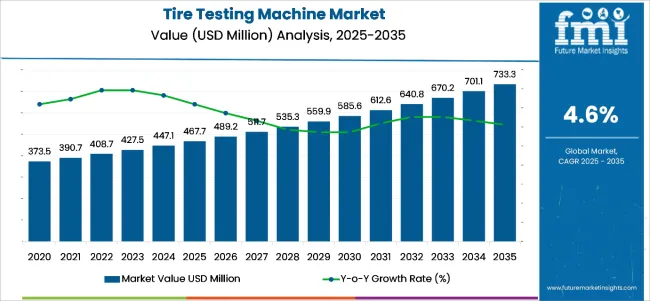

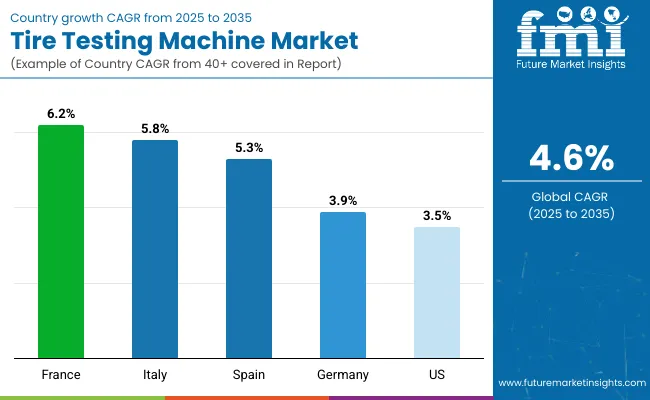

The tire testing machine market is valued at USD 467.7 million in 2025 and is projected to reach USD 733.3 million by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

The tire testing machine market is gaining steady traction, driven by the increasing focus on vehicle safety standards and stringent regulatory frameworks governing tire performance. Industry developments and technical publications have highlighted the growing need for reliable, precise, and automated tire testing solutions that ensure compliance with safety norms.

Automotive manufacturers and tire producers have expanded their investments in advanced testing infrastructure to meet the rising demand for quality assurance across various vehicle categories. Additionally, advancements in tire technologies, such as low rolling resistance and high-performance tires, have created a need for sophisticated testing machines capable of handling complex evaluation parameters.

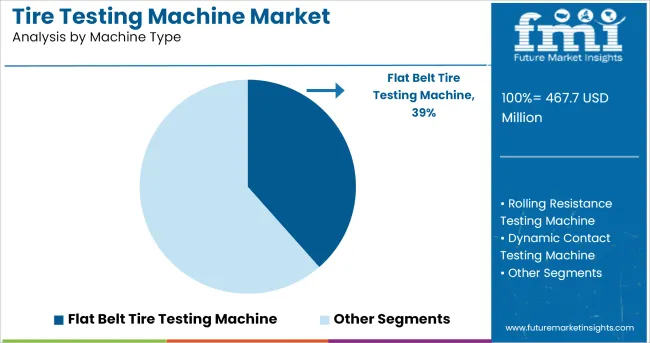

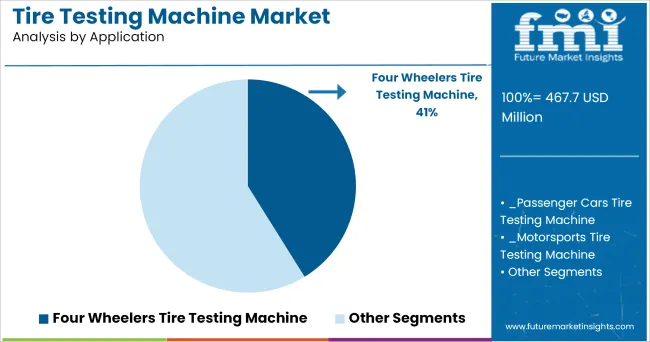

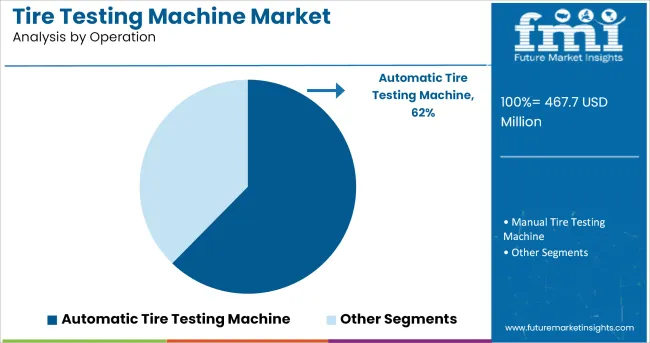

Future market growth is expected to be supported by the adoption of automation in manufacturing processes, integration of IoT-enabled testing systems, and the growing production of passenger and commercial vehicles globally. Segmental momentum is expected to be led by Flat Belt Tire Testing Machines, Four Wheelers Tire Testing Machine applications, and Automatic Tire Testing Machines, reflecting market preferences for versatility, widespread vehicle category testing, and operational efficiency.

The market is segmented by machine type, application, operation, and end-use and region. By Machine Type, the market is divided into flat belt tire testing machine, rolling resistance testing machine, dynamic contact testing machine, tire balancing machine, drum tire testing machine, endurance testing machine, 2 position, 4 position, endurance + high speed testing machine, tire force & moment measurement systems, and plunger test & bead unseating test machine,

In terms of application, the market is classified into four wheelers tire testing machine, passenger cars tire testing machine, motorsports tire testing machine, heavy commercial vehicles tire testing machine, industrial & off-road vehicles tire testing machine, aircraft tire testing machine, defence vehicles tire testing machine, and two wheelers tire testing machine.

Based on operation, the market is segmented into automatic tire testing machine and manual tire testing machine. by end-use, the market is divided into automotive, OEMs, repair & maintenance service stations, tire dealers & specialty shops, aerospace, tire manufacturers, and other testing, research & certification agencies. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The flat belt tire testing machine segment is projected to hold 39% of the tire testing machine market revenue in 2025, positioning itself as the leading machine type. Growth of this segment has been driven by the versatility of flat belt machines, which have been widely adopted for dynamic tire testing simulations.

Manufacturers have preferred flat belt systems due to their ability to replicate real-world driving conditions, such as rolling resistance and load variations, across multiple tire types. The segment’s growth has also been supported by its application in laboratory environments and production lines, where flexibility and testing precision are critical.

Furthermore, advancements in belt material durability and system calibration accuracy have enhanced the reliability of flat belt machines. As automotive brands continue to innovate tire designs for safety and fuel efficiency, the Flat Belt Tire Testing Machine segment is expected to retain its prominence in tire testing operations.

The four wheelers tire testing machine segment is projected to account for 41% of the tire testing machine market revenue in 2025, maintaining its leading position among application segments. Growth of this segment has been fueled by the large-scale production and use of four-wheeler vehicles, including passenger cars and light commercial vehicles, which necessitate rigorous tire performance validation.

Automotive industry reports have highlighted the continuous evolution of four-wheeler tire designs, requiring advanced testing for parameters such as tread wear, wet grip, and sidewall durability. Regulatory compliance for vehicle safety has further driven tire manufacturers and OEMs to adopt specialized four-wheeler tire testing machines.

Additionally, increasing consumer expectations for ride comfort, fuel efficiency, and all-weather performance have necessitated extensive tire testing during product development cycles. With the growing adoption of electric and hybrid four-wheelers, the Four Wheelers Tire Testing Machine segment is expected to sustain its leadership, addressing evolving tire performance requirements.

The automatic tire testing machine segment is projected to capture 62% of the tire testing machine market revenue in 2025, establishing itself as the dominant operational mode. Growth of this segment has been driven by the automotive industry's shift towards automation to improve testing accuracy, operational efficiency, and repeatability.

Automatic tire testing machines have enabled manufacturers to conduct high-volume testing with minimal human intervention, reducing labor costs and improving throughput. Technological advancements in machine vision systems, sensor integration, and data analytics have enhanced the capabilities of automatic testing systems, allowing for real-time monitoring and error detection.

Automotive manufacturing facilities and tire production plants have increasingly integrated automatic testing machines into their quality assurance lines, ensuring consistent compliance with international safety standards. As the automotive sector continues to embrace Industry 4.0 practices, the Automatic Tire Testing Machine segment is expected to dominate, offering scalability and efficiency for tire performance validation.

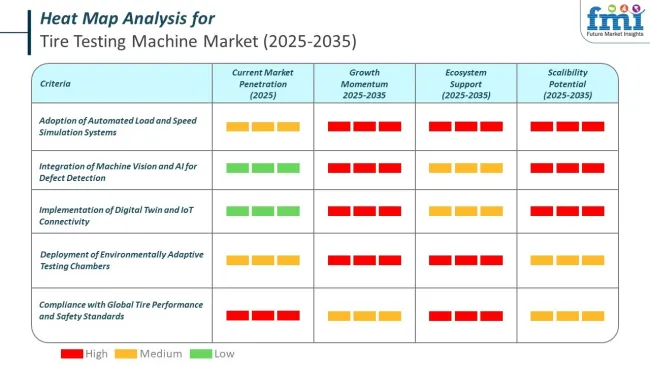

The tire testing machine market is evolving rapidly due to advancements in automation, AI-based analytics, and precision engineering. Leading manufacturers are focusing on improving testing speed, accuracy, and real-time defect detection across various tire types.

Government mandates are playing a decisive role in shaping the tire testing machine market by enforcing stringent standards for tire performance, safety, labeling, and sustainability. These regulatory pressures are compelling tire manufacturers to upgrade testing capabilities and comply with regional laws.

Tires play a pivotal role in today’s vehicles. Given the conditions vehicles have to ride on, tires are required to perform under extreme conditions in terms of weather, driving characteristics, and serve longer miles before they wear out. Product innovations, patent filings, technical developments, research, and tire testing have paved way for the entry of many tire testing machine manufacturers.

Most of the investments have been focused on the improvement of machine compatibility, its performance and its output. According to FMI’s analysis, on the back of these factors, tire testing machine will grow at 4.6% CAGR between 2025 and 2035.

The consequences have been wide reaching, particularly for automotive end-use industry with declining usage in aerospace sector. Regions such as Asia-Pacific, Europe and North America have been drastically affected with devastating effects on supply chain, production, sales and market development.

Globally, the automotive industry experienced a sharp decline in 2024. Arguably, the challenge for tire testing machine manufacturers is unprecedented.

At the onset of fourth industrial revolution, development of smart factories and digital age, tire testing suppliers are ramping their machines to be able to address evolving market demand.

Tire machinery manufacturers are investing more in R&D, evolving quickly in technology, and offering tailored automated solutions for optimum production to their customers due to the rapid pace of change faced by tire producers. The effect of increasing automation to eradicate human errors for tire producers would be that strict testing on 100% of tire manufacturing would be a legal requirement.

Automatic tire testing machines provide faster cycling times, surge in productivity, reduce dependency on labor, decrease the lead time, reduce errors and provide considerable benefits to owner as well as end-user.

The key players in the tire testing machine market are actively engaged in various forms of partnerships with tire manufacturers and automotive OEMs to help them address a large market. These partnerships are creating new avenues for product development, its market positioning, improving the product value, its lifecycle, and easy deployment of product into the market. They are providing a stimulus in the Tire Testing Machine market.

Innovative tire design and development ideas and improved production processes with a higher degree of automation and more transparency, are needed by tire manufacturers and machine builders. Reduced downtime, detailed diagnostics, and lower energy usage are also important features.

Around the same time, considering the numerous integrations into a tire testing machine, several plants must be upgraded to meet current standards and new regulations, which are costly and not feasible. These solutions tend to become expensive and cost becomes a critical factor deterring the market growth.

The USA is home to some of the prominent market players such as MTS Systems Corp, Ametek Inc and Calspan Corporation, These companies serve tire manufacturers, automotive OEMs, and aircraft industry. There is ample opportunity for product development in the country backed by regulatory norms including the FMVSS 119 which are the North American requirements according to the National Highway and Traffic Safety Administration (NHTSA)

In China, many American and European tire testing machine manufacturers as well as automotive OEMs have set up manufacturing units. There is large activity in this country as the tire industry is poised for global growth. It will attract global attention and serve a large consumer base in the Chinese market as well as other parts of East Asia.

Also, the increasing vehicle production has been enabling growth in the country. According to the China Association of Automobile Manufacturers, in July 2024, the production and sales of automobiles in China were 2.201 and 2.12 million, respectively. With the numbers forecast to rise, China will continue offering lucrative prospects for tire testing machine sales.

European countries such as Germany, are considered hotspots for tire testing machines sales. Some of the key manufacturers have partnered with leading OEMs from Germany. These partnerships aim to provide a collaborative effort towards driving profitable solutions while simultaneously serving market needs. The country is likely to generate profitable business in the forecast period. It has a very high market potential considering supply-side development.

In India, a large portion of tire testing facilities serve a small to medium sized market but there is large number of cost leadership in the country. Testing machines are used for defense vehicles, laboratories and majorly at tire dealers and specialty shops.

The India Brand Equity Foundation (IBEF), has identified the rising middle class income to be a key driver of automobile sales in India. IBEF also has forecast India to displace leading automotive producing countries such as Germany and Japan, to emerge at the fore by 2024.

With automotive product gaining pace, India will continue offering conducive environment for sales of tire testing machines.

In the country of Japan, developments in tire testing machines are positively impacting the market growth. The country has a large supplier base for tire manufacturers based in the country like Sumitomo Tires and Bridgestone Tires.

In the current scenario, tire force & measurement machines, endurance testing machines and tire uniformity machines are dominating the global market. These machines play a crucial role on evaluating tire parameters before it runs on the track. There is a lot of activity at supplier side concerning development of these machines. Demands from motorsports, EVs and aircrafts are fueling the market growth.

As per, leading tire manufacturer, Continental AG, approximately 150,000 tires get tested at every large tire manufacturing company, every year. Coupled with the global tire production rate, which gradually increases 3-4% every year, testing machines will be required on a large scale to meet the ever-rising demand. Tire manufacturing is also impacted positively by growing automotive production and aerospace fleet.

In the current industry scenario, a large number of tire testing machines are currently operated automatically due to the onset of industrial automation. The reduced dependence on workforce, improved productivity and reduced lead time offer considerable advantages than manual machines. Due to automatic machines, cycle time considerably increases and this positively impacts the adoption of automatic machines. Manual machine however can be found in small to medium tire testing facilities having batch testing of 50-100 tires per day.

Four wheelers including passenger cars, motorsports and heavy commercial vehicles constitute a larger chunk of the global automotive production. In 2020, total of 92 million passenger cars and commercial vehicles were sold. With rising population and automotive commercial activities like taxi services, ride sharing and electrification, there will be ample opportunities for rising demands from this application type.

Some of the ley players profiled in FMI’s tire testing machine market study include MTS Systems Corp, A&D Co. Ltd, Ametek Inc and ZF AG.

The tire testing machine market is a highly competitive market dominated by both global and regional players which are aiming to provide the most cost competitive solution for various end-uses of tire testing. There is a lot of product differentiation concerning the types of solutions which are offered to tire manufacturers, automotive OEMs and for contract and laboratory purposes.

The key participants currently driving the market, hold approximately half the market value share. Drive for product positioning and aggressive marketing are some of the common behavioral trends in the global market.

Some of the leading companies operating in the market are:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for value and units for Volume |

| Key Regions Covered | North America; Latin America; Asia-Pacific and Middle East & Africa |

| Key Countries Covered | USA, Canada, Germany, UK, Italy, Spain, Russia, China, Japan, South Korea, India, ASEAN countries, Australia, Turkey, Brazil |

| Key Segments Covered | Machine Type, Application, Operation, End-use and Region |

| Key Companies Profiled | MTS Systems Corporation; A&D Technology; Burke Porter Group; AMETEK,Inc.; TMSI LLC; Kistler Group; Kobelco Technology; Kokusai Co. Ltd; ZF Friedrichshafen AG; Zwick Roell LP; Calspan Corporation; Qingdao GaoCe Technology Co., LTD; Leonardo Automation |

| Report Coverage | Market Forecast, brand share analysis, competition intelligence, DROT analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global tire testing machine market is estimated to be valued at USD 467.7 million in 2025.

The market size for the tire testing machine market is projected to reach USD 733.3 million by 2035.

The tire testing machine market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in tire testing machine market are flat belt tire testing machine, rolling resistance testing machine, dynamic contact testing machine, tire balancing machine, drum tire testing machine, endurance testing machine, 2 position, 4 position, endurance + high speed testing machine, tire force & moment measurement systems, plunger test & bead unseating test machine, tire stiffness & footprint measurement machine, tire tread wear simulation systems, run flat tire durability tester, load tester and uniformity tester.

In terms of application, four wheelers tire testing machine segment is poised to command 41% share in the tire testing machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tire Marking Machine Market Size and Share Forecast Outlook 2025 to 2035

Tire Cutting Machine Market Trends, Outlook & Forecast 2025 to 2035

Tire Changing Machines Market Size and Share Forecast Outlook 2025 to 2035

Tire Inflating Machine Market

Bend Testing Machine Market Growth - Trends & Forecast 2025 to 2035

An Analysis of the Leak testing Machine Market by Detectors and Sensors Hardware Type through 2035

Market Share Distribution Among Leak Testing Machine Providers

Leak testing Machine Market

Pack Testing Machines Market

Impact Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

PCR Tire Building Machine Market Size and Share Forecast Outlook 2025 to 2035

Leather Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Fatigue Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tensile Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Hardness Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Resonant Testing Machine Market

Lubricant Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Universal Testing Machine Market Growth – Trends & Forecast 2025-2035

Compression Testing Machines Market Size and Share Forecast Outlook 2025 to 2035

Permeability Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA