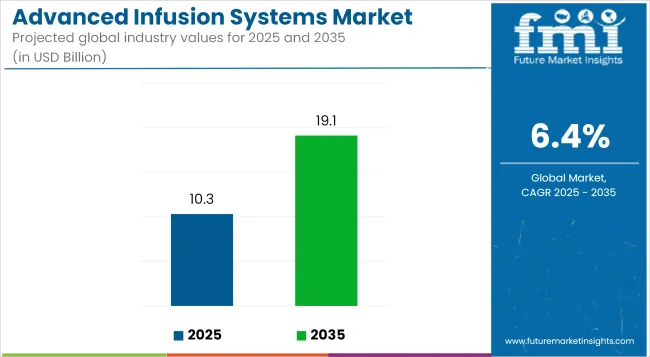

The Advanced Infusion Systems Market is anticipated to be valued at USD 10.3 billion in 2025 and is expected to reach USD 19.1 billion by 2035, registering a CAGR of 6.4%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 10.3 Billion |

| Industry Value (2035F) | USD 19.1 Billion |

| CAGR (2025 to 2035) | 6.4% |

The Advanced Infusion Systems Market is experiencing a transformative phase, driven by the escalating prevalence of chronic diseases such as diabetes, cancer, and cardiovascular disorders. This surge necessitates precise and controlled drug delivery mechanisms, positioning advanced infusion systems as critical components in modern healthcare.

Technological advancements, including the integration of smart features and wireless connectivity, are enhancing device efficiency and patient safety. The shift towards home healthcare and outpatient services further amplifies the demand for portable and user-friendly infusion devices.

Additionally, the aging global population and the emphasis on personalized medicine contribute to market growth. However, challenges such as high costs and stringent regulatory requirements persist. Despite these hurdles, the market outlook remains positive, with continuous innovations and strategic collaborations among key players fostering expansion and adoption of advanced infusion technologies.

Prominent manufacturers in the Advanced Infusion Systems Market include Baxter International Inc., B. Braun Melsungen AG, Fresenius Kabi AG, ICU Medical, Inc., and Terumo Corporation. These companies are at the forefront of innovation, focusing on developing sophisticated infusion technologies that enhance patient care and safety.

In April 2024, The USA FDA has granted 510(k) clearance to the Baxter Novum IQ’s large volume infusion pump (LVP) with Dose IQ Safety Software.Adding LVP modality to the Novum IQ Infusion Platform which includes Baxter’s syringe infusion pump (SYR) with Dose IQ Safety Software, powered by the IQ Enterprise Connectivity Suite enables clinicians to utilize a single, integrated system across a variety of patient care settings.

“The Novum IQ platform represents a meaningful shift in how connected and intelligent infusion therapy can impact the way clinicians provide care, Offering Novum IQ large volume and syringe infusion pumps unlocks the potential of advanced, intuitive technologies that customers seek to meet their needs.” said Heather Knight, executive vice president and group president, Medical Products and Therapies at Baxter.

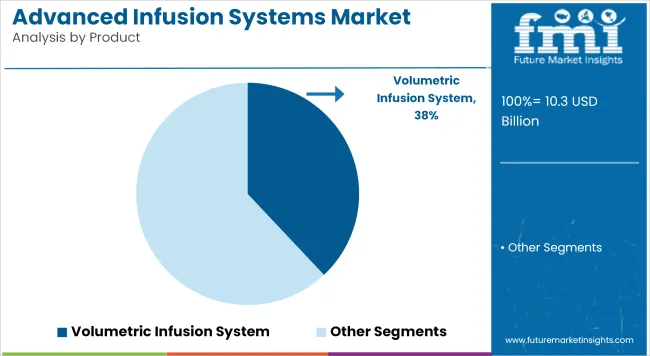

Holding a 38.0% share in 2025, the Volumetric Infusion Systems segment has emerged as the dominant category in the Advanced Infusion Systems Market. The segment's growth has been attributed to its widespread adoption in intensive care units (ICUs), operating rooms, and emergency settings, where high-volume, continuous fluid administration is essential.

These systems have been preferred for their high precision in delivering large volumes of fluids or medications, making them indispensable in managing trauma, sepsis, chemotherapy, and postoperative care. Technological advancements such as automated flow regulation, integrated safety alarms, and compatibility with electronic health records have further strengthened their clinical utility.

Additionally, the rising incidence of chronic diseases and surgical interventions has necessitated infusion solutions that support long-duration therapies with minimal user intervention. As regulatory authorities push for error-reduction in medication delivery, volumetric pumps equipped with dose-error reduction systems (DERS) and smart integration have been increasingly installed across healthcare infrastructures. Their reliability and adaptability in diverse clinical scenarios have positioned this segment as a market leader.

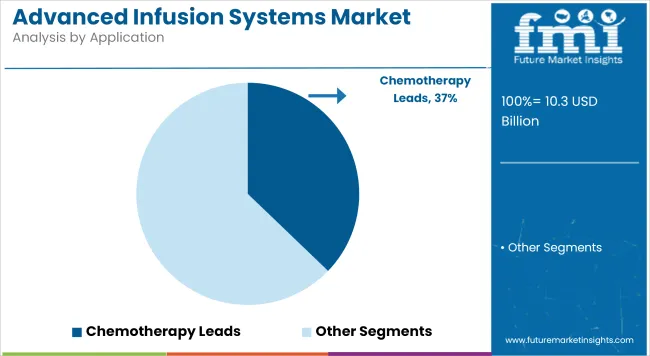

With a 37.2% share in 2025, Chemotherapy remains the largest application segment in the Advanced Infusion Systems Market. Its dominance has been driven by the increasing global cancer burden and the clinical demand for targeted, time-controlled drug administration.

Chemotherapeutic agents, known for their narrow therapeutic window, require precise infusion control a demand effectively met by programmable infusion systems. Advanced infusion technologies are increasingly integrated into oncology treatment protocols to minimize cytotoxic side effects, improve patient comfort, and deliver multi-agent regimens over extended durations. Patient-centric trends such as home-based chemotherapy and ambulatory oncology clinics have further fueled adoption.

Infusion pumps equipped with safety features, such as air-in-line sensors and drug libraries, have been favored for reducing administration errors. As cancer cases surge across aging populations and younger demographics alike, the need for safe and effective drug infusion continues to boost the segment. Additionally, strong support from oncology guidelines recommending infusion-assisted chemotherapy has reinforced this application’s prominence within the market.

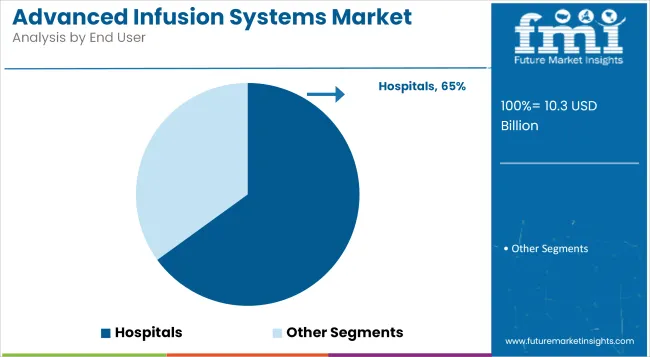

Hospitals, accounting for 65% of revenue share in 2025, have been identified as the leading end-user segment in the Advanced Infusion Systems Market. This leadership position has been underpinned by the widespread availability of centralized infusion management systems within inpatient care settings.

The requirement for high-acuity monitoring, continuous drug administration, and rapid-response therapies in hospital departments such as ICUs, oncology wards, and surgical units has necessitated the use of sophisticated infusion solutions.

Advanced infusion systems are being increasingly deployed to reduce medication errors, enhance workflow efficiency, and support clinical decision-making. Hospital-driven investments in digital health infrastructure, including smart pumps integrated with EHR systems, have accelerated the deployment of technologically advanced devices.

Additionally, regulatory mandates focused on infusion safety, coupled with growing procedural volumes, have contributed to segmental growth. Procurement practices among hospital networks favor standardization and scalability two attributes strongly aligned with volumetric and syringe-based infusion systems. As hospital-based treatments remain the backbone of critical care delivery, this segment is expected to retain its dominance over the forecast period.

Risk of Infusion Errors and Device Failures is Emerging as a Significant Market Restraint

Such issues hinder current and ongoing developments in infusion pump technology. Despite this, the misuse may herald the continuous danger associated with infusion errors resulting from equipment failure. A few of the programming mistakes involve incorrect dosages or software malfunctions, which end up creating serious medication errors, thereby jeopardizing patient safety.

Mechanical failures include such factors as occlusions, poor battery functions, or pump dislodgments, thus adding to the risk of improper drug delivery. Studies thereby indicate infusion pump errors, such as improper dosage input or programming errors, as one of the leading causes of adverse drug events (ADEs) among health care facilities.

Alarm fatigue, caused by excessive or even false alerts, can cause delays in the response made by professionals across the establishments. Such risks related to safety not only limit the use and increase efforts for continual product recall and the high magnitude of scrutiny by regulatory bodies but also raise liability risks for manufacturers as well, thus limiting further market growth.

Expansion of Home Healthcare and Ambulatory Infusion Therapy as a Market Opportunity

The advanced infusion systems market has a wonderful opportunity as home care treatments and ambulatory care become more popular. The burden of chronic illnesses such as cancer, diabetes, and CNS disorders brings many patients to long-term IV drug administration. Outside the hospital, the employment of portable and wearable infusion pumps further augments the comfort of the patient with the continuous delivery of medication, minimizing hospital visits.

Moreover, the demand for ambulatory infusion therapy that reduces hospital stays and expenditure will increase, while the industry is changing towards cost-effective healthcare options. Remote monitoring and wireless connectivity are two technological advancements that further bolster patient safety and therapy adherence. As healthcare systems promote more home-based care models, manufacturers can now build very user-friendly, compact, and efficient infusion systems designed for outpatient use.

Growth of Wearable and Home-Based Infusion Systems

The increasing adoption of compact wireless infusion pumps is revolutionizing drug administration and creating vast opportunities in home healthcare and long-term management of diseases. Patients with chronic conditions that require continuous or intermittent medication delivery, such as diabetes, cancer, or autoimmune diseases, find wearable infusion systems an attractive and effective solution.

These modern pumps offer improved mobility, comfort for the patient, and reduced dependence on hospitals, thus lowering healthcare costs. The flexibility of self-administering medications by the patient provides added incentive for treatment compliance or personalizing treatment.

Bluetooth technology, remote patient monitoring, and integration with mHealth applications all greatly enhance safety and treatment efficacy. In keeping with this transition, demand for wearable, user-friendly, and automated infusion platforms is escalating as healthcare itself migrates to a patient-centric and ambulatory care model.

Expansion of Closed-Loop and Non-Invasive Infusion Technologies

Closed-loop infusion with or without invasiveness is going to change the entire landscape of infusion technology into one where drug delivery will be automated, sensor-based, and highly focused on patient safety. Closed-loop systems provide automated dose adjustment on the basis of real-time patient monitoring so that the whole unit of medication delivery gets rid of lots of human error and gives very high precision in drug delivery.

Closed-loop systems are of utmost importance in the fields of critical care, diabetes management (automated insulin delivery), and pain management, where drug modulation is required continuously. Apart from closed-loop systems, other non-invasive infusion systems, such as microneedle patches and transdermal drug delivery, further increase patient comfort while reducing the risks of infection.

Additionally, an AI-assisted infusion management system enhances treatments by analyzing patients' response trends and predicting dosage needs. The more healthcare works toward precision medicine and real-time monitoring, the greater will be the adoption of these advanced self-tuning infusion systems.

Market Outlook

The United States market has been continuing to have a steady upward trend in the advanced infusion systems segment of the United States, basically because of the influx of chronic diseases, like diabetes, cancer, and gastrointestinal disorders. These conditions necessitate very accurate and effective methods of drug delivery, thus increasing the demand for advanced infusion systems.

Besides, new devices, including smart infusion pumps that are better prepared for safety specifications, are factors that bring hype in the very fertile market. It has something to do with the innovations in home healthcare in further encouraging the use of portable, easy-to-use infusion systems.

Market Growth Factors

Market Forecast

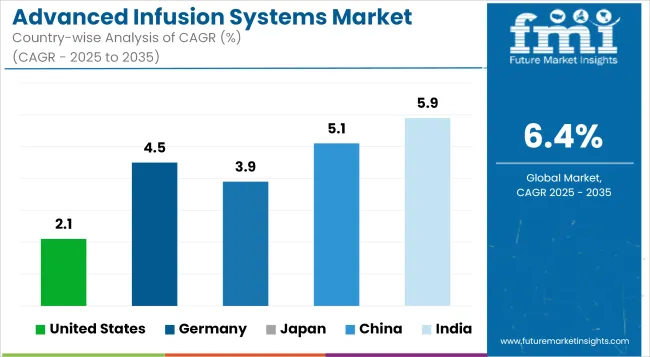

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 2.1% |

Market Outlook

Market Outlook: Advanced infusion systems in Germany have witnessed a gradual increase due to the improved healthcare infrastructure of the country and a bent towards innovation in medical technologies. The growing elderly population and burdensome cases of chronic diseases propel the demand for sophisticated infusion therapy. Besides, stringent standards of regulations ensure the adoption of high-quality and safe infusion devices.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 4.5% |

Market Outlook

Japan's advanced infusion system market has been rapidly advancing with recent technology and has a very high standard of healthcare. With the growing prevalence of chronic diseases due to a super-aging society, the demand for efficient and reliable infusion therapies will further escalate. The incorporation of smart technologies into medical devices corresponds to Japan's approach towards precision medicine and patient safety.

Market Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

Market Outlook

China's advanced infusion systems market grows rapidly due to ongoing developments in healthcare infrastructure and tremendous investments in medical technology. The increase in the number of patients suffering from chronic diseases and associated government measures to improve healthcare access also trigger the growth in demand for advanced infusion therapies.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 5.1% |

Market Outlook

Market OutlookSubstantial developments in India's advanced infusion systems market are due to the expansion of healthcare institutions with enormous government funding and a heavier burden of chronic diseases. Medical infrastructure improvements, matched with digital health demand, expedite advanced infusion therapies. The focus on affordable healthcare solutions filed under fit grants more strength toward the use of innovative cost-effective infusion systems.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.9% |

The advanced infusion systems market is competitive and has been fueled by increasing pressure on precision drug delivery, advances in smart infusion technology, and growing adoption of wireless connectivity in healthcare settings.

There have been investments in AI-driven infusion pump technologies, closed-loop medication management, and better safety features of the infusion device. With well established medical device manufacturers, infusion technology providers and emerging digital health firms in the industry, the dynamics of infusion therapy solutions are changing.

the market is segmented into Elastomeric Infusion System, Volumetric Infusion System - Large Volume and Small Volume Pump, Patient Controlled Analgesia Pump, Disposable Infusion System, Syringe Infusion System, Ambulatory Infusion System, and Implantable Infusion System.

the market is segmented into Chemotherapy, Diabetes, Pain Management, Asthma, and Clinical Nutrition.

the market is segmented into Hospitals, Ambulatory Surgical Centers, Diagnostic Centers, and Bedside.

the Advanced Infusion Systems Market is analyzed across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

The global advanced infusion systems industry is projected to witness CAGR of 6.4% between 2025 and 2035.

The global advanced infusion systems industry stood at USD 9,430.0 million in 2024.

The global advanced infusion systems industry is anticipated to reach USD 19.1 billion by 2035 end.

India is expected to show a CAGR of 5.9% in the assessment period.

The key players operating in the global advanced infusion systems industry are Baxter International, Becton, Dickinson (BD), ICU Medical Inc., Fresenius Kabi, Smiths Medical, Medtronic plc, Moog Inc., Mindray Medical, Terumo Corporation, Nipro Corporation & Others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Advanced Active Cleaning System for ADAS Market Forecast and Outlook 2025 to 2035

Advanced Driver Assistance System (ADAS) Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Advanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Advanced Energy Storage System Market Size and Share Forecast Outlook 2025 to 2035

Advanced Gear Shifter System Market Size and Share Forecast Outlook 2025 to 2035

Advanced Therapeutics Pharmaceutical Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Advanced Airport Technologies Market Size and Share Forecast Outlook 2025 to 2035

Advanced Air Mobility Market Size and Share Forecast Outlook 2025 to 2035

Advanced Sensor Market Size and Share Forecast Outlook 2025 to 2035

Advanced Combat Helmet Market Size and Share Forecast Outlook 2025 to 2035

Advanced Optics Material Market Size and Share Forecast Outlook 2025 to 2035

Advanced Functional Materials Market Size and Share Forecast Outlook 2025 to 2035

Advanced Drill Data Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Advanced Water Management And Filtration Equipment Market Size and Share Forecast Outlook 2025 to 2035

Advanced Coating Market Size and Share Forecast Outlook 2025 to 2035

Advanced Aerospace Coatings Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Advanced Tires Market Size and Share Forecast Outlook 2025 to 2035

Advanced Therapy Medicinal Products Market Size and Share Forecast Outlook 2025 to 2035

Advanced Glass Market Size and Share Forecast Outlook 2025 to 2035

Advanced Server Energy Monitoring Tools Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA