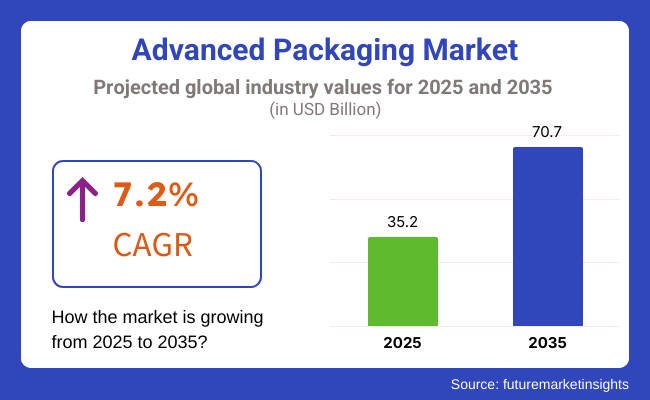

The advanced packaging market is projected to grow from USD 35.2 billion in 2025 to USD 70.7 billion by 2035, registering a CAGR of 7.2% during the forecast period. Sales in 2024 reached USD 32.8 billion, reflecting steady demand across various sectors. Growth has been driven by increasing applications in semiconductor devices, where advanced packaging is essential for efficient and compact solutions.

The market's expansion is further supported by advancements in packaging technology and the rising demand for energy-efficient and high-performance electronic components. The adoption of advanced substrates and interconnect materials aligns with the industry's push towards miniaturization and increased functionality, driving the demand for advanced packaging solutions.

In May 2025, Advanced Semiconductor Engineering, Inc. (ASE), a member of ASE Technology Holding Co., Ltd., announced Fan-Out Chip-on-Substrate-Bridge with Through Silicon Via (TSV), propelling technology enablement for artificial intelligence (AI) and its pervasive impact on global life.

The integration of TSV expands ASE’s VIPack™ FOCoS-Bridge capabilities to deliver critical energy efficiency. “ASE is strategically positioned at the forefront of the industry as a premier provider of advanced packaging solutions for high-power AI and high-performance computing applications,” said Charles Lee, Director of Engineering and Technical Promotion at ASE. “Our strength lies in our ability to deliver innovative technologies that address customers’ evolving needs in a rapidly advancing market.”

| Metric | Key Insights |

|---|---|

| Industry Size (2025E) | USD 35.2 billion |

| Industry Value (2035F) | USD 70.7 billion |

| CAGR (2025 to 2035) | 7.2% |

Environmental concerns and regulatory pressures have driven innovation in the advanced packaging market. The development of eco-friendly packaging solutions has been prioritized to meet environmental regulations and consumer preferences. Advancements in packaging design have led to improved performance and durability, enhancing product efficiency.

Integration of smart features, such as thermal management and signal integrity enhancements, has been implemented to ensure device reliability and performance. These innovations have not only reduced the environmental footprint of packaging products but have also opened new avenues for application in various industries.

The advanced packaging market is expected to witness steady growth, driven by increasing demand in consumer electronics, automotive, and telecommunications sectors. Manufacturers focusing on sustainable and innovative solutions are anticipated to gain a competitive edge.

Emerging markets in Asia-Pacific and Latin America are projected to offer significant growth opportunities due to rising consumer awareness and industrialization. Strategic collaborations and investments in research and development are likely to foster product innovation and market expansion. As environmental concerns continue to influence consumer behavior, the adoption of eco-friendly advanced packaging solutions is expected to become a key differentiator in the industry.

The market is segmented based on packaging technology, device type, end-use application, and region. By packaging technology, the market includes embedded die packaging, flip chip packaging, system-in-package (SiP), and wafer-level chip scale packaging (WLCSP), 3D integrated circuits, and 2.5D integrated circuits.

In terms of device type, the market is categorized into logic devices, memory devices, sensors, RF devices, power management ICs, and LEDs. By end-use application, the market comprises consumer electronics, automotive electronics, telecommunications, Internet of Things (IoT) devices, healthcare devices, and aerospace & defense. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

Flip Chip Packaging is projected to hold a 34.7% market share in 2025, driven by its ability to support high I/O density and improved heat dissipation. It has been adopted widely in advanced microprocessors, graphics units, and AI accelerators, ensuring higher bandwidth and better power management across device architectures.

Micro-bump and copper pillar technologies have been integrated into flip chip formats to enhance mechanical reliability and electrical performance. These innovations have enabled compatibility with high-frequency and miniaturized electronics, further accelerating demand across premium segments. Cost reduction in bumping and substrate manufacturing has supported increased adoption in consumer and enterprise-grade devices.

Flip chip technology has been supported by wafer-level assembly lines and through-silicon via (TSV) advancements, optimizing vertical stacking and multi-chip packaging solutions. OEMs and OSAT providers have continued investing in cleanroom infrastructure and bonding machines to meet stringent production specifications for flip chip-based modules.

With the transition toward heterogeneous integration and 2.5D/3D hybrids, flip chip packaging is expected to remain essential in bridging traditional planar architectures with future chiplet-based systems. Environmental reliability, robust signal integrity, and strong thermal endurance will ensure its use in AI, data centers, and edge computing environments.

Consumer Electronics are estimated to account for 36.2% of the global advanced packaging market in 2025, due to mass demand for high-performance, space-constrained products like smartphones, tablets, and wearables. Advanced packaging formats have been employed to enable slimmer designs, higher processing speeds, and extended battery life without compromising thermal stability.

Wearables and mobile devices have increasingly adopted WLCSP and flip chip solutions to support high-frequency connectivity, biometric sensing, and AI-powered functions. Processors and RF components in these devices have required advanced encapsulation and fine-pitch interconnects to meet performance and form factor targets.

OEMs have invested heavily in advanced packaging R&D to develop compact, modular chip designs. The introduction of foldable phones, AR/VR systems, and ultra-slim laptops has further fueled demand for fan-out and system-in-package technologies, allowing multiple functions to be integrated within small footprints.

Consumer electronics manufacturers have relied on high-yield assembly and packaging scalability to meet global demand while balancing unit costs. With consumer preference shifting toward multi-functional and durable smart devices, advanced packaging solutions are expected to remain central to innovation cycles and competitive differentiation in the sector.

Rising Demand for Sustainable and Smart Packaging Solutions is Driving Market Growth

Resorting to advanced packaging technologies in the wake of sustainability demands and rising environmental concerns In fact, packaging solutions that can offer recyclability, biodegradability, and a low carbon footprint are quickly gaining favor.

Another technology helping drive the sector is smart packaging, such as that with sensors and RFID tags. Functional and eco-friendly packaging is becoming increasingly appealing to consumers. Moreover, regulations and incentives for sustainability are also pushing manufacturers to adopt advanced packaging to meet increasingly stringent environmental standards.

Technological Advancements and Customization Promote Market Growth

The packaging sector is seeing new trends in the development of advanced packaging, with packaging materials and methods enhancing technology. Nanotechnology, active and intelligent packaging, and flexible materials are some developing areas that are considerably upgrading the efficiency and reliability of packaging. The ability to customize these packaging, for branding or functional reasons, or both is also boosting the growth of the packaging sector.

Unfortunately, they are a separate concern, a need to innovate, as manufacturers aim to compete with each other based on needs such as food, electronics, and medicine, industries where packaging and protection are not only a means of protection but also additional functionality.

High Costs of Production and Raw Materials Remain Challenges

Widespread penetration highly depends on the accessibility and cost of advanced materials and the complexity of processing. High-end packaging materials include smart packaging, biodegradable plastics, and nanocomposites, which are expensive compared to conventional packaging and prevent widespread adoption, especially in developing areas.

Moreover, integrating advanced technologies such as sensors and smart features contributes to the costs involved in manufacturing. While it is true that these solutions represent much higher production costs today, as they become more mainstream, economies of scale and new technological solutions will bring down the production costs/downstream use, making them more accessible across large parts of every industry.

The USA advanced packaging is projected to reach USD 5.7 billion by 2025, driven by rapid innovation in flexible packaging and rising consumer demand for sustainable and high-performance solutions. The 6.6% CAGR from 2023 to 2033 highlights the country’s leadership in advanced packaging technology.

Firms are expanding past R&D fabrication to benefit in areas such as electronics, automotive, and food packaging. The growth of e-commerce will further drive the expansion along with the need for tamper-evident and moisture-resistant packaging. The American systems will remain established, technology will help advancement.

The Canadian advanced packaging will be reaching USD 1.1 billion by 2025, growing with moderate momentum. The 5.8% CAGR from the Jeeps over the forecast for the Jeeps packaging also reflects the steady complement of Jeeps packaging innovation and adoption.

The demand for better, lighter, and more secure packaging is rising as a result of growing e-commerce and travel. Furthermore, Canada's regulatory framework supports green packaging initiatives, opening doors for expansion, particularly in the consumer goods, electronics, and food and beverage industries.

The UK advanced packaging is anticipated to reach USD 2.8 billion by 2025, with a steady 5.4% CAGR. One major factor is the UK's growing focus on environmentally friendly packaging options, as companies embrace new ideas to cut waste and increase recyclability.

Given the continued success of online retail, there will likely be a greater need for packaging solutions in consumer goods and e-commerce. The expansion is aided by government regulations that promote sustainability and eco-friendly packaging materials. Additionally, developments in barrier technologies and tamper-evident packaging meet the demands of the food and pharmaceutical sectors.

France’s advanced packaging is projected to reach USD 2.1 billion by 2025, with a 5.6% CAGR. The country’s focus on eco-conscious packaging technologies plays a crucial role in the growth, with consumer demand for environmentally friendly and recyclable materials rising.

France's food and beverage sector is a major contributor to the demand for high-performance packaging solutions, including moisture barriers and tamper-evident features. E-commerce’s expansion also drives the need for efficient packaging that ensures product safety and convenience. As the government enforces sustainability measures, France is well-positioned for significant advancements in advanced packaging.

At a 5.9% compound annual growth rate (CAGR), the advanced packaging in Germany is projected to reach USD 3.4 billion by 2025. Thanks to strong industrial demand in the consumer goods, electronics, and automotive industries, Germany continues to be one of Europe's leading manufacturing hubs. Make advancements in packaging technology to increase the product's shelf life, ensure product security, and make package materials recyclable and up cyclable.

The advanced packaging in South Korea is 1.4 billion dollars (USD 2.4 billion for the region) from 2025 with a 6.1% CAGR. Japan’s strong emphasis on technological progress with its electronics and semiconductor sectors translates into high demand for advanced packaging.

In the race of global packaging technology, companies are investing notably in research and development. High-performance packaging materials that provide safety and durability of products are primarily influenced by the consumer electronics, particularly mobile devices.

The nation's demand for advanced packaging is primarily driven by the food, automotive, and electronics industries, all of which require high-performing and environmentally friendly packaging solutions. Japan's industry for flexible, tamper-evident, and moisture-resistant packaging is driven by the country's strong emphasis on innovation and technological advancements.

The demand for packaging solutions that improve the sustainability, safety, and convenience of product deliveries is rising as e-commerce and online retail continue to grow. The opportunities are further enhanced by regulatory pressure to adopt eco-friendly materials.

The advanced packaging in China is projected to grow to USD 12.6 billion by the year 2025, boasting a strong +7.2% CAGR. Two important factors propelling this trend are the push for eco-friendly packaging and the Chinese government's endorsement of eco-friendly regulations.

Increased focus on safety and protection of products being shipped is pushing the demand for safe packaging solutions, coupled with growth in the e-commerce industry. With its large-scale production capacity and expanding consumer base, China has become the leading player on the global advanced packaging stage.

India’s advanced packaging is projected to grow to USD 4.3 billion by 2025 (at a CAGR of 6.4%). Growing sectors like food, pharmaceuticals, and e-commerce in India are fueling demand for niche packaging solutions. With consumers increasingly looking for sustainable packaging solutions that meet their need for convenience, flexible, recyclable, and tamper-evident packaging is seeing more interest. Demand for packaged goods is further fueled by the country’s growing middle class and rising disposable income.

Key players in the advanced packaging industry are focusing on technological advancements, sustainable materials, and product diversification to strengthen their positions in the industry. Companies are forming partnerships and collaborating with other firms to accelerate product innovation and extend their geographical reach.

The year 2024 brought about a concentration of the major companies within the advanced packaging industry on both sustainability and technology innovations. For example, ASE Technology Holding Co. predicted that 2025 revenue from advanced packaging and testing would more than double, i.e., to USD 1.6 Billion, because of a growing global appetite for AI chips. This strategic decision emphasizes ASE's focus on enhancing its advanced packaging solution ability.

Further, Amazon changed its packaging to remove all single-use plastics, replacing them with recyclable paper and cardboard. This program not only helps other companies achieve their net-zero goals but also showcases Amazon's commitment to sustainable operations.

Breakthrough startups in the packaging industry use very different tactics to grab the gaze of consumers. The "chaos packaging" idea, where instead of the usual forms of products, they are shown in unusual ways-for instance, tampons stored in an ice cream tub or sunscreen packaged in a whipped cream container-has been popularized.

Brands can rise above the flood of ads, draw in customers, and generate social media buzz using this new method. Both established brands and startups are working to meet evolving customer demands and comply with environmental rules. This shift highlights a wider industry trend of merging sustainable practices with creative packaging solutions.

Key Developments in Advanced Packaging Market

Product Launch

UFP Technologies, Inc. launched a newly designed line of eco-friendly advanced packaging solutions aimed at offering increased protection for electronic devices, providing safer transportation with reduced carbon footprint compared to traditional plastic packaging. This innovation caters to the rising demand for sustainable packaging in electronics.

Partnership

Dart Container partnered with PulPac to introduce the first dry molded fiber production line in North America, Dart Container has teamed with PulPac to launch the first dry molded fiber production line, the PulPac Scala. It seeks to improve the production of sustainable packaging and make advanced, green packaging more widely available in the region.

Acquisition

Mondi acquired the Western European operations of Germany's Schumacher Packaging for USD 634 million. This acquisition, which adds state-of-the-art box production plants in Germany and a packaging plant in the UK to the already attractive portfolio, further strengthens Mondi's position in the attractive European advanced packaging.

Acquisition

International Paper announced a USD 7.20 billion all-share takeover of DS Smith, aimed at consolidating its position in the packaging industry. This acquisition, expected to close in early 2025, will create a stronger presence in the advanced packaging.

Certification

Pactiv Evergreen received the FSC®-Recycled certification in recognition of our high-performance packaging solutions and the company's dedication to sustainability. This certification was presented at the International Production & Processing Expo in Atlanta, Georgia, emphasizing the brand’s dedication to eco-friendly practices.

Acquisition

Amcor agreed to acquire Berry Global Group in an approximately USD 8.4 billion stock exchange deal, which will form a consumer and healthcare packaging company with combined annual revenues of around USD 24 billion. This merger is expected to close by mid-2025, positioning the companies for greater innovation in advanced packaging solutions.

Increased demand for miniaturized devices, Heterogeneous integration, Growth in emerging markets, and sustainability and innovation are the advanced packaging industry.

The global advanced packaging industry stood at USD 35.2 billion in 2025.

The global advanced packaging industry is anticipated to reach USD 70.7 billion by the end of 2035.

South Asia & Pacific is set to record a CAGR of 7.5% during the forecast period.

Key players include Intel Corporation, ASE Technology Holding Co., Ltd, STMicroelectronics, and Nordic Semiconductor.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Key Companies & Market Share in the Advanced Packaging Sector

Advanced Driver Assistance System (ADAS) Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Advanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Advanced Energy Storage System Market Size and Share Forecast Outlook 2025 to 2035

Advanced Gear Shifter System Market Size and Share Forecast Outlook 2025 to 2035

Advanced Therapeutics Pharmaceutical Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Advanced Airport Technologies Market Size and Share Forecast Outlook 2025 to 2035

Advanced Air Mobility Market Size and Share Forecast Outlook 2025 to 2035

Advanced Sensor Market Size and Share Forecast Outlook 2025 to 2035

Advanced Combat Helmet Market Size and Share Forecast Outlook 2025 to 2035

Advanced Optics Material Market Size and Share Forecast Outlook 2025 to 2035

Advanced Functional Materials Market Size and Share Forecast Outlook 2025 to 2035

Advanced Drill Data Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Advanced Water Management And Filtration Equipment Market Size and Share Forecast Outlook 2025 to 2035

Advanced Coating Market Size and Share Forecast Outlook 2025 to 2035

Advanced Aerospace Coatings Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Advanced Tires Market Size and Share Forecast Outlook 2025 to 2035

Advanced Therapy Medicinal Products Market Size and Share Forecast Outlook 2025 to 2035

Advanced Glass Market Size and Share Forecast Outlook 2025 to 2035

Advanced Server Energy Monitoring Tools Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA