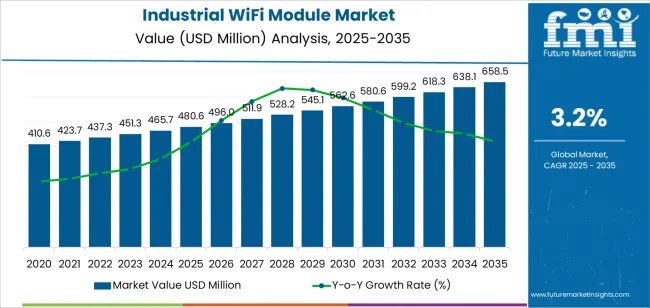

The global industrial WiFi module market is projected to reach USD 658.5 million by 2035, recording an absolute increase of USD 177.9 million over the forecast period. The industrial wifi module market is valued at USD 480.6 million in 2025 and is expected to grow at a CAGR of 3.2% over the assessment period. The overall market size is expected to grow by nearly 1.4 times during the same period, supported by increasing demand for wireless connectivity in industrial automation and IoT applications, driving demand for reliable communication modules and increasing investments in smart factory infrastructure and industrial digitalization initiatives globally.

The industrial wifi module market demonstrates steady growth momentum driven by expanding Industrial Internet of Things (IIoT) deployments requiring robust wireless connectivity, rising adoption of Industry 4.0 technologies necessitating real-time data transmission and remote monitoring capabilities, and growing integration of WiFi modules in industrial equipment enabling predictive maintenance and operational optimization. Growth is particularly concentrated in energy sector applications serving smart grid systems, renewable energy monitoring, and utility infrastructure management, transportation implementations including fleet management, vehicle telematics, and logistics tracking, and manufacturing operations where wireless connectivity supports automation, quality control, and production monitoring. The global manufacturing digitalization trend continues to drive substantial demand, with industrial WiFi modules serving as critical enabling components for wireless sensor networks, machine-to-machine communication, and edge computing architectures.

Technology advancement in WiFi standards and industrial-grade hardware is reshaping market dynamics, with manufacturers developing Wi-Fi 6 modules offering enhanced performance through higher data rates, improved spectral efficiency, and superior handling of dense device environments. The IIoT revolution creates sustained demand for modules featuring extended temperature ranges, vibration resistance, and electromagnetic compatibility meeting stringent industrial environmental requirements. Cybersecurity concerns, particularly in critical infrastructure applications, drive adoption of modules incorporating advanced encryption, secure boot capabilities, and authentication protocols protecting industrial networks from cyber threats.

Regional dynamics show accelerated growth across Asia Pacific markets, led by China's massive manufacturing base and India's expanding industrial infrastructure, while established markets in North America and Europe maintain steady investments through industrial modernization programs and smart city initiatives. However, competition from alternative wireless technologies including 5G cellular modules and proprietary industrial protocols, cybersecurity vulnerabilities requiring ongoing security updates and patches, and integration complexity with legacy industrial systems may pose challenges to market expansion in certain applications and conservative industrial environments with extended equipment lifecycles.

Between 2025 and 2030, the industrial WiFi module market is projected to expand from USD 480.6 million to USD 562.5 million, resulting in a value increase of USD 81.9 million, which represents 46.0% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for industrial wireless connectivity solutions and IIoT deployments, product innovation in Wi-Fi 6 technology offering enhanced performance and efficiency, as well as expanding smart factory implementations and industrial automation projects driving comprehensive wireless infrastructure requirements. Companies are establishing competitive positions through investment in industrial-grade hardware development, cybersecurity feature integration, and strategic market expansion across energy, transportation, and manufacturing applications.

From 2030 to 2035, the industrial wifi module market is forecast to grow from USD 562.5 million to USD 658.5 million, adding another USD 96.0 million, which constitutes 54.0% of the overall ten-year expansion. This period is expected to be characterized by the maturation of Wi-Fi 6 and emergence of Wi-Fi 6E adoption in industrial environments, strategic collaborations between module manufacturers and industrial equipment OEMs, and an enhanced focus on edge computing integration and artificial intelligence capabilities at the network edge. The growing emphasis on predictive maintenance and real-time analytics will drive demand for high-performance, reliable industrial WiFi module solutions across diverse industrial automation, infrastructure monitoring, and transportation management applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 480.6 million |

| Market Forecast Value (2035) | USD 658.5 million |

| Forecast CAGR (2025-2035) | 3.2% |

The industrial WiFi module market grows by enabling industrial equipment manufacturers and facility operators to achieve wireless connectivity, real-time data transmission, and remote monitoring capabilities while addressing harsh environmental conditions and reliability requirements unique to industrial applications. Industrial operations face mounting pressure to digitalize processes and implement predictive maintenance strategies, with industrial WiFi modules typically providing 100-1000 Mbps data rates supporting high-bandwidth sensor data, video streaming, and control system communications essential for modern smart factory operations. The IIoT ecosystem's need for standardized, interoperable wireless connectivity creates demand for WiFi-based solutions that leverage existing IT infrastructure, support seamless integration with enterprise systems, and enable flexible device deployment without dedicated wireless network buildouts.

Government Industry 4.0 initiatives and smart infrastructure programs drive adoption in manufacturing automation, energy management, and transportation systems, where wireless connectivity has a direct impact on operational efficiency and data-driven decision making. The global shift toward predictive maintenance and condition monitoring accelerates industrial WiFi module demand as operators seek real-time equipment health insights, remote diagnostics capabilities, and proactive failure prevention reducing downtime and maintenance costs. However, cybersecurity concerns regarding industrial network vulnerabilities and competition from cellular IoT technologies including 5G and LTE-M may limit adoption rates in security-critical applications and scenarios where wide-area coverage advantages favor cellular alternatives.

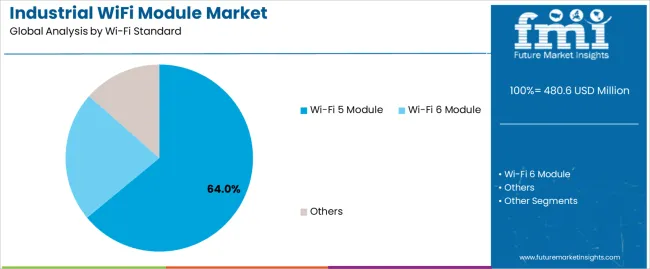

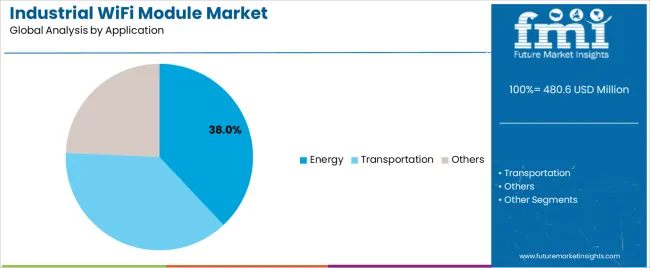

The industrial wifi module market is segmented by Wi-Fi standard, application, and region. By Wi-Fi standard, the industrial Wi-Fi module market is divided into Wi-Fi 5, Wi-Fi 6, and other modules. Based on application, the industrial wifi module market is categorized into energy, transportation, and others. Regionally, the industrial wifi module market is divided into Asia Pacific, Europe, North America, Latin America, and the Middle East & Africa.

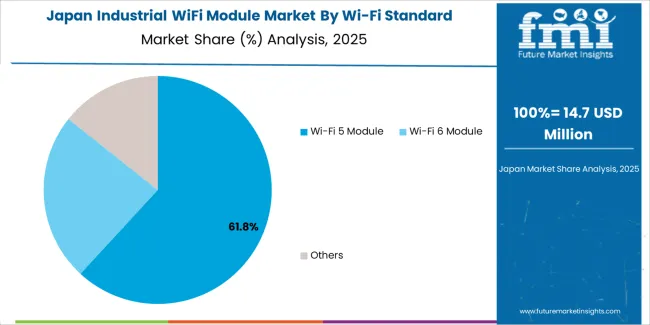

The Wi-Fi 5 module segment represents the dominant force in the industrial WiFi module market, capturing approximately 64% of total market share in 2025. This mature technology standard encompasses modules based on IEEE 802.11ac specifications, delivering proven performance with data rates up to 1.3 Gbps, dual-band operation supporting both 2.4 GHz and 5 GHz frequencies, and widespread ecosystem support including extensive driver availability and integration experience. The Wi-Fi 5 segment's market leadership stems from its established reliability in industrial deployments with years of field-proven operation, cost-effectiveness compared to newer Wi-Fi 6 alternatives supporting budget-conscious industrial projects, and sufficient performance for most current industrial applications including sensor networks, control systems, and moderate-bandwidth data transmission.

The Wi-Fi 6 module segment maintains a substantial 28.0% market share, serving next-generation industrial applications requiring enhanced performance including higher device density support, improved power efficiency through target wake time (TWT) features, and superior performance in congested RF environments through orthogonal frequency-division multiple access (OFDMA) technology. Other Wi-Fi standards including legacy Wi-Fi 4 and emerging Wi-Fi 6E formulations account for the remaining 8.0% market share.

Key advantages driving the Wi-Fi 5 module segment include:

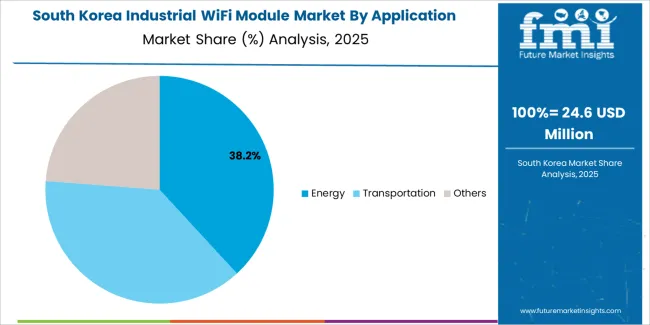

Energy applications dominate the industrial WiFi module market with approximately 38% market share in 2025, reflecting the critical importance of wireless connectivity in smart grid systems, renewable energy installations, and utility infrastructure enabling remote monitoring, automated meter reading, and distributed energy resource management. The energy segment's market leadership is reinforced by massive global smart grid deployments replacing aging utility infrastructure, renewable energy expansion requiring monitoring systems for solar farms and wind installations, and regulatory requirements driving advanced metering infrastructure (AMI) and demand response capabilities.

The transportation segment represents 32.0% market share through fleet management systems, vehicle telematics, logistics tracking applications, and intelligent transportation systems requiring real-time connectivity supporting GPS tracking, driver behavior monitoring, and cargo management. Other applications including manufacturing automation, building management systems, healthcare equipment, and retail infrastructure account for the remaining 30.0% market share.

Key market dynamics supporting application preferences include:

The industrial wifi module market is driven by three concrete demand factors tied to industrial digitalization and automation requirements. First, IIoT deployment expansion creates increasing requirements for wireless connectivity, with global IIoT device installations projected to reach 40-50 billion connected devices by 2030, requiring WiFi modules enabling sensor networks, edge computing nodes, and industrial equipment connectivity across manufacturing, energy, and infrastructure applications. Second, predictive maintenance adoption drives demand for real-time monitoring capabilities, with condition-based maintenance strategies reducing equipment downtime by 30-50% through early failure detection and proactive intervention enabled by continuous wireless data transmission from industrial assets. Third, Industry 4.0 initiatives through government programs, manufacturing competitiveness strategies, and operational excellence pursuits accelerate adoption across Asia Pacific, Europe, and North America where digital manufacturing transformation receives strategic priority and investment allocation.

Market restraints include cybersecurity vulnerabilities affecting industrial network integrity, as WiFi-connected industrial equipment creates potential attack vectors requiring ongoing security patches, network segmentation, and authentication protocols addressing sophisticated threat landscapes targeting critical infrastructure and manufacturing operations. Competition from cellular IoT technologies including 5G, LTE-M, and NB-IoT poses adoption barriers as cellular alternatives offer advantages in wide-area coverage, simplified deployment without local WiFi infrastructure, and carrier-managed security potentially displacing WiFi in certain mobile and distributed applications. Integration complexity with legacy industrial systems creates additional challenges, as retrofitting wireless connectivity into existing equipment requires protocol translation, real-time performance validation, and extensive testing ensuring wireless communication reliability meets industrial control system requirements.

Key trends indicate accelerated adoption of Wi-Fi 6 modules in demanding industrial applications, particularly scenarios requiring high device density, deterministic latency, and improved power efficiency where Wi-Fi 6 enhancements including OFDMA, target wake time, and 1024-QAM modulation deliver measurable advantages over Wi-Fi 5 implementations. Technology advancement trends toward integrated edge computing capabilities with industrial WiFi modules incorporating processing power, memory, and AI acceleration enabling local data processing, reducing cloud dependency, and supporting real-time decision-making at the network edge. However, the industrial wifi module market thesis could face disruption if 5G private networks achieve cost parity with WiFi infrastructure while delivering superior performance, coverage, and mobility support, potentially fundamentally restructuring industrial wireless connectivity preferences toward cellular technologies in specific application domains.

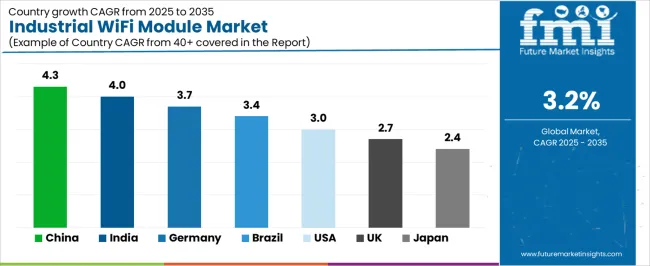

| Country | CAGR (2025-2035) |

|---|---|

| China | 4.3% |

| India | 4.0% |

| Germany | 3.7% |

| Brazil | 3.4% |

| USA | 3.0% |

| UK | 2.7% |

| Japan | 2.4% |

The industrial WiFi module market is gaining momentum worldwide, with China taking the lead thanks to massive manufacturing infrastructure and aggressive Industry 4.0 implementation programs driving comprehensive industrial connectivity requirements. Close behind, India benefits from expanding manufacturing sector and smart city initiatives requiring industrial wireless connectivity, positioning itself as a strategic growth hub in the Asia-Pacific region. Germany shows strong advancement, where industrial automation excellence and Industry 4.0 leadership strengthen its role in advanced manufacturing technology adoption. The USA demonstrates robust growth through IIoT deployment and smart infrastructure investments, signaling continued demand for industrial wireless connectivity solutions. Meanwhile, Japan stands out for its industrial technology leadership and quality manufacturing focus, while the UK continues recording progress through industrial digitalization and infrastructure modernization programs. Together, China and India anchor the global expansion story, while established markets build technological sophistication and application diversity into the industrial wifi module market's growth path.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

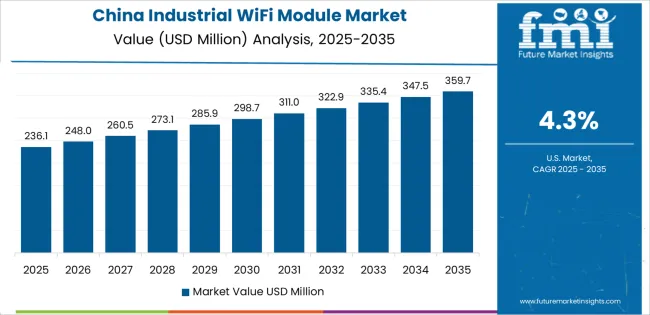

China demonstrates the strongest growth potential in the Industrial WiFi Module Market with a CAGR of 4.3% through 2035. The country's leadership position stems from comprehensive Made in China 2025 manufacturing upgrade initiatives, massive industrial equipment production base, and extensive smart factory implementations driving industrial wireless connectivity requirements across diverse manufacturing sectors. Growth is concentrated in major manufacturing regions, including Guangdong, Jiangsu, Zhejiang, and Shandong provinces, where electronics manufacturing, automotive production, and industrial equipment assembly operations integrate WiFi modules supporting factory automation, quality monitoring, and production optimization. Government support through Industry 4.0 programs and smart manufacturing incentives accelerates industrial WiFi adoption across manufacturing facilities, energy infrastructure, and transportation systems. The country's dual advantages of being both major industrial WiFi module consumer through domestic manufacturing modernization and significant producer supplying global markets create favorable conditions for sustained market expansion.

Key market factors:

In major industrial regions including Maharashtra, Tamil Nadu, Karnataka, and Gujarat, the deployment of industrial WiFi connectivity is accelerating across manufacturing facilities, energy infrastructure, and smart city projects, driven by expanding manufacturing sector, government digitalization initiatives, and growing adoption of automation technologies. The industrial wifi module market demonstrates strong growth momentum with a CAGR of 4.0% through 2035, linked to comprehensive industrial modernization and increasing focus on smart manufacturing capabilities addressing competitiveness requirements. Indian manufacturers and infrastructure operators are implementing industrial WiFi modules in factory automation systems, energy management platforms, and transportation infrastructure while navigating cost considerations and building technical expertise managing wireless industrial networks.

Germany's advanced manufacturing sector demonstrates sophisticated industrial WiFi integration, with documented implementations across automotive production, chemical processing, and machinery manufacturing showcasing wireless connectivity supporting flexible production systems and digital twin technologies. The country's industrial infrastructure in major manufacturing regions, including Baden-Württemberg, Bavaria, and North Rhine-Westphalia, showcases integration of industrial WiFi with existing automation systems, leveraging expertise in industrial networking and cyber-physical systems. German manufacturers emphasize reliability standards and industrial-grade specifications, creating demand for high-performance WiFi modules meeting stringent electromagnetic compatibility, temperature range, and certification requirements including CE marking and industrial safety standards. The industrial wifi module market maintains strong growth through Industry 4.0 leadership and advanced manufacturing innovation, with a CAGR of 3.7% through 2035.

Key development areas:

Brazil's expanding industrial sector demonstrates growing interest in automation technologies and wireless connectivity, with implementations across automotive manufacturing, food processing, and energy infrastructure supporting operational efficiency improvements and competitive positioning. The country shows solid potential with a CAGR of 3.4% through 2035, driven by manufacturing modernization initiatives, smart grid deployments, and infrastructure development programs. Brazilian manufacturers and utilities are adopting industrial WiFi connectivity supporting automation upgrades, energy management systems, and transportation infrastructure while managing equipment selection, system integration, and ongoing technical support requirements.

Key market characteristics:

The USA market demonstrates advanced industrial WiFi deployment supporting diverse applications from smart factories to critical infrastructure monitoring, with extensive implementations across automotive, aerospace, food processing, and chemical manufacturing sectors. The country shows solid potential with a CAGR of 3.0% through 2035, driven by continued IIoT adoption, infrastructure modernization programs, and advanced manufacturing initiatives supporting domestic production competitiveness. American manufacturers deploy industrial WiFi modules across automation systems, predictive maintenance platforms, and edge computing architectures leveraging extensive industrial networking expertise and technology innovation leadership.

Leading market segments:

The UK's industrial WiFi module market focuses on manufacturing modernization, infrastructure upgrades, and smart city implementations supporting industrial connectivity requirements across diverse sectors. The country maintains steady momentum with a CAGR of 2.7% through 2035, driven by industrial strategy initiatives, infrastructure investment programs, and growing adoption of Industry 4.0 technologies among progressive manufacturers. British industrial facilities implement WiFi connectivity supporting automation projects, energy management systems, and predictive maintenance applications while navigating integration with existing systems and building operational expertise.

Key market characteristics:

In major industrial centers including Tokyo, Osaka, Nagoya, and Fukuoka regions, manufacturers and infrastructure operators utilize industrial WiFi modules across advanced manufacturing facilities, transportation systems, and energy infrastructure, with documented emphasis on reliability, quality, and seamless integration with sophisticated automation systems. The industrial wifi module market shows steady growth potential with a CAGR of 2.4% through 2035, linked to continuous manufacturing excellence pursuits, infrastructure modernization programs, and technology leadership in industrial automation and robotics. Japanese manufacturers demonstrate particular expertise in integrating wireless connectivity with precision manufacturing systems, collaborative robotics, and quality control systems requiring reliable, deterministic communication performance.

Market development factors:

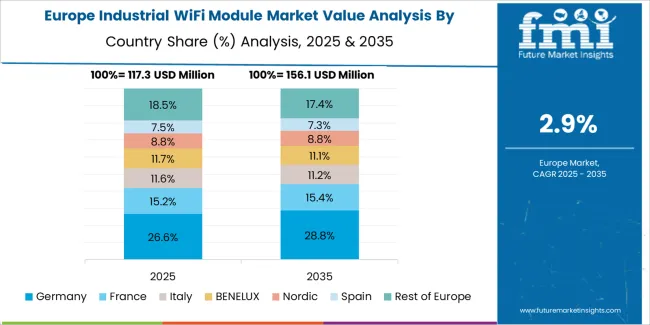

The industrial WiFi module market in Europe is projected to grow from USD 152.0 million in 2025 to USD 202.0 million by 2035, registering a CAGR of 2.9% over the forecast period. Germany is expected to maintain its leadership position with a 32.5% market share in 2025, declining slightly to 31.8% by 2035, supported by its extensive manufacturing infrastructure and major industrial regions including Baden-Württemberg, Bavaria, and North Rhine-Westphalia production centers. The United Kingdom follows with a 18.8% share in 2025, projected to reach 19.2% by 2035, driven by industrial digitalization initiatives and infrastructure modernization programs. France holds a 16.5% share in 2025, expected to rise to 16.8% by 2035 through manufacturing automation and smart infrastructure projects. Italy commands a 13.2% share in both 2025 and 2035, backed by machinery manufacturing and industrial automation sectors. Spain accounts for 9.5% in 2025, rising to 9.7% by 2035 on growing industrial automation adoption. The Netherlands maintains 5.8% in 2025, reaching 6.0% by 2035 on logistics automation and smart port implementations. The Rest of Europe region is anticipated to hold 3.7% in 2025, expanding to 3.8% by 2035, attributed to diverse industrial developments across Nordic countries and emerging Central & Eastern European manufacturing growth.

The Japanese industrial WiFi module market demonstrates mature technology integration characterized by sophisticated manufacturing systems, stringent quality requirements, and advanced automation platforms incorporating wireless connectivity supporting precision production and collaborative robotics applications. Japan's emphasis on manufacturing excellence and continuous improvement drives demand for industrial-grade WiFi modules delivering consistent performance, electromagnetic compatibility, and seamless integration with existing factory automation infrastructure. The industrial wifi module market benefits from domestic electronics manufacturing expertise and established supply relationships between Japanese module manufacturers including Murata Manufacturing and international suppliers, creating comprehensive procurement ecosystems prioritizing reliability, technical support, and long-term product availability. Major industrial centers showcase advanced WiFi implementations across automotive production, electronics manufacturing, and machinery fabrication where wireless connectivity supports flexible manufacturing systems, quality monitoring, and predictive maintenance applications.

The South Korean industrial WiFi module market is characterized by advanced manufacturing capabilities and growing IIoT adoption, with manufacturers implementing wireless connectivity through semiconductor fabrication facilities, automotive production lines, and electronics assembly operations requiring reliable industrial communication supporting automation systems and quality control processes. The industrial wifi module market demonstrates emphasis on technology innovation and manufacturing competitiveness, as Korean manufacturers increasingly adopt Industry 4.0 technologies incorporating industrial WiFi modules enabling real-time production monitoring, predictive maintenance analytics, and flexible manufacturing configurations. Domestic electronics companies supply substantial module volumes while international suppliers provide specialized industrial-grade products for demanding applications. The competitive landscape shows strong presence of domestic electronics manufacturers including LG Innotek supplying WiFi modules alongside international industrial connectivity specialists, creating diverse supply options combining local manufacturing capabilities with global technology innovation and application expertise.

The industrial WiFi module market features approximately 25-35 meaningful players with moderate concentration, where established cellular module manufacturers, specialized WiFi technology companies, and electronics component suppliers compete across industrial-grade product offerings and application-specific solutions. Market leadership distributes across companies with different technology focus areas including cellular/WiFi converged module portfolios, pure-play WiFi specialists, and semiconductor companies offering connectivity solutions. Competition centers on industrial qualification credentials, technical performance, and comprehensive support rather than module pricing alone, as end-users prioritize proven reliability, long-term availability, and vendor technical expertise in industrial WiFi module selection decisions.

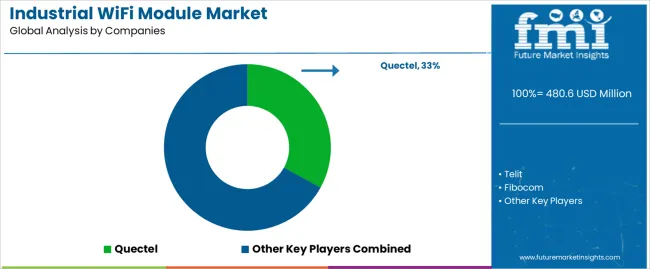

Market leaders include Quectel, Telit, and Fibocom, which maintain competitive advantages through extensive wireless module portfolios spanning cellular and WiFi technologies, global sales and technical support networks, and comprehensive industrial certifications meeting diverse regional and application-specific requirements. These companies leverage established customer relationships with industrial equipment OEMs, extensive product roadmaps ensuring technology evolution and long-term availability, and comprehensive development tools including evaluation kits, reference designs, and integration support accelerating customer product development cycles.

Challengers encompass Espressif, Cavli Wireless, and Sierra Wireless, which compete through specialized technology focus, innovative product architectures, or integrated solutions combining connectivity with processing capabilities. WiFi technology specialists, including Laird Connectivity, SparkLAN, and U-Blox, focus on industrial-grade WiFi solutions offering differentiated capabilities in rugged hardware design, extended temperature operation, or application-optimized configurations serving specific industrial verticals.

Technology giants including Huawei and electronics manufacturers including Murata Manufacturing create market dynamics through comprehensive technology portfolios, semiconductor integration advantages, and substantial R&D capabilities advancing WiFi performance and industrial suitability. Market dynamics favor companies that combine proven industrial qualification and reliability with comprehensive technical support and flexible commercial models addressing diverse customer requirements from module-only procurement through turnkey connectivity solutions, alongside ongoing relationships ensuring technology roadmap alignment, obsolescence management, and responsive technical support throughout extended industrial product lifecycles.

Industrial WiFi modules represent critical connectivity components that enable industrial equipment manufacturers and facility operators to achieve wireless communication, real-time data transmission, and remote monitoring capabilities in harsh industrial environments, typically delivering 100-1000 Mbps data rates supporting sensor networks, control systems, and video surveillance while withstanding extended temperature ranges, vibration, and electromagnetic interference characterizing industrial operating conditions. With the industrial wifi module market projected to grow from USD 480.6 million in 2025 to USD 658.5 million by 2035 at a 3.2% CAGR, these specialized modules offer compelling value - industrial reliability, ecosystem compatibility, and flexible deployment - making them essential for energy applications (38.0% market share), transportation systems (32.0% share), and industrial operations requiring wireless connectivity supporting automation, predictive maintenance, and operational optimization across manufacturing, infrastructure, and logistics environments. Scaling effective deployment and ensuring reliable performance requires coordinated action across industrial policy, wireless standards, module manufacturers, equipment OEMs, and system integration expertise.

How Governments Could Support Industrial Digitalization?

How Industry Bodies Could Support Market Development?

How Module Manufacturers Could Strengthen Offerings?

How Equipment OEMs Could Enable Adoption?

How System Integrators Could Facilitate Deployment?

How Investors Could Support Market Growth?

| Item | Value |

|---|---|

| Quantitative Units | USD million |

| Wi-Fi Standard | Wi-Fi 5 Module, Wi-Fi 6 Module, Others |

| Application | Energy, Transportation, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Quectel, Telit, Fibocom, Espressif, Cavli Wireless, Sierra Wireless, Laird Connectivity, SparkLAN, U-Blox, Huawei |

| Additional Attributes | Dollar sales by Wi-Fi standard and application categories, regional adoption trends across Asia Pacific, North America, and Europe, competitive landscape with cellular module manufacturers and WiFi technology specialists, industrial qualification requirements including extended temperature and EMC compliance, cybersecurity features addressing industrial IoT threats, integration with industrial protocols and control systems, edge computing capabilities enabling local processing, and deployment considerations including network design, protocol translation, and lifecycle management across diverse industrial environments. |

The global industrial wifi module market is estimated to be valued at USD 480.6 million in 2025.

The market size for the industrial wifi module market is projected to reach USD 658.5 million by 2035.

The industrial wifi module market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in industrial wifi module market are wi-fi 5 module, wi-fi 6 module and others.

In terms of application, energy segment to command 38.0% share in the industrial wifi module market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Furnace Industry Analysis in Europe Size and Share Forecast Outlook 2025 to 2035

Industrial Absorbent Market Size and Share Forecast Outlook 2025 to 2035

Industrial Denox System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronic Pressure Switch Market Size and Share Forecast Outlook 2025 to 2035

Industrial Security System Market Forecast Outlook 2025 to 2035

Industrial Film Market Forecast Outlook 2025 to 2035

Industrial Floor Mat Market Forecast Outlook 2025 to 2035

Industrial Insulation Market Forecast and Outlook 2025 to 2035

Industrial Process Water Coolers Market Forecast and Outlook 2025 to 2035

Industrial Grade Ammonium Hydrogen Fluoride Market Forecast and Outlook 2025 to 2035

Industrial Grade Sodium Bifluoride Market Forecast and Outlook 2025 to 2035

Industrial Evaporative Condenser Market Size and Share Forecast Outlook 2025 to 2035

Industrial Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Industrial Crystallizer Market Size and Share Forecast Outlook 2025 to 2035

Industrial Counterweight Market Size and Share Forecast Outlook 2025 to 2035

Industrial Gas Market Size and Share Forecast Outlook 2025 to 2035

Industrial Furnace Market Size and Share Forecast Outlook 2025 to 2035

Industrial Weighing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Industrial Drum Market Size and Share Forecast Outlook 2025 to 2035

Industrial Food Slicers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA