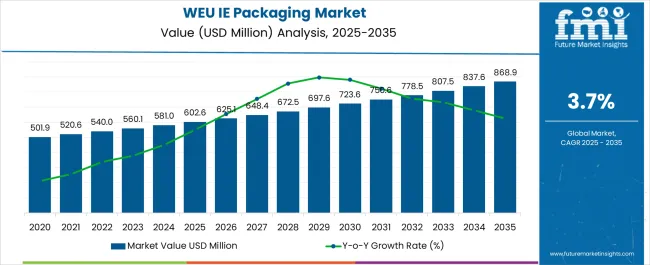

The Industrial Electronics Packaging Industry Analysis in Western Europe is estimated to be valued at USD 602.6 million in 2025 and is projected to reach USD 868.9 million by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

| Metric | Value |

|---|---|

| Industrial Electronics Packaging Industry Analysis in Western Europe Estimated Value in (2025 E) | USD 602.6 million |

| Industrial Electronics Packaging Industry Analysis in Western Europe Forecast Value in (2035 F) | USD 868.9 million |

| Forecast CAGR (2025 to 2035) | 3.7% |

The industrial electronics packaging industry in Western Europe is experiencing steady growth. Rising demand for reliable packaging solutions to safeguard sensitive electronic components is driving expansion. Market dynamics are influenced by the rapid adoption of industrial automation systems, strict compliance with safety standards, and the need for cost-efficient yet durable packaging formats.

Growing emphasis on sustainability is reshaping material selection, with producers balancing performance and recyclability. Advancements in packaging design and material engineering are improving protection against environmental stress, static discharge, and mechanical damage. The future outlook remains positive as industrial modernization and smart manufacturing continue to expand across the region, necessitating greater volumes of tailored packaging.

Growth rationale is supported by increasing investments in automation, higher throughput of electronic components, and evolving customer expectations for secure and sustainable packaging Strategic integration of supply chain efficiencies and enhanced distribution networks will further underpin consistent adoption and revenue generation over the forecast horizon.

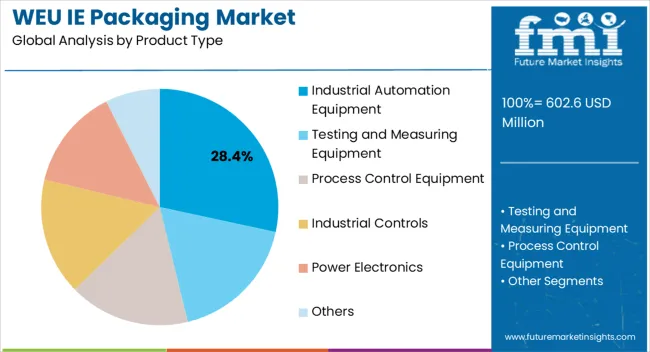

The industrial automation equipment segment, holding 28.40% of the product type category, has maintained leadership due to the rising penetration of automation technologies across Western European industries. Packaging demand in this category is driven by the need to protect high-value and delicate equipment during handling, storage, and transportation.

Adoption has been reinforced by increasing automation in manufacturing, energy, and logistics sectors, where operational reliability is critical. Continuous advancements in packaging design have improved vibration resistance and ensured compliance with international safety standards, further strengthening confidence in this segment.

Integration of custom-fit solutions and enhanced traceability features has enabled optimized inventory management and reduced operational risks As industrial automation remains central to productivity gains and competitiveness in Western Europe, packaging solutions for this product type are expected to sustain a strong share, ensuring resilience and adaptability to evolving end-user requirements.

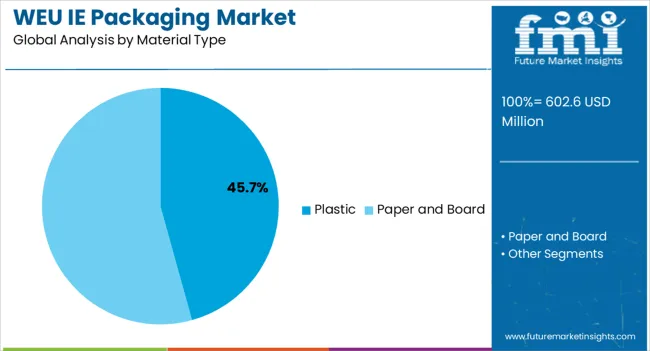

The plastic segment, accounting for 45.70% of the material type category, dominates the market owing to its versatility, durability, and cost efficiency. Its wide adoption has been reinforced by the material’s ability to provide robust protection while maintaining lightweight properties, which supports transportation efficiency.

Enhanced polymer technologies have improved resistance to static discharge, moisture, and mechanical damage, making plastic a preferred material for safeguarding sensitive electronics. Despite growing pressure from sustainability concerns, innovation in recyclable and bio-based plastics is addressing environmental challenges and securing long-term applicability.

The segment’s growth is further supported by its adaptability to both standardized and custom packaging formats, enabling broad applicability across diverse industrial electronics With ongoing advancements in eco-friendly plastic solutions and regulatory compliance driving adoption, this material type is expected to retain its leading market position in the forecast period.

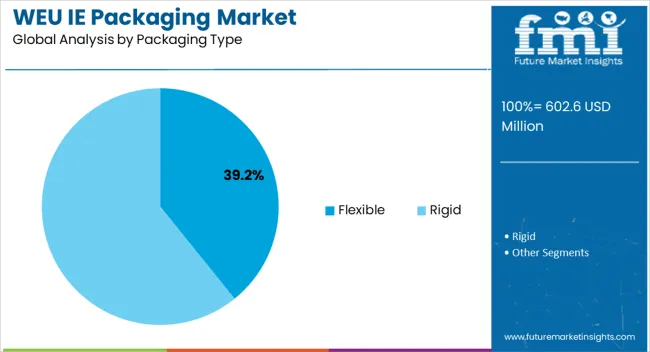

The flexible packaging segment, representing 39.20% of the packaging type category, has emerged as the leading format due to its adaptability, lightweight structure, and cost-effectiveness. Its widespread use is supported by efficiency in space utilization and ease of handling during logistics and storage.

Enhanced barrier properties and anti-static features have increased its suitability for packaging sensitive electronic components, ensuring product integrity throughout the supply chain. Demand for flexible packaging is being reinforced by its alignment with sustainability goals, as recyclable and reusable variants are gaining traction among manufacturers and end-users.

Integration of smart labeling and tracking technologies has further enhanced its value proposition by improving traceability and operational efficiency With industrial operations in Western Europe increasingly requiring scalable and customizable solutions, the flexible packaging segment is expected to maintain its dominance and continue driving growth within the overall industry landscape.

| Leading Packaging Type | Rigid |

|---|---|

| Segment Share % (2025) | 96.50% |

The rigid electronics packaging is predicted to acquire a maximum stake of 96.50% in 2025. Following factors are augmenting the sales of rigid industrial electronics packaging in Western Europe:

| Leading Material Type | Plastic |

|---|---|

| Segment Share % (2025) | 58.80% |

The plastic segment is predicted to obtain a share of 58.80% in 2025. Plastics have enjoyed a prominent presence in the industrial electronics packaging industry in the historical period, and it is predicted that the momentum is going to be sustained over the forecast period as well.

Growing sustainability concerns are anticipated to influence the demand for industrial electronics packaging in Western Europe, and the plastic segment is expected to lose some of its share to eco-friendly alternatives in the next decade. Demand for the paper and board segment is expected to observe healthy growth as plastic is witnessing reduced adoption due to its adverse impact on the environment.

| Country | Germany |

|---|---|

| Forecast CAGR % (2025 to 2035) | 4.0% |

The sales of industrial electronics packaging in Germany are predicted to expand at a CAGR of 4.0% through 2035. Leading factors augmenting the sales of industrial electronics packaging in Germany are as follows:

| Country | Italy |

|---|---|

| Forecast CAGR % (2025 to 2035) | 3.2% |

The adoption of industrial electronics packaging in Italy is projected to inflate at a CAGR of 3.2% through 2035. Mentioned below are the leading factors pushing the adoption of industrial electronics packaging:

| Country | Netherlands |

|---|---|

| Forecast CAGR % (2025 to 2035) | 1.9% |

The Netherlands is predicted to display a growth trajectory of 1.9% CAGR for the adoption of industrial electronics packaging through 2035. Given below are the leading factors augmenting the sales of industrial electronics packaging in the country:

| Country | France |

|---|---|

| Forecast CAGR % (2025 to 2035) | 3.7% |

The France industrial electronics packaging industry is anticipated to expand at a CAGR of 3.7% through 2035. Following factors augmenting investments in industrial electronics packaging business include:

| Country | United Kingdom |

|---|---|

| Forecast CAGR % (2025 to 2035) | 2.9% |

The uptake of industrial electronics packaging in the United Kingdom is predicted to increase at a CAGR of 2.9% through 2035. Over the forecast period, the sales are forecast to rise on the back of following factors:

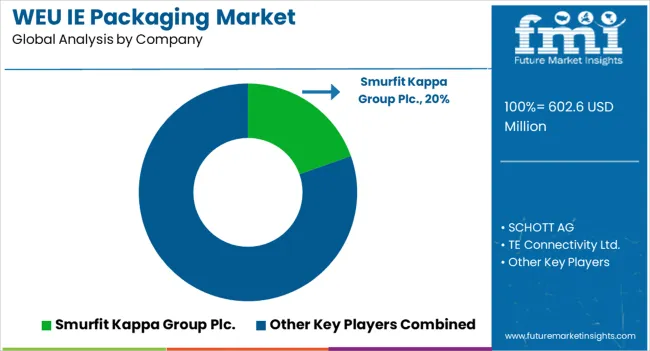

Key leaders in industrial electronics product packaging in Western Europe are concentrating their resources on mergers and acquisitions to coordinate research and development of distinctive products. Another key strategy followed by key players to generate higher revenues is the development of advanced electronic packaging solutions. The following developments are ramping up the sales of industrial electronics packaging in Western Europe:

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 602.6 million |

| Projected Industry Size by 2035 | USD 868.9 million |

| Anticipated CAGR between 2025 to 2035 | 3.7% CAGR |

| Historical Analysis of Demand for Industrial Electronics Packaging in Western Europe | 2020 to 2025 |

| Demand Forecast for Industrial Electronics Packaging in Western Europe | 2025 to 2035 |

| Report Coverage for Industrial Electronics Packaging in Western Europe | Industry Size, Industry Trends, Analysis of Key Factors Influencing the Adoption of Industrial Electronics Packaging in Western Europe, Insights on Western Europe Players and their Industry Strategy in Western Europe, Ecosystem Analysis of Local and Regional Western Europe Providers |

| Key Countries Analyzed for Industrial Electronics Packaging in Western Europe | Germany, Italy, France, United Kingdom, Spain, The Netherlands, BENELUX, Rest of Western Europe |

| Key Companies Profiled for Industrial Electronics Packaging in Western Europe | SCHOTT AG; TE Connectivity Ltd.; DS Smith Plc.; Smurfit Kappa Group Plc.; Sealed Air Corporation; Others |

The global industrial electronics packaging industry analysis in Western Europe is estimated to be valued at USD 602.6 million in 2025.

The market size for the industrial electronics packaging industry analysis in Western Europe is projected to reach USD 868.9 million by 2035.

The industrial electronics packaging industry analysis in Western Europe is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in industrial electronics packaging industry analysis in Western Europe are industrial automation equipment, testing and measuring equipment, process control equipment, industrial controls, power electronics and others.

In terms of material type, plastic segment to command 45.7% share in the industrial electronics packaging industry analysis in Western Europe in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Industrial Crystallizer Market Size and Share Forecast Outlook 2025 to 2035

Industrial Counterweight Market Size and Share Forecast Outlook 2025 to 2035

Industrial Gas Market Size and Share Forecast Outlook 2025 to 2035

Industrial Furnace Market Size and Share Forecast Outlook 2025 to 2035

Industrial Weighing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Industrial Drum Market Size and Share Forecast Outlook 2025 to 2035

Industrial Food Slicers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Printer Market Size and Share Forecast Outlook 2025 to 2035

Industrial Fryers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Paper Sacks Market Size and Share Forecast Outlook 2025 to 2035

Industrial Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Industrial Valve Market Size and Share Forecast Outlook 2025 to 2035

Industrial Air Filtration Market Size and Share Forecast Outlook 2025 to 2035

Industrial Phosphates Market Size and Share Forecast Outlook 2025 to 2035

Industrial Elevators Market Size and Share Forecast Outlook 2025 to 2035

Industrial Boilers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Battery Market Size and Share Forecast Outlook 2025 to 2035

Industrial Nailers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Relay Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA