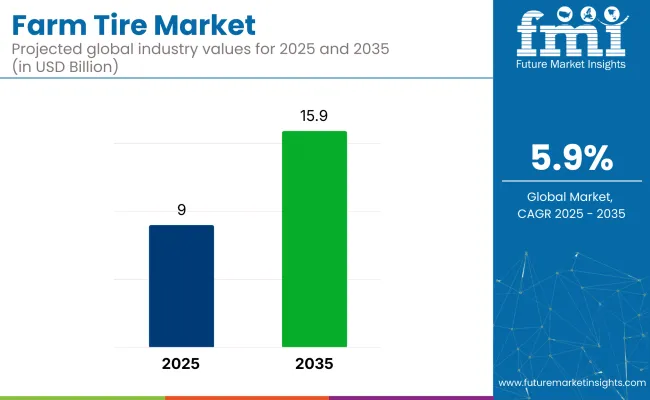

The global farm tire market is projected to grow from USD 9 billion in 2025 to USD 15.9 billion by 2035, registering a CAGR of 5.9% during the forecast period.

Growth is being driven by increased mechanization in agriculture. The rising demand for durable and high-performance tires is further accelerating industry expansion. Agricultural activities are being expanded globally, boosting demand for specialized tires. The need for improved efficiency, reduced soil compaction, and enhanced traction in farming operations is fueling adoption of advanced tire technologies.

The industry holds a specialized share within its parent markets. In the tire market, it accounts for approximately 3-4%, as these tires are just one category within the larger tire industry. Within the agricultural equipment market, the share is higher, around 10-12%, driven by the essential role of tires in agricultural machinery like tractors, harvesters, and plows.

In the broader automotive and transportation market, these tires represent around 1-2%, as they are used specifically for agricultural vehicles. In the construction and mining equipment market, these tires make up approximately 2-3%, as they are similar to off-road tires used in heavy machinery. Within the rubber and plastics market, farm tires contribute about 2-3%, being a part of the overall tire manufacturing sector.

In a recent interview, Thom Clark, President of Ascenso Tires North America, discussed the challenges in the farm tire market, stating, “With less government financial support, farmers are feeling more pressure to save where they can.” This highlights the financial strain on farmers, making them more cautious in their purchasing decisions, particularly in the industry, where cost-saving measures are becoming increasingly important due to reduced government assistance.

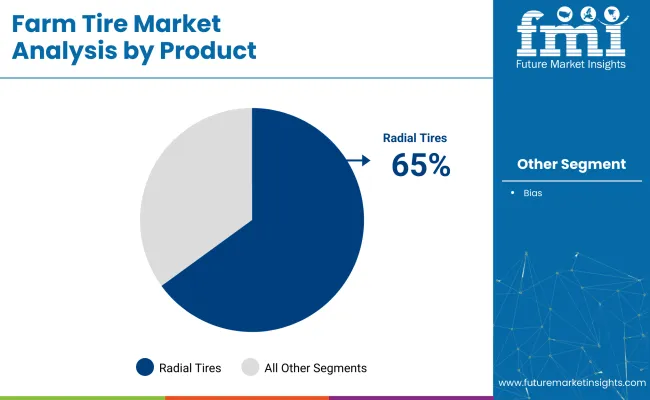

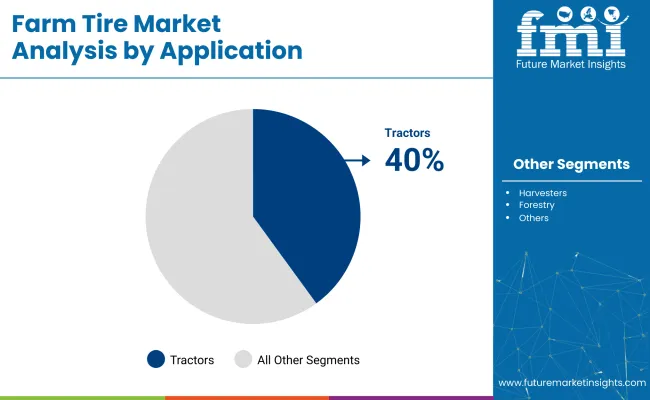

The industry is being shaped by investments in radial tire manufacturing and tractor-based applications, driven by agricultural automation, fuel efficiency, and soil conservation needs. Radial tires are expected to capture 65% of the industry share, while tractors will hold 40%, and OEMs will dominate the distribution channel with 55-60% share in 2025.

Radial tires are projected to dominate the industry, capturing 65% of the industry share in 2025. Their superiority in traction, fuel savings, and reduced soil compaction has made them the preferred choice for modern farming. Companies like Michelin, Trelleborg, and Mitas are at the forefront of developing advanced radial tire systems, integrating digital pressure monitoring and innovative tread compounds.

These technological advancements are particularly beneficial for modern tractors used in plowing, tilling, and precision seeding. Radial tires are increasingly utilized in row crop and large-scale farming operations, where soil preservation is vital, enhancing their relevance in North America, Europe, and Asia-Pacific.

Tractors are expected to remain the leading application for these tires, capturing 40% of the industry share in 2025. This is driven by rising farm mechanization, supported by government subsidies and rural modernization programs, particularly in emerging industries like India, Brazil, and China. Companies like BKT, CEAT, and Continental are manufacturing durable tires designed for a wide range of tractors, from compact to high-horsepower models.

These tires are engineered for improved load-bearing capacity, lateral stability, and tread longevity to handle both field and road conditions. The growing adoption of precision farming and high-horsepower tractors creates new demand for technologically advanced tires.

The OEM distribution channel is projected to capture 55-60% of the industry share in 2025. OEMs supply tires as part of agricultural machinery, including tractors, harvesters, and sprayers. This channel holds a significant share due to its direct integration with machinery manufacturers, ensuring seamless tire supply to farmers.

OEMs offer specialized, durable tires tailored to the specific needs of various farming operations. The widespread adoption of mechanized farming, along with government support for agricultural infrastructure, further strengthens the OEM distribution channel’s dominance in the industry.

The industry is growing due to increased agricultural mechanization, rising food demand, and technological advancements in tire design. However, high operational costs and complex regulatory challenges limit broader industry growth, particularly for small-scale farmers and in developing regions.

Increasing Mechanization and Demand for Food Are Driving Farm Tire Adoption

The global expansion of agricultural mechanization is significantly boosting the demand for specialized tires used in equipment like tractors, harvesters, and sprayers. This trend is driven by the growing global population and increasing food demand, which require more efficient and productive farming.

High-performance tires are essential for modern machinery, providing stability, durability, and improved performance in the field. The integration of advanced equipment is growing in both developed and emerging industries, enhancing the importance of these tires in agricultural operations.

High Operational Costs and Regulatory Complexities Are Limiting Market Growth

The adoption of advanced technologies and specialized agricultural equipment is driving up operational costs, creating barriers for small and medium-sized farms. High costs limit access to modern tires and equipment, hindering widespread adoption.

Additionally, the complexity of complying with varying regional and international regulations on manufacturing, quality standards, and distribution raises expenses, further limiting industry penetration, particularly in developing countries. Overcoming these challenges with cost-reduction strategies and streamlined regulatory frameworks is vital for enhancing industry access and fostering sustainable growth.

The global industry demand is projected to rise at a 5.9% CAGR from 2025 to 2035. Of the five profiled markets out of 40 covered, India leads at 8%, followed by China at 7% and the United Kingdom at 5.5%, while the United States records 4.5% and Germany posts 3.5%. These rates translate to a growth premium of +35% for India, +19% for China, and -23% for Germany versus the baseline, whereas the United States and the United Kingdom show more moderate growth.

Divergence reflects local catalysts: increasing demand for mechanization in India, growth in agricultural technology and machinery adoption in China, steady demand in the UK, and slower growth driven by industry saturation in the USA and traditional farming practices in Germany.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.5% |

| United Kingdom | 5.5% |

| China | 7% |

| India | 8% |

| Germany | 3.5% |

The industry in the United States is set to record a CAGR of 4.5% through 2035. Advancements in tire design for traction, flotation, and fuel efficiency have aligned with the evolution of precision agriculture. Firms such as Goodyear, Bridgestone, Michelin, and Alliance Tire Group have introduced radials and IF/VF tires to match high-horsepower equipment. Integration of smart tire technologies with telematics has expanded across Midwest and Southern states. Strong aftermarket distribution and OEM demand sustain volume.

Sales of these tires in the United Kingdom are projected to grow at a CAGR of 5.5% through 2035. Mechanization grants and efficiency-driven land management policies have increased the demand for advanced tire systems. Cold-weather compounds and low-compaction treads have been prioritized by brands like Michelin, Continental, and Trelleborg. Collaboration with agricultural universities has advanced field trials of new-generation tires. The push for automation in livestock and arable farms supports continued expansion.

Demand for these tires in China is estimated to grow at a CAGR of 7.0% through 2035. Strategic initiatives tied to the country’s rural revitalization plan have catalyzed mechanization and increased tire procurement. Domestic manufacturers such as ZC Rubber, Double Coin, and Linglong Tire have expanded rural dealer networks. Government funding tied to equipment renewal has increased IF tire installation in smart farming zones. Partnerships with European brands have added competitive pressure in high-end segments.

The industry in India is forecasted to grow at a CAGR of 8.0% through 2035.Tractorization under central schemes and higher awareness of tire lifespan have boosted demand in tier-2 and tier-3 rural industries. JK Tyre, MRF, Apollo, and BKT are scaling production of bias-ply and radial models tailored for variable field conditions. Increasing awareness of soil health and fuel economy is reinforcing the shift to low-pressure tires. State-level subsidy programs continue to expand procurement.

The industry in Germany is expected to grow at a CAGR of 3.5% through 2035. High standards for environmental compliance and export-ready tire design drive development. Continental, Mitas, and Trelleborg have launched energy-efficient tires to meet strict EU norms. Adoption of precision machinery and reduced soil-pressure systems is reinforcing demand. Germany’s role as a manufacturing hub supports cross-border tire exports, aided by logistical efficiency and consistent quality benchmarks.

Leading Company -Balkrishna Industries Limited (BKT) Industry Share - 15%

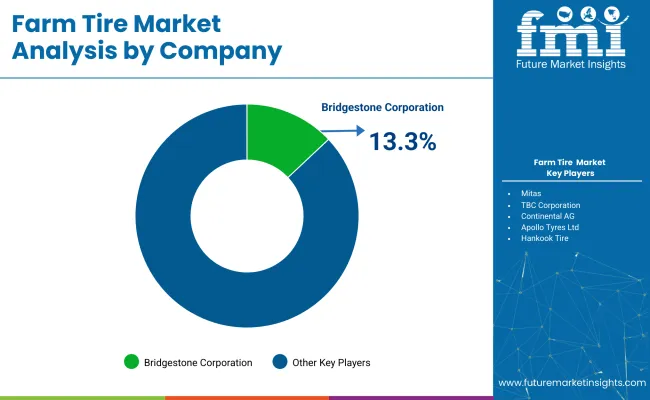

The global industry features a competitive landscape with dominant players, key players, and emerging players. Dominant players such as Balkrishna Industries Limited (BKT), Bridgestone Corporation, and CompagnieGénérale des Établissements Michelin (CGEM) lead the industry with extensive product portfolios, strong R&D capabilities, and robust distribution networks across agricultural machinery, construction, and industrial sectors.

Key players including Continental AG, Sumitomo Rubber Industries, Ltd., and Titan International, Inc. offer specialized solutions tailored to specific applications and regional industries. Emerging players, such as Mitas, TBC Corporation, and Apollo Tyres Ltd., focus on innovative technologies and cost-effective solutions, expanding their presence in the global industry.

Recent Industry Developments

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 9 billion |

| Projected Industry Size (2035) | USD 15.9 billion |

| CAGR (2025 to 2035) | 5.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Product Segmentation | Bias Tires, Radial Tires |

| Application Segmentation | Tractors, Harvesters, Forestry, Irrigation, Implements, Sprayers |

| Distribution Channel Segmentation | OEM, Aftermarket |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Key Players Influencing the Industry | Balkrishna Industries Limited (BKT), Bridgestone Corporation, Continental AG, Compagnie Générale des Établissements Michelin (CGEM), Sumitomo Rubber Industries, Ltd., Titan International, Inc., Mitas, TBC Corporation, Apollo Tyres Ltd., Hankook Tire, MRF Limited, JK Tyre & Industries Ltd., CEAT, The Carlstar Group, LLC, Specialty Tires of America, Inc., Alliance Tire Group (ATG), Trelleborg AB |

| Additional Attributes | Dollar sales by product type, application, and distribution channel, increasing demand for high-performance tires in agricultural machinery, growing adoption in emerging industrie s, regional trends in agricultural mechanization and tire technology. |

The industry is segmented by product into bias and radial tires.

By application, the industry includes tractors, harvesters, forestry, irrigation, implements, and sprayers.

By distribution channel, the industry is categorized into OEM and aftermarket.

The industry covers North America, Asia Pacific, Europe, Latin America, and Middle East & Africa.

The industry size is projected to be USD 9 billion in 2025 and USD 15.9 billion by 2035.

The expected CAGR is 5.9% from 2025 to 2035.

Radial tires are expected to dominate with a 65% industry share in 2025.

Balkrishna Industries Limited (BKT) is the leading company, holding a 15% industry share.

India is projected to grow at a CAGR of 8% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Farming Sack and Tote Market Size and Share Forecast Outlook 2025 to 2035

Tire Marking Machine Market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market Forecast and Outlook 2025 to 2035

Tire Pressure Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Tire Cord Fabric Market Size and Share Forecast Outlook 2025 to 2035

Farm Animal Drug Market Size and Share Forecast Outlook 2025 to 2035

Tire Retreading Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tire Cobalt Salt Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Tire Curing Bladder Release Agent Market Size and Share Forecast Outlook 2025 to 2035

Tire and Wheel Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tire Changing Machines Market Size and Share Forecast Outlook 2025 to 2035

Tire Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Tire Cord and Tire Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Tire Materials Market Insights – Size, Trends & Forecast 2025–2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Tire Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tire & Wheel Cleaners Market Size and Share Forecast Outlook 2025 to 2035

Tire Repair Patch Market Analysis By Type, Application, and Region Through 2035

Tire Inspection System Market - Outlook 2025 to 2035

Tire Curing Press Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA