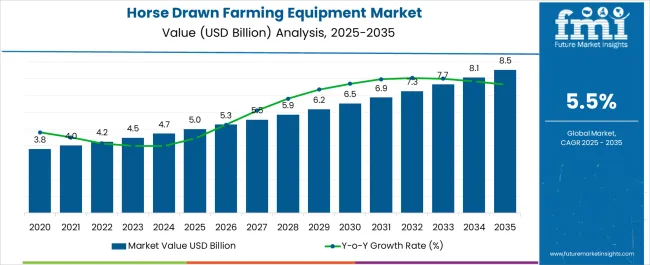

The horse drawn farming equipment market is estimated to be valued at USD 5.0 billion in 2025 and is projected to reach USD 8.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

Agricultural equipment manufacturers observe renewed interest from farming operations managing steep terrain, sensitive soil conditions, or restricted acreage where traditional tractors prove impractical or potentially damaging. Equipment specifications focus on durability and multi-functionality as farmers seek implements capable of performing cultivation, planting, and harvesting tasks using standardized hitching systems compatible with various horse breeds and team configurations. Procurement decisions involve balancing initial equipment costs against long-term operational expenses including animal care, feed requirements, and specialized maintenance needs unique to horse-powered agricultural systems.

Supply relationships between equipment manufacturers and agricultural dealers navigate limited production volumes while maintaining quality standards essential for safe animal operation. Specialty manufacturers concentrate on niche market segments including Amish farming communities, organic certification programs, and agritourism operations where horse drawn equipment serves both functional and educational purposes. Engineering teams design implements using traditional construction methods combined with modern materials that improve durability while preserving authentic operational characteristics valued by heritage farming practitioners.

Cross-functional challenges emerge between farm management seeking productivity gains and animal welfare specialists ensuring proper equipment sizing relative to horse capabilities and working conditions. Quality control protocols address weight distribution, draft requirements, and safety mechanisms that protect both animals and operators during field operations. Manufacturing processes involve skilled craftsmen familiar with traditional blacksmithing techniques alongside modern welding and fabrication methods required for producing implements that withstand seasonal agricultural demands.

Global market distribution concentrates primarily in North American regions with established horse farming traditions, particularly Pennsylvania, Ohio, and Indiana where Amish communities maintain traditional agricultural practices. European markets demonstrate growing interest among sustainable agriculture advocates and small farm operations seeking to reduce fossil fuel dependence while maintaining viable crop production systems. Limited availability of trained draft horses creates bottlenecks for market expansion as farming operations require significant investment in animal acquisition, training, and facilities development before implementing horse drawn equipment systems.

Educational institutions including agricultural colleges and living history museums represent emerging market segments where horse drawn equipment serves dual purposes of functional demonstration and historical preservation. Farm operators must coordinate equipment purchases with animal training schedules, seasonal workload planning, and storage facility requirements that accommodate both implements and draft animals throughout annual production cycles. Maintenance considerations involve specialized knowledge of both mechanical components and animal handling techniques, creating workforce development challenges for agricultural operations transitioning from mechanized to horse powered systems.

| Metric | Value |

|---|---|

| Horse Drawn Farming Equipment Market Estimated Value in (2025 E) | USD 5.0 billion |

| Horse Drawn Farming Equipment Market Forecast Value in (2035 F) | USD 8.5 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The horse drawn farming equipment market is experiencing renewed demand in specific regions due to the sustained use of traditional agricultural practices, cultural preferences, and limited mechanization in rural economies. Rising interest in sustainable farming methods and the revival of organic agriculture have also contributed to the steady use of non mechanized equipment.

Farmers in small scale operations continue to adopt horse drawn tools owing to their cost effectiveness, low maintenance requirements, and adaptability to small fields where mechanized equipment may not be practical. Additionally, the market benefits from heritage farming movements and government initiatives that support sustainable and environmentally friendly cultivation practices.

The outlook remains stable as horse drawn farming equipment continues to play a role in bridging the gap between tradition and sustainability, especially in areas where access to modern machinery remains limited or where ecological considerations are prioritized.

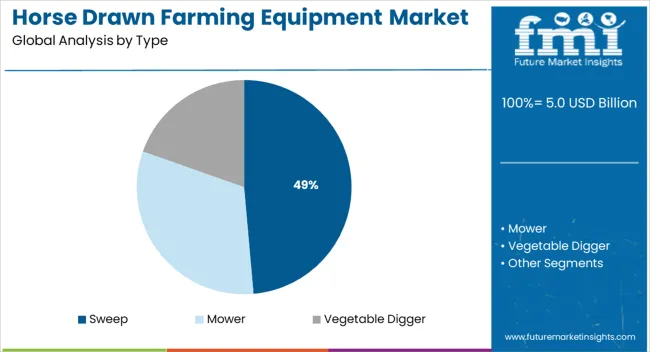

The market is segmented by Type and Sales Channel and region. By Type, the market is divided into Sweep, Mower, and Vegetable Digger. In terms of Sales Channel, the market is classified into Direct Sales and Retail Sales. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The sweep type is projected to represent 48.60% of total revenue by 2025 within the type category, making it the dominant product type. Its growth is being driven by its efficiency in soil preparation, weeding, and residue management, all of which are essential for crop cultivation.

Farmers value the sweep type for its versatility, durability, and suitability across various soil conditions. Its ability to reduce manual labor while maintaining soil structure has further supported adoption.

The consistent demand for multifunctional and reliable tools has ensured the strong position of sweep type equipment within the market.

Historical Period (2020 to 2025)

| Attributes | Details |

|---|---|

| CAGR | 4.9% |

| 2020 Value | 3.18 billion |

| 2025 Value | 4.25 billion |

The use of horse drawn farming equipment has a long history dating back to the early days of agriculture. However, with the advent of mechanized equipment like the internal combustion engine, tractors and other mechanized equipment, horse drawn farming equipment was gradually phased out. However, in the last decade, there has been renewed interest in a horse drawn farming. This renewed interest is driven by concerns about the environmental impact of mechanized farming and the desire to reduce dependence on fossil fuels.

Forecast Period (2025 to 2035)

| Attributes | Details |

|---|---|

| CAGR | 5.5% |

| 2025 Value | 4.48 billion |

| 2035 Value | 8.5 billion |

The future prospects for the horse drawn farming equipment sector look progressive since people are turning to sustainable and traditional forms of farming. The market is expected to grow rapidly during the forecast period as farmers desire to lessen their reliance on fossil fuels. They are also looking for sustainable ways to improve soil health and reduce soil erosion. This is also projected to increase adoption since horses can till the soil without compaction. There is also a potential for growth in Asia Pacific and Africa where traditional farming practices are still widely used.

These factors are anticipated to support a 1.7X increase in the horse drawn farming equipment market between 2025 and 2035. According to FMI analysts, the market is projected to be worth USD 8.5 billion by the end of 2035.

FMI analysts have identified certain drivers, opportunities and trends which are affecting the market positively. However, according to them, there are certain limiting factors exist as well in the market which may move the market in a negative direction.

Market Drivers: There are several key drivers fueling market expansion. These include:

Market Restraints: The market is also constrained by certain factors including:

Market Opportunities: Even though the market is a niche, still it offers several opportunities such as:

Market Trends: The market is currently experiencing numerous trends, including:

| Attribute | Details |

|---|---|

| Country | United States |

| Market Share (2025) | 30.1% |

| Market Value (2025) | USD 1,280.8 million |

| Attribute | Details |

|---|---|

| Country | Germany |

| Market Share (2025) | 15.7% |

| Market Value (2025) | USD 667.7 million |

| Attribute | Details |

|---|---|

| Country | United Kingdom |

| Market Share (2025) | 9.8% |

| Market Value (2025) | USD 416.8 million |

| Attribute | Details |

|---|---|

| Country | China |

| Market Share (2025) | 10.1% |

| Market Value (2025) | USD 429.8 million |

| Attribute | Details |

|---|---|

| Country | Japan |

| Market Share (2025) | 4.7% |

| Market Value (2025) | USD 198.3 million |

| Attribute | Details |

|---|---|

| Country | India |

| Market Share (2025) | 3.6% |

| Market Value (2025) | USD 151.9 million |

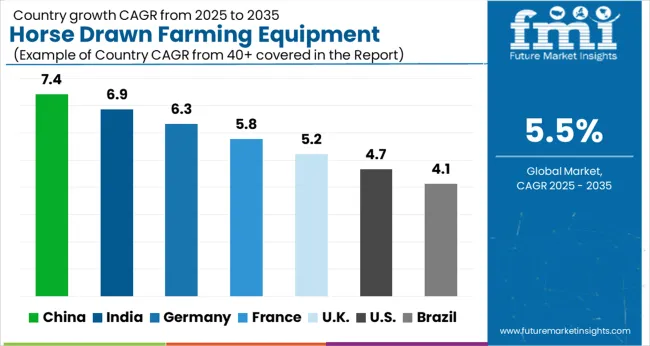

North America dominates the global horse drawn farming equipment market. The primary contributor to this massive market growth. The United States horse drawn farming equipment market is relatively small as maximum farmers use modern and mechanized equipment.

Nonetheless, there is still a niche industry for horse drawn farming equipment among small-scale farmers who are dedicated to keeping alive the traditional method and machinery. Certain manufacturers in the country still manufacture and sell horse drawn ploughs, cultivators, harrows and other equipment.

Additionally, there are organizations that promote and support horse drawn farming equipment and provide resources and training for those interested in using it. The market is typically driven by the demand from farmers who want to reduce their carbon footprint and sustainability.

The United Kingdom horse drawn farming equipment market size is comparatively trivial since automated equipment has largely replaced it in modern commercial farming operations. However, this equipment is still used by some small-scale and organic farmers as well as hobby farmers and historical reenactment enthusiasts. Historically, this equipment was widely used in the country before the 20th century.

Therefore, the market is likely to be driven by a combination of nostalgia and the desire for a more sustainable and natural form of farming rather than by large-scale commercial demand. With a CAGR of 5.9%, the market in the United Kingdom is therefore predicted to reach USD 8.5 million by 2035.

Even though horse drawn farming equipment is not commonly used in modern commercial farming operations in Germany, it has witnessed a slight resurgence in recent years. A recent trend of turning to a more sustainable form of farming has been seen among German farmers.

This, in turn, has increased the adoption of horses as an alternative to tractors. The German horse drawn farming equipment market is also supported by a growing number of horse breeding farms which has led to an increase in the number of horses available for farming.

The Chinese horse drawn farming equipment market is still excellent but in decline. Nevertheless, there are still certain areas in China, particularly in rural and remote regions, where horse drawn farming equipment is widely used. These areas often have poor infrastructure and limited access to modern machinery.

This makes horse drawn farming equipment a more practical option for farmers. Moreover, the government has been implementing policies to support the preservation of traditional farming methods and culture which is likely to increase product adoption. The market in China is therefore anticipated to reach USD 661.7 million by 2035, reflecting a CAGR of 4.4%.

Japan has a highly mechanized agriculture sector since the country is known for its technological advancements. However, certain farmers in the country, particularly in mountainous and hilly regions where the tractor and other heavy machinery cannot be deployed, prefer using traditional farming tools.

In recent years, the Japanese government has been promoting the adoption of sustainable farming methods such as organic farming and permaculture. These types of farming heavily rely on horse drawn equipment coupled with manual labor. This is likely to drive the Japanese horse drawn farming equipment market.

The Indian horse drawn farming equipment market is expected to rise significantly since the country heavily relies on agriculture. Many farmers in India still use horse drawn farming equipment owing to a lack of access to modern machinery and limited infrastructure in rural areas. The policies of the Indian government regarding the mechanization of agriculture had limited success due to a lack of infrastructure and financial resources in the rural areas.

Many farmers still prefer to use traditional farming equipment like horse drawn equipment as it is more affordable and accessible. These factors are expected to favorably impact horse drawn farming equipment industry in India. Therefore, a valuation of USD 284.1 million is projected for the Indian market by 2035, with a CAGR of 6.5%.

Horse drawn mowers are preferred by farmers and there are several reasons for this. Mowers can be used to cut various crops such as grass, hay and alfalfa which are commonly grown on many farms. Horse drawn mowers are capable of cutting large areas of land quickly as well as efficiently. This makes the mowers a valuable tool for farmers who need to maintain large fields or pastures.

Moreover, compared to other types of farming equipment, horse drawn mowers are relatively inexpensive to purchase and maintain. As with other horse drawn equipment, mowers do not emit pollutants or require fossil fuels. Therefore, horse drawn mower is an affordable and sustainable option for farmers.

The direct sales channel segment is more popular and generates more revenues for certain reasons. Horse drawn farming equipment is a niche industry and this equipment is not readily available through retail sales channels.

Direct sales allow customers to access specialized equipment that may not be found in retail stores, Moreover, direct sales allow farmers to work directly with manufacturers to customize equipment to their specific needs and preferences. Direct sales channels also offer more competitive prices as there is no middleman markup. Furthermore, direct sales allow for building a relationship with the manufacturer which is beneficial for future support.

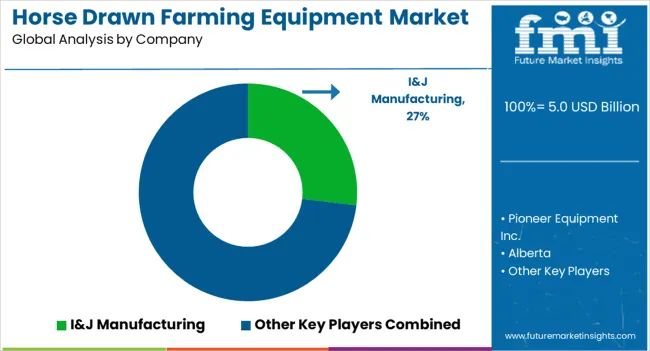

The horse-drawn farming equipment market is a niche yet vital sector, with both traditional manufacturers and specialized companies serving agricultural businesses that prefer or require horse-powered machinery. Key players include John Deere, Case IH (International Harvester), B W Macknair & Son, Pioneer Equipment Inc., Allen Machinery & Equipment, I&J Manufacturing, Avril Industrie, Hesston Corporation, Capodanno Villa Mazzucchelli, and Innoquest, Inc., each offering distinct products to cater to the diverse needs of farmers focused on sustainable, low-impact farming practices. John Deere and Case IH (International Harvester) are renowned for their longstanding history in agricultural machinery, providing high-quality, durable equipment adapted for horse-drawn operations. These brands maintain a legacy of reliability and innovation, ensuring efficiency in traditional farming methods.

B W Macknair & Son and Pioneer Equipment Inc. specialize in bespoke horse-drawn equipment, with a focus on tailored solutions for small-scale farms and those seeking heritage farming techniques. Allen Machinery & Equipment and I&J Manufacturing provide heavy-duty, reliable models suited for a range of farming needs, from plowing to harvesting. Avril Industrie and Hesston Corporation contribute to the market with a range of high-quality, efficient farming tools designed to work harmoniously with horse power. Capodanno Villa Mazzucchelli and Innoquest, Inc. focus on more specialized, handcrafted equipment, ensuring authenticity in traditional farming practices.

| Items | Values |

|---|---|

| Quantitative units (2025) | USD 5.0 billion |

| Type | Sweep; mower; vegetable digger |

| Sales Channel | Direct sales; retail sales |

| Regions Coverage | North America; Latin America; Western Europe; Eastern Europe; Balkan & Baltic; Russia & Belarus; Central Asia; East Asia; South Asia & Pacific; Middle East & Africa |

| Key Countries Covered | United States; Germany; United Kingdom; China; Japan; India; plus broader 60+ country splits in full dataset |

| Top companies profiled | John Deere, Case IH (International Harvester), B W Macknair & Son, Pioneer Equipment Inc., Allen Machinery & Equipment, I&J Manufacturing, Avril Industrie, Hesston Corporation, Capodanno Villa Mazzucchelli, Innoquest, Inc |

| Additional attributes | Dollar sales by type and sales channel and region; demand driven by sustainability, low-mechanization farming, heritage agriculture, agro-tourism, and smallholder income diversification; emphasis on low-capex durable designs and niche customization |

The global horse drawn farming equipment market is estimated to be valued at USD 5.0 billion in 2025.

The market size for the horse drawn farming equipment market is projected to reach USD 8.5 billion by 2035.

The horse drawn farming equipment market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in horse drawn farming equipment market are sweep, mower and vegetable digger.

In terms of sales channel, direct sales segment to command 54.2% share in the horse drawn farming equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Horse Bunk Feeder Market Size and Share Forecast Outlook 2025 to 2035

Horse Grain Feeders Market Size and Share Forecast Outlook 2025 to 2035

Horse Corral Panels Market Size and Share Forecast Outlook 2025 to 2035

Horse Insurance Market Size and Share Forecast Outlook 2025 to 2035

Horse Stable Supplies Market Size and Share Forecast Outlook 2025 to 2035

Horse Chestnut Seed Extract Market Size, Growth, and Forecast for 2025–2035

Horse Riding Equipment Market Analysis – Growth & Forecast 2025-2035

African Horse Sickness Treatment Market

Compound Horse Feedstuff Market Analysis by Feed Type, Horse Activity, and Ingredient Composition Through 2035

Industrial Fractional Horsepower Motors Market Analysis by End-user and Region: Forecast for 2025 to 2035

Evaluating Cold Drawn Seamless Steel Pipes Market Share & Provider Insights

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Garage Equipment Market Forecast and Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA