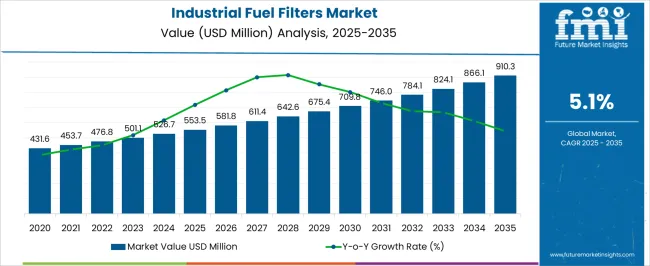

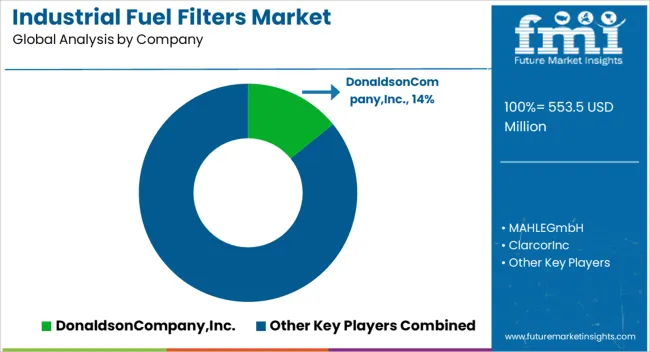

The Industrial Fuel Filters Market is estimated to be valued at USD 553.5 million in 2025 and is projected to reach USD 910.3 million by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

| Metric | Value |

|---|---|

| Industrial Fuel Filters Market Estimated Value in (2025 E) | USD 553.5 million |

| Industrial Fuel Filters Market Forecast Value in (2035 F) | USD 910.3 million |

| Forecast CAGR (2025 to 2035) | 5.1% |

The industrial fuel filters market is experiencing robust growth, fueled by rising demand for cleaner fuel delivery systems across heavy-duty applications in energy, manufacturing, and transportation sectors. Stringent emission norms and increased sensitivity of fuel injection systems have heightened the need for high-efficiency filtration to protect engines and enhance operational reliability.

Technological advancements in filter design, including multi-layered filtration media, extended service life, and enhanced water separation capabilities, have played a pivotal role in shaping the current market landscape. Growing investments in industrial machinery and expansion of the oil and gas sector have amplified the consumption of fuel filters that ensure optimal fuel quality under harsh operating conditions.

Additionally, the transition toward low-sulfur diesel and biofuels has further necessitated more precise filtration to prevent system fouling As automation and digitization penetrate deeper into industrial operations, predictive maintenance and smart monitoring of fuel filters are expected to become essential, propelling future growth opportunities in the market.

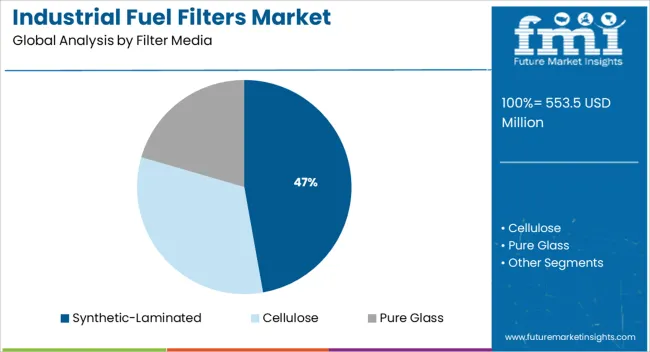

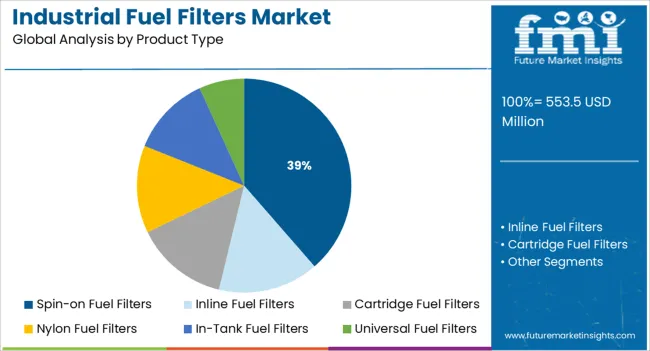

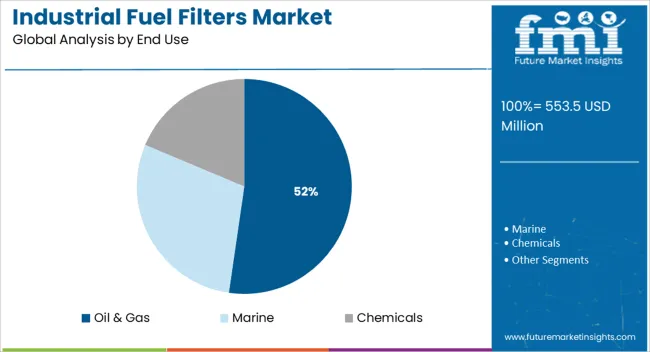

The market is segmented by Filter Media, Product Type, and End Use and region. By Filter Media, the market is divided into Synthetic-Laminated, Cellulose, and Pure Glass. In terms of Product Type, the market is classified into Spin-on Fuel Filters, Inline Fuel Filters, Cartridge Fuel Filters, Nylon Fuel Filters, In-Tank Fuel Filters, and Universal Fuel Filters. Based on End Use, the market is segmented into Oil & Gas, Marine, and Chemicals. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The synthetic laminated segment is projected to hold 47.2% of the industrial fuel filters market share in 2025, making it the most dominant filter media type. This growth is being driven by the superior filtration efficiency and extended service life offered by synthetic laminated materials, which are specifically engineered to handle high-contaminant environments.

The segment's performance advantage lies in its multilayer construction, which allows for enhanced dirt-holding capacity and consistent micron-level filtration without compromising fuel flow. Resistance to moisture, chemical degradation, and thermal stress has made synthetic laminated filters suitable for challenging operating conditions across energy and heavy equipment industries.

Their compatibility with ultra-low sulfur diesel and biofuels has further solidified their use in modern fuel systems that demand tighter contamination control The rising deployment of high-pressure common rail engines and fuel systems with minimal tolerance for impurities has accelerated the preference for synthetic laminated media, positioning it as the most reliable solution for sustained industrial performance.

The spin-on fuel filters segment is expected to account for 38.6% of the total revenue in the industrial fuel filters market by 2025, owing to its operational simplicity and rapid serviceability. The self-contained design of spin-on filters, which includes integrated housing and filtration media, has supported widespread adoption in environments where quick maintenance and system uptime are critical.

Their straightforward installation and replacement processes have made them the preferred choice in field-based operations and remote industrial setups. The compact and disposable nature of spin-on fuel filters reduces service intervals and minimizes contamination risks during maintenance, which is particularly valuable in dusty or high-particulate settings.

Technological upgrades in spin-on filters now include advanced sealing systems, pressure relief valves, and water separation features, enhancing their utility across various fuel compositions and flow rates The cost-efficiency and broad applicability across engines, compressors, and generators continue to reinforce the segment’s role as a dependable choice in industrial filtration systems.

The oil and gas sector is anticipated to represent 52.3% of the total revenue share in the industrial fuel filters market in 2025, making it the largest end-use segment. This dominance is attributed to the sector’s reliance on high-capacity equipment and continuous fuel supply systems where contamination control is critical for operational integrity. Harsh environments, ranging from offshore platforms to desert-based drilling sites, necessitate robust fuel filtration solutions capable of handling volatile conditions and variable fuel quality.

Fuel filters used in this segment are expected to perform consistently under high pressure, fluctuating temperatures, and exposure to water and particulates, all of which are common in hydrocarbon processing and transportation. The adoption of advanced engines and pumps with reduced impurity tolerance has further increased the demand for precision filtration.

Regulatory pressures surrounding emissions and equipment efficiency have also encouraged proactive maintenance strategies, where high-performance filters play a vital role As exploration and production activities expand into new geographies, fuel filters optimized for reliability and efficiency are expected to remain central to oil and gas operations.

The demand for industrial fuel filters is growing due to providing engine safety during the forecast period. Moreover, types of industrial fuel filters such as metal cartridge fuel filters, fuel injection filters, spin-on fuel filters, and metal-free filters are likely to increase the demand by end-users requirement during the forecast period. In addition, rising awareness related to environmental concerns and government initiative policies is driving the industrial fuel filter market growth in recent years.

The adoption of industrial fuel filters is growing to protect engines from harmful dust and increase the life of the engine system. On the other hand, improving engine maintenance is another factor that has flourished in the market size in recent years. In addition, controlling carbon emissions and curbing particulate pollution is other prominent factor that boosts the market share during the forecast period.

A blemished industrial fuel filter's consequences are poor gas mileage, erratic performance, and in some cases, complete engine shutdown. Even the nominal particles cause considerable wear and tear to an engine. The growing demand for long drain intervals associated with industrial fuel filters is expected to hinder the growth of the industrial fuel filter market.

Rapid industrialization and the government’s strict policy on air pollution make the Asia Pacific one of the fastest-growing industrial fuel filters market during the forecast period. The shifting of industries towards the region has observed exponential growth of industrial activities, which results in enormous emissions of pollutants. This ultimately increases the demand for industrial fuel filters, acquiring higher CAGR in the region.

Countries such as India and the Middle East countries are upsurging the chemical and oil & gas industries are growing quickly. This ultimately increases the usage of industrial fuel filters in this region during the forecast period.

The market is growing rapidly in Europe, followed by the Asia Pacific due to increasing machinery and EV electric cars in the region in recent years. Europe is likely to secure a share of 28% in the market globally during the forecast period. Moreover, rising environmental norms control air pollution in Europe.

North America is likely to secure 24% of the share during the forecast period. Due to rising new technology and increasing vehicle production rising, the market grew during the forecast period. Moreover, manufacturing is anticipated to boom in the market by investing in various automotive, and industrial fuel filters during the forecast period in the region.

The market is segmented into the type it further categorized into oil & gas, marine, and chemicals. The oil & gas industry is likely to dominate the market during the forecast period. Increasing environmental regulation and increasing technology in the industry boosted the market during the forecast period. It improves the oil & gas quality likely to accelerate the demand for oil & gas during the forecast period.

The market is fragmented by the presence of prominent players globally during the forecast period. These players are launching and developing new products and focusing on the consumer's demand as per their requirements. Some common marketing strategies are acquisitions, product launches, collaborations, and mergers.

Launches:

In June 2020, Mahle GmBH developed its new fuel filter clean line, reducing fuel pump costs.

Acquisitions:

In Aug 2020, Mann+Hummel announced an acquisition with Hardy Filtration, which helps to expand the global business footprint.

Recent Developments in the Industrial Fuel Filters

Some of the market participants in industrial fuel filters are

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.1% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million, Volume in Kilotons, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Sales Channel, Filters Media, Product Type, End-user, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Countries Profiled | The USA, Canada, Brazil, Argentina, Germany, The United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASIAN, GCC, South Africa |

| Key Companies Profiled | The Mann+Hummel Group; Donaldson Company, Inc.; MAHLE GmbH; Clarcor Inc.; AC Delco Inc.; Ahlstrom Corporation; Cummins Inc.; Sogefi SpA; Denso Corporation; Hengst Se & Co. Kg; GUD Holdings Limited; Ryco filters; Advanced Filtration Systems |

| Customization | Available Upon Request |

The global industrial fuel filters market is estimated to be valued at USD 553.5 million in 2025.

The market size for the industrial fuel filters market is projected to reach USD 910.3 million by 2035.

The industrial fuel filters market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in industrial fuel filters market are synthetic-laminated, cellulose and pure glass.

In terms of product type, spin-on fuel filters segment to command 38.6% share in the industrial fuel filters market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Industrial Furnace Industry Analysis in Europe Forecast and Outlook 2025 to 2035

Industrial Denox System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronic Pressure Switch Market Size and Share Forecast Outlook 2025 to 2035

Industrial WiFi Module Market Size and Share Forecast Outlook 2025 to 2035

Industrial Security System Market Forecast Outlook 2025 to 2035

Industrial Film Market Forecast Outlook 2025 to 2035

Industrial Floor Mat Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA