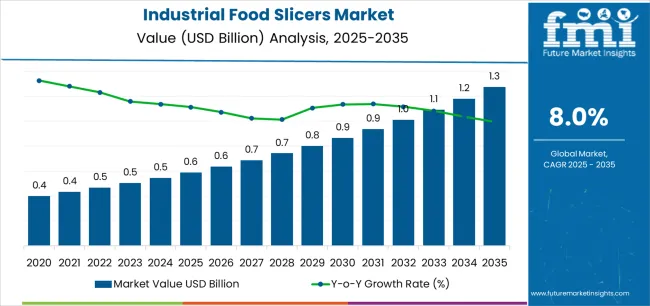

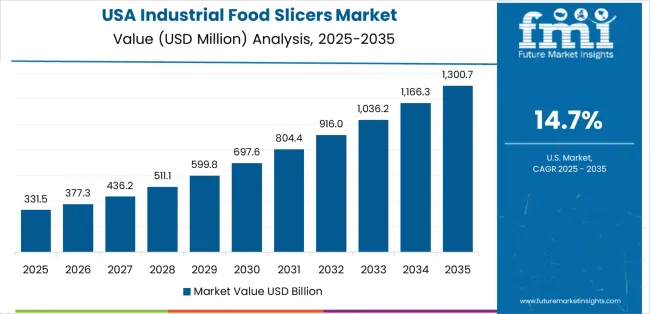

The industrial food slicers market is projected to grow from USD 0.6 billion in 2025 to USD 1.3 billion by 2035, at a CAGR of 8.0%. Growth will be supported by automation in food processing, rising demand for consistent slicing in the meat and deli industries, and increased deployment across global food manufacturing operations. As per Future Market Insights, recognized by ESOMAR for upholding global analytics standards, the expansion from USD 0.6 billion in 2025 to USD 1.3 billion in 2035 highlights the accelerating adoption of precision slicing solutions integrated with digital and automated systems.

During the first half of the forecast period (2025–2030), the industry is expected to advance from USD 0.6 billion to approximately USD 0.9 billion, generating USD 0.3 billion in new value and accounting for around 45% of the decade’s growth. This stage will be shaped by modernization of meat and poultry processing lines and early adoption in developed economies.

In the latter half (2030–2035), expansion is expected to continue from USD 0.9 billion to USD 1.3 billion, contributing an additional USD 0.4 billion, or 55%, of the overall growth. This period will be characterized by the stronger penetration of automated slicers, increased integration with digital monitoring, and growing traction in emerging economies.

| Period | Primary Revenue Buckets | Share (%) | Notes |

|---|---|---|---|

| Today | Horizontal slicers | 40% | Core adoption in meat & deli processing |

| Today | Meat & poultry applications | 30% | Main demand center across global markets |

| Future (3–5 yrs) | Automated slicers with digital monitoring | 30–35% | Operational efficiency, consistent quality |

| Future (3–5 yrs) | Multi-product slicing solutions | 20–25% | Expanding use in bakery, cheese, and ready meals |

| Future (3–5 yrs) | Compact/mobile slicers | 15–20% | Adoption by mid-sized processors |

| Future (3–5 yrs) | Sustainable/easy-clean slicers | 10–15% | Compliance with food safety regulations |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 0.6 billion |

| Market Forecast (2035) | USD 1.3 billion |

| Growth Rate | 8.0% CAGR |

| Leading Product | Horizontal Slicers (40%) |

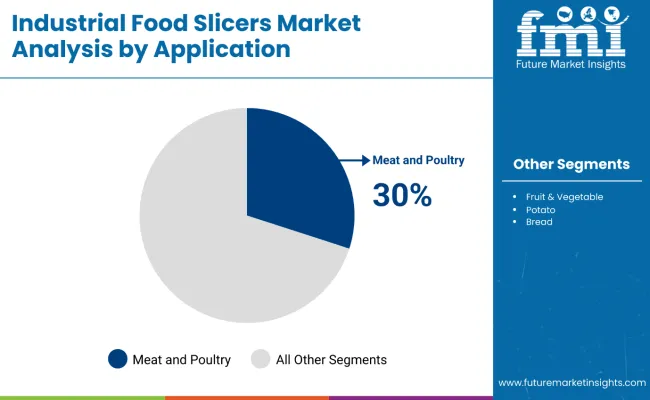

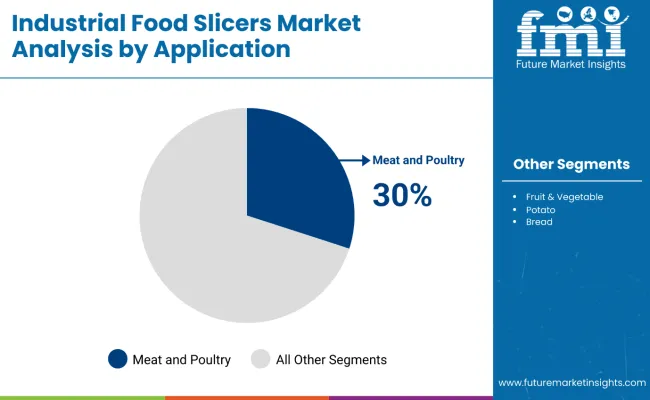

| Primary Application | Meat & Poultry (30%) |

The market demonstrates strong fundamentals with automation and efficiency driving adoption. While North America and Europe remain mature, the Asia-Pacific region is expected to be the fastest-growing region, led by China, India, Japan, and Indonesia. Meat and poultry remain the core applications, while bakery, cheese, and ready meals exhibit emerging growth potential.

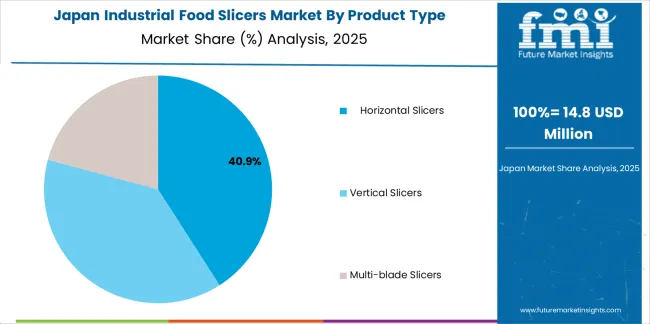

Primary Classification: By product type — horizontal slicers, vertical slicers, and multi-blade slicers.

Secondary Classification: By application — meat & poultry, cheese, bakery, fruits & vegetables, and others.

Regional Classification: North America, Latin America, Europe, Asia-Pacific, Middle East & Africa.

By Product Type, Horizontal Slicers Hold Market Leadership

Market Position: Horizontal slicers accounted for 40% market share in 2025, widely adopted in meat and deli processing.

Drivers: Consistent slice thickness, efficiency in large-scale production.

By Application, Meat & Poultry Lead Demand

Market Position: 30% market share in 2025, driven by rising processed meat consumption.

Drivers: Expanding packaged food demand and efficiency gains in industrial meat processing.

Regional Outlook: The Asia-Pacific region emerges as the fastest-growing market, while North America and Europe exhibit strong adoption of automation. Latin America and MEA show moderate but rising demand.

Market Position: Horizontal slicers account for the leading position in the industrial food slicers market, with a 40% share in 2025. These machines dominate large-scale meat and deli operations due to their superior efficiency, consistent slice thickness, and ability to optimize production throughput across diverse industrial and commercial food environments.

Value Drivers: Horizontal slicers benefit from processor preference for reliable equipment that delivers uniform performance, reduced setup time, and operational efficiency without major infrastructure modifications. Advanced engineering enables automated controls, slice consistency, and integration with existing processing lines, where operational performance and food safety compliance are critical requirements.

Competitive Advantages: Horizontal slicers differentiate through proven operational stability, durability under high-capacity usage, and seamless integration with automated food processing systems. These features enhance facility effectiveness while ensuring optimal food safety and quality standards suitable for meat, poultry, and deli applications.

Key market characteristics:

Market Context: Electric-powered slicers demonstrate the highest growth rate in the industrial food slicers market, with a market share of 42% due to their eco-compliance, suitability for indoor food environments, and increasing demand for energy-efficient, emission-free food processing equipment.

Appeal Factors: Electric slicer users prioritize system reliability, hygiene compliance, and integration with existing automated infrastructure. These machines benefit from modernization programs that emphasize energy savings, reduced maintenance, and cleaner operation.

Growth Drivers: Food safety regulations and energy-efficiency mandates position electric slicers as standard in modern processing facilities. Rising demand from ready-to-eat and packaged food manufacturers reinforces adoption of low-emission slicing equipment.

Market Challenges: Standardization of motor/battery technology and varying facility electrical requirements may limit seamless adoption across all processor types.

Application dynamics include:

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Rising demand for processed & packaged foods | ★★★★★ | Expanding global food processing industry requires slicing automation |

| Driver | Automation & labor efficiency | ★★★★★ | Cuts labor costs, improves consistency |

| Driver | Hygiene & food safety regulations | ★★★★☆ | Pushes adoption of easy-clean, stainless designs |

| Restraint | High upfront costs | ★★★★☆ | Barrier for small processors in emerging markets |

| Restraint | Maintenance & training | ★★★☆☆ | Requires skilled operators and regular servicing |

| Trend | Smart & IoT-enabled slicers | ★★★★★ | Predictive maintenance and monitoring drive next-gen adoption |

| Trend | Sustainability & eco-design | ★★★★☆ | Machines designed for energy efficiency, longer lifecycle |

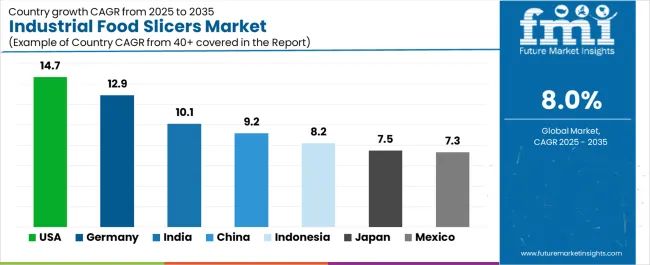

The market exhibits diverse regional growth patterns, with the USA, Germany, China, and India showing the strongest expansion.

| Region / Country | Growth (2025–2035 CAGR) | How to Win | What to Watch Out |

|---|---|---|---|

| USA | 14.66 | Lead in automation, efficiency solutions | Cost sensitivity among mid-tier processors |

| Germany | 12.90 | Premium slicers with precision engineering | Strict regulatory compliance |

| China | 9.19 | Localized production with scalable solutions | Price competition, IP issues |

| India | 10.10 | Affordable mid-range slicers | Fragmented processing market |

| Japan | 7.49 | High-tech automated slicers | Aging workforce, shrinking meat consumption |

| Indonesia | 8.20 | Compact, easy-to-use slicers | Infrastructure and cold chain gaps |

| Mexico | 7.32 | Meat and poultry expansion | Import dependency |

The USA emerges as the most dynamic market with a 14.66% CAGR, driven by strong demand for automation, efficiency, and hygiene compliance in meat and poultry processing. Advanced slicer technology is being rapidly integrated across deli and packaged food operations, supported by large-scale processors with significant capital expenditure capabilities. Growth is concentrated in food hubs such as California, Texas, and Illinois, where industrial automation trends and ready-to-eat food production dominate.

American food processors emphasize premium, automated slicers that integrate with digital monitoring and predictive maintenance systems. Market expansion is reinforced by strict food safety regulations, compelling adoption of easy-clean, stainless-steel slicers.

Strategic Market Indicators:

Germany posts a 12.90% CAGR, anchored by its advanced food processing sector and strong export capabilities. German facilities emphasize premium engineering, precision cutting, and compliance with EU food safety standards. Adoption is concentrated in regions such as Bavaria and North Rhine-Westphalia, where high-value meat and cheese industries thrive.

The country benefits from strong R&D and collaboration between domestic slicer manufacturers and European food processing firms. Regulatory compliance ensures premium slicers dominate, though the strict environment also slows flexibility for small entrants.

Strategic Market Indicators:

China shows a 9.19% CAGR, fueled by localized manufacturing and scalable solutions for large food processors. Urban centers such as Shanghai, Beijing, and Guangzhou lead slicer adoption, especially in processed meat and bakery products. Rising middle-class demand for packaged foods is accelerating investment in food automation.

Domestic producers are competing aggressively with international brands, offering cost-effective slicers tailored for Chinese facilities. The price competition, intellectual property issues, and fragmented regional standards pose challenges.

Strategic Market Indicators:

India achieves a 10.10% CAGR, supported by expanding packaged food and meat processing sectors. Growth is concentrated in major metropolitan hubs such as Mumbai, Delhi, and Bangalore, where food manufacturing modernization is accelerating. Domestic mid-range slicers are in demand, catering to fragmented processing markets and cost-sensitive buyers.

Government food safety initiatives and rising urban consumption patterns further drive adoption, while global brands find opportunities in premium, automated slicer segments.

Strategic Market Indicators:

Japan records a 7.49% CAGR, with growth tied to advanced automation and high-tech slicer deployment in precision food environments. Facilities emphasize hygiene, efficiency, and long lifecycle machines. Demand is centered on meat and convenience food facilities in urban hubs like Tokyo and Osaka.

The aging workforce and declining meat consumption challenge long-term demand. Japanese processors are shifting toward ready-to-eat and convenience foods, boosting demand for compact, automated slicers.

Strategic Market Indicators:

Indonesia achieves an 8.20% CAGR, driven by rapid urbanization and rising demand for affordable packaged foods. Compact and easy-to-use slicers are particularly attractive for mid-sized processors and emerging bakery chains.

Challenges persist in infrastructure and cold chain logistics, slowing adoption in rural regions, foreign partnerships and low-cost imports are expanding accessibility.

Strategic Market Indicators:

Mexico is projected to grow at a 7.32% CAGR in the industrial food slicers market from 2025 to 2035, with momentum coming primarily from its meat and poultry processing industry, one of the country’s most dynamic agribusiness sectors. Major processing hubs such as Monterrey, Guadalajara, and Mexico City are leading adoption as facilities modernize operations to meet both domestic consumption needs and export-oriented production standards. Increasing demand for packaged, ready-to-eat meat products is prompting processors to replace manual slicing methods with automated and semi-automated slicers that offer consistency, hygiene, and efficiency.

Despite this growth, import dependency remains a challenge. Mexico’s domestic production of industrial slicers is limited, creating reliance on international suppliers, particularly from the United States and Europe. The growing cross-border collaborations with U.S. manufacturers are helping bridge the gap by improving equipment availability, aftersales support, and technical servicing. The United States–Mexico–Canada Agreement (USMCA) has further facilitated trade in food machinery, lowering barriers for technology transfer.

Strategic Market Indicators:

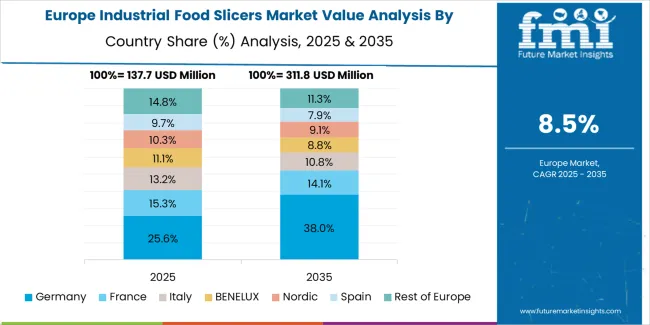

The European industrial food slicers market is projected to grow from USD 220.0 million in 2025 to USD 320.0 million by 2035, registering a CAGR of 3.9% over the forecast period. Growth is underpinned by strong regulatory compliance, advanced food processing infrastructure, and a mature packaged food sector across the region.

Germany maintains the largest share at 28.5% in 2025, supported by its precision engineering capabilities, premium positioning in meat and cheese processing, and strong export orientation. The market is expected to expand at a 3.7% CAGR, reflecting steady adoption of automation and hygiene-certified slicers.

Italy represents the second-largest market with 22.0% share in 2025, driven by its vibrant deli, cured meats, and bakery sectors, and is forecast to grow at a 4.0% CAGR as artisanal traditions integrate with modern slicer technologies. France accounts for 20.5% share in 2025, growing at 3.6% CAGR, with demand concentrated in bakery and cheese slicing applications, alongside rising clean-label and organic food processing needs.

Spain follows with 15.0% share in 2025 and a relatively higher 4.3% CAGR, reflecting growth in meat processing and retail modernization. The Netherlands and Rest of Europe collectively contribute 14.0% share in 2025, expected to grow at 4.1% CAGR, supported by strong packaged food demand in Nordic countries and sustainability-driven slicer adoption in BENELUX markets.

In Germany, the industrial food slicers market is anchored by horizontal slicer systems, which capture the largest share across meat, deli, and cheese processing facilities. German food manufacturers emphasize precision, hygiene, and durability, creating strong demand for slicers engineered with stainless-steel designs, EU-compliant safety features, and advanced automation compatibility. Facilities require consistent slicing performance with minimal waste, reinforcing the leadership of horizontal slicers as the backbone of industrial food processing operations. Other slicer types including vertical and multi-blade maintain smaller positions, serving bakery and specialty food segments where specific slicing characteristics are required but overall demand remains secondary.

Market Characteristics:

In the United Kingdom, the market structure favors international food machinery brands such as Bizerba, Hobart, and Berkel, which hold leading positions through comprehensive product portfolios and strong distribution networks. These companies dominate in meat, cheese, and ready-meal processing, providing end-to-end solutions that combine advanced slicer systems with technical training, maintenance, and aftersales support. British food operators value turnkey service offerings that reduce operational complexity and ensure compliance with food safety regulations. Local distributors and service providers capture a moderate share by offering competitive pricing, tailored maintenance services, and niche slicing solutions for smaller bakeries and delis.

Channel Insights:

Structure: ~20–25 credible players; top 5 account for ~40–45% revenue.

Leadership: Established via technology, durability, automation, and service support.

Commoditization: Standard slicers without digital monitoring.

Margin Opportunities: Automated slicers, easy-clean solutions, multipurpose slicing.

| Stakeholder | What They Control | Strengths | Weak Spots |

|---|---|---|---|

| Global manufacturers | Automation integration, R&D, quality control | Technology leadership | Price competitiveness in emerging markets |

| Regional suppliers | Affordable, locally adapted slicers | Proximity to markets | Limited scalability |

| Premium brands | Hygiene-focused, durable machines | Compliance & reliability | Higher pricing |

| Innovation leaders | IoT-enabled, predictive maintenance | Differentiation, service bundles | Complexity, training required |

| Item | Value |

|---|---|

| Quantitative Units | USD 0.6 billion |

| Product Type | Horizontal, Vertical, Multi-blade slicers |

| Application | Meat & Poultry, Cheese, Bakery, Fruits & Vegetables, Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | USA, Germany, China, India, Japan, Indonesia, Mexico, Brazil, Italy, France, UK, South Africa, and others |

| Key Companies | Bizerba, Hobart, Berkel, Vollrath, Grote Company |

| Additional Attributes | Dollar sales by product & application; regional adoption trends; competitive landscape; automation integration; innovations in digital monitoring & smart slicers; food safety & compliance features. |

The global industrial food slicers market is estimated to be valued at USD 0.6 billion in 2025.

The market size for the industrial food slicers market is projected to reach USD 1.3 billion by 2035.

The industrial food slicers market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in industrial food slicers market are horizontal slicers, vertical slicers and multi-blade slicers.

In terms of application, meat & poultry segment to command 40.0% share in the industrial food slicers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Industrial Crystallizer Market Size and Share Forecast Outlook 2025 to 2035

Industrial Counterweight Market Size and Share Forecast Outlook 2025 to 2035

Industrial Gas Market Size and Share Forecast Outlook 2025 to 2035

Industrial Furnace Market Size and Share Forecast Outlook 2025 to 2035

Industrial Weighing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Industrial Drum Market Size and Share Forecast Outlook 2025 to 2035

Industrial Printer Market Size and Share Forecast Outlook 2025 to 2035

Industrial Fryers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Paper Sacks Market Size and Share Forecast Outlook 2025 to 2035

Industrial Chemical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Industrial Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Industrial Valve Market Size and Share Forecast Outlook 2025 to 2035

Industrial Air Filtration Market Size and Share Forecast Outlook 2025 to 2035

Industrial Phosphates Market Size and Share Forecast Outlook 2025 to 2035

Industrial Elevators Market Size and Share Forecast Outlook 2025 to 2035

Industrial Boilers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Battery Market Size and Share Forecast Outlook 2025 to 2035

Industrial Nailers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Relay Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA