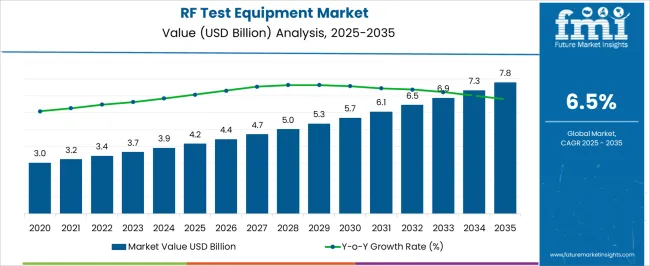

The RF Test Equipment Market is estimated to be valued at USD 4.2 billion in 2025 and is projected to reach USD 7.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period. This growth is driven by increasing demand for testing solutions that ensure the performance and reliability of radio frequency components across industries such as telecommunications, aerospace, defense, and automotive. Between 2025 and 2030, the market experiences gradual expansion as companies invest in advanced testing equipment to keep pace with the growing complexity of wireless technologies and communication systems.

The rollout of 5G networks and the expansion of Internet of Things (IoT) devices create a higher need for precise and efficient RF testing. The aerospace and defense sectors rely heavily on RF test equipment for radar and secure communication systems, contributing to steady market growth. Automotive applications, including connected and autonomous vehicles, also increase demand for RF testing solutions during this timeframe. The increase from USD 4.2 billion to USD 5.7 billion highlights consistent market momentum, supported by broad adoption of wireless technologies and increasing regulatory requirements. The five-year period from 2025 to 2030 lays a strong foundation for further expansion into 2035 and beyond.

| Metric | Value |

|---|---|

| RF Test Equipment Market Estimated Value in (2025 E) | USD 4.2 billion |

| RF Test Equipment Market Forecast Value in (2035 F) | USD 7.8 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The RF test equipment market is undergoing significant evolution, influenced by the rapid deployment of 5G infrastructure, rising demand for connected devices, and ongoing innovations in wireless communication standards. Equipment manufacturers are increasingly focused on supporting mid-band and high-frequency testing environments as industries shift toward wider bandwidths and faster signal processing.

Demand is being further amplified by R&D investments in aerospace, automotive radar systems, satellite communications, and semiconductor testing. Technological convergence across defense, IoT, and cloud-connected services has reinforced the need for high-precision RF testing tools capable of real-time diagnostics, protocol validation, and spectrum efficiency assessment.

Additionally, modular instrumentation and multi-format compatibility are becoming essential, enabling scalability while minimizing total cost of ownership. These shifts are redefining procurement decisions, with compact form factors, software-defined testing, and frequency versatility shaping the future growth trajectory of the market.

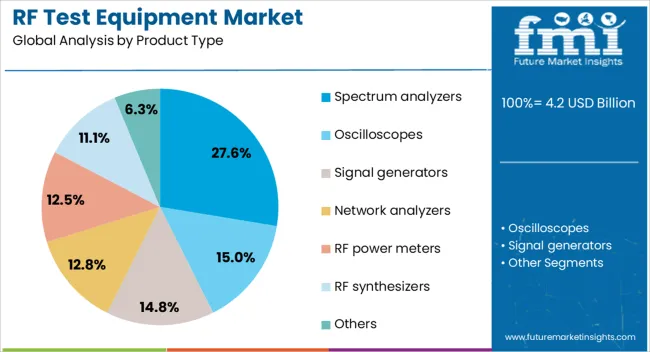

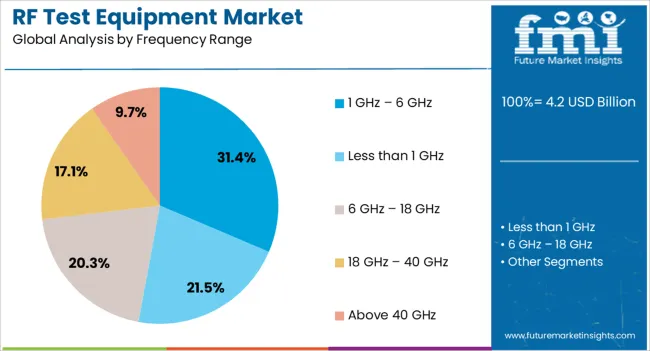

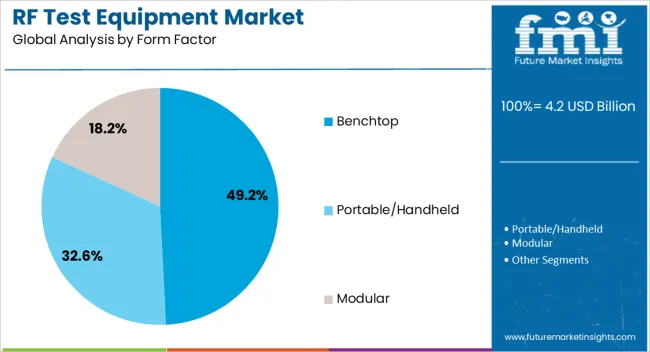

The RF test equipment market is segmented by product type, frequency range, form factor, application, end use, and geographic regions. By product type, the RF test equipment market is divided into Spectrum analyzers, Oscilloscopes, Signal generators, Network analyzers, RF power meters, RF synthesizers, and Others. The frequency range of the RF test equipment market is classified into 1 GHz – 6 GHz, Less than 1 GHz, 6 GHz – 18 GHz, 18 GHz – 40 GHz, and Above 40 GHz. Based on form factor, the RF test equipment market is segmented into Benchtop, Portable/Handheld, and Modular. By application of the RF test equipment market is segmented into Design & development, Manufacturing, Installation & maintenance, and Others. The end use of the RF test equipment market is segmented into Telecommunications, Consumer electronics, Automotive & transportation, Aerospace & defense, Industrial, Medical, and Others. Regionally, the RF test equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Spectrum analyzers are expected to account for 27.6% of the total revenue share in the RF test equipment market in 2025, positioning them as the leading product type. This growth is being driven by their ability to measure signal amplitude across frequency ranges with high accuracy, making them indispensable in EMI compliance, interference detection, and signal integrity assessments.

The increasing complexity of RF environments, especially in 5G, Wi-Fi 6/6E, and military communications, has intensified the need for precise spectrum analysis. Advancements in real-time and swept-tuned spectrum analysis capabilities have enabled engineers to detect transient signals and noise bursts that are critical in validating wireless performance.

In addition, their integration with vector signal analysis software and automation tools has improved workflow efficiency, ensuring broad applicability in both R&D and field testing.

The 1 GHz – 6 GHz frequency range is projected to lead the RF test equipment market with a 31.4% share in 2025. This band represents the sweet spot for a broad range of wireless applications, including 4G LTE, 5G NR mid-band, Bluetooth, and Wi-Fi protocols.

The increasing allocation of licensed and unlicensed spectrum within this range has made it a primary testing zone for telecom operators and device manufacturers. Equipment designed for this band supports a balanced trade-off between signal range and bandwidth, allowing reliable performance validation in both lab and operational environments.

As 5G mid-band rollouts continue globally, test equipment optimized for this frequency range is being prioritized to ensure compliance with network interoperability, device certification, and interference management standards.

Benchtop RF test equipment is anticipated to hold 49.2% of the market revenue in 2025, establishing it as the dominant form factor in the industry. The popularity of benchtop systems stems from their stability, enhanced measurement capabilities, and modular expansion features required for high-precision applications.

These platforms offer robust signal generation and analysis performance, supporting multi-port measurements, wide frequency sweeps, and high dynamic range in complex test setups. They are particularly valued in research labs, production testing, and compliance validation environments where continuous power supply and extended use cycles are critical.

As the demand for precise RF characterization increases in aerospace, defense, semiconductor, and telecommunications sectors, benchtop equipment continues to be the preferred choice for advanced testing due to its reliability and technical flexibility.

The RF test equipment market is expanding as wireless communication technologies evolve and proliferate across industries. Growing adoption of 5G, IoT devices, and connected systems increases demand for precise testing tools that ensure signal integrity and compliance with standards. The market is driven by the need for high-frequency measurement accuracy and rapid testing solutions in manufacturing and field applications. Challenges include the high cost of advanced equipment and the complexity of emerging communication protocols. Innovation in automated testing and portable devices offers significant growth opportunities, especially in emerging markets with expanding wireless infrastructure.

The surge in wireless technologies such as 5G, Wi-Fi 6, and IoT networks fuels demand for RF test equipment. These devices are essential for validating performance, interference, and signal quality in components like antennas, transceivers, and chips. As telecom operators roll out new network generations, manufacturers require sophisticated test solutions to accelerate product development and ensure regulatory compliance. The proliferation of smart devices and connected vehicles further drives testing needs. This growth creates opportunities for suppliers offering multi-functional, high-frequency, and high-speed test systems that accommodate complex signal environments. Testing in both production lines and field deployments is increasingly critical to maintain quality and reliability.

RF test equipment often involves substantial investment due to the advanced technology and precision engineering required. High costs can be prohibitive for smaller manufacturers or startups, limiting widespread adoption. Additionally, the rapid evolution of communication protocols demands continuous upgrades in test equipment capabilities, increasing total cost of ownership. The technical complexity of operating sophisticated test systems requires skilled personnel, presenting a training challenge. Integration of test equipment with automated production lines and software platforms adds to implementation complexity. These factors can slow down adoption rates and affect market growth, particularly in cost-sensitive regions. Vendors focusing on user-friendly interfaces and scalable solutions are better positioned to overcome these barriers.

To meet market demands, manufacturers are advancing automation in RF testing processes. Automated test systems reduce human error, improve throughput, and lower operational costs in production environments. Portable and handheld RF test instruments enable field testing, essential for network deployment and maintenance, especially in remote locations. Innovations include compact spectrum analyzers, signal generators, and network analyzers with enhanced user interfaces and wireless connectivity. Integration with cloud platforms allows remote monitoring and data analysis. These developments increase testing efficiency and flexibility, appealing to a broader customer base. Collaborations between equipment makers and wireless technology developers help align test solutions with evolving standards and applications, driving further market growth.

Emerging markets in Asia Pacific, Latin America, and Africa present significant opportunities due to rapid telecom infrastructure development and rising smartphone penetration. Government initiatives to improve connectivity and digital inclusion increase investments in wireless networks, thereby boosting RF testing requirements. Expanding industrial IoT applications and smart city projects further support demand. Local manufacturers are adopting advanced test equipment to compete globally. However, supply chain constraints and economic uncertainties can impact equipment availability and pricing. Establishing regional service centers and training programs helps vendors strengthen customer relationships and support market expansion. Overall, increasing wireless adoption worldwide sustains robust growth prospects for the RF test equipment market.

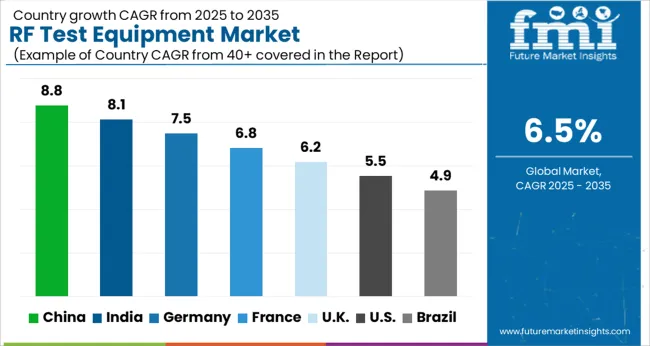

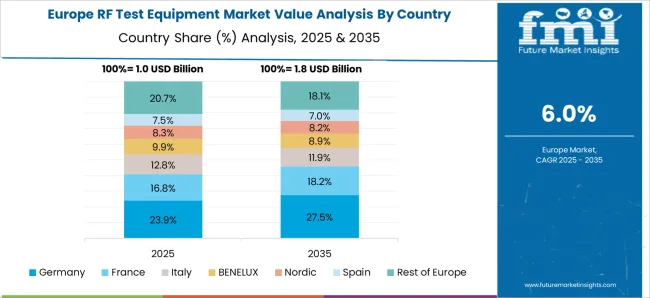

The global RF test equipment market is expanding at a 6.5% CAGR, driven by rising demand for wireless communication testing and advancements in 5G technology. China leads with 8.8% growth, supported by extensive manufacturing capabilities and increasing telecom infrastructure investments. India follows at 8.1%, fueled by growing telecommunications networks and government initiatives. Germany reports 7.5% growth, reflecting strong industrial innovation and regulatory compliance. The United Kingdom grows at 6.2%, driven by advancements in testing technologies and communication services. The United States, a mature market, shows 5.5% growth, shaped by high standards for equipment reliability and integration. These countries collectively influence market trends through technological innovation, stringent regulations, and expanding telecom networks. This report includes insights on 40+ countries; the top countries are shown here for reference.

China RF test equipment market is expanding at an 8.8% CAGR, driven by rapid growth in telecommunications infrastructure and 5G network deployment. The country's aggressive investment in smart cities, IoT devices, and wireless communication fuels demand for advanced, high-precision test solutions. Local manufacturers focus on developing cost-effective and scalable equipment to support large-scale telecom projects. Compared to Western markets, China benefits from strong government support and faster technology adoption cycles. Growing export opportunities further boost market dynamics. Increasing collaboration with international technology firms accelerates innovation in RF testing.

India RF test equipment market grows at an 8.1% CAGR, powered by expanding telecom infrastructure and government initiatives promoting digital connectivity. Growing smartphone penetration and IoT device adoption create rising demand for reliable RF testing during product development and network optimization. Compared to China, India's market is still maturing but evolving quickly with increasing local manufacturing and R&D investments. Focus is on affordable and ruggedized equipment to suit diverse geographic and climatic conditions. Training programs for telecom engineers enhance market readiness and technical proficiency.

Germany RF test equipment market grows steadily at a 7.5% CAGR, driven by strong telecom networks and industrial automation demands. The market favors highly accurate and versatile equipment compliant with strict EU standards. Compared to Asian markets, Germany places more emphasis on quality, precision, and integration with advanced data analytics. Industrial IoT and automotive applications contribute to diversified testing requirements. Collaborative research with universities and tech institutes fosters cutting-edge innovations. The mature market supports a stable ecosystem of specialized suppliers and service providers.

United Kingdom market grows at a 6.2% CAGR, supported by continuous investment in 5G networks and emerging wireless technologies. The market demands flexible and user-friendly test solutions adaptable to various communication protocols. Compared to Germany, the UK market is smaller but focused on rapid innovation and ease of deployment. Telecom operators and equipment manufacturers collaborate closely to accelerate product testing cycles. Government-backed innovation hubs promote development of next-generation RF testing technologies. Increasing cybersecurity concerns also influence equipment feature sets.

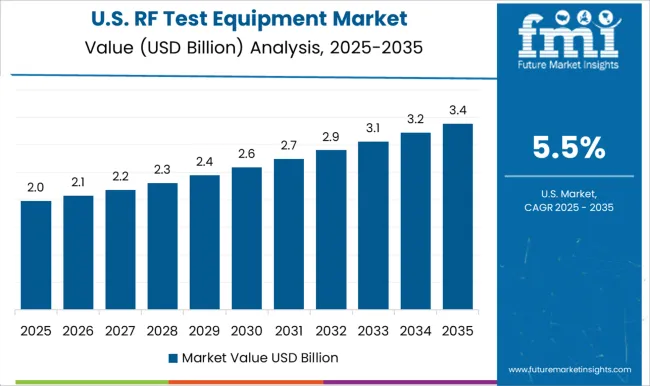

United States RF test equipment market grows at 5.5% CAGR, driven by a mature telecom industry and extensive 5G and IoT deployments. The market is characterized by advanced, automated testing systems designed for speed and accuracy. Compared to other regions, the USA emphasizes integration with software analytics and cloud-based solutions. High R&D investment and strong presence of leading test equipment manufacturers sustain innovation. The demand for testing in aerospace, defense, and automotive wireless systems broadens application scope. Growing focus on cybersecurity and data integrity shapes product development priorities.

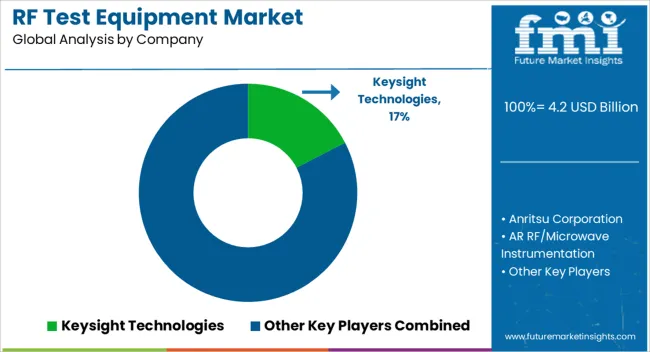

The RF test equipment market is a critical segment in the electronics and telecommunications industries, focusing on tools and instruments used to test, measure, and analyze radio frequency (RF) signals and systems. Key players in this market include industry leaders such as Keysight Technologies, Anritsu Corporation, AR RF/Microwave Instrumentation, B&K Precision Corporation, Berkeley Nucleonics Corporation, Bird Technologies, Copper Mountain Technologies, Giga-tronics Incorporated, National Instruments (NI), Qorvo, Rigol Technologies, Rohde & Schwarz, Saelig Company, Signal Hound, Teledyne LeCroy, Teledyne Technologies Incorporated, Thorlabs, Vaunix Technology Corporation, and Yokogawa Electric Corporation.

These companies offer a wide range of products including spectrum analyzers, signal generators, network analyzers, power meters, vector signal analyzers, and other specialized test equipment designed to evaluate RF performance in applications such as wireless communications, aerospace, defense, automotive, and consumer electronics. The market is propelled by the continuous evolution of wireless technologies like 5G, IoT, and satellite communications, which demand highly precise and reliable testing solutions to ensure signal integrity, compliance with standards, and optimal device performance.

Innovation in this market revolves around enhancing measurement accuracy, expanding frequency ranges, integrating software-based analysis, and developing portable, cost-effective equipment to meet diverse testing needs across research and development, manufacturing, and field testing.

Companies like Keysight Technologies and Rohde & Schwarz are renowned for their advanced, high-performance instruments, while emerging players focus on affordable and user-friendly solutions. With the growing complexity of RF systems and increasing regulatory requirements, the RF test equipment market is expected to witness steady growth, driven by advancements in wireless infrastructure, semiconductor technologies, and the proliferation of connected devices globally.

Companies are integrating automated RF testing systems to reduce human error, speed up testing processes, and increase efficiency. Automated test equipment (ATE) systems are being designed to streamline production workflows, particularly for high-volume manufacturing sectors like semiconductors and consumer electronics.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.2 Billion |

| Product Type | Spectrum analyzers, Oscilloscopes, Signal generators, Network analyzers, RF power meters, RF synthesizers, and Others |

| Frequency Range | 1 GHz – 6 GHz, Less than 1 GHz, 6 GHz – 18 GHz, 18 GHz – 40 GHz, and Above 40 GHz |

| Form Factor | Benchtop, Portable/Handheld, and Modular |

| Application | Design & development, Manufacturing, Installation & maintenance, and Others |

| End Use | Telecommunications, Consumer electronics, Automotive & transportation, Aerospace & defense, Industrial, Medical, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Keysight Technologies, Anritsu Corporation, AR RF/Microwave Instrumentation, B&K Precision Corporation, Berkeley Nucleonics Corporation, Bird Technologies, Copper Mountain Technologies, Giga-tronics Incorporated, National Instruments (NI), Qorvo, Rigol Technologies, Rohde & Schwarz, Saelig Company, Inc., Signal Hound, Teledyne LeCroy, Teledyne Technologies Incorporated, Thorlabs, Inc., Vaunix Technology Corporation, and Yokogawa Electric Corporation |

| Additional Attributes | Dollar sales vary by type, including oscilloscopes, signal generators, spectrum analyzers, and network analyzers; by frequency range, such as sub-1 GHz, 1–6 GHz, and above 6 GHz; by form factor, including benchtop, modular, and portable units; and by region, led by Asia-Pacific, North America, and Europe. Growth is driven by 5G adoption, IoT expansion, and increasing wireless device complexity. |

The global RF test equipment market is estimated to be valued at USD 4.2 billion in 2025.

The market size for the RF test equipment market is projected to reach USD 7.8 billion by 2035.

The RF test equipment market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in RF test equipment market are spectrum analyzers, oscilloscopes, signal generators, network analyzers, rf power meters, rf synthesizers and others.

In terms of frequency range, 1 ghz – 6 ghz segment to command 31.4% share in the RF test equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

RF Tester Market Growth – Trends & Forecast 2019-2027

RFID Tester Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

LTE Testing Equipment Market Growth – Trends & Forecast 2019-2027

Video Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wi-Fi Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Mining Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Drug Testing Equipment Market

Steel Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Metal Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Levelling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Glass Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Shear Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Stress Tests Equipment Market Size and Share Forecast Outlook 2025 to 2035

Blood Testing Equipment Market Growth - Trends & Forecast 2025 to 2035

Motor Testing Equipment Market - Growth & Demand 2025 to 2035

Test and Measurement Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA