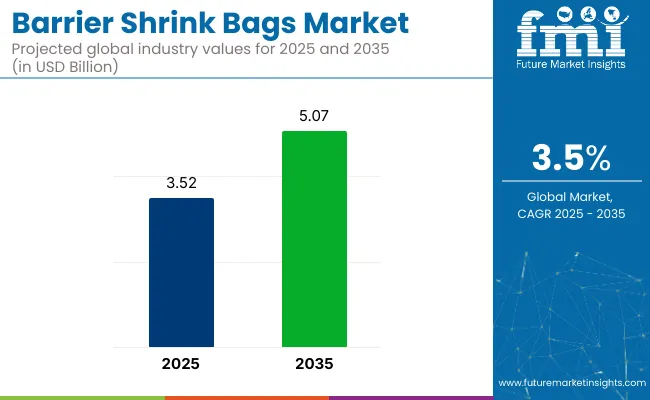

The global barrier shrink bags market is projected to reach USD 5.07 billion by 2035, rising from USD 3.52 billion in 2025, growing at a CAGR of 3.5% over the forecast period. Demand is being shaped by the rising need for high-barrier packaging in chilled meat, poultry, and seafood sectors, as processors seek to extend shelf life while meeting evolving safety, freshness, and traceability standards across global cold chain systems.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3.52 billion |

| Industry Value (2035F) | USD 5.07 billion |

| CAGR (2025 to 2035) | 3.5% |

Regulatory frameworks such as the USA FDA’s FSMA and Europe’s EN 13428 standard have propelled manufacturers to adopt oxygen- and moisture-barrier solutions to ensure safety and reduce spoilage. Global retail chains, including Costco and Carrefour, are aligning procurement policies with food waste reduction targets, prioritizing advanced shrink packaging to extend shelf life. The World Packaging Organization continues to spotlight barrier shrink bags as essential for maintaining food quality and supporting sustainability in cold chain logistics.

Traceability and safety-enhancing technologies are being widely adopted. In 2024, Multivac unveiled a smart-label integration system compatible with GS1 standards to streamline cold chain tracking. Winpak’s antimicrobial shrink bag was recognized by Flexible Packaging Europe for minimizing contamination risks.

By 2035, high-barrier shrink bags for red meat will comprise over 52% of the share, followed by poultry at 31%. As processors adopt packaging that balances product integrity, shelf life, and sustainability, barrier shrink bags will remain a foundational element in protein distribution strategies.

The next decade will also see material innovation reshape the competitive landscape, as manufacturers respond to mounting pressure to decouple performance from plastic intensity. Bio-based multilayer films, recyclable polyolefin blends, and low-temperature shrink solutions are gaining traction among processors aiming to meet ESG targets without compromising on barrier properties. This has led to a surge in pilot collaborations between packaging suppliers and protein producers, with particular focus on mono-material shrink systems that align with circular economy frameworks and EU-wide recyclability benchmarks.

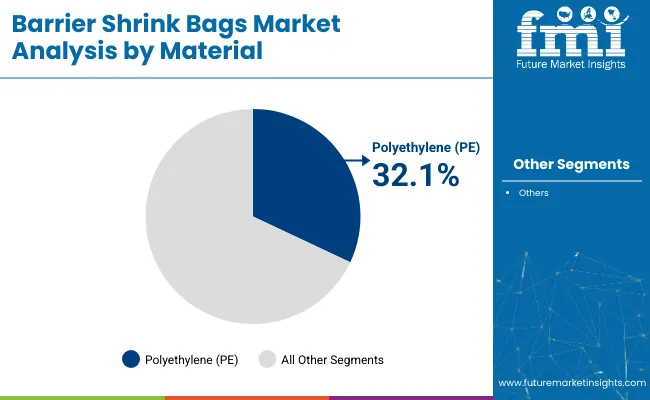

The polyethylene (PE) segment is projected to be the most lucrative in the industry, holding a dominant share of 32.1% by 2035 and expanding at a CAGR of 3.1% over the forecast period. Polyethylene (PE), encompassing both LDPE and LLDPE, is favored for its cost-effectiveness, flexibility, and excellent sealing properties. These attributes make it ideal for packaging a wide range of food products, contributing to its substantial share. Polypropylene (PP), known for its higher clarity and rigidity, is suitable for applications requiring product visibility and durability.

While it offers advantages in specific use cases, its share is comparatively lower than PE. Polyamide (PA), or nylon, provides superior puncture resistance and enhanced barrier properties, making it suitable for packaging delicate meats and cheeses. However, its higher cost limits its widespread adoption. EVOH and PVDC are high-performance materials offering exceptional oxygen and moisture barrier properties.

They are particularly valuable for packaging perishable products like seafood and poultry, where extended shelf life and freshness are critical. Other materials, including various co-extruded films and biodegradable options, are emerging in response to sustainability trends. While they currently hold a smaller share, their growth potential is notable as environmental concerns drive innovation in packaging materials.

| Material Segment | Market Share (2025) |

|---|---|

| Polyethylene (PE) | 32.1% |

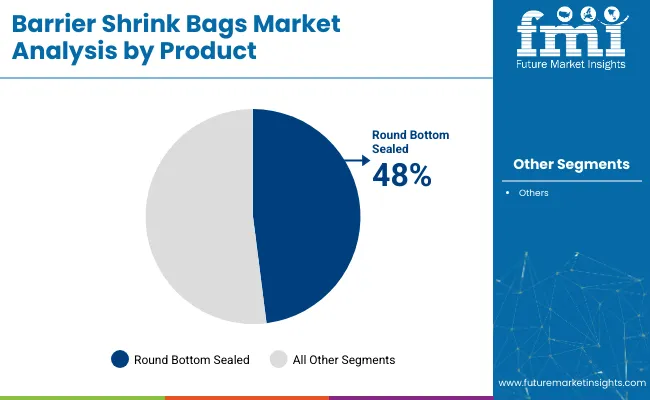

Round bottom sealed bags are projected to hold the most lucrative share, leading the segment with an estimated market share of 48% in 2025. Their popularity stems from enhanced sealing integrity, excellent puncture resistance, and adaptability for vacuum packaging in meat processing applications. These bags are widely used across beef, pork, and poultry distribution channels due to their ability to conform around irregularly shaped cuts and maintain barrier integrity.

Moreover, they align well with automated packing lines, making them suitable for high-volume operations. In contrast, straight bottom sealed bags and side sealed bags cater to more uniform products or niche applications, limiting their penetration. The round bottom variant’s design advantages and strong presence in cold-chain logistics ensure it will continue to be the preferred choice for processors prioritizing freshness, hygiene, and shelf-life optimization.

| Product Segment | Market Share (2025) |

|---|---|

| Round Bottom Sealed | 48% |

The ultra high barrier product is increasingly being adopted in cold-chain and export-focused packaging environments. In 2025, this segment contributed an estimated USD 1.12 billion to the global industry and is forecast to surpass USD 1.68 billion by 2035. The higher CAGR of 4.1% reflects its ability to meet stringent shelf-life and hygiene requirements, particularly in high-protein categories like vacuum-packed beef and processed poultry.

These bags typically feature multilayer co-extrusions involving PVDC, EVOH, or nanocomposite blends, offering oxygen transmission rates (OTR) as low as 0.5 cc/m²/day, and water vapor transmission rates (WVTR) below 1.5 g/m²/day. This performance reduces spoilage rates, improves logistics flexibility, and aligns with retailer demands for extended shelf life.

Conversely, the high barrier segment-estimated at USD 2.28 billion in 2025 is primarily deployed for regional and domestic use, especially for frozen and semi-perishable food items. While effective, its lower barrier thresholds (OTR between 1-5 cc/m²/day) limit its suitability for ultra-sensitive applications.

However, cost-efficiency and compatibility with conventional heat-sealing lines ensure stable adoption in mid-tier packaging operations. Despite its lower CAGR of 3.2%, the high installed base and broader range of compatible films help maintain its overall volume leadership through the next decade.

| Barrier Segment | CAGR (2025 to 2035) |

|---|---|

| Ultra High Barrier | 4.10% |

The meat segment is expected to remain the most lucrative application area in the industry. In 2025, the segment accounted for approximately USD 1.49 billion in revenue and is projected to reach USD 2.22 billion by 2035, expanding at a CAGR of 3.8%.

This growth is underpinned by the increasing global demand for processed and fresh meat products, rising cold chain logistics in emerging industries, and stringent hygiene compliance across the protein supply chain. The use of ultra-high barrier films in vacuum-packaged beef, pork, and lamb further contributes to this segment’s value growth, especially in export-heavy regions like North America, Europe, and Australasia.

The seafood segment follows, with a forecast CAGR of 3.5%, driven by heightened export activity and the perishability of products such as shrimp, salmon, and tuna. Seafood requires packaging that offers extremely low oxygen permeability, where shrink bags with advanced co-extrusion layers are gaining traction.

Poultry is anticipated to grow at a stable CAGR of 3.4%, benefiting from a shift toward flexible packaging for marinated and frozen chicken parts. The Cheese & Dairy Products segment is expected to post a CAGR of 3.2%, supported by growth in premium and aged cheese categories. Other Foods, which include bakery, produce, and ready-to-eat meals, will grow at a relatively slower CAGR of 2.7%, constrained by the limited use of shrink films compared to rigid or semi-rigid packaging in these categories.

| Application Segment | CAGR (2025 to 2035) |

|---|---|

| Meat | 3.8% |

The United States remains the single most influential market for barrier shrink bags globally, accounting for a projected USD 1.25 billion in 2025. Driven by a mature, highly automated food packaging industry, the USA industry benefits from strong demand in red meat, poultry, and dairy segments. The barrier shrink bag ecosystem is well-integrated with downstream meat processing firms and upstream resin suppliers. Players such as Sealed Air, Berry Global, and Winpak are at the forefront of delivering multilayer solutions compatible with vacuum packaging, MAP (Modified Atmosphere Packaging), and export-grade shelf-life standards.

Regulatory oversight by the FDA and USDA enforces strict hygiene and migration standards, pushing manufacturers toward high-performance EVOH- and PVDC-based films. Advanced film technology offering oxygen transmission rates below 1.0 cc/m²/day is widely adopted for beef and pork packaging, particularly in the Midwest and Southeast regions. The growth of e-commerce grocery delivery and fresh meat subscriptions is also expanding the need for tamper-proof, robust shrink bags that can maintain seal integrity through longer transit cycles.

From a sustainability standpoint, the USA is witnessing gradual movement toward recyclable barrier films and downgauging. However, these initiatives are concentrated among large processors and Tier-1 retailers due to cost barriers. The overall regulatory environment, consumer demand for convenience, and large-scale cold chain infrastructure make the USA industry attractive but competitive, with a moderate CAGR of 3.3% expected through 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.3% |

Germany represents the largest industry for barrier shrink bags in Europe, projected to be valued at USD 650 million by 2025. The country’s robust meat export industry, high penetration of cold chain infrastructure, and stringent EU food safety and sustainability mandates position it as a technologically advanced but compliance-heavy environment. Large meatpackers and dairy firms in North Rhine-Westphalia and Bavaria use multi-layer PVDC and EVOH-based shrink bags for pork, sausage, and cheese applications.

Germany's packaging ecosystem is guided by the Verpackungsgesetz (Packaging Act), which imposes recycling quotas and Extended Producer Responsibility (EPR) requirements. As a result, packaging converters are aggressively transitioning toward mono-material and recyclable high-barrier alternatives, especially for cheese and premium meat. Adoption of ultra-high barrier variants is relatively slower than in the USA due to cost pressures and a preference for rigid formats in some applications.

The industry remains attractive due to deep vertical integration across food value chains and strong exports to Italy, France, and Eastern Europe. However, saturation in high-volume segments and regulatory friction in multi-material use slightly moderate growth prospects. Germany’s industry will expand at a modest CAGR of 2.7% through 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 2.7% |

China is positioned as the second-largest industry for barrier shrink bags in Asia, contributing an estimated USD 510 million in 2025. Driven by expanding cold chain logistics, government focus on food safety, and the growing scale of meat and seafood imports, the Chinese industry is undergoing rapid structural upgrades in food packaging practices. A surge in demand from processed poultry and aquatic product segments is propelling the adoption of multilayer, oxygen-resistant shrink bags in urban centers like Shanghai, Shenzhen, and Chongqing.

The National Food Safety Standards (GB standards) have begun mandating stricter material migration limits and labeling norms, pushing converters and importers toward more reliable, compliant materials. However, local manufacturing is still catching up with the technical sophistication required for EVOH or PVDC-based films, leading to higher dependency on imports for ultra-high barrier bags.

The domestic meat processing sector, historically dominated by wet industries, is becoming more formalized. Major players like WH Group and China Yurun are setting up centralized, automated packaging lines that use barrier shrink formats for retail and export packaging. However, adoption outside Tier 1 cities remains nascent, creating a dual-speed industry.

Given these tailwinds and constraints, the Chinese industry is expected to grow at a CAGR of 4.2%, outpacing the global average but moderating from earlier speculative highs.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 4.2% |

The UK’s industry is expected to reach USD 395 million by 2025. It is shaped by a strong demand for pre-packaged fresh meat and cheese, stringent food safety laws, and increasing sustainability regulations post-Brexit. The Food Standards Agency (FSA) and the UK Plastic Pact are driving reform in packaging practices, with a specific focus on recyclability and reduced film thickness.

Supermarket chains like Tesco and Sainsbury’s are key volume drivers, as they demand ultra-high barrier packaging formats to reduce food waste and improve shelf life across distributed supply chains. Cheese packaging remains a major application, especially in the West and southwest regions.

Despite this, inflationary pressures and regulatory uncertainty in post-Brexit EU-UK trade have slightly dampened investment in capital-intensive packaging upgrades. Nonetheless, local film manufacturers and European exporters continue to maintain strong supply relationships with domestic packers.

The UK industry is forecast to grow steadily at a CAGR of 3.4% through 2035, reflecting its maturity and sustainability-driven innovation trajectory.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.4% |

Japan’s barrier shrink bags industry benefits from strict hygiene regulations, high consumer expectations for packaging aesthetics, and advanced cold chain logistics. The industry is expected to increase from USD 140 million in 2025 to USD 200 million by 2035, at a CAGR of 3.6%. Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) requires detailed traceability and quality controls, encouraging the adoption of ultra-high barrier solutions for seafood, wagyu beef, and dairy.

Consumer preference for clear, odorless, and tamper-evident packaging has also driven innovation in EVOH-PA multilayer shrink bags. Given the high cost of protein and premium positioning of fresh meat, Japanese processors prioritize long shelf life, especially for export-bound goods. Shrink bag formats with integrated QR codes and anti-fog coating are in high demand. Japan is also among the earliest adopters of antimicrobial barrier films, responding to aging population concerns over food safety.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.1% |

France holds a well-established position in the industry, valued at USD 370 million in 2025. The country’s premium food culture, including artisanal cheeses and high-value meat products, necessitates barrier formats that deliver freshness, transparency, and extended shelf life. Adoption is particularly strong in the cheese-producing regions of Auvergne-Rhône-Alpes and Bourgogne.

France’s regulatory environment shaped by the EU Single-Use Plastics Directive and local initiatives like the “Loi AGEC” is accelerating the shift toward recyclable shrink films. Processors are experimenting with downgauged multilayer films that balance barrier properties with compliance.

The industry has also benefited from export resilience, particularly to the Middle East and Southeast Asia. This has prompted meat and seafood exporters to upgrade to ultra-high barrier films, supported by government co-financing for export-packaging modernization under Bpifrance schemes.

Given its balance of mature infrastructure, premium product focus, and regulatory compliance pressure, France is expected to register a moderate CAGR of 3.2% over the forecast period.

| Country | CAGR (2025 to 2035) |

|---|---|

| France | 3.2% |

India’s industry is gaining momentum with rising consumption of packaged poultry, dairy, and seafood, contributing a projected USD 440 million in 2025. Although currently underpenetrated, India’s industry is benefiting from strong macro trends: rapid urbanization, expansion in refrigerated logistics, and government-led investments under the PMKSY and Cold Chain Development Program.

A key differentiator is the shift from conventional LDPE wraps to high-barrier formats in organized retail chains and export clusters. Packaging in Tier 1 cities like Delhi, Mumbai, and Bengaluru is evolving rapidly, with processors increasingly opting for EVOH and nylon-based films to meet export-grade compliance, especially for Gulf-bound shipments.

Regulatory tightening by FSSAI around packaging standards and labeling practices is further driving interest in barrier shrink solutions among domestic producers. However, affordability remains a friction point, and most high-barrier bags are still imported or manufactured by joint ventures with limited domestic capacity.

With a combination of rising protein intake, packaging modernization, and formalization of the food supply chain, India is expected to post a CAGR of 4.5% through 2035, well above the global average, albeit from a smaller base.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 4.5% |

Brazil’s barrier shrink bags industry is projected to reach USD 355 million in 2025, supported by its globally competitive meat export industry and growing domestic demand for frozen and processed food. Brazil is the world’s largest beef exporter, and its large-scale slaughterhouses in Mato Grosso, Goiás, and São Paulo are driving the use of high-barrier packaging to ensure product integrity during international shipping. Demand is primarily concentrated in vacuum-packed beef, poultry, and pork, particularly for exports to China, the Middle East, and Europe.

The industry is also experiencing strong tailwinds from domestic retail. Rising disposable income, the growth of frozen food chains, and urbanization are increasing demand for packaged protein products. Barrier shrink bags provide a longer shelf life and visual appeal that aligns well with modern supermarket trends.

However, the regulatory environment in Brazil is somewhat fragmented, with ANVISA (National Health Surveillance Agency) providing baseline packaging rules, but enforcement varies regionally. Sustainability adoption is slower than in Europe, though major players are beginning to pilot recyclable EVOH-based shrink formats for export industries.

The combination of export-oriented growth, gradual modernization of domestic packaging, and increased cold chain penetration makes Brazil an attractive industry, projected to grow at a CAGR of 3.7% above the global average.

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 3.7% |

Italy’s barrier shrink bags industry is estimated at USD 305 million in 2025, driven by its strong tradition in processed meats and specialty cheeses. Products like Parma ham, salami, and regional cheeses (e.g., Gorgonzola, Grana Padano) require high-performance packaging to maintain quality across extended distribution chains, especially for export industries in North America, Germany, and Japan.

Italian food processors heavily rely on vacuum and MAP packaging that uses shrink films with high transparency and excellent sealing integrity. Barrier packaging adoption is concentrated in the northern regions Lombardy, Emilia-Romagna, and Veneto where the bulk of industrial food production is located. The transition to ultra-high barrier shrink formats is underway, particularly for cheese and deli products in the retail channel.

While Italy is aligned with EU mandates on packaging sustainability, implementation has been inconsistent due to high cost sensitivity among small-scale producers. However, larger players are investing in downgauged, recyclable shrink formats, especially under co-financing schemes from EU innovation funds.

Italy presents a stable, brand-oriented packaging landscape with moderate innovation. Its growth will be driven by premiumization and export demand, rather than volume expansion, resulting in a projected CAGR of 3.0% through 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| Italy | 3.0% |

Canada’s industry for barrier shrink bags is projected to be worth USD 275 million by 2025. The country’s packaging industry benefits from close integration with USA food supply chains and high domestic demand for packaged meat, poultry, and seafood, particularly in provinces like Ontario, Quebec, and British Columbia. Regulatory oversight by Health Canada and CFIA ensures adherence to stringent food packaging standards.

The Canadian meat processing sector, led by companies like Maple Leaf Foods and Olymel, has heavily invested in vacuum shrink bag technologies, especially for pork and chicken segments. The country's status as a major exporter to the USA, China, and Japan necessitates the use of ultra-high barrier formats that meet international compliance.

Sustainability is a core theme in Canada’s packaging strategy. Federal goals for plastic waste reduction and circular economy incentives have accelerated trials of recyclable and bio-based barrier shrink films. However, wide-scale adoption is still emerging due to cost barriers and limited domestic resin supply chains.

The Canadian industry is forecast to grow at a CAGR of 3.6% through 2035, supported by food exports, sustainability alignment, and high consumer expectations for freshness and safety.

| Country | CAGR (2025 to 2035) |

|---|---|

| Canada | 3.6% |

Sealed Air Corporation

Sealed Air Corporation leads the global barrier shrink bags industry, driven by its flagship CRYOVAC® line of high-performance shrink packaging for meat, poultry, and cheese. The company commands the largest share due to its scale, patented multilayer film technologies, and strong penetration in North America, Europe, and Latin America.

Its products are characterized by ultra-high oxygen and moisture barrier performance, easy-seal characteristics, and high puncture resistance. Sealed Air’s relationships with top meat processors in the USA and Brazil provide recurring demand. The company is also a pioneer in sustainability, having developed recyclable shrink film prototypes and downgauged options to meet evolving regulations. Integration of automation-friendly films for high-speed packing lines further cements its lead.

Amcor plc

Amcor holds a strong position in the global industry with wide adoption of its barrier shrink bags across processed meats and dairy. Amcor’s strength lies in its diversified manufacturing footprint across North America, Europe, and the Asia-Pacific, allowing it to serve multinational CPGs with consistent quality.

Its shrink films are engineered with high clarity, extended shelf-life capability, and are increasingly available in recyclable mono-material formats. The company’s focus on sustainability and product innovation, through its AmLite Ultra range, has helped increase share, especially in regulated EU industries. Amcor is also known for robust product customization and is investing heavily in R&D for biodegradable barrier film development.

WINPAK LTD.

WINPAK is a North American packaging company with deep specialization in flexible food packaging. It maintains a loyal customer base among mid-sized meat processors and cheese manufacturers across Canada and the USA. The company’s shrink bags are noted for excellent optical properties and high-performance seals.

WINPAK operates in a cost-competitive segment and differentiates through vertically integrated operations, ensuring supply consistency and customization. Though not as globally diversified, its regional dominance and high production efficiencies give it a stable foothold. Recent capital investments in nylon coextrusion and EVOH multilayer lines have improved its capability in premium barrier applications.

FLEXOPACK S.A.

FLEXOPACK is headquartered in Greece and focuses largely on the European industry. Its key strength lies in delivering high-performance vacuum and shrink films to processors of meat, seafood, and dairy, especially in Southern and Eastern Europe. The company offers a range of co-extruded shrink films designed to extend shelf life and improve product presentation.

While its share is relatively modest, FLEXOPACK has built a strong export base in the Middle East and Australia. The firm is also actively pursuing bio-based packaging development in line with EU directives, which may provide growth leverage in the coming decade.

Viscofan Group

While traditionally known for its dominance in sausage casings, Viscofan has diversified its product portfolio into high-barrier shrink films, particularly through its plastics division. It has established a strong presence in shrink bag solutions for whole-muscle meats and charcuterie, with a competitive advantage in products requiring a superior oxygen and aroma barrier.

Operating in over 100 countries, Viscofan's supply chain is particularly robust in Europe and Latin America. The company invests consistently in coextrusion technology and has expanded capacity in smart packaging with built-in barrier indicators. Its recent moves into compostable casing materials signal a broader pivot toward circular packaging strategies.

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 3.52 billion |

| Projected Market Size (2035) | USD 5.07 billion |

| CAGR (2025 to 2035) | 3.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion |

| By Material | Polyethylene, Polypropylene, Polyamide, EVOH, PVDC, and Others |

| By Product | Round Bottom Sealed, Straight Bottom Sealed, and Side Sealed |

| By Barrier | High Barrier and Ultra High Barrier |

| By Application | Meat, Seafood, Poultry, Cheese & Dairy Products, and Other Foods |

| Regions Covered | North America, Latin America, Western Europe, East Asia, South Asia & Pacific, Middle East and Africa (MEA), and Eastern Europe |

| Countries Covered | United States, Germany, China, United Kingdom, Japan, France, India, Brazil, Italy, and Canada |

| Key Players | Sealed Air Corporation, Amcor plc, WINPAK LTD., FLEXOPACK S.A., Viscofan Group, Atlantis-Pak, Tipack Group, allfo GmbH & Co. KG, Asahi Kasei Corporation, Flavorseal , BUERGOFOL GmbH, PREMIUMPACK GmbH, VACPAC INC., Astar Packaging Pte Ltd., Millepack srl ., Spektar d.o.o ., AMPAC PACKAGING, Flexipol , Duropac , and Transcontinental Inc. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The barrier shrink bags industry is segmented into polyethylene, polypropylene, polyamide, evoh, PVDC, and others.

The industry is divided into round bottom sealed, straight bottom sealed, and side sealed.

The industry is divided into high-barrier and ultra-high-barrier.

The industry is categorized into meat, seafood, poultry, cheese & dairy products, and other foods.

The industry in North America, Latin America, Western Europe, East Asia, South Asia & Pacific, Middle East and Africa (MEA), and Eastern Europe.

The barrier shrink bags market is projected to grow from USD 3.52 billion in 2025 to USD 5.07 billion by 2035.

Ultra-high barrier shrink bags are expected to witness the fastest growth through 2035, driven by increasing adoption in vacuum-sealed meat, seafood, and export-grade dairy packaging applications.

North America remains the leading region in terms of value, with the United States accounting for the largest market share, fueled by its advanced cold chain logistics and high meat consumption.

Key companies dominating the market include Sealed Air Corporation, Amcor plc, WINPAK LTD., Viscofan Group, and FLEXOPACK S.A., together commanding over 40% of the global market share.

Technological advancements in co-extrusion and sustainability have led to the emergence of recyclable and downgauged barrier shrink films, addressing environmental regulations and consumer preferences for eco-friendly packaging.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Insights for Barrier Shrink Bag Providers

Barrier Packaging Market Size and Share Forecast Outlook 2025 to 2035

Barrier Coated Papers Market Size and Share Forecast Outlook 2025 to 2035

Barrier Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Barrier Resins Market Size and Share Forecast Outlook 2025 to 2035

Barrier Material Market Size and Share Forecast Outlook 2025 to 2035

Barrier Coated Paper Industry Analysis in Europe - Demand, Growth & Future Outlook 2025 to 2035

Key Players & Market Share in the Barrier Coated Paper Industry

Barrier Coatings for Packaging Market Trends - Growth & Forecast 2025 to 2035

Competitive Landscape of Barrier Packaging Providers

Barrier Film Market Trends & Industry Growth Forecast 2025 to 2035

Europe Barrier Packaging Market Growth – Demand & Forecast 2024-2034

Barrier System Market Size, Share, Trends & Forecast 2024-2034

Japan Barrier Coated Paper Market Growth – Trends & Forecast 2023-2033

Korea Barrier Coated Paper Market Growth – Trends & Forecast 2023-2033

Barrier Bags Market

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

Air Barrier Market Size and Share Forecast Outlook 2025 to 2035

Non-Barrier Bag Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Non-Barrier Bag Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA