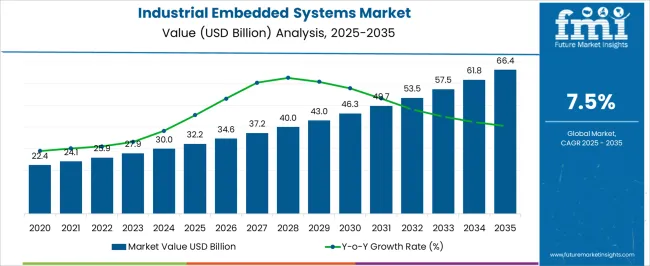

The Industrial Embedded Systems Market is estimated to be valued at USD 32.2 billion in 2025 and is projected to reach USD 66.4 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

| Metric | Value |

|---|---|

| Industrial Embedded Systems Market Estimated Value in (2025 E) | USD 32.2 billion |

| Industrial Embedded Systems Market Forecast Value in (2035 F) | USD 66.4 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The industrial embedded systems market is undergoing steady advancement driven by increased automation, the expansion of smart manufacturing, and demand for real-time system control across large-scale production environments. Rising investments in Industry 4.0 technologies, integration of AI/ML at the edge, and improvements in industrial connectivity infrastructure are transforming embedded systems from fixed-function controllers into intelligent, networked computing platforms.

Adoption is further supported by the convergence of IT and OT (Operational Technology), leading to better interoperability and centralized system diagnostics. Semiconductor innovation, component miniaturization, and power-efficient computing are making embedded systems viable for both legacy upgrades and new system installations.

With industries focusing on process visibility, predictive maintenance, and energy optimization, the market is expected to gain traction across multiple industrial verticals, particularly in environments that demand high reliability, scalability, and long-term performance.

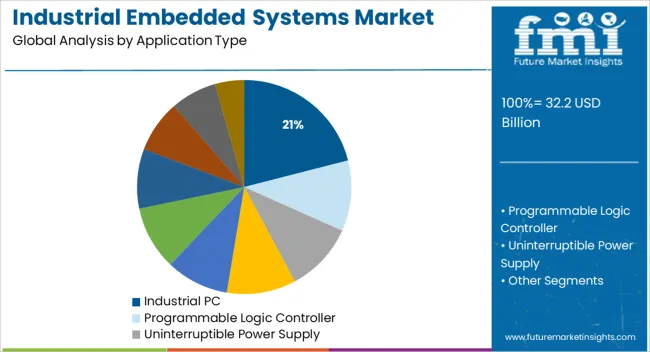

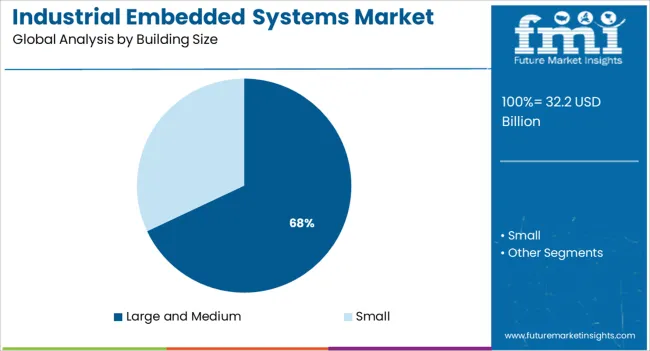

The market is segmented by Application Type and Building Size and region. By Application Type, the market is divided into Industrial PC, Programmable Logic Controller, Uninterruptible Power Supply, Micro Programmable Logic Controller, Motor Control, Industrial Sensors, Actuator, Security Systems, Industrial Communication, and Digital Input Output. In terms of Building Size, the market is classified into Large and Medium and Small. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Industrial PCs are expected to account for 21.0% of total revenue in the industrial embedded systems market by 2025, making this the leading application type segment. This leadership is attributed to their ability to support complex, data-heavy operations in environments requiring robust computing and ruggedized hardware.

Industrial PCs offer high configurability, enabling support for multiple I/O interfaces, operating systems, and real-time control functionalities. Their role in SCADA systems, factory automation, and distributed control networks continues to expand as industries prioritize remote access, cybersecurity, and system scalability.

Enhanced processor capabilities, fanless designs, and edge analytics integration have made industrial PCs suitable for harsh industrial conditions, boosting their adoption in production, energy, and utility sectors.

Large and medium-sized buildings are projected to contribute 68.0% of the overall market share in 2025, establishing this as the dominant building size segment for embedded system deployments. Growth in this segment is being supported by the extensive infrastructure required in such facilities to manage HVAC, lighting, security, and production systems through intelligent automation.

The need for integrated control solutions that ensure operational efficiency, safety, and compliance has accelerated the implementation of embedded systems. These buildings often feature complex layout and equipment hierarchies, necessitating distributed control networks and centralized monitoring capabilities.

The scalability and flexibility of embedded platforms allow seamless expansion as industrial plants grow or undergo retrofitting, reinforcing their utility in large and medium-sized operations. Energy efficiency mandates and digital twin adoption are further expected to amplify the relevance of embedded systems in these environments.

The industrial embedded systems market is primarily driven by manufacturers' increased focus on enhancing energy efficiency, which encourages the adoption of devices supported by embedded systems. In addition to wireless connectivity, smart embedded systems are being adopted in the industrial embedded systems market at a faster rate.

The industrial embedded systems market is anticipated to expand quickly over the next few years in order to increase production efficiency. The global industrial embedded systems market is anticipated to grow due to technological advancements in embedded systems that will result in higher reliability, lower operational costs, less power consumption, and improved applications.

The industrial embedded systems market is anticipated to expand across various geographies as a result of rising consumer demand for gadgets like smart meters. In addition, rising disposable income and urbanization are two other factors that will contribute to industrial embedded systems market value growth.

Robotics and industrial automation are becoming more widely used, which will accelerate the growth of the industrial embedded systems market. There will be more opportunities for industrial embedded systems market growth as a result of an increase in R&D activities and technological advancements. Over the coming years, the industrial embedded systems market will grow favorably as smarter. More energy-efficient devices are released.

The industrial embedded systems market is predicted to be dominated by North America. About 37.5% of the market share is predicted to belong to the region in 2025.

The industrial embedded systems market is anticipated to expand significantly in this region as embedded systems assist automation systems. The market is anticipated to grow as a result of increasing industry adoption of Industrial Internet of Things (IIoT) solutions and digital industry transformation.

Industrial embedded systems are anticipated to expand as a result of the big players present in the area. IoT technology is gaining popularity in the United States, and consumers are increasingly looking for smart, connected devices that minimize the need for human intervention. This trend will favorably affect the industry's growth in the industrial embedded systems market.

The biggest and fastest-growing industrial embedded systems market is in the Asia Pacific. The region will generate significant revenue in industrial embedded systems as industrialization in this area progresses. Rising per capita incomes, ongoing industrialization, and urbanization in the region are all factors contributing to the growth of the Asia Pacific industrial embedded systems market.

India, China, and Japan are anticipated to contribute to the market for industrial embedded systems as the regional market expands. Since there are more affordable electronic products available in APAC, the demand for microprocessors and microcontrollers may increase.

As autonomous robots and embedded vision systems are used more frequently, there is expected to be an increase in demand for industrial embedded systems hardware for industrial applications in APAC.

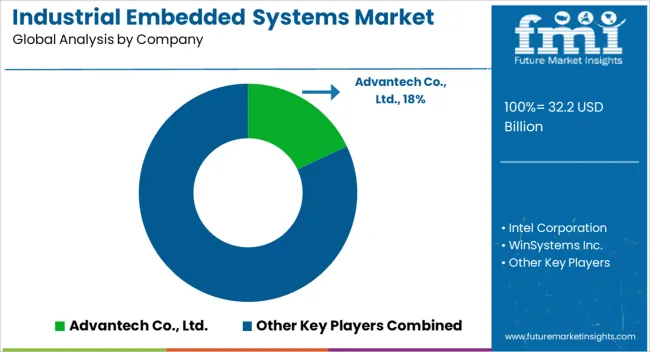

The existence of numerous manufacturers, designers, integrators, service providers, and software developers has led to a highly fragmented industrial embedded systems market. Innovation in embedded systems is a focus for several market players.

For about USD 32.2 billion in cash and stock, Broadcom purchased VMware in May 2025. As a part of Broadcom, VMware is likely to give business customers more options and flexibility to handle the most difficult IT infrastructure problems. With pro forma revenue of over USD 40 billion, including 49% software revenue, this is anticipated to accelerate software scale and growth opportunities for Broadcom.

Officially the largest acquisition in the history of semiconductors, AMD completed the acquisition of Xilinx in January 2025. The merger of two market leaders with complementary product portfolios, clientele, and market knowledge results in the creation of a premier high-performance and adaptive computing company.

Industrial embedded systems are used in a wide range of applications, such as sensors, process control, robotics, actuators, etc. Embedded systems are commonly used in industrial applications because they provide high performance, power efficiency, and robust environmental design that can withstand extreme temperatures and conditions such as water, moisture, dust, and extreme temperatures.

In addition to the ability to support a low-cost and advanced Human Machine Interface (HMI), industrial embedded systems support wired or wireless communication, as well as a number of safety features that make the operation safer. Systems on chip (SoC) and systems on module (SoM) embedded platforms are replacing the conventional micro-controllers and microprocessors found in industrial applications.

The industrial embedded systems market is largely driven by the increasing focus of manufacturers on improving energy efficiency, which leads to the adoption of embedded systems-supported devices. In addition to imaging and smart sensors, and wireless connectivity, smart embedded systems are increasingly being adopted in the market.

In order to improve production efficiency, the global embedded systems market for industrial applications is expected to grow rapidly over the coming years. Technology advancements in embedded systems are expected to drive the growth of the global industrial embedded systems market with increased reliability, reduced operational costs, reduced power consumption, and enhanced applications.

Increased demand for devices such as smart meters is expected to grow the market for industrial embedded systems in various regions. Moreover, the increase in disposable income and the growing urbanization are two factors that will drive market value growth.

The rising adoption of industrial automation and robotics will enhance the growth rate of the embedded systems market. A rise in the number of research and development activities as well as technological advancements will result in an increase in market growth opportunities. As smarter, energy-efficient gadgets are introduced, the embedded systems market's growth will be positively impacted over the next few years.

Embedded systems are facing numerous obstacles in the current age. Incorporating multiple functions in an embedded system could lead to complex design architecture. This also increases the energy consumption of embedded systems. The high energy consumption of embedded devices often results in a reduction in the overall lifetime of the device. Thus, the market for industrial embedded systems might slow down.

Operations related to embedding systems are negatively affected by changes in the business. Efforts have been made to speed up the deployment of the system. Due to low consumer demand for gadgets, adoption rates are slow in the market.

The temperature of embedded devices affects energy consumption, and it goes up as it gets hotter. As a result, the embedded system's overall performance is negatively impacted. Compact embedded systems consume a lot of energy, thus posing a great challenge to their growth.

As per the analysis, North America is expected to dominate the global industrial embedded systems market. In 2025, the region is expected to secure about 37.5% of the total market share. As embedded systems assist automation systems, the industrial embedded systems market is expected to grow significantly in this region.

Increasing adoption of Industrial Internet of Things (IIoT) solutions and the digital transformation of industries are expected to drive growth in the industrial embedded systems market.

Due to the presence of large players in the region such as Intel, and Microsoft, embedded systems are expected to grow in the near future. Additionally, IoT technology is becoming more widely accepted in the U.S., and consumers are increasingly seeking smart and connected devices that reduce the need for human intervention, which will positively impact the industry's development in the market.

According to the analysis, Asia Pacific represents the largest and fastest-growing market during the forecast period. As industrialization in this region advances, the region will generate significant revenue in industrial embedded systems during the forecast period. Asia Pacific embedded system market growth is attributed to rising per capita incomes and ongoing industrialization and urbanization in the market.

As the regional market develops, countries such as India, China, and Japan are expected to make the largest contribution to the market in industrial embedded systems. Microprocessors and microcontrollers will also be in greater demand in APAC due to the availability of low-cost electronic products in this region.

Embedded system hardware for industrial applications is also expected to increase in demand in APAC as autonomous robots and embedded vision systems are increasingly used.

Based on application the market is segmented into Industrial PC, Programmable Logic Controller, Uninterruptible Power Supply, Micro Programmable Logic Controller, Motor Control, Industrial Sensors, Actuator, Security Systems, Industrial Communication, and Digital Input Output. According to the analysis, industrial communication will account for the largest share of embedded system markets by 2025.

There are many appliances and devices that utilize embedded technology, including routers, network switches, and mobile devices. The development of high-speed networks is also facilitated through this technology.

Having key operations that utilize little power is an advantage in the communications industry since connection and uptime are so vital in the market. Security is also an advantage of embedded systems due to their integration within larger devices. A combination of all these factors has contributed to the rapid growth of industrial communication systems in the market.

As the global automation industry continues to thrive, demand for adjusting motor and valve speeds, controlling assembly-line speeds, adjusting temperatures, etc. A number of embedded solutions are available that are designed to optimize the performance and efficiency of processes as a whole. Numerous start-ups have realized the potential of the market and are firmly establishing their presence in the global market.

Some notable industrial embedded systems start-up manufacturers are as follows:

Key players in the global industrial embedded systems market include Advantech Co., Ltd., Intel Corporation, WinSystems Inc., National Instruments, Toradex Systems (India) Pvt. Ltd., Infineon Technologies AG, Beckhoff Automation GmbH & Co. KG, Atmel Corporation, Texas Instruments, VIA Technologies, Inc., Foundries.io, Black Sesame Technologies, AVIN System, Lynx, Leopard Imaging Inc., Dedicated Computing and others.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 7.5% from 2025-2035 |

| Market Value in 2025 | USD 32.2 billion |

| Market Value in 2035 | USD 66.4 billion |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Application, Building Size, Region |

| Regions Covered | USA; Canada; Brazil; Mexico; Germany; UK; France; Spain; Italy; China; Japan; South KoreaNorth America; Latin America; Europe; South Asia; East Asia; Oceania; Middle East and Africa; India; Malaysia; Singapore; Thailand; Australia; New Zealand; GCC; South Africa; Israe |

| Key Countries Profiled |

|

| Key Companies Profiled | Advantech Co., Ltd.; Intel Corporation; WinSystems Inc.; National Instruments; Toradex Systems (India) Pvt. Ltd.; Infineon Technologies AG; Beckhoff Automation GmbH & Co. KG; Atmel Corporation; Texas Instruments; VIA Technologies Inc.; Foundries.io; Black Seasame Technologies; AVIN System; Lynx; Leopard Imaging Inc.; Dedicated Computing |

| Customization | Available Upon Request |

The global industrial embedded systems market is estimated to be valued at USD 32.2 billion in 2025.

The market size for the industrial embedded systems market is projected to reach USD 66.4 billion by 2035.

The industrial embedded systems market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in industrial embedded systems market are industrial pc, programmable logic controller, uninterruptible power supply, micro programmable logic controller, motor control, industrial sensors, actuator, security systems, industrial communication and digital input output.

In terms of building size, large and medium segment to command 68.0% share in the industrial embedded systems market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Grade Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA