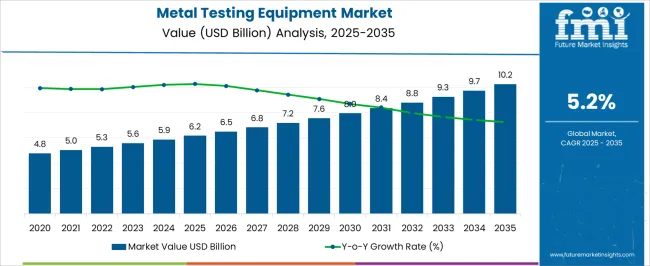

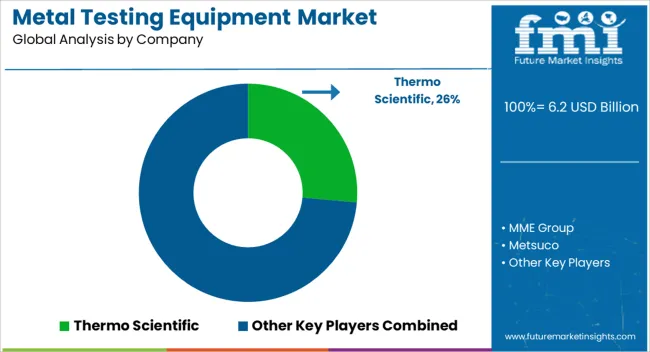

The Metal Testing Equipment Market is estimated to be valued at USD 6.2 billion in 2025 and is projected to reach USD 10.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

| Metric | Value |

|---|---|

| Metal Testing Equipment Market Estimated Value in (2025 E) | USD 6.2 billion |

| Metal Testing Equipment Market Forecast Value in (2035 F) | USD 10.2 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The Metal Testing Equipment market is being driven by the increasing demand for precise material characterization, quality assurance, and safety compliance across industries such as automotive, aerospace, and construction. The current market environment reflects rising investments in advanced testing technologies that support regulatory standards, particularly in regions with strict environmental and safety guidelines.

As industries focus on improving manufacturing efficiency and reducing material waste, testing equipment that enables accurate measurement of metal properties is being prioritized. Furthermore, the growth of lightweight material applications, along with the expansion of electric vehicle production and aerospace manufacturing, is contributing to the increasing adoption of metal testing solutions.

The future outlook of the market is expected to be shaped by the integration of digital data analytics, automation, and real-time testing solutions that allow manufacturers to streamline their operations Continuous advancements in spectroscopy-based analysis and other non-destructive testing methods are paving the way for enhanced precision and cost-effectiveness, supporting the sustained expansion of this market across multiple end-use industries.

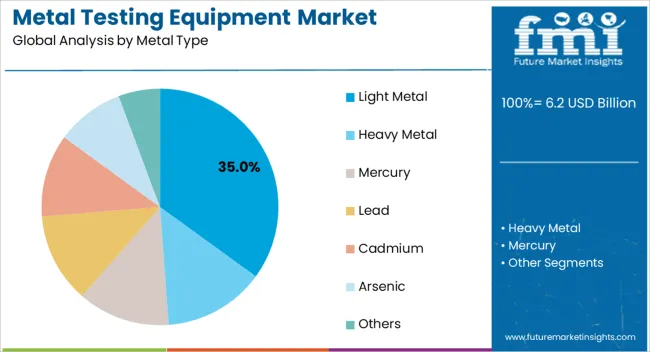

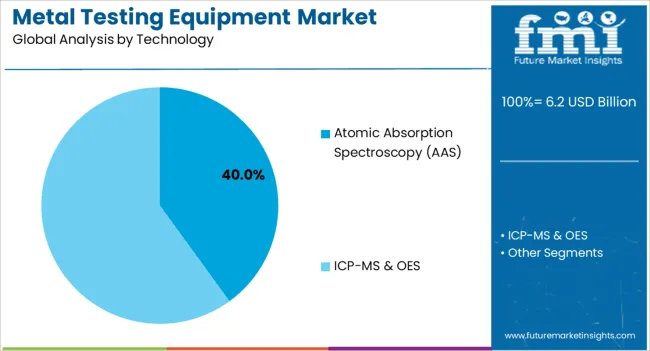

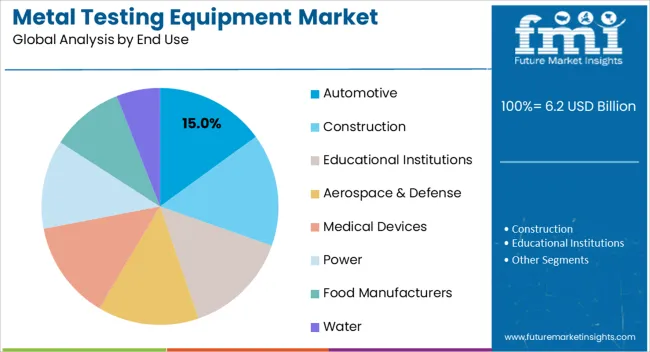

The metal testing equipment market is segmented by metal type, technology, end use, and geographic regions. By metal type, metal testing equipment market is divided into Light Metal, Heavy Metal, Mercury, Lead, Cadmium, Arsenic, and Others. In terms of technology, metal testing equipment market is classified into Atomic Absorption Spectroscopy (AAS) and ICP-MS & OES. Based on end use, metal testing equipment market is segmented into Automotive, Construction, Educational Institutions, Aerospace & Defense, Medical Devices, Power, Food Manufacturers, Water, and Blood Samples. Regionally, the metal testing equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The light metal segment is expected to account for 35.0% of the total revenue share in the Metal Testing Equipment market in 2025, making it one of the most significant segments by metal type. This segment’s leadership is being attributed to the growing use of lightweight alloys in industries such as automotive and aerospace, where weight reduction is critical for fuel efficiency and performance.

Increased research and development efforts have supported the adoption of aluminum and magnesium alloys, which require detailed testing to ensure mechanical strength, corrosion resistance, and structural integrity. Testing equipment that enables accurate measurement of these properties has been widely implemented across manufacturing plants.

Additionally, environmental regulations promoting energy-efficient vehicles have further reinforced the demand for light metals, necessitating rigorous material verification As material substitution strategies expand, the need for advanced metal testing solutions tailored to light metal compositions is expected to drive sustained growth in this segment, supported by rising applications that demand high-performance and lightweight solutions.

The atomic absorption spectroscopy segment is projected to hold 40.0% of the total revenue share in the Metal Testing Equipment market in 2025, making it the largest segment by technology type. This prominence is being supported by the ability of atomic absorption spectroscopy to deliver highly accurate detection of trace elements and impurities in metal samples. The technique’s sensitivity, repeatability, and reliability have made it a preferred choice for industries that require stringent material quality control, such as automotive, aerospace, and electronics.

Its application in identifying compositional variations, alloy consistency, and potential contaminants has been critical in ensuring product safety and regulatory compliance. Furthermore, advancements in instrumentation, including improved software integration and automation, have allowed testing processes to be streamlined and more cost-effective.

As demand for lightweight, high-performance alloys grows, atomic absorption spectroscopy is increasingly being implemented in testing laboratories to meet the requirements of precision engineering The segment’s continued dominance is expected to be reinforced by the expanding need for thorough elemental analysis across various industries.

The automotive segment is anticipated to hold 15.0% of the total revenue share in the Metal Testing Equipment market in 2025, positioning it as a key end-use industry. This prominence is being driven by the rising need for material testing in vehicle manufacturing, where safety, durability, and efficiency are top priorities. With increasing integration of lightweight metals and advanced alloys in vehicle design, rigorous testing is required to ensure compliance with performance and emission standards.

Additionally, the transition toward electric and hybrid vehicles has introduced new material requirements, such as higher corrosion resistance and better thermal conductivity, which further necessitate advanced testing solutions. The implementation of strict safety regulations and emission control standards has accelerated investments in testing infrastructure within automotive manufacturing facilities.

As the industry continues to pursue weight reduction, fuel efficiency, and longer product lifecycles, the demand for accurate and efficient metal testing equipment is expected to rise The segment’s growth is being supported by its critical role in optimizing material properties and ensuring high-quality vehicle production in a rapidly evolving market landscape.

A metal is a material with a lustrous appearance that conducts electricity and heat relatively well when freshly prepared, polished, or fractured. Metals are typically malleable (they can be hammered into thin sheets) or ductile (they can be beaten into thin sheets) (can be drawn into wires). A metal can be a chemical element, like iron, an alloy, like stainless steel, or a molecular compound, like polymeric sulphur nitride. Metals are natural compounds of the earth's crust that are found in the form of metal ores and are associated with each other as well as many other elements.

They are also found naturally in rocks washed by surface and groundwater, as well as in atmospheric dust. Metals are natural compounds of the earth's crust that are found in the form of metal ores and are associated with each other as well as many other elements. They are also found naturally in rocks washed by surface and groundwater, as well as in atmospheric dust. In the food industry, metal testing equipment is required to detect the presence of metal.

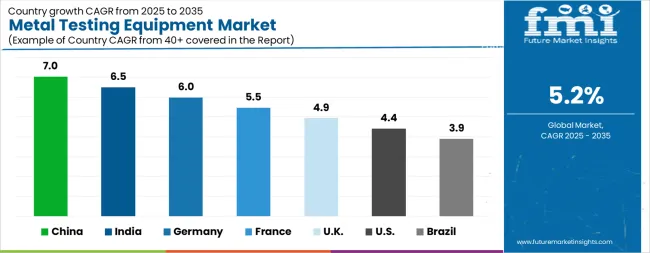

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

The Metal Testing Equipment Market is expected to register a CAGR of 5.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.0%, followed by India at 6.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.9%, yet still underscores a broadly positive trajectory for the global Metal Testing Equipment Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.0%. The USA Metal Testing Equipment Market is estimated to be valued at USD 2.3 billion in 2025 and is anticipated to reach a valuation of USD 3.6 billion by 2035. Sales are projected to rise at a CAGR of 4.4% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 294.8 million and USD 202.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.2 Billion |

| Metal Type | Light Metal, Heavy Metal, Mercury, Lead, Cadmium, Arsenic, and Others |

| Technology | Atomic Absorption Spectroscopy (AAS) and ICP-MS & OES |

| End Use | Automotive, Construction, Educational Institutions, Aerospace & Defense, Medical Devices, Power, Food Manufacturers, Water, and Blood Samples |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Thermo Scientific, MME Group, Metsuco, QATM Metallography, Superb Technologies, Starrett, Mitutoyo, FLSmidth, TA Instruments, DM Instruments, and NSL |

The global metal testing equipment market is estimated to be valued at USD 6.2 billion in 2025.

The market size for the metal testing equipment market is projected to reach USD 10.2 billion by 2035.

The metal testing equipment market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in metal testing equipment market are light metal, heavy metal, mercury, lead, cadmium, arsenic and others.

In terms of technology, atomic absorption spectroscopy (aas) segment to command 40.0% share in the metal testing equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metallurgical Lighting Market Size and Share Forecast Outlook 2025 to 2035

Metal Evaporation Boat Market Size and Share Forecast Outlook 2025 to 2035

Metal Miniature Bone Plates Market Size and Share Forecast Outlook 2025 to 2035

Metal Locking Plate and Screw System Market Size and Share Forecast Outlook 2025 to 2035

Metal Pallet Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Varistor (MOV) Surge Arresters Market Size and Share Forecast Outlook 2025 to 2035

Metal Straw Market Size and Share Forecast Outlook 2025 to 2035

Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Metal IBC Market Forecast and Outlook 2025 to 2035

Metalized Barrier Film Market Forecast and Outlook 2025 to 2035

Metal Packaging Market Size and Share Forecast Outlook 2025 to 2035

Metal Bellow Market Size and Share Forecast Outlook 2025 to 2035

Metal based Safety Gratings Market Size and Share Forecast Outlook 2025 to 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Metal Forming Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Removal Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Deactivators Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA