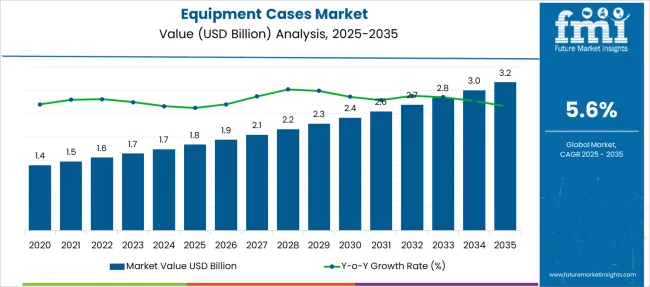

The Equipment cases market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 3.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| Equipment cases market Estimated Value in (2025 E) | USD 1.8 billion |

| Equipment cases market Forecast Value in (2035 F) | USD 3.2 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The equipment cases market is advancing steadily due to the rising need for durable, customizable, and impact-resistant enclosures across sectors such as defense, electronics, and automotive. The increased transportation of sensitive equipment in rugged environments has heightened demand for shock-proof and water-resistant cases.

Technological advancements in polymer engineering and molding precision are enabling manufacturers to produce lighter, high-strength cases tailored to specific industry needs. Rising demand for protective transit solutions, coupled with logistical globalization and field-level equipment mobility, is reinforcing the adoption of versatile, long-life casing products.

As end users seek both ergonomic performance and brand customization, opportunities are expanding in both OEM and aftermarket distribution channels. The shift toward recyclable materials and modular case construction is expected to enhance sustainability profiles and support long-term growth.

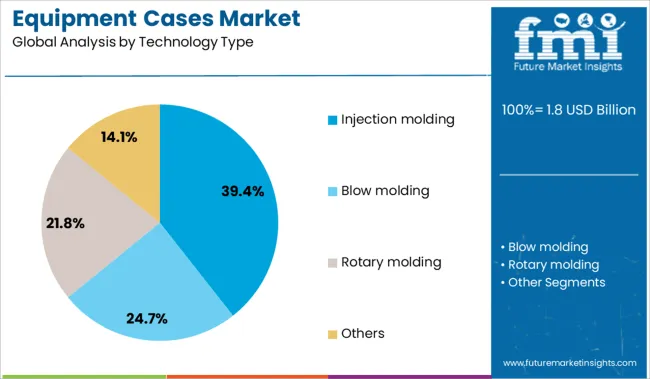

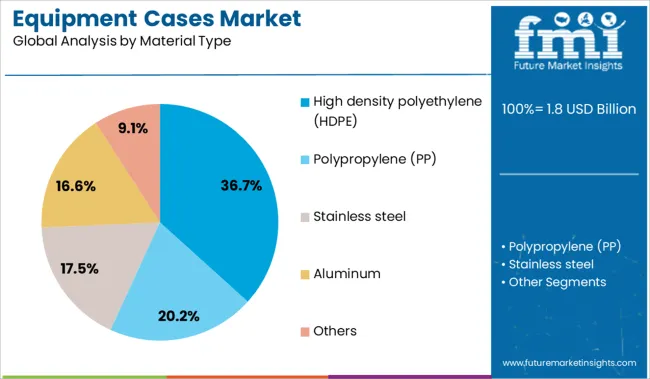

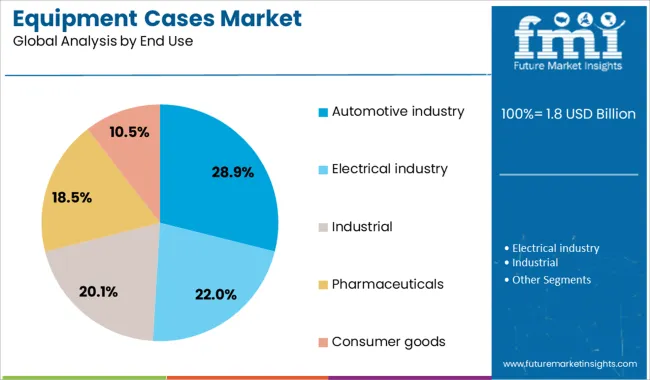

The market is segmented by Technology Type, Material Type, and End Use and region. By Technology Type, the market is divided into Injection molding, Blow molding, Rotary molding, and Others. In terms of Material Type, the market is classified into High density polyethylene (HDPE), Polypropylene (PP), Stainless steel, Aluminum, and Others. Based on End Use, the market is segmented into Automotive industry, Electrical industry, Industrial, Pharmaceuticals, and Consumer goods. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Injection molding is projected to account for 39.4% of the total equipment cases market revenue in 2025, making it the dominant technology segment. Its widespread adoption is being driven by precision manufacturing capabilities, scalability for mass production, and lower material waste.

The technology supports complex geometries and integrated component molding, allowing for enhanced case functionality without added assembly. Consistent wall thickness, dimensional accuracy, and resistance to moisture and chemicals are also enabling its use across high-stakes environments.

Injection molding’s compatibility with both thermoplastics and recyclable resins further supports manufacturers’ cost and environmental goals. Its ability to meet exacting tolerance and durability requirements has led to its leadership in applications that demand repeatable performance under physical stress.

High density polyethylene (HDPE) is expected to hold 36.7% of the overall market revenue in 2025, establishing it as the leading material type for equipment cases. This is attributed to HDPE’s lightweight profile, superior impact strength, and chemical resistance, which make it highly suitable for rugged use in harsh environments.

The material’s long service life and resistance to UV radiation, solvents, and extreme temperatures have positioned it as a preferred choice for transit, storage, and deployment cases. HDPE’s molding flexibility allows for the creation of ergonomic designs with improved handle and hinge integration, aligning with evolving end-user preferences.

Furthermore, its recyclability and compliance with global packaging and material safety standards have enhanced its appeal in sustainability-conscious procurement environments.

The automotive industry is anticipated to account for 28.9% of the total market share in 2025, ranking as the leading end-use segment in the equipment cases market. This leadership stems from the growing demand for secure transport and storage of diagnostic tools, electronic control units (ECUs), and vehicle-specific testing devices.

As vehicles integrate more advanced electronics and modular components, the need for shock-resistant, sealed protective enclosures has become critical in both OEM production and aftermarket service ecosystems. Additionally, portable equipment used in vehicle diagnostics and remote maintenance requires rugged, lightweight, and durable casings that can withstand repeated handling.

The rise in autonomous and electric vehicle servicing has also elevated the demand for customized case solutions capable of housing sensitive components during transport, reinforcing the segment’s position in the overall market.

Equipment cases are often placed in a humid climatic condition and in order to prevent them from rust, these are powder coated with stainless steel.

This coating increases barrier properties of the material, thereby providing corrosion resistance solution. This property is required for tools used in the automotive industry.

This feature of equipment cases creating demand in the industry is thus driving the market. Equipment cases have high-security lock system, thus providing security of the costlier items, from burglers. This feature is required for carrying consumer goods, and equipment cases are suitable for this purpose.

Equipment cases are scratch resistant, have hardness and tamper resistance property. These packaging product have long life compared to other material.

These factors are fueling equipment cases market. Several key market participants offer custom manufacturing services, to cater to the different consumer-specific requirement. The high price of the equipment cases is the major restraining factor for the growth of the equipment cases market.

Global equipment cases market is segmented into seven regions including North America, Latin America, Eastern Europe, Western Europe, Middle East and Africa (MEA), Asia Pacific excluding Japan (APeJ) and Japan.

Equipment cases manufacturers in North America region are focusing on developing innovative equipment cases. Equipment cases manufacturers’ upgrading the material in terms of material and the lock system.

Therefore, creative solutions are the reason for the increase in the sales of equipment cases in the market. In Asia Pacific region, global manufacturers are facing fierce competition from the local manufacturers, as consumers in this region prefer cheaper equipment case.

Since Chinese manufacturers are significant producers of cheaper equipment cases, therefore, the high price of equipment cases provided by the global manufacturers has low preference.

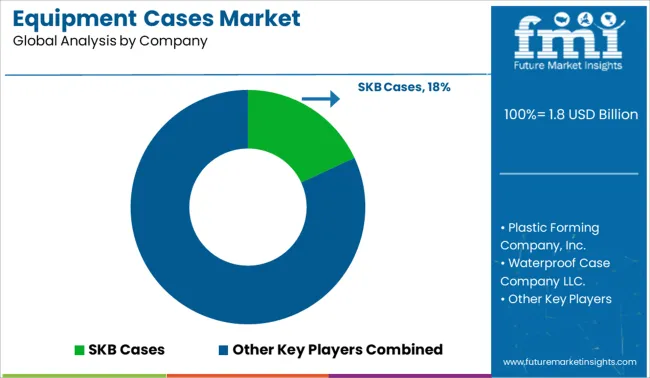

Some of the key players of equipment cases market are SKB Cases, Plastic Forming Company, Inc., Waterproof Case Company LLC., and USA Case, among others.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data.

It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, application, and industry.

The global equipment cases market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the equipment cases market is projected to reach USD 3.2 billion by 2035.

The equipment cases market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in equipment cases market are injection molding, blow molding, rotary molding and others.

In terms of material type, high density polyethylene (HDPE) segment to command 36.7% share in the equipment cases market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Garage Equipment Market Forecast and Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Galley Equipment Market Analysis and Forecast by Fit, Application, and Region through 2035

Sorting Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bagging Equipment Market Size and Share Forecast Outlook 2025 to 2035

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Telecom Equipment Market Size and Share Forecast Outlook 2025 to 2035

Canning Equipment Market Size, Growth, and Forecast 2025 to 2035

Cricket Equipment Market Analysis by Type, End User, Distribution Channel and Region Through 2025 to 2035

Brewery Equipment Market Analysis by Fermentation equipment, Brew house equipment, Carbonation and other Product Type Through 2025 to 2035

Butcher Equipment Market Analysis by Product Type, Application, and Region through 2035

Market Share Breakdown of Hunting Equipment Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA