The Industrial Furnace Industry in Europe is witnessing strong growth driven by advancements in energy-efficient technologies and the increasing adoption of sustainable manufacturing practices. The market outlook is influenced by the rising demand for high-performance materials, stringent environmental regulations, and the growing focus on optimizing production efficiency.

European industries are progressively adopting advanced furnace systems that reduce emissions and improve thermal performance, aligning with regional carbon neutrality goals. The integration of automation, digital control, and predictive maintenance technologies is enhancing furnace reliability and operational efficiency across manufacturing sectors.

Additionally, the growth of steel, automotive, and aerospace industries in Europe is boosting the demand for industrial furnaces capable of maintaining precise temperature control and high productivity levels As companies continue to modernize production facilities and adopt eco-friendly heating technologies, the European industrial furnace market is expected to expand steadily, driven by innovation, sustainability initiatives, and supportive government policies.

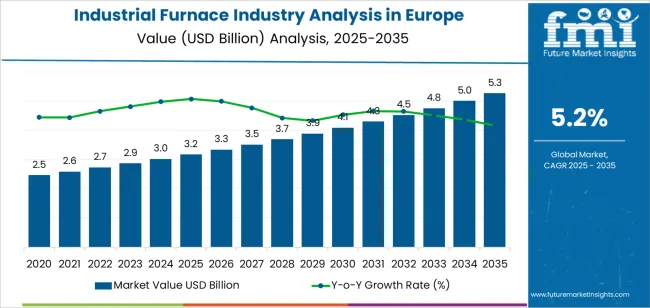

| Metric | Value |

|---|---|

| Industrial Furnace Industry Analysis in Europe Estimated Value in (2025 E) | USD 3.2 billion |

| Industrial Furnace Industry Analysis in Europe Forecast Value in (2035 F) | USD 5.3 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

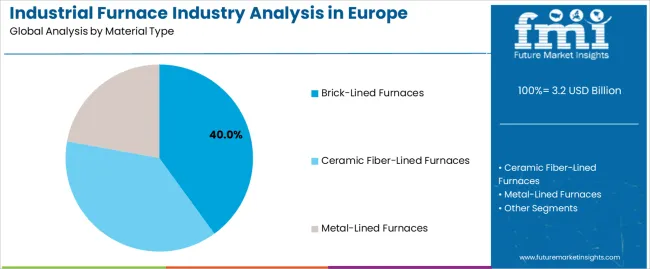

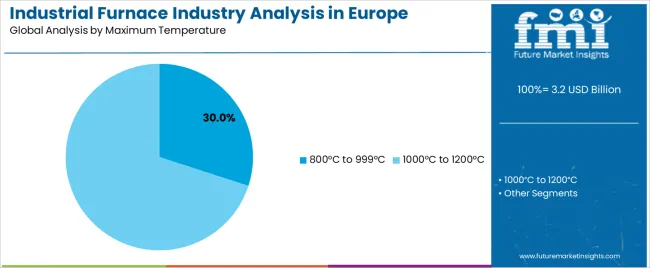

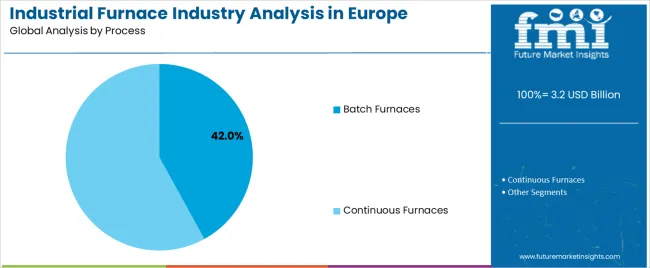

The market is segmented by Material Type, Maximum Temperature, Process, Operation, Control, and Application and region. By Material Type, the market is divided into Brick-Lined Furnaces, Ceramic Fiber-Lined Furnaces, and Metal-Lined Furnaces. In terms of Maximum Temperature, the market is classified into 800°C to 999°C and 1000°C to 1200°C. Based on Process, the market is segmented into Batch Furnaces and Continuous Furnaces. By Operation, the market is divided into Gas Burner Operated and Electrically Operated. By Control, the market is segmented into Manual Control Furnaces and Programmable Control Furnaces. By Application, the market is segmented into Automotive Manufacturing, Aerospace, Metalworking, Steel and Iron Production, Glass Manufacturing, Chemicals, Electronics, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Brick-Lined Furnaces segment is projected to hold 40% of the European Industrial Furnace market revenue share in 2025, making it the leading material type segment. The dominance of brick-lined furnaces is attributed to their superior thermal insulation, high mechanical strength, and long operational life. These furnaces are extensively used in industries requiring consistent high-temperature operations such as metal processing, ceramics, and chemical manufacturing.

The ability of brick-lined furnaces to retain heat effectively and minimize energy loss has been a key factor supporting their continued use in Europe’s energy-conscious industrial landscape. Additionally, advancements in refractory materials have enhanced the durability and performance of brick-lined structures, reducing maintenance frequency and improving overall efficiency.

The growing emphasis on thermal efficiency and cost optimization has further strengthened the demand for brick-lined furnaces across industrial applications As manufacturers focus on extending furnace lifespan while maintaining environmental compliance, the segment is expected to retain its leading position.

The 800°C to 999°C temperature range segment is expected to account for 30% of the European Industrial Furnace market revenue share in 2025, representing a key operational category within the industry. This range is extensively utilized for heat treatment, annealing, and tempering processes across sectors such as metallurgy, automotive, and mechanical component manufacturing. The segment’s growth has been influenced by its suitability for achieving optimal metallurgical properties while maintaining energy efficiency.

Industrial operations requiring medium-to-high thermal ranges often rely on this temperature bracket due to its balance between performance, energy consumption, and process safety. The rising demand for heat-treated components in Europe’s automotive and engineering industries is also contributing to the segment’s prominence.

Moreover, technological advancements in temperature monitoring and digital control systems have enhanced precision and consistency in furnace operations within this range, supporting higher-quality outputs The growing emphasis on operational efficiency and precision heating is expected to sustain the growth of this temperature segment.

The Batch Furnaces segment is projected to hold 42% of the European Industrial Furnace market revenue share in 2025, establishing it as the leading process type segment. Batch furnaces have gained traction due to their flexibility in handling varied product loads and processing multiple materials within controlled environments. This segment benefits from industries that prioritize precision, customization, and smaller production runs, such as aerospace and specialty metals manufacturing.

The capability of batch furnaces to provide consistent heating, superior temperature control, and adaptability for different heat treatment cycles has driven their adoption across Europe. Moreover, advancements in digital automation and process optimization have further enhanced the efficiency of batch furnace operations, reducing energy consumption and improving throughput.

The growing demand for specialized materials that require tailored thermal treatment has strengthened the use of batch furnaces in the region As manufacturers continue to shift toward high-value, precision-oriented production, batch furnaces are expected to maintain their leading market position.

The table below presents a comparative assessment of the variations in CAGRs over six months for the base year (2025) and current year (2025) for the Europe industrial furnace industry. This analysis reveals crucial shifts in performance and indicates revenue realization patterns, thereby providing stakeholders with a better vision of the growth trajectory over the year.

The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December. In the first half (H1) of 2025 to 2035, the business is predicted to surge at a CAGR of 4.9%, followed by a higher growth rate of 5.3% in the second half (H2) of the same period.

| Particular | Value CAGR |

|---|---|

| H1 | 4.9% (2025 to 2035) |

| H2 | 5.3% (2025 to 2035) |

| H1 | 5.1% (2025 to 2035) |

| H2 | 5.4% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to dip slightly to 5.1% in the first half and relatively grow to 5.4% in the second half. In the first half (H1), the industry witnessed an increase of 20 BPS while in the second half (H2), there was a slight surge of 10 BPS.

Demand for Energy-efficient Electric Arc Furnaces Skyrockets in Europe

There is a fast-growing demand for energy-efficient furnaces across Europe. This is mainly driven by the need to address climate change and comply with strict environmental policies. In most parts of the region, manufacturers are increasingly shifting their preference from high-energy-consuming furnaces to low-energy-consuming ones while maintaining superior production efficiency.

In 2025, steel production in Europe was about 3.2 million metric tons, which was down by 3.8% Y-o-Y from 2025. This drop led to the rising emphasis on efficiency and sustainability in the sector, with electric arc furnaces (EAFs) being significant in optimizing production processes that need to adhere to strict ecological regulations.

The use of energy-efficient furnaces, such as EAFs enables industries to not only save on costs but also to meet their environmental obligations. The steel manufacturing industry is investing in modern EAFs as conventional blast furnaces consume high energy. These EAFs not only help reduce energy consumption but also decrease greenhouse gas emissions, thereby making these highly preferable.

Increasing Demand for Heat Treatment from Automakers Creates Opportunities

Ongoing expansion of the automotive industry in Europe, especially owing to the rising demand for electric vehicles (EVs), is set to boost industrial furnace sales. Increased production of EVs in countries, such as Germany and France is leading to a high demand for special-purpose furnaces.

Such types of furnaces are significant for heat treatment during the production of battery cells, electric motors, and lightweight aluminum parts. Due to this factor, cutting-edge furnaces are being developed to accommodate the needs of these kinds of vehicles.

In 2025, for instance, Stellantis N.V. launched an electric vehicle battery plant in Italy. This fact implies that the automobile industry is committed to scaling up EV production, which is raising demand for modern industrial furnaces. These types of furnaces are necessary as they help ensure the proper functioning and safety of EV components.

Focus on Decarbonization and Green Manufacturing Tactics is a Key Trend

A significant trend is the shift toward decarbonization and green manufacturing, propelled by the European Union's (EU) Green Deal and other stringent emissions targets. Industries across Europe are increasingly adopting eco-friendly industrial furnaces that reduce carbon emissions. This trend includes the transition from traditional fossil-fuel-powered furnaces to more sustainable options, such as electric and hydrogen-based furnaces.

In 2025, Tenova, a leading furnace manufacturer, introduced a new hydrogen-based furnace technology specifically designed for the steel industry. This technology allows steel producers to replace natural gas with hydrogen.

It further helps in significantly reducing carbon dioxide emissions during the steelmaking process. Such innovations are gaining traction as industries seek to align with EU sustainability goals, making decarbonization a central focus of industrial furnace development and adoption across various fields, including metallurgy, automotive, and chemical processing.

Increasing Demand for Customization in Industrial Furnaces to Bolster Sales

Demand for customized furnaces is increasing in Europe as companies try to meet specific production requirements, especially in a few specialized industries such as aerospace, automotive, and electronics. These industries employ exact material characteristics and process specifications that necessitate tailor-made furnaces. Moreover, the demand for flexible and scalable furnaces is set to skyrocket in the region.

Manufacturing companies need equipment that can be easily modified or expanded according to changes in product specifications or fluctuations in production volume. This enables efficient operations and quick response to the demands, thereby improving productivity and competitiveness. Hence, suppliers are increasingly focused on developing versatile furnaces that are adaptable to changing needs, further supporting the dynamic production environments of current industries.

The industry witnessed a CAGR of 2.3% between 2020 and 2025. Total revenue reached about USD 2,882.9 million in 2025. During the forecast period, sales are projected to fetch a CAGR of 5.2%.

The historical period was marked by a relatively slow growth trajectory due to several factors, including technological stagnation, economic disruptions, and supply chain challenges exacerbated by the COVID-19 pandemic. Additionally, regulatory changes and environmental concerns led to increased costs and complexities in implementing unique furnace technologies. The industry further faced challenges from alternative technologies and shifting industrial needs, which constrained expansion.

Looking ahead to 2025 to 2035, the Europe industrial furnace industry is projected to witness a steady CAGR of 5.2%. This anticipated growth is pushed by several converging factors. The ongoing demand for energy-efficient and environmentally compliant solutions is projected to boost the adoption of cutting-edge industrial furnace technologies.

Increased investments in infrastructure projects and manufacturing sectors are also set to drive demand, as industries look to modernize their equipment for improved performance and low operational costs. Moreover, technological innovations in furnace design and materials are anticipated to enhance efficiency and competitiveness, contributing to a highly dynamic and rapidly growing landscape.

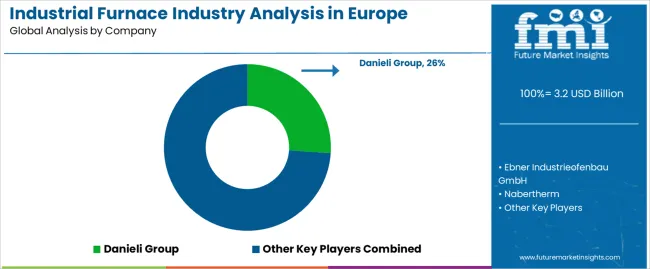

Tier 1 companies include leaders with annual revenues exceeding USD 80 million. These companies are currently capturing a significant share of 20% to 25%. These frontrunners are characterized by high production capacity and a wide product portfolio.

They are distinguished by extensive expertise in manufacturing and a broad geographical reach, underpinned by a robust consumer base. The firms provide a wide range of products and utilize the latest technology to meet regulatory standards.

Prominent companies within Tier 1 include Ispen, Danieli Group, SECO/WARWICK Group, Ebner Industrieofenbau GmbH, and Nabertherm.

Tier 2 companies encompass most of the mid-sized enterprises operating within the regional sphere and catering to specialized needs with revenues between USD 30 and 80 million. These businesses are notably focused on meeting Tier 1 demands and are hence categorized within the Tier 2 segment.

Tier 2 players such as ECM Technologies, Lindberg/MPH, Heatmasters Group, and BMI Fours Industriels are considered in this study. They are projected to account for 35 to 40% of the overall share.

Tier 3 includes most of the small-scale companies operating at the local level and serving niche areas. These have revenue below USD 30 million. These companies are notably oriented toward fulfilling local demands and are consequently classified within the Tier 3 segment.

They are small-scale players and have limited geographical reach. Manufacturers in the segment include BOREL Swiss and Furnace Engineering Pty Ltd. They are set to hold 30 to 35% of the total share.

The table below shows the estimated CAGRs of the significant countries in Europe. Italy, France, and Spain are set to record high CAGRs of 5.9%, 5.6%, and 5.4%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| Italy | 5.9% |

| France | 5.6% |

| Spain | 5.4% |

| Germany | 5.1% |

| United Kingdom | 4.7% |

| Russia | 4.1% |

Germany is poised to exhibit a CAGR of 5.1% during the assessment period. It is projected to attain a value of USD 5.3 million by 2035.

Germany's industrial furnace industry is expanding due to its prominent position as a global leader in the field of iron and steel. In 2025, the country exported iron and steel worth USD 36.9 billion, making it the second most prominent exporter of these products worldwide and the eighth most exported product in the country. This strong export performance underscores the significant role of Germany's industrial sector, which drives demand for cutting-edge industrial furnaces.

The country's focus on technological innovations and Industry 4.0, including smart and automated furnace systems, further supports growth. Additionally, Germany's commitment to high-tech manufacturing and energy efficiency enhances the need for modern furnaces across its diverse industrial base.

Italy's industrial furnace industry is set to rise due to its robust manufacturing sector and significant infrastructure projects. The country has a strong presence in automotive, aerospace, and metal processing industries, all of which rely heavily on unique industrial furnaces. Italy's automotive industry is constantly investing in new manufacturing facilities and technologies, boosting demand for high-performance furnaces.

In 2025, Ferrari, for instance, broadened its production line in Maranello, and Fiat Chrysler announced plans for a new facility in Turin. Additionally, significant infrastructure projects, such as the modernization of Italy’s industrial zones to support cutting-edge manufacturing technologies, are underway. These recent expansions and upgrades are contributing to the increased need for efficient furnace systems, further boosting growth.

Sales of industrial furnaces in Italy are projected to soar at a CAGR of around 5.9% during the assessment period. The total value in the country is anticipated to reach USD 668.7 million by 2035.

The United Kingdom is projected to reach USD 646.3 million by 2035. Over the assessment period, the country is set to rise at 4.7% CAGR.

Industrial furnace demand is experiencing considerable growth in the United Kingdom due to a strong focus on sustainable manufacturing practices and significant industrial upgrades. The country’s government prioritizes reduced carbon emissions and better energy efficiency across industries.

In order to achieve “Net Zero” by 2050, there will likely be a rising need for more efficient and environmentally friendly new generation of furnaces that comply with regulations.

Recent initiatives include investments by international companies in modernizing steel production facilities across the country. It includes Tata Steel’s plan to implement unique, energy-efficient furnace technologies at its Port Talbot plant.

Demand for state-of-the-art industrial furnaces has also increased due to the adoption of green manufacturing approaches by vehicle manufacturers and metal processors among others. These initiatives are helping to develop clean technologies that are more efficient, thereby promoting the growth of the country.

The section explains the growth trajectories of the two leading segments. In terms of material type, the brick-lined furnace segment is projected to lead and generate a share of around 47.3% in 2025. Based on control, the programmable control furnaces segment is likely to hold a share of 72% in 2025. The analysis would enable potential clients to make effective business decisions for investment purposes.

| Segment | Brick-lined Furnaces (Material Type) |

|---|---|

| Value Share (2025) | 47.3% |

In 2025, brick-lined furnaces are projected to dominate, generating a significant share of around 47.3%. This dominance is primarily due to their superior durability and thermal insulation properties, which are important for high-temperature industrial processes.

Brick-lined furnaces are mainly favored in industries like steel and metal processing, where these are required to withstand extreme heat while maintaining structural integrity over long periods. Their ability to reduce energy consumption by retaining heat more efficiently compared to other furnace types also makes them a preferred choice.

The furnaces efficiently retain heat, reducing energy consumption and offering long-lasting performance, which lowers maintenance costs. Their robust construction allows them to withstand extreme conditions, ensuring reliability and longevity. Their relatively low maintenance requirements and long lifespan further contribute to their widespread use, securing their leading position in Europe.

| Segment | Programmable Control Furnaces (Control) |

|---|---|

| Value Share (2025) | 72% |

In 2025, programmable control furnaces are estimated to dominate, commanding a 72% share in Europe. This growth is primarily pushed by the rising demand for precision and automation in industrial processes.

Programmable control furnaces offer cutting-edge temperature management and customizable settings, allowing for consistent and high-quality production across several industries, including automotive, aerospace, and metal processing. Their ability to integrate seamlessly with modern industrial systems enhances efficiency, reduces operational costs, and supports the push toward smart manufacturing.

The furnaces are increasingly favored for their adaptability to specific production needs, making them a key component in optimizing manufacturing operations. These are set to be exponentially utilized in bolstering industrial automation, making them an attractive investment for companies looking to stay competitive in a rapidly evolving landscape.

The section provides comprehensive assessments and insights that highlight current opportunities and emerging trends for companies in developed and developing countries across Europe. It analyzes innovations in manufacturing and identifies the latest trends poised to push new applications.

A few key players in the regional industrial furnace industry are actively enhancing capabilities and resources to cater to the growing demand across diverse applications. Leading companies also leverage partnership and joint venture strategies to co-develop innovative products and bolster their resource base.

Significant players are further introducing new products to address the increasing need for cutting-edge solutions in various end-use sectors. Geographic expansion is another important strategy that is being embraced by reputed companies.

Start-ups are likely to emerge through 2035, thereby making it highly competitive. Key companies are investing in continuous research to produce new solutions and increase their production capacity.

Industry Updates

A few key material types included in the study are brick-lined furnaces, ceramic fiber-lined furnaces, and metal-lined furnaces.

800’C to 999’C and 1000’C to 1200’C are the two maximum temperature segments.

Two processes included in the study are batch furnaces and continuous furnaces.

Gas burner-operated and electrically operated are the key operation segments.

Manual control furnaces and Programmable control furnaces are the main control segments.

A few significant applications are automotive manufacturing, aerospace, metalworking, steel and iron production, glass manufacturing, chemicals, electronics, and others.

Countries considered in the study include Germany, France, Spain, Italy, the United Kingdom, Belgium, the Netherlands, Luxembourg, Russia, and the rest of Europe.

The global industrial furnace industry analysis in europe is estimated to be valued at USD 3.2 billion in 2025.

The market size for the industrial furnace industry analysis in europe is projected to reach USD 5.3 billion by 2035.

The industrial furnace industry analysis in europe is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in industrial furnace industry analysis in europe are brick-lined furnaces, ceramic fiber-lined furnaces and metal-lined furnaces.

In terms of maximum temperature, 800°c to 999°c segment to command 30.0% share in the industrial furnace industry analysis in europe in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Europe Industrial Drum Market Growth – Trends & Forecast 2023-2033

Industrial Electronics Packaging Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Europe Industrial Lubricants Market: Growth, Trends, and Forecast 2025 to 2035

Industrial Furnace Market Size and Share Forecast Outlook 2025 to 2035

Korea Industrial Drum Market Analysis – Growth & Forecast 2023-2033

Japan Industrial Drum Market Insights – Growth & Forecast 2023-2033

Industrial Lubricants Industry Analysis in India - Growth Trends, Regional Insights 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe OTR Tire Market Growth – Trends & Forecast 2024-2034

Trash Bag Industry Analysis in Europe Forecast Outlook 2025 to 2035

Industrial High-Temperature Graphitization Furnaces Market Size and Share Forecast Outlook 2025 to 2035

Mezcal Industry Analysis in Western Europe Report – Growth, Demand & Forecast 2025 to 2035

Western Europe Pectin Market Analysis by Product Type, Application, and Country Through 2035

Western Europe Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Europe Second-hand Apparel Market Growth – Trends & Forecast 2024-2034

I2C Bus Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Isomalt Industry Analysis in Western Europe – Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA