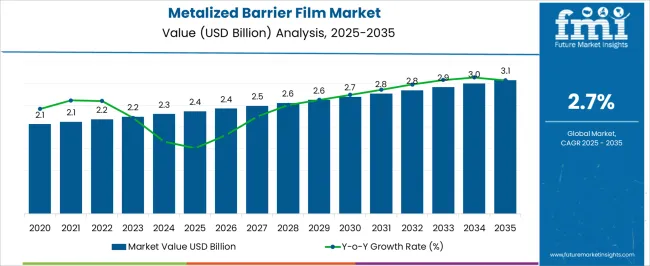

The metalized barrier film market is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 3.1 billion by 2035, registering a compound annual growth rate (CAGR) of 2.7% over the forecast period. The metalized barrier film market is experiencing significant growth, driven by increasing demand for high-performance packaging materials across food, beverage, and other consumer goods industries. The market expansion is supported by the superior barrier properties of metalized films, which provide protection against moisture, oxygen, and light, ensuring product freshness and extended shelf life. Rising consumer awareness regarding food quality, safety, and sustainability is accelerating adoption, particularly in the fast-moving consumer goods sector.

Advanced production technologies, including metallization and co-extrusion techniques, have improved the performance, durability, and flexibility of these films. The market is also benefiting from the growing preference for lightweight, cost-effective, and recyclable packaging materials that reduce environmental impact.

Integration with automated packaging lines and compatibility with various sealing methods enhances operational efficiency and broadens application potential As regulations on food safety and packaging standards tighten globally, demand for metalized barrier films is expected to continue its upward trajectory, with innovation and customization driving sustained growth in both established and emerging markets.

| Metric | Value |

|---|---|

| Metalized Barrier Film Market Estimated Value in (2025 E) | USD 2.4 billion |

| Metalized Barrier Film Market Forecast Value in (2035 F) | USD 3.1 billion |

| Forecast CAGR (2025 to 2035) | 2.7% |

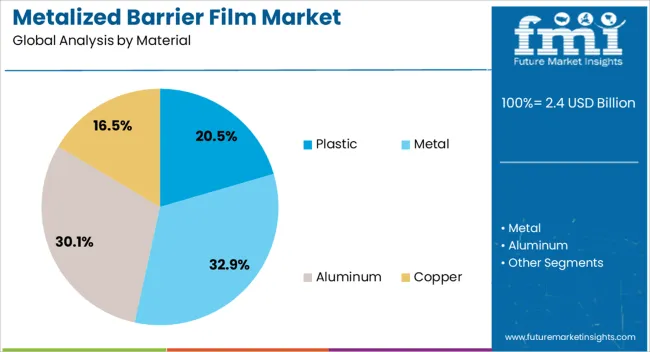

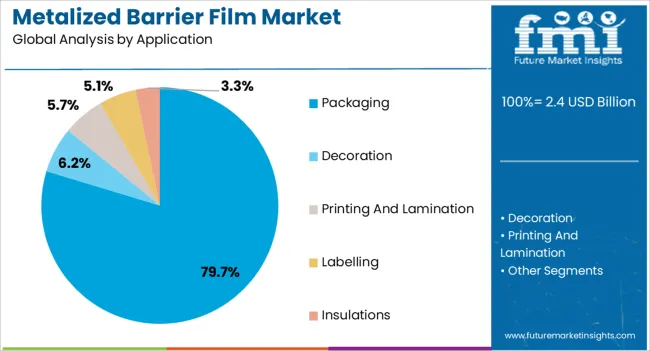

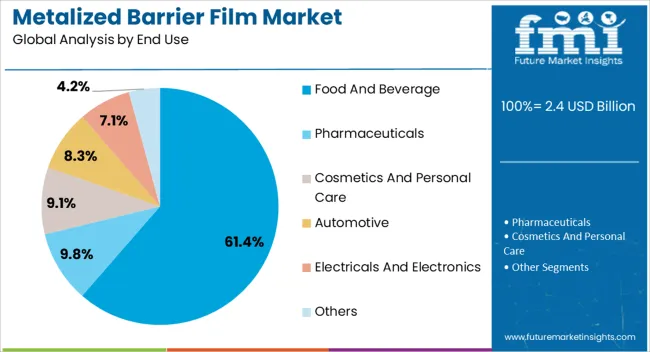

The market is segmented by Material, Application, and End Use and region. By Material, the market is divided into Plastic, Metal, Aluminum, and Copper. In terms of Application, the market is classified into Packaging, Decoration, Printing And Lamination, Labelling, and Insulations. Based on End Use, the market is segmented into Food And Beverage, Pharmaceuticals, Cosmetics And Personal Care, Automotive, Electricals And Electronics, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plastic material segment is projected to hold 20.5% of the market revenue in 2025, establishing it as the leading material type. This growth is being driven by the widespread use of plastic-based films in packaging applications due to their lightweight nature, flexibility, and ease of processing. Plastic metalized films provide excellent barrier properties while allowing for efficient production and cost-effective scalability.

Their compatibility with automated packaging systems and various sealing techniques makes them preferred among manufacturers seeking operational efficiency and product consistency. Advancements in plastic formulation and metallization processes have enhanced durability, heat resistance, and optical clarity, making these films suitable for a wide range of applications.

Rising demand for high-quality packaging that ensures product freshness and compliance with food safety regulations further reinforces market leadership As companies continue to prioritize sustainable and efficient packaging solutions, plastic metalized barrier films are expected to maintain a dominant position, supported by ongoing innovation and process optimization.

The packaging application segment is anticipated to account for 79.7% of the market revenue in 2025, making it the largest application category. Growth in this segment is being driven by the critical need for materials that preserve product quality, extend shelf life, and enhance consumer appeal. Metalized barrier films provide superior protection against moisture, oxygen, and light, which is particularly important for perishable goods in food and beverage industries.

These films are increasingly adopted in flexible packaging, pouches, wraps, and laminated structures due to their functional performance and aesthetic appeal. Automation compatibility and ease of processing allow manufacturers to optimize operational efficiency while meeting regulatory standards.

Consumer demand for safe, convenient, and visually appealing packaging is further driving adoption As brands and manufacturers focus on sustainability and reducing packaging waste, metalized barrier films are expected to play a key role in achieving lightweight, durable, and recyclable solutions, reinforcing the packaging segment as the primary revenue contributor in the market.

The food and beverage end-use industry segment is projected to hold 61.4% of the market revenue in 2025, positioning it as the leading sector. Growth in this segment is being driven by the need for high-quality packaging that maintains freshness, extends shelf life, and ensures safety for perishable products. Metalized barrier films offer superior protection against moisture, oxygen, and light, which is essential for dairy products, snacks, beverages, and processed foods.

Increasing consumer awareness regarding food safety, hygiene, and sustainability has further accelerated adoption. The films’ compatibility with automated packaging systems allows manufacturers to improve operational efficiency while maintaining compliance with regulatory standards.

Advancements in film metallization and co-extrusion processes have enhanced durability, barrier performance, and visual appeal, supporting wider adoption in food and beverage packaging As the demand for packaged and processed food products continues to rise globally, the food and beverage sector is expected to remain the largest revenue contributor, with metalized barrier films playing a pivotal role in meeting quality, safety, and sustainability requirements.

The market for metalized barrier films grew at a CAGR of 1.90% from 2020 to 2025. However, sales have increased at a prompter pace, showcasing a CAGR of 2.70% from 2025 to 2035.

| Attributes | Details |

|---|---|

| Historical CAGR for 2020 to 2025 | 1.9% |

Metalized barrier films are expensive, non-microwavable, and susceptible to degradation due to moisture absorption, limiting their market development and requiring controlled storage conditions.

Acute aspects that are anticipated to influence the demand for metalized barrier films through 2035.

Market players are going to desire to be prudent and flexible over the anticipated period since these challenging attributes position the industry for accomplishment in subsequent decades.

Ready-to-eat Food Packaging Generating the Demand for Metalized Barrier Films

Development of Retail Supply Stores in Emerging Nations Fuels the Demand for Metalized Barrier Films

Demand for Specialized Metallic Barrier Packaging Is On the Rise in Chemical Packaging

An in-depth segmental analysis of the metalized barrier films market indicates that packaging applications are in significant demand. Similarly, the food and beverage sector develops an emergent demand based on the end-use industry.

| Attributes | Details |

|---|---|

| Top Application | Packaging |

| Market share in 2025 | 79.7% |

The demand for metalized barrier film packaging is significant in 2025, with a market share of 79.7%. The following aspects display the demand for metalized barrier film packaging:

| Attributes | Details |

|---|---|

| Top End User | Food and Beverage |

| Market share in 2025 | 61.4% |

The food and beverage sector utilizes metalized barrier films ominously, which is anticipated to acquire almost 61.4% market share in 2025. The development of the food and beverage sector demands the following aspects:

The following section explains the demand for metalized barrier films in various countries. Chinese and Indian industries are experiencing intermediate growth in the upcoming decade, while Thailand and South Korea are progressing in metalized barrier films, with Spain having a lower CAGR than other nations.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| Spain | 2.1% |

| Thailand | 4.1% |

| China | 5.1% |

| India | 6.5% |

| South Korea | 2.4% |

The metalized barrier film industry in India is projected to experience a CAGR of 6.5% through 2035. Here are a few of the major aspects:

Demand for metalized barrier films in China is estimated to develop at a CAGR of 5.1% through 2035. The following factors are propelling the demand for metalized barrier films in China:

The demand for metalized barrier films in Thailand is anticipated to showcase a CAGR of 4.1% from 2025 to 2035. Some of the primary trends in the industry are:

The demand for metalized barrier films in South Korea is projected to report a CAGR of 2.4% from 2025 to 2035. Some of the primary trends are:

The metalized barrier films industry in Spain is supposed to display a CAGR of 2.1% through 2035. Among the primary drivers of the market are:

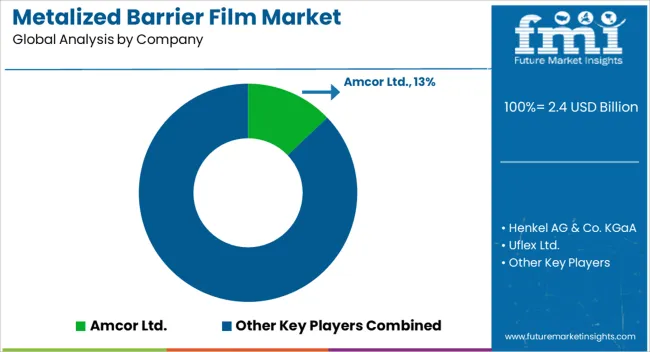

The metalized barrier film market is competitive and has evolved significantly in recent years. Metalized barrier films are in high demand, especially in emerging countries. Manufacturers invest heavily in research and development, employ pristine machinery, and construct manufacturing facilities to keep up with the market demand and competition.

Such methodologies are anticipated to improve production capabilities and stay ahead of the competition.

The major companies in the metalized barrier films market are working to improve their distribution networks to make their products more accessible to customers.

They want to meet the changing needs of consumers and maintain their market share in an industry that is growing quickly. Companies leveraging new technologies to meet consumer demands are expected to propel the metalized barrier films market growth in the forthcoming decade.

Recent Developments in the Metalized Barrier Film Market

The global metalized barrier film market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the metalized barrier film market is projected to reach USD 3.1 billion by 2035.

The metalized barrier film market is expected to grow at a 2.7% CAGR between 2025 and 2035.

The key product types in metalized barrier film market are plastic, _polypropylene (pp), _polyethylene terephthalate (pet), _polyamide (pa), _polyethylene (pe), _polyvinyl chloride (pvc), _other plastics, metal, aluminum and copper.

In terms of application, packaging segment to command 79.7% share in the metalized barrier film market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Landscape of Metalized Barrier Film Packaging Providers

Market Share Insights of Metalized Barrier Film Providers

Metallized Barrier Film Packaging Market by Material Type from 2025 to 2035

Gold Metalized Film Market Trends & Growth Forecast 2024-2034

Barrier System Market Forecast Outlook 2025 to 2035

Barrier Packaging Market Size and Share Forecast Outlook 2025 to 2035

Barrier Coated Papers Market Size and Share Forecast Outlook 2025 to 2035

Barrier Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Barrier Resins Market Size and Share Forecast Outlook 2025 to 2035

Barrier Material Market Size and Share Forecast Outlook 2025 to 2035

Barrier Shrink Bags Market Analysis - Size, Share, and Forecast 2025 to 2035

Barrier Coated Paper Industry Analysis in Europe - Demand, Growth & Future Outlook 2025 to 2035

Market Share Insights for Barrier Shrink Bag Providers

Key Players & Market Share in the Barrier Coated Paper Industry

Barrier Coatings for Packaging Market Trends - Growth & Forecast 2025 to 2035

Competitive Landscape of Barrier Packaging Providers

Europe Barrier Packaging Market Growth – Demand & Forecast 2024-2034

Japan Barrier Coated Paper Market Growth – Trends & Forecast 2023-2033

Korea Barrier Coated Paper Market Growth – Trends & Forecast 2023-2033

Barrier Bags Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA