The market for Low-Code Embedded Analytics will display substantial growth during the period from 2025 to 2035 because organizations require data-driven choices and embrace low-code frameworks and embed analytics modules into business applications.

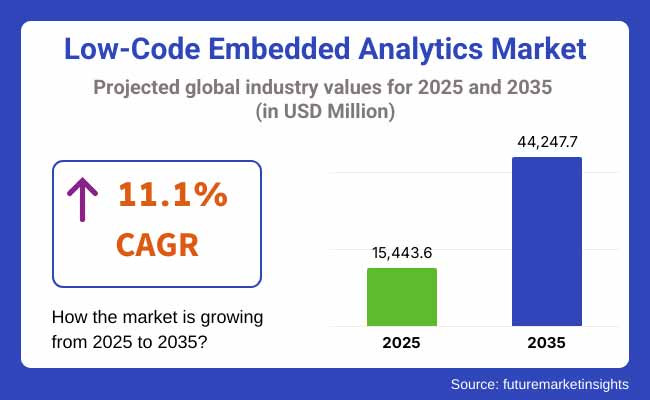

Low-code embedded analytics enable businesses to add data visualization together with reporting and predictive analysis into their applications without writing long code which makes the resulting tools easier to use and more operationally effective. According to analysts the market value is projected to achieve USD 15,443.6 million in 2025 then extend to USD 44,247.7 million by 2035 at a compound annual growth rate (CAGR) of 11.1% throughout the forecast period.

;

;

Market expansion occurs through several factors including digital transformation speed increases across industries together with rising cloud solution adaptations and expanding self-service analytics requirements. Through low-code analytics enterprises enable users to receive instant insights which enhances report performance while improving customer relationships. Embedded analytics solutions receive additional value through AI analytics and automation functionalities and machine learning capabilities.

Multiple issues such as data security risks and complicated interface with outdated systems and restricted customization independence obstruct successful implementation. Solution providers work on developing flexible analytics solutions with AI enhancements, intuitive interfaces along with easy integration access for business applications to resolve the identified challenges.

Two main segments define the low-code embedded analytics market according to deployment model and end-user industry and the market experiences rapid growth in banking, financial services, insurance (BFSI), healthcare, retail and IT sectors. The market deployment system divides into two fundamental groups: cloud-based embedded analytics and on premise embedded analytics.

Cloud-based solutions control the market because they deliver scalable solutions at competitive prices which enables enterprises to extract data insights in real time. The delivery of on premise solutions remains popular among businesses which need strict data security and compliance requirements since they offer better control and monitoring abilities.

The BFSI sector represents the biggest user group of low-code embedded analytics solutions to accomplish fraud detection tasks and management of risks and customer insight generation. The healthcare sector currently adopts analytics solutions to handle patient records alongside predictive analysis for healthcare management and operational improvement.

Through embedded analytics implementation the retail sector enhances inventory management while improving customer experience and creating personalized marketing initiatives. Software providers launch AI-powered embedded analytics tools that contain improved visualization components along with automatic system functions and advanced forecasting abilities for data-driven decision processes

The market strength of low-code embedded analytics in North America stems from how quickly artificial intelligence analytics spreads along with growing digital transformation investments and the extensive implementation of low-code development tools.

Embedded analytics solutions are growing in demand across financial services and healthcare and enterprise-based cloud applications throughout the United States and Canada. The market expands because developers actively innovate AI analytics solutions each day.

The Europe low-code embedded analytics market grows due to data transparency regulations along with rising cloud computing adoption and growing business demand for real-time business intelligence. The market for low-code analytics has seen significant development in Europe through German, French and UK companies that adopt this technology to boost their data-based strategic decisions. The business landscape in Europe compels companies to invest in secured and scalable analytic solutions because data protection remains their highest priority.

The Asia-Pacific region stands as the fastest growing market for low-code embedded analytics because digital transformation continues apace while cloud adoption grows at a rapid rate together with expanding analytics adoption within e-commerce banking and manufacturing industries. Indian and Chinese organizations together with businesses in Japan and South Korea experience significant growth in their embedded analytics requirements particularly for operational intelligence systems and enhanced customer experiences.

The market expansion receives additional momentum from government programs that support both AI implementation and big data analytics adoption. The market potential in this region is growing because of ongoing progress in AI-powered analytics together with improved cloud security despite staying challenges with data privacy.

Challenge

Integration Complexity with Legacy Systems and Data Silos

The low-code embedded analytics market establishes itself as a stumbling block because of its problems with combining legacy technology platforms and complex networked data systems. Modern enterprises encounter difficulties when implementing low-code analytics solutions in their workflows because they continue to use outdated IT infrastructure alongside on premise database management strategies.

Various data storage systems established within different company departments and individual applications prevent real-time data integration and analysis capacity. Struggling organizations face delays in adoption along with efficiency reductions because they encounter difficulties when matching data standards between modern low-code systems and their established enterprise software products.

Opportunity

Rising Demand for AI-Powered Self-Service Analytics

Market demand for self-service analytics capabilities and artificial intelligence insights creates the biggest chance for low-code embedded analytics solutions to establish themselves. Modern businesses from various industries need flexible no-code and low-code analytics solutions to help non-technical personnel create real-time analytical outputs without needing IT assistance.

Organizations can exploit actionable insights through minimal technical expertise using combinations of machine learning algorithms along with natural language processing (NLP) features and AI-powered visualization tools. Current technology trends enable embedded analytics to reach more organizations through cloud-based and API-first analytics solutions which support finance, healthcare, retail, and SaaS applications.

During the period from 2020 to 2024 the marketplace experienced swift adoption of SaaS applications and business intelligence tools and enterprise applications since organizations needed faster decision-making based on real-time data insights.

Business organizations invested in interactive dashboard technology and automation for their platform infrastructure to make data more accessible to their users. The limited adoption of these technologies stemmed from data governance issues and security problems which combined with slow legacy IT system integration processes.

The market switch will occur between 2025 and 2035 to fully automated low-code analytics platforms which use AI for real-time anomaly detection and adaptive learning models alongside conversational analytics capabilities.

The combination of embedded analytics with edge computing and IoT mechanisms and block chain data platforms will transform how companies access business intelligence data. The emerging trend of compassable analytics architecture allows businesses to dynamically build and connect low-code analytics features which enhances scalability together with flexibility levels.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Focus on data privacy regulations (GDPR, CCPA) and compliance in analytics applications. |

| Technological Advancements | Rise of low-code BI dashboards, drag-and-drop data visualization tools. |

| Sustainability Trends | Adoption of cloud-native analytics solutions for remote and hybrid workplaces. |

| Market Competition | Dominated by SaaS vendors embedding analytics into enterprise applications. |

| Industry Adoption | Widely used in finance, e-commerce, healthcare, and operational intelligence. |

| Consumer Preferences | Demand for user-friendly, no-code report generation and data visualization. |

| Market Growth Drivers | Growth fuelled by data-driven digital transformation and the rise of embedded BI. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-driven automated compliance monitoring for embedded analytics platforms. |

| Technological Advancements | Expansion of AI-driven analytics automation, natural language queries, and predictive modelling. |

| Sustainability Trends | Integration of energy-efficient AI processing and decentralized data management frameworks. |

| Market Competition | Rise of compassable analytics solutions and adaptive AI-powered embedded analytics. |

| Industry Adoption | Expansion into IoT-driven analytics, smart manufacturing, and decentralized finance (DeFi) analytics. |

| Consumer Preferences | Preference for AI-assisted, real-time decision-making and predictive data intelligence. |

| Market Growth Drivers | Expansion driven by AI-powered automation, compassable analytics, and decentralized data ecosystems. |

The United States low-code embedded analytics market continues to grow rapidly because organizations need real-time data visualization tools and Business Intelligence software solutions along with cloud-based analytics solutions. Organizations from financial, healthcare and retail industry segments invest in low-code platforms that support embedded analytics to boost their decision-making capabilities while creating automated reports and improving internal workflows.

The market demand for low-code solutions has been driving business growth through AI analytics capabilities along with self-service BI functions and API integration tools that let companies achieve cost reduction and speed up deployment processes. Market growth receives support from two factors: government support for digital transformation projects and the spread of no-code/low-code development tools throughout industry sectors.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 11.3% |

The embedded analytics segment of low-code technologies in the UK is increasing because organizations demand data-driven decisions and focus on digital transformation while the fintech and e-commerce sectors keep expanding. Companies deploy low-code analytics tools to merge visualization dashboards together with predictive analytics functionalities into their business apps without demanding expert coders.

The market is expanding because organizations apply embedded analytics to detect fraud and meet regulatory requirements and analyse customer data. The market demand for low-code platforms equipped with AI and machine learning features rises as businesses actively pursue automation through business intelligence initiatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 10.9% |

The market for low-code embedded analytics within the European Union continues to grow because of the GDPR data protection laws and the increasing use of cloud-based analytics solutions and the Industrial Revolution 4.0. Industrial automation combined with financial services and healthcare receive the highest rate of AI-based embedded analytics implementation from Germany and France along with the Netherlands.

Real-time analytics solutions with automated reporting capabilities gain increased demand because companies want more efficient operations together with enhanced productivity. Market expansion occurs because low-code analytics tools now integrate seamlessly with ERP systems and CRM solutions as well as supply chain management platforms. Edge computing and IoT-based analytics implementations together expand the use of low-code embedded analytics for predictive maintenance applications and operational intelligence functions.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 11.2% |

The embedded analytics market within Japan continues its steady expansion because businesses fast adopt digital transformation technologies while simultaneously increasing data analytics requirements in manufacturing operations and expanding their adoption of AI-driven business intelligence solutions. Industrial automation and IoT analytics activities in Japan produce greater requirements for embedded analytics within low-code platforms to optimize real-time data processing.

The Japanese banking sector along with financial services uses low-code embedded analytics systems for fraud prevention activities and risk assessment and regulatory compliance needs. Public support from the government through AI and automation policies stimulates companies to use low-code analytics solutions for improved operational performance.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 11.1% |

The South Korean low-code embedded analytics market is booming, driven by the growth of smart manufacturing, digital banking, and real-time business intelligence use cases. File a Report on South Korea’s tech-driven economy and increasing emphasis on automation and AI-powered analytics have driven high uptake of low-code platforms with integrated embedded analytics for real-time insights and process automation.

Furthermore, the increasing adoption of cloud computing and SaaS-based analytical solutions further accelerates the need for customizable, low-code BI tools. Also, the increasing adoption of digital banking, e-commerce analytics, and IoT-based applications is contributing to the accelerating adoption of low-code embedded analytics in enterprise and SME segments.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.9% |

The low-code embedded analytics market is booming as organizations embed real-time, AI driven analytics in enterprise applications. CRM analytics and supply chain analytics dominate the market among the key application segments, with a focus on engaging customers in a better way, managing inventory effectively, and enhancing business intelligence overall.

Low-code development platforms are being used by companies to seamlessly integrate analytics into CRM and supply chain management software, providing faster insights and automated reporting as well as interactive data visualization without a multitude of coding expertise.

The demand for low-code embedded analytics solutions has taken off thanks to the rise of digital transformation, AI-driven business intelligence, and the need for agile, real-time decision-making. On the other hand, businesses can leverage customized analytics dashboards, predictive modelling, and automated workflow integration, which in turn facilitate better data accessibility, user-friendly reporting, and improved operational efficiency. As hyper-personalization, automated customer engagement, and real-time logistics optimization gain prominence, the adoption of embedded analytics in CRM and supply chain applications is also on the rise.

CRM Analytics - Unlocking The Power Of Your Customer Data - The next slice of opportunity came from the embedded analytics market (with low code bases) which was led by CRM analytics as businesses turned their attention to visualizing customer data, tracking their sales performance and deploying AI-driven customer engagement strategies.

Firms are integrating low-code analytics solutions within CRM platforms as well, allowing marketers to track customer behaviour, measure lead conversion rates, and assess the performance of personalized marketing efforts, in real time.

Enterprise use of CRM analytics solutions enables the automation of sales forecasting, as well as monitoring key customer touchpoints and data segmentation for targeted engagement. The rising dependence on AI-powered customer insights, predictive sales modelling, and automating chatbot analytics has fuelled the need for embedded analytics in CRM platforms.

Respective research shows, more than 65% of enterprises that deploy low-code analytics overwhelmingly focus on CRM applications to improve customer lifecycle, boost lead generation, and enhance retention processes.

AI-powered sentiment analysis, real-time customer behaviour modelling with predictive analytics, and hyper-personalized recommendation engines are revolutionizing the field of customer relationship management in industries by automating crochet using CRM analytics solutions. This is driving strong adoption in the e-commerce, financial services, and digital marketing spaces with the ability to be integrated into CRM applications with real-time dashboards, interactive reports and AI-driven engagement tools.

While it has its benefits, adoption of CRM analytics is hindered by the complexity of data integration, data security risks, and concerns over regulatory compliance. Nonetheless, companies are overcoming these challenges with low-code AI automation, cloud-native analytics framework, and quality cybersecurity protocols to deploy CRM analytics in a seamless, secure, and scalable manner.

Stock analytics and CRM analytics solutions are gaining popularity within the e-commerce, financial services, and AI-driven marketing automation industries with the need for real-time customer data analytics and predictive engagement tools.

Low-code CRM analytics are increasingly being leveraged by e-commerce platforms to improve product recommendation personalization, increase conversion rates, and improve automation for customer support. Embedded analytics is used by financial service providers to monitor customer transactions, understand a customer’s credit risk and automate fraud detection using AI-driven CRM solutions.

In fact, in line with the ongoing focus of markets toward customer-centric strategies, AI-enabled personalization, and real-time data-driven decision-making, CRM analytics will continue to be a growth driver for the low-code embedded analytics market. Join this with advances in natural language processing (NLP/natural language processing), machine learning-based customer sentiment tracking, and embedded AI-driven engagement insights will just reinforce the market demand.

Low-code embedded analytics solutions have come a long way, with enterprises deciding to go for either cloud-based or on-premises platforms according to their data security needs, scalability, and operational efficiency. Cloud-based analytics platforms have become more popular with their flexibility, cost-effectiveness, and AI-powered automation features; on-premises analytics solutions on the other hand, are often preferred by organizations that prioritize data sovereignty, security, and compliance with industry-specific regulations.

The advent of big data analytics, AI-based business intelligence and a pressing need for real-time decision making has led enterprises to invest in low-code cloud-native analytics solutions to cover the integration for adaptive, scalable, and predictive analytics. Keeper’s on-premises platforms continue to fill a critical need in heavily governed industries, where businesses need total control of their sensitive business data and internal analytics infrastructure.

The balance between getting actionably relevant data into their hands, without overwhelming them with costly information of limited value, comes from cloud-based low-code analytics solutions that have changed the game for how organizations process, visualize and act on real-time insights from data in scalable analytics deployments across customer relationship management (CRM), supply chain and financial management applications.

Cloud-native analytics platforms are characterized by instant system updates, seamless integration with third-party APIs, and native data automation tools underpinned by AI: enabling data-driven insights in real-time while minimizing infrastructure expenses.

As businesses seek real-time, adaptive analytics capabilities, cloud-based deployment has become the preferred choice, fuelled by the growing adoption of predictive analytics, AI-powered automation, and machine learning-based data visualization. The addition of AI-driven data modelling, automated anomaly detection, and NLP-powered insights has made cloud-based low-code analytics solutions even more effective.

Cloud deployment allows business to adjust analytics CDAP infrastructure with demand, integrate cross-functional analytics tool kits, and high-level adjust decision intelligence based on machine learning. The evolution of AI-based data processing, automated business forecasting and cloud-native cybersecurity frameworks have strengthened the market position of cloud-based low-code embedded analytics platforms.

But the adoption of cloud-based analytics is still a challenge due to data privacy concerns, reliance on third-party cloud suppliers, and compliance with regulations on cross-border data management. Nevertheless, organizations are addressing these challenges with hybrid cloud approaches, block chain- powered data authentication and AI-enabled security upgrades, so data analytics on the cloud can remain secure and scalable, while meeting regulatory requirements.

For enterprises focused on internal data governance, security and compliance, on-premises deployments are still the most popular choice. On-premises analytics solutions are particularly preferred by organizations in financial services, government and healthcare fields owing to the demands of localized control over sensitive business data, decreased cybersecurity risk, and legacy infrastructure compatibility.

Organizations with on premise low-code analytical solutions gain the advantage of direct system ownership, stronger data handling capabilities, and enhanced security features, enabling them to maintain controls for security, eliminate the chances of fraud detection, and enhance their regulatory framework for reporting on real-time transactional data. Likewise, healthcare enterprises tap on-premises analytics platforms to protect patient data privacy, meet HIPAA compliance, and run logical and analytical AI clinical data analytics without external cloud dependency.

On-premise platform and infrastructure entails greater upfront cost and investment in maintaining infrastructure and dedicated IT resources but installs preference-driven firms prioritizing direct control over analytics processes, proprietary data processing, and bespoke development and customizations local solutions deployed.

As businesses adapt to emerging data privacy regulations, AI-fuelled automation strategies, and real-time business intelligence innovations, the need for cloud and on premise low-code embedded analytics solutions is poised to grow across a number of industry verticals. As development continues for AI-driven predictive analytics, self-service business intelligence tools, and hybrid analytics infrastructure, and businesses around the world embrace low-code analytics platforms to foster intelligent, data-driven decision-making across business functions.

The low-code embedded analyticsmarket is a rapidly growing industry that has been fuelled by the rise of data-driven decision-making, real-time business intelligence (BI), and a need for seamless integration of analytics into enterprise applications. Low-code embedded analytics platforms allow organizations to personalize dashboards, automate reporting, and deploy AI-driven insights with little coding experience.

The industry's major players are honing in on scalability, data visualization powered by artificial intelligence, and deployment in the cloud to accommodate ever-growing demands coming from the finance, healthcare, retail, technology, and other sectors. The overall market includes global BI software vendors, enterprise analytics solution providers, and third-party low-code/no-code development platforms that address various industries.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Microsoft Corporation | 18-22% |

| Salesforce, Inc. | 15-19% |

| QlikTech International AB | 12-16% |

| Tableau Software (Salesforce) | 8-12% |

| Sisense, Inc. | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Microsoft Corporation | Provides Power BI Embedded, allowing developers to integrate interactive reports and AI-driven insights into enterprise applications. |

| Salesforce, Inc. | Offers Tableau CRM (formerly Einstein Analytics), enabling low-code BI integration with AI-powered automation for Salesforce users. |

| QlikTech International AB | Develops Qlik Sense Embedded, a self-service low-code analytics solution with AI-enhanced data visualization capabilities. |

| Tableau Software (Salesforce) | Specializes in low-code embedded dashboards, ensuring seamless integration with third-party applications and cloud services. |

| Sisense, Inc. | Provides low-code embedded analytics APIs, focusing on real-time insights, AI-driven automation, and white-label customization. |

Key Company Insights

Microsoft Corporation

Microsoft dominates the market with Power BI Embedded, a comprehensive low-code analytics solution that enables businesses to embed AI-powered dashboards and reports into enterprise applications.

Salesforce, Inc.

Salesforce offers Tableau CRM, an AI-enhanced low-code analytics platform designed for seamless BI integration, predictive analytics, and automated reporting.

QlikTech International AB

QlikTech specializes in Qlik Sense Embedded, a low-code business intelligence solution that provides intuitive drag-and-drop analytics and real-time data connectivity.

Tableau Software (Salesforce)

Tableau delivers low-code embedded analytics, supporting customizable dashboards, machine learning integration, and enterprise-grade scalability.

Sisense, Inc.

Sisense focuses on low-code embedded analytics APIs, enabling organizations to build custom dashboards, automate insights, and deploy AI-driven BI solutions.

Other Key Players (30-40% Combined)

Several other companies contribute to the low-code embedded analytics market, focusing on customization, AI-driven data processing, and cloud-native analytics:

The overall market size for the low-code embedded analytics market was USD 15,443.6 million in 2025.

The low-code embedded analytics market is expected to reach USD 44,247.7 million in 2035.

The increasing adoption of data-driven decision-making, rising demand for real-time business insights, and growing integration of analytics into enterprise applications fuel the low-code embedded analytics market during the forecast period.

The top 5 countries driving the development of the low-code embedded analytics market are the USA, UK, European Union, Japan, and South Korea.

CRM analytics and supply chain analytics lead market growth to command a significant share over the assessment period.

Table 01: Global Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Solution

Table 02: Global Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Deployment Mode

Table 03: Global Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Enterprise Size

Table 04: Global Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Industry

Table 05: Global Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Industry

Table 06: Global Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Region

Table 07: North America Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Solution

Table 08: North America Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Deployment Mode

Table 09: North America Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Enterprise Size

Table 10: North America Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Industry

Table 11: North America Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Industry

Table 12: North America Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Country

Table 13: Latin America Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Solution

Table 14: Latin America Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Solution

Table 15: Latin America Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Enterprise Size

Table 16: Latin America Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Industry

Table 17: Latin America Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Industry

Table 18: Latin America Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Country

Table 19: South Asia & Pacific Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Solution

Table 20: South Asia & Pacific Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Deployment Mode

Table 21: South Asia & Pacific Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Enterprise Size

Table 22: South Asia & Pacific Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Industry

Table 23: South Asia & Pacific Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Industry

Table 24: South Asia & Pacific Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Country

Table 25: East Asia Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Solution

Table 26: East Asia Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Deployment Mode

Table 27: East Asia Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Enterprise Size

Table 28: East Asia Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Industry

Table 29: East Asia Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Industry

Table 30: East Asia Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Country

Table 31: Western Europe Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Solution

Table 32: Western Europe Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Deployment Mode

Table 33: Western Europe Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Enterprise Size

Table 34: Western Europe Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Industry

Table 35: Western Europe Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Industry

Table 36: Western Europe Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 37: Eastern Europe Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Solution

Table 38: Eastern Europe Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Deployment Mode

Table 39: Eastern Europe Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Enterprise Size

Table 40: Eastern Europe Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Industry

Table 41: Eastern Europe Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Industry

Table 42: Eastern Europe Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 43: Central Asia Europe Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Solution

Table 44: Central Asia Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Deployment Mode

Table 45: Middle East and Africa Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Solution

Table 46: Middle East and Africa Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Deployment Mode

Table 47: Middle East and Africa Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Enterprise Size

Table 48: Middle East and Africa Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Industry

Table 49: Middle East and Africa Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Industry

Table 50: Middle East and Africa Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Country

Figure 01: Global Market Value (US$ Million), 2018 to 2022

Figure 02: Global Market Value (US$ Million), 2023 to 2033

Figure 03: Global Market Size (US$ Million) and Y-o-Y Growth Rate from 2023 to 2033

Figure 04: Global Market Size and Y-o-Y Growth Rate from 2023 to 2033

Figure 05: Global Market: Market Share Analysis, by Solution – 2023 & 2033

Figure 06: Global Market: Y-o-Y Growth Comparison, by Solution, 2023 to 2033

Figure 07: Global Market: Market Attractiveness, by Solution

Figure 08: Global Market: Market Share Analysis, by Deployment Mode – 2023 & 2033

Figure 09: Global Market: Y-o-Y Growth Comparison, by Deployment Mode, 2023 to 2033

Figure 10: Global Market: Market Attractiveness, by Deployment Mode

Figure 11: Global Market: Market Share Analysis, by Enterprise Size – 2023 & 2033

Figure 12: Global Market: Y-o-Y Growth Comparison, by Enterprise Size, 2023 to 2033

Figure 13: Global Market: Market Attractiveness, by Enterprise Size

Figure 14: Global Market: Market Share Analysis, by Industry – 2023 & 2033

Figure 15: Global Market: Y-o-Y Growth Comparison, by Industry, 2023 to 2033

Figure 16: Global Market: Market Attractiveness, by Industry

Figure 17: Global Market: Market Share Analysis, by Region – 2023 & 2033

Figure 18: Global Market: Y-o-Y Growth Comparison, by Region, 2023 to 2033

Figure 19: Global Market: Market Attractiveness, by Region

Figure 20: North America Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 21: Latin America Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 22: East Asia Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 23: South Asia & Pacific Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 24: Western Europe Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 25: Eastern Europe Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 26: Middle East & Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 27: North America Market Value (US$ Million), 2018 to 2022

Figure 28: North America Market Value (US$ Million), 2023 to 2033

Figure 29: North America Market: Market Share Analysis, by Solution – 2023 & 2033

Figure 30: North America Market: Y-o-Y Growth Comparison, by Solution, 2023 to 2033

Figure 31: North America Market: Market Attractiveness, by Solution

Figure 32: North America Market: Market Share Analysis, by Deployment Mode – 2023 & 2033

Figure 33: North America Market: Y-o-Y Growth Comparison, by Deployment Mode, 2023 to 2033

Figure 34: North America Market: Market Attractiveness, by Deployment Mode

Figure 35: North America Market: Market Share Analysis, by Enterprise Size – 2023 & 2033

Figure 36: North America Market: Y-o-Y Growth Comparison, by Enterprise Size, 2023 to 2033

Figure 37: North America Market: Market Attractiveness, by Enterprise Size

Figure 38: North America Market: Market Share Analysis, by Industry – 2023 & 2033

Figure 39: North America Market: Y-o-Y Growth Comparison, by Industry, 2023 to 2033

Figure 40: North America Market: Market Attractiveness, by Industry

Figure 41: North America Market: Market Share Analysis, by Country – 2023 & 2033

Figure 42: North America Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 43: North America Market: Market Attractiveness, by Country

Figure 44: U.S. Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 45: Canada Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 46: Latin America Market Value (US$ Million), 2018 to 2022

Figure 47: Latin America Market Value (US$ Million), 2023 to 2033

Figure 48: Latin America Market: Market Share Analysis, by Solution – 2023 & 2033

Figure 49: Latin America Market: Y-o-Y Growth Comparison, by Solution, 2023 to 2033

Figure 50: Latin America Market: Market Attractiveness, by Solution

Figure 51: Latin America Market: Market Share Analysis, by Deployment Mode – 2023 & 2033

Figure 52: Latin America Market: Y-o-Y Growth Comparison, by Deployment Mode, 2023 to 2033

Figure 53: Latin America Market: Market Attractiveness, by Deployment Mode

Figure 54: Latin America Market: Market Share Analysis, by Enterprise Size – 2023 & 2033

Figure 55: Latin America Market: Y-o-Y Growth Comparison, by Enterprise Size, 2023 to 2033

Figure 56: Latin America Market: Market Attractiveness, by Enterprise Size

Figure 57: Latin America Market: Market Share Analysis, by Industry – 2023 & 2033

Figure 58: Latin America Market: Y-o-Y Growth Comparison, by Industry, 2023 to 2033

Figure 59: Latin America Market: Market Attractiveness, by Industry

Figure 60: Latin America Market: Market Share Analysis, by Country – 2023 & 2033

Figure 61: Latin America Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 62: Latin America Market: Market Attractiveness, by Country

Figure 63: Brazil Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 64: Mexico Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 65: Argentina Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 66: Rest of LATM Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 67: South Asia & Pacific Market Value (US$ Million), 2018 to 2022

Figure 68: South Asia & Pacific Market Value (US$ Million), 2023 to 2033

Figure 69: South Asia & Pacific Market: Market Share Analysis, by Solution – 2023 & 2033

Figure 70: South Asia & Pacific Market: Y-o-Y Growth Comparison, by Solution, 2023 to 2033

Figure 71: South Asia & Pacific Market: Market Attractiveness, by Solution

Figure 72: South Asia & Pacific Market: Market Share Analysis, by Deployment Mode – 2023 & 2033

Figure 73: South Asia & Pacific Market: Y-o-Y Growth Comparison, by Deployment Mode, 2023 to 2033

Figure 74: South Asia & Pacific Market: Market Attractiveness, by Deployment Mode

Figure 75: South Asia & Pacific Market: Market Share Analysis, by Enterprise Size – 2023 & 2033

Figure 76: South Asia & Pacific Market: Y-o-Y Growth Comparison, by Enterprise Size, 2023 to 2033

Figure 77: South Asia & Pacific Market: Market Attractiveness, by Enterprise Size

Figure 78: South Asia & Pacific Market: Market Share Analysis, by Industry – 2023 & 2033

Figure 79: South Asia & Pacific Market: Y-o-Y Growth Comparison, by Industry, 2023 to 2033

Figure 80: South Asia & Pacific Market: Market Attractiveness, by Industry

Figure 81: South Asia and Pacific Market: Market Share Analysis, by Country – 2023 & 2033

Figure 82: South Asia and Pacific Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 83: South Asia and Pacific Market: Market Attractiveness, by Country

Figure 84: India Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 85: ASEAN Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 86: Oceania Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 87: Rest of South Asia & Pacific Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 88: East Asia Market Value (US$ Million), 2018 to 2022

Figure 89: East Asia Market Value (US$ Million), 2023 to 2033

Figure 90: East Asia Market: Market Share Analysis, by Solution – 2023 & 2033

Figure 91: East Asia Market: Y-o-Y Growth Comparison, by Solution, 2023 to 2033

Figure 92: East Asia Market: Market Attractiveness, by Solution

Figure 93: East Asia Market: Market Share Analysis, by Deployment Mode – 2023 & 2033

Figure 94: East Asia Market: Y-o-Y Growth Comparison, by Deployment Mode, 2023 to 2033

Figure 95: East Asia Market: Market Attractiveness, by Deployment Mode

Figure 96: East Asia Market: Market Share Analysis, by Enterprise Size – 2023 & 2033

Figure 97: East Asia Market: Y-o-Y Growth Comparison, by Enterprise Size, 2023 to 2033

Figure 98: East Asia Market: Market Attractiveness, by Enterprise Size

Figure 99: East Asia Market: Market Share Analysis, by Industry – 2023 & 2033

Figure 100: East Asia Market: Y-o-Y Growth Comparison, by Industry, 2023 to 2033

Figure 101: East Asia Market: Market Attractiveness, by Industry

Figure 102: East Asia Market: Market Share Analysis, by Country – 2023 & 2033

Figure 103: East Asia Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 104: East Asia Market: Market Attractiveness, by Country

Figure 105: China Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 106: Japan Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 107: South Korea Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 108: Western Europe Market Value (US$ Million), 2018 to 2022

Figure 109: Western Europe Market Value (US$ Million), 2023 to 2033

Figure 110: Western Europe Market: Market Share Analysis, by Solution – 2023 & 2033

Figure 111: Western Europe Market: Y-o-Y Growth Comparison, by Solution, 2023 to 2033

Figure 112: Western Europe Market: Market Attractiveness, by Solution

Figure 113: Western Europe Market: Market Share Analysis, by Deployment Mode – 2023 & 2033

Figure 114: Western Europe Market: Y-o-Y Growth Comparison, by Deployment Mode, 2023 to 2033

Figure 115: Western Europe Market: Market Attractiveness, by Deployment Mode

Figure 116: Western Europe Market: Market Share Analysis, by Enterprise Size – 2023 & 2033

Figure 117: Western Europe Market: Y-o-Y Growth Comparison, by Enterprise Size, 2023 to 2033

Figure 118: Western Europe Market: Market Attractiveness, by Enterprise Size

Figure 119: Western Europe Market: Market Share Analysis, by Industry – 2023 & 2033

Figure 120: Western Europe Market: Y-o-Y Growth Comparison, by Industry, 2023 to 2033

Figure 121: Western Europe Market: Market Attractiveness, by Industry

Figure 122: Western Europe Market: Market Share Analysis, by Country – 2023 & 2033

Figure 123: Western Europe Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 124: Western Europe Market: Market Attractiveness, by Country

Figure 125: Germany Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 126: Italy Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 127: France Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 128: U.K. Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 129: Spain Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 130: BENELUX Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 131: Nordics Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 132: Rest of Western Europe Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 133: Eastern Europe Market Value (US$ Million), 2018 to 2022

Figure 134: Eastern Europe Market Value (US$ Million), 2023 to 2033

Figure 135: Eastern Europe Market: Market Share Analysis, by Solution – 2023 & 2033

Figure 136: Eastern Europe Market: Y-o-Y Growth Comparison, by Solution, 2023 to 2033

Figure 137: Eastern Europe Market: Market Attractiveness, by Solution

Figure 138: Eastern Europe Market: Market Share Analysis, by Deployment Mode – 2023 & 2033

Figure 139: Eastern Europe Market: Y-o-Y Growth Comparison, by Deployment Mode, 2023 to 2033

Figure 140: Eastern Europe Market: Market Attractiveness, by Deployment Mode

Figure 141: Eastern Europe Market: Market Share Analysis, by Enterprise Size – 2023 & 2033

Figure 142: Eastern Europe Market: Y-o-Y Growth Comparison, by Enterprise Size, 2023 to 2033

Figure 143: Eastern Europe Market: Market Attractiveness, by Enterprise Size

Figure 144: Eastern Europe Market: Market Share Analysis, by Industry – 2023 & 2033

Figure 145: Eastern Europe Market: Y-o-Y Growth Comparison, by Industry, 2023 to 2033

Figure 146: Eastern Europe Market: Market Attractiveness, by Industry

Figure 147: Eastern Europe Market: Market Share Analysis, by Country – 2023 & 2033

Figure 148: Eastern Europe Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 149: Eastern Europe Market: Market Attractiveness, by Country

Figure 150: Poland Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 151: Hungary Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 152: Romania Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 153: Czech Republic Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 154: Rest of Eastern Europe Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 155: Middle East and Africa Market Value (US$ Million), 2018 to 2022

Figure 156: Middle East and Africa Market Value (US$ Million), 2023 to 2033

Figure 157: Middle East and Africa Market: Market Share Analysis, by Solution – 2023 & 2033

Figure 158: Middle East and Africa Market: Y-o-Y Growth Comparison, by Solution, 2023 to 2033

Figure 159: Middle East and Africa Market: Market Attractiveness, by Solution

Figure 160: Middle East and Africa Market: Market Share Analysis, by Deployment Mode – 2023 & 2033

Figure 161: Middle East and Africa Market: Y-o-Y Growth Comparison, by Deployment Mode, 2023 to 2033

Figure 162: Middle East and Africa Market: Market Attractiveness, by Deployment Mode

Figure 163: Middle East and Africa Market: Market Share Analysis, by Enterprise Size – 2023 & 2033

Figure 164: Middle East and Africa Market: Y-o-Y Growth Comparison, by Enterprise Size, 2023 to 2033

Figure 165: Middle East and Africa Market: Market Attractiveness, by Enterprise Size

Figure 166: Middle East and Africa Market: Market Share Analysis, by Industry – 2023 & 2033

Figure 167: Middle East and Africa Market: Y-o-Y Growth Comparison, by Industry, 2023 to 2033

Figure 168: Middle East and Africa Market: Market Attractiveness, by Industry

Figure 169: Middle East and Africa Market: Market Share Analysis, by Country – 2023 & 2033

Figure 170: Middle East and Africa Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 171: Middle East and Africa Market: Market Attractiveness, by Country

Figure 172: Saudi Arabia Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 173: UAE Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 174: Turkey Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 175: Northern Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 176: South Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 177: Israel Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 178: Rest of MEA Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Embedded AI Market Size and Share Forecast Outlook 2025 to 2035

Embedded Universal Integrated Circuit Card (eUICC) Market Size and Share Forecast Outlook 2025 to 2035

Embedded Finance Market Size and Share Forecast Outlook 2025 to 2035

Embedded Controllers Market Size and Share Forecast Outlook 2025 to 2035

Embedded Multimedia Card Market Size and Share Forecast Outlook 2025 to 2035

Embedded Hypervisor Market Report – Trends, Demand & Industry Forecast 2025–2035

Smart Embedded Systems – AI-Optimized for IoT & 5G

Embedded Banking Market Insights – Growth & Forecast 2024-2034

Embedded Lending Market Trends – Growth & Forecast 2024-2034

Embedded Intelligence Market Growth – Trends & Industry Forecast 2023-2033

Embedded Business Intelligence Market Growth – Trends & Forecast 2023-2033

Embedded Smart Cameras Market Growth – Trends & Forecast 2023-2033

Embedded Security for IoT Market Report – Trends & Forecast 2017-2027

Device-Embedded Biometric Authentication Market Size and Share Forecast Outlook 2025 to 2035

Europe Embedded Finance Market – Trends & Forecast 2025 to 2035

Europe Embedded Banking Market - Trends & Forecast 2025 to 2035

Military Embedded Systems Market Size and Share Forecast Outlook 2025 to 2035

Industrial Embedded Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Embedded System Market Growth - Trends & Forecast 2024 to 2034

Analytics Of Things Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA