |

| Hikma Pharmaceuticals | 18-22% |

| Mallinckrodt Pharmaceuticals | 10-14% |

| Camurus AB | 8-12% |

| Viatris (Mylan) | 5-9% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Indivior PLC | Develops buprenorphine-based opioid substitution treatments, including Suboxone and Sublocade, targeting opioid dependence. |

| Hikma Pharmaceuticals | Manufactures methadone and buprenorphine generics, ensuring affordability and availability in LMICs. |

| Mallinckrodt Pharmaceuticals | Produces opioid agonist therapies and extended-release formulations for opioid dependence treatment. |

| Camurus AB | Specializes in long-acting buprenorphine treatments, such as Buvidal, osffering extended relief for patients. |

| Viatris (Mylan) | Provides cost-effective generic alternatives for opioid substitution therapy, increasing access in developing markets. |

Indivior PLC (22-26%)

A global leader in opioid dependence treatment, Indivior offers innovative buprenorphine-based therapies, supporting harm reduction efforts worldwide.

Hikma Pharmaceuticals (18-22%)

A key provider of methadone and buprenorphine, Hikma focuses on affordability and accessibility for opioid substitution therapy in LMICs.

Mallinckrodt Pharmaceuticals (10-14%)

Specializing in opioid addiction management, Mallinckrodt produces both agonist and antagonist therapies to support treatment programs.

Camurus AB (8-12%)

With its long-acting Buvidal formulation, Camurus enhances patient adherence and treatment outcomes in opioid dependence therapy.

Viatris (Mylan) (5-9%)

A major supplier of generic opioid substitution medications, Viatris expands access to cost-effective therapies in underserved regions.

Other Key Players (25-35% Combined)

By drug class, the segmentation is as opioid antagonists and opioid agonists and partial agonists.

By indication, the segmentation is as pain management, opioid withdrawal/opioid use disorder (OUD), alcohol de-addiction, and depression.

By distribution channel, the segmentation is as government-supported centers/NGOs/tenders, institutional sales, and retail sales.

By region, the segmentation is as Latin America, China, South Asia and Pacific, Europe, Central Asia, Africa.

The market is expected to be USD 864.8 million in 2025.

The market is predicted to reach a size of USD 1,742.9 million by 2035.

The key companies in the market include Pfizer Inc., Takeda Pharmaceuticals, Alkermes Inc., Hikma Pharmaceuticals, Emergent BioSolutions Inc., Indivior Inc., Mundipharma GmbH, Purdue Pharma LP, Orexo US Inc., Boehringer Ingelheim, Jamp Pharma Corporation, Vistapharm Inc., Atlantic Biologicals Corp., BLISTECO S.A.S., BioDelivery Sciences International Inc., Braeburn Inc., Camurus AB, Knight Therapeutics Inc., Titan Pharmaceuticals Inc., Braeburn Pharmaceuticals, L. Molteni & C. Dei Fratelli Alitti Società Di Esercizio S.P.A., Sterinova Inc., Teva Pharmaceutical Industries Ltd., USWM LLC, Wellona Pharma, Taj Pharmaceuticals Limited, Livealth Biopharma Pvt Ltd, Somerset Therapeutics Limited, Walter Healthcare Private Limited, Mallinckrodt Pharmaceuticals, Rusan Pharma Ltd, Viatris Inc., RINQUE PHARMA, Par Pharmaceutical, The Bristol-Myers Squibb Company, Intas Pharmaceuticals, and STERIS PHARMA.

India, slated to witness 7.9% CAGR during the study period, will witness fastest growth.

The most widely used product segment is methadone-based therapy.

Table 01: Average Pricing Analysis Benchmark of Drug in US$ (2023)

Table 02: Average Pricing Analysis Benchmark of Drug in US$ (2023)

Table 03: Average Pricing Analysis Benchmark of Drug in US$ (2023)

Table 04: Average Pricing Analysis Benchmark of Drug in US$ (2023)

Table 05: Average Pricing Analysis Benchmark of Drug in US$ (2023)

Table 06: Average Pricing Analysis Benchmark of Drug in US$ (2023)

Table 07: Average Pricing Analysis Benchmark of Drug in US$ (2023)

Table 08: Average Pricing Analysis Benchmark of Drug in US$ (2023)

Table 09: Average Pricing Analysis Benchmark of Drug in US$ (2023)

Table 10: Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 11: Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 12: Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 13: Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 14: Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 15: Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Country

Table 16: Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Country

Table 17: Brazil Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 18: Brazil Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 19: Brazil Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 20: Brazil Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 21: Brazil Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 22: Brazil Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 23: Brazil Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 24: Brazil Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 25: Peru Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 26: Peru Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 27: Peru Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 28: Peru Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 29: Peru Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 30: Peru Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 31: Peru Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 32: Peru Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 33: China Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 34: China Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 35: China Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 36: China Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 37: China Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 38: China Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 39: China Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 40: China Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 41: India Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 42: India Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 43: India Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 44: India Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 45: India Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 46: India Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 47: India Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 48: India Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 49: Vietnam Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 50: Vietnam Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 51: Vietnam Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 52: Vietnam Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 53: Vietnam Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 54: Vietnam Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 55: Vietnam Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 56: Vietnam Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 57: Afghanistan Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 58: Afghanistan Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 59: Afghanistan Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 60: Afghanistan Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 61: Afghanistan Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 62: Afghanistan Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 63: Afghanistan Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 64: Afghanistan Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 65: Bangladesh Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 66: Bangladesh Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 67: Bangladesh Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 68: Bangladesh Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 69: Bangladesh Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 70: Bangladesh Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 71: Bangladesh Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 72: Bangladesh Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 73: Cambodia Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 74: Cambodia Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 75: Cambodia Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 76: Cambodia Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 77: Cambodia Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 78: Cambodia Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 79: Cambodia Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 80: Cambodia Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 81: Myanmar Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 82: Myanmar Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 83: Myanmar Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 84: Myanmar Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 85: Myanmar Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 86: Myanmar Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 87: Myanmar Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 88: Myanmar Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 89: Nepal Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 90: Nepal Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 91: Nepal Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 92: Nepal Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 93: Nepal Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 94: Nepal Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 95: Nepal Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 96: Nepal Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 97: Pakistan Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 98: Pakistan Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 99: Pakistan Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 100: Pakistan Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 101: Pakistan Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 102: Pakistan Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 103: Pakistan Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 104: Pakistan Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 105: Malaysia Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 106: Malaysia Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 107: Malaysia Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 108: Malaysia Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 109: Malaysia Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 110: Malaysia Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 111: Malaysia Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 112: Malaysia Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 113: Thailand Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 114: Thailand Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 115: Thailand Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 116: Thailand Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 117: Thailand Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 118: Thailand Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 119: Thailand Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 120: Thailand Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 121: Ukraine Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 122: Ukraine Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 123: Ukraine Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 124: Ukraine Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 125: Ukraine Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 126: Ukraine Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 127: Ukraine Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 128: Ukraine Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 129: Georgia Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 130: Georgia Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 131: Georgia Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 132: Georgia Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 133: Georgia Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 134: Georgia Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 135: Georgia Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 136: Georgia Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 137: Armenia Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 138: Armenia Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 139: Armenia Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 140: Armenia Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 141: Armenia Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 142: Armenia Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 143: Armenia Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 144: Armenia Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 145: Kyrgyzstan Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 146: Kyrgyzstan Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 147: Kyrgyzstan Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 148: Kyrgyzstan Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 149: Kyrgyzstan Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 150: Kyrgyzstan Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 151: Kyrgyzstan Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 152: Kyrgyzstan Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 153: Kazakhstan Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 154: Kazakhstan Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 155: Kazakhstan Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 156: Kazakhstan Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 157: Kazakhstan Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 158: Kazakhstan Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 159: Kazakhstan Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 160: Kazakhstan Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 161: Tajikistan Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 162: Tajikistan Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 163: Tajikistan Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 164: Tajikistan Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 165: Tajikistan Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 166: Tajikistan Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 167: Tajikistan Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 168: Tajikistan Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 169: South Africa Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 170: South Africa Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 171: South Africa Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 172: South Africa Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 173: South Africa Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 174: South Africa Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 175: South Africa Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 176: South Africa Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 177: Nigeria Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 178: Nigeria Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 179: Nigeria Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 180: Nigeria Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 181: Nigeria Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 182: Nigeria Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 183: Nigeria Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 184: Nigeria Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 185: Egypt Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 186: Egypt Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 187: Egypt Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 188: Egypt Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 18: Egypt Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 190: Egypt Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 191: Egypt Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 192: Egypt Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 193: Tanzania Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 194: Tanzania Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 195: Tanzania Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 196: Tanzania Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 197: Tanzania Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 198: Tanzania Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 199: Tanzania Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 200: Tanzania Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 201: Ghana Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 202: Ghana Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 203: Ghana Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 204: Ghana Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 205: Ghana Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 206: Ghana Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 207: Ghana Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 208: Ghana Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 209: Kenya Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 210: Kenya Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 211: Kenya Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 212: Kenya Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 213: Kenya Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 214: Kenya Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 215: Kenya Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 216: Kenya Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 217: Mozambique Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 218: Mozambique Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 219: Mozambique Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 220: Mozambique Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 221: Mozambique Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 222: Mozambique Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 223: Mozambique Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 224: Mozambique Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 225: Senegal Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 226: Senegal Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 227: Senegal Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 228: Senegal Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 229: Senegal Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 230: Senegal Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 231: Senegal Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 232: Senegal Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 233: Uganda Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 234: Uganda Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 235: Uganda Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 236: Uganda Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 237: Uganda Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 238: Uganda Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 239: Uganda Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 240: Uganda Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 241: Côte d'Ivoire Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 242: Côte d'Ivoire Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 243: Côte d'Ivoire Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 244: Côte d'Ivoire Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 245: Côte d'Ivoire Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 246: Côte d'Ivoire Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 247: Côte d'Ivoire Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 248: Côte d'Ivoire Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Table 249: Rest of LIMCs Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 250: Rest of LIMCs Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 251: Rest of LIMCs Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 252: Rest of LIMCs Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 253: Rest of LIMCs Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 254: Rest of LIMCs Market Volume (Units) Analysis and Opportunity Assessment 2018 to 2034, By Drug Class

Table 255: Rest of LIMCs Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Indication

Table 256: Rest of LIMCs Market Value (US$ Million) Analysis and Opportunity Assessment 2018 to 2034, By Distribution Channel

Figure 01: Market Share, By Drug Class, 2024 (E)

Figure 02: Market Share, By Indication, 2024 (E)

Figure 03: Market Share, By Distribution Channel, 2024 (E)

Figure 04: Market Volume (in Units) Analysis, 2018 to 2023

Figure 05: Market Volume (in Units) Analysis, 2024 to 2034

Figure 06: Market Value Analysis (US$ Million), 2018 to 2023

Figure 07: Market Forecast (US$ Million) & Y-o-Y Growth, 2024 to 2034

Figure 08: Market Absolute $ Opportunity, 2024 to 2034

Figure 09: Market Share Analysis (%), By Drug Class, 2024(E) to 2034(F)

Figure 10: Market Y-o-Y Analysis (%), By Drug Class, 2024 to 2034

Figure 11: Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 12: Market Share Analysis (%), By Indication, 2024(E) to 2034(F)

Figure 13: Market Y-o-Y Analysis (%), By Indication, 2024 to 2034

Figure 14: Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 15: Market Share Analysis (%), By Distribution Channel , 2024(E) to 2034(F)

Figure 16: Market Y-o-Y Analysis (%), By Distribution Channel , 2024 to 2034

Figure 17: Market Attractiveness Analysis By Distribution Channel , 2024 to 2034

Figure 18: Market Share Analysis (%), By Country, 2024(E) to 2034(F)

Figure 19: Market Y-o-Y Analysis (%), By Country, 2024 to 2034

Figure 20: Market Attractiveness Analysis By Country, 2024 to 2034

Figure 21: Brazil Market Share, By Drug Class, 2024 (E)

Figure 22: Brazil Market Share, By Indication, 2024 (E)

Figure 23: Brazil Market Share, By Distribution Channel, 2024 (E)

Figure 24: Brazil Market Value (US$ Million) Analysis 2018 to 2023

Figure 25: Brazil Market Value (US$ Million) Analysis 2024 to 2034

Figure 26: Brazil Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 27: Brazil Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 28: Brazil Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Figure 29: Peru Market Share, By Drug Class, 2024 (E)

Figure 30: Peru Market Share, By Indication, 2024 (E)

Figure 31: Peru Market Share, By Distribution Channel, 2024 (E)

Figure 32: Peru Market Value (US$ Million) Analysis 2018 to 2023

Figure 33: Peru Market Value (US$ Million) Analysis 2024 to 2034

Figure 34: Peru Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 35: Peru Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 36: Peru Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Figure 37: China Market Share, By Drug Class, 2024 (E)

Figure 38: China Market Share, By Indication, 2024 (E)

Figure 39: China Market Share, By Distribution Channel, 2024 (E)

Figure 40: China Market Value (US$ Million) Analysis 2018 to 2023

Figure 41: China Market Value (US$ Million) Analysis 2024 to 2034

Figure 42: China Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 43: China Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 44: China Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Figure 45: India Market Share, By Drug Class, 2024 (E)

Figure 46: India Market Share, By Indication, 2024 (E)

Figure 47: India Market Share, By Distribution Channel, 2024 (E)

Figure 48: India Market Value (US$ Million) Analysis 2018 to 2023

Figure 49: India Market Value (US$ Million) Analysis 2024 to 2034

Figure 50: India Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 51: India Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 52: India Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Figure 53: Vietnam Market Share, By Drug Class, 2024 (E)

Figure 54: Vietnam Market Share, By Indication, 2024 (E)

Figure 55: Vietnam Market Share, By Distribution Channel, 2024 (E)

Figure 56: Vietnam Market Value (US$ Million) Analysis 2018 to 2023

Figure 57: Vietnam Market Value (US$ Million) Analysis 2024 to 2034

Figure 58: Vietnam Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 59: Vietnam Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 60: Vietnam Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Figure 61: Afghanistan Market Share, By Drug Class, 2024 (E)

Figure 62: Afghanistan Market Share, By Indication, 2024 (E)

Figure 63: Afghanistan Market Share, By Distribution Channel, 2024 (E)

Figure 64: Afghanistan Market Value (US$ Million) Analysis 2018 to 2023

Figure 65: Afghanistan Market Value (US$ Million) Analysis 2024 to 2034

Figure 66: Afghanistan Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 67: Afghanistan Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 68: Afghanistan Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Figure 69: Bangladesh Market Share, By Drug Class, 2024 (E)

Figure 70: Bangladesh Market Share, By Indication, 2024 (E)

Figure 71: Bangladesh Market Share, By Distribution Channel, 2024 (E)

Figure 72: Bangladesh Market Value (US$ Million) Analysis 2018 to 2023

Figure 73: Bangladesh Market Value (US$ Million) Analysis 2024 to 2034

Figure 74: Bangladesh Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 75: Bangladesh Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 76: Bangladesh Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Figure 78: Cambodia Market Share, By Drug Class, 2024 (E)

Figure 79: Cambodia Market Share, By Indication, 2024 (E)

Figure 80: Cambodia Market Share, By Distribution Channel, 2024 (E)

Figure 81: Cambodia Market Value (US$ Million) Analysis 2018 to 2023

Figure 82: Cambodia Market Value (US$ Million) Analysis 2024 to 2034

Figure 83: Cambodia Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 84: Cambodia Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 85: Cambodia Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Figure 86: Myanmar Market Share, By Drug Class, 2024 (E)

Figure 87: Myanmar Market Share, By Indication, 2024 (E)

Figure 88: Myanmar Market Share, By Distribution Channel, 2024 (E)

Figure 89: Myanmar Market Value (US$ Million) Analysis 2018 to 2023

Figure 90: Myanmar Market Value (US$ Million) Analysis 2024 to 2034

Figure 91: Myanmar Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 92: Myanmar Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 93: Myanmar Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Figure 94: Nepal Market Share, By Drug Class, 2024 (E)

Figure 95: Nepal Market Share, By Indication, 2024 (E)

Figure 96: Nepal Market Share, By Distribution Channel, 2024 (E)

Figure 97: Nepal Market Value (US$ Million) Analysis 2018 to 2023

Figure 98: Nepal Market Value (US$ Million) Analysis 2024 to 2034

Figure 99: Nepal Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 100: Nepal Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 101: Nepal Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Figure 102: Pakistan Market Share, By Drug Class, 2024 (E)

Figure 103: Pakistan Market Share, By Indication, 2024 (E)

Figure 104: Pakistan Market Share, By Distribution Channel, 2024 (E)

Figure 105: Pakistan Market Value (US$ Million) Analysis 2018 to 2023

Figure 106: Pakistan Market Value (US$ Million) Analysis 2024 to 2034

Figure 107: Pakistan Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 108: Pakistan Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 109: Pakistan Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Figure 110: Malaysia Market Share, By Drug Class, 2024 (E)

Figure 111: Malaysia Market Share, By Indication, 2024 (E)

Figure 112: Malaysia Market Share, By Distribution Channel, 2024 (E)

Figure 113: Malaysia Market Value (US$ Million) Analysis 2018 to 2023

Figure 114: Malaysia Market Value (US$ Million) Analysis 2024 to 2034

Figure 115: Malaysia Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 116: Malaysia Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 117: Malaysia Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Figure 118: Thailand Market Share, By Drug Class, 2024 (E)

Figure 119: Thailand Market Share, By Indication, 2024 (E)

Figure 120: Thailand Market Share, By Distribution Channel, 2024 (E)

Figure 121: Thailand Market Value (US$ Million) Analysis 2018 to 2023

Figure 122: Thailand Market Value (US$ Million) Analysis 2024 to 2034

Figure 123: Thailand Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 124: Thailand Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 125: Thailand Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Figure 126: Ukraine Market Share, By Drug Class, 2024 (E)

Figure 127: Ukraine Market Share, By Indication, 2024 (E)

Figure 128: Ukraine Market Share, By Distribution Channel, 2024 (E)

Figure 129: Ukraine Market Value (US$ Million) Analysis 2018 to 2023

Figure 130: Ukraine Market Value (US$ Million) Analysis 2024 to 2034

Figure 131: Ukraine Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 132: Ukraine Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 133: Ukraine Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Figure 134: Georgia Market Share, By Drug Class, 2024 (E)

Figure 135: Georgia Market Share, By Indication, 2024 (E)

Figure 136: Georgia Market Share, By Distribution Channel, 2024 (E)

Figure 137: Georgia Market Value (US$ Million) Analysis 2018 to 2023

Figure 138: Georgia Market Value (US$ Million) Analysis 2024 to 2034

Figure 139: Georgia Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 140: Georgia Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 141: Georgia Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Figure 142: Armenia Market Share, By Drug Class, 2024 (E)

Figure 143: Armenia Market Share, By Indication, 2024 (E)

Figure 144: Armenia Market Share, By Distribution Channel, 2024 (E)

Figure 145: Armenia Market Value (US$ Million) Analysis 2018 to 2023

Figure 146: Armenia Market Value (US$ Million) Analysis 2024 to 2034

Figure 147: Armenia Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 148: Armenia Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 149: Armenia Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Figure 150: Kyrgyzstan Market Share, By Drug Class, 2024 (E)

Figure 151: Kyrgyzstan Market Share, By Indication, 2024 (E)

Figure 152: Kyrgyzstan Market Share, By Distribution Channel, 2024 (E)

Figure 153: Kyrgyzstan Market Value (US$ Million) Analysis 2018 to 2023

Figure 154: Kyrgyzstan Market Value (US$ Million) Analysis 2024 to 2034

Figure 155: Kyrgyzstan Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 156: Kyrgyzstan Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 157: Kyrgyzstan Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Figure 158: Kazakhstan Market Share, By Drug Class, 2024 (E)

Figure 159: Kazakhstan Market Share, By Indication, 2024 (E)

Figure 160: Kazakhstan Market Share, By Distribution Channel, 2024 (E)

Figure 161: Kazakhstan Market Value (US$ Million) Analysis 2018 to 2023

Figure 162: Kazakhstan Market Value (US$ Million) Analysis 2024 to 2034

Figure 163: Kazakhstan Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 164: Kazakhstan Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 165: Kazakhstan Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Figure 166: Tajikistan Market Share, By Drug Class, 2024 (E)

Figure 167: Tajikistan Market Share, By Indication, 2024 (E)

Figure 168: Tajikistan Market Share, By Distribution Channel, 2024 (E)

Figure 169: Tajikistan Market Value (US$ Million) Analysis 2018 to 2023

Figure 170: Tajikistan Market Value (US$ Million) Analysis 2024 to 2034

Figure 171: Tajikistan Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 172: Tajikistan Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 173: Tajikistan Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Figure 174: South Africa Market Share, By Drug Class, 2024 (E)

Figure 175: South Africa Market Share, By Indication, 2024 (E)

Figure 176: South Africa Market Share, By Distribution Channel, 2024 (E)

Figure 177: South Africa Market Value (US$ Million) Analysis 2018 to 2023

Figure 178: South Africa Market Value (US$ Million) Analysis 2024 to 2034

Figure 179: South Africa Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 180: South Africa Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 181: South Africa Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Figure 182: Nigeria Market Share, By Drug Class, 2024 (E)

Figure 183: Nigeria Market Share, By Indication, 2024 (E)

Figure 184: Nigeria Market Share, By Distribution Channel, 2024 (E)

Figure 185: Nigeria Market Value (US$ Million) Analysis 2018 to 2023

Figure 186: Nigeria Market Value (US$ Million) Analysis 2024 to 2034

Figure 187: Nigeria Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 188: Nigeria Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 189: Nigeria Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Figure 190: Egypt Market Share, By Drug Class, 2024 (E)

Figure 191: Egypt Market Share, By Indication, 2024 (E)

Figure 192: Egypt Market Share, By Distribution Channel, 2024 (E)

Figure 193: Egypt Market Value (US$ Million) Analysis 2018 to 2023

Figure 194: Egypt Market Value (US$ Million) Analysis 2024 to 2034

Figure 195: Egypt Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 196: Egypt Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 197: Egypt Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Figure 198: Tanzania Market Share, By Drug Class, 2024 (E)

Figure 199: Tanzania Market Share, By Indication, 2024 (E)

Figure 200: Tanzania Market Share, By Distribution Channel, 2024 (E)

Figure 201: Tanzania Market Value (US$ Million) Analysis 2018 to 2023

Figure 202: Tanzania Market Value (US$ Million) Analysis 2024 to 2034

Figure 203: Tanzania Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 204: Tanzania Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 205: Tanzania Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Figure 206: Ghana Market Share, By Drug Class, 2024 (E)

Figure 207: Ghana Market Share, By Indication, 2024 (E)

Figure 208: Ghana Market Share, By Distribution Channel, 2024 (E)

Figure 209: Ghana Market Value (US$ Million) Analysis 2018 to 2023

Figure 210: Ghana Market Value (US$ Million) Analysis 2024 to 2034

Figure 211: Ghana Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 212: Ghana Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 213: Ghana Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Figure 214: Kenya Market Share, By Drug Class, 2024 (E)

Figure 215: Kenya Market Share, By Indication, 2024 (E)

Figure 216: Kenya Market Share, By Distribution Channel, 2024 (E)

Figure 217: Kenya Market Value (US$ Million) Analysis 2018 to 2023

Figure 218: Kenya Market Value (US$ Million) Analysis 2024 to 2034

Figure 219: Kenya Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 220: Kenya Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 221: Kenya Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Figure 222: Mozambique Market Share, By Drug Class, 2024 (E)

Figure 223: Mozambique Market Share, By Indication, 2024 (E)

Figure 224: Mozambique Market Share, By Distribution Channel, 2024 (E)

Figure 225: Mozambique Market Value (US$ Million) Analysis 2018 to 2023

Figure 226: Mozambique Market Value (US$ Million) Analysis 2024 to 2034

Figure 227: Mozambique Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 228: Mozambique Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 229: Mozambique Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Figure 230: Senegal Market Share, By Drug Class, 2024 (E)

Figure 231: Senegal Market Share, By Indication, 2024 (E)

Figure 232: Senegal Market Share, By Distribution Channel, 2024 (E)

Figure 233: Senegal Market Value (US$ Million) Analysis 2018 to 2023

Figure 234: Senegal Market Value (US$ Million) Analysis 2024 to 2034

Figure 235: Senegal Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 236: Senegal Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 237: Senegal Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Figure 238: Uganda Market Share, By Drug Class, 2024 (E)

Figure 239: Uganda Market Share, By Indication, 2024 (E)

Figure 240: Uganda Market Share, By Distribution Channel, 2024 (E)

Figure 241: Uganda Market Value (US$ Million) Analysis 2018 to 2023

Figure 242: Uganda Market Value (US$ Million) Analysis 2024 to 2034

Figure 243: Uganda Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 244: Uganda Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 245: Uganda Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Figure 246: Côte d'Ivoire Market Share, By Drug Class, 2024 (E)

Figure 247: Côte d'Ivoire Market Share, By Indication, 2024 (E)

Figure 248: Côte d'Ivoire Market Share, By Distribution Channel, 2024 (E)

Figure 249: Côte d'Ivoire Market Value (US$ Million) Analysis 2018 to 2023

Figure 250: Côte d'Ivoire Market Value (US$ Million) Analysis 2024 to 2034

Figure 251: Côte d'Ivoire Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 252: Côte d'Ivoire Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 253: Côte d'Ivoire Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Figure 254: Rest of LIMCs Market Share, By Drug Class, 2024 (E)

Figure 255: Rest of LIMCs Market Share, By Indication, 2024 (E)

Figure 256: Rest of LIMCs Market Share, By Distribution Channel, 2024 (E)

Figure 257: Rest of LIMCs Market Value (US$ Million) Analysis 2018 to 2023

Figure 258: Rest of LIMCs Market Value (US$ Million) Analysis 2024 to 2034

Figure 259: Rest of LIMCs Market Attractiveness Analysis By Drug Class, 2024 to 2034

Figure 260: Rest of LIMCs Market Attractiveness Analysis By Indication, 2024 to 2034

Figure 261: Rest of LIMCs Market Attractiveness Analysis By Distribution Channel, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Low Light Imaging Market Forecast Outlook 2025 to 2035

Low Density Polyethylene Market Forecast and Outlook 2025 to 2035

Low-Temperature Cable Market Size and Share Forecast Outlook 2025 to 2035

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Radiators Market Size and Share Forecast Outlook 2025 to 2035

Low Rolling Resistance Tire Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Low Emissivity Film Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Substation Market Size and Share Forecast Outlook 2025 to 2035

Low Migration Inks Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Low Density Polyethylene Packaging Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Low Clearance Loaders Market Size and Share Forecast Outlook 2025 to 2035

Low Calorie Desserts Market Size and Share Forecast Outlook 2025 to 2035

Low-Grade Glioma Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Low Power Wide Area Network (LPWAN) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA