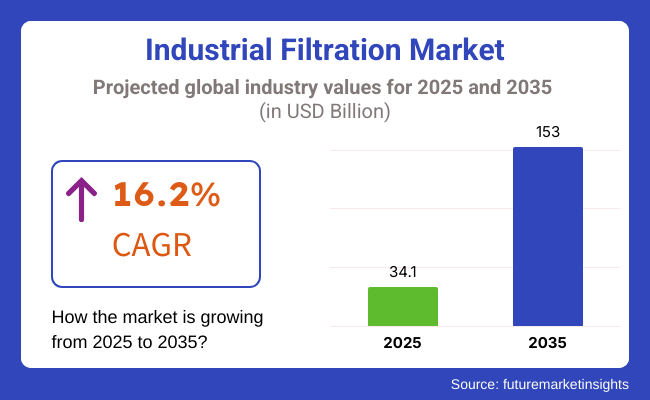

The industrial filtration market was valued at USD 34.1 billion in 2025 and is projected to reach USD 153.0 billion by 2035, expanding at a CAGR of 16.2%. This growth has been driven by stricter regulatory enforcement, greater demand for operational efficiency, and advanced product quality standards in processing industries. Companies have adopted newer technologies, including HEPA-grade and membrane-based systems, to comply with emission norms and enhance yield.

Donaldson Company, in a 2024 press release, confirmed the launch of filtration services across France, Germany, and Austria, targeting life sciences, food, and beverage segments. “Demand is rising in high-purity markets. Our new solutions aim to support zero-contamination production,” said Tod Carpenter, CEO of Donaldson. The launch emphasized high-efficiency, low-downtime filter replacements to optimize energy use and operational continuity.

In January 2025, Filter News reported on the breakthrough in PFAS (forever chemicals) filtration by a USA-based developer, which deployed advanced sorbent media that captured up to 99.6% of targeted contaminants. This innovation aligned with the tightening USA EPA regulations under the 2024 National Primary Drinking Water Regulation Rule, further influencing filtration system upgrades across industrial sectors.

A filtration tool introduced by Cleanova in 2024 specifically addressed industrial fluid applications. This modular, scalable system enabled adaptive contaminant removal in dynamic operational environments. It was adopted by European automotive and chemical manufacturers to reduce cartridge change-out frequency by 28%, helping extend production cycles.

The global filtration trend is being shaped by shifts in material usage. Filtration+Separation reported in 2025 that nanofiber filters, ceramic membranes, and nonwoven materials have seen increased adoption due to their superior resistance to temperature and corrosion. These technologies have been utilized in pharmaceutical solvent recovery and semiconductor manufacturing where purity levels are mission-critical.

Global installations of filtration systems have surged in the Middle East and APAC, as petrochemical and electronics sectors demand greater uptime and particulate control. This expansion has been supported by local government incentives, especially in South Korea and Saudi Arabia, where industrial diversification programs are underway.

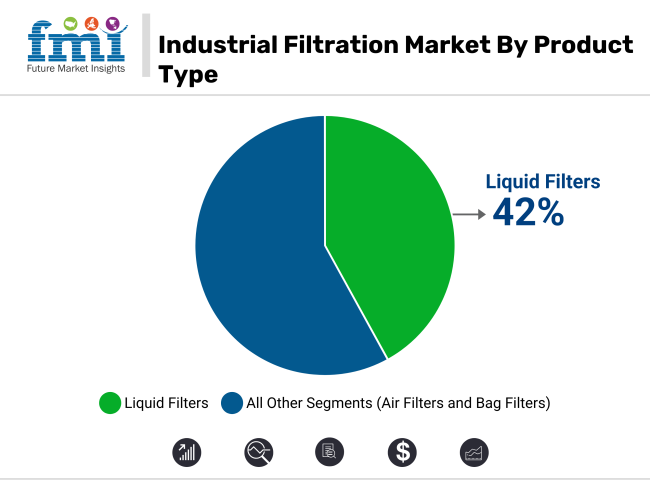

Liquid filters captured 42% of the global industrial filtration market in 2025 and are expected to grow at a CAGR of 17.5% from 2025 to 2035. The segment was supported by rising integration in industries where water and process fluid treatment are mandated by regulatory bodies. Membrane filtration and sorbent media technologies were deployed to address compliance needs under frameworks such as the USA Clean Water Act and EU wastewater directives.

Installations in chemical and food processing facilities focused on reducing effluent discharge and achieving water reuse targets. In 2025, operational upgrades were undertaken in regions like North America and Western Europe to meet sector-specific contaminant thresholds. Filtration units were selected based on required retention rates and compatibility with closed-loop systems.

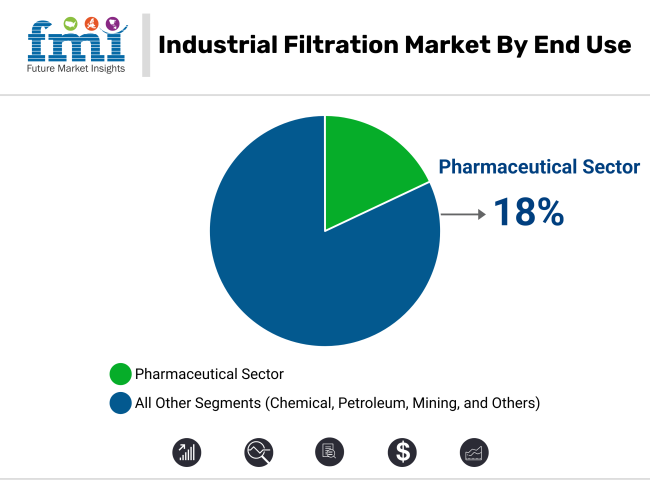

The pharmaceutical industry accounted for 18% of industrial filtration demand in 2025 and is projected to register a CAGR of 18.4% through 2035. Increased use of filtration was observed in sterile drug production, biologics processing, and cleanroom environments. Regulatory frameworks such as FDA current Good Manufacturing Practice (cGMP) and EU GMP Annex 1 drove investments in HEPA-grade air filtration and absolute liquid filters.

Between 2024 and 2025, new manufacturing facilities in India, Ireland, and the USA integrated multi-stage filtration across critical operations. Filters were installed to maintain particulate-free environments, especially in vaccine filling lines and high-potency drug areas. Equipment validations and traceability systems were incorporated to support batch integrity and regulatory inspections.

Challenge

High Maintenance Costs and Stringent Environmental Regulations

Due to high operating and maintenance costs, changing environmental regulation, and requirement of advance filtration technologies. Industries like manufacturing which include but are not limited to chemicals, pharmaceuticals, food processing, the need for efficient filtration system owing to pollution and workplace safety compliance. But routine maintenance, filter changes, and energy consumption add to operational expenses.

Global Environmental Policies, such as EPA, ISO 16890, and EU air quality directives also add compliance complexity. To meet these challenges, companies need to invest in self-cleaning filtration systems, energy-efficient filter media, and AI-powered predictive maintenance solutions to optimise filtration performance while balancing cost and regulatory risks.

Opportunity

Growth in Smart Filtration and Sustainable Technologies

The shift toward sustainability, clean air, & modernized industrial processes provides an enormous opportunity for the Industrial Filtration Market. As industries seek more eco-friendly modes, demand for high-efficiency particulate air (HEPA) filters, nanofiber filtration and bio-based filter material is on the rise. Monitoring Filtration in Real-time through IoT Improved filtration through IoT enabled filtration monitoring, artificial intelligence (AI) based air quality analysis, and smart sensors integration is transforming industrial filtration.

The increasing adoption of membrane filtration to purify wastewater and the growing adoption of chemical-free air purification systems are enabling green manufacturing. To remain relevant, companies that adopt AI-powered filtration diagnostics, resistor designs, and intelligent monitoring will log a key competitive advantage in the emerging industrial filtration scenario.

Environmental Sustainability & Focus on Cleanliness the latest demands from environmental agencies such as the EPA and OSHA are based on rigorous air and water filtration requirements that push industries towards high-performance filtration technologies.

Food & beverage, pharmaceuticals, oil & gas, and chemicals industries are investing in advanced filtration systems to adhere to regulatory compliance while enhancing product purity and improving operational efficiency. More recently, sustainable manufacturing solutions and measures to improve workplace air quality are contributing to increased demand for industrial filtration.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 16.8% |

Growing air and water quality regulations, increasing industrial automation and a shift to sustainable manufacturing are expanding the UK industrial filtration market. UK Environment Agency imposes strict emissions regulations, leading industrial players to adopt high efficiency particulate air (HEPA) filters, activated carbon, and membrane filtration.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 16.3% |

The industrial filtration industry in the European Union (EU) is witnessed to be the prominent market owing to the stringent environmental regulations, a strong industrial base, and growing investments in clean energy technologies. Countries like Germany, France and Italy have developed industries related to chemicals, pharmaceuticals, and automobiles, which need advanced filtration solutions.

REACH and Industrial Emissions Directive by the EU impose stringent air and water filtration standards, driving industries to invest in efficient filtration systems. Moreover, the rising hydrogen and battery manufacturing industries are driving the strong demand for specialized filtration solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 16.5% |

Technological innovation, precision engineering, and stringent environmental standards are driving Japan’s industrial filtration markets. It requires high-performance air and liquid filtration systems that meet cleanroom standards in its semiconductor, electronics, and pharmaceutical industries.

Japan, which is investing heavily in energy-saving and sustainability strategies, is also shifting to next-generation filtration technologies, like nanofiber membranes and electrostatic filtration systems. Burnishing this trend, the commitment of Japan to hydrogen energy and carbon neutrality is driving location of advanced gas and liquid filtration solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 16.7% |

The industrial filtration market in South Korea is growing rapidly, fuelled by the country's thriving semiconductor, EV battery, and industrial manufacturing industries. Advanced air and water filtration systems are in high demand as the country pushes for hydrogen energy and carbon-neutral industries.

In addition, with the government-enforced air pollution control policies, industries have invested in high-efficiency particulate filtration and industrial exhaust purification systems to tackle air pollution. Furthermore, the rise in demand for a semiconductor cleanroom and pharmaceutical processing is propelling the demand for ultra-fine filtration systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 16.6% |

Industrial filtration market is growing because of the demand for air, liquid and gas filtration, as well as air filtration, liquid filtration and gas filtration applications in various industries such as manufacturing, power generation and wastewater treatment. Companies are investing in AI-powered predictive maintenance, advanced membrane filtration technologies, and energy-efficient filtration solutions to improve operational efficiency, meet environmental compliance, and ensure the safety of their workplace. The market consists of global filtration technology providers, industrial equipment manufacturers, and specialized filtration system integrators, all organizing ongoing innovations in the field of HEPA filters, baghouse filtration, depth filtration, and membrane separation technologies.

The industrial filtration market features a competitive landscape dominated by a mix of global filtration giants, regional players, and technology innovators. Tier 1 players include companies like Donaldson Company, Inc., Parker Hannifin Corporation, 3M Company, Mann+Hummel Group, and Alfa Laval AB. These companies command significant market shares globally, benefiting from extensive product portfolios, strong distribution networks, and consistent investment in R&D. For instance, Donaldson expanded its life-sciences filtration segment through a strategic 49% acquisition in Medica S.p.A. in 2024, while Parker Hannifin has focused on energy-efficient membrane systems to enhance industrial air and liquid filtration performance.

Tier 2 players such as Camfil AB, Pentair Plc, Eaton Corporation, and DuPont de Nemours, Inc. contribute to market competitiveness by offering niche, application-specific filtration technologies. These firms are increasingly investing in advanced membrane separation, depth filtration, and nanofiber media to target pharmaceutical, food, and wastewater industries. For example, DuPont continues to lead in membrane innovation with graphene-based solutions, while Pentair is strengthening its industrial water filtration capabilities through product innovation.

Tier 3 players include regional and specialized firms like Cleanova and Allied Filter Systems, focusing on customizable, client-specific solutions for liquid and gas filtration. Cleanova’s 2025 acquisition of Allied Filter Systems highlights the ongoing consolidation trend among smaller players aiming to expand product reach and technological expertise.

Recent Industrial Filtration Industry News

The overall market size for Industrial Filtration Market was USD 34.1 Billion in 2025.

The Industrial Filtration Market is expected to reach USD 153.0 Billion in 2035.

The demand for the industrial filtration market will grow due to increasing environmental regulations, rising need for clean and safe air and water in industries, growing adoption in manufacturing and power generation, and advancements in filtration technologies for improved efficiency and sustainability.

The top 5 countries which drives the development of Industrial Filtration Market are USA, UK, Europe Union, Japan and South Korea.

Power Generation Plants and Chemical Industry Drive Market to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 13: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 14: Global Market Attractiveness by End Use, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 28: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 29: North America Market Attractiveness by End Use, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 44: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 47: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 48: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 77: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 101: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 103: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 104: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Air Filtration Market Size and Share Forecast Outlook 2025 to 2035

GCC Industrial Air Filtration Market Size and Share Forecast Outlook 2025 to 2035

North America Industrial Air Filtration Market Growth - Trends & Forecast 2025-2035

North America Industrial Air Filtration Market Share Analysis

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Industrial Furnace Industry Analysis in Europe Forecast and Outlook 2025 to 2035

Industrial Denox System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronic Pressure Switch Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA