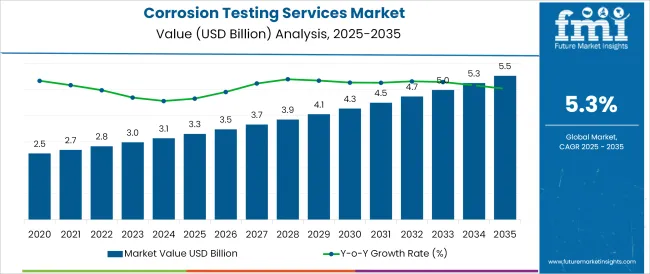

The Corrosion Testing Services Market is estimated to be valued at USD 3.3 billion in 2025 and is projected to reach USD 5.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

The corrosion testing services market is advancing steadily as industrial sectors prioritize asset integrity, safety compliance, and lifecycle cost optimization of infrastructure and equipment. Heightened awareness of the economic and environmental consequences of corrosion, along with stricter regulatory oversight, has reinforced the role of testing services as an integral component of maintenance and quality assurance programs.

Industry journals and corporate ESG reports indicate that increasing investments in energy infrastructure, pipelines, and offshore installations are fueling demand for reliable and standardized corrosion testing solutions. Technological advancements, such as electrochemical analysis and accelerated corrosion simulation techniques, are enhancing the precision and scope of services offered, while digitalization is enabling better reporting and traceability.

Future growth is expected to be supported by the ongoing expansion of energy and manufacturing sectors, rising environmental concerns, and the need for sustainable materials management, all of which are driving innovation and adoption of corrosion testing services globally.

The market is segmented by Substrate Type and End-use Industry and region. By Substrate Type, the market is divided into Metallic and Non-Metallic. In terms of End-use Industry, the market is classified into Oil & Gas, Energy and Chemicals, Transportation, Electrical and Electronics, Medical, Chemical & Materials, and Other. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

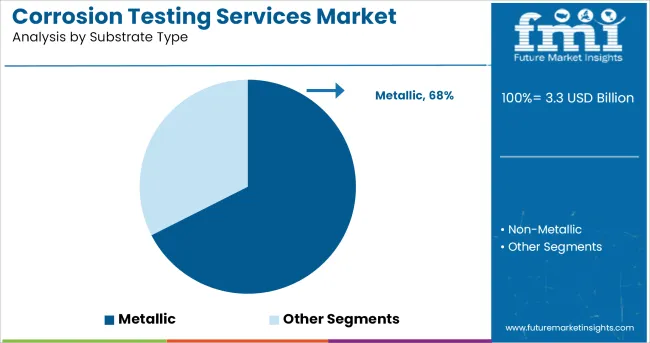

When segmented by substrate type, metallic substrates are projected to account for 67.5% of the total market revenue in 2025, making it the dominant segment. This leadership has been driven by the widespread use of metals such as steel, aluminum, and copper in critical infrastructure, pipelines, marine vessels, and industrial machinery all of which are highly susceptible to corrosion in harsh environments.

Corporate technical publications and maintenance reports have emphasized the necessity of rigorous corrosion testing to ensure the longevity and reliability of metallic components under varying conditions of moisture, salinity, and chemical exposure. The economic implications of metal degradation, including operational downtime and costly replacements, have further underscored the demand for specialized testing.

Additionally, advancements in surface treatment technologies, coatings evaluation, and failure analysis methods have strengthened the service offerings specific to metallic substrates, ensuring that this segment remains indispensable in addressing industry needs.

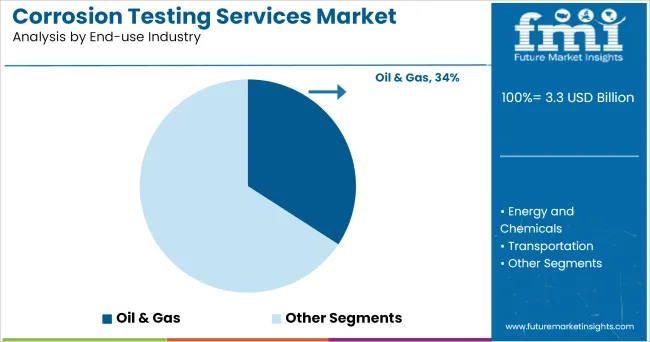

Segmenting by end-use industry, oil & gas is expected to hold 34.2% of the market revenue in 2025, maintaining its position as the leading industry segment. This dominance has been reinforced by the criticality of corrosion management in upstream, midstream, and downstream operations where equipment and infrastructure are constantly exposed to corrosive agents such as seawater, hydrogen sulfide, and high-pressure fluids.

Industry reports and operational audits highlight that oil & gas operators invest significantly in corrosion testing to safeguard assets, prevent environmental incidents, and comply with stringent safety regulations. The high cost of failure in this sector, including potential spills, explosions, and legal liabilities, has heightened the focus on proactive testing strategies.

Moreover, the deployment of advanced inspection techniques and predictive maintenance frameworks has made corrosion testing an integral part of operational excellence programs. The sector’s global scale, harsh operating environments, and regulatory demands have collectively ensured that oil & gas continues to lead in driving demand for corrosion testing services.

Increasing industrialization is forecasted for raising demand for industrial machinery and components. Market players in the field of services are offering corrosion testing for various field such as soil corrosion, metal corrosion, corrosion due to gas and water, and amongst others

Corrosion testing services is being sought owing to increasing concern of manufacturers about costs associated with metal corrosion on the existing equipment. To arrest any significant damage and replacement of the asset incurring high sum of expenditure, the periodic monitoring and inspection via designated service is estimated to accelerate the growth of the market.

Wide range of manufacturers are attracting towards corrosion tests for manufacturing critical components and other materials for various industries such as oil & gas, automotive, electronics, aerospace & defense, etc. Therefore, increasing demand for wide range of application is forecasted for boosting the growth of the corrosion testing services market.

Market participants and service providers are focusing on increasing their offering owing to significantly cover wide range of end-users. Moreover, player are using high-tech testing equipment such as EM with EDX, EPMA, X-ray diffraction and OES, Hydrogen analysis, FT-IR with ATR, DSC etc. for various corrosion testing.

Moreover, local/regional player are prompting cost-effective testing analysis to gain high customer base. Increasing development for various corrosion testing is estimated to shape the demand pattern.

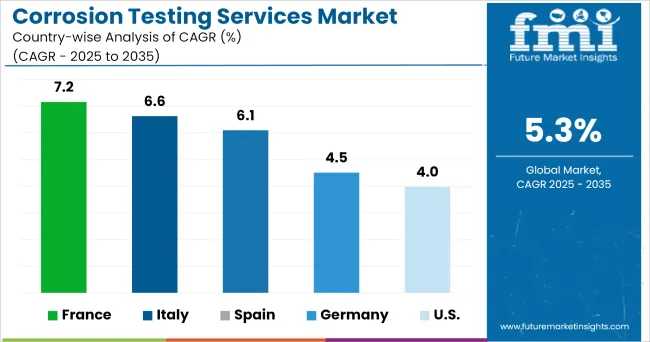

Demand from established and upcoming oil & gas refineries & reserves is expected to boost the regional market for upstream, midstream and downstream processes. While is USA is believed to acquire a major share, Canada is expected to gain greater growth due to new investments and sales by the end stakeholder. Other industries are also expected to offer sound growth opportunities in the region.

With petrochemicals market gaining robust growth in the region, countries of East Asia are expected to be the key regional markets for undertaking corrosion testing services. Moreover, growth of water supply and distribution infrastructure in emerging economies of South Asia, the demand is expected to augment further generating continued subscription and penetration across various end use verticals in the region.

Some of the leading manufacturers and suppliers include

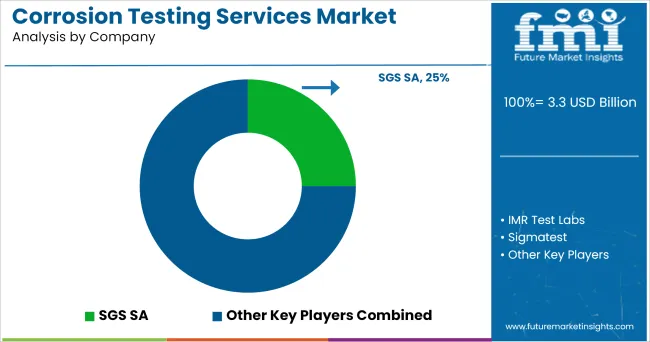

Corrosion Testing Services market is fairly fragmented as number of service providers and independent laboratories are offering different corrosion testing services according to international standards for various manufacturers of component/material manufacturers of industries.

Various service providers are offering customized services according to particular industry standards. Also, a number of regional services providers and independent laboratories have started corrosion testing services in respective regions owing to high demand from end-use industries.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments.

The report also maps the qualitative impact of various market factors on market segments and geographies.

The global corrosion testing services market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the corrosion testing services market is projected to reach USD 5.5 billion by 2035.

The corrosion testing services market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in corrosion testing services market are metallic and non-metallic.

In terms of end-use industry, oil & gas segment to command 34.2% share in the corrosion testing services market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Corrosion Resistant Resin Market Size and Share Forecast Outlook 2025 to 2035

Corrosion Protection Coatings & Acid Proof Lining Market Growth - Trends & Forecast 2025 to 2035

Corrosion Inhibitors Market Growth - Trends & Forecast 2025 to 2035

Corrosion Protection Tape Market Growth – Forecast 2024-2034

CUI & SOI Coating Market Growth – Trends & Forecast 2024-2034

Corrosion Protection Rubber Linings Market 2022 to 2032

Corrosion Protection Polymer Coating Market 2022 to 2032

Anti-corrosion Bags Market Size and Share Forecast Outlook 2025 to 2035

Anti-corrosion Coatings Market Size and Share Forecast Outlook 2025 to 2035

Volatile Corrosion Inhibitors Market Size and Share Forecast Outlook 2025 to 2035

Volatile Corrosion Inhibitors (VCI) Packaging Market Insights - Growth & Demand 2025 to 2035

Volatile Corrosion Inhibitor Bags Market Analysis by Zipper Bags, Gusset Bags and Flat Bags Through 2035

Ballast Tank Corrosion Inhibitors Market

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HSV Testing Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA