The embedded lending market is expanding rapidly as financial services become more integrated within digital ecosystems. Growing demand for seamless credit access, coupled with the rise of fintech partnerships, is fueling adoption across multiple industries. Businesses are leveraging embedded lending solutions to offer instant financing options within customer journeys, thereby improving engagement and conversion rates.

Regulatory support for digital lending and advancements in API-driven architectures are enhancing interoperability and compliance. The current landscape reflects strong participation from both established financial institutions and new technology entrants seeking scalable, data-driven lending solutions.

Future market growth is expected to be driven by the proliferation of e-commerce platforms, digitization of small business financing, and increasing focus on personalized credit offerings Growth rationale centers on improved customer experience, real-time risk assessment capabilities, and the ability of businesses to diversify revenue streams through integrated financial models, positioning embedded lending as a core enabler of the evolving digital economy.

| Metric | Value |

|---|---|

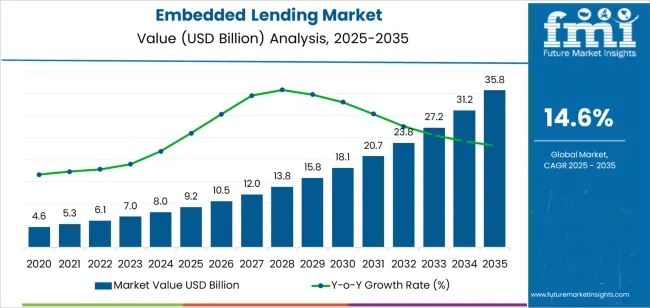

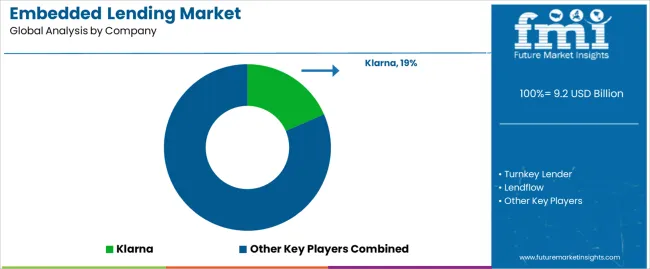

| Embedded Lending Market Estimated Value in (2025 E) | USD 9.2 billion |

| Embedded Lending Market Forecast Value in (2035 F) | USD 35.8 billion |

| Forecast CAGR (2025 to 2035) | 14.6% |

The market is segmented by Solution, Deployment, Enterprise Size, and Industry and region. By Solution, the market is divided into Embedded Lending Platform and Embedded Lending Services. In terms of Deployment, the market is classified into Cloud / Web Based and On-Premise. Based on Enterprise Size, the market is segmented into Small And Mid-Sized Enterprises (SMEs) and Large Enterprises. By Industry, the market is divided into Retail, Education, Medical And Healthcare, IT / IT Services, Real Estate, Manufacturing, Transportation, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

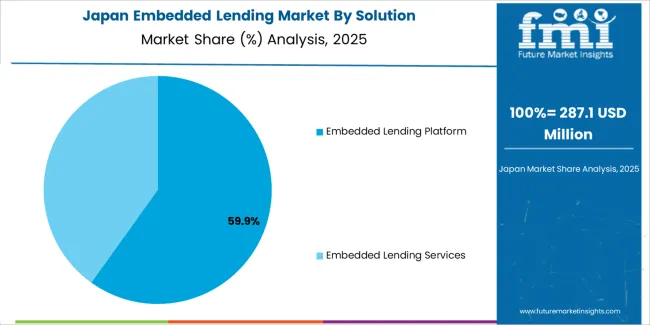

The embedded lending platform segment, holding 57.80% of the solution category, has emerged as the dominant offering due to its ability to integrate credit functionalities directly within existing digital platforms. Adoption has been driven by scalability, flexibility, and faster time-to-market for financial service delivery.

Businesses are utilizing platform-based models to streamline credit approvals and enhance borrower experiences through automation and data analytics. The segment’s leadership is reinforced by the growing adoption of open banking frameworks, enabling secure data sharing and risk profiling.

Continuous advancements in platform architecture are allowing for greater customization, improved security, and enhanced performance As organizations prioritize embedded finance strategies, platform-centric solutions are expected to maintain their dominance and drive innovation across multiple sectors.

The cloud or web-based segment, accounting for 63.40% of the deployment category, has established its leadership through scalability, cost efficiency, and remote accessibility. Enterprises are favoring cloud infrastructure to support dynamic transaction volumes and ensure faster deployment of lending solutions.

Cloud-based systems enable real-time data processing and integration with third-party applications, improving operational flexibility and compliance management. Adoption has been further supported by enhanced data security protocols and the ability to conduct predictive analytics for credit assessment.

The transition to digital ecosystems and the widespread availability of SaaS models have reinforced this segment’s growth trajectory Continuous cloud innovation and regulatory acceptance are expected to strengthen its dominance across global markets.

The small and mid-sized enterprises (SMEs) segment, representing 54.60% of the enterprise size category, has become the leading contributor owing to increasing digital adoption among smaller businesses seeking flexible financing solutions. Embedded lending enables SMEs to access instant credit options without relying on traditional banking channels, thereby improving cash flow and operational agility.

Growth in e-commerce, retail, and service-based sectors has amplified demand for integrated financial products tailored to SME needs. The segment’s share is further supported by government-backed digital finance initiatives and fintech partnerships aimed at improving credit accessibility.

Cloud-based lending models and automated risk assessment tools are empowering SMEs to obtain funding more efficiently, ensuring this segment remains a key driver of the embedded lending market’s continued expansion.

| Leading Solution | Embedded Lending Platform |

|---|---|

| Value Share (2025) | 71.30% |

Based on the solution, the embedded lending platform is projected to acquire 71.30% of the market by 2025 end. Key factors that are driving the segment growth are:

The growth of small and mid-sized enterprises is backed by the following factors:

| Leading Industry | Real Estate |

|---|---|

| Value Share (2025) | 19.40% |

By industry, the real estate segment is projected to acquire 19.40% in 2025. Over the assessment period, the industry is expected to be supported by:

Growth of embedded lending is expected to be relatively more in Asia Pacific over the forecast period than its counterparts, North America and Europe. Key factors that are driving the regional expansion in Asia Pacific are:

Embedded Lending Market Analysis by Country

| Countries | Forecast CAGR (2025 to 2035) |

|---|---|

| The United States | 16.40% |

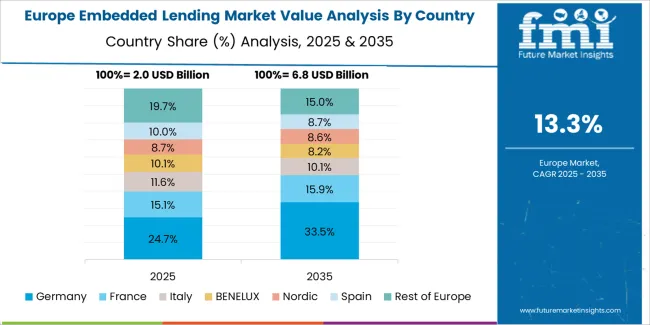

| Germany | 15.0% |

| Japan | 14.30% |

| China | 20.10% |

| Australia | 23.10% |

The Australia embedded lending industry is expected to register a CAGR of 23.1% over the forecast period, higher than the global average. Key factors that support the market growth are:

The market in China is estimated to record a CAGR of 20.1% CAGR through 2035. Top factors backing the regional market are:

The Japan embedded lending industry is projected to expand at a CAGR of 14.3% through 2035. The main forces behind the market dynamics in the country are:

The embedded lending industry in the United States is forecast to register a CAGR of 16.4% over the assessment period. The adoption of embedded lending is propelled by:

The adoption of embedded lending in Germany is projected to be at 15% CAGR over the next 10 years. Key factors that are propelling market growth are:

Fintech companies are collaborating with traditional banks to create powerful partnerships. Thus, allowing them to provide a broader range of financial products and reach more customers.

Key players are further partnering with different platforms that are linked with certain customer segments. Thereby, allowing embedded lending players to effectively reach the targeted audiences.

Industry participants are significantly investing in dynamic and user-friendly Application Programming Interfaces (APIs) to seamlessly integrate with different platforms.

This simplifies the lending process for customers and businesses. Additionally, players are leveraging artificial intelligence and data analytics to improve risk assessment, personalize loan offerings, and automate decision-making processes.

For continued growth, players are expected to expand geographically and continuously develop new products.

Latest Developments in the Embedded Lending Market

The global embedded lending market is estimated to be valued at USD 9.2 billion in 2025.

The market size for the embedded lending market is projected to reach USD 35.8 billion by 2035.

The embedded lending market is expected to grow at a 14.6% CAGR between 2025 and 2035.

The key product types in embedded lending market are embedded lending platform and embedded lending services.

In terms of deployment, cloud / web based segment to command 63.4% share in the embedded lending market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Embedded Banking Market Size and Share Forecast Outlook 2025 to 2035

Embedded AI Market Size and Share Forecast Outlook 2025 to 2035

Embedded Universal Integrated Circuit Card (eUICC) Market Size and Share Forecast Outlook 2025 to 2035

Embedded Finance Market Size and Share Forecast Outlook 2025 to 2035

Embedded Controllers Market Size and Share Forecast Outlook 2025 to 2035

Embedded Multimedia Card Market Size and Share Forecast Outlook 2025 to 2035

Embedded Hypervisor Market Report – Trends, Demand & Industry Forecast 2025–2035

Smart Embedded Systems – AI-Optimized for IoT & 5G

Embedded Intelligence Market Growth – Trends & Industry Forecast 2023-2033

Embedded Business Intelligence Market Growth – Trends & Forecast 2023-2033

Embedded Smart Cameras Market Growth – Trends & Forecast 2023-2033

Embedded Security for IoT Market Report – Trends & Forecast 2017-2027

NFT Lending Dapps Market Size and Share Forecast Outlook 2025 to 2035

Device-Embedded Biometric Authentication Market Size and Share Forecast Outlook 2025 to 2035

Europe Embedded Finance Market – Trends & Forecast 2025 to 2035

Europe Embedded Banking Market - Trends & Forecast 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Military Embedded Systems Market Size and Share Forecast Outlook 2025 to 2035

Low-Code Embedded Analytics Market Growth - Trends & Forecast 2025 to 2035

Contract Blending Services Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA