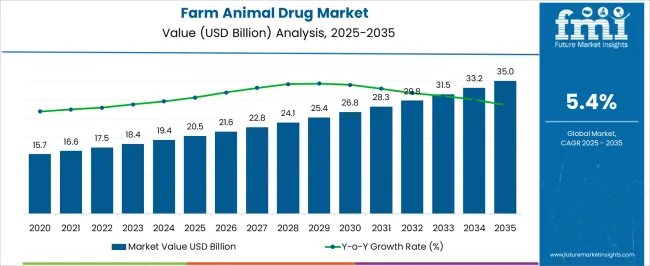

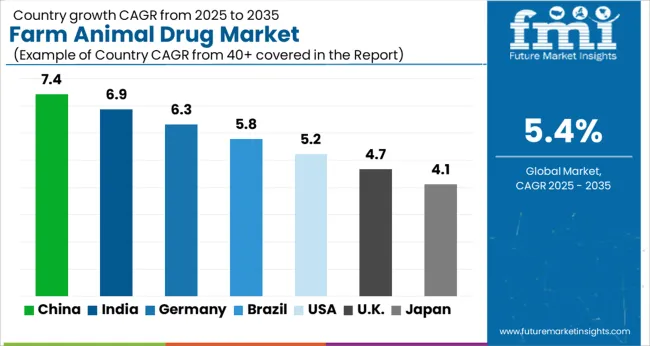

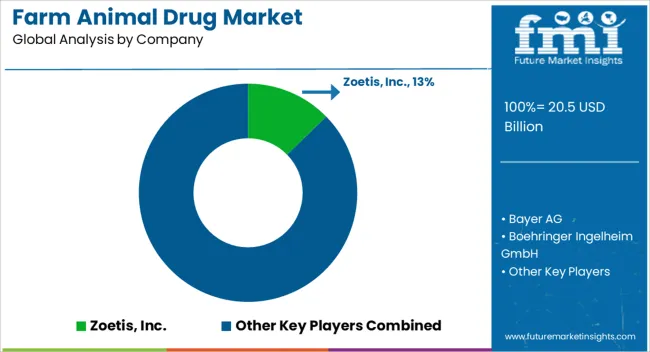

The Farm Animal Drug Market is estimated to be valued at USD 20.5 billion in 2025 and is projected to reach USD 35.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

| Metric | Value |

|---|---|

| Farm Animal Drug Market Estimated Value in (2025 E) | USD 20.5 billion |

| Farm Animal Drug Market Forecast Value in (2035 F) | USD 35.0 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The farm animal drug market is expanding steadily, driven by the growing demand for animal protein and the rising prevalence of infectious diseases in livestock. Industry journals and veterinary health publications have emphasized the role of effective disease management in improving animal productivity and ensuring food security. Pharmaceutical companies have increased their investments in veterinary drug development, focusing on formulations that enhance compliance and treatment effectiveness in large-scale farming environments.

Regulatory approvals and government-backed vaccination and treatment programs have further supported the market’s adoption. In addition, global trade in meat and dairy products has reinforced the need for stringent health management practices to meet safety and export standards. Advances in oral and parenteral formulations, along with heightened awareness of antimicrobial stewardship, have diversified therapeutic options available to veterinarians.

Looking forward, the market is expected to benefit from innovations in long-acting formulations, precision dosing systems, and integrated herd health programs. Segmental growth is expected to be driven by Anti-Infectives, Livestock Animals, and Oral administration, reflecting clinical necessity and practical adoption patterns in intensive animal farming.

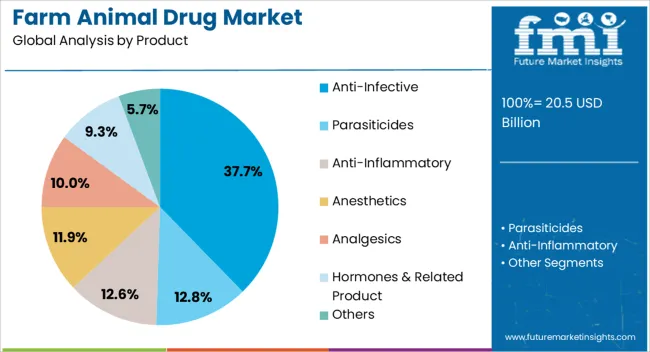

The Anti-Infective segment is projected to account for 37.7% of the farm animal drug market revenue in 2025, establishing itself as the leading product category. Growth in this segment has been driven by the widespread prevalence of bacterial and parasitic infections in livestock, which can severely affect productivity and animal welfare. Veterinary journals have reported that antimicrobials remain the cornerstone of disease prevention and treatment in intensive farming systems, where animal density increases disease transmission risk.

Pharmaceutical companies have developed broad-spectrum anti-infective formulations that are easy to administer and effective across multiple species, supporting their adoption. Additionally, government and industry programs focused on food safety and disease control have emphasized timely treatment of infections to reduce mortality and economic losses.

Despite regulatory measures to curb antimicrobial resistance, the need for effective infection control has ensured the continued dominance of the Anti-Infective segment in the farm animal drug market.

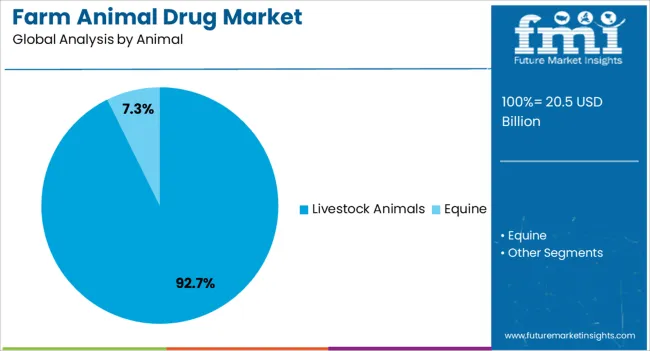

The Livestock Animals segment is projected to hold 92.7% of the farm animal drug market revenue in 2025, highlighting its overwhelming dominance. This growth has been supported by the central role of livestock—particularly cattle, swine, and poultry—in meeting global food demand. Veterinary associations and agricultural reports have highlighted that the majority of veterinary drug consumption is concentrated in livestock farming, given the scale of production and economic importance of these animals.

Increased susceptibility of livestock to infectious and metabolic diseases, coupled with the intensive nature of modern farming practices, has reinforced the need for consistent therapeutic interventions. Rising consumer demand for milk, meat, and eggs has further encouraged investments in animal health solutions that enhance productivity while ensuring food safety.

As livestock farming continues to expand in both developed and emerging economies, the Livestock Animals segment is expected to maintain its dominant market share.

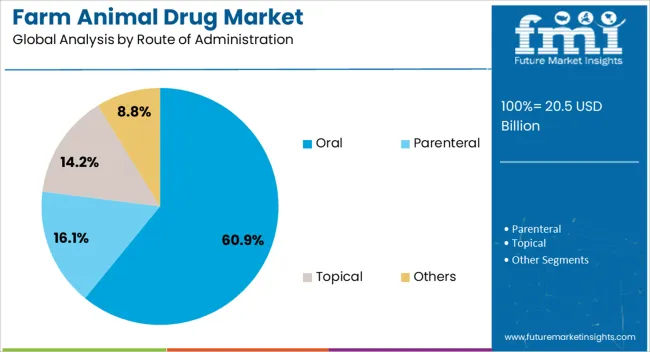

The Oral segment is projected to contribute 60.9% of the farm animal drug market revenue in 2025, making it the most widely used route of administration. This preference has been driven by the ease of administration across large herds and flocks, where oral formulations such as medicated feed and water-soluble drugs allow efficient mass treatment. Veterinary practice reports have highlighted that oral delivery ensures better compliance, reduced labor costs, and faster implementation of treatment programs in farm settings.

Additionally, advancements in oral drug formulations have improved bioavailability and stability, ensuring therapeutic effectiveness. Oral administration has been especially critical in prophylactic treatments, where drugs are delivered to prevent outbreaks in high-density livestock populations.

Its scalability, combined with reduced stress on animals compared to injections, has made oral administration the preferred method in commercial farming operations. With ongoing innovations in drug delivery technologies, the Oral segment is expected to sustain its leadership in the farm animal drug market.

Side Effects from Drugs Raise Concerns in Farm Animal Health Industry

Factors such as the popularity of natural remedies are likely to hinder the sector's growth during the forecast horizon. Many farmers from underdeveloped regions are unaware of diseases, leading them to use home remedies for their animals. Moreover, rising concerns regarding antibiotic resistance are setting up barriers to the industry. Animals are increasingly experiencing side effects from particular drugs.

Industry Responds to Health Challenges with Innovations in Farm Animal Drugs

Technological advancements are also playing a significant role, introducing innovations such as monoclonal antibodies, stem cells, and digital technologies. These innovations are improving treatment options for farm animals.

Concerns about antimicrobial resistance (AMR) influencing drug development and usage practices are on the rise. Longer hospital stays, less protection for surgery patients, and higher treatment costs are bad outcomes from infections caused by AMR. Additionally, there is a notable surge in the production of anti-infective drugs. This reflects the farm animal drug market’s response to health challenges faced by farm animals.

Farm animal drug sales grew by 6.5% annually from 2020 to 2025 worldwide. Factors instrumental in this market progress during this period included increasing rates of livestock farming and a rise in awareness about animal welfare. The proliferation of animal-based products was also a key factor.

Spending on these drugs could, however, decrease slightly during the forecast period. Several restraints are holding back the industry. Regulations regarding drug manufacture are set to contribute to the negativity surrounding the industry. The rise in production costs is also expected to hinder the sector going forward.

On a positive note, however, the same concern for animal welfare that helped the industry in the historical period is expected to be a profitable factor. As drug development continues to advance, newer drug formulations take center stage and give the market a fresh new outlook. Like, the integration of digital technologies and data analytics in farm animal drug management and administration is apparent.

These newer drug formulations are made possible by the advent of advanced technologies, and the technological revolution is poised to yield more benefits for the market over the forecast period.

Asia Pacific is performing well in the farm animal drug industry, with China at the forefront. Additionally, Australia and the United States are witnessing a surge in demand for these drugs. The rapidly progressing farming sector plays a crucial role in driving this growth in these countries.

The farm animal drug market in the United States is set to witness a promising surge in the coming years, with a projected CAGR of 5.7% through 2035. The increasing rate of various animal illnesses is linked to a strong demand for meat exports from the United States. Also, antibiotic resistance in animals is contributing to this trend. So, top players in the industry are expected to develop unique farm animal medications in the nation to address these challenges.

Germany's farm animal drug market is poised to witness a moderate growth trajectory in the coming years, with a projected CAGR of 4.6% through 2035. One of the key factors influencing drug sales in the country is strict regulations limiting the use of antibiotics to increase farm animal productivity. Livestock production in Germany is largely industrialized and mechanized.

An increasing portion of production is using biosecurity measures and strategies to reduce disease threats. Regulations and consumer pressures have forced the country to adopt disease-reduction initiatives, which would benefit Germany’s farm animal medicine industry.

The United Kingdom's farm animal drug market is expected to demonstrate an impressive CAGR of 5.3% from 2025 to 2035. Drug manufacturers in the United Kingdom are increasingly expanding innovative and effective product lines in the country.

Moreover, increased sustainable and responsible animal healthcare practices are contributing to the industry in the current period. Additionally, manufacturers are heavily investing in research and development activities and collaborating with other pharmaceutical companies to improve their products in the country.

The farm animal drug market in China is on the cusp of a modest growth trajectory, with a presumed CAGR of 6.1% between 2025 and 2035. The need for meat and food products in the country has driven the industry's growth in recent years. This need is increasing day by day due to significant population expansion in China. As per the demand, livestock farmers are highly focused on maintaining their animal health in the country. This has emerged as a significant growth driver for the farm animal medicine industry t in China nowadays.

The industry in Australia is all set to witness a considerable surge in the coming years, with a projected CAGR of 5.4% through 2035. A sudden upsurge in animal husbandry automation has been observed in Australia. With this automation, the demand for drugs and vaccines has increased in the country. Furthermore, government initiatives toward improving animal health and welfare are contributing to the farm animal drug industry.

In the following section, the key impacting segments of the farm animal drug market are analyzed and demonstrated by the data from the research. The industry has gained a significant boost from anti-infective drugs due to the high number of cases of spreading infectious diseases like zoonotic diseases as of 2025. On the other hand, numerous farm animal drugs are used for livestock animals.

| Segment | Anti-infective (Product Type) |

|---|---|

| Value Share (2025) | 37.7% |

Increased prevalence of zoonotic diseases is anticipated to heighten the demand for anti-infective drugs. Zoonotic diseases affect 2.5 billion people and cause 2.7 million deaths every year around the world. The World Economic Forum warns that these diseases are a big danger to global health security.

The emergence of antibiotic-resistant pathogens further stresses the importance of effective anti-infective drugs in managing and preventing infectious diseases in farm animals. This ensures the safety of the food supply chain and reduces the risk of zoonotic disease transmission. As consumers become more conscious about meat and dairy products, farmers are increasingly using these types of drugs to maintain the health and production quality of their animals.

| Segment | Livestock Animals (Animal Type) |

|---|---|

| Value Share (2025) | 92.7% |

The worldwide dependence on animal and dairy products is growing, driven by modern farming practices. This trend is boosting the demand for animal drugs in livestock. This trend is driven by an increasing need to avoid meat contamination and ensure food safety.

HealthforAnimals says that every year, one out of every five farm animals die from disease, and many others get sick. The World Organization for Animal Health contemplates that diseases make up 20% of the yearly loss in livestock production. Disease prevention and control, as well as the development of innovative formulations for manufacturing safe and high-quality meals, are projected to drive growth in this area.

The farm animal drug market is observed as dynamic and quite diverse. Established players are increasingly vying for the maximum industry share by launching advanced product lines. Moreover, through conducting surveys and campaigns in villages and gathering feedback from farmers about their animal drug concerns, manufacturers have gained consumer trust in recent years.

Industry Updates

Depending on the product type, the sector is categorized into anti-infective, parasiticides, anti-inflammatory, anesthetics, analgesics, hormones, and related products. Moreover, parasiticides are further divided into endo-parasiticides, ecto-parasiticides, and endectocides.

The animal type segment is bifurcated into livestock animals and equine. Livestock animals include ruminants, swine, and poultry.

Route of administration of farm animal drugs include oral, parenteral, topical, and others.

Farm animal drugs are distributed through veterinary hospitals, veterinary clinics, pharmacies drug stores, and other channels.

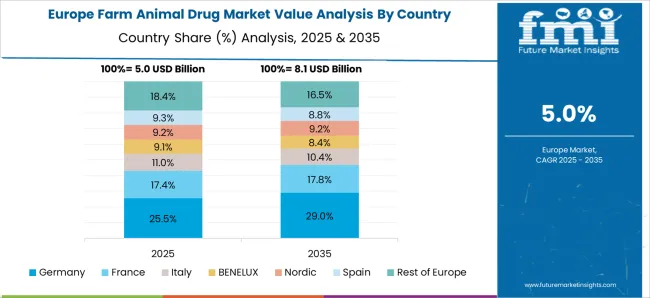

Regional analysis of the industry is conducted in North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East and Africa.

The global farm animal drug market is estimated to be valued at USD 20.5 billion in 2025.

The market size for the farm animal drug market is projected to reach USD 35.0 billion by 2035.

The farm animal drug market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in farm animal drug market are anti-infective, parasiticides, _endo-parasiticides, _ecto-parasiticides, _endectocides, anti-inflammatory, anesthetics, analgesics, hormones & related product and others.

In terms of animal, livestock animals segment to command 92.7% share in the farm animal drug market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Farm Tire Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Farming Sack and Tote Market Report – Trends, Size & Forecast 2024 to 2034

Farm Equipment Market – Advanced Agricultural Machinery 2024-2034

Indoor Farming Market Analysis - Size, Share, and Forecast 2025 to 2035

A Detailed Global Analysis of Brand Share for the Indoor Farming Market

Poultry Farming Equipment Market Size and Share Forecast Outlook 2025 to 2035

Vertical Farming Market Size and Share Forecast Outlook 2025 to 2035

Horse Drawn Farming Equipment Market Size and Share Forecast Outlook 2025 to 2035

AI for Hydroponic Farming Market Size and Share Forecast Outlook 2025 to 2035

Precision Livestock Farming Market - Trends & Forecast 2034

Internet Of Things In Farm Management Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Disinfectant for Pets and Farms Market - Outlook 2025 to 2035

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA