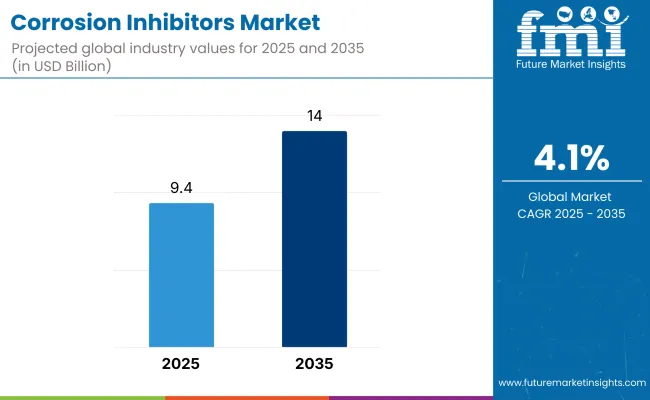

Global sales of corrosion inhibitors reached USD 9 billion in 2024. In 2025, the industry is expected to grow by 3.9% year-on-year, estimated at USD 9.4 billion. Over the forecast period of 2025 to 2035, demand is projected to rise at a CAGR of 4.1%, pushing total revenues to USD 14 billion by 2035.

Surging adoption in water treatment and oil & gas sectors has been primarily responsible for this uptick. A company spokesperson at Lanxess AG stated that stricter water discharge regulations in Asia and Europe have led to heightened demand for phosphate-free corrosion inhibitors.

In parallel, demand for volatile corrosion inhibitors (VCIs) surged across pipeline maintenance operations. In a February 2025 press release, Cortec Corporation confirmed a record expansion of its VpCI product line due to growing adoption in off-shore oil rigs in the Gulf of Mexico.

Growth in manufacturing and infrastructure investments has also played a key role towards the demand expansion of corrosion inhibitors. In its 2025 sustainability briefing, BASF SE highlighted the critical role of amine-based inhibitors in enhancing longevity of concrete and metal structures across industrial zones in Eastern Europe. “Minimizing structural degradation has become a top priority for our clients,” said Martin Jung, President of BASF’s Performance Chemicals division, in a January 2025 investor call.

In the automotive industry, increased use of hybrid engines and light-metal alloys has intensified corrosion protection requirements. In response, Henkel AG expanded its BONDERITE portfolio in early 2025, targeting electric vehicle (EV) manufacturing plants in Germany and China. The company’s Chief Technology Officer emphasized during a March 2025 innovation summit that next-gen surface treatments had achieved a 20% improvement in anti-corrosion efficacy under high-humidity conditions.

Advances in green chemistry are reshaping the market as well. Bio-based inhibitors derived from plant extracts and waste oils are witnessing fast uptake. In a 2025 white paper, researchers at the Fraunhofer Institute confirmed successful field trials of biodegradable inhibitors in seawater desalination plants. Industry experts have linked this trend to increased ESG commitments among public-private consortia operating in arid regions of the Middle East and North Africa.

While raw material cost volatility and regional disparities in regulatory enforcement remain concerns, innovation in materials science and coatings technology is expected to offset these risks. By 2035, corrosion inhibitors are forecasted to play a pivotal role in extending asset lifespan, particularly in sectors reliant on high-performance metallurgy and extreme environmental resilience

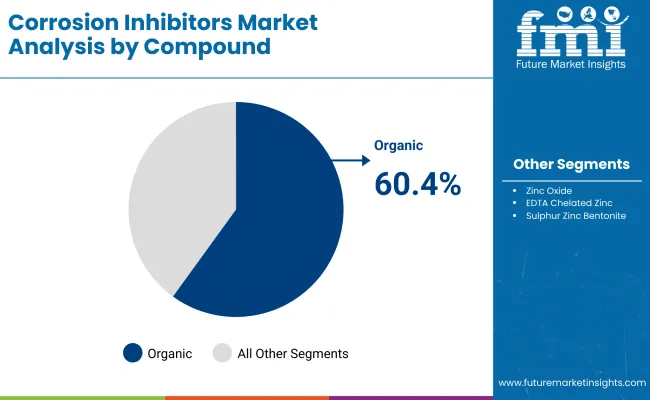

The section explains the market value of the leading segments in the industry. In terms of compounds, the organic corrosion inhibitors category will likely dominate and generate a share of around 60.4% in 2025.

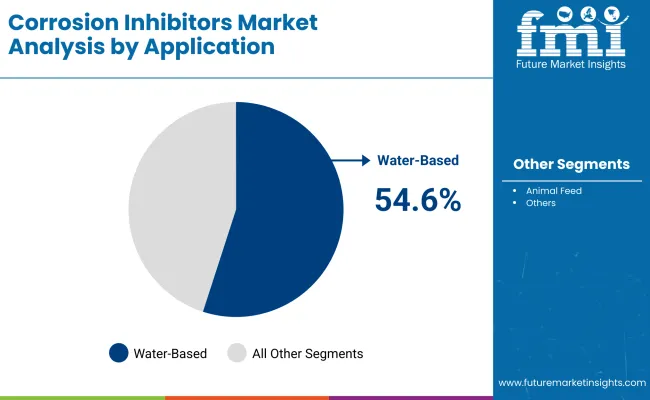

Based on type, the water-based segment is projected to hold a share of 54.6% in 2025. The analysis would enable potential clients to make effective business decisions for investment purposes.

| Segment | Organic Corrosion Inhibitors (Compound) |

|---|---|

| Value Share (2025) | 60.4% |

Organic corrosion inhibitors have the largest share of 60.4% of the total as they are widely used in industries such as oil and gas, automotive, and power generation. Organic inhibitors, such as amines and azoles, prevent severe corrosion when used in the system based on water or oil.

They are chosen for their high efficiency, low toxicity, and ability to deposit protective films on metal surfaces preventing oxidation. Organic corrosion inhibitors dominate the market because of their versatility in a wide range of applications and increasing demand for environmentally friendly and sustainable solutions.

| Segment | Water-Based (Type) |

|---|---|

| Value Share (2025) | 54.6% |

Water-based corrosion inhibitors have the highest market share, accounting for around 54.6% due to their eco-friendly nature and effectiveness across various industries. These inhibitors are widely used in oil and gas, power generation, and metal processing industries because they offer excellent protection against corrosion without the harmful environmental impact associated with oil-based or volatile solutions.

Water-based corrosion inhibitors are safer to handle and generally less expensive, making them a preferred choice in applications where frequent cleaning and maintenance are necessary. Their broad application in environmentally-conscious industries contributes to their dominance in the market.

The table below presents the annual growth rates of the global corrosion inhibitors industry from 2025 to 2035. With a base year of 2024 extending to the current year 2025, the report examines how the sector's growth trajectory evolves from the first half of the year (January to June, H1) to the second half (July to December, H2).

This analysis offers stakeholders insights into the industry's performance over time, highlighting potential developments that may emerge.

These figures indicate the growth of the sector in each half-year between the years 2024 and 2025. The industry is expected to grow at a CAGR of 3.8% in H1-2024. In H2, the growth rate increases.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 3.8% (2024 to 2034) |

| H2 2024 | 3.9% (2024 to 2034) |

| H1 2025 | 4.0% (2025 to 2035) |

| H2 2025 | 4.1% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2025, the CAGR is projected to slightly decrease to 4.0% in the first half and relatively increase to 4.1% in the second half. In the first half (H1), the sector saw an increase of 20 BPS, while in the second half (H2), there was a slight increase of 20 BPS.

Growing Demand for Corrosion Protection in the Oil and Gas Industry for Pipelines and Equipment Maintenance

The oil and gas industry is in great demand for corrosion protection, considering the immense pipeline network, rigs, and offshore platforms. Aggressive environments, such as deep-sea conditions and high-pressure drilling, accelerate metal deterioration; therefore, corrosion inhibitors have become essential.

These inhibitors will help maintain equipment integrity and reduce operational downtime, minimizing costly repairs.

As the search for oil, in general, is increasingly being conducted in remote and extreme environments, the demand for effective corrosion protection will increase.

Shale oil, natural gas extraction, and offshore drilling further raise demand for high-performance corrosion inhibitors that avoid damage caused by exposure to very corrosive substances such as brine, hydrogen sulfide, and carbon dioxide.

Rising Need for Corrosion Inhibitors in Power Generation Industry to Protect Boilers, Turbines, and Cooling Systems

Boilers, turbines, and cooling systems are some of the main elements that this industry relies on. Corrosion inhibitors will greatly help prevent water, heat, and other corrosive agents from causing damage.

The corrosion inhibitors extend the life of the expensive equipment by protecting such components, ensuring minimal operational disruption with reduced maintenance costs.

The power generation industry is growing given increasing demand for clean energy sources, primarily owing to the rise in nuclear, hydropower, and solar plants. These plants also require corrosion control solutions for infrastructural durability and hence demand high value for advanced corrosion inhibitors.

Increasing Automotive Production Fuels Demand for Corrosion Inhibitors in Vehicle Coatings, Parts, and Rust Protection

Growth in automotive production supports the increase in corrosion inhibitors within vehicle manufacturing. These additives control rust and corrosion on all metallic parts, chassis, and exterior coatings.

Since such corrosion protection enhances durability and elongates the life cycle of a vehicle, minimizing potential maintenance needs, the customers are better off. In cases where a more long-lasting appearance in vehicles is required, automakers rely on corrosion protection solutions.

Automotive manufacturers are increasingly under pressure to produce vehicles that are durable, long-lasting, and in compliance with environmental regulations.

Corrosion inhibitors meet these standards by ensuring vehicles resist rust and environmental degradation, especially in regions with harsh weather conditions. This growing emphasis on vehicle quality and performance further drives the demand for advanced corrosion inhibitors.

High Costs of Premium Corrosion Inhibitors Limit Adoption among Small and Medium Enterprises in Various Industries

One of the key entry barriers to the market for SMEs, particularly for construction, manufacturing, and automotive industries, may be the high price of premium inhibitors. SMEs have to face budget constraints, and the high initial costs of quality corrosion protection solutions may be hard to justify. Thus, they often opt to forgo using these inhibitors or seek out less effective but lower-cost options.

Low-margin industries will always look for cheaper solutions. Industries that do not experience too many cases of corrosion may not invest in good inhibitors even if the perceived benefits are long-term. These factors may prevent the overall growth of the market because the reluctance toward inhibitors that cost higher may exist.

Environmental and Health Concerns Over Toxic Chemical Inhibitors May Hinder Market Growth and Regulatory Compliance

Most chemical corrosion inhibitors, especially those containing hazardous materials, increasingly come under regulatory scrutiny and strict environmental laws. Regulations regarding hazardous waste disposal and emissions make industries switch to safer, eco-friendly alternatives, which are often more expensive or less effective, thereby hindering market growth.

The toxicity associated with certain chemicals in corrosion inhibitors is a big health and environmental hazard. Because of this, companies are searching for less hazardous and more environmentally friendly alternatives.

These alternatives may not be as effective in corrosion protection, hence limiting their use and hindering the market growth rate. Strict regulations, such as the REACH regulation by the EU, further complicate the use of traditional inhibitors and increase compliance costs.

The global corrosion inhibitors industry recorded a CAGR of 3.7% during the historical period between 2020 and 2024. The growth of the corrosion inhibitors industry was positive as it reached a value of USD 9.0 billion in 2024 from USD 7.7 billion in 2020.

Some factors contributed to positive growth in the corrosion inhibitors industry from the year 2020 to 2024. Increased demand for corrosion protection in vital industries such as oil and gas, automotive, and power generation urged the need for advanced inhibitors.

Growing focus on sustainable solutions and eco-friendly products also contributed to this, with industries seeking much safer alternatives to the conventionally used toxic chemicals. The increase in industrial expansion, especially in developing economies, has also contributed to the market's growth.

The demand for corrosion protection of costly infrastructure, like pipelines, turbines, and machinery, to reduce losses caused by its failure and minimize maintenance costs propels the demand even more. These factors have pushed the market from USD 7.7 billion in 2020 to USD 9.0 billion in 2024, at a CAGR of 3.7%.

Tier 1 companies include industry leaders with annual revenues exceeding USD 1,000 million. These companies are currently capturing a significant share of 40-45% globally. These frontrunners are characterized by high production capacity and a wide product portfolio.

They are distinguished by extensive expertise in manufacturing and a broad geographical reach underpinned by a robust consumer base. The firms provide a wide range of products and utilize the latest technology to meet regulatory standards. Prominent companies within Tier 1 include Nouryon, Cortec Corporation, Ashland Chemicals, Ecolab, Henkel Ibérica S.A.

Tier 2 companies encompass mid-sized participants with revenues ranging from USD 500-1,000 million, holding a presence in specific regions and exerting significant influence in local economies. These firms are distinguished by robust presence overseas and in-depth industry expertise.

They possess strong technology capabilities and adhere strictly to regulatory requirements. However, the firms may not wield cutting-edge technology or maintain an extensive global reach. Noteworthy entities in Tier 2 include The Lubrizol Company, BASF SE, Dow Chemical Company, and others.

Tier 3 encompasses most small-scale enterprises operating within the regional sphere and catering to specialized needs with revenues below USD 500 million. These businesses are notably focused on meeting local demand and are categorized within the Tier 3 segment.

They are small-scale participants with limited geographical presence. In this context, Tier 3 is acknowledged as an informal sector, indicating a segment distinguished by a lack of extensive organization and formal structure compared to the structured one. Tier 3 includes DuPont de Nemours, Inc., Baker Hughes, and many more small and local players.

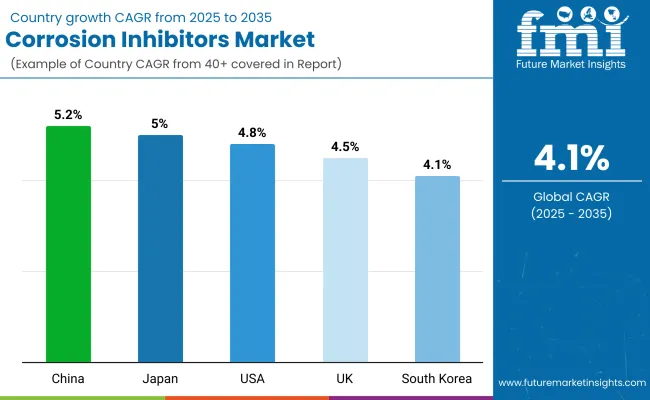

The section below highlights assessments of corrosion inhibitors market sale across key countries. China, USA, UK, Japan, and South Korea are expected to showcase promising growth, with each exhibiting a strong CAGR through the forecast period.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| China | 5.2% |

| USA | 4.8% |

| UK | 4.5% |

| Japan | 5.0% |

| South Korea | 4.1% |

The rapid urbanization of China and its large-scale infrastructure projects, such as bridges, highways, and buildings, increase the demand for corrosion inhibitors. Such projects call for materials and equipment that can protect against harsh environmental factors, which cause rust and corrosion, hence driving the demand for corrosion-resistant solutions.

As long as China continues to dominate the global market in manufacturing, especially in industries such as automotive, machinery, and steel production, it will continue to fuel growth in corrosion inhibitor demand. Protective coatings applied to machinery, vehicles, and other steel products against corrosion make them last longer and reduce maintenance, contributing to overall market growth in these categories.

The USA is a significant oil and gas exploration country with large-scale offshore and onshore drilling operations. Such operations expose equipment like pipelines, tanks, and offshore rigs to harsh environments, accelerating corrosion. Corrosion inhibitors are essential to protect these assets, extend their lifespan, and reduce maintenance costs, driving high demand for such solutions in the industry.

The US power generation sector, including nuclear, thermal, and renewable energy plants, relies on corrosion inhibitors for equipment protection. Corrosion of boilers, turbines, industrial cooling systems, and pipelines can cause downtimes and inefficiencies, thereby increasing costs. Corrosion inhibitors prevent such issues, making critical infrastructure in the power generation industry reliable and long-lasting, further enhancing market growth.

The UK has a large share in the offshore oil and gas industry, with many oil rigs and platforms in the North Sea. These structures are exposed to harsh environmental conditions, including saltwater, which accelerates corrosion. Corrosion inhibitors are essential for protecting offshore drilling rigs, pipelines, and storage tanks from rust and degradation, ensuring the safety and longevity of operations in this challenging environment.

The UK is among the leading markets in the international marine industry; many ships and vessels operate at sea. Owing to being exposed to seawater makes the vessels prone to corrosion, which requires expensive overhauls. Corrosion inhibitors are primarily used in ship hulls and engines and even other vital elements in the maritime industry, accounting for a big demand for corrosion protection chemicals in the area.

The section provides comprehensive assessments and insights that highlight current opportunities and emerging trends for companies in developed and developing countries. It analyzes advancements in manufacturing and identifies the latest trends poised to drive new applications in the market.

A few key players in the corrosion inhibitors industry are actively enhancing capabilities and resources to cater to the growing demand for the compound across diverse applications. Leading companies also leverage partnership and joint venture strategies to co-develop innovative products and bolster their resource base.

Significant players are further introducing new products to address the increasing need for cutting-edge solutions in various end-use sectors. Geographic expansion is another important strategy that is being embraced by reputed companies. Start-ups are likely to emerge in the sector through 2035, thereby making it more competitive.

Industry Updates

In terms of compound, the industry is divided into Organic corrosion inhibitors, and Inorganic corrosion inhibitors

In terms of type, the industry is divided Water-based, Oil-based, and Volatile Corrosion Inhibitors

In terms of end use industry, the industry is divided into water treatment, building and construction, automotive Oil and gas, Power generation, Chemicals, Metals processing, Pulp and paper, and others

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Middle East and Africa (MEA), have been covered in the report

The global market was valued at USD 9.0 billion in 2024.

The global market is set to reach USD 9.4 billion in 2025.

Global demand is anticipated to rise at 4.1% CAGR.

The industry is projected to reach USD 14.0 billion by 2035.

Table 01: Global Market Value (US$ Mn),By Compound, 2015 – 2021

Table 02: Global Market Value (US$ Mn),By Compound, 2022 – 2032

Table 03: Global Market Value (US$ Mn), By Application, 2015 – 2021

Table 04: Global Market Value (US$ Mn), By Application, 2022 – 2032

Table 05: Global Market Value (US$ Mn), By Type, 2015 – 2021

Table 06: Global Market Value (US$ Mn), By Type, 2022 – 2032

Table 07: Global Market Value (US$ Mn), By End-use Industry, 2015 – 2021

Table 08: Global Market Value (US$ Mn), By End-use Industry, 2022 – 2032

Table 09: Global Market, By Region, 2015 – 2021

Table 10: Global Market, By Region, 2022 – 2032

Table 11: North America Market Value (US$ Mn),By Compound, 2015 – 2021

Table 12: North America Market Value (US$ Mn),By Compound, 2022 – 2032

Table 13: North America Market Value (US$ Mn), By Application, 2015 – 2021

Table 14: North America Market Value (US$ Mn), By Application, 2022 – 2032

Table 15: North America Market Value (US$ Mn), By Type, 2015 – 2021

Table 16: North America Market Value (US$ Mn), By Type, 2022 – 2032

Table 17: North America Market Value (US$ Mn), By End-use Industry, 2015 – 2021

Table 18: North America Market Value (US$ Mn), By End-use Industry, 2022 – 2032

Table 19: North America Market, By Country, 2015 – 2021

Table 20: North America Market, By Country, 2022 – 2032

Table 21: Latin America Market Value (US$ Mn),By Compound, 2015 – 2021

Table 22: Latin America Market Value (US$ Mn),By Compound, 2022 – 2032

Table 23: Latin America Market Value (US$ Mn), By Application, 2015 – 2021

Table 24: Latin America Market Value (US$ Mn), By Application, 2022 – 2032

Table 25: Latin America Market Value (US$ Mn), By Type, 2015 – 2021

Table 26: Latin America Market Value (US$ Mn), By Type, 2022 – 2032

Table 27: Latin America Market Value (US$ Mn), By End-use Industry, 2015 – 2021

Table 28: Latin America Market Value (US$ Mn), By End-use Industry, 2022 – 2032

Table 29: Latin America Market, By Country, 2015 – 2021

Table 30: Latin America Market, By Country, 2022 – 2032

Table 31: Europe Market Value (US$ Mn),By Compound, 2015 – 2021

Table 32: Europe Market Value (US$ Mn),By Compound, 2022 – 2032

Table 33: Europe Market Value (US$ Mn), By Application, 2015 – 2021

Table 34: Europe Market Value (US$ Mn), By Application, 2022 – 2032

Table 35: Europe Market Value (US$ Mn), By Type, 2015 – 2021

Table 36: Europe Market Value (US$ Mn), By Type, 2022 – 2032

Table 37: Europe Market Value (US$ Mn), By End-use Industry, 2015 – 2021

Table 38: Europe Market Value (US$ Mn), By End-use Industry, 2022 – 2032

Table 39: Europe Market, By Country, 2015 – 2021

Table 40: Europe Market, By Country, 2022 – 2032

Table 41: Asia Pacific Market Value (US$ Mn),By Compound, 2015 – 2021

Table 42: Asia Pacific Market Value (US$ Mn),By Compound, 2022 – 2032

Table 43: Asia Pacific Market Value (US$ Mn), By Application, 2015 – 2021

Table 44: Asia Pacific Market Value (US$ Mn), By Application, 2022 – 2032

Table 45: Asia Pacific Market Value (US$ Mn), By Type, 2015 – 2021

Table 46: Asia Pacific Market Value (US$ Mn), By Type, 2022 – 2032

Table 47: Asia Pacific Market Value (US$ Mn), By End-use Industry, 2015 – 2021

Table 48: Asia Pacific Market Value (US$ Mn), By End-use Industry, 2022 – 2032

Table 49: Asia Pacific Market, By Country, 2015 – 2021

Table 50: Asia Pacific Market, By Country, 2022 – 2032

Table 51: MEA Market Value (US$ Mn),By Compound, 2015 – 2021

Table 52: MEA Market Value (US$ Mn),By Compound, 2022 – 2032

Table 53: MEA Market Value (US$ Mn), By Application, 2015 – 2021

Table 54: MEA Market Value (US$ Mn), By Application, 2022 – 2032

Table 55: MEA Market Value (US$ Mn), By Type, 2015 – 2021

Table 56: MEA Market Value (US$ Mn), By Type, 2022 – 2032

Table 57: MEA Market Value (US$ Mn), By End-use Industry, 2015 – 2021

Table 58: MEA Market Value (US$ Mn), By End-use Industry, 2022 – 2032

Table 59: MEA Market, By Country, 2015 – 2021

Table 60: MEA Market, By Country, 2022 – 2032

Figure 01: Global Market Value (US$ Mn) and Year-on-Year Growth, 2015-2032

Figure 02: Global Market Absolute $ Historical Gain (2015 - 2021) and Opportunity (2022 – 2032), US$ Mn

Figure 03: Global Market Share, By Compound, 2022 & 2032

Figure 04: Global Market Y-o-Y Growth Projections, By Compound – 2022-2032

Figure 05: Global Market Attractiveness Index, By Compound – 2022-2032

Figure 06: Global Market Share, By Application, 2022 & 2032

Figure 07: Global Market Y-o-Y Growth Projections, By Application – 2022-2032

Figure 08: Global Market Attractiveness Index, By Application – 2022-2032

Figure 09: Global Market Share, By End-use Industry, 2022 & 2032

Figure 10: Global Market Y-o-Y Growth Projections, By End-use Industry – 2022-2032

Figure 11: Global Market Attractiveness Index, By End-use Industry – 2022-2032

Figure 12: Global Market Share, By Type, 2022 & 2032

Figure 13: Global Market Y-o-Y Growth Projections, By Type – 2022-2032

Figure 14: Global Market Attractiveness Index, By Type – 2022-2032

Figure 15: Global Market Share, By Region, 2022 & 2032

Figure 16: Global Market Y-o-Y Growth Projections, By Region – 2022-2032

Figure 17: Global Market Attractiveness Index, By Region – 2022-2032

Figure 18: North America Market Value (US$ Mn) and Year-on-Year Growth, 2015-2032

Figure 19: North America Market Absolute $ Opportunity Historical (2015 - 2021) and Forecast Period (2022 – 2032), US$ Mn

Figure 20: North America Market Share, By Compound, 2022 & 2032

Figure 21: North America Market Y-o-Y Growth Projections, By Compound – 2022-2032

Figure 22: North America Market Attractiveness Index, By Compound – 2022-2032

Figure 23: North America Market Share, By Application, 2022 & 2032

Figure 24: North America Market Y-o-Y Growth Projections, By Application – 2022-2032

Figure 25: North America Market Attractiveness Index, By Application – 2022-2032

Figure 26: North America Market Share, By End-use Industry, 2022 & 2032

Figure 27: North America Market Y-o-Y Growth Projections, By End-use Industry – 2022-2032

Figure 28: North America Market Attractiveness Index, By End-use Industry – 2022-2032

Figure 29: North America Market Share, By Type, 2022 & 2032

Figure 30: North America Market Y-o-Y Growth Projections, By Type – 2022-2032

Figure 31: North America Market Attractiveness Index, By Type – 2022-2032

Figure 32: North America Market Share, By Country, 2022 & 2032

Figure 33: North America Market Y-o-Y Growth Projections, By Country – 2022-2032

Figure 34: North America Market Attractiveness Index, By Country – 2022-2032

Figure 35: Latin America Market Value (US$ Mn) and Year-on-Year Growth, 2015-2032

Figure 36: Latin America Market Absolute $ Opportunity Historical (2015 - 2021) and Forecast Period (2022 – 2032), US$ Mn

Figure 37: Latin America Market Share, By Compound, 2022 & 2032

Figure 38: Latin America Market Y-o-Y Growth Projections, By Compound – 2022-2032

Figure 39: Latin America Market Attractiveness Index, By Compound – 2022-2032

Figure 40: Latin America Market Share, By Application, 2022 & 2032

Figure 41: Latin America Market Y-o-Y Growth Projections, By Application – 2022-2032

Figure 42: Latin America Market Attractiveness Index, By Application – 2022-2032

Figure 43: Latin America Market Share, By End-use Industry, 2022 & 2032

Figure 44: Latin America Market Y-o-Y Growth Projections, By End-use Industry – 2022-2032

Figure 45: Latin America Market Attractiveness Index, By End-use Industry – 2022-2032

Figure 46: Latin America Market Share, By Type, 2022 & 2032

Figure 47: Latin America Market Y-o-Y Growth Projections, By Type – 2022-2032

Figure 48: Latin America Market Attractiveness Index, By Type – 2022-2032

Figure 49: Latin America Market Share, By Country, 2022 & 2032

Figure 50: Latin America Market Y-o-Y Growth Projections, By Country – 2022-2032

Figure 51: Latin America Market Attractiveness Index, By Country – 2022-2032

Figure 52: Europe Market Value (US$ Mn) and Year-on-Year Growth, 2015-2032

Figure 53: Europe Market Absolute $ Opportunity Historical (2015 - 2021) and Forecast Period (2022 – 2032), US$ Mn

Figure 54: Europe Market Share, By Compound, 2022 & 2032

Figure 55: Europe Market Y-o-Y Growth Projections, By Compound – 2022-2032

Figure 56: Europe Market Attractiveness Index, By Compound – 2022-2032

Figure 57: Europe Market Share, By Application, 2022 & 2032

Figure 58: Europe Market Y-o-Y Growth Projections, By Application – 2022-2032

Figure 59: Europe Market Attractiveness Index, By Application – 2022-2032

Figure 60: Europe Market Share, By End-use Industry, 2022 & 2032

Figure 61: Europe Market Y-o-Y Growth Projections, By End-use Industry – 2022-2032

Figure 62: Europe Market Attractiveness Index, By End-use Industry – 2022-2032

Figure 63: Europe Market Share, By Type, 2022 & 2032

Figure 64: Europe Market Y-o-Y Growth Projections, By Type – 2022-2032

Figure 65: Europe Market Attractiveness Index, By Type – 2022-2032

Figure 66: Europe Market Share, By Country, 2022 & 2032

Figure 67: Europe Market Y-o-Y Growth Projections, By Country – 2022-2032

Figure 68: Europe Market Attractiveness Index, By Country – 2022-2032

Figure 69: MEA Market Value (US$ Mn) and Year-on-Year Growth, 2015-2032

Figure 70: MEA Market Absolute $ Opportunity Historical (2015 - 2021) and Forecast Period (2022 – 2032), US$ Mn

Figure 71: MEA Market Share, By Compound, 2022 & 2032

Figure 72: MEA Market Y-o-Y Growth Projections, By Compound – 2022-2032

Figure 73: MEA Market Attractiveness Index, By Compound – 2022-2032

Figure 74: MEA Market Share, By Application, 2022 & 2032

Figure 75: MEA Market Y-o-Y Growth Projections, By Application – 2022-2032

Figure 76: MEA Market Attractiveness Index, By Application – 2022-2032

Figure 77: MEA Market Share, By End-use Industry, 2022 & 2032

Figure 78: MEA Market Y-o-Y Growth Projections, By End-use Industry – 2022-2032

Figure 79: MEA Market Attractiveness Index, By End-use Industry – 2022-2032

Figure 80: MEA Market Share, By Type, 2022 & 2032

Figure 81: MEA Market Y-o-Y Growth Projections, By Type – 2022-2032

Figure 82: MEA Market Attractiveness Index, By Type – 2022-2032

Figure 83: MEA Market Share, By Country, 2022 & 2032

Figure 84: MEA Market Y-o-Y Growth Projections, By Country – 2022-2032

Figure 85: MEA Market Attractiveness Index, By Country – 2022-2032

Figure 86: Asia Pacific Market Value (US$ Mn) and Year-on-Year Growth, 2015-2032

Figure 87: Asia Pacific Market Absolute $ Opportunity Historical (2015 - 2021) and Forecast Period (2022 – 2032), US$ Mn

Figure 88: Asia Pacific Market Share, By Compound, 2022 & 2032

Figure 89: Asia Pacific Market Y-o-Y Growth Projections, By Compound – 2022-2032

Figure 90: Asia Pacific Market Attractiveness Index, By Compound – 2022-2032

Figure 91: Asia Pacific Market Share, By Application, 2022 & 2032

Figure 92: Asia Pacific Market Y-o-Y Growth Projections, By Application – 2022-2032

Figure 93: Asia Pacific Market Attractiveness Index, By Application – 2022-2032

Figure 94: Asia Pacific Market Share, By End-use Industry, 2022 & 2032

Figure 95: Asia Pacific Market Y-o-Y Growth Projections, By End-use Industry – 2022-2032

Figure 96: Asia Pacific Market Attractiveness Index, By End-use Industry – 2022-2032

Figure 97: Asia Pacific Market Share, By Type, 2022 & 2032

Figure 98: Asia Pacific Market Y-o-Y Growth Projections, By Type – 2022-2032

Figure 99: Asia Pacific Market Attractiveness Index, By Type – 2022-2032

Figure 100: Asia Pacific Market Share, By Country, 2022 & 2032

Figure 101: Asia Pacific Market Y-o-Y Growth Projections, By Country – 2022-2032

Figure 102: Asia Pacific Market Attractiveness Index, By Country – 2022-2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Volatile Corrosion Inhibitors Market Size and Share Forecast Outlook 2025 to 2035

Volatile Corrosion Inhibitors (VCI) Packaging Market Insights - Growth & Demand 2025 to 2035

Ballast Tank Corrosion Inhibitors Market

Corrosion Resistant Resin Market Size and Share Forecast Outlook 2025 to 2035

Corrosion Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Corrosion Protection Coatings & Acid Proof Lining Market Growth - Trends & Forecast 2025 to 2035

Corrosion Protection Tape Market Growth – Forecast 2024-2034

CUI & SOI Coating Market Growth – Trends & Forecast 2024-2034

Corrosion Protection Polymer Coating Market 2022 to 2032

Corrosion Protection Rubber Linings Market 2022 to 2032

Anti-corrosion Bags Market Size and Share Forecast Outlook 2025 to 2035

Anti-corrosion Coatings Market Size and Share Forecast Outlook 2025 to 2035

Volatile Corrosion Inhibitor Bags Market Analysis by Zipper Bags, Gusset Bags and Flat Bags Through 2035

FcRn Inhibitors Market Size and Share Forecast Outlook 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

SGLT2 Inhibitors Market Size and Share Forecast Outlook 2025 to 2035

SGLT2 Inhibitors Treatment Market Overview – Trends & Growth 2024-2034

NF-KB Inhibitors Market

Mould Inhibitors Market

Kinase Inhibitors For Cancer Treatment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA