The barrier system market is expanding steadily, driven by increased infrastructure development, road safety initiatives, and growing urban transportation networks. Rising incidences of road accidents and stricter government regulations on traffic safety have accelerated demand for advanced barrier installations. Modern designs integrating high-impact resistance, corrosion protection, and modular assembly have enhanced performance and maintenance efficiency.

The market is also supported by technological innovations such as energy-absorbing mechanisms and smart monitoring features. Infrastructure investment in highways, bridges, and urban transit corridors is providing consistent growth momentum.

Additionally, public-private partnerships in infrastructure safety enhancement projects are encouraging wider adoption. With the continued prioritization of roadway safety and infrastructure resilience, the market is expected to maintain strong growth prospects globally..

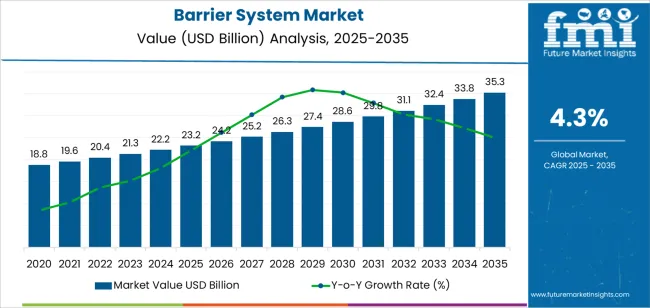

| Metric | Value |

|---|---|

| Barrier System Market Estimated Value in (2025 E) | USD 23.2 billion |

| Barrier System Market Forecast Value in (2035 F) | USD 35.3 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The market is segmented by Material, Application, Device Type, and Technology and region. By Material, the market is divided into Metal and Non-metal. In terms of Application, the market is classified into Roadways, Airports, Railways, and Others. Based on Device Type, the market is segmented into Crash Barrier Systems, Fences, Bollards, Gate, and Drop Arms. By Technology, the market is divided into Semi-rigid, Rigid, and Flexible. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

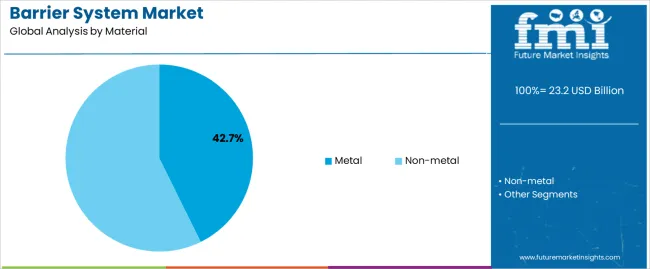

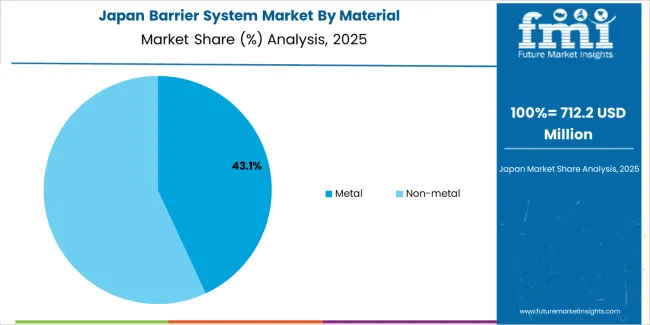

The metal segment leads the material category with approximately 42.7% share, driven by its superior strength, durability, and cost-effectiveness. Metal barriers, particularly galvanized steel and aluminum, are widely used due to their ability to withstand high-impact collisions and environmental stress.

The segment’s popularity is reinforced by established standards for road safety compliance and widespread contractor familiarity. Manufacturers are focusing on corrosion-resistant coatings and modular assembly systems to enhance service life and reduce maintenance costs.

The recyclability of metal barriers also contributes to sustainability objectives, making them favorable in public infrastructure projects. With ongoing highway expansion and bridge reinforcement initiatives worldwide, the metal segment is projected to sustain its dominance over the forecast period..

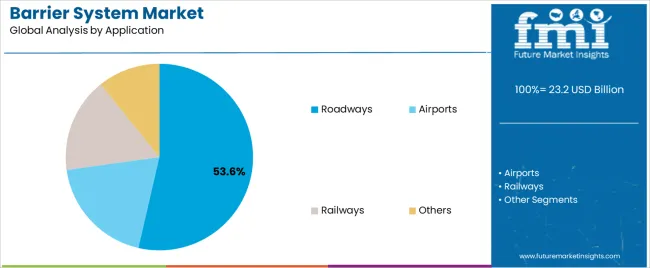

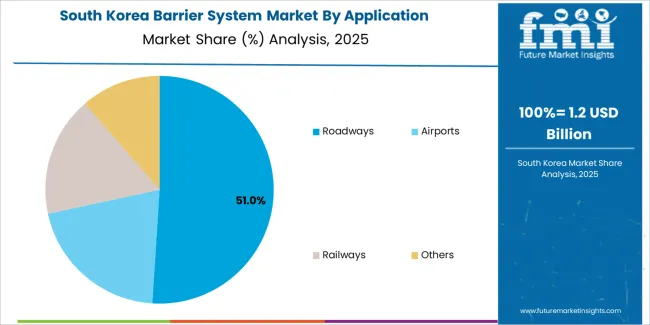

The roadways segment dominates the application category, accounting for approximately 53.6% share of the barrier system market. This segment’s growth is underpinned by increasing investments in road expansion, maintenance, and safety improvement programs.

Government policies prioritizing the reduction of vehicular fatalities have driven large-scale installations of crash barriers, guardrails, and median separators. The segment benefits from continuous technological improvements that enhance energy absorption and minimize post-impact damage.

Urbanization and rising vehicular density have further strengthened the need for advanced roadway safety infrastructure. With the expansion of expressways and urban corridors, the roadways segment is expected to remain the principal application area for barrier systems globally..

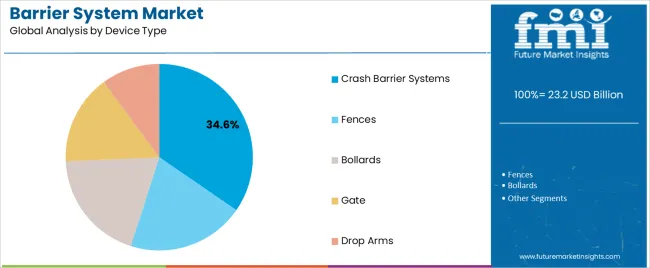

The crash barrier systems segment holds approximately 34.6% share in the device type category, supported by its essential role in preventing vehicle run-offs and reducing collision severity. These systems are extensively deployed along highways, bridges, and tunnels to enhance occupant safety.

The segment benefits from continuous design innovations, including flexible and semi-rigid configurations that improve energy dissipation during impacts. Regulatory emphasis on standardized crash performance testing has ensured consistent quality across deployments.

Moreover, the integration of smart sensors and connected monitoring systems is improving real-time safety management. With growing infrastructure development and increasing road traffic volumes, crash barrier systems are expected to sustain their leading market position through the forecast period..

Between 2020 and 2025, the barrier system market ecosystem experienced a CAGR of 6%. This robust growth can be attributed to several factors, including increasing industrialization, stringent safety regulations, and technological advancements driving the adoption of more sophisticated barrier systems. Industries sought to enhance workplace safety and security, leading to a significant demand for these solutions during this period.

Looking ahead to the forecasted period of 2025 to 2035, the market is anticipated to exhibit a slightly lower CAGR of 4.3%. Several factors contribute to this moderated growth rate.

These may include market saturation in certain regions or industries, a slowdown in industrial growth rates, or a shift in focus towards other areas of industrial automation.

Advancements in alternative security technologies or economic factors could influence the demand for barrier systems during this period. Despite the slightly reduced growth rate, the market is still expected to expand steadily, driven by ongoing industrialization efforts and continued emphasis on safety and security in industrial environments.

| Historical CAGR from 2020 to 2025 | 6% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 4.3% |

The provided table highlights the top five countries in terms of revenue, with South Korea leading the list.

The country boasts a robust technology sector and is home to several leading manufacturers specializing in barrier system technology. This proximity allows the companies of South Korea to leverage the latest materials, sensors, automation, and software advancements.

It gives them a competitive edge in developing cutting-edge barrier solutions that meet the evolving needs of industries worldwide.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 4.6% |

| China | 4.9% |

| Japan | 6% |

| South Korea | 6.6% |

| The United Kingdom | 5.5% |

In the United States, the market finds extensive use across various sectors, including industrial facilities, transportation infrastructure, commercial properties, and public spaces.

Manufacturing, logistics, and warehousing industries rely on barrier systems for access control, perimeter security, and worker safety. Barrier systems are widely deployed in transportation hubs, parking facilities, and event venues to manage traffic flow, enhance security, and ensure crowd control.

The rapid urbanization and infrastructure development of the country drive the market. Barrier systems are extensively utilized in transportation infrastructure projects, including highways, railways, airports, and urban metro systems, to regulate traffic flow, enhance road safety, and manage vehicle access.

Barrier systems are deployed in commercial and residential properties for perimeter security, access control, and crowd management.

The market in Japan is primarily used in industrial facilities, manufacturing plants, and logistics centers to ensure workplace safety, control access to restricted areas, and protect assets.

With a focus on technological innovation and automation, barrier systems incorporate advanced features such as IoT integration, automated operation, and real-time monitoring. Barrier systems are employed in public spaces, parking facilities, and transportation hubs to manage traffic and control crowds.

The advanced technological capabilities drive the market in South Korea and focus on innovation. Barrier systems are extensively utilized in industrial automation, manufacturing facilities, and logistics centers to ensure workplace safety, regulate access, and optimize operational efficiency.

The manufacturers lead the development of cutting-edge barrier solutions incorporating AI, IoT, and automation technologies. For traffic management and security, barriers are deployed in public infrastructure projects, including transportation hubs and smart city initiatives.

In the United Kingdom, the market is widely used across diverse sectors, including transportation, retail, hospitality, and critical infrastructure. Barrier systems are employed in transportation networks, including roads, railways, and airports, to manage traffic flow, enhance safety, and mitigate security risks.

Barrier systems are utilized in commercial properties, public venues, and events for access control, crowd management, and perimeter security. With the increasing emphasis on smart city initiatives and urban development projects, barrier systems are crucial in enhancing public safety and security in the United Kingdom.Top of Form

The below section shows the leading segment. Based on material, the metal segment is projected to register at a CAGR of 4.1% by 2035. Based on application, the roadways segment is anticipated to expand at a CAGR of 3.8% by 2035.

Metal barriers offer robust protection against various threats such as vehicle impacts, unauthorized access, and vandalism. Barrier systems deployed along roadways play a crucial role in achieving these objectives by providing physical separation between opposing traffic lanes, guiding vehicles safely through construction zones, and protecting vulnerable road users such as pedestrians and cyclists.

| Category | CAGR from 2025 to 2035 |

|---|---|

| Metal | 4.1% |

| Roadways | 3.8% |

The metal segment, which pertains to barriers constructed primarily from metal materials, is projected to lead with a CAGR of 4.1% by 2035. This growth is attributed to the durability, strength, and versatility of metal barriers, making them ideal for various industrial, commercial, and infrastructure applications.

Metal barriers offer robust protection against unauthorized access, vehicular collisions, and security threats, thus witnessing sustained demand across manufacturing, transportation, and utilities.

In terms of application, the roadways segment is expected to be the leading segment, with an anticipated CAGR of 3.8% by 2035. This growth can be attributed to increasing investments in transportation infrastructure projects globally and growing concerns regarding road safety and traffic management.

Barrier systems deployed along roadways mitigate the risk of accidents, control traffic flow, and enhance overall road safety for motorists and pedestrians. Roadway barriers are essential for delineating lanes, directing traffic during construction activities, and providing protection against roadside hazards, contributing to their significant market demand and expansion.

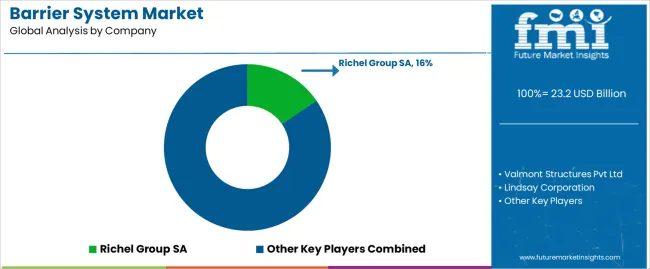

The competitive landscape of the barrier system market is characterized by the presence of several key players competing for market share. Leading companies in the market focus on product innovation, strategic partnerships, and expansion into emerging markets to gain a competitive edge. These companies offer diverse barrier solutions tailored to specific industry requirements, including industrial, transportation, commercial, and residential sectors.

Some of the Key Developments

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 23.2 billion |

| Projected Market Valuation in 2035 | USD 35.3 billion |

| Value-based CAGR 2025 to 2035 | 4.3% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Market Segments Covered | Material, Application, Device Type, Technology, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, Italy, France, United Kingdom, Spain, Russia, BENELUX, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Australia, New Zealand, GCC countries |

| Key Companies Profiled | Gramm Barriers Systems Limited; Valmont Structures Pvt Ltd; Lindsay Corporation; Avon Barriers Corporation Limited; Barrier 1 Systems; Hill & Smith Ltd; Deltabloc International GmbH; Global Grab Technologies Inc; Tata Steel Group; Bekaert |

The global barrier system market is estimated to be valued at USD 23.2 billion in 2025.

The market size for the barrier system market is projected to reach USD 35.3 billion by 2035.

The barrier system market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in barrier system market are metal and non-metal.

In terms of application, roadways segment to command 53.6% share in the barrier system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vehicle Barrier System Market Size and Share Forecast Outlook 2025 to 2035

Barrier Packaging Market Size and Share Forecast Outlook 2025 to 2035

Barrier Coated Papers Market Size and Share Forecast Outlook 2025 to 2035

Barrier Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Barrier Resins Market Size and Share Forecast Outlook 2025 to 2035

System-On-Package Market Size and Share Forecast Outlook 2025 to 2035

Barrier Material Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Barrier Shrink Bags Market Analysis - Size, Share, and Forecast 2025 to 2035

Barrier Coated Paper Industry Analysis in Europe - Demand, Growth & Future Outlook 2025 to 2035

Systemic Sclerosis Treatment Market - Trends & Forecast 2025 to 2035

System on Module Market Growth – Trends & Forecast 2025 to 2035

Market Share Insights for Barrier Shrink Bag Providers

Key Players & Market Share in the Barrier Coated Paper Industry

Barrier Coatings for Packaging Market Trends - Growth & Forecast 2025 to 2035

Competitive Landscape of Barrier Packaging Providers

Barrier Film Market Trends & Industry Growth Forecast 2025 to 2035

SLE Drugs Market Insights - Growth & Forecast 2025 to 2035

Europe Barrier Packaging Market Growth – Demand & Forecast 2024-2034

Japan Barrier Coated Paper Market Growth – Trends & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA