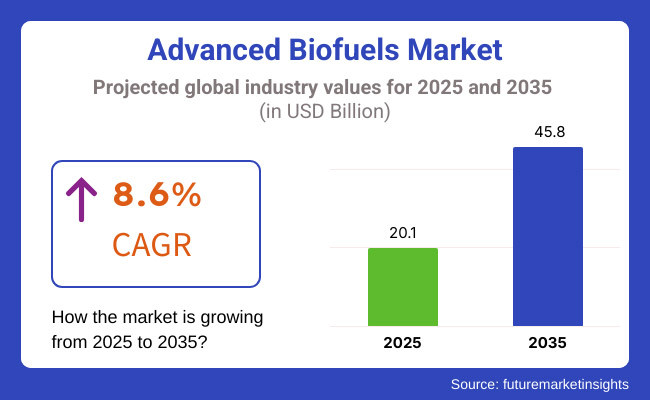

The advanced biofuels market will see outlandish growth during the period 2025 to 2035 with government policies being the driving force towards technological advancements. The market of 2024 was far in excess of USD 19.4 billion and, being calculated in value terms, can grow with the said 8.6% compound annual rate to cover the period under forecast.

Following the advent of technology, new-generation biofuels such as cellulosic ethanol, algae biofuels, and renewable diesel exist. They attain highest efficiency and productivity of production using the current feedstocks, to the advantage of development in the market.

Designing government policy globally is one of the factors that are in the interest of advanced biofuels. For example, the European Union is requesting a 2% use by the aviation industry of sustainable aviation fuel (SAF) by 2025 and the United States for end-use of all of the aviation fuel consumption by SAF by 2050. Such regulation promotes investment and adoption of cleaner fuels. Its largest oil and gas producers also invest in the biofuels industry today, with 43 to be added online by 2030 and adding a total of 286,000 barrels per day of capacity.

The largest market for advanced biofuels is found in North America, with the US leading production as well as innovation.Its mature infrastructure, combined with welcoming policies, have spurred development of advanced biofuels. Together, US oil and biofuel producers have already petitioned the Environmental Protection Agency (EPA) to open the door to more renewable fuels in America's fuel mix in 2026 and beyond.

It is in an effort to make the biofuels sector cleaner and offset anticipated declines in liquid fuel use with higher electric vehicle adoption. Near-term policies by the EPA for blending biofuels will also be raised modestly from 20.94 billion gallons in 2023 to 22.33 billion gallons by 2025. All these agencies are looking forward to the future eagerly for even stricter blending mandates, which will witness even greater development and growth entering the industry of biofuelling.

Europe's premium biofuels industry is being driven towards sustainability due to the reason that EU Renewable Energy Directive II (RED II) requires member states to supply at least 14% of rail and road transport fuel thus renewable by 2030. Technologies such as cellulosic ethanol and algae biofuels are holding their breaths awaiting for the industry to provide the requirement.

Nordic Electrofuel, for instance, is constructing an e-fuel plant in Herøya, Norway, to produce 10 million liters of synthetic fuel annually by 2027. The venture is among the Europe projects of transforming the energy sources to clean sources in the transport sector.

Asia-Pacific advanced biofuels market will grow robustly with support from high levels of urbanization, rising energy demand, and supportive government policies. India and China are also investing in the emerging technology of biofuels to help cut down fossil fuel usage and combat the environmental issues.

India has initiated 19.6% ethanol blending and is eager to go beyond 20%, and the NITI Aayog committee has this on the agenda. Chinese biofuel consumption would be anticipated to grow strongly in the wake of government and private investment in the biofuels industry. All these are keeping on the agenda investment in clean energy sources as well as carbon emissions control.

Challenges

Availability and Feedstock Sustainability

There must be guaranteed availability of renewable feedstocks like agricultural non-food crops, farm residues, and farm residues in order to produce advanced biofuels. But guaranteed long-term availability of such a commodity is a humongous task. Global climatic change can reasonably influence availability of feedstocks, i.e., crop residues, owing to uncertainty in crop production.

Besides this, increasing demand for clean fuel has resulted in it record feedstocks demand and consequently shortages. For this reason, companies are responding by turning to alternative feedstocks like algae. Algae have the following advantages: they may be grown very quickly in almost all but poorest environments, like wastewater and seawater, and will not compete with crops for land to grow.

Furthermore, algae are easily mass-cultivated in case of biomass in relation to traditional land-grown crops and therefore would prove to be an optimum feedstock for biofuels. Therefore, so dearly desired as they may seem, commercial scale algae-based biofuels are equally plagued by manufacturing cost and technology that needs to be implemented in order to bring about maximum efficiency. All of these are required in the sustainable production of next-generation biofuels industry.

Economic and Technological Barriers

Production technology for next-generation biofuels like algal fuels and cellulosic ethanol is in its infancy stage and is not scaled up. Next-generation biofuels are costly and cannot be compared to traditional fuels and will fall out of the market competition. For instance, Braya Renewable Fuels' Come By Chance refinery in Newfoundland and Labrador province in Canada was shut in January 2025 on account of uneconomic margins and market imbalances created by phasing out the USA Blenders Tax Credit.

The plant had spent more than USD 650 million to manufacture 18,000 barrels of renewable diesel every day and was dependent on USA markets because of tax credits as well as regulatory necessity. Policy decisions of California and ambiguity regarding future tax credits created over-supply and low prices, forcing other biofuel producers like Braya to close shop temporarily. The above illustrates government policy dependence by the industry and economies of massive deployment of next-generation biofuel technology.

Opportunities

Government Policies and Incentives

Governments all over the world are adopting pro-more use of next-generation biofuels policies and incentives. In the United States, the 2022 Inflation Reduction Act provides various tax credits for stimulating biofuel production like tax incentives for sustainable aviation fuel (SAF), renewable diesel, and biodiesel.

Apart from this, the IRA also allocates USD 500 million towards the deployment of biofuel infrastructure up to 2034. The European Green Deal also is relying on the use of green fuels to achieve climate neutrality by 2050. The EU has grand plans for next-generation biofuels, especially in aviation and shipping, and stronger sustainability conditions for phasing out subsidies on non-sustainable biofuels.

Technological Progress

Technological advancements assist in the research and development for additional improvement in technological advancements to make them more effective and economical in terms of the production of innovative biofuels. Genetic manipulation of microorganisms, bacteria, and yeast so that they are able to produce biofuels at a faster rate is one of the big progresses. CRISPR/Cas9 technology assists in the targeted gene editing by which pathways become simpler to manage for the purpose of optimizing yields as well as process efficacy.

For example, genetically engineered Escherichia coli microbes capable of fermenting hexose and pentose have been used in ethanol optimization from lignocellulosic biomass. Use of advanced technology in the operation of the fermentation and equipment for converting the biomass has hugely augmented the yield and minimizing the cost of operation.

During the period 2020 to 2024, the advanced biofuels market also grew steadily in the form of R&D investment, greenfield facility additions, and policy-friendly government support. This was coupled with feedstock supply chain disruption and policy volatility.

By 2025 to 2035, the technology will further advance with next-generation feedstock processing technologies, innovative feedstocks and synergism between other renewable power systems for the production of biofuels. Uses of digital technology for supply chain optimization and hybrid systems of biofuels production with biologic and chemist processes will make it efficient and sustainable.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Introduction of renewable energy mandates and blending targets. |

| Technological Advancements | Development of pilot-scale advanced biofuel production facilities. |

| Industry Adoption | Early adoption by niche markets and eco-conscious consumers. |

| Supply Chain and Sourcing | Reliance on regional feedstock supplies with limited diversification. |

| Market Competition | Dominance of established energy companies with emerging startups. |

| Market Growth Drivers | Government subsidies and environmental awareness. |

| Sustainability and Ethics | Focus on reducing greenhouse gas emissions and promoting renewable energy. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Implementation of stricter emissions regulations and increased biofuel blending requirements. |

| Technological Advancements | Commercialization of large-scale production technologies and integration with carbon capture systems. |

| Industry Adoption | Widespread adoption across various sectors, including aviation and maritime industries. |

| Supply Chain and Sourcing | Globalized supply chains with diversified and sustainable feedstock sourcing strategies. |

| Market Competition | Increased competition with new entrants and collaborative ventures between traditional energy firms and biotech companies. |

| Market Growth Drivers | Technological innovations, cost reductions, and robust policy frameworks supporting biofuel integration. |

| Sustainability and Ethics | Emphasis on full lifecycle sustainability, including land use |

America takes the leadership position in the advanced biofuels sector with effective policy and extensive research and development funding. Renewable Fuel Standard mandates the presence of renewable fuel within the transport sector fuel pool, and this has created a market for advanced biofuels.

New companies such as LanzaTech have evolved industrial gas conversion methods to ethanol and showcase new technology to create biofuels. LanzaTech's patented gas-to-liquid technology converts heterogeneous waste gas streams to fuel and high-value chemicals, guiding the world towards a clean energy future.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.0% |

Sustainability and low carbon are German energy policy priorities, meeting Renewal Energy Directive II (RED II) targets. Germany is investing in transport carbon savings with waste- and residue-based clean transport fuels.

One of the finest examples is Clariant, as it has developed the sunliquid® technology that produces cellulosic ethanol from cereal straw crop residues in an efficient manner. The process not only gives a green source of energy, but is also environmentally friendly as it uses non-food biomass. Clariant's process is the best example of Germany's focus on green energy solutions and biofuel technology advancements.

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 8.6% |

Brazil's established market for biofuels is supported by its established bioethanol sector and vast biomass feedstock. Government-supported RenovaBio program would lower greenhouse gas emissions and boost biofuels by promoting second-generation biofuels from non-food biomass.

GranBio is among the leading companies, which convert sugarcane straw and bagasse into cellulosic ethanol. GranBio's commercial-scale licensed biorefinery platforms like A GP+ have been proven to be able to transform biomass into next-generation net-zero carbon-emission biomaterials as well as biofuels and biochemicals. Besides helping with energy security, it strives towards sustainability.

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 8.6% |

China invests heavily in capital on advanced biofuels in a bid to diversify energy for the aim of enhancing the energy mix without radical negative environmental impacts. Agriculture waste-agriculture waste-convertible subsidised government-sponsored schemes are promoted.

For example, Shandong Longlive Bio-Technology Co., Ltd. has a corn cob cellulosic ethanol production line. The 2001 company converts biomass feedstocks into functional starches and sugars and recycles corn cob waste to produce second-generation biofuels. In terms of this measurement, not just is the utilization of fossil fuel reduced, but the environment is also rendered sustainable in the sense that the agricultural product wastes are converted into renewable fuels.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 8.2% |

India is taking next-generation biofuels very seriously with an aim to boost energy security and reduce farm residues. The National Policy for Biofuels, 2018, encourages the use of non-food biomass such as crop residues to produce biofuels.

For instance, there is Indian Oil Corporation's Panipat 2G Ethanol Plant in the Haryana state that yields some 30 million litres of ethanol from about 200,000 tonnes of rice straw every year. The plant, with an over ₹900 crore cost price, reflects India's emphasis on cleaner energy options and gives farm waste a money earner to rural farmers, promoting rural economic growth and conserving the environment.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 8.4% |

The future of Canada's future-generation biofuels depends on policy like the Clean Fuel Regulations, which decrease greenhouse gases by promoting low-carbon fuels. These are regulations phasing down step by step the carbon content in liquid fossil fuels to reach 15% below 2016 levels by 2030.

Leading the pack are such cutting-edge firms as Enerkem, which is turning non-recyclable municipal solid waste into biofuels. Enerkem's Edmonton, Alberta plant turns 100,000 tonnes of waste per year into biofuels as a clean waste-to-energy technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| Canada | 8.3% |

Japan is banking on the next-generation biofuels to be carbon-free by 2050. There are ENEOS Corporation partnerships with biotech companies to produce biofuels from algae and other biomass feedstocks. For example, ENEOS collaborated with CHITOSE BIO EVOLUTION PTE. LTD. in alga cultivation and algae biomass/algae-materials production for the realization of a bio-based, low-carbon, and sustainable society. ENEOS also undertakes the MATSURI project, an enterprise initiative for realization of an algae society.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.3% |

The Green New Deal in South Korea heavily burdened the future role of advanced biofuels as means of decreasing transport emissions. The government engages industry in a bid to make biofuels from waste feedstocks. An example is where SK Innovation has been exploring various different ways of making biodiesel from waste cooking oil.

SK Trading International, a subsidiary of SK Innovation, bought Daekyung Oil & Transportation in 2021, a firm that deals with the manufacturing of waste-based feedstocks such as used cooking oil for biodiesel and bio-aviation fuel use. The purchase is the latest among South Korea's efforts to make low-carbon power generation and green processes part of its green aspirations.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.5% |

Cellulosic fuels are used as an alternate fuel green source on non-food crop residues to generate energy. Corn stover and wheat straw are utilized for its ethanol production. DuPont Danisco Cellulosic Ethanol (DDCE) has commissioned refineries with the capability of converting these wastes as cellulosic ethanol feedstock with low greenhouse emissions.

DDCE, in 2010, granted a demonstration plant to Genera Energy and the University of Tennessee for the manufacture of fuel ethanol from crop residues and bioenergy crops. The application of cellulosic biofuels is complemented by optimization of biochemical and thermochemical conversion processes, and thus the productivity and cost savings rise.

The most significant category of next-generation biofuels is currently still biodiesel with production from mixed feedstocks. Abengoa Bioenergy and others are producing biodiesel from energy crops like camelina and algae and waste fats and oil.

Diversification of feedstock is not only constructing a robust supply chain but also recycling waste and going green. Abengoa Bioenergy has also studied the utilization of algae as a feedstock for biodiesel because it is able to utilize CO₂ and never compete with the food supply. Feedstock flexibility allows for ease of accommodation in changing markets and regulation.

Bio-butanol is gaining momentum on the platforms of greater energy content and acceptability with existing fuel infrastructure. Operators are contemplating the production of bio-butanol from lignocellulosic biomass like forest residues and municipal solid waste. Alcohol-based biofuel is gas compatible and offers cleaner fuel with more energetic engine performance and reduced emissions.

Abengoa Bioenergy has also been streamlining the process of manufacturing biobutanol from sugars for commercial production by 2015. The most efficient fermentation processes have to be worked out to start large-scale bio-butanol production and make cost estimates feasible.

Specialty energy crop cultivation, such as switchgrass and miscanthus, is a reliable and renewable feedstock supply for next-generation biofuels manufacturing. The energy crops are produced solely for energy production purposes, realizing the highest return with minimum inputs on the farm.

Energy crop production for biofuel utilization sequesters carbon and improves soil quality, which maximizes environmental protection. Companies like DuPont have leased farmers to supply energy crops in a manner that supplies feedstock for cellulosic ethanol production. Government subsidies and research to expand crops are the major columns for expanding energy crop plantations.

Use of municipal solid waste (MSW) as a feedstock for biofuels solves energy supply and waste problems. Industrial sectors such as those implementing the technologies being developed are converting organic MSW fractions to biogas and ethanol biofuels. It doesn't utilize landfills or emit greenhouses, both of which are conformant to the cycles of circular economies.

Abengoa Bioenergy had created technology that converted wastes to biofuels and that started commercial-scale production in June of 2013 and recommended on commercializing production of biofuels from wastes. Deployment of the waste-to-energy technology in the city is one method of clean waste management with the generation of renewable energy.

Green waste like grass clippings and farm organic waste are good feedstock to be utilized for the production of next-generation biofuels. Anaerobic digestion produces biogas while fermentation produces ethanol, both from treatment of biomass. Use of green waste not only avoids landfilling of organic waste but also stimulates production of renewable energy.

Technology investment in more efficient green waste to fuel conversion by companies propels the overall market growth of advanced biofuels. The best example is Verbio's Iowa plant, which started injecting renewable natural gas into its pipeline system early in December 2020 and using agricultural residues as a feedstock. Advanced biofuels sector employs biochemical as well as thermochemical pathways to convert diverse feedstocks to a replacement fuel.

Thermochemical processes such as pyrolysis and gasification employ heat energy to decompose biomass to generate bio-oil or syngas, from which fuel is produced. Biochemical processes employ microorganisms and enzymes in fermentation for the transformation of biomass into ethanol and other biofuels.

Further research and technology development in the aforementioned technologies will enhance the conversion efficiency, reduce the cost of production, and unveil the scale of feedstocks to be harvested, and hence render advanced biofuels as energy-intensive as energy. Abengoa Bioenergy has also pioneered first-generation and second-generation technology for biofuels in a bid to streamline the process of production and find new sources of feedstocks.

Advanced biofuels are increasing rapidly with technological advancement and collaborations. The firms are also showing greater interest in sources of clean energy in order to address the world's needs as well as policy requirements.These giant oil firms such as ExxonMobil, Chevron, BP, Shell, TotalEnergies, and Eni are increasingly investing in biofuels and anticipate sanctioning over 40 projects by 2030 with capacity that will raise the production capacity up to 286,000 barrels per day.

These initiatives are most likely to encompass the production of sustainable aviation fuel (SAF) from government-sanctioned waste streams such as the 2% SAF aviation use by 2025 required by the European Union. Technologies are also putting advanced biofuels into mainstream acceptance.

Chevron, for example, is marketing renewable gasoline blends that can be utilized in existing vehicles and will reduce lifecycle CO₂ emissions by over 40%. Such co-operation and creativity are essential to upscale low-carbon solutions and achieve durable greenhouse gas reductions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Praj Industries | 10-15% |

| Gevo | 8-12% |

| LanzaTech | 7-10% |

| Virent | 5-8% |

| LanzaJet | 4-7% |

| Other Companies (combined) | 50-66% |

| Company Name | Key Offerings/Activities |

|---|---|

| Praj Industries | Develops integrated biorefineries producing ethanol and biodiesel from non-food feedstocks; collaborates with global partners to deploy advanced biofuel technologies. |

| Gevo | Specializes in renewable jet fuel and isobutanol; utilizes proprietary technology to convert renewable energy into low-carbon fuels. |

| LanzaTech | Employs gas fermentation technology to convert industrial waste gases into ethanol; partners with various industries to reduce carbon emissions. |

| Virent | Focuses on catalytic conversion of plant-based materials into hydrocarbons; produces bio-based gasoline, diesel, and jet fuel compatible with existing infrastructure. |

| LanzaJet | Produces sustainable aviation fuel (SAF) through alcohol-to-jet technology; collaborates with airlines and governments to promote SAF adoption. |

Key Company Insights

Praj Industries (10-15%)

Praj Industries stands at the technology forefront with its innovation to design integrated biorefineries for producing ethanol and biodiesel from non-food feedstocks. Praj industries collaborates with international companies to leadership in adoption of high-tech biofuel technologies.

Gevo (8-12%)

Gevo is a manufacturer of renewable jet fuel and isobutanol through proprietary technology for converting renewable energy into low-carbon fuels. Its investment in sustainable aviation fuels positions it on the right trajectory with regards to industry trends for decarbonization of flying.

LanzaTech (7-10%)

LanzaTech applies the science of fermentation for gases in developing ethanol out of industrial waste gases and cooperates with other sectors to limit carbon and empower circular economy approaches.

Virent (5-8%)

Virent catalytically converts biomass into hydrocarbons to deliver bio-based fuel that is consumable in an existing infrastructure capacity to facilitate access to markets.

LanzaJet (4-7%)

LanzaJet produces alcohol-to-jet sustainable aviation fuel and collaborates with governments and airlines to promote take-up of SAF and facilitate aviation carbon reduction aspirations.

Other Major Players (50-66% Combined)

The rest of the market share is held by technologically advanced and niche product companies for the advanced biofuels segment. Some of the key industry players are:

The advanced biofuels market size was estimated to be approximately USD 20.1 billion in 2025.

The advanced biofuels market is projected to reach approximately USD 45.8 billion by 2035.

The demand for advanced biofuels will be driven by favorable government policies, increasing use in the automotive and aviation industries, and growing awareness about renewable energy sources.

The top 5 countries driving the development of the advanced biofuels market are the United States, China, Brazil, Germany, and India.

Cellulosic ethanol is expected to lead the advanced biofuels market, offering a sustainable alternative to traditional fuels.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Litre) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Litre) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Raw Materials, 2018 to 2033

Table 6: Global Market Volume (Litre) Forecast by Raw Materials, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Process, 2018 to 2033

Table 8: Global Market Volume (Litre) Forecast by Process, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: North America Market Volume (Litre) Forecast by Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Raw Materials, 2018 to 2033

Table 14: North America Market Volume (Litre) Forecast by Raw Materials, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Process, 2018 to 2033

Table 16: North America Market Volume (Litre) Forecast by Process, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 20: Latin America Market Volume (Litre) Forecast by Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Raw Materials, 2018 to 2033

Table 22: Latin America Market Volume (Litre) Forecast by Raw Materials, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Process, 2018 to 2033

Table 24: Latin America Market Volume (Litre) Forecast by Process, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Europe Market Volume (Litre) Forecast by Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Raw Materials, 2018 to 2033

Table 30: Europe Market Volume (Litre) Forecast by Raw Materials, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Process, 2018 to 2033

Table 32: Europe Market Volume (Litre) Forecast by Process, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (Litre) Forecast by Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Raw Materials, 2018 to 2033

Table 38: Asia Pacific Market Volume (Litre) Forecast by Raw Materials, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Process, 2018 to 2033

Table 40: Asia Pacific Market Volume (Litre) Forecast by Process, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 44: MEA Market Volume (Litre) Forecast by Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Raw Materials, 2018 to 2033

Table 46: MEA Market Volume (Litre) Forecast by Raw Materials, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Process, 2018 to 2033

Table 48: MEA Market Volume (Litre) Forecast by Process, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Raw Materials, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Process, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Litre) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 10: Global Market Volume (Litre) Analysis by Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Raw Materials, 2018 to 2033

Figure 14: Global Market Volume (Litre) Analysis by Raw Materials, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Raw Materials, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Raw Materials, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Process, 2018 to 2033

Figure 18: Global Market Volume (Litre) Analysis by Process, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Process, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Process, 2023 to 2033

Figure 21: Global Market Attractiveness by Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Raw Materials, 2023 to 2033

Figure 23: Global Market Attractiveness by Process, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Raw Materials, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Process, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 34: North America Market Volume (Litre) Analysis by Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Raw Materials, 2018 to 2033

Figure 38: North America Market Volume (Litre) Analysis by Raw Materials, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Raw Materials, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Raw Materials, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Process, 2018 to 2033

Figure 42: North America Market Volume (Litre) Analysis by Process, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Process, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Process, 2023 to 2033

Figure 45: North America Market Attractiveness by Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Raw Materials, 2023 to 2033

Figure 47: North America Market Attractiveness by Process, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Raw Materials, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Process, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 58: Latin America Market Volume (Litre) Analysis by Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Raw Materials, 2018 to 2033

Figure 62: Latin America Market Volume (Litre) Analysis by Raw Materials, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Raw Materials, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Raw Materials, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Process, 2018 to 2033

Figure 66: Latin America Market Volume (Litre) Analysis by Process, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Process, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Process, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Raw Materials, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Process, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Raw Materials, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Process, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 82: Europe Market Volume (Litre) Analysis by Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Raw Materials, 2018 to 2033

Figure 86: Europe Market Volume (Litre) Analysis by Raw Materials, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Raw Materials, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Raw Materials, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Process, 2018 to 2033

Figure 90: Europe Market Volume (Litre) Analysis by Process, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Process, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Process, 2023 to 2033

Figure 93: Europe Market Attractiveness by Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Raw Materials, 2023 to 2033

Figure 95: Europe Market Attractiveness by Process, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Raw Materials, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Process, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Litre) Analysis by Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Raw Materials, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Litre) Analysis by Raw Materials, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Raw Materials, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Raw Materials, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Process, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Litre) Analysis by Process, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Process, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Process, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Raw Materials, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Process, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Raw Materials, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Process, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 130: MEA Market Volume (Litre) Analysis by Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Raw Materials, 2018 to 2033

Figure 134: MEA Market Volume (Litre) Analysis by Raw Materials, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Raw Materials, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Raw Materials, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Process, 2018 to 2033

Figure 138: MEA Market Volume (Litre) Analysis by Process, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Process, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Process, 2023 to 2033

Figure 141: MEA Market Attractiveness by Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Raw Materials, 2023 to 2033

Figure 143: MEA Market Attractiveness by Process, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Advanced Process Control Market Size and Share Forecast Outlook 2025 to 2035

Advanced Active Cleaning System for ADAS Market Forecast and Outlook 2025 to 2035

Advanced Driver Assistance System (ADAS) Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Advanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Advanced Energy Storage System Market Size and Share Forecast Outlook 2025 to 2035

Advanced Gear Shifter System Market Size and Share Forecast Outlook 2025 to 2035

Advanced Therapeutics Pharmaceutical Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Advanced Airport Technologies Market Size and Share Forecast Outlook 2025 to 2035

Advanced Air Mobility Market Size and Share Forecast Outlook 2025 to 2035

Advanced Sensor Market Size and Share Forecast Outlook 2025 to 2035

Advanced Combat Helmet Market Size and Share Forecast Outlook 2025 to 2035

Advanced Optics Material Market Size and Share Forecast Outlook 2025 to 2035

Advanced Functional Materials Market Size and Share Forecast Outlook 2025 to 2035

Advanced Drill Data Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Advanced Water Management And Filtration Equipment Market Size and Share Forecast Outlook 2025 to 2035

Advanced Coating Market Size and Share Forecast Outlook 2025 to 2035

Advanced Aerospace Coatings Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Advanced Tires Market Size and Share Forecast Outlook 2025 to 2035

Advanced Therapy Medicinal Products Market Size and Share Forecast Outlook 2025 to 2035

Advanced Glass Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA