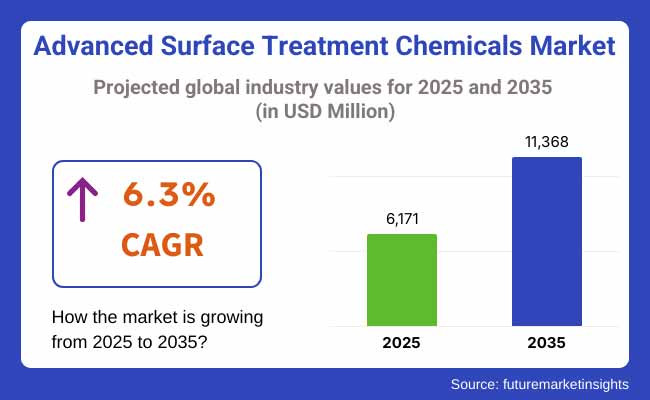

The global advanced surface treatment chemicals industry is poised to reach USD 6,171 million in 2025. Over the projected period between 2025 and 2035, global sales are expected to surge at a CAGR of 6.3%. The total market valuation will grow by USD 11,368 million by the end of 2035.

In 2024, the industry for surface treatment chemicals witnessed significant growth due to expanded demand across industries. The automotive industry also witnessed growing demand for surface treatment chemicals, especially in response to the fast-paced adoption of electric vehicles (EVs). Surface treatment chemicals were crucial in providing corrosion resistance and durability for battery components and lightweight materials.

The industry is likely to witness continued growth driven by the advancement in nanotechnology and material science during the forecasted period. These developments will make the treatment chemicals more efficient and specialized for the evolving needs of industry. Additionally, Sustainability will continue to be a significant aspect, with a growing emphasis on environmentally benign formulations.

Future Market Insights conducted the latest survey of industry leaders in the advanced surface treatment chemicals industry and observed several important trends in the sector. Most respondents indicated that the need for sustainable and environmentally friendly treatment options was at the top of their list of priorities. Regulatory requirements and consumer demand are forcing companies to produce low-VOC and biodegradable products, with more than 65% of firms making active investments in green options.

Industry executives also identified the pace of technological innovations as one of the prime drivers of industry transformation. Over 70% of the respondents recognized the increasing influence of nanotechnology and precision chemistry on improving the performance of products. New coating and surface treatment innovations are enabling enhanced durability, corrosion protection, and energy efficiency, especially in the automotive and aerospace industries.

Supply chain issues continue to be a challenge, with approximately 60% of stakeholders pointing to raw material shortages and price volatility as the major challenges. Companies are looking at diversifying sourcing practices and embracing digital supply chain solutions to help reduce these risks.

| Country/Region | Impact of Government Regulations and Mandatory Certifications |

|---|---|

| United States | The USA Environmental Protection Agency (EPA) enforces strict regulations on volatile organic compound (VOC) emissions, affecting the production and application of surface treatment chemicals. Compliance with standards such as the Toxic Substances Control Act (TSCA) is mandatory. |

| European Union | The EU's REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulation requires companies to register chemicals and assess risks. The European Chemicals Agency (ECHA) oversees compliance, impacting industry entry and chemical usage. |

| China | China's Ministry of Ecology and Environment enforces the "Measures for Environmental Management of New Chemical Substances," requiring registration and evaluation of new chemicals. The country also implements strict VOC emission standards, influencing the formulation of surface treatment chemicals. |

| India | The Central Pollution Control Board (CPCB) regulates industrial emissions, including those from chemical processes. Compliance with the Manufacture, Storage and Import of Hazardous Chemical Rules is mandatory, affecting the surface treatment chemicals industry. |

| Japan | Japan's Chemical Substances Control Law (CSCL) mandates the evaluation and classification of chemicals before industry entry. The country also enforces stringent environmental regulations, influencing the development and use of surface treatment chemicals. |

| United Kingdom | Post-Brexit, the UK has established its chemical regulation framework, UK REACH, mirroring the EU's REACH but requiring separate registrations. This has introduced complexities and increased compliance costs for companies operating in both industries. |

| South Korea | The Act on Registration and Evaluation of Chemicals (K-REACH) requires companies to register chemicals and conduct risk assessments, aligning with global standards and impacting the surface treatment chemicals industry. |

The advanced surface treatment chemicals industry in the USA is expected to grow at a CAGR of nearly 6.0% from 2025 to 2035. This growth is fueled by strong industrial sectors such as automotive, aerospace, and electronics, which require high-performance surface treatment solutions.

Ongoing infrastructure development and technological innovation from the USA government also serve as a driver for industry expansion. Furthermore, the implementation of strict environmental regulations imposed by government agencies such as the Environmental Protection Agency (EPA) is promoting the use of green and sustainable chemical formulations, driving product innovation and shaping industrial trends.

FMI opines that the United States' advanced surface treatment chemicals sales will grow at nearly 6.0% CAGR through 2025 to 2035.

The industry for advanced surface treatment chemicals in the UK will reach at a CAGR of around 5.5% between 2025 and 2035. Strong automotive and aerospace industries and well-established renewable energy projects, in the country are increasing the demand for specialized surface treatment chemicals in the UK.

Regulatory schemes like UK REACH established after Brexit impose strict requirements on companies to ensure chemical safety, affecting industry dynamics and incentivizing the production of compliant goods. Increasing investments in research and development for clean, high-performance chemicals are anticipated to foster industry growth.

FMI opines that the United Kingdom's advanced surface treatment chemicals sales will grow at nearly 5.5% CAGR through 2025 to 2035.

The advanced surface treatment chemicals industry in France is anticipated to grow at a CAGR of over 5.8% between 2025 and 2035. With a strong automotive and aerospace national base and a developing electronics sector, this country also has a demand for high-technology surface finishes.

Environmentally sustainable formulations of chemical compounds are largely driven through REACH and French obligations under EU rules in addition to their commitments to green chemistry. Government incentives to promote green technologies and sustainable manufacturing practices are also fuelling the industry growth.

FMI opines that France's advanced surface treatment chemicals sales will grow at nearly 5.8% CAGR through 2025 to 2035.

The advanced surface treatment chemicals industry in Germany is anticipated to grow at a CAGR of 6.2% from 2025 to 2035. Germany's position as a major international hub for automotive manufacturing, industrial machinery and electronics ensures a continuing demand for high-quality surface treatment chemicals. Stringent environmental regulations and a commitment to innovation have fostered the development of sustainable and resource-efficient chemical solutions in the country.

FMI opines that Germany's advanced surface treatment chemicals sales will grow at nearly 6.2% CAGR through 2025 to 2035.

The Italian advanced surface treatment chemicals industry is expected to witness growth at a rate of around 5.0% during the forecast period (2025 to 2035). The automotive, fashion and luxury goods sectors of the country also depend on specialized surface coatings to reinforce product durability and aesthetics.

These include compliance with European Union regulations like REACH and an increasing emphasis on sustainability in manufacturing practices, which stimulate demand for environmentally friendly chemical solutions. Increased investment focused on the modernization of industrial processes and the usage of other advanced technologies is likely to create opportunities for industry growth.

FMI opines that Italy’s advanced surface treatment chemicals sales will grow at nearly 5.0% CAGR through 2025 to 2035.

From 2025 to 2035, the industry for advanced surface treatment chemicals in South Korea is projected to grow at a CAGR of nearly 6.5%. Robust industries including electronics, automotive and shipbuilding create a high demand for customized surface treatment solutions in the country.

With governments promoting technological innovation and sustainability, there is a greener and more advanced pathway for growing chemical formulations. The high-tech manufacturing focuses on maintaining its edge in South Korea and is aiding the surface treatment chemicals industry.

FMI opines that South Korea’s advanced surface treatment chemicals sales will grow at nearly 6.5% CAGR through 2025 to 2035.

The advanced surface treatment chemicals industry in Japan will expand at a CAGR of 5.7% between 2025 and 2035. Automotive and electronics industries are the two dominant industries in the country and high-performance surface treatment is required to enhance the quality and lifetime of the products.

The country’s commitment to ensuring environmental sustainability and compliance with international regulations will drive the development and adoption of eco-friendly chemical solutions. Ongoing investments in R&D and a culture of innovation help develop the surface treatment chemicals industry.

FMI opines that Japan's advanced surface treatment chemicals sales will grow at nearly 5.7% CAGR through 2025 to 2035.

The advanced surface treatment chemicals industry in China is expected to grow at a CAGR of 7.0% during 2025 - 2035. Rapid industrialization, a large manufacturing sector, and growing automobile and electronics industries in the country are major contributory factors to industry demand.

The government policies designed to promote modernization and environmental protection in the industries will boost the adoption of advanced sustainable chemical formulations. China's status as an international manufacturing centre and continued investment in infrastructure development also drive demand.

FMI opines that China’s advanced surface treatment chemicals sales will grow at nearly 7.0% CAGR through 2025 to 2035.

The advanced surface treatment chemicals industry in Australia and New Zealand is expected to grow at a CAGR of around 5.2% during the forecast period. The construction, automotive, and mining industries in the region also need specialized surface treatment solutions to increase the durability and performance of the material.

Eco-friendly chemical formulations are also driven by increased government regulations for environmental sustainability and compliance with safety standards. Infrastructure development and technological innovation drive the growth of the surface treatment chemicals industry in these nations.

FMI opines that Australia-NZ advanced surface treatment chemicals sales will grow at nearly 5.2% CAGR through 2025 to 2035.

Adhesion promoters will witness steady demand across industries, particularly in automotive, aerospace, and packaging applications. These chemicals enhance the bonding strength between different materials, ensuring durability and reliability. As lightweight materials such as composites and plastics gain popularity, manufacturers will increasingly rely on adhesion promoters to optimize performance.

Anti-corrosion agents will play a crucial role in protecting metal surfaces from degradation, especially in the automotive, construction, and aerospace industries. As industries focus on extending product lifespans and reducing maintenance costs, companies will invest in advanced anti-corrosion solutions with self-healing and nanotechnology-based properties.

Cleaners and activators will see growing adoption in electronics, automotive, and industrial applications. These chemicals ensure optimal surface preparation by removing contaminants, enhancing adhesion, and improving coating effectiveness. The need for high-precision surface treatments in semiconductor and electronics manufacturing will drive demand for advanced cleaning and activation solutions.

Anodizing agents will continue to be essential in metal finishing, particularly for aluminium components in aerospace, automotive, and architectural applications. The rising demand for lightweight yet durable materials will strengthen the industry for anodizing treatments.

Conversion coatings will gain importance in industrial applications, providing corrosion resistance and improving paint adhesion. Their use in automotive, electronics, and aerospace industries will expand as manufacturers seek to enhance product longevity and surface performance.

Other surface treatment chemicals, including speciality coatings and multifunctional solutions, will continue to evolve to meet industry-specific requirements. The demand for custom formulations catering to emerging materials and advanced manufacturing processes will drive innovation in this segment.

Metal surface treatment chemicals will continue to dominate the industry, driven by their widespread use in automotive, aerospace, construction, and industrial machinery. Corrosion protection, enhanced durability, and improved aesthetic appeal will remain key objectives for manufacturers. Innovations in nanocoating and smart surface treatments will enhance the efficiency of metal treatment processes while reducing environmental impact.

Plastic surface treatments will experience rapid growth as industries including automotive, electronics and consumer goods have increasingly adopted polymers for lightweight and cost-effective solutions. Automotive manufacturers will continue integrating plastic components into vehicle structures, requiring advanced surface treatment solutions to enhance adhesion and durability. The electronics industry will also drive demand for plastic surface treatments, ensuring improved performance and reliability of consumer and industrial devices.

Glass and ceramic surface treatments will expand in response to their growing use in electronics, construction, and automotive applications. Smart glass technologies, self-cleaning coatings, and anti-reflective treatments will gain traction as the industry moves toward enhanced functionality. The demand for protective coatings in the consumer electronics sector will further boost innovations in this segment.

Other surfaces, including composites and hybrid materials, will see increasing demand for specialized treatment solutions. The rise of advanced manufacturing techniques, such as additive manufacturing and high-performance composite fabrication, will create opportunities for tailored surface treatments that enhance durability and performance.

The automotive industry will remain a key driver of surface treatment chemicals, with electric vehicle adoption fuelling demand for corrosion-resistant coatings, adhesion promoters, and lightweight material treatments. As automakers prioritize fuel efficiency and sustainability, surface treatment solutions will evolve to meet the performance needs of next-generation vehicles.

The building and construction sector will see sustained demand for surface treatment chemicals, particularly in protective coatings, anti-corrosion solutions, and adhesion promoters. Urbanization and infrastructure projects will drive innovations in durable and energy-efficient coatings. Smart coatings with self-healing and pollution-resistant properties will gain prominence, addressing the growing need for sustainable and long-lasting building materials.

Electrical and electronics manufacturers will increasingly rely on surface treatment chemicals to improve product reliability and performance. The miniaturization of components, expansion of semiconductor manufacturing, and development of next-generation consumer electronics will drive demand for advanced cleaning agents, adhesion promoters, and protective coatings. The shift toward lead-free and environmentally safe formulations will further influence industry trends.

The aerospace and defence industry will demand high-performance surface treatments to enhance aircraft durability, reduce maintenance costs, and improve fuel efficiency. Advanced coatings, corrosion inhibitors, and lightweight material treatments will remain critical as aerospace manufacturers seek to optimize aircraft performance. Sustainable and regulation-compliant formulations will become essential as the industry moves towards greener technologies.

The packaging sector will see growing interest in functional and protective surface treatments, particularly for food and pharmaceutical packaging. Anti-microbial coatings, barrier coatings, and adhesion promoters will play a crucial role in maintaining product integrity and extending shelf life.

Other industries, including healthcare and textiles, will embrace surface treatment chemicals to enhance material performance and safety. Medical devices will require specialized coatings to ensure biocompatibility and longevity, while the textile industry will adopt advanced treatments for stain resistance, durability, and moisture management.

| 2020 to 2024 (Historical Analysis) | 2025 to 2035 (Forecasted Outlook) |

|---|---|

| The industry experienced moderate growth, driven by recovery from the COVID-19 pandemic and the resurgence of industrial activities. Automotive, aerospace, and electronics sectors witnessed fluctuations due to supply chain disruptions and shifting consumer demand. | The industry is expected to grow steadily, with a focus on sustainable, high-performance solutions. Expansion in electric vehicles, green construction, and advanced electronics will drive innovation in surface treatment chemicals. |

| Stringent environmental regulations led to increased research into eco-friendly alternatives, including low-VOC and chromium-free formulations. Companies began transitioning toward greener solutions to comply with global sustainability goals. | Sustainability will be a major driving force, with governments enforcing stricter emissions and hazardous material regulations. The adoption of biodegradable and water-based chemicals will accelerate. |

| Nanotechnology and precision chemistry gained momentum, improving the efficiency and durability of surface treatments. However, adoption remained limited due to cost constraints and a lack of large-scale infrastructure. | Nanocoatings, self-healing materials, and smart coatings will gain widespread adoption as production costs decline and industries recognize their long-term benefits. |

| Supply chain disruptions caused fluctuations in raw material prices, impacting manufacturing costs. Companies focused on diversifying supply sources and improving logistics efficiency. | Digitalization and AI-driven supply chain management will optimize production, reducing dependencies on single-source suppliers and mitigating price volatility. |

| The automotive industry remained a dominant consumer, but demand was inconsistent due to the semiconductor shortage and transition toward electric vehicles. | Electric vehicle expansion will drive demand for lightweight material treatments, corrosion resistance, and advanced adhesion technologies, significantly boosting industry growth. |

| Aerospace and defence saw slow recovery post-pandemic, with demand for high-performance coatings and anti-corrosion solutions increasing gradually. | The aerospace sector will invest heavily in advanced coatings for fuel efficiency and durability, while the defence industry will require specialized treatments for enhanced operational performance. |

| Consumer electronics saw steady growth, particularly in coatings for semiconductors, touchscreens, and display panels. However, regional disruptions affected production timelines. | The electronics industry will drive high demand for surface treatments that improve conductivity, durability, and miniaturization, especially with the expansion of 5G and AI-driven devices. |

| Companies focused on regional expansion and mergers to strengthen industry presence. However, regulatory challenges in different regions limited seamless global expansion. | Industry consolidation will continue, with leading players forming strategic alliances and investing in R&D to develop breakthrough surface treatment solutions. |

| The adoption of automation in chemical processing increased but remained in the early stages, with limited integration in small and mid-sized enterprises. | AI and IoT-driven automation will revolutionize the industry, enhancing precision, reducing waste, and improving overall production efficiency. |

The advanced surface treatment chemicals industry is a part of the speciality chemicals industry, which serves numerous industries, such as automotive, aerospace, construction, electronics, and packaging. These chemicals improve surface characteristics such as adhesion, corrosion resistance, and durability, and are critical for high-performance industrial applications.

The industry is likely to have a strong impact on the advanced surface treatment chemicals industry between 2025 and 2035. Industrial growth in emerging industries, especially in the Asia-Pacific region, will fuel growth, boosting demand for surface treatment solutions. Infrastructure development, fast-paced urbanization, and growing automotive manufacturing will result in a strong demand for protective coatings, adhesion promoters, and anti-corrosion agents.

Sustainability will be at the core as governments globally set stricter environmental controls. The adoption of green chemistry will expedite investments in eco-friendly, water-based, and bio-based products. Technological progress in nanotechnology, AI-driven automation, and smart coatings will redefine industry forces.

The advanced surface treatment chemicals industry presents significant growth opportunities, particularly in electric vehicles (EVs), semiconductors, and sustainable solutions. The rise of EVs demands advanced corrosion-resistant coatings and adhesion promoters for lightweight materials like aluminium and composites. The semiconductor and electronics sector will require high-purity cleaners and nano-coatings as miniaturization and 5G expansion accelerate.

Additionally, the shift to sustainable chemistries will push companies to develop chromium-free, water-based, and bio-based alternatives to meet stringent regulations. AI-driven automation in surface treatment processes will enhance precision and efficiency, reducing costs.

Top key players in the advanced surface treatment chemical industry are competing through pricing strategies that reconcile premium formulations with cost-effective options to address varied industry segments. Innovation has now become a crucial aspect, with emerging companies putting a lot of investment in R&D to create environment-friendly formulations with better performance properties.

These innovations are mainly focused on lower VOC emissions, lower energy consumption in application processes, and formulations that are compatible with lightweight materials being used more and more in the car and aircraft industries. Strategic alliances have become an important competitive factor, with chemical producers entering collaborations along the value chain.

Henkel AG: 18% industry share

Chemetall (BASF): 16% industry share

PPG Industries: 12% industry share

Atotech (MKS Instruments): 12% industry share

Nihon Parkerizing: 7% global industry share

Grauer & Weil: 5% industry share

MacDermid: 4% industry share

Quaker Houghton: 3% industry share

Regional and specialized players: 23% industry share combined

ExxonMobil Acquires Pioneer Natural Resources

Capital One Acquires Discover Financial Services

Synopsys Acquires Ansys

Mars Acquires Kellanova

ConocoPhillips Acquires Marathon Oil

Volkswagen and Rivian Joint Venture

Microsoft and Constellation Energy Partnership

Details: In September 2024, Microsoft signed a power purchase agreement to restart the Crane Clean Energy Center (formerly Three Mile Island Unit 1) with Constellation Energy, supporting its data centres with clean energy.

Google, Intersect Power, and TPG Partnership

BlackRock, Global Infrastructure Partners, Microsoft, and Middle Eastern AI Investor Partnership

The focus is shifting towards sustainable, high-performance coatings, with innovations in bio-based formulations, nanocoatings, and smart surface treatments.

Firms are investing in chromium-free coatings, water-based solutions, and AI-driven automation to enhance efficiency while ensuring compliance.

EVs are driving demand for lightweight material treatments, advanced adhesion promoters, and corrosion-resistant coatings to improve durability.

Ultra-pure cleaners, precision etching solutions, and anti-contamination coatings are emerging to support next-gen semiconductor manufacturing.

AI-driven quality control, predictive maintenance, and automated surface treatments will enhance efficiency, reduce waste, and optimize production.

Table 01: Global Market Size Volume (Tons) and Value (US$ Million) Forecast by Chemical Type, 2018 to 2033

Table 02: Global Market Size Volume (Tons) and Value (US$ Million) Forecast by Surface Type, 2018 to 2033

Table 03: Global Market Size Volume (Tons) and Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 04: Global Market Size Volume (Tons) and Value (US$ Million) Forecast by Region, 2018 to 2033

Table 05: North America Market Size (US$ Million) and Volume (Tons) Forecast by Country, 2018 to 2033

Table 06: North America Market Volume (Tons) and Value (US$ Million) Forecast by Chemical Type, 2018 to 2033

Table 07: North America Market Volume (Tons) and Value (US$ Million) Forecast by Surface Type, 2018 to 2033

Table 08: North America Market Size Volume (Tons) and Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 09: Latin America Market Size (US$ Million) and Volume (Tons) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Size Volume (Tons) and Value (US$ Million) Forecast by Chemical Type, 2018 to 2033

Table 11: Latin America Market Size Volume (Tons) and Value (US$ Million) Forecast by Surface Type, 2018 to 2033

Table 12: Latin America Market Size Volume (Tons) and Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 13: Western Europe Market Size (US$ Million) and Volume (Tons) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Size Volume (Tons) and Value (US$ Million) Forecast by Chemical Type, 2018 to 2033

Table 15: Western Europe Market Size Volume (Tons) and Value (US$ Million) Forecast by Surface Type, 2018 to 2033

Table 16: Western Europe Market Size Volume (Tons) and Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 17: Eastern Europe Market Size (US$ Million) and Volume (Tons) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Size Volume (Tons) and Value (US$ Million) Forecast by Chemical Type, 2018 to 2033

Table 19: Eastern Europe Market Size Volume (Tons) and Value (US$ Million) Forecast by Surface Type, 2018 to 2033

Table 20: Eastern Europe Market Size Volume (Tons) and Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 21: East Asia Market Size (US$ Million) and Volume (Tons) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Volume (Tons) and Value (US$ Million) Forecast by Chemical Type, 2018 to 2033

Table 23: East Asia Market Volume (Tons) and Value (US$ Million) Forecast by Surface Type, 2018 to 2033

Table 24: East Asia Market Size Volume (Tons) and Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 25: South Asia and Pacific Market Size (US$ Million) and Volume (Tons) Forecast by Country, 2018 to 2033

Table 26: South Asia and Pacific Market Size Volume (Tons) and Value (US$ Million) Forecast by Chemical Type, 2018 to 2033

Table 27: South Asia and Pacific Market Size Volume (Tons) and Value (US$ Million) Forecast by Surface Type, 2018 to 2033

Table 28: South Asia and Pacific Market Size Volume (Tons) and Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 29: MEA Market Size (US$ Million) and Volume (Tons) Forecast by Country, 2018 to 2033

Table 30: MEA Market Volume (Tons) and Value (US$ Million) Forecast by Chemical Type, 2018 to 2033

Table 31: MEA Market Volume (Tons) and Value (US$ Million) Forecast by Surface Type, 2018 to 2033

Table 32: MEA Market Size Volume (Tons) and Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Figure 01: Global Market Historical, Current and Forecast Volume (Tons), 2018 to 2033

Figure 02: Global Market Historical, Current and Forecast Value (US$ Million), 2018 to 2033

Figure 03: Global Market Incremental $ Opportunity (US$ Million), 2018 to 2033

Figure 04: Global Market Share and BPS Analysis by Chemical Type– 2023 and 2033

Figure 05: Global Market Y-o-Y Growth Projections by Chemical Type, 2023 to 2033

Figure 06: Global Market Absolute $ Opportunity by Adhesion Promoters Segment, 2018 to 2033

Figure 07: Global Market Absolute $ Opportunity by Anti-corrosion Agents Segment, 2018 to 2033

Figure 08: Global Market Absolute $ Opportunity by Cleaners and Activators Segment, 2018 to 2033

Figure 09: Global Market Absolute $ Opportunity by Anodising Agents Segment, 2018 to 2033

Figure 10: Global Market Absolute $ Opportunity by Conversion Coatings additives Segment, 2018 to 2033

Figure 11: Global Market Absolute $ Opportunity by Others Segment, 2018 to 2033

Figure 12: Global Market Attractiveness Analysis by Chemical Type, 2023 to 2033

Figure 13: Global Market Share and BPS Analysis by Surface Type– 2023 and 2033

Figure 14: Global Market Y-o-Y Growth Projections by Surface Type, 2023 to 2033

Figure 15: Global Market Absolute $ Opportunity by Metal Surface Segment, 2018 to 2033

Figure 16: Global Market Absolute $ Opportunity by Plastic Surface Segment, 2018 to 2033

Figure 17: Global Market Absolute $ Opportunity Glass & Ceramic Surface Segment, 2018 to 2033

Figure 18: Global Market Absolute $ Opportunity by Others Segment, 2018 to 2033

Figure 19: Global Market Attractiveness Analysis by Surface Type, 2023 to 2033

Figure 20: Global Market Share and BPS Analysis by End Use Industry – 2023 and 2033

Figure 21: Global Market Y-o-Y Growth Projections by End Use Industry, 2023 to 2033

Figure 22: Global Market Absolute $ Opportunity by Automotive Segment, 2018 to 2033

Figure 23: Global Market Absolute $ Opportunity by Building & Construction Segment, 2018 to 2033

Figure 24: Global Market Absolute $ Opportunity by Electrical & Electronics Segment, 2018 to 2033

Figure 25: Global Market Absolute $ Opportunity by Aerospace & Defense Segment, 2018 to 2033

Figure 26: Global Market Absolute $ Opportunity by Packaging Segment, 2018 to 2033

Figure 27: Global Market Absolute $ Opportunity by Others (Healthcare, Textile) Segment, 2018 to 2033

Figure 28: Global Market Attractiveness Analysis by End Use Industry, 2023 to 2033

Figure 29: Global Market Share and BPS Analysis by Region– 2023 and 2033

Figure 30: Global Market Y-o-Y Growth Projections by Region, 2023 to 2033

Figure 31: Global Market Absolute $ Opportunity by North America Segment, 2018 to 2033

Figure 32: Global Market Absolute $ Opportunity by Latin America Segment, 2018 to 2033

Figure 33: Global Market Absolute $ Opportunity by Western Europe Segment, 2018 to 2033

Figure 34: Global Market Absolute $ Opportunity by Eastern Europe Segment, 2018 to 2033

Figure 35: Global Market Absolute $ Opportunity by East Asia Segment, 2018 to 2033

Figure 36: Global Market Absolute $ Opportunity by South Asia and Pacific Segment, 2018 to 2033

Figure 37: Global Market Absolute $ Opportunity by MEA Segment, 2018 to 2033

Figure 38: Global Market Attractiveness Analysis by Region, 2023 to 2033

Figure 39: North America Market Share and BPS Analysis by Country– 2023 and 2033

Figure 40: North America Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 41: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 42: North America Market Share and BPS Analysis by Chemical Type– 2023 and 2033

Figure 43: North America Market Y-o-Y Growth Projections by Chemical Type, 2023 to 2033

Figure 44: North America Market Attractiveness Analysis by Chemical Type, 2023 to 2033

Figure 45: North America Market Share and BPS Analysis by Surface Type– 2023 and 2033

Figure 46: North America Market Y-o-Y Growth Projections by Surface Type, 2023 to 2033

Figure 47: North America Market Attractiveness Analysis by Surface Type, 2023 to 2033

Figure 48: North America Market Share and BPS Analysis by End Use Industry– 2023 and 2033

Figure 49: North America Market Y-o-Y Growth Projections by End Use Industry, 2023 to 2033

Figure 50: North America Market Attractiveness Analysis by End Use Industry, 2023 to 2033

Figure 51: Latin America Market Share and BPS Analysis by Country– 2023 and 2033

Figure 52: Latin America Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 53: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 54: Latin America Market Share and BPS Analysis by Chemical Type– 2023 and 2033

Figure 55: Latin America Market Y-o-Y Growth Projections by Chemical Type, 2023 to 2033

Figure 56: Latin America Market Attractiveness Analysis by Chemical Type, 2023 to 2033

Figure 57: Latin America Market Share and BPS Analysis by Surface Type– 2023 and 2033

Figure 58: Latin America Market Y-o-Y Growth Projections by Surface Type, 2023 to 2033

Figure 59: Latin America Market Attractiveness Analysis by Surface Type, 2023 to 2033

Figure 60: Latin America Market Share and BPS Analysis by End Use Industry– 2023 and 2033

Figure 61: Latin America Market Y-o-Y Growth Projections by End Use Industry, 2023 to 2033

Figure 62: Latin America Market Attractiveness Analysis by End Use Industry, 2023 to 2033

Figure 63: Western Europe Market Share and BPS Analysis by Country– 2023 and 2033

Figure 64: Western Europe Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 65: Western Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 66: Western Europe Market Share and BPS Analysis by Chemical Type– 2023 and 2033

Figure 67: Western Europe Market Y-o-Y Growth Projections by Chemical Type, 2023 to 2033

Figure 68: Western Europe Market Attractiveness Analysis by Chemical Type, 2023 to 2033

Figure 69: Western Europe Market Share and BPS Analysis by Surface Type– 2023 and 2033

Figure 70: Western Europe Market Y-o-Y Growth Projections by Surface Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness Analysis by Surface Type, 2023 to 2033

Figure 72: Western Europe Market Share and BPS Analysis by End Use Industry– 2023 and 2033

Figure 73: Western Europe Market Y-o-Y Growth Projections by End Use Industry, 2023 to 2033

Figure 74: Western Europe Market Attractiveness Analysis by End Use Industry, 2023 to 2033

Figure 75: Eastern Europe Market Share and BPS Analysis by Country– 2023 and 2033

Figure 76: Eastern Europe Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 77: Eastern Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 78: Eastern Europe Market Share and BPS Analysis by Chemical Type– 2023 and 2033

Figure 79: Eastern Europe Market Y-o-Y Growth Projections by Chemical Type, 2023 to 2033

Figure 80: Eastern Europe Market Attractiveness Analysis by Chemical Type, 2023 to 2033

Figure 81: Eastern Europe Market Share and BPS Analysis by Surface Type– 2023 and 2033

Figure 82: Eastern Europe Market Y-o-Y Growth Projections by Surface Type, 2023 to 2033

Figure 83: Eastern Europe Market Attractiveness Analysis by Surface Type, 2023 to 2033

Figure 84: Eastern Europe Market Share and BPS Analysis by End Use Industry– 2023 and 2033

Figure 85: Eastern Europe Market Y-o-Y Growth Projections by End Use Industry, 2023 to 2033

Figure 86: Eastern Europe Market Attractiveness Analysis by End Use Industry, 2023 to 2033

Figure 87: East Asia Market Share and BPS Analysis by Country– 2023 and 2033

Figure 88: East Asia Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 89: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 90: East Asia Market Share and BPS Analysis by Chemical Type– 2023 and 2033

Figure 91: East Asia Market Y-o-Y Growth Projections by Chemical Type, 2023 to 2033

Figure 92: East Asia Market Attractiveness Analysis by Chemical Type, 2023 to 2033

Figure 93: East Asia Market Share and BPS Analysis by Surface Type– 2023 and 2033

Figure 94: East Asia Market Y-o-Y Growth Projections by Surface Type, 2023 to 2033

Figure 95: East Asia Market Attractiveness Analysis by Surface Type, 2023 to 2033

Figure 96: East Asia Market Share and BPS Analysis by End Use Industry– 2023 and 2033

Figure 97: East Asia Market Y-o-Y Growth Projections by End Use Industry, 2023 to 2033

Figure 98: East Asia Market Attractiveness Analysis by End Use Industry, 2023 to 2033

Figure 99: South Asia and Pacific Market Share and BPS Analysis by Country– 2023 and 2033

Figure 100: South Asia and Pacific Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 101: South Asia and Pacific Market Attractiveness Analysis by Country, 2023 to 2033

Figure 102: South Asia and Pacific Market Share and BPS Analysis by Chemical Type– 2023 and 2033

Figure 103: South Asia and Pacific Market Y-o-Y Growth Projections by Chemical Type, 2023 to 2033

Figure 104: South Asia and Pacific Market Attractiveness Analysis by Chemical Type, 2023 to 2033

Figure 105: South Asia and Pacific Market Share and BPS Analysis by Surface Type– 2023 and 2033

Figure 106: South Asia and Pacific Market Y-o-Y Growth Projections by Surface Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness Analysis by Surface Type, 2023 to 2033

Figure 108: South Asia and Pacific Market Share and BPS Analysis by End Use Industry– 2023 and 2033

Figure 109: South Asia and Pacific Market Y-o-Y Growth Projections by End Use Industry, 2023 to 2033

Figure 110: South Asia and Pacific Market Attractiveness Analysis by End Use Industry, 2023 to 2033

Figure 111: MEA Pacific Market Share and BPS Analysis by Country– 2023 and 2033

Figure 112: MEA Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 113: MEA Market Attractiveness Analysis by Country, 2023 to 2033

Figure 114: MEA Market Share and BPS Analysis by Chemical Type– 2023 and 2033

Figure 115: MEA Market Y-o-Y Growth Projections by Chemical Type, 2023 to 2033

Figure 116: MEA Market Attractiveness Analysis by Chemical Type, 2023 to 2033

Figure 117: MEA Market Share and BPS Analysis by Surface Type– 2023 and 2033

Figure 118: MEA Market Y-o-Y Growth Projections by Surface Type, 2023 to 2033

Figure 119: MEA Market Attractiveness Analysis by Surface Type, 2023 to 2033

Figure 120: MEA Market Share and BPS Analysis by End Use Industry– 2023 and 2033

Figure 121: MEA Market Y-o-Y Growth Projections by End Use Industry, 2023 to 2033

Figure 122: MEA Market Attractiveness Analysis by End Use Industry, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Advanced Process Control Market Size and Share Forecast Outlook 2025 to 2035

Advanced Active Cleaning System for ADAS Market Forecast and Outlook 2025 to 2035

Advanced Driver Assistance System (ADAS) Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Advanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Advanced Energy Storage System Market Size and Share Forecast Outlook 2025 to 2035

Advanced Gear Shifter System Market Size and Share Forecast Outlook 2025 to 2035

Advanced Therapeutics Pharmaceutical Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Advanced Airport Technologies Market Size and Share Forecast Outlook 2025 to 2035

Advanced Air Mobility Market Size and Share Forecast Outlook 2025 to 2035

Advanced Sensor Market Size and Share Forecast Outlook 2025 to 2035

Advanced Combat Helmet Market Size and Share Forecast Outlook 2025 to 2035

Advanced Optics Material Market Size and Share Forecast Outlook 2025 to 2035

Advanced Functional Materials Market Size and Share Forecast Outlook 2025 to 2035

Advanced Drill Data Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Advanced Water Management And Filtration Equipment Market Size and Share Forecast Outlook 2025 to 2035

Advanced Coating Market Size and Share Forecast Outlook 2025 to 2035

Advanced Aerospace Coatings Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Advanced Tires Market Size and Share Forecast Outlook 2025 to 2035

Advanced Therapy Medicinal Products Market Size and Share Forecast Outlook 2025 to 2035

Advanced Glass Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA